- Eli Lilly's Q1 2024 performance showcased significant revenue growth driven by successful product launches and improved gross margins.

- With growth opportunities in key segments like oncology drugs, diabetes medications, and neuroscience therapies, Eli Lilly may continue to derive growth in the pharmaceutical industry.

- The company's stock price surged in Q1 2024, outpacing major market indices and technicals reflecting positive market sentiment for 2024.

- Eli Lilly competes in a saturated pharmaceutical market but has sequentially expanded its market share.

I. Eli Lilly Q1 2024 Performance Analysis

A. Eli Lilly Key Segments Performance

Eli Lilly's performance in the first quarter of 2024 exhibited significant growth and strategic advancements across key segments.

Financial Highlights:

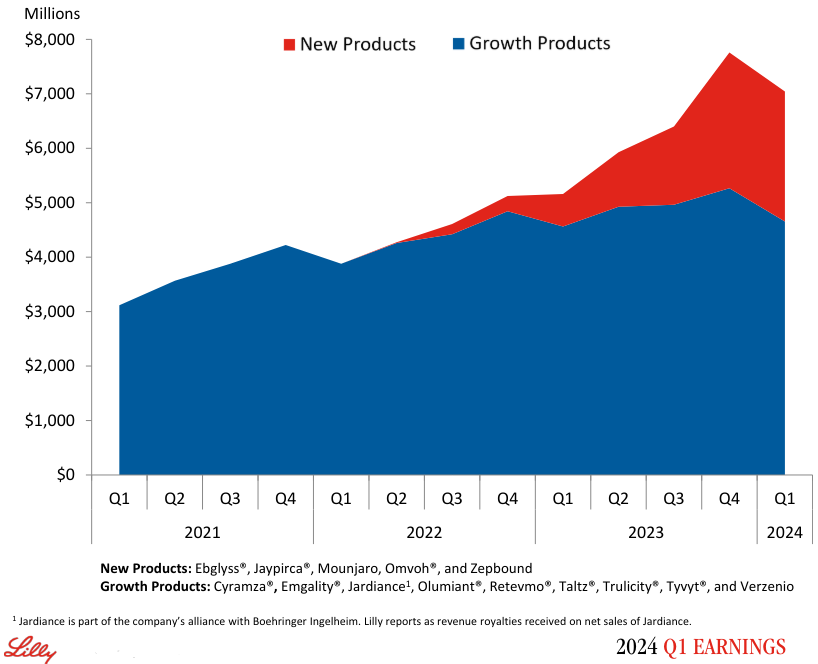

Eli Lilly reported robust financial performance in Q1 2024, marked by a 26% increase in revenue compared to the same period last year. This growth was primarily driven by the successful launch of new products such as Mounjaro and Zepbound. They contributed nearly $1.8 billion in revenue. Gross margin as a percentage of revenue also saw a notable improvement, increasing from 78.4% to 82.5%, attributed to higher realized prices, favorable product mix, and improved production costs.

Source: 2024 Q1 Earnings

Operating income surged by 63% in Q1, reflecting higher revenue from new products, although partially offset by increased operating expenses. Earnings per share (EPS) witnessed a significant uptick, soaring by 59% to $2.58 on a non-GAAP basis, inclusive of a $0.10 impact from acquired IPR&D charges. The company's effective tax rate decreased slightly to 11.9% compared to the previous year, primarily due to a larger net discrete tax benefit.

Operational Performance:

In terms of operational performance, Eli Lilly saw substantial revenue growth across various geographical regions. In the U.S., revenue surged by 28%, fueled by strong demand for key products like Mounjaro and Zepbound. However, challenges such as supply constraints for Trulicity impacted sales in international markets. Nevertheless, the company maintained a robust growth trajectory, with revenue in the rest of the world increasing by 31%.

Product-wise, Mounjaro emerged as a significant revenue driver, with global sales reaching $1.8 billion in Q1 2024. The multi-dose KwikPen delivery device approval for Mounjaro in the EU expanded the market reach, further boosting revenue potential. Additionally, the successful launch of Zepbound in the U.S. garnered over $0.5 billion in sales during the quarter, with efforts underway to broaden access and increase market penetration.

Technological Advancements and Innovations:

Eli Lilly demonstrated notable progress in technological advancements and innovations during the first quarter of 2024. The company achieved several key pipeline milestones, including positive Phase 3 results for tirzepatide in obstructive sleep apnea, and the approval of the multi-dose KwikPen delivery device for Mounjaro in Europe. Furthermore, submissions for mirikizumab in the U.S. and EU for Crohn's disease underscored the company's focus on addressing unmet medical needs.

Moreover, strategic initiatives such as the acquisition of an injectable medicine facility in Wisconsin and the groundbreaking of a parenteral manufacturing site in Germany exemplified Eli Lilly's efforts to expand its manufacturing capacity. These investments align with the company's focus on accelerating growth.

B. LLY Stock Price Performance

In Q1 2024, Eli Lilly’s stock exhibited robust performance, with its stock price soaring by 31%, reflecting investor confidence and positive market sentiment. The company's market capitalization stood at a formidable $706 billion. The stock witnessed significant volatility, with highs reaching $800 and lows hitting $579 during the quarter. Notably, the opening and closing prices were $581 and $776, respectively. This impressive performance outpaced major market indices, as evidenced by the S&P 500 (SPX) and NASDAQ (NDX) posting price returns of 10% and 9%, respectively.

Source: tradingview.com

II. Eli Lilly Stock Forecast 2024: Outlook & Growth Opportunities

Eli Lilly holds a promising outlook, driven by several growth opportunities and strategic initiatives across different segments of the pharmaceutical market.

A. Segments with Growth Potential

Eli Lilly’s topline growth potency can be observed in the projected revenue of the US pharmaceuticals market. As per statista.com, the market revenue may hit $636.90 billion in 2024. This reflects a growth rate (CAGR) of 5.96% from 2024 to 2028.

Source: statista.com

Oncology Drugs: The projected market volume for oncology drugs in the United States is expected to reach US$114.60 billion in 2024, making it one of the largest segments. Eli Lilly has the opportunity to capitalize on this growth by continuing to innovate and develop new oncology therapies. Despite challenges such as the termination of the Verzenio prostate program, the company remains committed to advancing its oncology portfolio with new molecules entering clinical trials.

Diabetes and Obesity Medications: Eli Lilly has a significant presence in the diabetes market, with drugs like Ozempic and Mounjaro showing promising growth. Recent breakthroughs in GLP-1 agonists have expanded their utility beyond diabetes treatment to include weight reduction, tapping into a substantial market opportunity. The company's focus on tirzepatide for the treatment of obesity and obstructive sleep apnea further highlights its commitment to addressing unmet medical needs in this segment.

Neuroscience and Immunology: Despite setbacks in certain programs such as the discontinuation of GBA1 gene therapy for Gaucher disease type 2, Eli Lilly continues to pursue innovation in neuroscience and immunology. The company's pipeline includes promising candidates like donanemab for Alzheimer's disease and mirikizumab for Crohn's disease, indicating potential growth avenues in these therapeutic areas.

B. Expansions and Strategic Initiatives

Manufacturing Expansion: Eli Lilly is actively investing in expanding its manufacturing capacity to meet growing demand for its products. Initiatives such as acquiring an injectable medicine facility in Wisconsin and breaking ground on a parenteral manufacturing site in Germany demonstrate the company's commitment to enhancing its production capabilities.

Pipeline Advancements: The company is focused on advancing its pipeline of new medicines through research and development (R&D) investments. Key pipeline milestones, including positive Phase 3 results for tirzepatide in obstructive sleep apnea and the submission of mirikizumab for Crohn's disease, highlight Eli Lilly's dedication to bringing innovative therapies to market.

III. LLY Stock Price Forecast 2024

A. LLY Stock Forecast: Technical Analysis

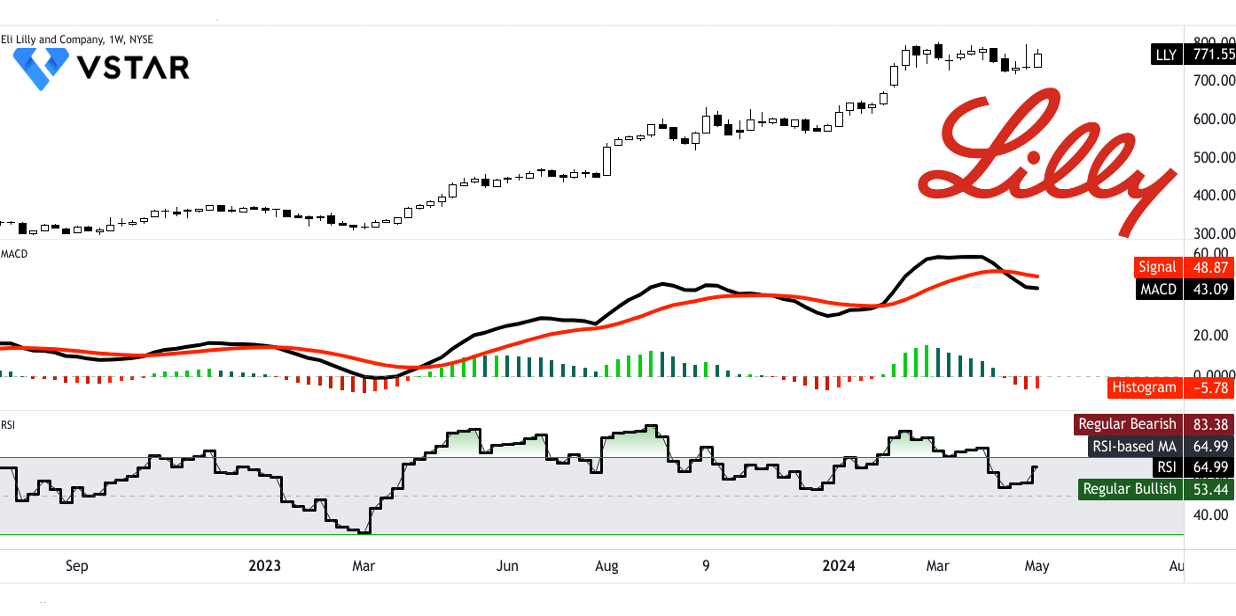

The forecasted average Eli Lilly price target by the end of 2024 is $1,035.00, with an optimistic target of $1,110.00. However, the current stock price of LLY stands at $771.55, with a trendline and baseline of $711.61 and $703.60 respectively, indicating a sideways trend in the stock price direction. These projections are based on the momentum of change-in-polarity over short-term, projected over Fibonacci retracement/extension levels, suggesting potential upward movement in the stock price.

Key support and resistance levels provide additional insight into potential price movements. The primary support level is identified at $734.45, with a pivot of the current horizontal price channel at $754.19. Resistance levels, particularly in case of heightened volatility, are projected at $872.26 and $962.47. Conversely, core support is at $691.86, providing a baseline for potential downside risk.

Source: tradingview.com

Looking at the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) indicators further refines the forecast. The RSI value of 64.99 without divergence suggests a bullish trend, albeit approaching the overbought threshold. Meanwhile, the MACD indicators indicate a bearish trend with decreasing strength, reflected in the negative MACD histogram.

Source: tradingview.com

B. Lilly Stock Forecast: Fundamental Analysis

Eli Lilly's P/E ratio, for example, stands at 57.05, significantly higher than the sector median of 20.29 and historical average of 36.47, suggesting a relative and absolute premium valuation. Similarly, the PEG ratio, at 1.61, indicates the stock may be slightly undervalued against the earnings growth expectations both in relative and absolute terms.

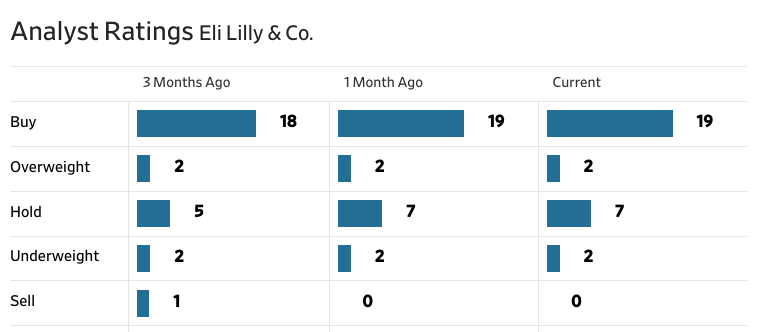

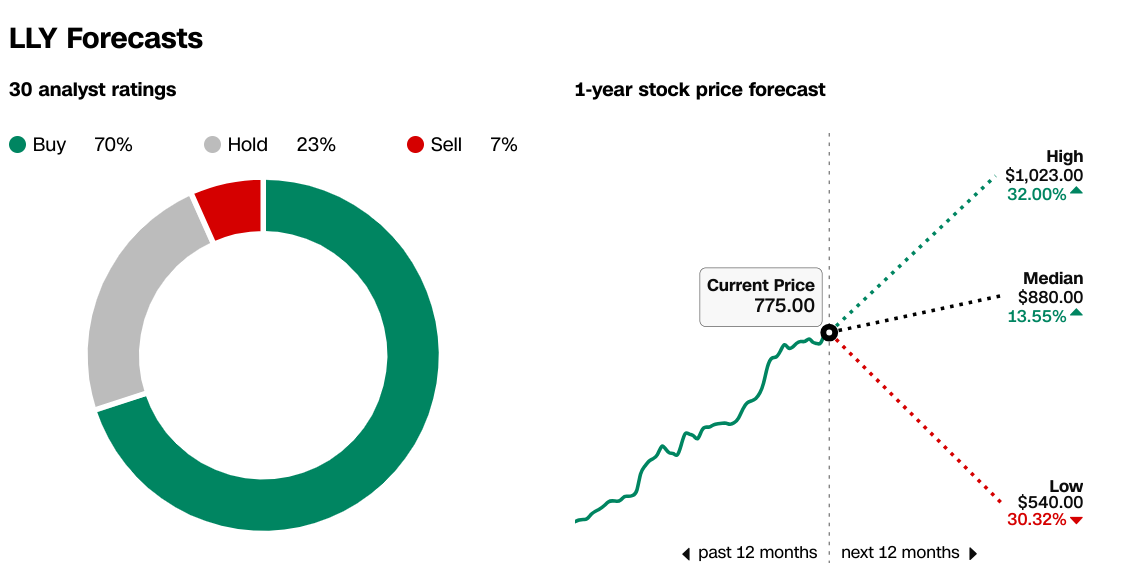

LLY Price Target

Analyst recommendations further support this outlook, with the majority of analysts maintaining "Buy" or "Hold" ratings. Price targets suggest a bullish sentiment, with a median target of $880, implying considerable upside potential from the current price of $775.

Source: WSJ.com

Source: cnn.com

C. LLY Stock Prediction: Market Sentiment

Market sentiment surrounding Eli Lilly's stock forecast includes factors like investor confidence, institutional holdings, and short interest. Institutional ownership stands at 82.74%. This indicates solid confidence from large investors. This high level of institutional ownership suggests a positive outlook for the stock. Whereas, Short interest, at 0.65%, indicates a relatively low level of bearish sentiment among investors. The short interest is overing 2.41 days of average daily volume. With only 5.5 million shares held short, representing a small percentage of total shares outstanding, there's little indication of significant negative speculation in the market.

Source: nasdaq.com

Source: benzinga.com

IV. Eli Lilly Stock Prediction 2024: Challenges & Risk Factors

Eli Lilly Competitors

Eli Lilly competes in a saturated pharmaceutical market. As of Q1 2024, its market share stands at 9.5% (on a trailing twelve month basis), trailing behind major competitors like Johnson & Johnson (21.7%) and Pfizer (15.5%). This competition intensifies pressure on Eli Lilly to maintain its market presence and develop innovative products to stay relevant. On this metric, Eli Lilly expanded its market share sequentially.

LLY's vs. Market share relative to its competitors, as of Q1 2024 within the Major Pharmaceutical Preparations Industry

Source: csimarket.com

Other Risks

The company heavily relies on a few products for a significant portion of its revenue. Products like Trulicity and Mounjaro accounted for 36% of total revenue in 2023. Any loss of patent protection, changes in prescription rates, or regulatory issues could severely impact revenue streams. Moreover, increasing government price controls and regulations on drug pricing and reimbursement pose additional threats. For instance, the selection of Jardiance for government-set prices in 2026 signals potential revenue erosion before exclusivity expiry.

Further, Eli Lilly faces risks related to supply chain disruptions, product liability lawsuits, unexpected side effects, and negative publicity affecting consumer confidence. Additionally, state-level regulations and initiatives, such as drug affordability boards and 340B program modifications, add administrative burdens and cost pressures.

In conclusion, Eli Lilly's Q1 2024 performance showcased significant revenue growth driven by successful product launches and improved gross margins. Operational challenges in international markets were offset by strong performance in the US. The stock is outpacing major market indices and reflecting positive market sentiment.

Eli Lilly stock is Buy. Eli Lilly's strong financial performance, promising outlook, and bullish market sentiment make it an attractive investment option. For investors seeking shorter-term opportunities, trading Eli Lilly stock through Contracts for Difference (CFDs) could provide exposure to price movements without owning the underlying asset.

Utilize the VSTAR trading app, an institutional-level trading platform, to monitor Eli Lilly's stock performance, access real-time market data, and execute trades efficiently. Explore trading Eli Lilly stock CFDs through platforms like VSTAR, leveraging price fluctuations to potentially maximize returns.