Why Amazon (AMZN) Is a High-Conviction Buy for 2026

Despite being the only “Magnificent Seven” stock to underperform in 2025, Amazon’s fundamentals have significantly improved. This disconnect—weak price, strong business momentum—creates a compelling opportunity before capital rotations in 2026.

Amazon’s upside is supported by three major drivers:

1. AWS Becomes an AI Growth Engine Again

- Q3 AWS revenue: $33B, +20% YoY, fastest growth since 2022

- AI workloads growing 3× faster than traditional cloud workloads

- AWS backlog hits $200B, signaling multi-year revenue visibility

- Large enterprise bookings surged in October, exceeding all of Q3

AWS is finally re-accelerating—and Wall Street hasn’t fully priced it in.

2. Amazon’s Full-Stack AI Strategy

- Creates a Durable Competitive Moat

Amazon is now one of the few companies with complete AI vertical integration:

- Trainium/Inferentia AI chips

- Bedrock foundation-model platform

- Nova AI models

- Custom high-performance cloud infrastructure

Trainium chip revenue grew 150% QoQ, becoming a multi-billion-dollar business.

Trainium3 launches with 2× performance and 50% energy efficiency gains, which strengthens AWS’s cost advantage vs. NVIDIA-based platforms.

Major proof point:

✔ OpenAI signed a $3.8B multi-year contract for AWS compute capacity

This validates AWS as one of the world’s top AI infrastructure providers.

3. Multi-Cloud Strategy & Government Cloud

- Build-Out Expand Total Addressable Market

Multi-Cloud Partnership With Google Cloud

Amazon and Google Cloud launched a fast-deploy multi-cloud network service, reducing setup time from weeks to minutes.

This:

- boosts enterprise reliability after the October outage

- increases AWS stickiness

- aligns with the rising multi-cloud architecture trend

Government & Defense Cloud Expansion

Amazon plans to invest $50B to build AI and HPC infrastructure for U.S. government clients across Top Secret, Secret, and GovCloud regions.

Government cloud is a high-margin, high-barrier, long-contract-duration business—exactly the type of segment that supports long-term valuation expansion.

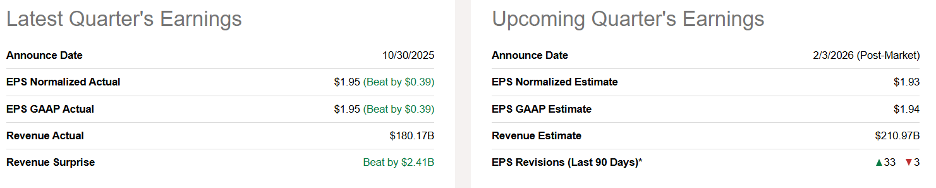

Financial Highlights (Q3 2025)

Revenue

- $180.2B (+13% YoY) — beat expectations

Profitability

- GAAP operating income: $17.4B

- Adjusted operating income: $21.7B

- EPS: $1.95 (+36% YoY)

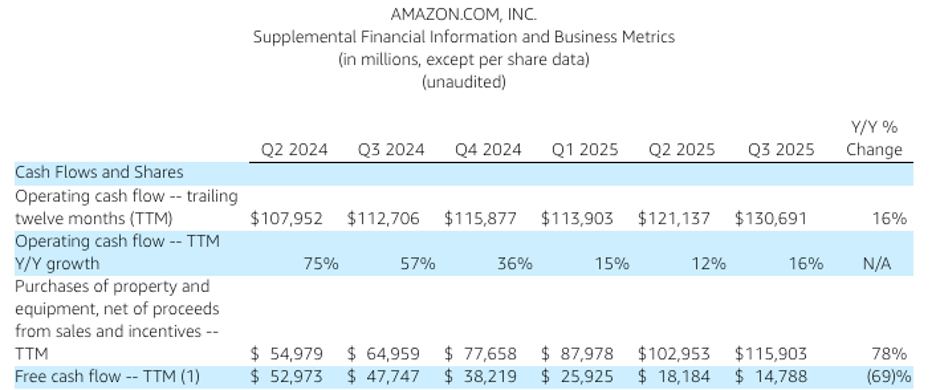

Cash Flow

- Operating cash flow (TTM): $130.7B (+16% YoY)

- Free cash flow: $14.8B

- Capex rose due to AI & data center expansion—necessary for long-term dominance.

Valuation: Upside Remains Underappreciated

- AMZN trades at ~32.5× forward earnings

- With ROIC rising from 3% → 16.5%, this reflects true business quality

- Sustained AWS AI momentum should support ~30× forward P/E

- Resulting Price Target: $270.48 (≈18% upside)

- Wall Street consensus upside: ~28%

Given AWS re-acceleration and AI infrastructure leadership, Amazon appears undervalued relative to its long-term growth potential.

Technical Analysis: Bullish Reversal Forming

AMZN closed at $233.24 (+1.77%), breaking above the 20-day SMA (230).

This signals:

- short-term trend reversal

- strengthening buying momentum

- potential move toward the next resistance at ~$240–245

Volume confirmation will determine whether this transition becomes a mid-term uptrend.

Risks to Watch

- Competition from Azure/OpenAI and Google Cloud/TPU

- Long ROI cycles for large AI/data center investments

- Valuation compression if growth stocks de-rate

- Regulatory or operational disruptions (e.g., cloud outages)

Conclusion: Amazon’s 2025 Weakness Sets Up a 2026 Rebound

Amazon enters 2026 with:

✔ accelerating AWS growth

✔ AI monetization across chips, models, and platforms

✔ new multi-cloud partnerships

✔ major expansion into high-value government cloud markets

The market is still underestimating these catalysts.

We maintain a BUY rating with a $270 target price.

Key events to monitor:

- AWS re:Invent announcements

- AWS AI workload growth

- U.S. government cloud contract wins

- Data center capex efficiency trends