I. Introduction

A. Recent Amazon Stock Performance

Amazon's recent stock performance reflects a dynamic trajectory, with key data indicating its resilience and potential for future growth. The 52-week range showcases a fluctuation between $81.43 and $145.86, highlighting the stock's responsiveness to market dynamics. As of now, the stock is within the day range of $139.84 to $142.65, with a forward EPS of 2.66 and a forward PE of 52.87. The market cap stands at an impressive $1.48 trillion.

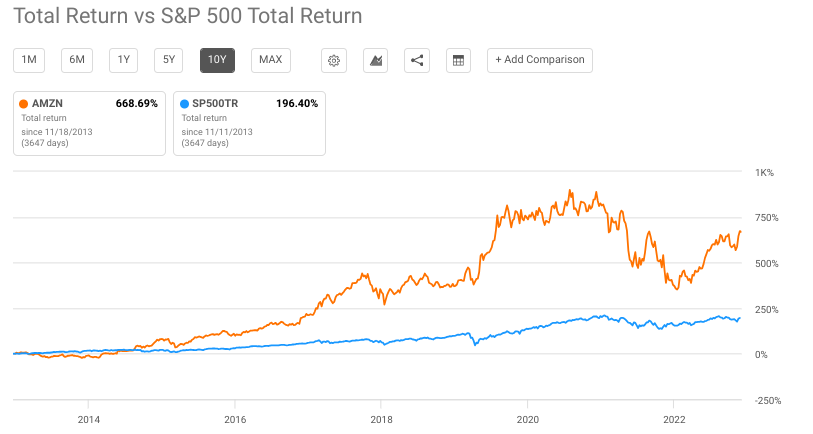

Price performance over different periods reveals a mixed trend. In the short term, Amazon has shown a modest 1.83% return over the past week, and a robust 67.38% YTD. The 1-year return of 63.22% aligns with the broader market, while the 3-year and 5-year performances reflect resilience and long-term growth potential. However, the 10-year return of 740% underscores Amazon's historical dominance and value creation for long-term investors.

Source: seekingalpha

Amazon's latest financial report for Q3 2023 reveals substantial revenue of $143.1 billion, a YoY increase of 11%. Operating income soared to $11.2 billion, marking a remarkable 343% YoY surge. The trailing 12-month free cash flow reached $20.2 billion, showcasing financial robustness.

The strategic move to regionalize the fulfillment network in the U.S. has proven successful, enhancing efficiency and reducing costs. Faster delivery speeds, especially for Prime customers, contribute to customer satisfaction and increased shopping frequency. The focus on lowering costs, improving customer experience, and investing for future growth indicates Amazon's commitment to long-term success.

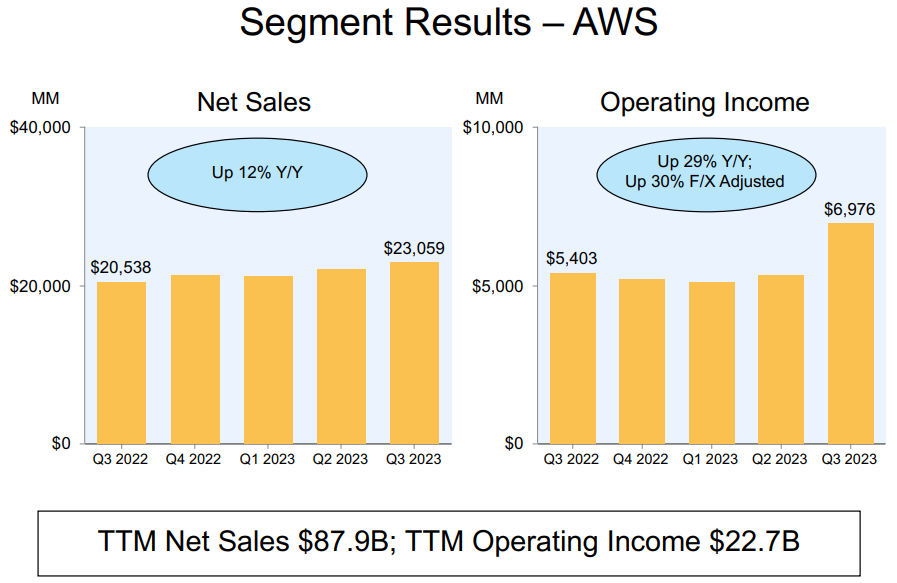

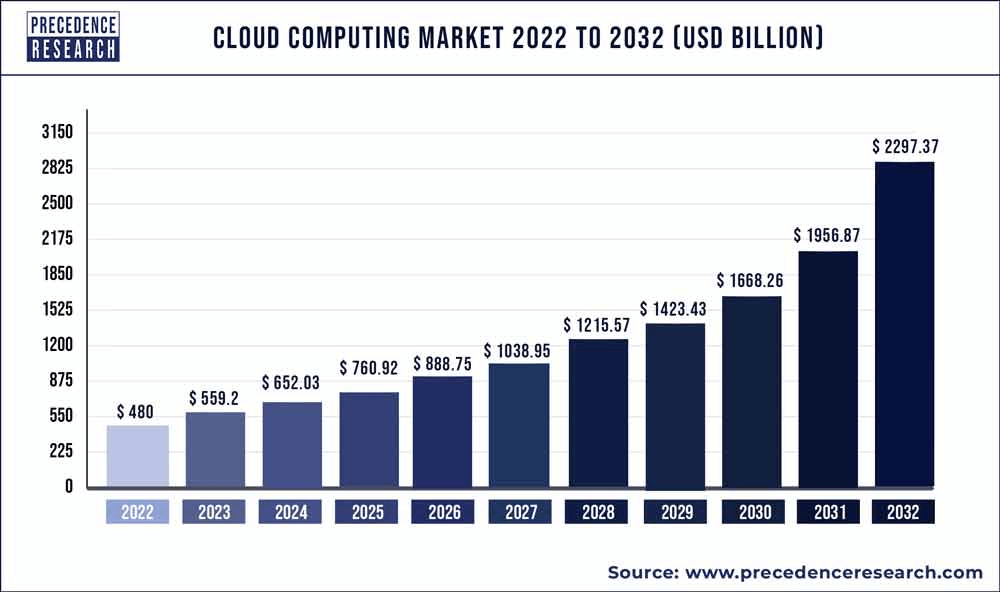

Amazon Web Services (AWS) remains a pivotal driver of Amazon's overall performance. With a revenue growth of 12% YoY in Q3, AWS is positioned as a clear cloud infrastructure leader. The generative AI initiatives, spanning three layers - compute, large language models as a service, and applications - are indicative of Amazon's commitment to staying at the forefront of technological innovation.

Source: Earnings Presentation Amazon

The collaboration with Anthropic, the introduction of Amazon Bedrock, and advancements in CodeWhisperer underscore Amazon's dedication to democratizing complex technologies. The application of generative AI across various business segments, from stores to advertising and Alexa, showcases Amazon's broad integration of cutting-edge technologies.

B. Expert Insights on AMZN Stock Forecast for 2023, 2025, 2030 and Beyond

Traders Union's forecast projects an upward trajectory for Amazon stock. Predicting a middle-of-the-year price of $159.71 in 2023 and reaching $610.13 by 2034, Traders Union emphasizes a steady growth pattern over the next decade. Notably, the end-of-year prices for each year demonstrate a consistent climb, with 2025 expected to see a price of $220.09.

Alternative forecasts from Coin Price Forecast depict a more aggressive growth trend. With mid-year projections starting at $130 in 2023 and reaching $476 by 2035, these predictions suggest a higher potential for Amazon stock price. The annual increases, such as a +56% growth from 2024 to 2025, underline a bullish outlook on the stock's performance.

Contrastingly, Walletinvestor offers a more conservative estimate. The beginning of 2025 is projected to see Amazon's stock at $93.317, a figure significantly lower than other forecasts.

Long Forecast's prediction, placing Amazon's stock at $220 at the beginning of 2025, aligns more closely with the Traders Union forecast. This suggests an optimistic outlook on Amazon's growth potential, emphasizing its market dominance and ability to drive value over the coming years.

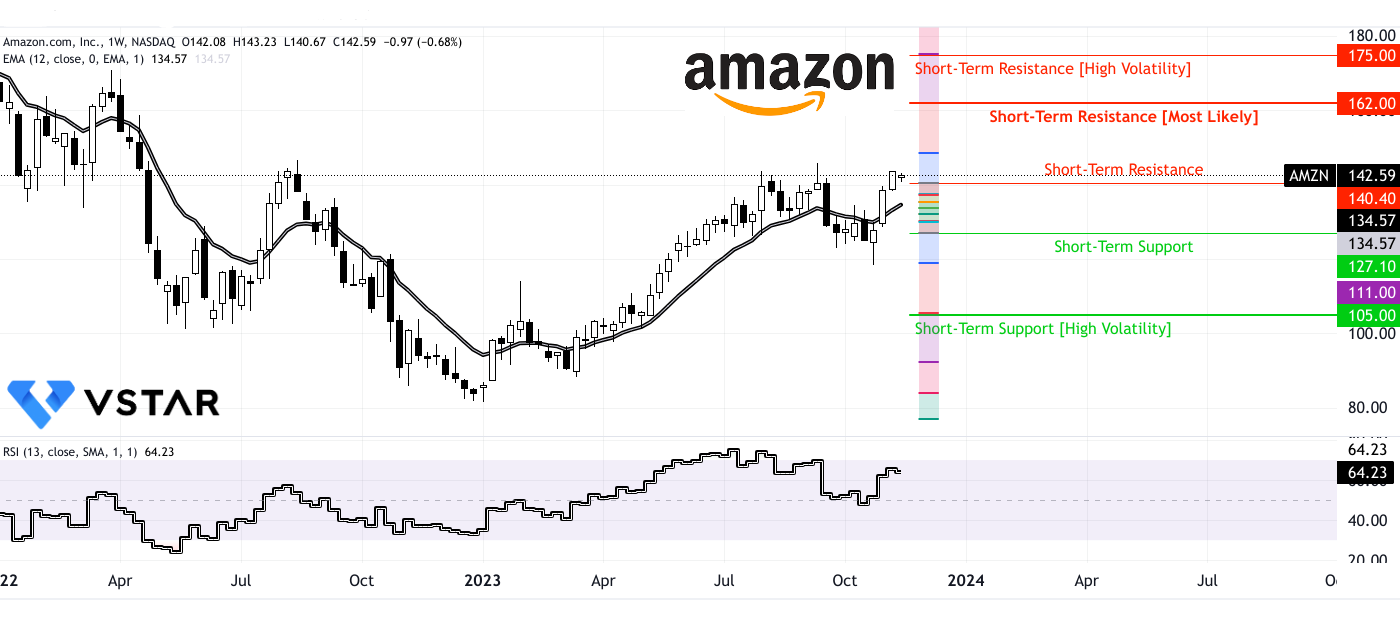

II. Amazon Stock Forecast 2023

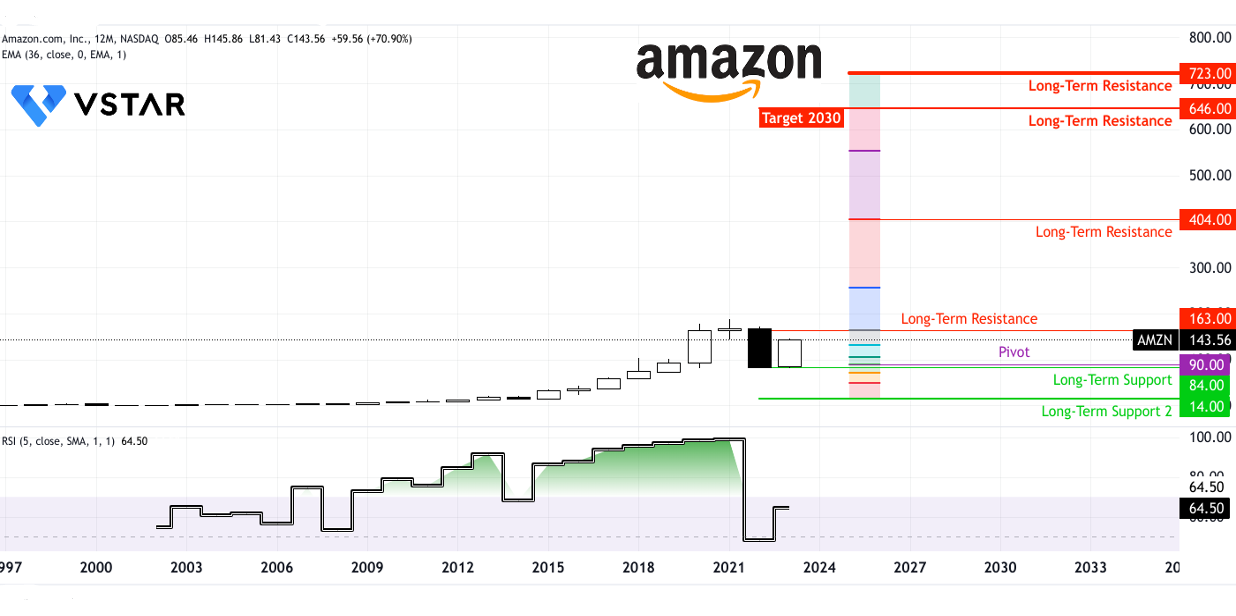

Amazon stock is poised for a potential surge, possibly reaching $162, given its current positive momentum and a successful close above the 13-week Exponential Moving Average (EMA). The Relative Strength Index (RSI) finding support around the neutral level of 50, coupled with a return to an overbought trajectory, indicates investor confidence. Notably, the stock has already tested and held the support level at $127.10.

In the event of unfavorable macroeconomic developments, there exists a downside risk, with the price potentially dropping to $105 due to the infusion of high volatility. On the upside, a minor resistance is anticipated at $150. However, assuming the current market conditions persist, the AMZN target price is set at $162.

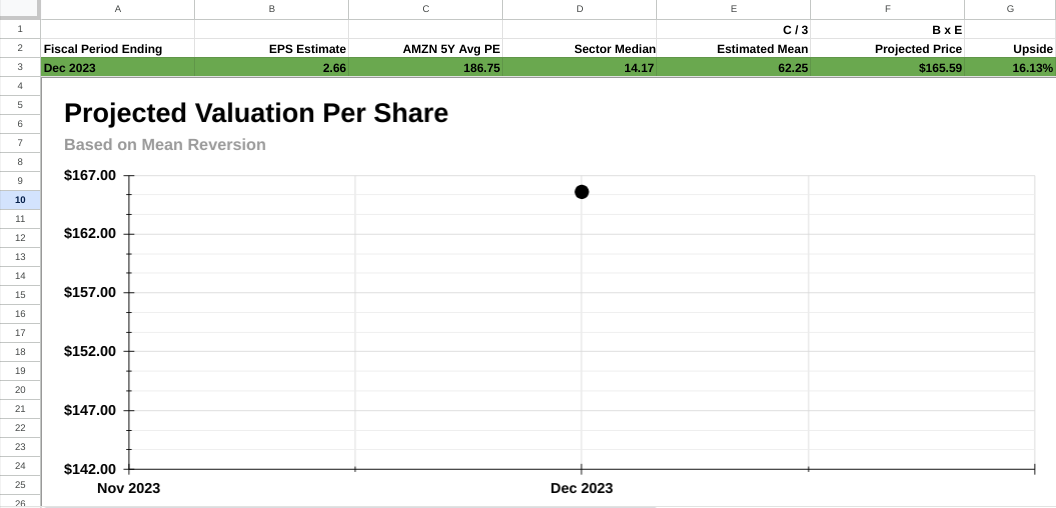

Taking a quantitative approach and adopting a conservative stance from a bullish perspective, the price projection considers one third of the 5-year historical mean of the forward Price-to-Earnings (PE) ratio. This approach suggests an upside potential of 16, reaching $166.

The AMZN stock forecasts for 2023 present a diverse range of perspectives. According to gov.capital, the stock is predicted to have a regular price of $140.623 on December 31, 2023, with a potential range between $119.52955 and $161.71645. This projection indicates a level of uncertainty in the forecast, acknowledging the dynamic nature of the stock market.

In contrast, coinpriceforecast.com provides a more straightforward outlook, anticipating a mid-year AMZN stock price target of $130 and a year-end price of $160, reflecting a modest but positive growth of 12%. This forecast implies a more conservative estimate compared to some analyst predictions but still suggests a positive trend for Amazon stock in 2023.

A. Other AMZN Stock Forecast 2023 Insights

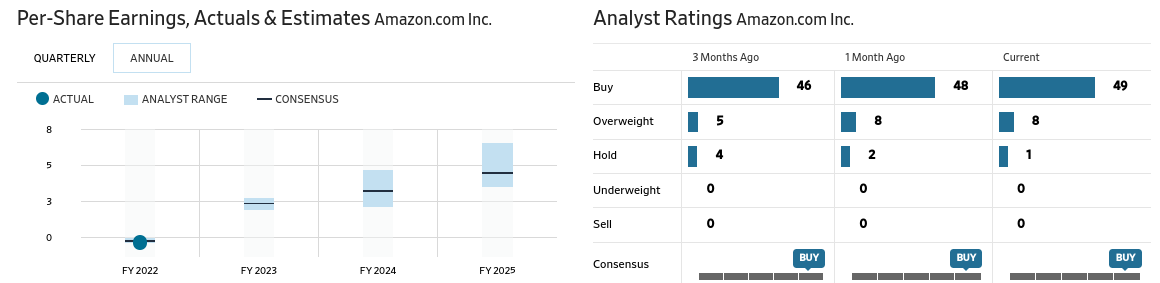

Is Amazon a good stock to buy? Amazon stock forecast for 2023 is marked by a series of optimistic ratings and price target adjustments from prominent financial analysts and institutions. These forecasts reflect a consensus among experts that Amazon stock (AMZN) is poised for significant growth in the coming year.

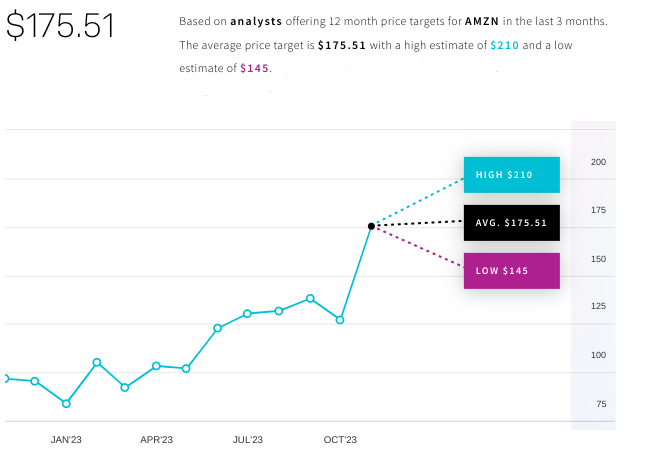

Ivan Feinseth of Tigress Financial maintains a "Strong Buy" rating on Amazon, with an increased Amazon price target from $204 to $210, indicating a substantial upside of 47.28% as of November 10, 2023. This optimistic outlook is supported by Christopher Johnen from HSBC, who initiated coverage with a "Strong Buy" rating and a Amazon stock price target of $160, reflecting a 12.21% potential gain as of November 2, 2023.

DA Davidson's Tom Forte also maintains a "Strong Buy" recommendation and raises the Amazon price target from $150 to $157, suggesting a 10.11% upside as of October 27, 2023. Barclays analyst Ross Sandler, with a "Buy" rating, maintains a Amazon target price of $190, indicating a notable 33.25% potential gain as of the same date.

Other analysts contributing to this positive sentiment include Barton Crockett of Rosenblatt, Laura Martin of Needham, and Joseph Feldman of Telsey Advisory Group. They maintain or reiterate their "Strong Buy" or "Buy" ratings with varying price targets, further reinforcing the positive outlook for Amazon stock in 2023.

Overall, the consensus among these analysts is that Amazon stock is expected to experience robust growth, supported by factors such as strong financial performance, market dominance, and potential expansion into new business areas.

Source: Nasdaq

B. Key Factors to Watch for Amazon Stock Price Prediction 2023

Amazon stock forecast 2023 - Bullish Factors

Strong Financial Guidance: Amazon's fourth-quarter 2023 guidance suggests positive growth, with net sales expected to be between $160.0 billion and $167.0 billion, marking a 7% to 12% increase compared to the same period in 2022.

Robust Operating Income: The anticipated operating income range of $7.0 billion to $11.0 billion is a significant improvement over the $2.7 billion reported in Q4 2022.

Customer-Centric Innovations: Amazon's focus on enhancing customer experience is evident through initiatives like Prime Big Deal Days, new features for merchants, expanded healthcare services, and partnerships to streamline the shopping process.

2023 Amazon stock forecast - Bearish Factors

Dependency on Favorable Conditions: The provided guidance assumes no unforeseen events such as business acquisitions, restructurings, or legal settlements, leaving Amazon vulnerable to unexpected challenges that could impact its performance.

Global Economic Factors: While not explicitly mentioned, any adverse changes in global economic conditions could affect Amazon's international operations and overall financial performance.

Recent Developments and News

Diversification in Advertisements: Amazon's collaboration with third-party brands like BuzzFeed and Pinterest to display sponsored product ads indicates a push for diversification and increased revenue streams.

Content Expansion: The success of Amazon Original series, films, and partnerships with MGM Studios showcases the company's commitment to expanding its content offerings on Prime Video.

Technological Advancements: Collaborations with Anthropic for generative AI and partnerships with companies like BMW and NatWest underscore Amazon's commitment to technological innovation and expanding its cloud services (AWS).

In conclusion, Amazon stock forecast for 2023 appears optimistic, driven by strong financial guidance, customer-focused innovations, and diverse business strategies. However, potential risks include external economic factors and dependencies on favorable conditions outlined in their guidance. Ongoing developments in AI, entertainment, and cloud services contribute to Amazon's resilience and growth potential.

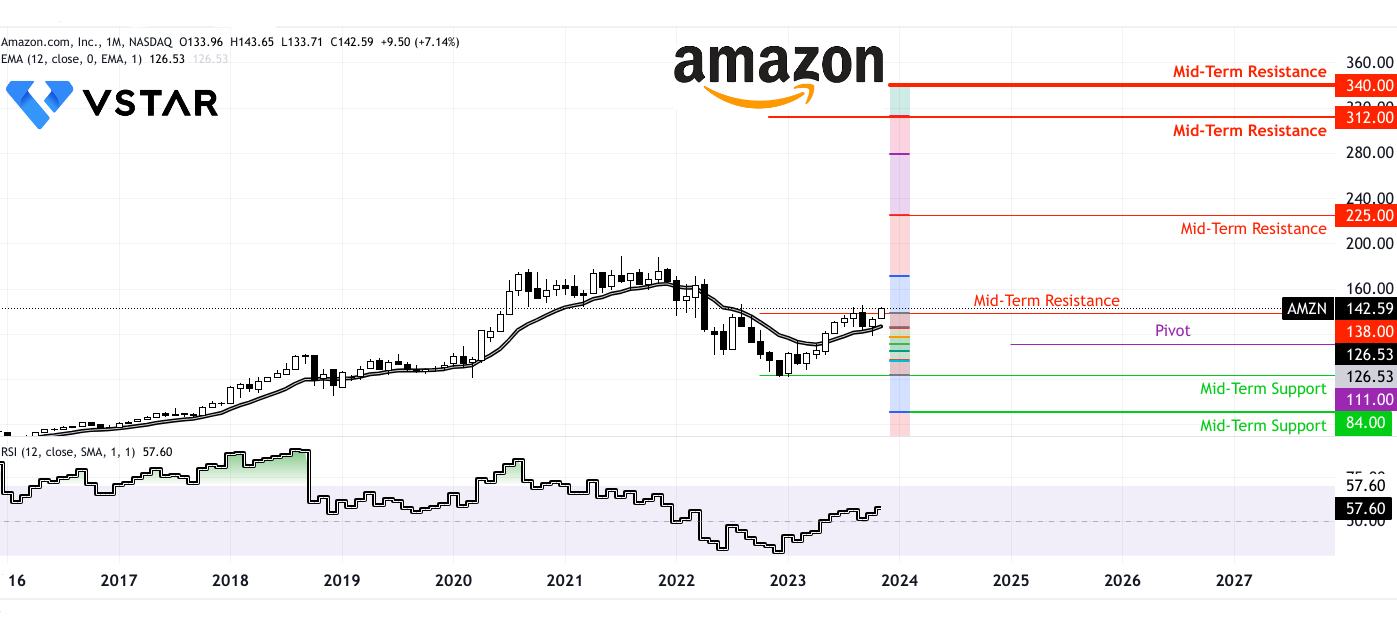

III. Amazon Stock Forecast 2025

Given the current momentum, Amazon stock is poised to potentially reach $312 by 2025, supported by a stabilized bullish trend over the 12-month EMA. Having completed a downtrend cycle with a full reversal of losses from 2022, the stock currently faces a mid-term resistance at the pivot level of $138. A failure to breach this resistance could lead to a retracement to $111 for support, with a further potential decline to $84 in a recessionary environment (mid-term support). However, reaching the long-term support at $50 appears unlikely.

On the upside, the stock may encounter mild resistance at $225, with an optimistic target of $340 by the end of 2025. The likelihood of reaching $312 is high, driven by potential rapid moves within the $200-$150 range, especially near all-time highs, and stabilization around $300, supported by bullish investor sentiment as the RSI approaches the overbought territory at 70 in the upcoming months.

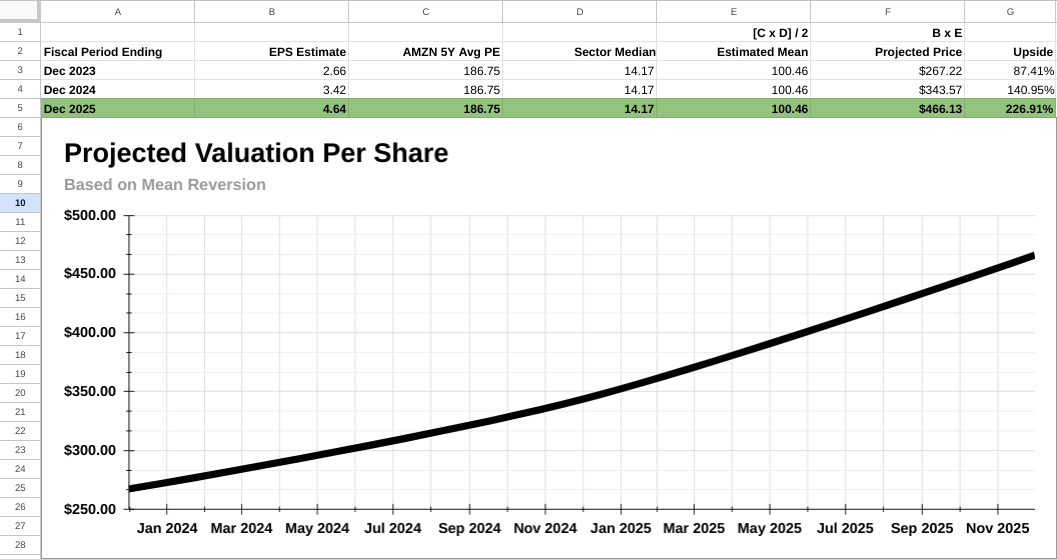

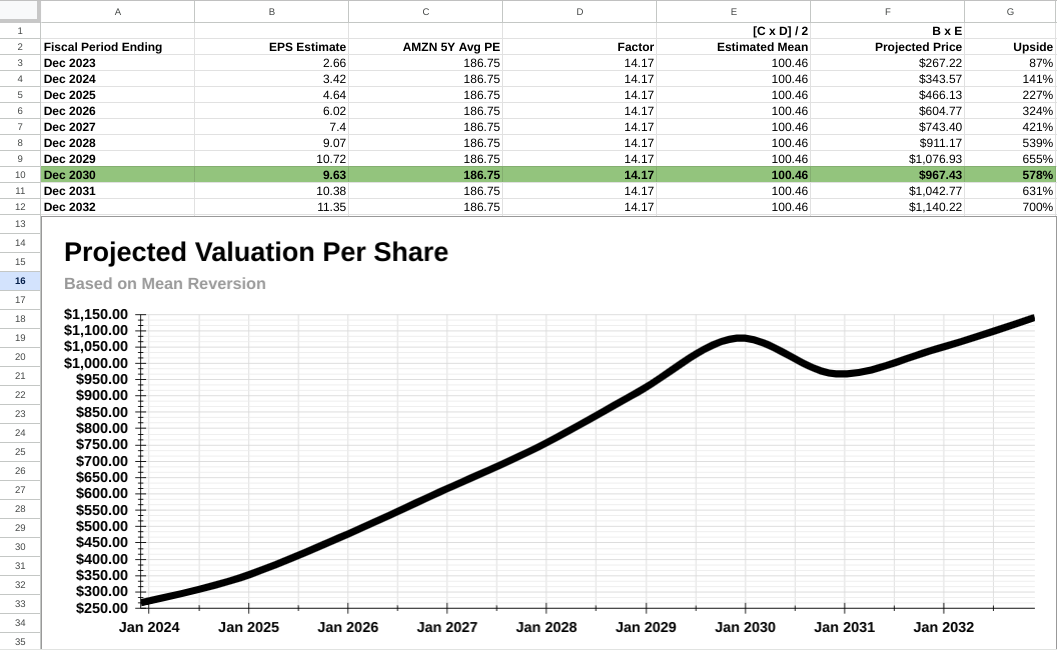

Quantitatively, Amazon stock appears undervalued with a Forward P/E ratio of 53. Applying mean reversion theory, there's potential for the P/E ratio to converge towards the long-term mean of approximately 186.75. This conservative projection aligns with the average of the 5-year historical P/E and the sector median, considering EPS expectations from market analysts (seekingalpha).

The 2025 Amazon stock forecast varies among sources, reflecting divergent opinions on the company's future performance. Coincodex predicts a 60.35% increase to $228.64, assuming a continuation of the average yearly growth of the past decade. In contrast, Gov.capital suggests a more optimistic outlook with a projected price of $419.083 by December 2025. However, coinpriceforecast.com anticipates a more modest rise, starting at $175, reaching $210 by the end of 2025, representing a 47% increase.

These disparities highlight the inherent uncertainty in stock predictions and the multitude of factors influencing market dynamics. Factors such as economic conditions, technological advancements, and competitive landscapes contribute to the challenge of accurately forecasting stock prices.

A. Other AMZN Stock Forecast 2025 Insights

Is Amazon stock a good buy? The AMZN stock forecast for 2025, as indicated by the Wall Street Journal, reflects an EPS estimate of 4.87, a Forward PE ratio of 53, and a AMZN price target of $258.11. This suggests a positive outlook for Amazon's future performance. Bank of America analyst Justin Post emphasizes Amazon's online retail model, highlighting high-margin third-party commissions and advertising sales as drivers for margin improvement. Post anticipates further multiple expansions, emphasizing the positive impact of recent AWS layoffs on segment margins. He predicts that an acceleration in AWS revenue growth will serve as a bullish catalyst for Amazon stock.

Source: WSJ

CFRA analyst Arun Sundaram also contributes to the optimistic forecast, citing potential AWS deals that could stimulate cloud revenue growth in 2024. Sundaram acknowledges the inherent variability in AWS deal volume, particularly as companies navigate the evolving landscape of generative AI adoption. Collectively, these analyses underscore Amazon's strategic positioning to capitalize on global e-commerce growth, cloud computing trends, and online advertising, reinforcing the positive sentiment reflected in the stock forecast and analysts' recommendations.

B. Key Factors to Watch for Amazon Stock Price Prediction 2025

Amazon Stock Prediction 2025 - Bullish Factors

Revenue and Earnings Growth: Consensus estimates project a robust growth trajectory for Amazon. The forecasted increase in EPS from $2.66 in Dec 2023 to $4.64 in Dec 2025 indicates a positive trend. Similarly, revenue estimates predict growth from $143.1 billion to $709.44 billion over the same period.

Operational Efficiency: Amazon's emphasis on regionalization in its fulfillment network has resulted in cost reductions and improved delivery speed. The strategic shift to 8 distinct regions has exceeded expectations, leading to higher in-stock levels, optimized connections, and faster deliveries, contributing to customer satisfaction.

AWS Performance: Amazon Web Services (AWS) remains a strong revenue driver. For instance, Q3 2023 revenue at $23.1 billion and a year-over-year growth rate of 12%. The stability in AWS's growth rate and the success in closing new deals suggest continued momentum in cloud services.

Amazon Stock Prediction 2025 - Bearish Factors

Elevated Costs: While operating income is impressive, the report acknowledges elevated costs, particularly in AWS, attributed to ongoing optimization efforts. The challenge lies in managing these costs as more companies transition to deploying new workloads in the cloud.

Economic Uncertainty: The report notes that some companies have been slow in finalizing deals due to economic uncertainties. While there's optimism about recent deal momentum, economic conditions could impact the pace of closed deals and overall revenue growth.

Competition in Streaming: The expansion of Prime Video with limited advertisements in 2024 aims to make it a profitable business. However, the streaming landscape is competitive, and success depends on the ability to offer compelling content and differentiate from other providers.

Overall, Amazon stock prediction reflects a positive trajectory, with strong revenue and earnings growth, operational improvements, and continued success in AWS. The bullish factors outweigh the bearish factors, indicating a favorable outlook. However, ongoing cost optimization efforts, economic uncertainties, and competition in certain sectors pose challenges that warrant monitoring.

IV. Amazon Stock Forecast 2030 and Beyond

Amazon stock, according to technical analysis, is poised to reach $646 by 2023, considering the Fibonacci extension derived from the current 12-month swing as a pivotal level for price projection. In 2023, the price found support at the long-term level near $84 and the pivot level at $90, with potential minor resistances at $260, $404, and $555 over the long term based on the macroeconomic market stance. The Relative Strength Index (RSI) indicates the initiation of another strength cycle.

From a quantitative standpoint, Amazon stock appears significantly undervalued, boasting a Forward P/E ratio of 53. Applying mean reversion theory, the P/E ratio may converge towards the long-term mean of approximately 186.75. To adopt a conservative approach, the projection considers an average of the 5-year historical P/E and the sector median, aligning with EPS expectations from market analysts (seekingalpha).

The provided Amazon (AMZN) stock forecasts from different sources paint an optimistic picture, projecting substantial growth over the next decade. According to coincodex, if Amazon maintains its current 10-year average growth rate, the stock is predicted to reach $744.38 by 2030, reflecting a remarkable 422.04% increase from its current value. Additionally, coinpriceforecast offers a more detailed breakdown, foreseeing the stock climbing to $250 in 2027, $400 in 2030, and reaching $500 by 2035.

The short-term predictions for 2025-2029 indicate a significant uptrend, with Amazon's price expected to surge from $175 to $390, reflecting a 123% increase. The forecast suggests a steady rise, starting at $175 in 2025, peaking at $210 by the year-end, indicating a 47% rise. Looking further into the 2030-2034 period, the projections anticipate a 25% increase, with the stock moving from $390 to $488. The year 2030 alone is expected to witness a jump from $390 to $406, indicating an impressive 185% surge.

These optimistic forecasts are rooted in the assumption of sustained growth rates, reflecting investor confidence in Amazon's long-term prospects and potential market dominance.

A. Other AMZN Stock Forecast 2030 and Beyond Insights

AWS stands out as a dominant growth engine, with the increasing adoption of artificial intelligence (AI) anticipated to be a significant catalyst for its cloud services. The CEO's emphasis on the centrality of data in AI aligns with AWS's comprehensive suite of services, making it well-positioned to capitalize on the AI trend. The conservative estimate suggests AWS could generate revenue of around $350 billion by 2030, assuming a substantial shift from on-premises to cloud IT spending.

Simultaneously, Amazon's core e-commerce business is expected to contribute significantly to future cash flow generation. Projections estimate potential revenue of close to $550 billion by 2030, driven by the overall growth in the e-commerce market, which is anticipated to reach around 20% of retail by the end of the decade.

Wild cards, such as healthcare and self-driving cars, add an element of uncertainty to the forecast. While their impact is challenging to quantify, a more conservative estimate assumes a relatively minimal contribution to overall growth.

So, is Amazon a buy? Combining these projections, a back-of-the-envelope calculation suggests Amazon's revenue could reach around $900 billion by 2030, potentially leading to a market cap of $2.5 trillion. However, the analyst expresses a belief that this is a conservative estimate, anticipating that AI and the wild card ventures will have a more significant impact than factored into the calculations. The analyst's gut feeling suggests that Amazon could be worth at least $3 trillion by 2030, doubling its current value.

Additionally, Morningstar analyst Dan Romanoff noted the positive financial impact expected from Amazon's advertising business, alongside improvements in e-commerce profitability and sustained growth in AWS. The importance of monitoring market share trends and keeping an eye on competitive threats is emphasized, as well as the need for Amazon to address underperforming segments, such as sales of groceries and luxury goods.

B. Key Factors to Watch for Amazon Stock Price Prediction 2030 and Beyond

As of the latest financial projections, Amazon stock forecast for the next decade presents a dynamic landscape, shaped by various factors that can influence its trajectory.

Amazon forecast 2030 - Bullish Factors

Consistent Revenue Growth: The consensus revenue estimates indicate a robust growth trajectory for Amazon. Despite the expected economic challenges, the company is forecasted to experience double-digit year-over-year growth in revenue through 2032. This reflects Amazon's ability to capture market share and capitalize on emerging trends.

Expanding Profit Margins: The consensus EPS estimates forecast a steady increase in earnings per share, with a peak expected in 2030. The YoY growth in EPS is particularly noteworthy, demonstrating Amazon's potential to enhance operational efficiency and profitability over the next decade.

Diversification and Innovation: Amazon's strategy of diversifying its business lines, including e-commerce, cloud services (AWS), and entertainment, positions it well for sustained growth. Additionally, investments in emerging technologies and innovations may contribute to revenue streams beyond traditional areas.

Source: precedenceresearch.com

Amazon stock projections 2030 - Bearish Factors

Declining EPS in 2030: The projected negative growth in EPS for 2030 stands out as a potential concern. A decrease in earnings could be attributed to increased expenses, economic downturns, or intensified competition. Investors may scrutinize Amazon's cost management and strategic decisions to understand the factors behind this anticipated decline.

Potential Saturation in Key Markets: As Amazon continues to expand globally, there's a risk of saturation in certain markets, leading to slower revenue growth. Sustaining the current growth rates may become challenging as the company navigates regulatory challenges and competition in established markets.

Market Sentiment and Investor Confidence: External factors, such as economic uncertainties, geopolitical events, or shifts in investor sentiment, could impact Amazon's stock performance. As the forward P/E ratios decrease towards 2030, it's crucial to monitor how market dynamics and macroeconomic conditions may influence investor confidence.

V. Amazon Stock Price History Performance

AMZN Stock Price Performance

1-Week to 5-Year Trends: Amazon's stock has displayed consistent positive returns over the past week, month, and 6 months, with 1-week returns at 1.83%, 1-month returns at 9.62%, and 6-month returns at 31.87%. The stock has outperformed the S&P 500 in these periods, indicating robust short to medium-term growth.

Longer-Term Trends: Over a 1-year period, Amazon has shown substantial growth, surpassing 63%. However, the 3-year performance reflects a slight decline of -10.55%, possibly influenced by various market dynamics. The 5-year and 10-year returns showcase the e-commerce giant's impressive long-term trajectory, with gains of 64.21% and a staggering 702.72%, respectively, outpacing the S&P 500 by a substantial margin.

Total Returns: Factoring in total returns, which include dividends and other sources of income, reinforces Amazon's strong performance, with 1-year returns surpassing 63%, and the 5-year and 10-year returns reaching 64.60% and 704.61%, respectively, once again outperforming the S&P 500.

2001-2010: Formative Years and Dot-Com Boom and Bust

2001: Amazon's stock faced challenges in the aftermath of the dot-com bubble burst. The market cap was $4.03 billion. The company navigated through the turbulent times with a focus on expanding its product offerings.

2004: Despite economic challenges, Amazon's market cap rose to $18.14 billion. The company's strategic expansion into new markets and continuous innovation played a role.

2009: Amid the global financial crisis, Amazon demonstrated resilience with a market cap of $59.72 billion. The company's focus on customer-centric strategies and the success of Amazon Web Services (AWS) contributed to its growth.

2011-2015: Prime, AWS, and Market Expansion

2011: Amazon's market cap reached $78.71 billion. The launch of the Kindle Fire and the expansion of Amazon Prime laid the foundation for future growth.

2013: With a market cap of $183.04 billion, Amazon continued its upward trajectory. The success of AWS and the acquisition of streaming service Twitch showcased its diversification strategy.

2015: Amazon's market cap surged to $318.34 billion. The company's focus on Prime, AWS dominance, and entry into new markets contributed to this milestone.

2016-2020: Trillion-Dollar Valuation and Pandemic Resilience

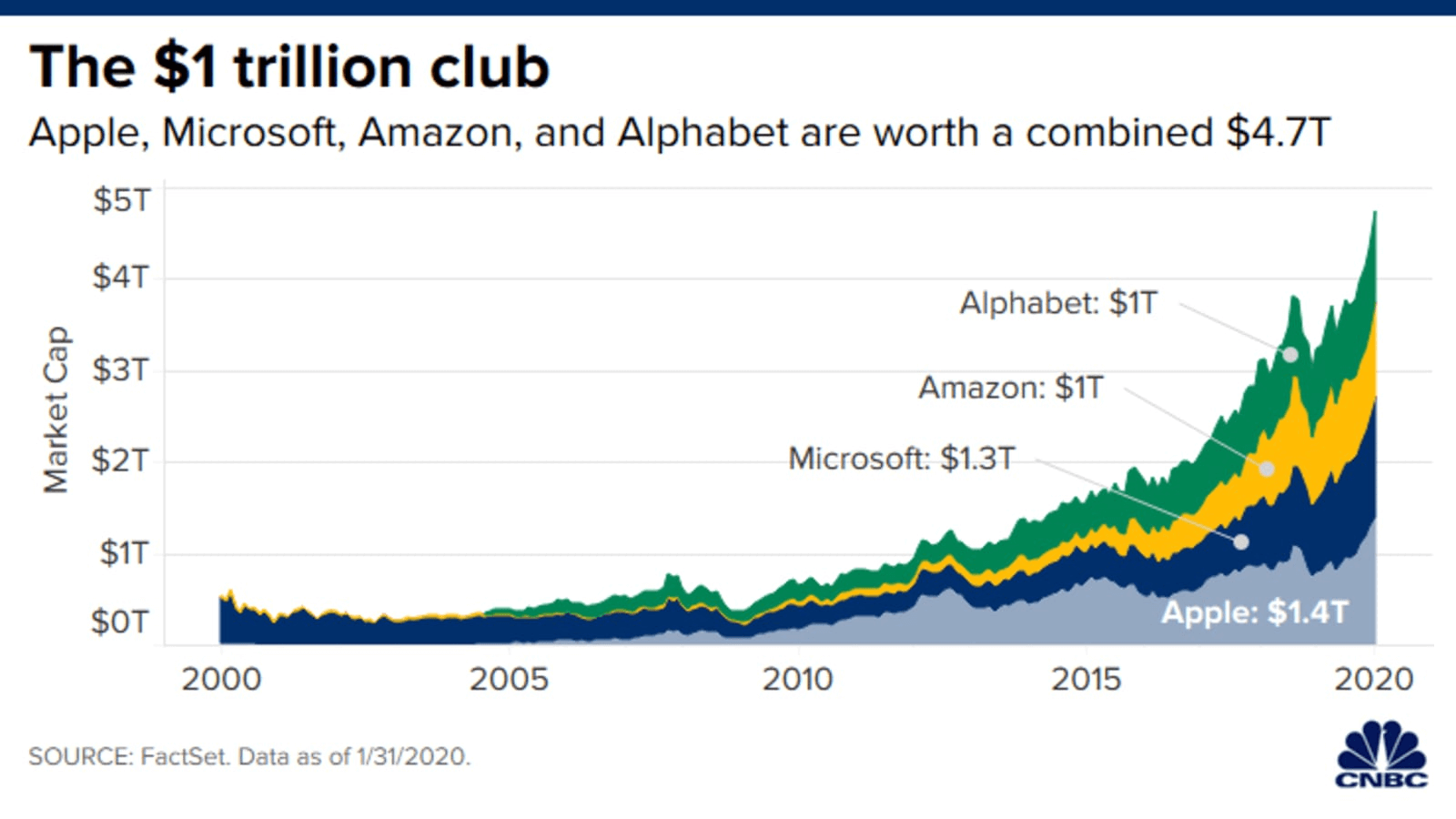

2018: Amazon became the second U.S. company to reach a $1 trillion market cap. The growth of e-commerce, AWS dominance, and successful ventures like Amazon Echo fueled this achievement.

2020: Despite the pandemic, Amazon's market cap was $1.634 trillion. The surge in online shopping and increased demand for cloud services underscored its pandemic resilience.

Source: CNBC

2021-2023: Market Cap Fluctuations and Continued Innovation

2021: Amazon's market cap reached $1.691 trillion. Continued growth in e-commerce, strong AWS performance, and ventures like Amazon Pharmacy contributed to this milestone.

2022: The market cap decreased to $856.94 billion. Factors such as increased competition, regulatory scrutiny, and economic uncertainties influenced the decline.

2023: Amazon rebounded with a market cap of $1.452 trillion. Strong financial performance, innovations in technology, and successful market strategies played a role in the recovery.

Throughout the years, Amazon's core competency in e-commerce has been a consistent driver.

VI. Conclusion

The trajectory of Amazon stock, as outlined in this analysis, presents a complex yet optimistic outlook. The company has demonstrated resilience, innovation, and a commitment to long-term success, evident in its robust financial performance, strategic initiatives, and market dominance.

Amazon Stock Price Predictions

2023 AMZN stock prediction

- Diverse forecasts suggest a potential range between $105 and $166.

- The midpoint of various projections positions the stock around $140 to $160, reflecting a positive trend.

2025 Amazon stock price forecast

- Amazon stock target price rojections range from $175 to $419, showcasing a broad spectrum of opinions.

- A stabilized bullish trend and strong momentum support a potential reach of $312, with variations based on different analyses.

2030 and Beyond Amazon stock projection

- Conservative estimates hint at $400, while optimistic projections soar to $744.38.

- AWS growth, e-commerce expansion, and innovative ventures contribute to a positive Amazon stock outlook.

AMZN Stock Investment Recommendations

Short-Term (2023)

- Current momentum and positive indicators support a potential surge to $162.

- Consideration of downside risks, including unfavorable macroeconomic conditions, is crucial.

Medium-Term (2025)

- Aiming for $312 with potential resistance at $225 and optimistic target at $340.

- Undervaluation signals according to Forward P/E ratios suggest room for growth.

Long-Term (2030 and Beyond)

- Diverse forecasts range from $175 to $744.38, with a consensus on sustained growth.

- Factors like AWS dominance, e-commerce expansion, and innovative ventures position Amazon for long-term success.

Why Trade Amazon Stock CFDs with VSTAR

- Leverage: Up to 1:200, allowing for more trading opportunities with smaller capital.

- Lower Trading Costs: $0 commission with transparent trading costs maximizes profit potential.

- Global Market Access: Access to a wide range of popular stocks from Asia, the US, and international markets.

- Lightning-Fast Execution: Milliseconds execution at the best market prices enhances efficiency.

In conclusion, while uncertainties and challenges exist, Amazon's strategic positioning, financial strength, and commitment to innovation provide a solid foundation for continued growth. Investors are advised to consider both short-term and long-term perspectives, aligning their strategies with the dynamic nature of the market and Amazon's evolving narrative.

FAQs

1. Is Amazon stock expected to go up or down?

With the current economic uncertainties, there are mixed opinions on the near-term direction, but long-term growth is still expected.

2. How much will Amazon be worth in 2025?

Various forecasts suggest different values for Amazon in 2025. Predictions range from around $175 to $419.

3. Will Amazon stock reach $1,000?

Reaching $1,000 per share in the next few years would require significant growth given the current price and growth projections.

4. Will Amazon stock reach $200?

Forecasts and current stock prices indicate that reaching $200 is a plausible scenario, but stock values are subject to change based on market conditions and company performance.