Introduction

Recent AMD Stock Performance

AMD continues to diversify its business to meet the market's desire. So, no wonder the recent technology evaluation opens opportunities for companies like AMD to progress more. The stock price of AMD, floating near $164.29, has remained on an uptrend over a year.

AMD Outperformed the S&P 500 in 2023

AMD showed a remarkable gain in 2023 by providing a 174% surge till February 2024. The continuous surge in the quarterly earnings report with the strong presence in the Artificial Intelligence (AI), were crucial factors for the bull run. Compared to AMD's strong price appreciation, the S&P 500 provided a 26% gain, which is much lower.

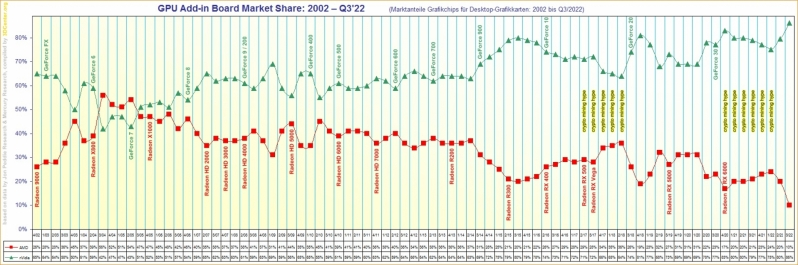

RX 6000 series GPUs

In recent years, a significant price fluctuation for AMD stock was seen in 2021, 52% higher than the yearly opening. This year, AMD launched the new RX 6000 series GPUs, which created competition in Nvidia's high-end GPU market. AMD grabbed a significant market share this year after launching the new product. Although the market share of the 6000 series is minor compared to Nvidia's 3000 series, there is more room to grow from the higher VRAM. Also, Arizona's $12 billion factory expansion was another achievement, which provided an early sign of future stock appreciation.

The above image represents AMD's GPU market share, which reached a record low after the launch of the 6000 series.

AMD's Zen 4 Architecture

A massive bearish was seen in the next year, but the price found a bottom at the 54.51 level, from where upward pressure has come. In the 138% year gain, key price drivers were next-generation Zen 4 architecture. This new architecture will deliver significant performance improvements for AMD's processors.

A massive innovation and Artificial Intelligence (AI) growth supported the American semiconductor company's successful year with minor decline. However, the AI war depends on the CPUs and requires software support. The chart shows the AMD stock price started in 2023 at nearly $64 and surged to nearly $130 by June with major declines. Then, in October, the price declined to nearly $93. However, the optimism about AI opportunities helped AMD's stock price to recover and since then, it has remained on an uptrend.

However, the technology sector is competitive, and no historical performance can guarantee future progress.

AMD's Presence In Artificial Intelligence (AI)

In 2023, Nvidia surpassed a market capitalization of $1 trillion, marking a momentous achievement as the first chipmaker to reach this threshold. Despite a significant annual growth of 123% in its share price, the complete realization of the company's potential has not yet occurred. Although Nvidia has attracted considerable interest due to its astounding 200% year-over-year share growth, other chip manufacturers that are investigating AI technologies in their nascent phases may present more substantial prospects for expansion. This particular attribute enhances the appeal of Advanced Micro Devices (NASDAQ: AMD) as a viable investment prospect within this industry.

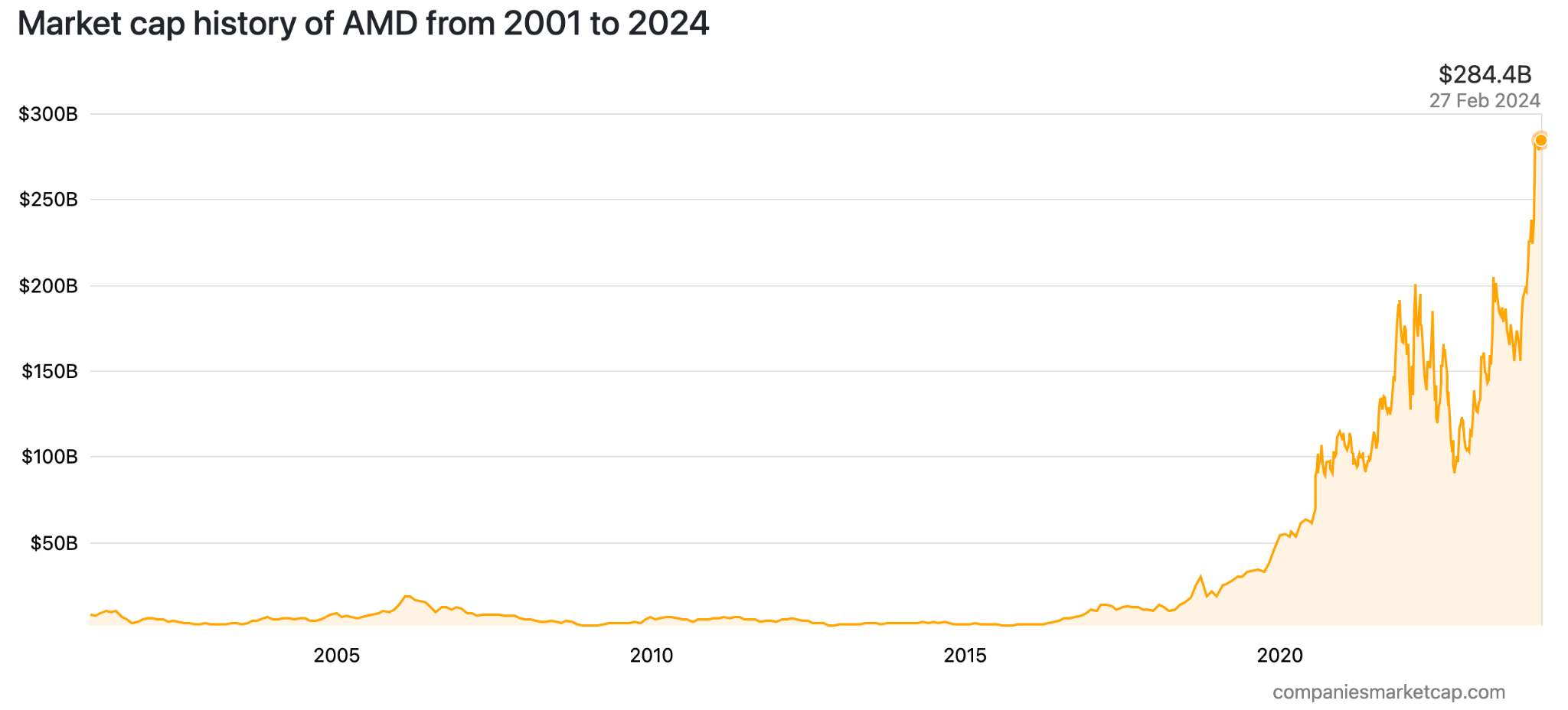

AMD Market Cap History

B. Expert Insights on AMD Stock Forecast for 2024, 2025, 2030, and Beyond

AMD provided a handsome return to its investors over the past five years. Chipmaker shares have surged nearly 600%, with more possibilities providing the same in coming years.

Let's see a glimpse of what analysts expect about this stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$411 |

$422 |

$990 |

|

Coincodex |

$ 261.16 |

$ 291.85 |

$ 3,658.16 |

|

Stockscan |

$310.92 |

$501.62 |

$688.58 |

|

BTTC Exchange |

$137.05 |

$195 |

$300 |

AMD Stock Forecast 2024

Following the ongoing price action and the recent Fibonacci Extension level, AMD stock has a higher possibility of moving beyond the all-time high level and reaching the 250.00 psychological mark before the end of 2024.

The weekly price of Advanced Micro Devices stock suggests a bullish continuation pattern initiated from the 54.90 low. As the recent price made a bullish break above the 164.90 existing high, an upward continuation is potent.

The dynamic 20-week EMA is crucial to bulls, while the 100-day SMA is a major support. Therefore, as long as the price trades above these lines, the buying pressure might extend beyond the 250.00 level.

In that case, the upward momentum might extend towards the 450.00 level as the extreme point.

Let's see the AMD stock outlook from other technical indicators:

- Relative Strength Index (RSI): The 14-week RSI is above the 70.00 line, suggesting an overbought market condition. Therefore, a decent downside correction is possible within 2024, creating another long opportunity.

- Moving Average Convergence Divergence (MACD): The MACD Histogram starts to lose bullish momentum when the signal line reaches the upper limit area. It is also an indication of a possible bearish correction.

- Average Directional Index (ADX): The current ADX line is above the 40.00 level, which suggests a stable market trend. The trend trading opportunity is valid as long as the ADX hovers above the 20.00 level.

According to Coinpriceforecast, AMD stock could reach the $303 level in mid-2024 before reaching the $413 level at the year's end. The gov.capital suggests the same structure but with a limited gain to the $252.75 area, which is a crucial Fibonacci Extension level.

A. Other AMD Stock Forecast 2024 Insights

Analysts' price targets for AMD stock in 2024 vary, with some predicting significant upside and others taking a more conservative approach. For instance, Traders Union suggests a AMD price target of $228.22 by the end of 2024, while others might have different estimations.

According to Motley Fool, AMD's earnings could hit just over $5 per share by the end of its next fiscal year. As a result, the stock price could rise 39% to the $239 level before the year's end, surpassing the S&P 500's 20% gain.

B. Key Factors to Watch for AMD Stock Forecast 2024

AMD is benefiting from artificial intelligence and the PC market's incremental improvement. Global personal computer shipments increased by 0.3% in the fourth quarter of 2023, the first increase in over a year. The gradual reduction of macroeconomic obstacles will facilitate additional advancements in the personal computer market through the year 2024.

The impact of these enhancements on AMD's financial performance is apparent. The client segment of the company's revenue increased by 42% year-over-year in the third quarter of 2023, reaching $1.4 billion. In conjunction with AI's potential, AMD seems positioned for significant expansion in 2024.

Strong liquidity is another bullish factor for this stock. The current ratio suggests a strong position as the current asset is 2.8X higher than the current liability. As the company has enough cash to run the day-to-day operation, any uncertain market condition might not affect the day-to-day business.

As demand for cloud computing and artificial intelligence (AI) increases, it is anticipated that the data center market will expand further. With EPYC server processors that are gaining ground against Intel offerings, AMD is well-positioned to capitalize on this trend.

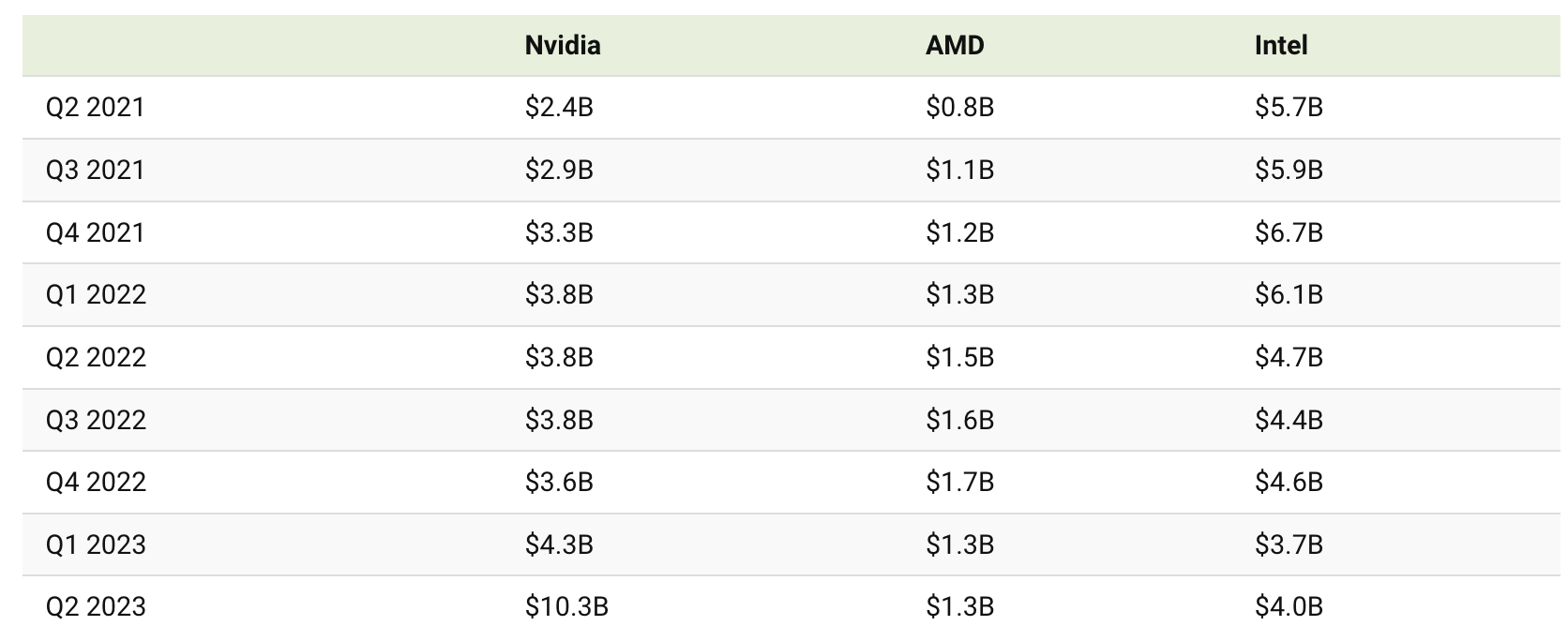

Source: visualcapitalist.com

With its Instinct accelerators, AMD is competing for a substantial portion of the AI processor market, which is a significant growth area. The critical determinant will be its ability to successfully capture market share and establish its technology in this rapidly expanding industry.

It is anticipated that the ongoing implementation of 5G technology will stimulate interest in AMD's mobile processors and other associated merchandise. It will be critical to its capacity to capitalize on this opportunity.

(1) AMD Stock Forecast 2024 - Bullish Factors

- Product launch: The favorable reception and prosperous debut of AMD's RDNA 4 graphics cards and next-generation Ryzen desktop processors on the market may bolster investor trust and revenue.

- Production expansion: AMD is proactively augmenting its manufacturing capacity to confront the scarcity of chips and satisfy the escalating demand. Adopting this proactive stance can alleviate supply chain obstacles and stimulate increased production and stock price appreciation.

- The integration of Xilinx: By effectively incorporating Xilinx, which it acquired in 2020, AMD has the potential to realize substantial synergies and expand its market presence and product portfolio, which could ultimately result in heightened profitability and stock valuation.

(2) AMD Stock Forecast 2024 - Bearish Factors

- Uncertain economic condition: A potential global economic downturn, escalating interest rates, and inflationary pressures could be challenging for AMD bulls. Macroeconomic headwinds may diminish investor confidence in AMD and the technology sector, potentially decreasing stock prices.

- Market competition: Emerging Chinese chipmakers and established competitors like Intel and Nvidia may pose formidable challenges to AMD stock.

- Supply-demand concern: AMD's production and delivery capabilities may be impeded due to the persistent processor shortage and possible future disruptions in the worldwide supply chain. Any sign of a lower supply could indicate a challenge for the production, resulting in a loss for the stock.

AMD Stock Forecast 2025

The ongoing bullish outlook with a stable innovation could take the AMD stock price to the 400.00 psychological level within 2025.

According to the weekly AMD chart, the rising trendline support could offer a long opportunity, followed by the rally-base-rally formation.

However, the recent price ticked at the multi-year high, where a recent downside recovery is pending before reaching the 250.00 psychological level. The dynamic 20-week EMA and 100-week SMA lines are supported by bulls. Any bearish correction to these lines could be a potential long opportunity, targeting the 360.00 level within 2025.

According to Coinpriceforecast, the upward pressure is solid, and the 2025 yearly close might happen at the $424.00 level before reaching the $413.00 level within the year.

Gov.capital provided a less optimistic outlook for this stock, setting the AMD target price at the 347.254 level at the year's end.

A. Other AMD Stock Prediction 2025 Insights

Motley Fool analyst, Parkev Tatevosian, CFA projected the EPS of AMD stock at $5.12, with the AMD stock price target at the $358.40 level before the year-end.

Seeking Alpha partner Chul Choi also provided an optimistic view of the AMD stock prediction, targeting the $190.00 level before the year-end of 2025.

According to Tradersunion, AMD stock might close 2025 at $268.78 level, after hitting the $246.12 level in the middle of the year.

B. Key Factors to Watch for AMD Stock Price Prediction 2025

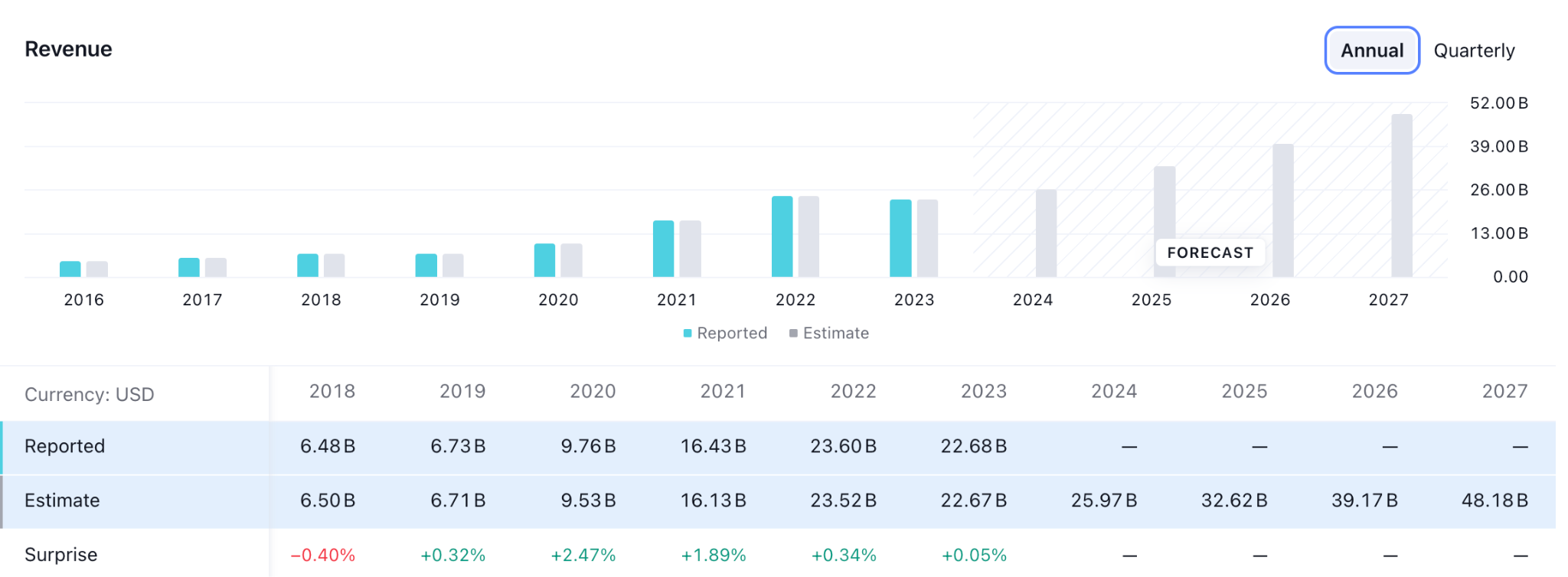

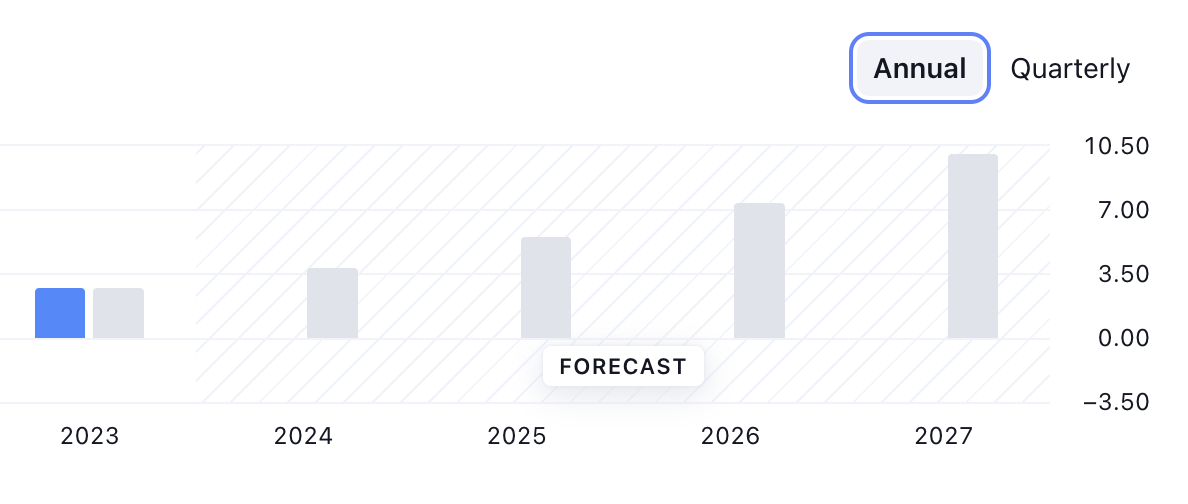

AMD Earnings Expectations

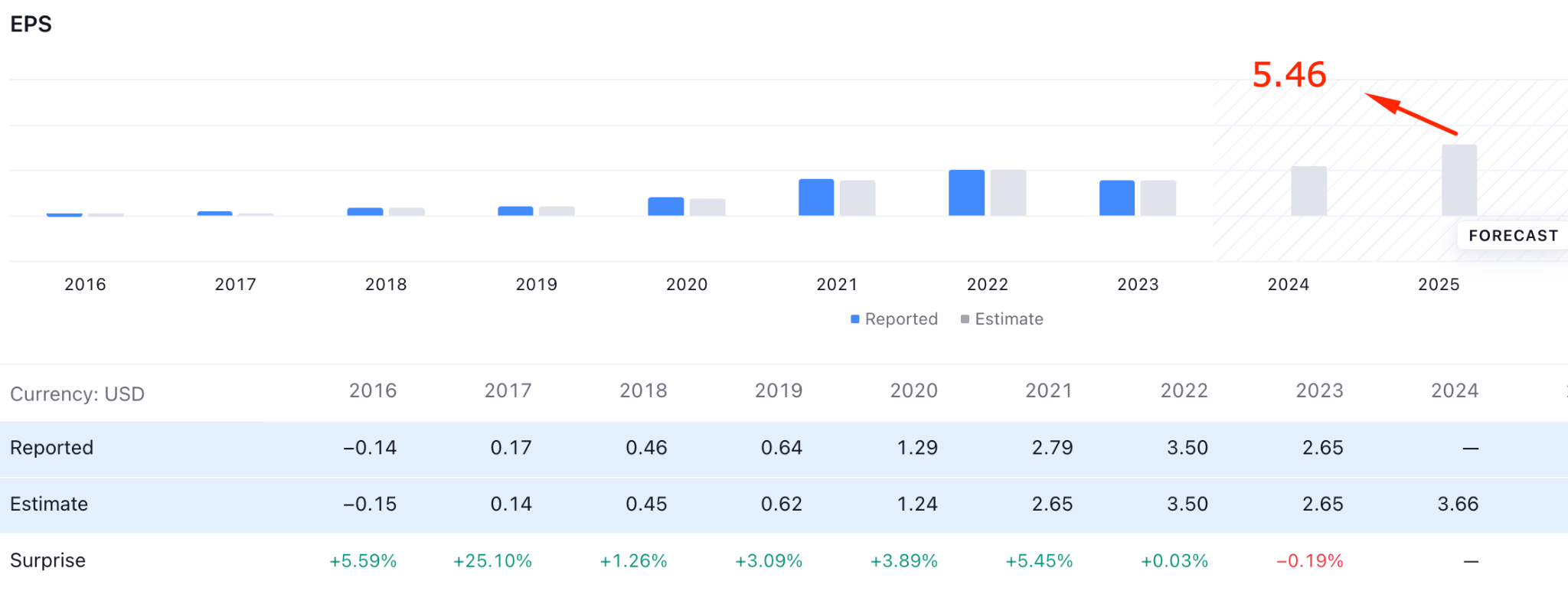

According to the latest data, AMD earnings could extend beyond the $5.00 per share and reach the $5.46 level before the year's end in 2025. In such a case, the bullish structure could remain valid, taking the price higher above any near-term levels.

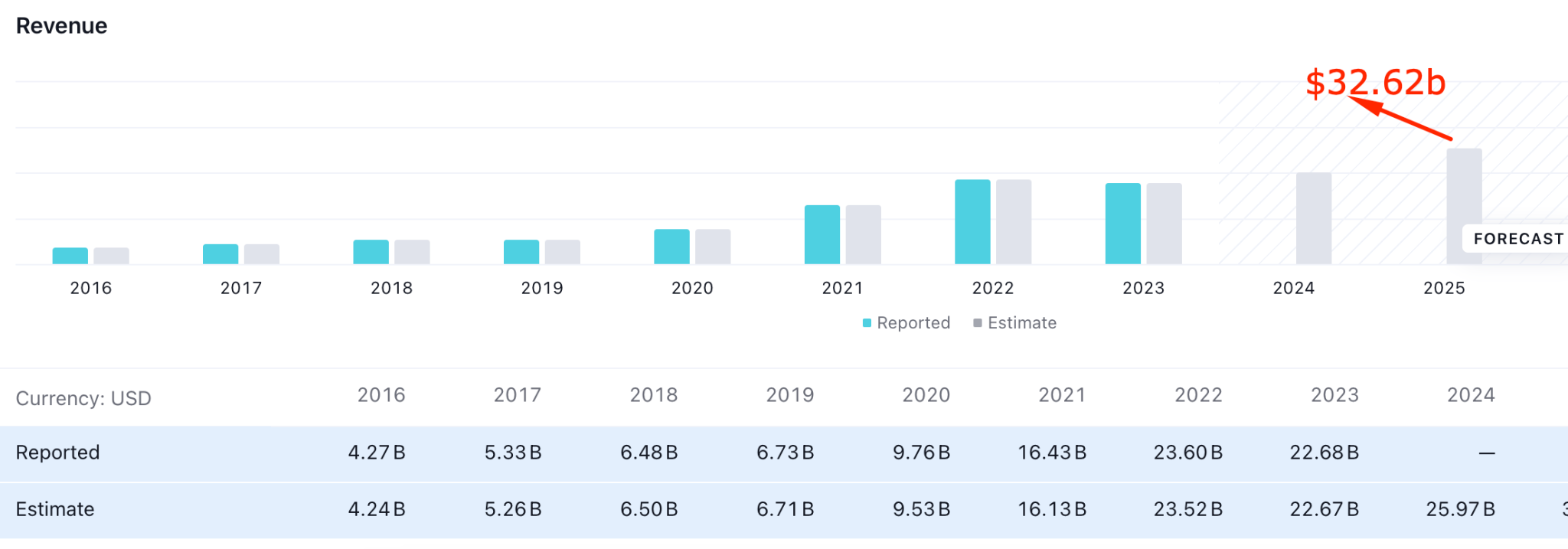

Following the EPS, the AMD revenue is also forecasted to provide a surge, where the current anticipation is to provide a $32.63 billion revenue in 2025, which is up from $25.97 billion in 2024.

To strengthen its foothold in the data center industry, AMD intends to compete fiercely with Intel for market share in server processors. It is anticipated that its EPYC processors will be instrumental in this undertaking. Investors should monitor AMD's business outlook report to gauge how the management implements this field in their outlook.

Source: amd.com

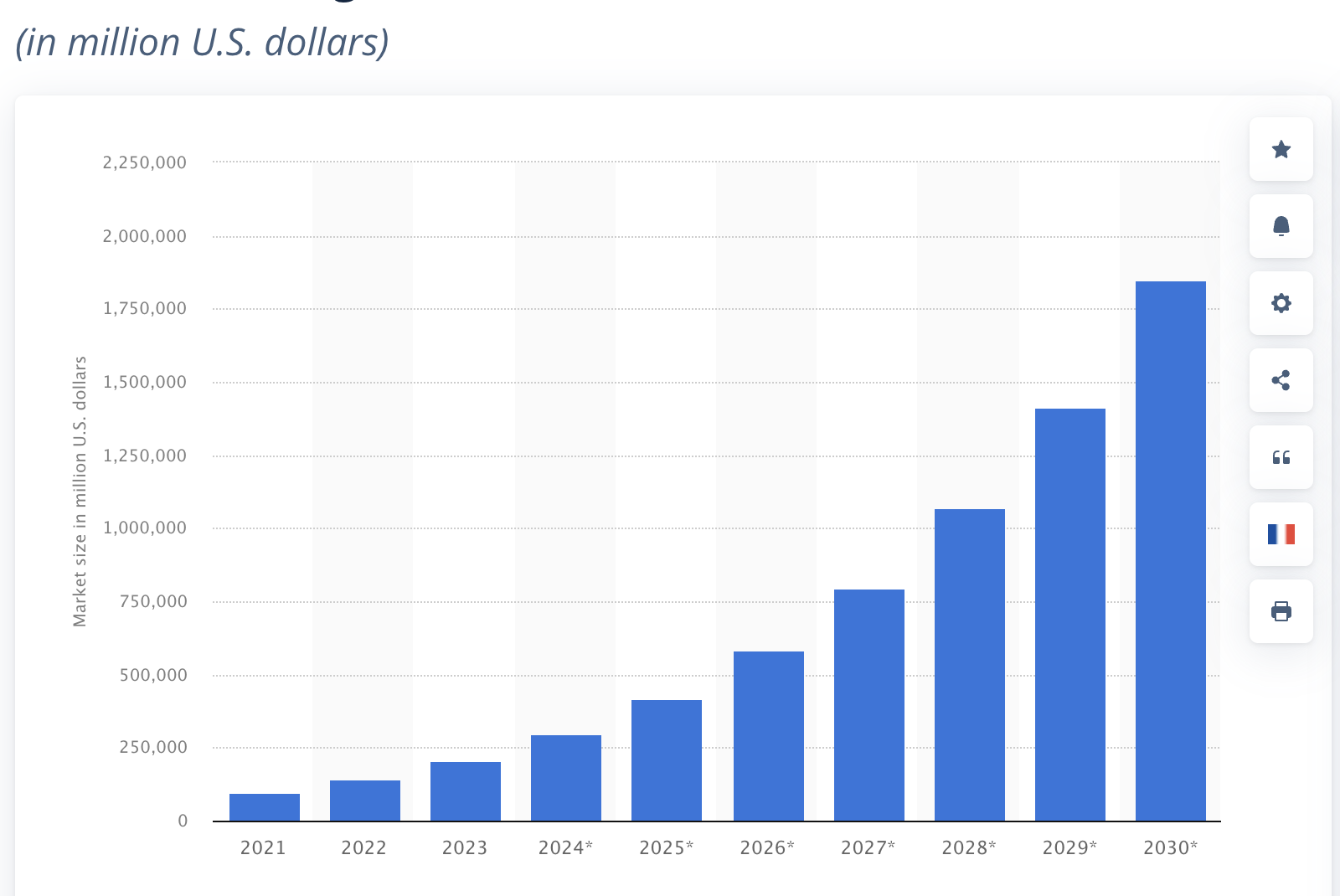

Another critical goal is to position itself as a frontrunner in the markets for artificial intelligence (AI) and high-performance computing (HPC) through its Instinct accelerators. Acquiring a substantial portion of this swiftly expanding sector can profoundly affect its subsequent earnings and expansion. As the AI market capital is rising and is forecasted to reach $4.2 billion in 2025, investors should monitor how AMD participates in it.

Source: statista.com

(1) AMD Stock Forecast 2025 - Bullish Factors

- With the provision of powerful and efficient mobile processors and related products, AMD intends to capitalize on the ongoing 5G deployment. Any development in this sector could indicate a business expansion, generating higher revenue.

- Ensuring a consistent release of groundbreaking products could be a bullish factor for this stock. Primary product lines such as CPU, GPU, and others will be indispensable for retaining market share and enticing fresh clientele.

- Focusing on R&D for next-generation technologies, such as chipsets and advanced packaging, will be imperative for the company to maintain its competitive advantage.

(2) AMD Stock Price Forecast for 2025 - Bearish Factors

- Investors might not be interested in this stock because it is expensive, even in the event of potential corrections in 2024. The upcoming earnings reports would be crucial in considering a pump-and-duck scenario for this stock.

- As the stock price recovers from any potential pullbacks in 2024, some early investors may choose to liquidate their holdings, resulting in brief price fluctuations.

- Potential trade conflicts and geopolitical tensions may impact the availability of critical materials and disrupt global supply chains. As a result, AMD's production might be affected and possibly affect its stock price.

AMD Stock Forecast 2030 and Beyond

Considering the upcoming surge in the AI market and innovation in next-gen GPUs, AMD's presence in the 5G market could break the $500.00 barrier for AMD stock and aim to reach the $1000.00 mark within 2030 and beyond.

AMD's monthly chart shows an open space above the current area. As the ongoing price action is bullish with no significant resistance, we may expect no pressure from the technical side to reach the $1000.00 mark.

Although a considerable downside correction is pending as a mean reversion, the upward pressure is intact from the 20-month EMA's position.

Let's see what other technical indicators say about AMD stock prediction 2030:

- Relative Strength Index (RSI): The highest RSI level in the last five years was 89.4 in July 2020. As the current level hovers at the 70.00 line with an all-time high area, investors might find it as a potential long opportunity as the RSI has more room upwards.

- Moving Average Convergence Divergence (MACD): The MACD signal line remains stable above the neutral level, while the Histogram is bullish. It is a sign of ongoing buying pressure, where bulls have a higher possibility of extending the momentum.

- Average Directional Index (ADX): The current ADX line shows a rebound from the 20.00 level, suggesting a stable market trend.

According to Coinpriceforecast, AMD stock price could reach the $993.00 level by the end of 2030 before tapping into the $1000.00 mark in 2031.

Coincodex provided a more optimistic outlook for AMD stock, setting the AMD target price at the $ 3,663.15 level by the end of 2030.

A. Other AMD Stock Forecast 2030 and Beyond Insights

The theglobeandmail.com provided an outlook for the AMD stock. According to the report, If the present momentum continues, AMD's earnings per share could increase substantially over the next five years, reaching $36 by 2030. Based on the present price-to-earnings (PE) ratio of 37, the potential share price in 2030 could amount to $1,330.

Another report from Stockscan suggests that AMD price prediction could rise up to the $693.16 level within 2030.

B. Key Factors to Watch for AMD Stock Forecast 2030 and Beyond

Balancing aggressive market expansion with maintaining healthy profit margins will be crucial for long-term financial sustainability and attracting investors. As of now, the earnings forecast is positive, with $9.91 forecasted EPS for 2027. However, investors should monitor how the company achieves these levels in the future, keeping the revenue stable.

Forming strategic partnerships with other companies could accelerate innovation and expand into new markets. Besides, the key revenue-generating area for AMD is the CPU and GPU market, which is expected to reach record levels in 2030. Following the trend, AMD could make a strong position in the industry to grab the maximum market share.

Source: finance.yahoo.com

(1) AMD Stock Price Prediction for 2030 and Beyond - Bullish Factors

- AMD's steadfast dedication to ongoing innovation and its robust product roadmap indicate a consistent flow of enhanced and novel products, ensuring its long-term competitiveness. Any sign of a revenue expansion or a new product implementation could be a bullish factor for this stock.

- Technological advancements such as neuromorphic and quantum computing could potentially provide AMD access to new markets, resulting in additional revenue growth and stock appreciation.

- Prominent market expansion drivers include the Internet of Things (IoT), cloud computing, and artificial intelligence (AI)-related developments in data centers. A significant long-term opportunity arises for AMD's data center processors as a result of this.

(2) AMD Stock Predictions for 2030 and Beyond - Bearish Factors

- AMD's competitive standing and financial performance may be influenced by its capacity to implement its business strategy, which encompasses product development, manufacturing, marketing, and distribution. Neglecting to fulfill customer expectations, failing to deliver high-quality products timely, or ineffectively managing costs may hurt AMD's stock performance.

- AMD utilizes a sophisticated global supply chain to manufacture its products. Natural disasters, geopolitical tensions, trade disputes, or shortages of semiconductors are examples of supply chain disruptions that could hinder AMD's ability to meet demand and hurt its financial performance.

- Economic recessions or downturns may impact consumer expenditure and corporate investment, which may affect the demand for AMD's products. Inflation, currency exchange rate fluctuations, and interest rate swings are additional factors that can affect AMD's profitability and stock performance.

AMD Stock Price History Performance

- 2019: AMD announces the acquisition of Xilinx, a major player in programmable logic devices. The price reaches $32.20. As the investor sentiment remains positive, the stock closed the year at $49.24 level.

- 2020: AMD launched the new 7nm Ryzen processors, further strengthening AMD's position against its strong competitor, Intel. However, the whole year was volatile regarding the Covid-19 pandemic.

- 2021: AMD launched the Radeon RX 6000 series graphics cards, further establishing AMD in the high-end GPU market. Moreover, a $12 billion factory expansion in Arizona indicated a strong market presence for this company. As a result, the price reached the 117.94 peak during the year and closed with a remarkable profit at the $149.44 level.

- 2022: AMD released the Ryzen 7 6800X processor, which maintains AMD's competitiveness in the CPU market. As a result, the price reached the 7-year high of $164.46 but closed at the $101.79 level due to economic uncertainties.

- 2023: AMD unveiled the next-generation Zen 4 architecture, generating renewed investor interest. The stock passed a positive year, closing at the $149.22 level at the year-end.

Conclusion

AMD stock has experienced significant growth in recent years, driven by strong product launches, market share gains, and increasing demand for its products in key growth areas like artificial intelligence and data centers.

So, is AMD a good stock to buy? Analysts are generally bullish on AMD's future prospects, with some predicting continued stock price appreciation in the coming years. However, it is important to remember that the stock market is inherently risky, and there is no guarantee that AMD stock price will continue to rise.

This report has provided a comprehensive overview of AMD stock, including its historical performance, future AMD forecast, key factors to watch, and potential risks and opportunities. By understanding these factors, investors can make informed decisions about whether AMD stock is a suitable investment for them.

Besides, finding a regulated and trustworthy platform to invest in a stock is a crucial factor for investors. For this case, VSTAR would be a good choice to trade AMD stock CFDs. It is easy to diversify your portfolio in currencies, stocks, indices, gold, and oil at the lowest cost through this platform. Investors can experience 0 commission, super tight spreads, and super fast order execution, which might save time and effort in financial market trading.

Other crucial benefits of the VSTAR platform are - an easy-to-use interface, lower minimum deposit requirement ($50), negative balance protection, demo trading facility, and most importantly - the multi-regulated trading environment.

FAQs

1. Is AMD Stock a Buy, Sell or Hold?

With the current price near its 52-week high of $214.81, AMD stock could be considered a hold or a sell for investors looking to take profits. However, it could still be a buy for long-term investors who believe in the company's growth prospects.

2. Is AMD a dividend stock?

No, AMD does not currently pay dividends. The company has focused on reinvesting its profits back into the business for growth.

3. What is the prediction for AMD stock?

Analysts have generally been bullish on AMD, with many predicting continued growth driven by its strong position in the CPU and GPU markets.

4. What will AMD stock be worth in 2025?

Based on analysts' projections and AMD's expected growth trajectory, some estimates suggest that AMD stock could potentially reach $300-$350 per share by 2025.