As one of the largest game developers in the world with best-selling games like Call of Duty and Diablo, Activision Blizzard has had a relatively good run in the market and has shown consistent growth in recent years.

However, its possible merger with Microsoft has thrown the company into the spotlight and increased the volatility of Blizzard stock as investors anticipate the possible outcome of the deal now that it is under review by regulators. But regardless of the deal, is Activision Blizzard stock a buy? It is safe to say that it is because there are a lot of factors working in its favour.

Background Story

Activision Blizzard started as two independent companies. Activision was founded in 1979 as an entertainment and gaming company in Santa Monica California, United States. On the other hand, Blizzard Entertainment was founded in 1991 as Silicon & Synapse until its name was eventually changed in 1994.

In 2008, Activision merged with Vivendi Games, a French media conglomerate that was the principal holding company for Blizzard Entertainment, and the merger brought Activision and Blizzard together. However, by 2013, Vivendi Games was no longer the parent company of the gaming company as it became an independent company after purchasing a majority of its shares from Vivendi. Brian Kelly and Bobby Kotick are the Chairman and CEO of the company respectively.

Activision Blizzard owns some of the most popular games in the world like Call of Duty, Candy Crush, Warcraft, Skylanders, Starcraft, and Hearthstone.

Business Model and Services

Activision Blizzard Inc has grown to become one of the most successful video game developers and publishers in the world, establishing various revenue streams along the way.

The video game developer focuses on creating an immersive gaming experience to cater to various consumer segments like eSports enthusiasts, advertisers, hardcore gamers, and casual players. They distribute their products through various channels like physical retail stores, digital downloads, and partnerships with platform providers like Microsoft, Sony, and Nintendo.

Activision Blizzard's main source of revenue is through the sales and downloads of its popular game franchises. The company mostly generates its revenue through game sales, in-game purchases, advertising, subscriptions, and licensing agreements. This ensures that they have consistent revenue coming in and room for generating additional revenue.

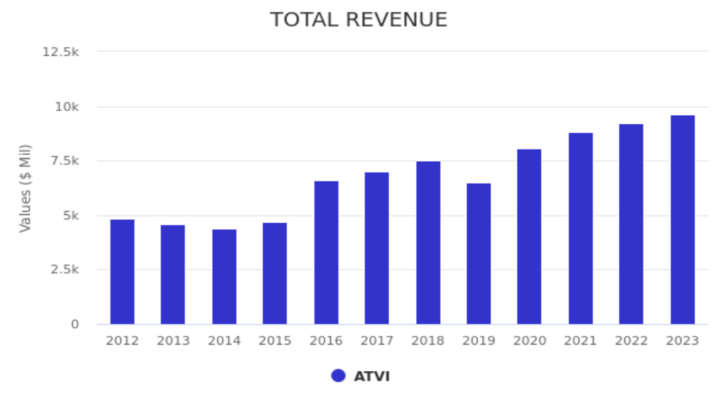

Key Financials and Growth

The company ended 2022 strong as it reported its Q4 earnings 2022 of $403 million and full-year revenue of $2.3 billion compared to its $2.2 billion revenue from the year before. Net bookings rose to $3.57 billion from $2.49 billion in the fourth quarter of 2021. Its financial report for the first quarter of 2023 also came out strong, revealing significant growth in major business segments. The company’s YoY net revenue grew by 35% from $1.77 billion in Q1 2022 to $2.38 billion in Q1 2023. Its operating income experienced the best jump, growing by 70% YoY.

Its GAAP operating margin is 34% and its earnings per diluted share is $0.93 compared with $0.50 for Q1 2022. On the other hand, its non-GAAP operating margin is 40% and earnings per diluted share is $1.09 compared with $0.64 in Q1 2022. However, Activision Blizzard’s monthly active users decreased from 389 million to 368 million. With a market cap of $62.2 billion, the company’s earnings are forecasted to grow by 4.99% per year.

When it comes to the company’s balance sheet, its saving grace is its low debt levels. It has $12.6 billion in cash and $764 million in receivables compared to its $7.28 billion in liabilities so, it could offset its liabilities with ease.

Key financial ratios and metrics

For the past three years, ATVI revenue has been declining but its other fundamentals puts it on the same level as its peers. While ATVI has a forward EV/EBITDA multiple of 12x, its peers Take-Two Interactive and Electronic Arts have multiples of 20x and 13x respectively. ATVI has the strongest free cash flow rate compared to the other two companies with 25% while Take-Two’s rate is close to zero and EA’s 16%.

Activision Blizzard is trading at a P/S of 7.5 and P/E of 32.7 suggesting a strong valuation even without the pending Microsoft merger. Meanwhile, EA is trading at a P/S of 4.6 and P/E of 43.3 meaning that it may be slightly overvalued when compared to the industry’s average. On the other hand, Take-Two’s P/E ratio of 71.43 makes it overvalued.

How is ATVI stock doing?

A. Trading Information

Primary exchange & Ticker: NASDAQ: ATVI

Country & Currency: USA (USD)

Trading Hours: Investors can trade in the pre-market hours (4:00 - 9:30 am) and after-hours market (4:00 - 8:00 pm).

Stock Splits: ATVI stock underwent a total of 6 stock splits

Dividends: $0.47

Dividend yield: 0.61%

Latest developments investors/traders should note

Microsoft’s takeover

Microsoft announced its plans to acquire Activision Blizzard in 2022 offering to acquire the company at $95 per share or $68.7 billion in an all-cash transaction. Various regulatory boards have approved the acquisition of Activision Blizzard and if the purchase goes through, Microsoft will have the best library in cloud gaming.

First Quarter 2023 Financial Results

The video game developer released its first quarter financial earnings showing very strong earnings. The revenue for its Blizzard Entertainment segment increased by 62% along with a growth in total mobile revenue with Call of Duty, Candy Crush, and Diablo Immortal bringing in the most revenue.

B. Overview of ATVI Stock Performance

After Microsoft’s $69 billion takeover of Activision Blizzard in 2022, ATVI stock has enjoyed a steady rise. Despite the pushback by some regulators, ATVI has achieved over 2.73% year-to-date as of May 22nd, 2023, and 15% in the past 6 months. The price however has slumped by more than 28% from its all-time high of $102.70 on February 2021. Activision stock is currently trading at $79 and is likely to increase pending the eventual purchase by Microsoft.

C. Key drivers of ATVI Stock Price

Success of Games

Investors are confident in Activision Blizzard’s continued growth mainly because of how successful their games continue to be. Candy Crush is the top-grossing game in the US app stores for the 23rd consecutive quarter.

Growth in the esports market

There is a steadily growing audience of video game spectators and Activision Blizzard currently owns 21.85% of the eSports market share worldwide. The company still has a lot of games that can become a famous eSports discipline. Microsoft is already in the eSports market as well but holds a much smaller position compared to the video game company.

If the purchase goes through, Microsoft is expected to support Activision's existing eSport disciplines like Starcraft 2 and Warcraft 3 and Microsoft might not change much of its existing business model.

D. Analysis of prospects of ATVI Stock

With its strong Financials and revenue from various sectors, Activision Blizzard stock is a hold but the growth potential for the company is now largely affected by the Microsoft deal. If negotiations fall through, ATVI stock price will drop to anywhere between $60-$70 which would present an excellent buying opportunity for those who still believe in the game developer and what it has to offer. But if the deal does go through, it is likely for ATVI stock price to rise by at least 12% in the months following the purchase.

Their Q1 2023 earnings did exceed market expectations but Activision is still experiencing year over year decline in revenues. For instance, its $7.5 billion reported revenue for 2022, was lower than 2021's $8.8 billion by nearly 15%.

But if Activision can grow and maintain 8-10% revenue growth for the next five years, it will be able to reach about $11 billion in revenue by 2028 and this is very possible because it is a large publisher with a lot of room for organic growth.

Risk and Opportunities

A. Potential risks

1. Tough Competition: In the gaming industry, the company is competing with Ubisoft, Electronic Arts (EA), CD Projekt, and Take-Two Interactive. As a hardware manufacturer, the company competes with Microsoft, Nintendo, and Sony Entertainment.

2. Legal Issues: Activision Blizzard is facing legal issues after being sued in April by the US Department of Justice over allegations that it established a "competitive balance tax." This isn't the first time the company has been embroiled in legal Issues recently because it faced a lawsuit back in 2020 from the California Department of Fair Employment and Housing after some of its employees walked out due to harassment and discrimination.

3. Acquisition pushback: The potential acquisition by Microsoft is making waves in the industry because it will be the biggest gaming deal in the history of the industry. However, there has been significant pushback because it is one of the biggest game publishers and regulators worry that it will give Microsoft too much power.

B. Opportunities for growth

1. The success of Call of Duty: The Call of Duty franchise has experienced major success on all types of platforms and the revenue it brought last year, was majorly due to the launch of the game in the Asia-Pacific region through the Steam platform. Also, players are anticipating the 2023 release of Call of Duty which will possibly be out in November.

2. Consistent cash flow in the face of economic uncertainty: The last three years, have resulted in some of the most volatile markets in recent history and the financials of most companies have taken a nosedive as a result of this.

Although Activision Blizzard's revenue has been steadily declining, its cash flow and revenue are still relatively steady with healthy levels of profitability from 2020 till now.

3. Maintains a direct connection with customers: One of the main reasons why Activision has remained profitable is because it remained directly connected to the players and customers that spend money while playing its games.

Future Outlook and Expansion

Activision got off to a strong start in 2023 in 2023 following the release of their quarterly earnings for 2023. Activision Blizzard games are some of the best in the industry and analysts’ Activision outlook for the year is relatively positive with an expected growth in full-year bookings by 24%. Activision stock price is also forecasted to be over $90 by the end of the year. Plus, with the emergence of new technologies like cloud gaming, VR/AR, and the development of the metaverse, there are a lot of growth opportunities and room for the development of more Activision games.

How to Invest in ATVI Stock

There are different ways you can invest in Activision stock:

1. Hold the share:Long-term hold is a great way to go when it comes to buying video game stocks like ATVI. There is still a lot of room for growth and the possible benefits of the Microsoft purchase are still important to consider.

2. Options: ATVI options are relatively safe to invest in because if used well, you can amplify the gains made on the movement of the underlying stock. Also, you will lose the amount you paid for the options contract if the market turns against you.

3. CFDs: Activision Blizzard stock has been going up and down since news of the acquisition came out and the current price movement, provides a good opportunity to invest in ATVI CFDs. You can make a profit on the difference between prices and use leverage to increase your position in the market easily.

It is also a suitable option for beginners because it is a means of short-term investing and you don't have to wait for months or years before you can make a profit.

Why Trade ATVI Stock CFD with VSTAR

The VSTAR trading platform offers several advantages for traders who want to invest in ATVI CFD and have an edge over the market:

Low fees and commissions: You pay zero fees and commissions to the platform to trade meaning that you get to keep all of the profits made from trading.

24/7 trading: You can invest in ATVI stock CFD and other gaming stocks and esports stocks any day and any time with no difficulty.

Licensed and Regulated: VSTAR adheres strictly to global regulatory requirements and every deposit made, is kept completely separate from the company’s funds.

How to trade ATVI Stock CFD with VSTAR - Quick Guide

VSTAR's easy-to-use platform makes trading ATVI CFD convenient from your phone or laptop. All you have to do is:

● Open the VSTAR website or the app

● Click on “Start trading now” to get registered. You can also choose to use the risk-free demo account to practice.

● Type in your email and password

● After login, submit your personal information and finish up your profile

● You are ready to start trading!

Conclusion

Activision has a lot of avenues for growth such as collaborating with creators, leveraging on new technology like cloud gaming, exploring profitable partnerships, and investing in emerging markets. Long-term, the video game developer is a solid buy as it still has a strong path to success despite the uncertainty of the Microsoft purchase and workplace reports. Activision Blizzard has also demonstrated its ability to be flexible and adapt to changing market and economic conditions ensuring long-term success for the company and its investors.