The AUDUSD currency pair is currently facing a challenging environment marked by significant factors on both the Australian and US fronts.

Australian Factors

Cash Rate Target:

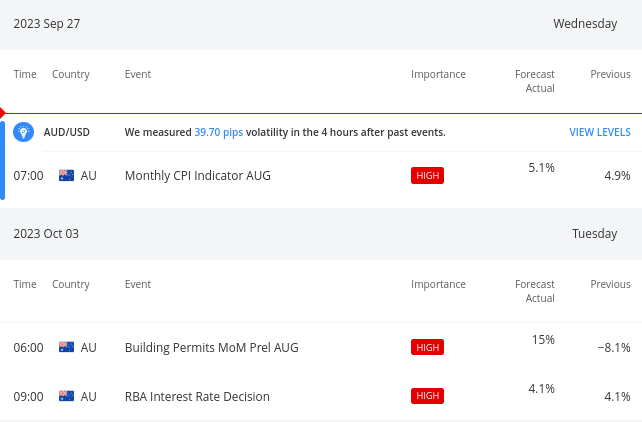

As of September 6, 2023, the Reserve Bank of Australia (RBA) maintained its cash rate target at 4.10%. The RBA's decision indicates a commitment to a neutral monetary policy stance. However, with inflationary pressures persisting, there is potential for future rate hikes. The next update is scheduled for October 3, 2023.

Inflation (Consumer Price Index):

Annual Change June Quarter 2023: Inflation in Australia remains elevated, standing at 6.0% in the June quarter of 2023. This high inflation rate could impact the RBA's policy decisions in the coming months.

Monthly Indicator July 2023: The monthly data reveals that inflation remained a concern, with a rate of 4.9% in July 2023. It suggests that inflationary pressures are not subsiding quickly.

US Factors

US Dollar Strength:

The US dollar (USD) has surged, reaching a ten-month high against major currencies. This strength is attributed to rising US bond yields and the Federal Reserve's stance on interest rates.

US Treasury Bond Yields:

The 10-year US Treasury bond rate has climbed to 4.533%, reflecting the Federal Reserve's commitment to a "higher for longer" interest rate policy. This has attracted investors to the US dollar, putting pressure on other currencies like the Australian dollar.

Federal Reserve Policy:

While Federal Reserve officials, including Boston and San Francisco Fed Presidents, advocate for a cautious approach to monetary policy, they have not ruled out the possibility of further rate hikes. This stance creates uncertainty in the financial markets and affects currency exchange rates.

Global Economic Context:

There are concerns about a potential slowdown in the global economy. Weakness in the Chinese economy, characterized by deflation risks and rising unemployment, has a direct impact on the Australian dollar. Australia's close economic ties with China make it vulnerable to fluctuations in the Chinese economy. Ongoing concerns about a global economic slowdown, particularly in China, will continue to be a significant factor affecting the AUDUSD pair. Any deterioration in global economic conditions could lead to risk aversion and a stronger US dollar.

RBA Policy:

The RBA's decision in the coming months will be pivotal. If inflation remains stubbornly high, the RBA may feel compelled to raise interest rates again, which could provide support for the Australian dollar.

US Federal Reserve:

The Federal Reserve's monetary policy will continue to influence the AUD USD pair. If the Fed maintains its hawkish stance, with the possibility of more rate hikes, it could further strengthen the US dollar and weaken the Australian dollar.

The release of monthly inflation data for August and other economic events should be closely watched. If inflation accelerates beyond expectations, it may increase pressure on the RBA to act decisively on interest rates.

Source: vstar.com

The technical perspective on the weekly moves of AUD/USD can be comprehended as follows:

Data source: tradingview.com

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.