Navigating the intricate web of global financial markets is akin to charting a course through a bustling metropolis. As we delve into the Weekly Performance and Outlook for the week of August 28–September 3, we find ourselves at a juncture where economic indicators, policy pronouncements, and market sentiment intertwine to shape the trajectories of key assets.

Gold's once robust rally now pauses in anticipation of pivotal data releases and the Federal Reserve's measured stance. Crude oil's fortunes dance at the crossroads of supply dynamics and stormy weather, while cryptocurrencies grapple with regulatory riddles. Currencies, like intricate threads, weave patterns of yield, sentiment, and central bank rhetoric. Amidst this bustling financial cityscape, the article delves into the fundamentals that will shape the ongoing week.

Gold / XAUUSD

Fundamental Outlook

The recent trajectory of the gold price indicates cautious market sentiment as investors anticipate upcoming economic data releases. Following a robust rebound, gold's momentum has stalled as stakeholders await fresh catalysts. Federal Reserve Chair Jerome Powell's inclination toward maintaining price stability leaves room for potential policy adjustments. Cleveland Fed President Loretta Mester's endorsement of an additional interest rate hike introduces an element of hawkishness.

At $1,903.60, gold's pivotal support level remains defended, but the metal's consolidation underscores the market's hesitancy. The impending publication of vital economic indicators, including Nonfarm Payrolls (NFP) and the ISM Manufacturing PMI for August, promises to steer market dynamics. This data carries heightened importance as Powell emphasized data-dependent policy actions at the Jackson Hole Symposium.

Powell's assertion that price stability objectives are far from achieved suggests a prolonged trajectory for policy decisions. Consequently, investors anticipate the potential for further tightening measures if economic data aligns with the Fed's objectives. The specter of a November interest rate hike gains traction, aligning with Powell's cautious stance. Overall, gold's current stagnation reflects the market's anticipation of imminent economic data that will shape the direction of both monetary policy and precious metal prices.

Technical Perspective

Gold prices created significant technical levels last week that will continue to influence gold prices in the current week.

Source: tradingview.com

The price is hovering at the high end of the range. From a technical perspective, it may continue the bullish momentum above the trend line after delivering a significant close above the resistance at $1922.50. If the price does not sustain above $1922.50, it may follow a downtrend or a sideways movement for the week.

Crude Oil / WTI

Fundamental Perspective

Oil prices are influenced by China's efforts to stimulate its economy through a halved stock trading stamp duty. Lingering concerns over the pace of growth and potential U.S. interest rate hikes impacting demand persisted. Attention was divided between China's economic measures, the progress of Tropical Storm Idalia, which poses risks to US Gulf oil and gas output, and Brent's capability to consolidate gains beyond $85.

The storm's potential disruptions were seen as short-term support for oil prices. Despite last week's losses linked to Jerome Powell's comments on potential rate hikes, a favorable scenario for the U.S. economy buoyed energy markets. Oil prices remained above $80 due to OPEC+ supply cuts and reduced inventories. Saudi Arabia's anticipated extension of a voluntary 1 million bpd output cut until October aimed to further stabilize the market. Iran's projection of increasing crude output to 3.4 million bpd by September's end contrasts with U.S. sanctions. U.S. crude production increased to 12.8 million bpd, while inventories fell amid higher refinery processing.

Technical Perspective

Source: tradingview.com

WTI crude oil prices are taking support at $78.10-$77.55, and vital resistance for the week emerged at $81.45-$80.80. Given the market uncertainties, the WTI crude oil price may represent a sideways pattern in the current week. However, a significant downtrend or uptrend can emerge beyond support and resistance ranges.

Cryptocurrencies

Fundamental Perspective

The crypto market currently faces a somber outlook, with Bitcoin (BTC) sliding beneath $26,000 amidst prevailing bearish sentiment and a dearth of catalysts for market resurgence. Despite notable investors increasing their BTC holdings, price charts indicate an imminent threat of further decline. The downward trajectory extends to major altcoins like XRP, ADA, and SOL, which witnessed drops of up to 2.2%, sustaining their downward trend since the previous week. Ether (ETH) also recorded a 1.1% decline, even though trading aggregator protocol 1Inch injected over $10 million in stablecoins to acquire 6,088 ETH, momentarily injecting some buying impetus into the subdued market.

This bearish sentiment can be attributed to a convergence of factors, including the absence of significant market drivers and apprehensions stemming from regulatory developments. The lackluster performance of established tokens underscores the need for compelling catalysts to reverse the current trend. Investor sentiment remains cautious, with a focus on how market fundamentals and external influences could impact the crypto landscape. Traders and investors should closely monitor not only technical indicators but also broader market dynamics and regulatory shifts that could shape the future trajectory of cryptocurrencies.

Technical Perspective

Source: tradingview.com

Source: tradingview.com

Bitcoin and Ether prices are experiencing solid consolidation for the week after experiencing high volatility last week. The critical levels for Bitcoin emerged at $26165 (resistance) and at $25865 (support), forming a consolidation. Similarly, for Ether, they are $1663 (resistance) and $1634 (support). Beyond consolidation, the key resistances that Bitcoin and Ether may face are $26530 and $1685, and the key support levels for the current week are $25660 and $1603.

Forex

Fundamental Perspective

The U.S. Dollar Index's decline follows Fed Chair Powell's remarks at the Jackson Hole Symposium, reflecting ongoing market interpretation. Concurrently, the EUR/USD pair is advancing, driven by traders capitalizing on multi-week lows and a lack of impactful EU economic data. The absence of significant EU reports maintains attention on broader market trends. Despite escalating Treasury yields, USD/JPY sustains near recent peaks. This suggests a complex interplay between yield dynamics and dollar demand. The dollar's retreat is partly influenced by diminishing yields, which exert downward pressure on the currency.

The EUR/USD's ascent is prompted by strategic profit-taking and subdued economic indicators, fostering a focus on the overall market mood. The USD/JPY's resilience near highs in spite of rising yields underscores intricate market forces. In conclusion, forward-looking analysis requires monitoring evolving yield trends, Powell's statements, EU economic indicators, and broader market sentiment for future insights into these currency pairs.

Technical Perspective

Source: tradingview.com

Source: tradingview.com

Technically, EUR/USD and GBP/JPY may experience strong consolidation at the lower end of the range. as the RSI is already standing at overbought levels for both pairs. Overall upside momentum may not be strong, as to establish an upside trend, the prices need to demonstrate a change of polarity at 1.08315 (EURUSD) and 184.715 (GBPJPY). If a change in polarity at the pivot level is established, then further upside can be expected.

Indices

Fundamental Perspective

US stocks closed higher, and U.S. Treasury yields retraced earlier gains. Despite initial gains, major indexes closed off in the range, possibly due to historical market trends of reduced activity and heightened market reactions during this time. Economic indicators, including the August employment report, PCE inflation, ISM PMI, and GDP data, are expected to influence the Fed's policy direction. Federal Reserve Chair Jerome Powell's comments at the Jackson Hole conference emphasized agility in monetary policy due to economic uncertainty.

China's moves to stimulate its economy are highlighted, such as halving the stamp duty on stock trading and implementing measures to restore investor confidence. Foreign investors have recently divested from Chinese stocks due to economic concerns. While these actions initially boosted Chinese stocks, lingering worries about the real estate crisis and slow growth caused gains to fade. The reduction in stamp duty is notable, as it marks the first cut since 2008 and is aimed at reinvigorating the capital market. Additional measures from the China Securities Regulatory Commission aim to boost investor confidence further. Despite temporary sentiment improvement, concrete steps are needed to address the property sector crisis and reverse bearish economic expectations.

Technical Perspective

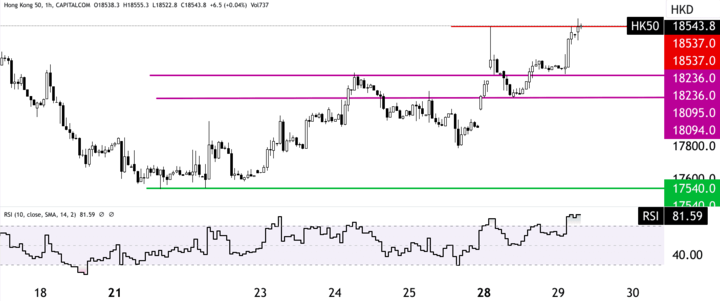

Source: tradingview.com

Source: tradingview.com

Technically, HK50 is hovering at the highs of the weekly range after taking support with a change of polarity in the range of $18236 and $18095. HK50 may also breach current resistance to make new highs due to a lack of bearish divergence in the RSI. However, US equities, that is, the S&P 500, are moving within the range and may retest critical resistance at $4455 as the RSI is losing strength before reaching overbought levels, showing weakness in bullish momentum. Overall, there is comparatively more weakness in US equities compared to Chinese stocks.

Note: Investors and traders can track key economic events scheduled for the week through the VSTAR economic calendar.