AutoZone (NYSE:AZO) is a leading retailer in the automotive parts and accessories industry, and its long-term prospects are fundamentally strong. The analysis delves into specific factors that contribute to AutoZone's value growth.

Financial Performance and Growth

AutoZone's financial performance is a testament to its long-term viability. In fiscal year 2023, the company reported impressive results. Total sales grew by 7.4%, reaching $17.5 billion, while earnings per share (EPS) increased by 12.9%. What's noteworthy is that this growth builds upon the exceptional performance achieved during the pandemic years of 2020 to 2022, highlighting AutoZone's ability to adapt and thrive in challenging market conditions.

One key metric that demonstrates AutoZone's growth is its domestic average weekly sales per store, which increased by a remarkable 33% compared to 2019. This substantial growth in sales has translated into substantial increases in operating profit, with this year's $3.474 billion being 61% higher than 2019, when adjusted for the 53-week fiscal year.

Market Expansion and International Growth

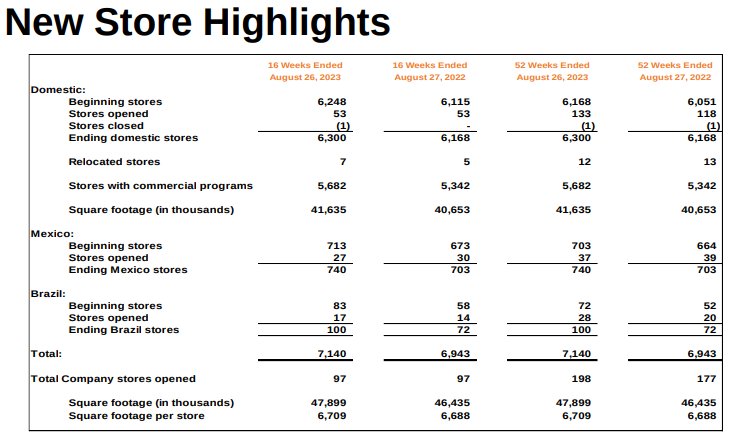

AutoZone's long-term strategy includes expanding its market presence through new store growth. While they may have fallen short of their goals in FY23, the company has ambitious plans to accelerate its global store development plan. Over the next five years, AutoZone aims to open as many as 500 new stores, with a focus on adding 300 in the U.S. and 200 internationally. This strategy underscores the company's confidence in its profitability per store and is fueled by commercial sales growth.

Source: Earnings Presentation

Furthermore, AutoZone's international operations, including stores in Mexico and Brazil, have shown impressive same-store sales growth. These markets are viewed as having significant untapped potential, which positions AutoZone favorably for long-term international expansion.

Commercial Business and Diversification

AutoZone's commercial business is a major driver of growth. Despite facing challenges during FY23, the company achieved 3.9% growth in domestic commercial sales, which now represent 30% of their domestic auto parts sales. Investments in improving satellite store availability, expanding hub and mega hub coverage, and offering high-quality products under the Duralast brand have significantly contributed to this growth. Additionally, AutoZone opened 156 net new commercial programs during FY23, positioning itself for even stronger results in FY24.

Disciplined Pricing and Inflation Management

AutoZone has a proven track record of disciplined pricing strategies, especially in response to inflation. They anticipate experiencing low single-digit inflation and expect their DIY sales to remain resilient while commercial trends improve. The company emphasizes that the automotive parts industry historically adjusts pricing to reflect cost increases, which enables them to manage inflation effectively.

Customer-Centric Culture

AutoZone's corporate culture is a significant driver of its long-term success. They place a strong emphasis on "putting the customer first," fostering exceptional performance, and nurturing a spirit of teamwork. This culture not only differentiates AutoZone in the competitive automotive retail sector but also contributes to its ability to retain and gain market share. It acts as a guiding principle that helps the company navigate challenges effectively, ensuring that customer satisfaction remains at the forefront of its operations.

The technical perspective on the weekly moves of AutoZone stock can be comprehended as follows:

Data source: tradingview.com

Specific risks to AutoZone include economic downturns affecting consumer spending, intense competition from online and offline retailers, supply chain disruptions due to factors like natural disasters, regulatory changes impacting product offerings, dependence on the age of the vehicle fleet, vulnerability to weather-related fluctuations in demand, foreign exchange rate fluctuations in international operations, cybersecurity threats, potential product liability litigation, labor disputes, shifts in consumer preferences, and industry trends such as electric vehicles.

In conclusion, AutoZone is strategically positioned for growth. Its robust financial performance, growth strategies, technological advancements, disciplined pricing, and customer-centric culture contribute to its resilience and competitiveness. The focus on commercial sales growth, international expansion, and investment in technology provides a strong foundation.