I. Recent AVGO Stock Performance

Broadcom - Google Cloud Partnership

Broadcom Inc. (NASDAQ: AVGO) is pleased to announce that it has been bestowed with the prestigious 2024 Google Cloud Technology Partner of the Year distinction in the Infrastructure sector, with particular recognition in networking and virtualization.

This acknowledgment encompasses Broadcom as a whole, including the recently acquired VMware, Inc., in recognition of its noteworthy contributions to the Google Cloud ecosystem. In close partnership with Google Cloud, Broadcom assists clients in transforming network observability and implementing a cloud-centric operational strategy.

The partnership between Broadcom and Google Cloud includes a range of flagship products, most notably AppNeta, which is accessible via the Google Cloud Marketplace. Customers of Google Cloud are endowed with comprehensive network performance monitoring capabilities through this partnership. By integrating AppNeta with Google Cloud, both parties benefit from enhanced visibility and management of their digital environments. This enables proactive network performance optimization and transparent end-to-end delivery paths.

Furthermore, VMware Cloud Foundation provides an extensively utilized, adaptable, and seamlessly integrating private cloud infrastructure that spans numerous cloud platforms. By utilizing VMware Cloud Foundation in conjunction with Google Cloud VMware Engine, clients gain access to an exceptionally effective cloud operational framework. This architectural design effectively merges the scalability and agility of public cloud services with the performance and security benchmarks typically associated with private cloud environments.

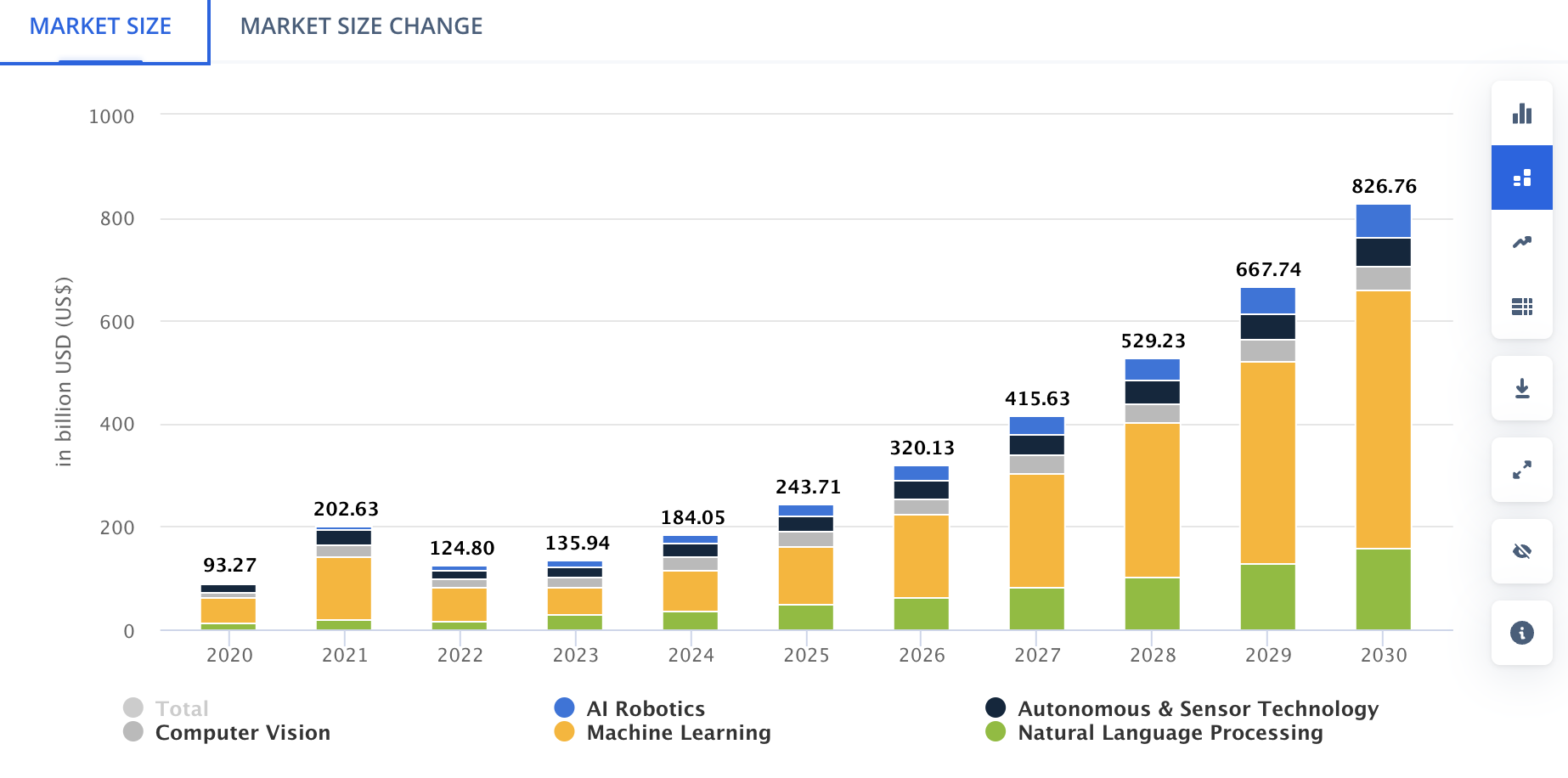

Broadcom's Presence In Artificial Intelligence (AI)

Broadcom Inc., the worldwide frontrunner in fiber optic components utilized in optical networking and communications, has declared noteworthy progressions in its control over the market (NASDAQ: AVGO). The organization has broadened its assortment of optical interconnect solutions specifically designed for applications involving artificial intelligence (AI) and machine learning (ML). These accomplishments highlight Broadcom's dedication to pioneering advancements and its capacity to address the changing demands of contemporary computing environments for rapid data transmission.

Fundamental to these progressions are state-of-the-art optics technologies developed by Broadcom. These technologies facilitate swift interconnections for front-end and back-end networks within expansive generative AI compute clusters. VCSEL and EML technologies are critical to this advancement as they enable high-speed interconnections within AI and ML systems.

The most recent products introduced by Broadcom are 200G VCSEL and EML devices. Expanding upon the achievements of its prior 100G/lane VCSEL and EML processors, these novel solutions offer an unprecedented density of interconnects and bandwidth for the forthcoming generation of AI and ML interconnects. These product families, widely recognized for their dependability, enable integration partners to capitalize on pre-existing infrastructure. At the same time, end users migrate to 1.6T optical transceivers, initiating the terabit connectivity era.

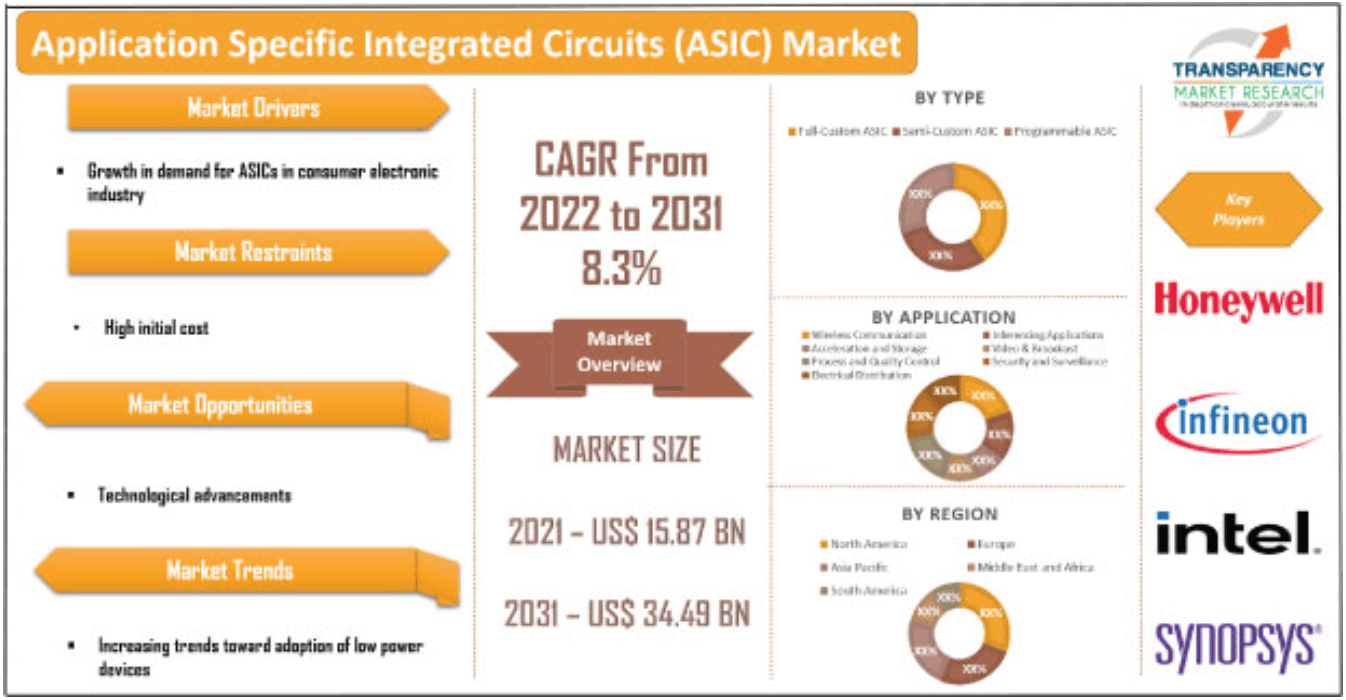

AVGO's Buy Rating Is Solid

Harlan Sur's Buy rating results from combining elements demonstrating Broadcom's innovation and leadership in the AI ASIC market. Sur underscores Broadcom's noteworthy advancements in developing custom integrated circuits (ASICs), as evidenced by fruitful collaborations with tech titans, including Google and Meta. Recent achievements for both organizations include securing contracts to manufacture 3nm AI ASIC processors of the next generation; Broadcom anticipates a substantial revenue increase for the current year as a result. Sur foresees that the combined revenues generated by Google and Meta will surpass $9 billion, representing a significant growth compared to prior years.

Sur's positive outlook is additionally reinforced by Broadcom's potential to become Meta's AI ASIC customer worth billions of dollars by 2025 and robust demand forecasts for Broadcom's other AI-powered semiconductor products. The anticipated rise in overall shipments of AI semiconductors, estimated to be between $10 and $12 billion this year, and the possibility of favorable revisions to Broadcom's earnings per share throughout the year are all substantial financial consequences of these factors. Supported by its technological prowess and strategic positioning, Sur enthusiastically advises investors to purchase Broadcom stock.

Expert Insights on AVGO Stock Forecast for 2024, 2025, 2030 and Beyond

AVGO showed a remarkable gain in 2024, setting a top above the 1400.00 line. Moreover, the recent surge in artificial intelligence could work as a confluence buying factor for Broadcom stock.

Before proceeding further, let's see what analysts project about AVGO target price:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$1,795 |

$2,360 |

$3,587 |

|

Coincodex |

$ 1,031.96 |

$ 1,783.84 |

$ 8,329.88 |

|

Stockscan |

$1,731 |

$2,316 |

$3,464 |

II. AVGO Stock Forecast 2024

The ongoing buying pressure has been potent since the beginning of 2024, and it can extend the momentum above the 1500.00 level by the end of 2024.

In the daily chart of AVGO, the ongoing buying pressure is potent above the dynamic 50-day EMA, which is working as a near-term support level. Moreover, the 200-day Simple Moving Average backs up the buying pressure by remaining below the 1175.45 static support level.

In the near-term price action, a trendline resistance is visible, which suggests sufficient liquidity above the line.

Based on the AVGO Stock Forecast 2024, investors should wait for a bullish reversal from the near-term 50-day EMA support line. A valid buying pressure with a daily candle above the trendline resistance could extend the momentum above the 1500.00 psychological line.

Let's see another AVGO Stock Forecast 2024, based on critical technical indicators:

- MACD: In the daily MACD outlook, the recent price shows an extreme corrective structure, where the current MACD Histogram hovers at the neutral zone. It is a sign of extreme corrective pressure from where a breakout could happen.

- Parabolic SAR: The latest Parabolic Dots are below the current price with an upward slope, which suggests an active buying pressure.

- Relative Strength Index (RSI): Like the structure in the MACD Histogram, the Relative Strength Index (RSI) shows a corrective momentum by remaining at the 50.00 neutral area.

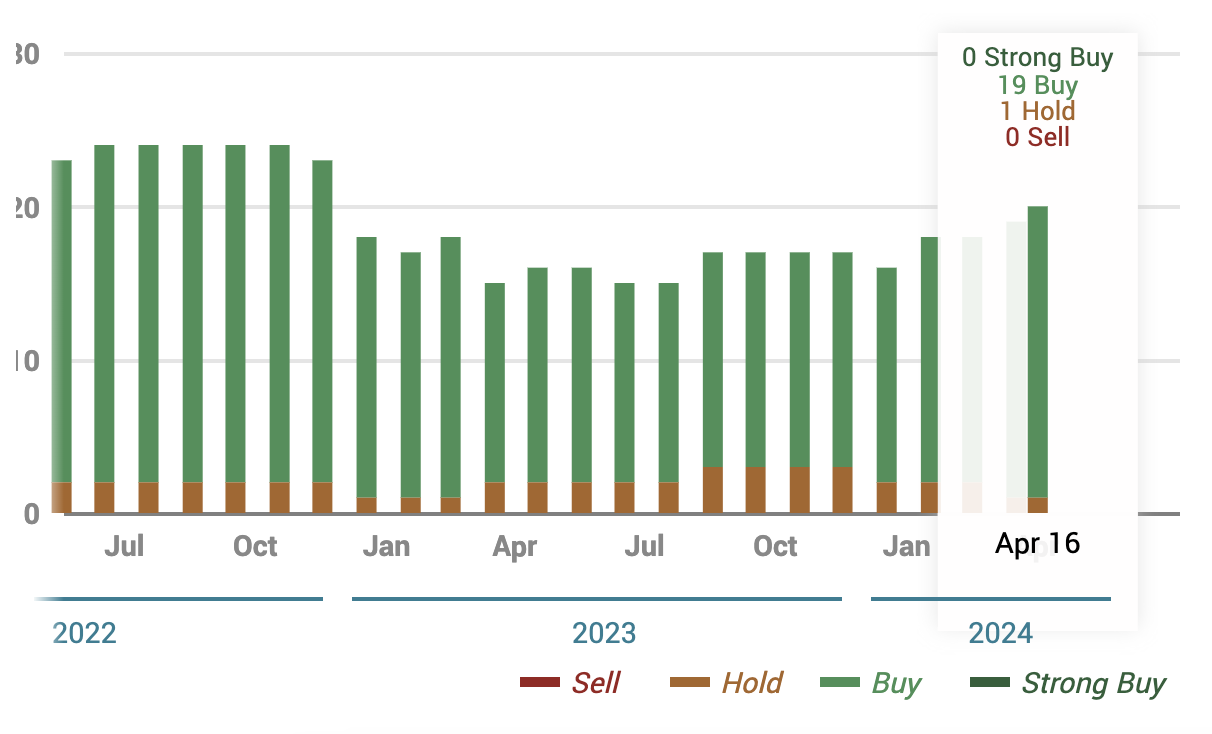

A. Other Broadcom Stock Prediction 2024 Insights: AVGO buy or sell?

According to a report from Marketbeat, AVGO has had a buy rating since July 2022. Moreover, investors are optimistic about this stock as per the current month's reading showing 18 buy, 1 hold, and no sell orders.

As per another projection from Motley Fool, AVGO stock can grow double, albeit not guaranteed. The resurgence of the semiconductor industry and the benefits derived from the acquisition of VMWare present Broadcom with substantial prospects for enhanced profitability. Furthermore, should market sentiment strengthen, the potential for additional growth in its multiples exists.

B. Key Factors to Watch for AVGO Stock Prediction 2024

Financial Strength

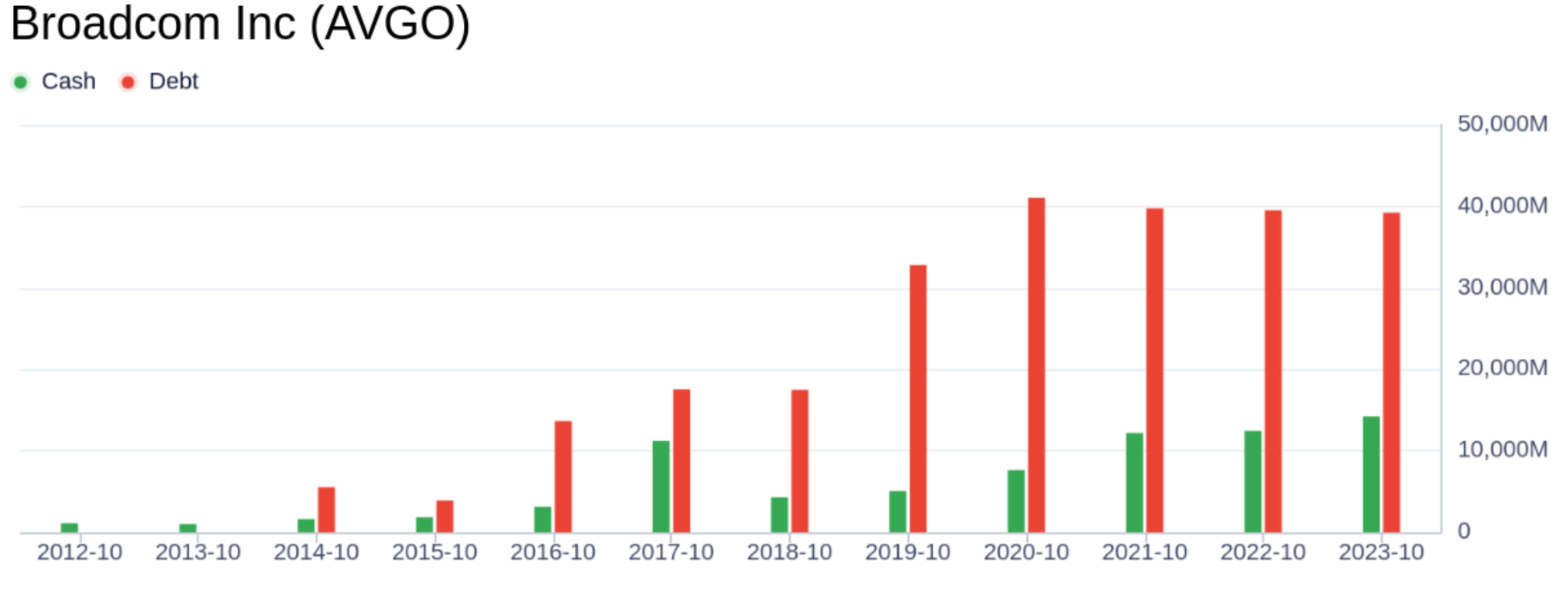

The cash-to-debt ratio is a crucial factor in finding a stock's future growth. As per the latest reading, the current cash-to-debt ratio for AVGO is 0.16, which is lower than 92% of the semiconductor industry. As a result, investors should remain cautious about considering this stock as a potential long opportunity, as shown in the balance sheet.

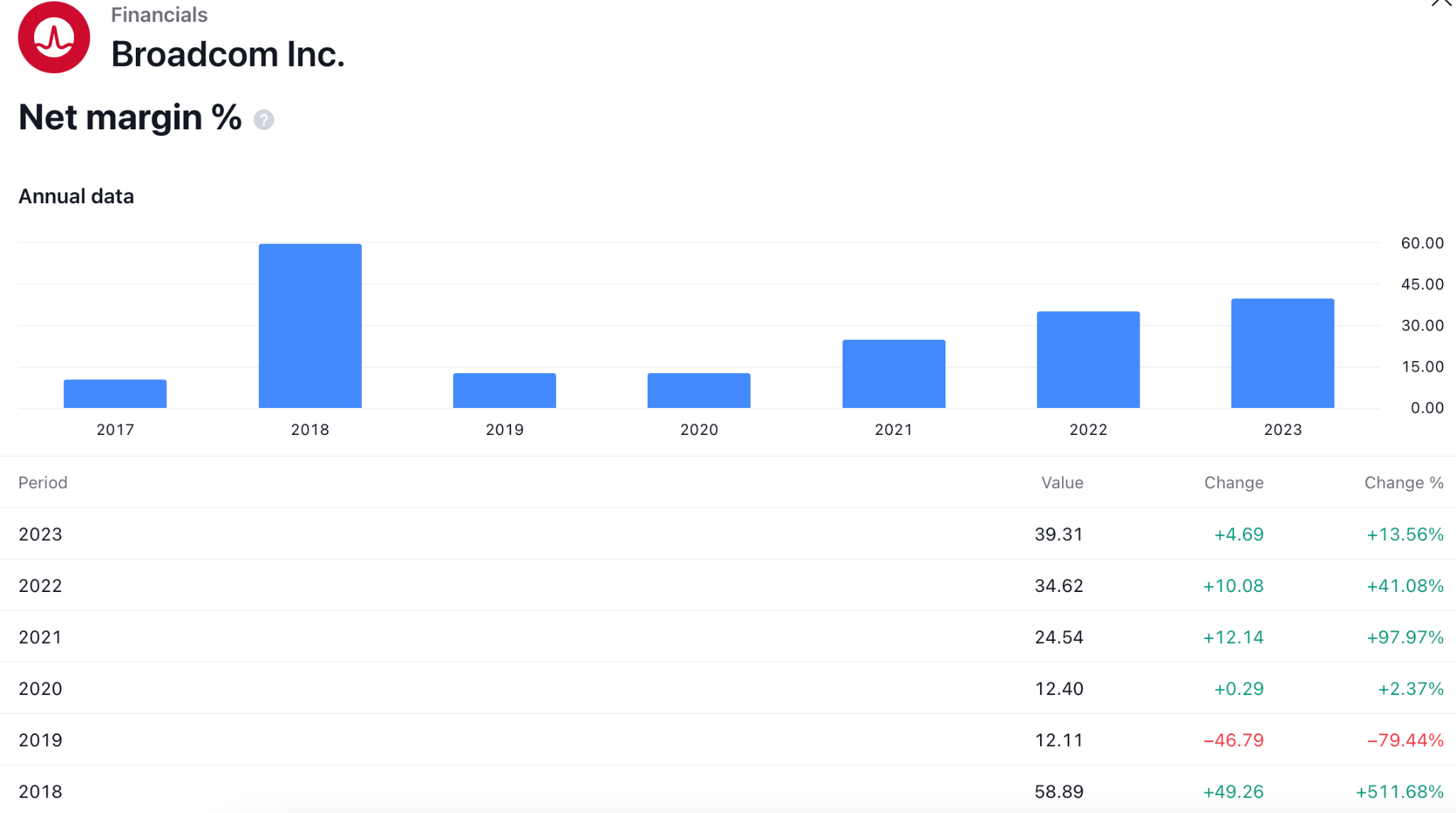

Profitability and Growth

Profitable companies generally carry a reduced level of risk, particularly those that have demonstrated a sustained history of profitability. Broadcom distinguishes itself by maintaining profitability for nine of the previous ten years and possessing a noteworthy operating margin of 38.7%, which exceeds the industry average of 97.86%. This substantial profitability provides potential investors with a positive indication.

AVGO EBITDA Ratio

Moreover, growth is an essential factor in establishing stock valuation, as it is intricately linked to the stock's performance over an extended period. Broadcom sustains an average annual revenue growth rate of 14%, surpassing the performance of 65.27% of its counterparts in the semiconductor industry. Furthermore, with a three-year average EBITDA growth rate of 22.2%, the company's growth prospects are exceptionally bright, surpassing 64.29% of its industry rivals.

Broadcom Stock Price Prediction 2024 - Bullish Factors

- Although the worldwide chip shortage is anticipated to subside by 2024, there will continue to be substantial demand for semiconductors used in data centers, smartphones, and various electronic devices. Maintaining robust demand for these chips, for which Broadcom is a significant provider, could increase the company's revenue and profitability.

- Broadcom is not dependent on a single market segment. The company's diversified product portfolio, including networking solutions, infrastructure software, and broadband communication processors, positions it favorably to capitalize on expanding numerous technology sectors.

- Broadcom has a track record of distributing cash to its shareholders via share repurchases and dividends. This shows the company's confidence in its future cash flow and may increase the value of remaining shares for investors.

- Broadcom has established a reputation for executing strategic acquisitions that effectively broaden its portfolio of products and market penetration. A prosperous acquisition within the burgeoning technology industry has the potential to inflate the stock value substantially.

AVGO Forecast 2024 - Bearish Factors

- Broadcom's sales could be negatively impacted by a recession or significant economic downturn, which would reduce demand for electronic devices.

- Broadcom encounters formidable competition in the semiconductor sector from firms such as Intel, Samsung, and TSMC. Heightened competition may exert a negative impact on Broadcom's pricing and profit margins.

- Even if the worldwide semiconductor shortage abates by 2024, supply chain disruptions may still impact Broadcom's production.

- If interest rates increase in 2024, investors may find Broadcom's stock less appealing because they can attain superior returns on alternative investments.

III. AVGO Stock Forecast 2025

AVGO stock showed a decent momentum in 2024, suggesting strong buyers' presence in the market. Following the trend, the price is more likely to move higher and reach the 1700.00 psychological line by the end of 2025.

In the weekly AVGO stock price, the ongoing price action is corrective at the top, suggesting a continuation after a valid breakout.

The dynamic 20-week EMA is the immediate support for the buying pressure while the current price hovers within a bullish pennant pattern.

Based on this outlook, a bullish pennant breakout with a weekly candle above the 1406.20 line could validate the long opportunity, targeting the 1700.00 psychological level.

The bearish approach is to find exhaustion from the current area with a weekly candle below the 1200.00 line, which could be a highly probable short opportunity.

Let's see the AVGO Stock Forecast 2025 based on other technical indicators:

AVGO Stock Forecast 2025- Ichimoku Cloud

Based on the Ichimoku outlook, the future could be bullish where both lines are flat, suggesting an upcoming corrective pressure. Moreover, the ongoing buying pressure is questionable as the dynamic Tenkan Sen support is broken, which suggests a possible downside correction.

Following the broader trend, investors might expect a trend change from the dynamic Kijun Sen line with a bullish reversal. However, the dynamic Ichimoku Cloud zone could be the last hope for bulls, as breaking below this line could make the price even lower.

A. Other Broadcom Stock Prediction 2025 Insights: Is Broadcom a good stock to buy?

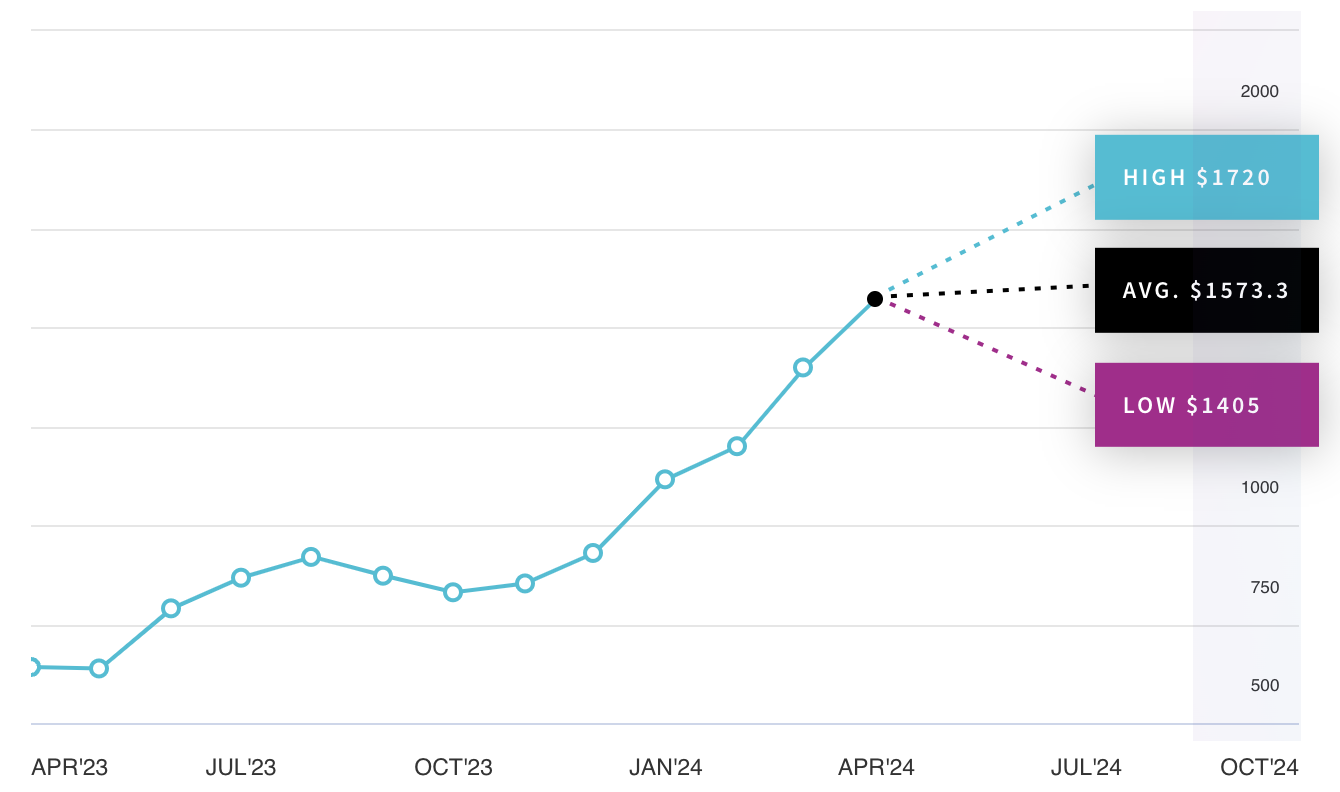

According to a recent report from Nasdaq, 28 analysts show a buy signal for this stock, targeting the $1573 level in the next 12 months.

Following the AVGO stock price prediction, Broadcom price target could reach as high as $1720.00 by that time.

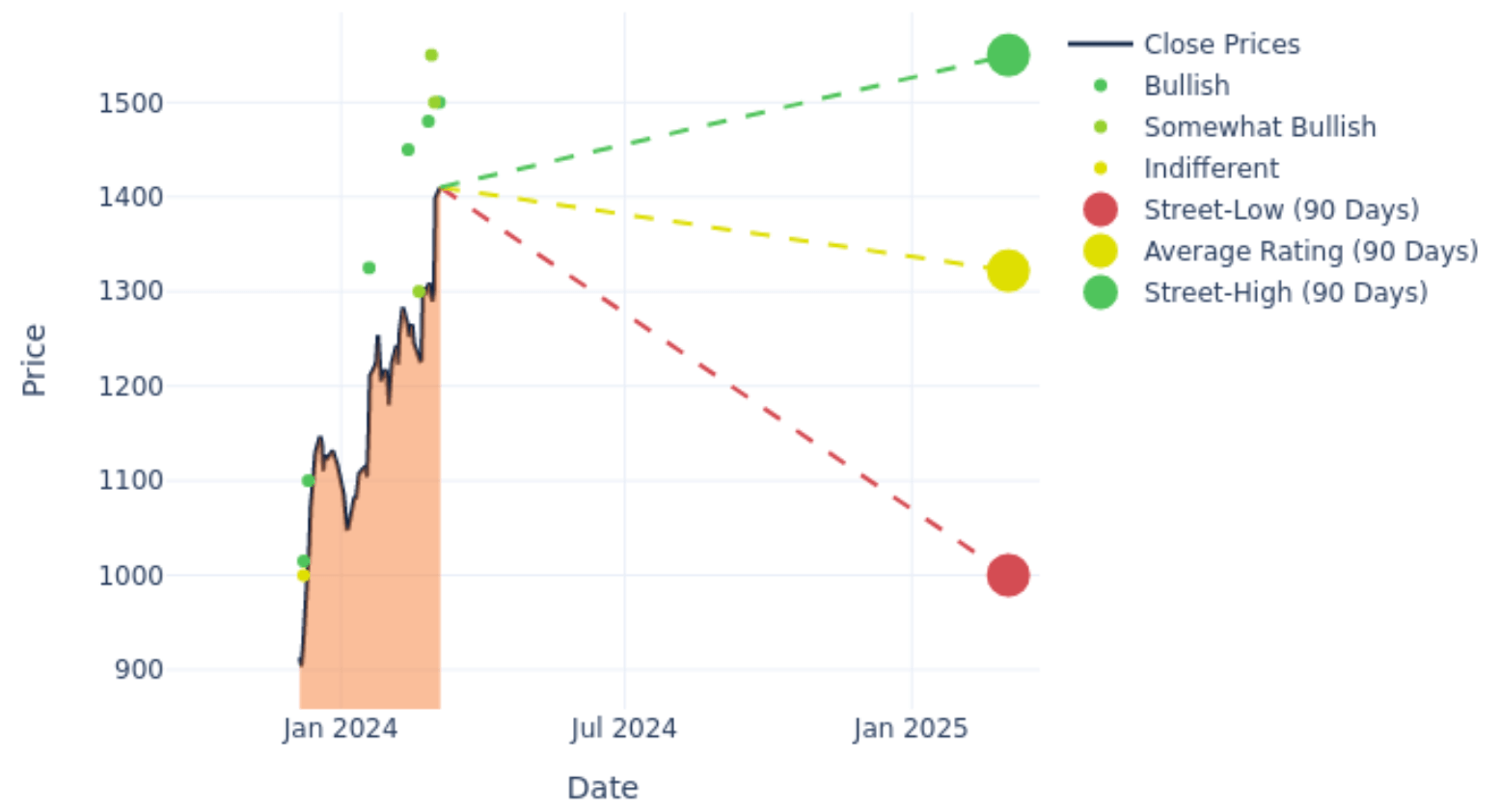

According to another report from Nasdaq, fourteen analysts evaluated Broadcom (NASDAQ: AVGO), offering an amalgamation of optimistic and pessimistic perspectives.

Analysts evaluated Broadcom and provided price forecasts for the next 12 months. The mean AVGO price target is $1305.71, with a minimum estimate of $1000.00 and a maximum estimate of $1550.00. The present average AVGO stock price target indicates a favorable increase, rising by 12.56% from the previous average Broadcom stock price target of $1160.00.

B. Key Factors to Watch for AVGO Stock Prediction 2025

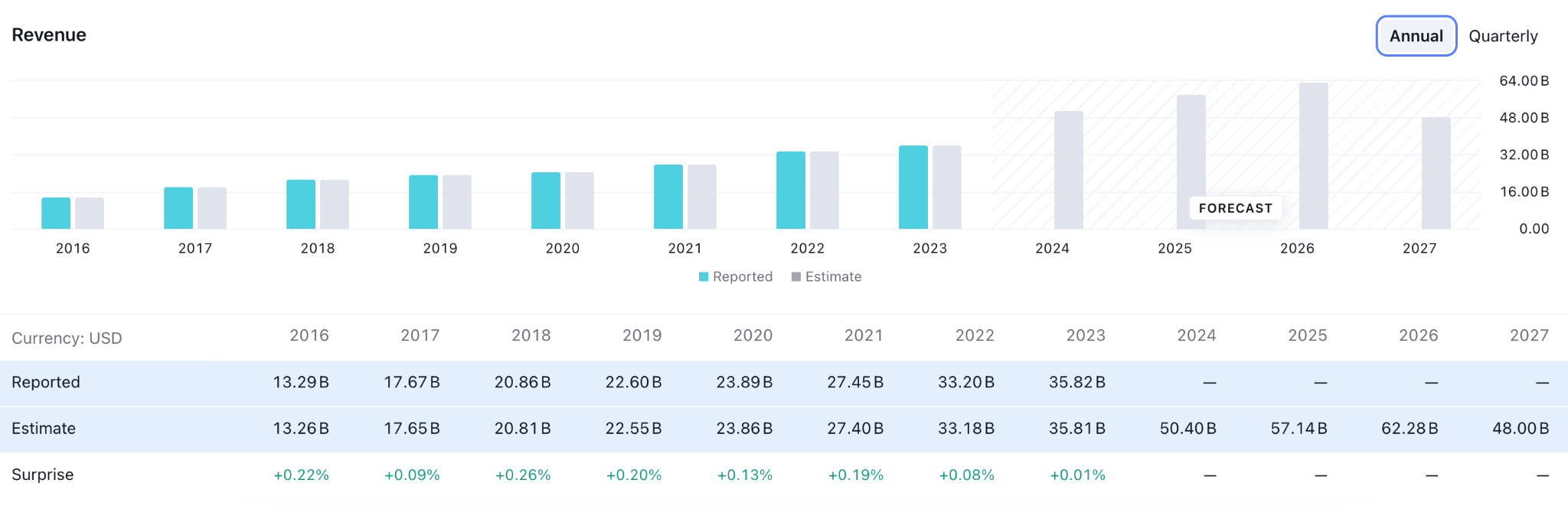

AVGO Revenue Forecast 2025

As per analysts' projections, Broadcom earnings could maintain growth and reach a peak in 2025.

The long-term projection is potent as the company maintained growth since 2016. The continued growth could reach $62.28 as a yearly revenue in 2025. Investors should closely monitor how the actual revenue comes, where an upbeat result could be a potential long signal.

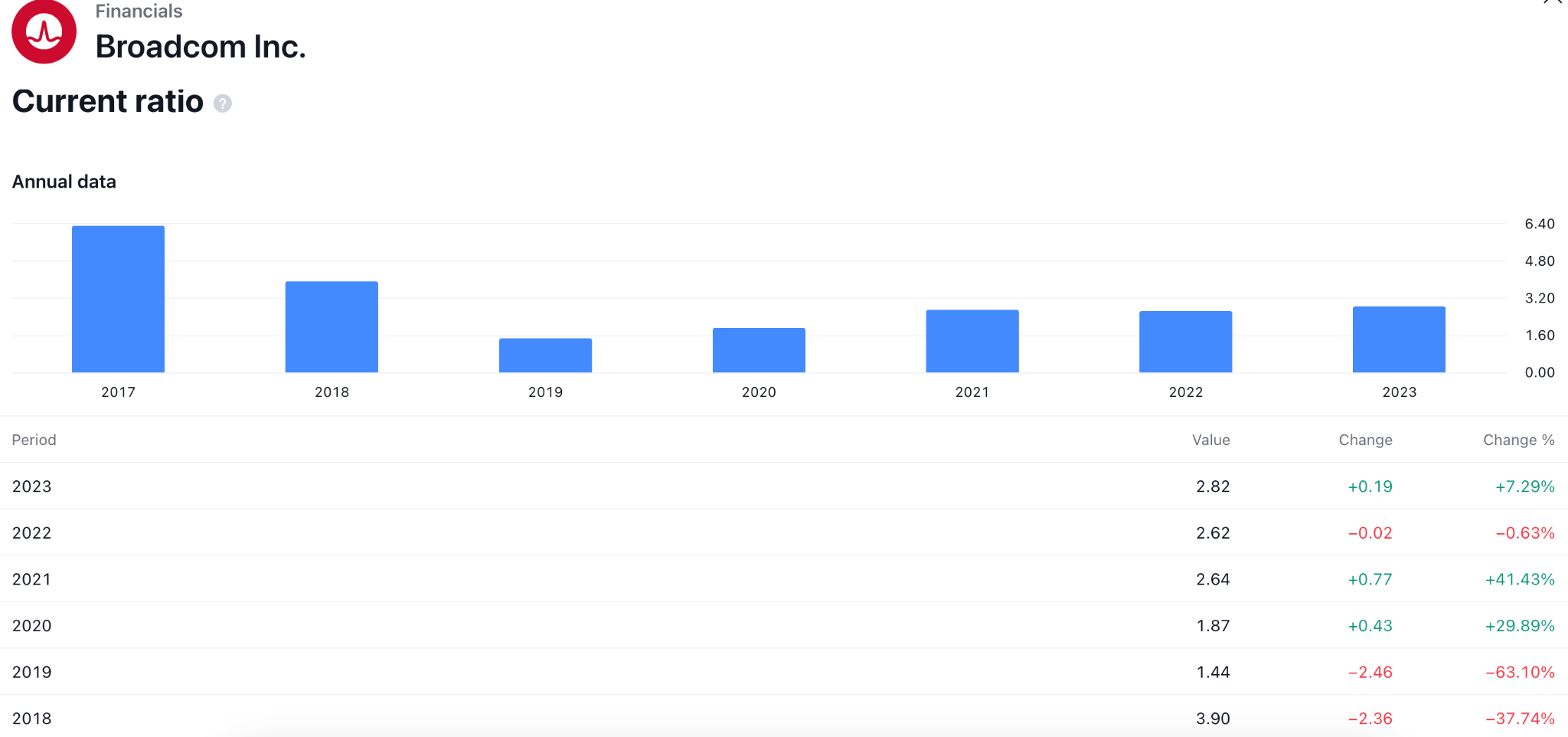

AVGO Current Ratio

As per the current reading, the company maintains a stable business as the current ratio remains above the 1.00 line for a considerable time.

The latest number shows 2.82X higher in the current asset, which suggests a stable day-to-day business operation. If the company maintains the growth, investors might expect a buying pressure in 2025.

AVGO ROIC vs WACC

Source: alphaspread.com

By comparing the Weighted Average Cost of Capital (WACC) and Return on Invested Capital (ROIC), one can gain insight into a company's profitability concerning its utilized capital. Broadcom's ROIC of 17.18 exceeds its WACC of 11.38, indicating that shareholder value has been created.

Analyzing the past correlation between ROIC and WACC yields valuable insights into Broadcom's financial efficacy over time.

AVGO Stock Forecast 2025 - Bullish Factors

- AVGO's history of aggressive stock repurchases can increase earnings per share (EPS) and decrease the number of outstanding shares, affecting the share price.

- Increasing dividends consistently can incentivize investors seeking income and indicate management's faith in forthcoming cash flows.

- The growing demand for cloud computing and data centers may stimulate sales of AVGO's high-performance ethernet and data center processors.

- The potential proliferation of 5G smartphones and the Internet of Things (IoT) may result in an increased need for AVGO's radio frequency (RF) processors, which are utilized in such devices.

Broadcom Stock Forecast 2025 - Bearish Factors

- Demand for smartphones, data center equipment, and other products that rely on AVGO's chips might decline in an international recession or economic downturn.

- Additional chipmakers like Nvidia and Qualcomm may increase their competition, threatening AVGO's market share and pricing power.

- The increasing expense of basic materials utilized in the fabrication of chips has the potential to reduce AVGO's profit margins.

- Trade tensions or more stringent government regulations on semiconductor exports could disrupt AVGO's supply chain and negatively impact its business.

IV. AVGO Stock Forecast 2030 and Beyond

The AVGO stock reached a peak in 2024, from which a decent downside recovery could come. However, the ongoing buying pressure is potent, and any bullish breakout could take the price higher toward the 2000.00 level.

Based on the monthly chart of AVGO, the recent prices have become sideways after finding a peak at the 1437.96 level. However, the price failed to form a bearish exhaustion at the top. It is a sign that bears are not active in the market, which could result in a bullish trend continuation after a considerable correction.

The dynamic 20-month Exponential Moving Average is below the current price and is working as a major support, while the strong gap between the current prices could signal a pending downside correction.

Based on the bearish AVGO Stock Forecast 2030 and Beyond, a red monthly candle below the 1200.00 psychological line could be a minor short opportunity, targeting the 793.60 support level.

Let's see AVGO Stock Forecast 2030 and Beyond from other technical indicators:

- MACD: In the monthly MACD outlook, the current signal line is at the overbought zone, suggesting a potential bearish reversal point. However, the histogram remains optimistic for bulls, signaling no potential reversal signal.

- Relative Strength Index (RSI): The 14-month RSI remains above the 70.00 overbought zone, with a potential divergence with the main price. It is a sign of a potential trend reversal, but more clues are needed from the price action before anticipating a trend change.

- Average Directional Index (ADX): The current ADX line shows strong bullish pressure as it hovers above the 50.00 line with a bullish slope.

A. Other Broadcom Stock Prediction 2030 and Beyond Insights: AVGO stock buy or sell?

Despite its sustained uptrend, Broadcom's current valuation remains favorable at 24 times forward earnings and 10 times this year's sales. Taking into consideration the acquisition of VMware, this valuation seems rational. In order to attain a market capitalization of $1 trillion by 2030 while preserving its present valuation multiples, Broadcom must demonstrate a revenue and earnings per share (EPS) compound annual growth rate (CAGR) of around 10%.

This objective appears attainable in light of analysts' forecasts for Broadcom. Revenue is anticipated to increase at a CAGR of 18% from fiscal 2023 to fiscal 2026, while earnings per share are anticipated to rise at a CAGR of 16%.

Another report from Stockraven suggests continued growth in the AVGO stock price, with the possible price growth within 2030 being 100%. Based on this outlook, the stock price could reach the $2690 level by the end of 2030.

B. Key Factors to Watch for AVGO Stock Forecast 2030 and Beyond

AVGO EPS Forecast

AVGO's anticipated EPS for 2023 was 42.11, while the actual result was 42.25. Following the growth, AVGO's earnings per share are anticipated at 78.41 in 2027. We may expect strong buying pressure in the main chart if the company can achieve the targeted EPS level.

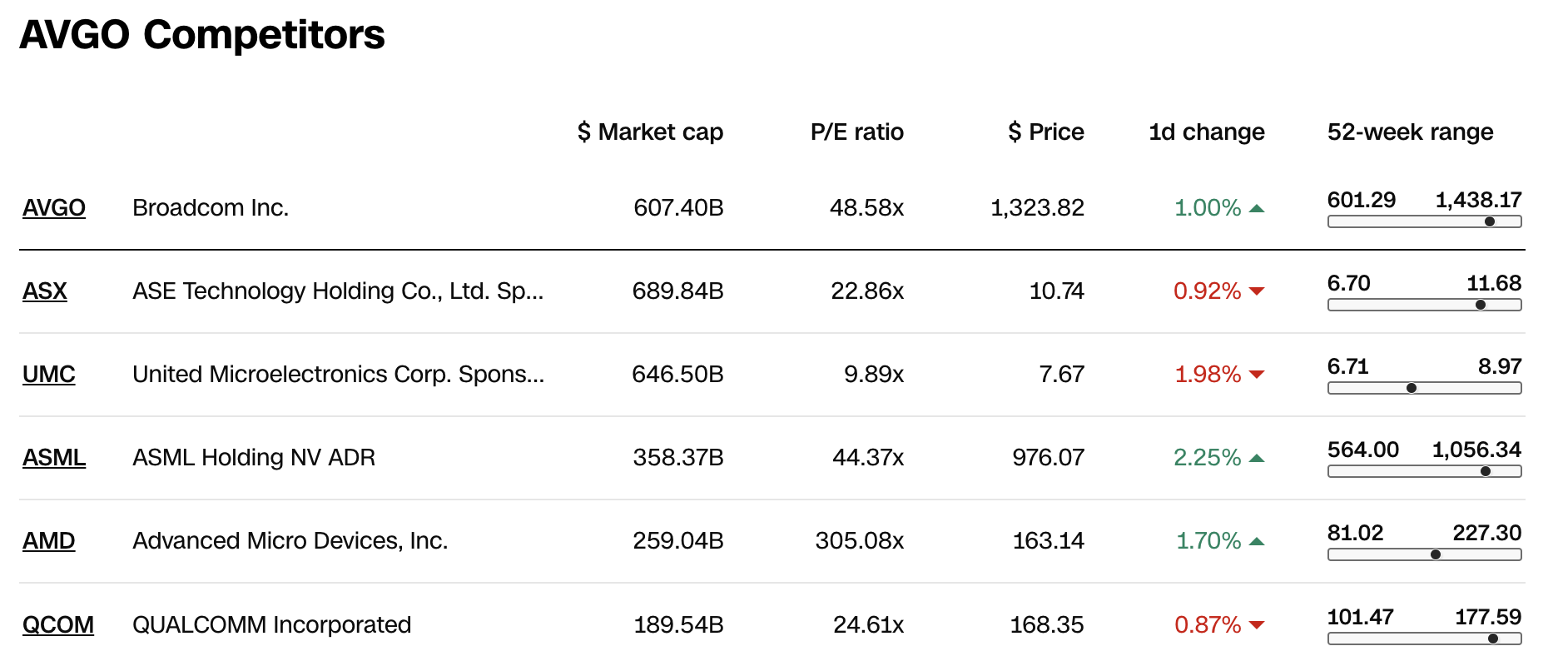

Broadcom Competitors Analysis

The ongoing surge in artificial intelligence could challenge AVGO stock price as other companies could develop products to lead the market. However, Broadcom maintained a strong position, where AMD leads the race by maintaining a 305X growth in the P/E ratio.

AVGO Debt-to-equity Ratio Analysis

The company's debt-to-equity ratio was 0.86 in 2017, increasing to 1.58 in 2023. The higher number suggests that the company generated higher debts, which could make it challenging to cover liabilities.

AVGO Stock Forecast 2030 and Beyond - Bullish Factors

- It is anticipated that the proliferation of generative artificial intelligence (AI) and the growing acceptance of cloud computing will stimulate substantial demand for processors utilized in data centers and infrastructures. Because of its expertise in this field, Broadcom is well-positioned to profit from this trend. For instance, as organizations further adopt AI for data analysis and decision-making, there may be a heightened need for Broadcom's high-performance processors to handle data processing and storage.

- A recovery in macroeconomic conditions is expected to stimulate increased investment in IT and mobile infrastructure. As enterprises and individuals enhance their technological devices and networks, Broadcom is positioned to capitalize on increased demand for its semiconductor products. For example, with the proliferation of 5G networks, Broadcom's sales of 5G radio frequency components will probably surge.

- Broadcom's stronghold in the semiconductor industry is reinforced by its strategic alliances and contracts, including the multibillion-dollar agreement with Apple for wireless connectivity components, which ensure a steady flow of revenue. Partnerships with key industry participants may propel Broadcom's development and market expansion.

Broadcom Stock Forecast 2030 and Beyond - Bearish Factors

- Extreme cyclicality characterizes the semiconductor industry, with boom-and-bust cycles precipitated by technology cycles, macroeconomic conditions, and geopolitical tensions. Economic recessions or voltage swings in the electronic device market may negatively impact Broadcom's financial performance.

- Swift market transformations and technological progress present threats to Broadcom's business model. Alternative semiconductor materials and quantum computing are examples of emerging technologies that have the potential to disrupt established markets and make current products obsolete. Neglecting to adjust to evolving technological advancements or failing to foresee changes in market dynamics may lead to a decline in market share and revenue.

- Certain markets and customers - data centers, telecommunications, and consumer electronics substantially impact Broadcom's revenue. Potentially detrimental occurrences, such as the attrition of a substantial client or a contraction in demand from critical markets, might substantially influence Broadcom's financial performance and stock valuation.

V. AVGO Stock Price History Performance

A. Broadcom Stock Price Key Milestones

- 2020: The COVID-19 pandemic impacts global markets, leading to supply chain disruptions and economic uncertainty. Broadcom stock experienced volatility amid pandemic-related concerns in the year's first half. However, it recovers gradually as markets stabilize.

- 2021: Demand for semiconductors surges as remote work, e-learning, and digital transformation. As a result, Broadcom experienced a surge in sales of networking, data centers, and wireless chips. Broadcom's stock price rises steadily throughout the year, reflecting robust financial performance and optimistic market sentiment.

- 2022:Broadcom announces strategic acquisitions to strengthen its position in key markets such as data centers, networking, and software. The stock price experiences moderate growth, supported by strong fundamentals and favorable market conditions.

- 2023: Broadcom faces supply chain challenges and component shortages, impacting production and delivery schedules. The stock price experiences fluctuations due to supply chain concerns and macroeconomic factors.

- 2024: Broadcom focuses on innovation in emerging technologies such as artificial intelligence, 5G, and edge computing. Broadcom's stock price shows resilience amid continued market volatility.

B. AVGO Stock Price Return and Total Return

|

Timeframe |

Return AVGO |

Return S&P 500 |

|

1 week |

-2.76% |

-1.18% |

|

1 month |

-0.63% |

+3.14% |

|

6 months |

+60.40% |

+25.50% |

|

Year to date |

+27.82% |

+9.72% |

|

1 year |

+115.13% |

+26.59% |

VI. Conclusion

In conclusion, Broadcom Inc. (NASDAQ: AVGO) has demonstrated remarkable resilience and innovation across various sectors, positioning itself as a leader in the ever-evolving technology landscape. The partnership with Google Cloud and advancements in artificial intelligence and machine learning underscores Broadcom's commitment to addressing the dynamic needs of modern computing environments.

The recognition as the 2024 Google Cloud Technology Partner of the Year in the Infrastructure sector is a testament to Broadcom's contributions to network observability and operational efficiency within the Google Cloud ecosystem. Additionally, expanding optical interconnect solutions tailored for AI and ML applications showcases Broadcom's dedication to pioneering advancements in data transmission technologies.

Expert forecasts and technical indicators support the positive outlook for AVGO's stock performance, indicating potential growth opportunities in the coming years. Therefore, investors can easily take this instrument into their investment portfolio through reliable brokers like VSTAR.

Open a trading account in VSTAR broker and expand your trading portfolio in different sectors like forex, stock, indices, commodities, and cryptocurrencies with these benefits:

- Enjoy the portability of trading with the VSTAR mobile app.

- Regulated trading platform with deep liquidity.

- Trade under ultra-low trading cost

- Premium trading tools, market signals, and trading analysis.

- 1000+ trading instruments to expand the portfolio.

However, Investors should carefully monitor key factors such as financial strength, profitability, and market dynamics to make informed decisions regarding AVGO stock. With a history of aggressive stock repurchases, consistent dividends, and strategic alliances, Broadcom remains poised to capitalize on emerging trends and deliver value to shareholders in the years ahead.

FAQs

1. Is AVGO a good stock to buy?

Currently, AVGO has a Zacks Rank of 4, which is a "Sell" rating. Valuation metrics indicate that Broadcom Inc. may be overvalued, with a Value Score of F.

2. What is the AVGO target price?

The average price target for Broadcom Inc. (AVGO) is $1,527.00, with a high estimate of $1,720.00 and a low estimate of $1,100.00.

3. What will AVGO stock be worth in 2024?

Analysts predict that AVGO stock will reach an average price of $1,285.41 and could go as high as $1,720.00.

4. Where will AVGO stock be in 5 years?

Long-term forecasts suggest that AVGO stock could reach $2,528.71 by 2030. With a 5-year investment, the revenue is expected to be around +66.41%.