Introduction

In the stock market, some of the companies have relatively small capital, and their shares are traded at below $5, known as penny stocks. This is the official definition of penny stocks that is set by the SEC (US Securities Exchange Commission).

These stocks are typically associated with smaller companies still in their early stages of growth and development.

If you want to make money from penny stocks, the following section is for you. In this article, we will discuss the nuts and bolts of penny stocks with the list of stocks that can provide a remarkable gain in the future.

What Are Penny Stocks?

Source: Unsplash

Penny stocks are like the underdogs of the stock market world - they may be small and not as well known as their larger counterparts, but they carry the potential for substantial returns. Traders are drawn to penny stocks because of their affordability, allowing individuals with modest budgets to enter the stock market arena. But there's a catch to the appeal of penny stocks: volatility. These stocks can experience significant price fluctuations over short periods. While this volatility creates opportunities for quick gains, it also exposes higher risks.

Potential Opportunities and Risks of Investing in Cheap Stocks

Many traders may find penny stocks very interesting because they're cheap and might bring in big profits. These stocks aren't traded on big stock exchanges, making them more popular recently. Some investors think that penny stocks can make their money grow faster, but some may doubt it because of the associated risk. It's no surprise that investing in penny stocks can be uncertain and a bit wild, but some still find them tempting. In this part, we'll check out the opportunities and risks involved.

A. Opportunities

Penny stocks or best cheap stocks to buy now may provide chances for high returns, drawing various traders' attention. However, you should be aware that investing in penny stocks requires careful consideration and research. Investing in cheap stocks may provide you with the following opportunities:

Chance for Large Percentage Gains

People are attracted to penny stocks because they might make a lot of money. Even though they're risky, some penny stocks can quickly increase in value, allowing investors to earn big profits. Imagine buying 1,000 shares of a penny stock at $0.50 each. If the stock goes up to $3 per share, you could profit by $2,500. That's the appeal of penny stocks - the chance to make good money with a small investment.

Let's see a real example of how it works:

The above image shows an example of best cheap stocks to buy now. You can see that the open price was marked at $2.57 at the beginning of 2020. Throughout the year, the yearly high of this stock was above the 70.00 level, representing more than 2700% gain.

Get In Early

Investing in cheap stocks will allow you to get into the market in the early stages of the company. It may be helpful as you'll gain the chance to profit from the growth before larger institutional investors, this will lead you to yield higher profits possibly.

Short Squeeze Potential

Cheap stocks are more vulnerable to short squeezes, resulting in a dramatic short squeeze when short sellers must purchase shares to cover their holdings. And the stock price begins to climb quickly. So, short squeezes like these might help you to maximize profits by investing in cheap stocks under $5.

As a skilled trader, you must keep a close eye on the low stocks to buy now that are experiencing high short potentials to identify opportunities to profit from remarkable short squeezes.

The above image represents a real example of a short opportunity in the best stocks under $5. The price became volatile at the top, signaling a struggle to make a new high. As a result, a sharp downside pressure came with a short opportunity.

B. Risks

Generally, cheap stocks are traded over-the-counter (OTC) or on smaller exchanges. Their market capitalization is frequently less than a predetermined level. Though there is still a chance for large gains in penny stocks, it carries a considerable risk. The following are some of the major risks associated with penny stocks:

Extreme Volatility

One of the main risks of investing in penny stocks or cheap stocks is extreme volatility. Without any warning, the price of these stocks can fluctuate even before you notice, as they are valued under $5 per share. In this case, speculative trading is a major contributor to this volatility, which makes it difficult for investors to predict market fluctuations and potentially leads to large losses.

Low Liquidity

Another major risk associated with cheap stocks is their lower liquidity rate. Often, these cheapest stocks encounter limited trading activity as the share prices are low. The lack of liquidity may lead traders to difficulty in getting involved in buying or selling shares at their desired prices. Also, they may experience wider bid-ask spreads. This makes it harder to execute trades at favorable terms.

Company Fundamentals

Company fundamentals are also a major risk factor for investing in the good cheap stocks or penny stock companies. Various penny stocks belong to companies with limited track records, uncertain financial health or unproven business models, and limited regulatory inspection. Hence, you may find it hard to gather trustworthy and accurate information about these companies, which raises the risk of investing in companies with weak fundamentals or even fraudulent activity.

Therefore, before buying penny stocks, review the earnings growth, debt structure, and liquidity positions.

Top 3 Best Stocks Under $5

The top best stocks under $5 or cheap stocks to invest in may indicate both low prices of the stocks with an affordable valuation. "Cheap" can encompass both a low stock price and an affordable valuation. Ideally, the best picks are those with both characteristics, featuring a share price under $5 and an attractive valuation based on earnings, sales, and future growth prospects. You may wonder: What are some penny stocks to buy now? Here are the top 3 best stocks under $5 to invest in:

Best Stocks Under $5 - PLUG Power Inc. (PLUG)

Source: Plugpower

PLUG Power Inc. (PLUG) is an interesting alternative as it is currently priced under $5. PLUG is a green energy revolution leader specializing in hydrogen fuel cell technology. This forward-thinking business specializes in developing and producing hydrogen fuel cell systems for stationary and electric vehicle applications. PLUG's dedication to sustainability is demonstrated by its strategic alliances with major players in the market, such as Amazon and Renault.

Hence, PLUG stands out as a major participant in the industry, given the rise in demand for renewable energy solutions worldwide. In order to contribute to a better future, the company's hydrogen fuel cells provide a more effective and environmentally responsible substitute for conventional batteries. Investors looking for value and environmental impact will find PLUG Power Inc. to be a convincing possibility because of its affordability and forward-thinking nature. As a wise investment in the future of sustainable energy, think about including PLUG in your portfolio right now.

Fundamentally, PLUG Power develops and produces hydrogen fuel cell devices to take the role of conventional batteries in electric machinery and cars. This technology solves the growing need for sustainable energy solutions while increasing efficiency and minimizing environmental effects.

Over the past few years, PLUG has grown significantly thanks to smart alliances with major players in the market. Their partnerships with businesses such as Amazon and Walmart highlight how widely accepted hydrogen fuel cells are as a practical and sustainable option for the shift to renewable energy.

PLUG Power stock is currently trading around the $4.52 price area. In the last 52 weeks PLUG stock price has dropped to the $3.30 price area, which is April 2020's low.

Key financial metrics and ratios

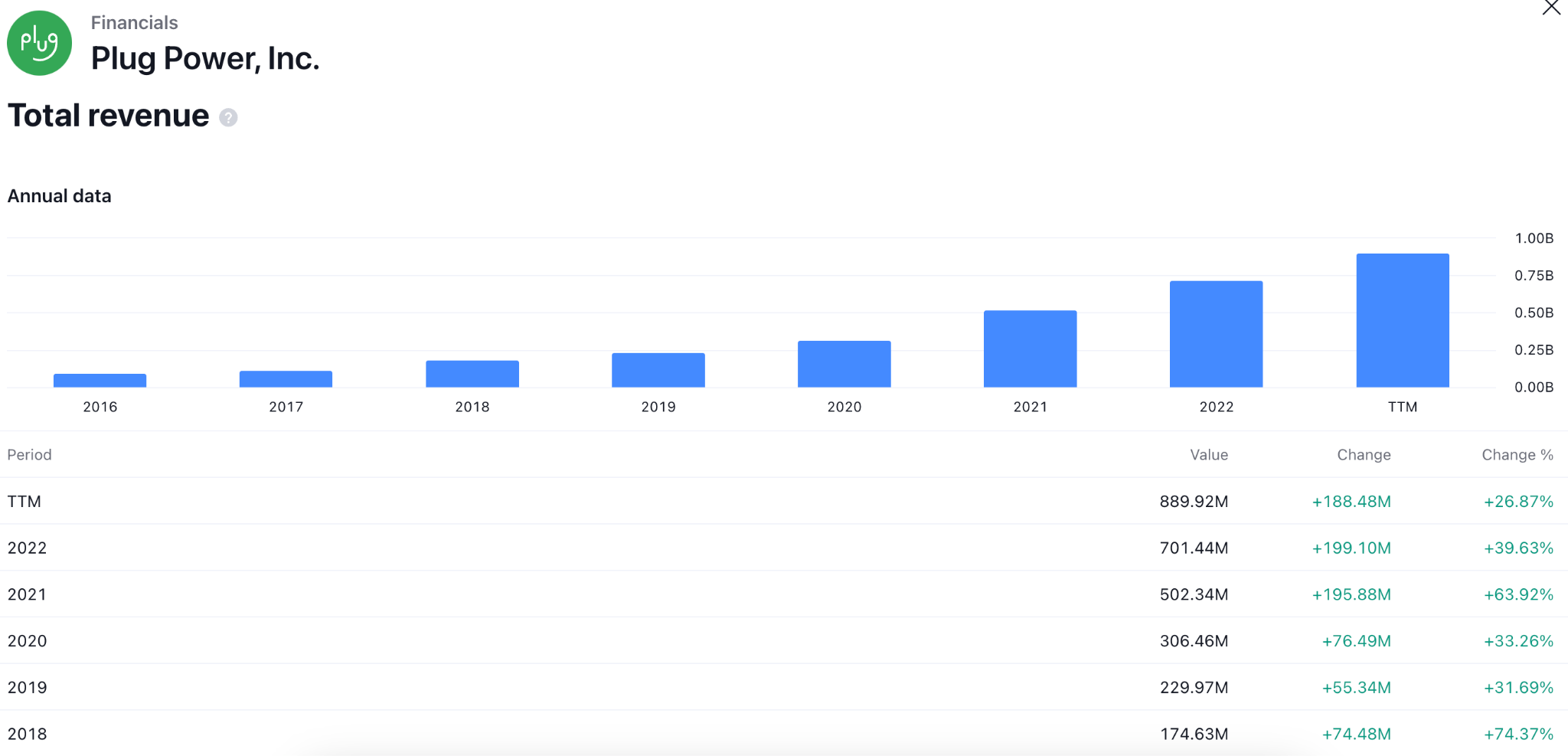

Plug Power Inc. shared its financial results for the three and nine months ending September 30, 2023. In the third quarter, the company earned $20.07 million in sales, up from $9.52 million last year.

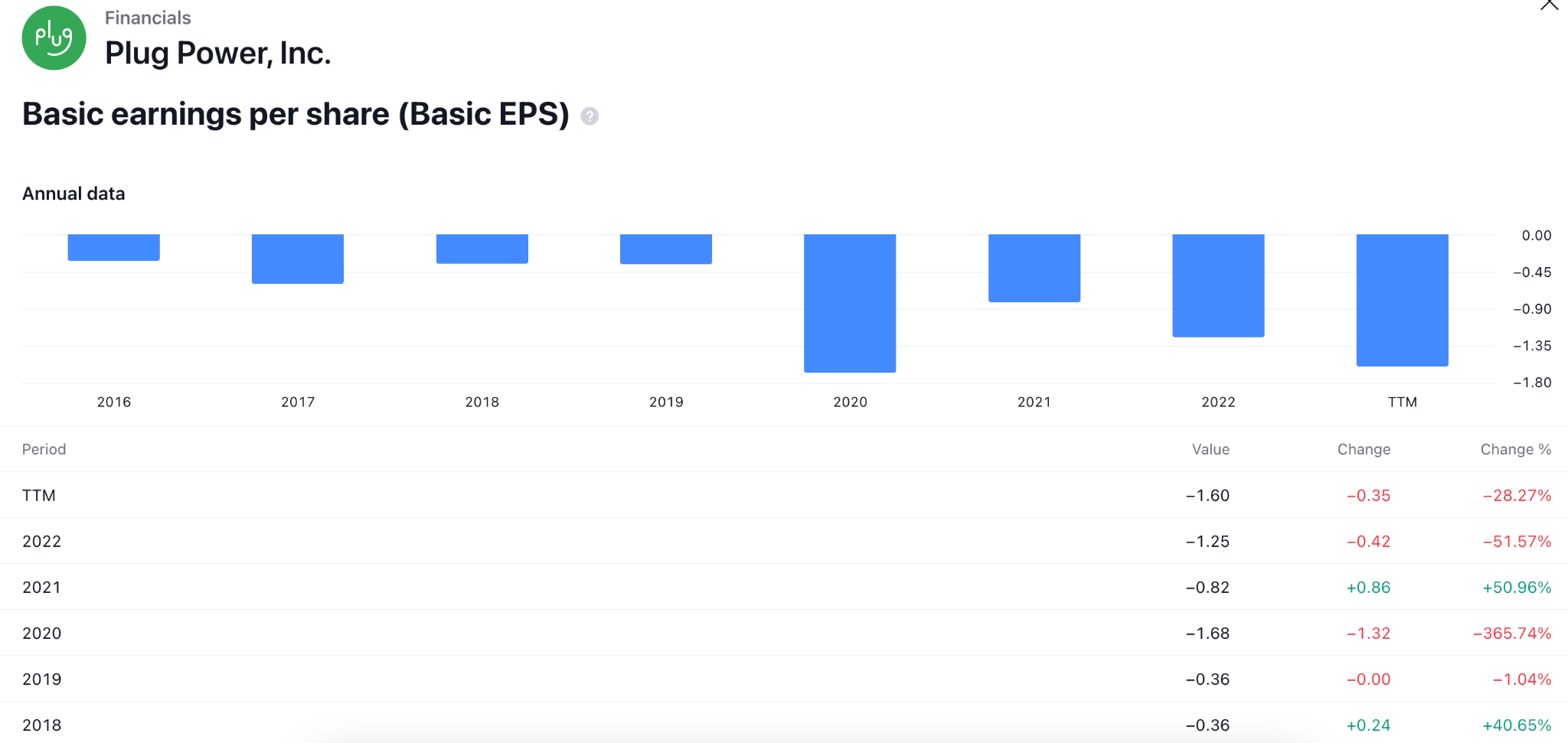

The total revenue was $198.71 million, compared to $188.63 million a year ago. The net loss for this quarter was $283.48 million, an increase from $170.76 million last year. The basic loss per share from ongoing operations was $0.47, up from $0.3 last year.

For the nine months, the sales were $44.14 million, showing growth from $30.73 million a year ago. The total revenue reached $669.18 million, up from $480.7 million last year. The net loss for the nine months was $726.44 million, compared to $500.54 million a year ago. The basic loss per share from continuing operations was $1.22, an increase from $0.87 last year.

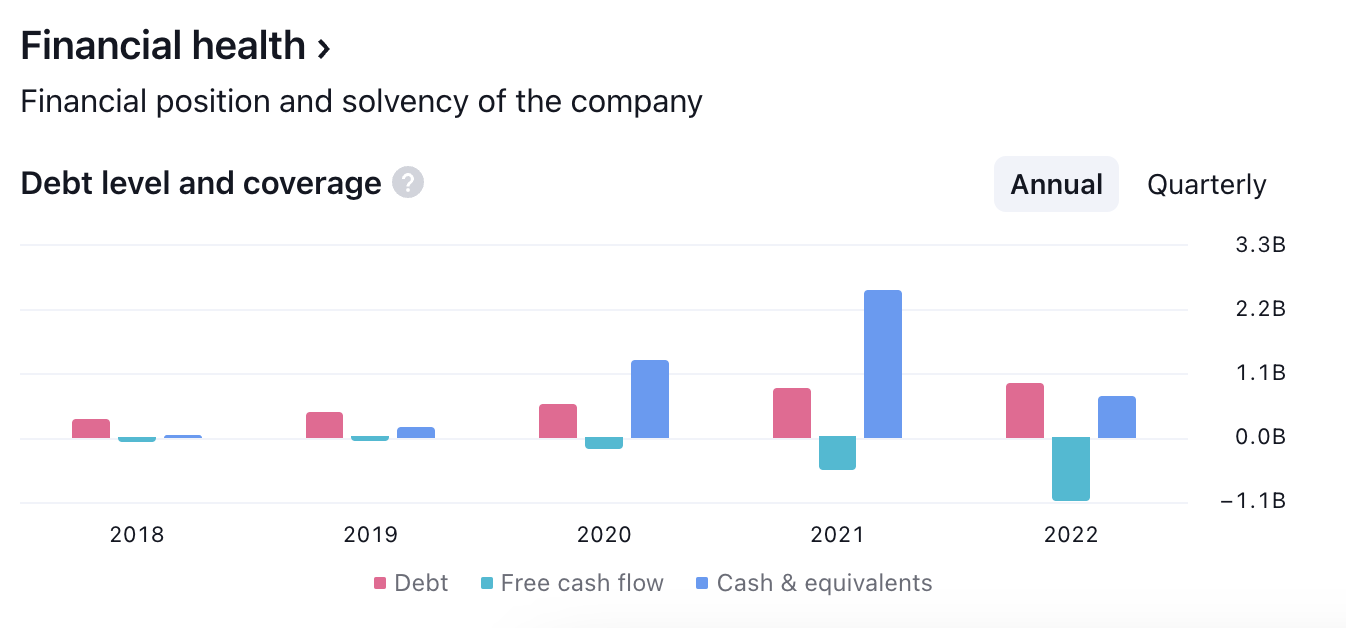

Now, come to the debt structure. The last 5 years' performance shows higher equity finance than debt, which suggests a growth opportunity by raising finance through debts:

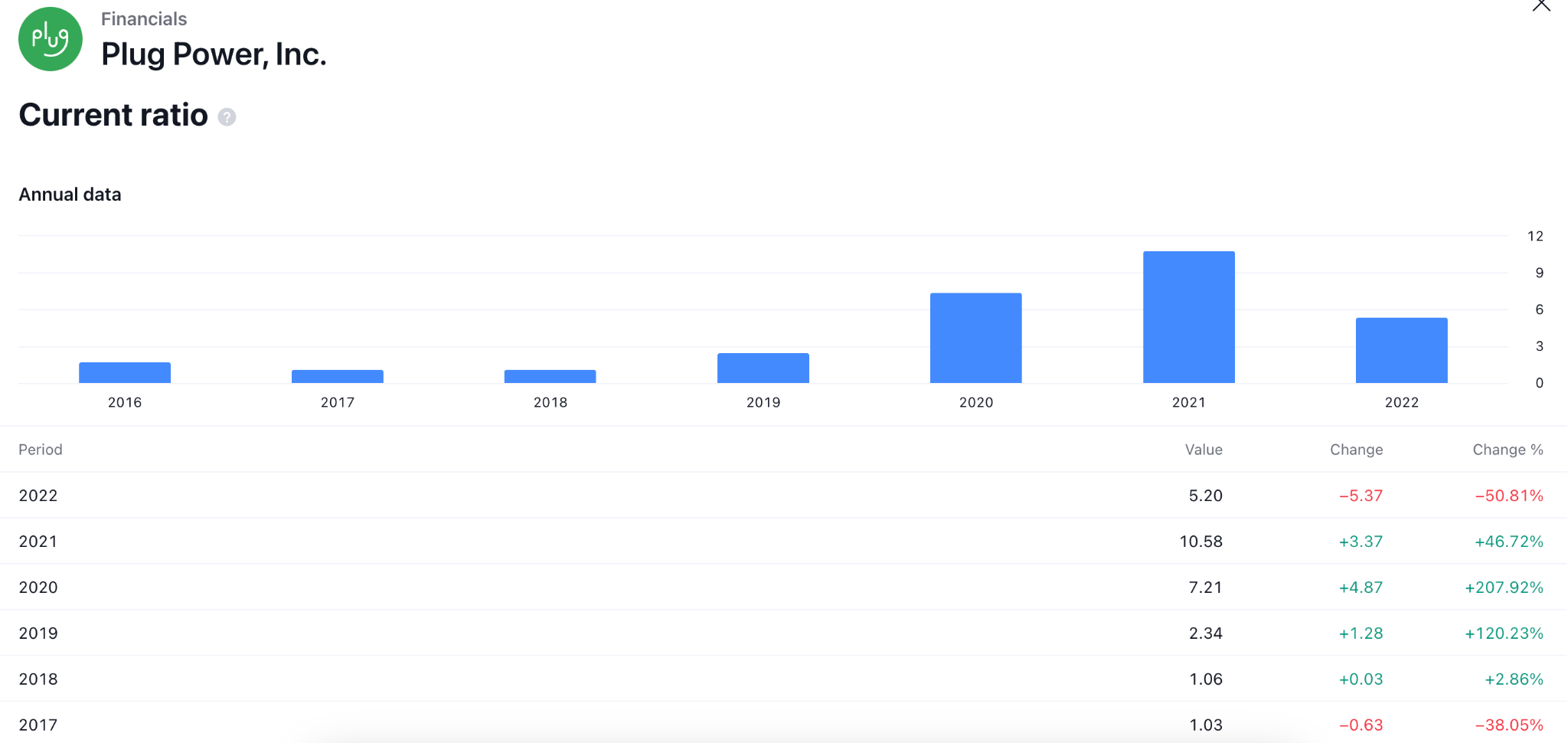

In the liquidity section, the current asset: current liability shows a stable position, suggesting that the company has enough cash and cash equivalent to run the day-to-day business:

Recent news events that may impact PLUG stock price

Plug Power has set up over 60,000 fuel cell systems for electric mobility, giving it a leading position. Additionally, it holds the title of being the world's largest buyer of liquid hydrogen.

Over the last decade, Plug Power has achieved a remarkable 40% annual growth in sales. Projections indicate that its sales will reach $1.7 billion in 2024, a significant jump from $230 million in 2019.

Recently, the company installed its first system for Amazon.com, deploying more than 17,000 fuel cells to replace batteries.

"This project demonstrates Plug's ability to execute across the full hydrogen value chain and shows how we can design and implement end-to-end solutions for our customers," Plug CEO Andy Marsh said in the news release.

Cheap Stocks to Buy: PLUG Stock Forecast

Source: TradingView

Plug stock price bounced from the $3.30 psychological support level and had a monthly bullish candle close. As per the current price action, PLUG stock price may recover higher toward the $8.00 price area. However, the long-term bullish reversal might come after a valid Change of Character or sell-side liquidity sweep formation.

Best Stocks Under $5 - Lucid Group Inc. (LCID)

Lucid Group Inc. (LCID) is among the best stocks under $5, unlocking investment potential. Lucid leads the electric vehicle (EV) revolution and provides an exciting opportunity for budget-conscious investors looking for growth. The innovative Lucid Air, known for its cutting-edge technology and sleek design, positions LCID as a disruptor in the automotive industry. Explore affordable stocks with high growth potential, considering Lucid's strategic partnerships and innovations. Join the green energy movement at an accessible entry point.

Source: Lucidmotors

Today, LCID is not just a low-cost investment but a gateway to the future of sustainable transportation. Invest wisely and see how Lucid Group Inc. drives your portfolio to new heights.

Leading luxury electric vehicle (EV) maker Lucid Group Inc. (LCID) carves a position for itself in the market with its flagship model, the Lucid Air. With LCID's exquisite design and advanced technology, you may enhance your driving experience. Lucid distinguishes itself in the high-end EV market with a strong commitment to sustainability and performance.

LCID stock is currently trading around the $4.26 price area, which makes it a potential best cheap stocks to buy now. In the last 52 weeks, the LCID stock price has dropped to the $3.65 price area, the all-time low level.

Financial condition and valuation concerns

As of September 30, 2023, Lucid Group, Inc. reports assets totaling $8.94 billion and liabilities of $3.54 billion. Current assets include $1.16 billion in cash, $3.26 billion in short-term investments, and $23.37 million in accounts receivable.

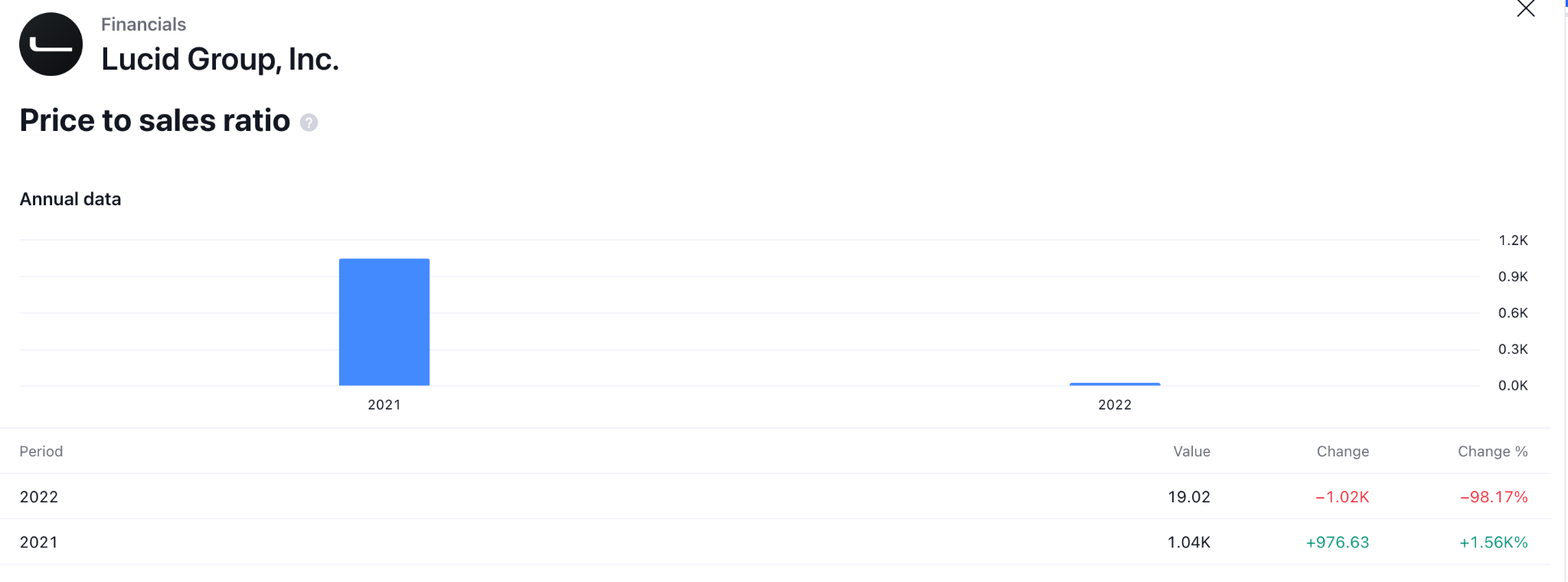

However, the company failed to show a remarkable stance on the P/S ratio as it remains a bit lower than the previous year:

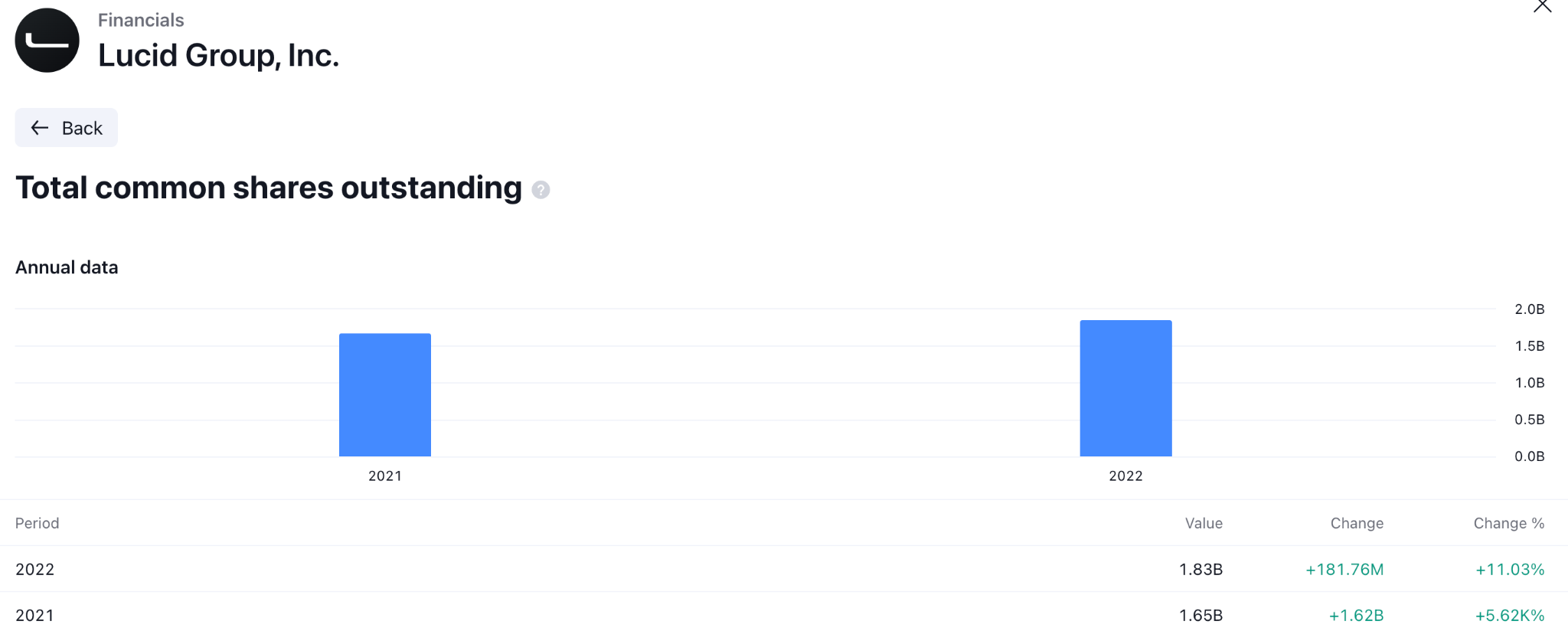

On the other hand, stockholders' equity stands at $5.41 billion, with common stock at $0.23 million and additional paid-in capital at $14.98 billion. The common share outstanding has faced a 11% growth in 2023, which indicates an upward possibility in the coming year:

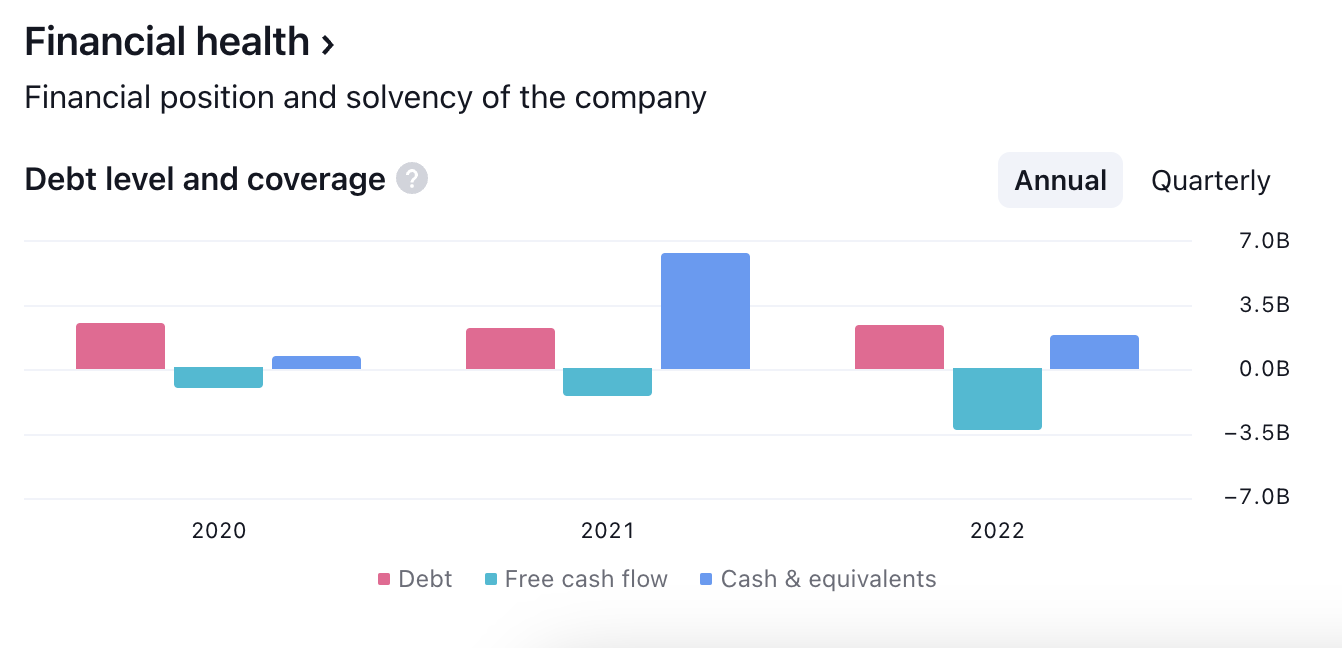

The long-term debt structure looks promising, as the company has more room to raise finance from the debt finance.

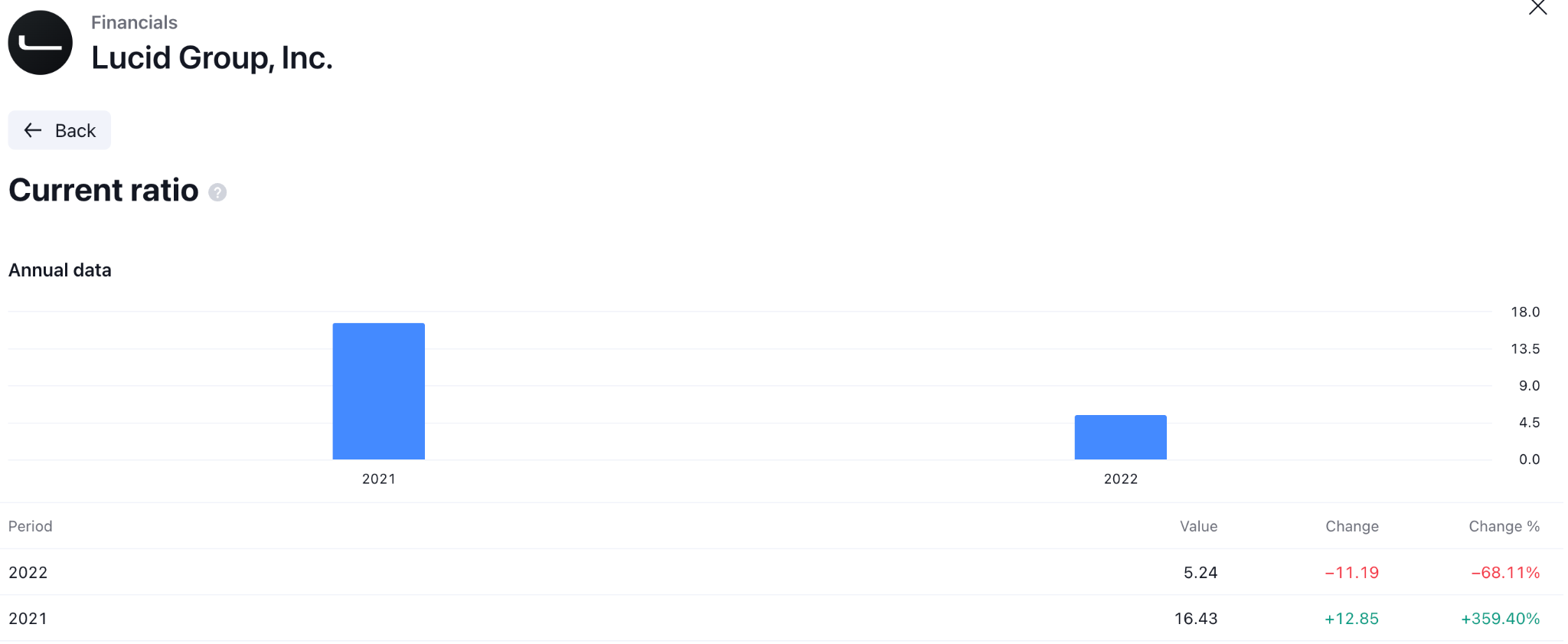

However, the current ratio faced a significant decline in the previous year but still, the current asset remains 5X higher than the current liability:

Recent news events that may impact LCID stock price

Lucid aims to benefit from entering new markets and focusing on improving profit margins. The introduction of the Gravity SUV is a positive move, expanding its potential market.

However, short-term demand worries are causing caution among analysts. With eight Holds and one Sell recommendation, LCID stock holds a consensus Hold rating. Analysts' average price target of $5.21 suggests a 22.3% potential upside from the current levels.

There have been reports indicating that the Biden administration is considering implementing higher tariffs on particular Chinese exports, such as electric vehicles (EVs). The primary aim is to foster domestic manufacturing, which has the potential to substantially bolster the renewable energy sector in the United States by 2024.

Although official confirmation from President Joe Biden or the White House has not yet been received, the anticipation of this new policy is causing LCID stock to rise and providing benefits to other companies in the sector. This trend could potentially act as the impetus required for the electric vehicle (EV) market to rebound in 2024.

Best Stock Under $5: Lucid Stock Price Prediction

Source: TradingView

LCID stock price found support around the $4.00 price area after an extended period of bearish momentum. As per the current situation, there is no sign of a significant bullish reversal, but if the price can break above the $6.10 resistance area with a monthly bullish candle close, we may expect the $10.00 level as the next resistance.

Before forming a stable bullish reversal, an early sign might come from the current descending channel breakout.

Best Stocks Under $5 - Aurora Cannabis Inc. (ACB)

Consider Aurora Cannabis Inc. (ACB), one of the top 3 best stocks under $5 or penny stocks to invest in, making waves in the cannabis industry. As a leading player, ACB excels in growing and distributing high-quality cannabis products. It positions itself as a key player in the rapidly expanding cannabis market, offering a range of products from medical to recreational, capturing diverse consumer preferences.

Source: Auroramj

Aurora Cannabis Inc. is a globally recognized cannabis company known for setting industry standards. Through wholly owned subsidiaries, strategic investments, and global partnerships, Aurora offers premium cannabis and hemp products and innovative technologies, and promotes consumer health.

Operating across continents, they focus on medical and recreational cannabis, patient education, hydroponic cultivation, extraction technologies, and hemp-based health products. With a global presence and a network of distributors, Aurora explores new cannabis markets, utilizing e-commerce and mobile applications.

Aurora stock is currently trading around the $0.4827 price area. After breaking the $4.00 support level, bears pushed the ACB stock price down to the $0.40 price area which is the 52-week low.

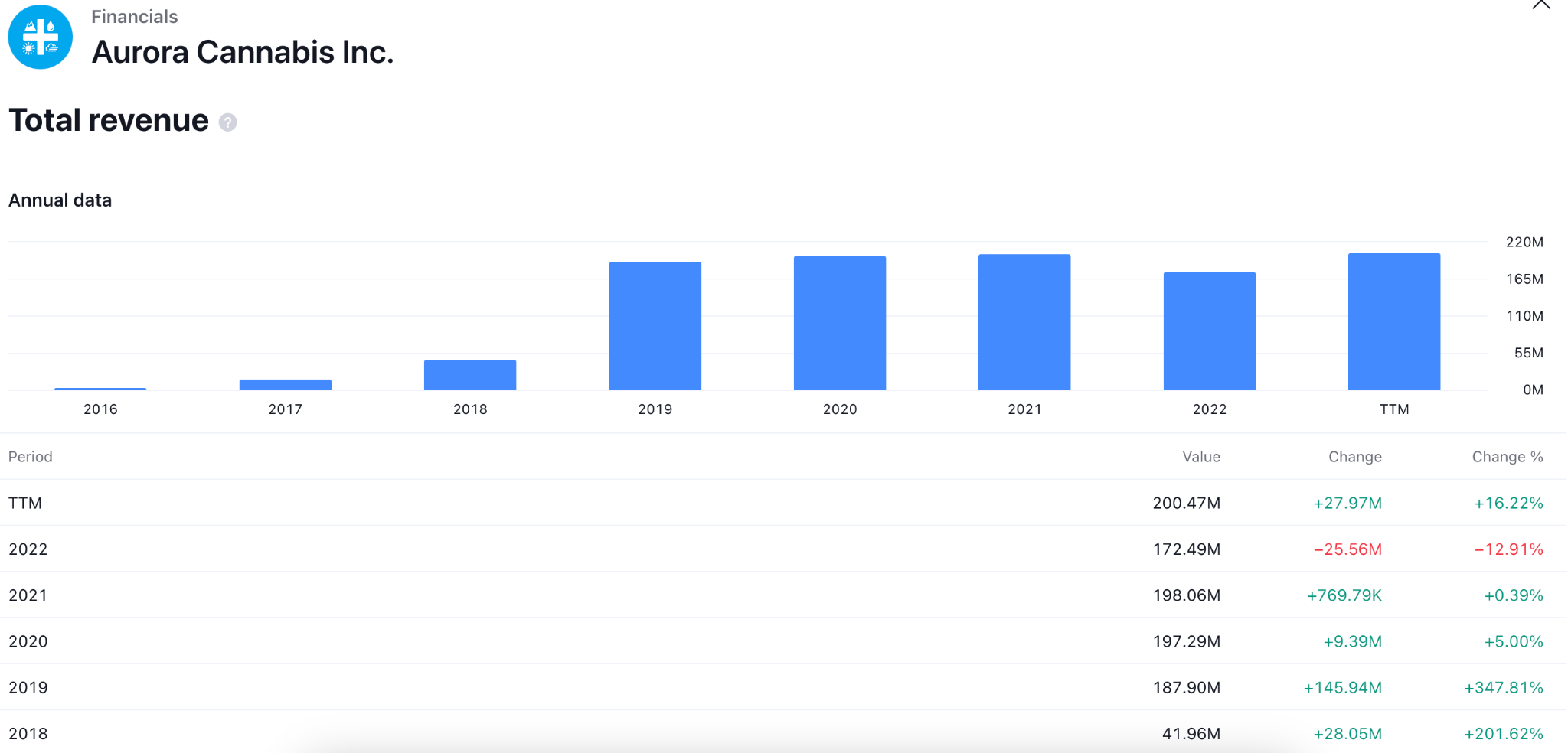

Aurora Cannabis Inc. (ACB) reports positive financial results for Q2 2023. Total net revenue reached $63.4 million, up from $48.6 million in the previous year, driven by growth in medical cannabis and plant propagation businesses.

Adjusted gross margin remains strong at 55%. Net income for Q2 2024 was $0.3 million, a significant improvement from a $45.5 million loss in the same period last year. Adjusted EBITDA turned positive at $3.4 million, compared to a $6.2 million loss in the prior year. Q3 2024 expectations include consistent cannabis revenue and sustained positive EBITDA, showcasing Aurora's financial progress.

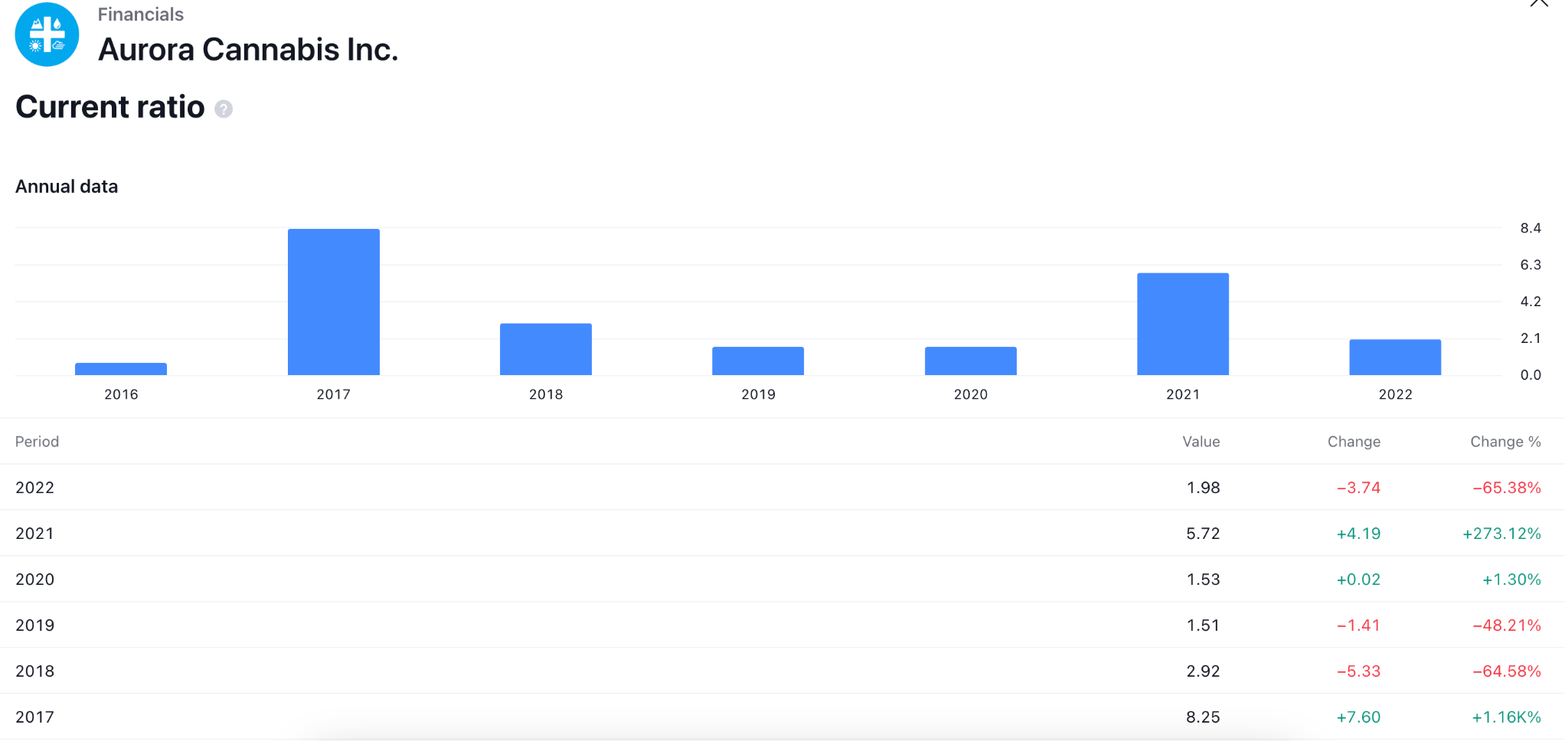

The liquidity structure remained positive even if the latest Current Ratio shows a 65% decline:

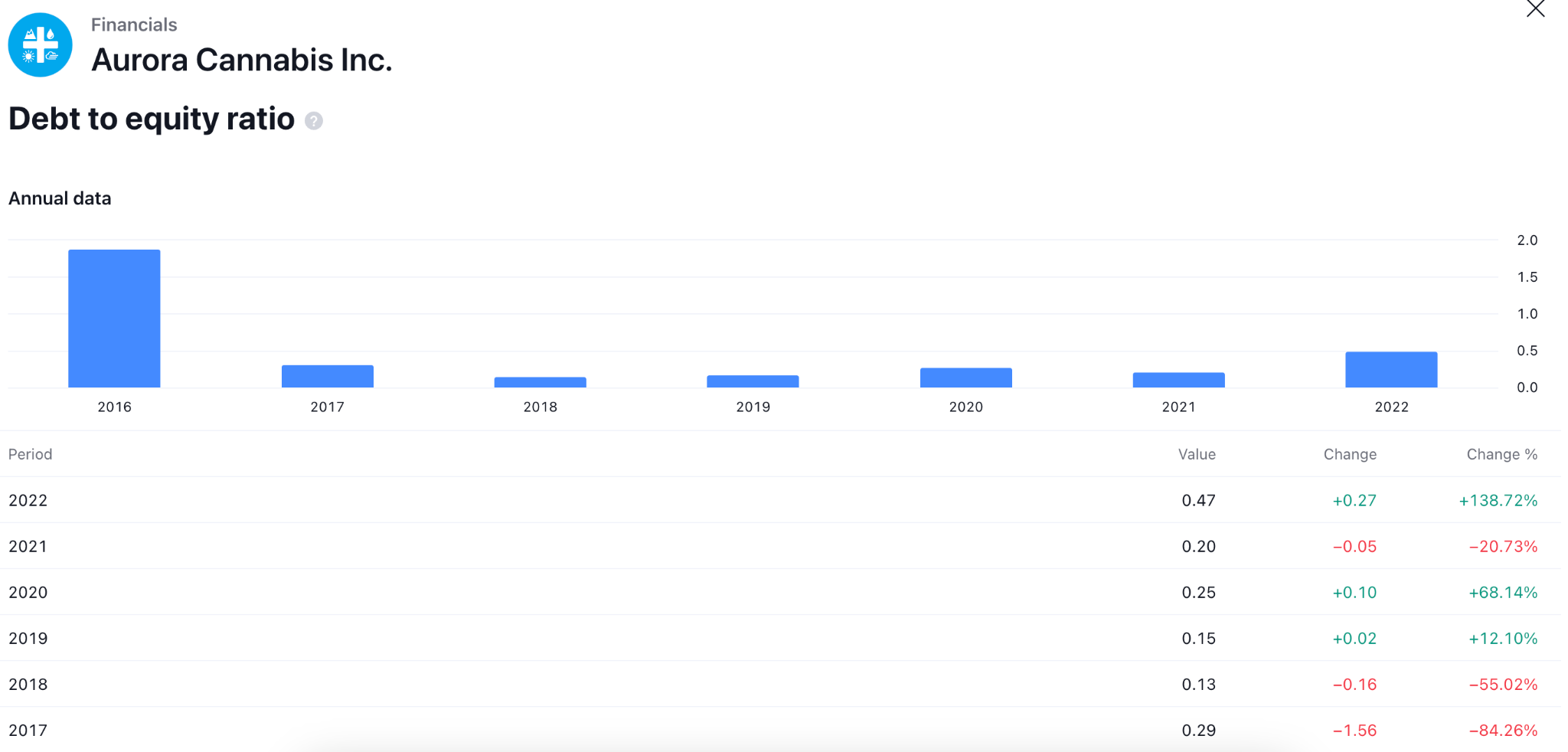

In the long-term debt structure, the debt-to-equity ratio moved slightly higher in 2022, suggesting a debt issue, but the company still has more room for further finance:

Recent news events that may impact ACB stock price

German lawmakers have delayed the final vote on a marijuana legalization bill due to concerns from the Social Democratic Party (SPD). The bill aims to legalize recreational marijuana use and cultivation, as well as establish cannabis social clubs by April 1 and July 1, respectively. Dirk Heidenblut, responsible for the SPD's cannabis policy, stated that as long as the bill advances by the end of next month, the schedule for marijuana legalization in Germany will stay on track.

Furthermore, a significant deficiency exists in the form of a comprehensive approach for Aurora to penetrate the lucrative U.S. market following the repeal of federal prohibition. Although this may not appear to be an urgent issue in light of the improbable likelihood that the United States will soon lift federal prohibition, it has the potential to restrict Aurora's prospects for long-term expansion.

Good Penny Stocks to Buy: ACB Stock Forecast

Source: TradingView

ACB stock price is ranging above the $0.40 price area for an extended period. As per the current price action context, if the price bounces higher again and has a monthly bullish candle close above the $1.00 psychological resistance area, bulls may sustain the bullish momentum toward the next resistance area of $2.50.

Tips for Trading Best Stocks Under $5 or Cheapest Penny Stocks

When it comes to trading stocks under $5, strategic insights and a keen understanding of market dynamics are crucial. Let's explore key tips to help you make informed decisions and maximize your gains, all while.

Source: Unsplash

A. Leverage Short-Term Opportunities

If you start trading stocks under 5 dollars, try to focus on short-term opportunities rather than committing to long-term investments. This approach may offer you flexibility and the potential for quick returns. The benefits of trading in the short term include the ability to capitalize on market volatility and adapt swiftly to changing trends.

The ideal approach is to identify the long-term market direction and follow the trend in the lower timeframe based on the price behavior of the best short term stocks or stocks under $5.

The above image shows the H1 chart of Aurora Cannabis Stock. Even if the stock is trading sideways for a long time, the short-term breakout and retest provide a potential long opportunity.

B. Techniques to Consider when trading stocks that are low right now

Try to apply various techniques to maximize your trading potential. Techniques like swing trading and scalping can be particularly effective in the low-priced stock market. Swing trading allows you to capture short- to medium-term gains, while scalping involves making rapid trades to exploit minor price fluctuations.

For intraday trading, a short-term price fluctuation during the active session could be a good way to join the market. However, investors can buy and HODL the asset based on the medium-term price action, but it needs solid support from the higher timeframe.

C. Manage Risk Carefully

Always focus on reducing risks by implementing decisive strategies. Set stop losses to limit potential losses, avoid over-leveraging your positions, and be cautious with position sizes, especially when dabbling in penny stock speculation. Careful risk management is crucial for long-term success in the volatile world of low-priced stocks or undervalue stock.

The above image shows how a long position was taken from a bullish order block, risking 4% to aim for a 7% gain.

D. Analyze Key Metrics

Before entering any trades, analyze key metrics to make informed decisions. Focus on factors like volume, liquidity, and technical indicator crossovers. These metrics provide valuable insights into the stock's performance and potential future movements.

Common metrics to look at are:

- Revenue growth

- Business expansion

- EPS growth

- Management report

E. Time Commitment and Focus

Successful trading stocks under $5 requires dedication. Be prepared for close intraday monitoring, as the market can be unpredictable. Stay focused on price movements, news, and market sentiment to make timely decisions.

F. Review Performance Extensively

Regularly review and assess your trading performance. Continuously improve your understanding of cheap stock dynamics by analyzing past trades and identifying areas for enhancement. Stay informed about market trends and adjust your strategies accordingly.

Trade Best Stocks Under $5 with VSTAR

Well, after all the discussion earlier on the best cheap stocks or penny stocks to buy under $5, now you must be thinking about which platform will be better to trade these cheap stocks. So, here comes the solution with VSTAR that will help you to make a significant impact during your journey of cheap stock trading.

VSTAR is a dynamic platform that opens doors to trade the best stocks under $5 and offers a fast and simple approach that may potentially boost your investment portfolio. VSTAR is not just a trading platform, it's a comprehensive solution designed to empower traders of all levels, from beginners to seasoned professionals. It combines cutting-edge technology with user-friendly features to create an environment where you can navigate the complexities of the stock market with ease.

With VSTAR, you can confidently access the best stocks under $5. The platform provides a step-by-step guide to help you easily navigate the market complexities, ensuring that you make informed decisions. Easy, quick, and simple – these power words define the VSTAR experience. Here are some key features of VSTAR:

- Real-Time Data: Stay ahead of market trends with VSTAR's up-to-the-minute data, ensuring that you have the latest information at your fingertips.

- User-Friendly Interface: VSTAR's intuitive design makes it easy for both novice and experienced traders to navigate the platform efficiently.

- Analytical Tools: Benefit from VSTAR's advanced analytical tools, enabling you to perform in-depth stock analysis and make well-informed decisions.

- Risk Management: Mitigate risks effectively with VSTAR's robust risk management features, allowing you to set limits and safeguard your investments.

Trading the penny stocks or cheap stocks under $5, VSTAR can be your reliable companion, offering a comprehensive toolkit to explore, analyze, and trade, potentially unlocking the gains from affordable stocks.

Conclusion

It takes a calculated strategy to trade the stocks less than $5 successfully. After reviewing the top penny stocks, it's important to be aware of both the potential for significant profits on the upside and the inherent risks associated with the downside. These good penny stocks to invest in have volatility even when they seem attractive. So it's important to invest wisely.

You should be aware of potential risks when trading cheap stocks to buy under $5, consider the market's dynamics, and assess each company's fundamentals. Diversify your portfolio, stay informed, and quickly respond to market fluctuations. Your choices today can shape your financial future, so invest in cheap good stocks wisely, considering both the exciting potential and the inherent uncertainties. Hence, sticking to a smart strategic approach is the key to optimizing the possibilities while reducing risks when investing in dynamic top stocks under $5.

FAQs

1. What are good stocks under $5?

PLUG Power (clean energy), Lucid Group (electric vehicles), and Aurora Cannabis (cannabis) are a few stocks under $5 that could have growth potential. But they come with high risk.

2. What is the best AI stock under $5?

BigBear.ai Holdings (NYSE: BBAI) could be a good AI stock under $5 based on its potential for triple-digit upside.