A seismic shift in market sentiment has been ignited by a recent ruling from a federal judge that seriously questions the SEC's decision to reject the conversion of the Grayscale Bitcoin Trust (GBTC) into a more enticing exchange-traded fund. This decision has led numerous analysts to reassess their outlook, with many now considering the approval of a spot Bitcoin ETF to be a matter of "when" rather than "if." In fact, Bloomberg analysts have pegged the likelihood of approval this year at an astounding 75%.

This newfound optimism isn't confined solely to Grayscale's Bitcoin product but extends to the entire cryptocurrency space. The Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE) have witnessed substantial reductions in their discounts to Net Asset Value (NAV) - a metric denoting the value of the Bitcoin and Ethereum they hold, respectively. GBTC's discount has shrunk from a staggering 46% to a more manageable 21%, while ETHE's discount has similarly improved from 59% to 29%. These developments serve as compelling evidence that investors are positioning themselves in anticipation of regulatory green lights for Bitcoin ETFs.

Along With Bitcoin, Ethereum's Outstanding Potential

Amid the chorus of voices championing Bitcoin ETFs, Ethereum ETFs, represented by Grayscale's ETHE, remain a tantalizing prospect. If the SEC approves a spot Bitcoin ETF, there's a strong argument for an analogous Ethereum ETF. Grayscale itself has already expressed intentions to convert ETHE and other products into ETFs. What's more, Ethereum's ETHE currently trades at a larger discount than GBTC, thereby presenting an even greater arbitrage opportunity for astute investors.

Ethereum's unique characteristics and potential role as the leading platform for Web3 development make it an exciting choice. Ethereum's discount, combined with its less liquid markets compared to Bitcoin, could result in the incremental buying pressure from an ETF having a more substantial impact on its price. From a fundamental standpoint, Ethereum's superior upside potential in Web3 development adds to its allure.

Futures ETFs vs. Spot ETFs

It is crucial to differentiate between futures-based ETFs and spot ETFs when discussing the potential impact of ETFs on the cryptocurrency market. Historically, futures-based ETFs have lagged behind spot markets due to the intricacies of futures contracts. Conversely, spot ETFs offer a straightforward and safe investment solution that appeals to both retail and institutional investors.

As the regulatory environment continues to mature, there is a growing consensus that spot ETFs are on the brink of approval. Investors would be prudent to closely monitor this development. However, it is imperative to underscore that this analysis emphasizes the importance of simultaneously considering Ethereum (ETH) and Ethereum-based ETFs (ETHE) within the broader context of cryptocurrency investments.

The Impact of Rising Interest Rates

While the cryptocurrency market braces for transformation, macroeconomic factors, particularly surging interest rates, warrant vigilant scrutiny. The U.S. 10-year Treasury yield has recently ascended to a 16-year high of 4.63%. Traditionally, rising interest rates exert downward pressure on Bitcoin's price.

However, there is a growing body of thought suggesting that the historical relationship between interest rates and Bitcoin is evolving. Some argue that Bitcoin's unique technical characteristics may counterbalance its traditional sensitivity to interest rates. An intriguing concept gaining traction is that of Bitcoin halving events, which occur every four years. These halving events can substantially influence Bitcoin's supply dynamics and potentially drive significant price appreciation.

Potentially, Bitcoin's "crypto winter" has ended and there may be a rapid increase in its value over 2024.

Potential Concerns: 'Stagflation'

In addition to rising interest rates, the cryptocurrency market faces potential headwinds in the form of "stagflation." This term, which denotes a combination of sluggish economic growth and rapid inflation, hasn't been a prominent concern since the 1970s.

The recent surge in interest rates, coupled with rising oil prices, has sparked discussions of stagflation. Such economic conditions could impact the cryptocurrency market. A recent survey conducted by The Wall Street Journal reveals that 41% of U.S. chief financial officers (CFOs) are contemplating capital spending reductions, while 42% are planning to trim operational costs in response to higher rates. This cautious approach among corporate leaders underscores the need for cryptocurrency investors to remain vigilant in a changing economic landscape.

Regulatory Developments

The regulatory landscape plays a pivotal role in shaping the cryptocurrency market's future. Recent developments in the U.S. House Financial Services Committee highlight the mounting congressional pressure on the SEC to promptly approve spot Bitcoin ETFs. A bipartisan group of lawmakers has vocally urged SEC Chair Gary Gensler to heed court rulings and refrain from obstructing Bitcoin ETF approvals.

A significant turning point in this ongoing battle came when a federal judge instructed the SEC to reevaluate its stance on these ETF applications. The judge argued that the SEC's rejection of the Grayscale case had been "arbitrary and capricious." Consequently, lawmakers are adamant that the SEC should no longer deny applications based on inconsistent standards.

Fundamentals

The potential approval of a Bitcoin Exchange-Traded Fund (ETF) by the U.S. Securities and Exchange Commission (SEC) has been a topic of significant interest and debate within the cryptocurrency and financial markets. While the SEC has not yet approved a Bitcoin ETF, the prospect of such an approval has generated considerable speculation about its potential impact on Bitcoin's market valuations.

To begin with, an ETF is a financial instrument that tracks the price of an underlying asset, in this case, Bitcoin. Unlike traditional investments in Bitcoin, which require investors to purchase and store the cryptocurrency themselves, an ETF allows investors to gain exposure to Bitcoin's price movements without actually owning the digital currency. This key distinction can have several significant implications for Bitcoin's market valuations.

One of the primary ways an SEC-approved Bitcoin ETF could boost BTC's market valuations is by making the cryptocurrency more accessible to a broader range of investors. Traditional Bitcoin investments often involve the complexities of setting up wallets, managing private keys, and dealing with exchanges, which can be intimidating for newcomers. With an ETF, investors can simply buy and sell shares through their brokerage accounts, just like they would with stocks. This increased accessibility could lead to a surge in demand from retail and institutional investors who were previously hesitant or unable to invest in Bitcoin.

Institutional investors, such as hedge funds, asset managers, and pension funds, have been cautious about entering the cryptocurrency market due to regulatory concerns and custodial issues. An SEC-approved Bitcoin ETF could provide a regulatory framework and a trusted custodian for institutional investors, making it easier for them to allocate funds to Bitcoin. The involvement of large institutional players could lead to substantial inflows of capital into the Bitcoin market, potentially driving up prices.

Fundamentally, regulatory approval from the SEC would serve as a form of validation for Bitcoin in the eyes of many investors. It would signify that Bitcoin has reached a level of maturity and regulatory acceptance that could reduce concerns about its legitimacy and security. This validation could encourage more conservative investors who were previously on the fence to allocate a portion of their portfolios to Bitcoin, contributing to increased demand and higher valuations.

In terms of liquidity and price discovery, ETFs typically have high liquidity, as they can be bought and sold throughout the trading day. An SEC-approved Bitcoin ETF would provide a more liquid way for investors to enter and exit the market, potentially reducing price volatility. Additionally, the continuous trading of the ETF shares would contribute to better price discovery, as it would reflect real-time market sentiment and demand for Bitcoin.

Overall, an ETF would integrate Bitcoin into the traditional financial ecosystem. It would enable investors to incorporate Bitcoin into diversified portfolios alongside traditional assets like stocks and bonds. This integration could lead to a more stable and balanced investment landscape, attracting even more capital into Bitcoin as a legitimate asset class. Also, the approval of a Bitcoin ETF by a major regulatory authority like the SEC could set a precedent for other countries and regions to follow suit. As more countries consider their own Bitcoin ETFs, it could create a global trend that further legitimizes and normalizes Bitcoin as a mainstream investment.

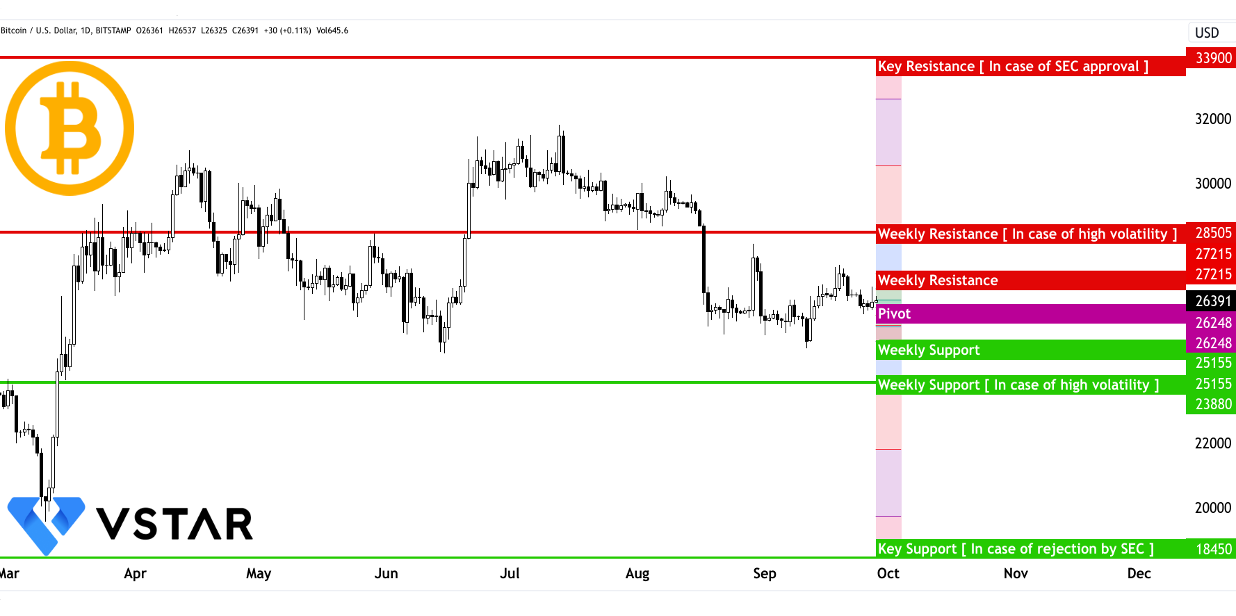

The technical perspective on the weekly moves of BTC/USD can be comprehended as follows:

Data source: tradingview.com

In conclusion, the cryptocurrency market stands on the precipice of profound change with the looming possibility of Bitcoin ETF approvals in the United States. While Bitcoin takes center stage in discussions, Ethereum and Ethereum-based ETFs present equally tantalizing opportunities. Investors should stay vigilant regarding regulatory developments and consider diversifying beyond Bitcoin.