Investors looking for a profitable investment opportunity in the online travel industry can consider Booking Holdings Inc (NASDAQ: BKNG), the world's leading provider of online travel and related services. Booking Holdings operates several well-known brands, such as Booking.com, Priceline.com, Agoda.com, Kayak.com, and Rentalcars.com, that offer a wide range of travel products and services to consumers and local partners in more than 220 countries and territories. Recent highlights include an established strategic partnership with Crypto.com to provide exclusive travel perks to Crypto.com users. The company posted strong Q2 2023 financials with a 15% increase in gross travel bookings, a 27% rise in total revenues, and $1.3 billion net income. The company also announced generative AI-enabled travel assistants at Priceline and Booking.com, which aim to enhance customer experience and satisfaction.

Booking Holdings Inc's Overview

Booking Holdings Inc. is a global leader in online travel and related services, operating in more than 220 countries and territories through six primary brands and several subsidiary brands. The company got founded in 1996 by Jay S. Walker as Priceline.com, an innovative platform that allowed customers to name their prices for travel products. In 2018, the company rebranded as Booking Holdings to reflect its diversified portfolio of brands, which includes Booking.com, Priceline.com, Agoda.com, Kayak.com, Rentalcars.com, and OpenTable. The company is headquartered in Norwalk, Connecticut, USA.

The company's current CEO is Glenn D. Fogel, who joined the company in 2000 as a senior vice president of corporate development and got appointed as CEO in 2017. Fogel has been instrumental in leading the company's growth strategy, including acquiring Booking.com in 2005 and Agoda.com in 2007. Fogel also serves as the president and CEO of Booking.com.

The company's top shareholders are The Vanguard Group, Inc., Blackrock Inc., Capital World Investors, State Street Corporation, and T. Rowe Price Associates, Inc., which collectively own about 30% of the company's outstanding shares. The company's top mutual fund holders as of March 2023 are Vanguard Total Stock Market ETF, Vanguard 500 Index Fund, Invesco QQQ Trust, Government Pension Fund - Global (Norway), and Fidelity 500 Index Fund, which collectively own about 10% of the company's outstanding shares.

Notable achievements include acquiring Booking.com in 2005, propelling it to become the world's foremost hotel booking platform. The company's evolution beyond hotels into flights, car rentals, attractions, and experiences got facilitated by acquisitions like Agoda.com, Rentalcars.com, Kayak.com, and OpenTable. A pivotal transformation occurred in 2019 when Booking.com unveiled a fresh brand identity and logo, reflecting its holistic travel marketplace status. Its innovative spirit persisted in 2022 with an exclusive partnership with Crypto.com, offering distinctive travel benefits to cryptocurrency users. Notably, Booking Holdings achieved operational carbon neutrality across all brands in 2020.

Source: Alamy

Booking Holdings Inc's Business Model and Products/Services

Booking Holdings makes money from two primary sources: travel commissions and advertising revenue. Travel commissions are fees that Booking Holdings charges to its customers or local partners when they book travel products or services through its platforms, such as hotels, flights, car rentals, attractions, and experiences. Advertising revenue is income that Booking Holdings generates from displaying ads on its websites or apps or from referring customers to third-party websites that pay Booking Holdings for the traffic.

Main Products and Services

Booking Holdings offers a wide range of travel products and services to consumers and local partners through its six primary brands:

Booking.com: The world's largest platform for hotel bookings, offering over 28 million accommodation listings, including hotels, apartments, vacation rentals, and more. Booking.com also offers flights, car rentals, attractions, and experiences.

Source: Alamy

Priceline.com: A leading online travel site that offers deals on hotels, flights, car rentals, cruises, and vacation packages. Priceline.com also features a Name Your Own Price bidding model and an Express Deals service that allows customers to save up to 60% on travel bookings.

Agoda.com: This is a leading online travel platform in Asia that offers over 2 million accommodation listings, including hotels, resorts, villas, and more. Agoda.com also offers flights, car rentals, airport transfers, and activities.

Kayak.com: A high-ranking travel metasearch engine that allows customers to compare prices and options from hundreds of travel sites for hotels, flights, car rentals, and more. Kayak.com also offers travel planning tools, such as Trips, Explore, and Price Alerts.

Rentalcars.com: The world's largest platform for car rental bookings, offering over 900 car rental companies in 160 countries. Rentalcars.com also provides airport transfers and car rental insurance.

OpenTable:The world's leading online restaurant reservation platform, offering over 60,000 restaurants in 20 countries. OpenTable also offers diners rewards points, reviews, menus, and photos.

Booking Holdings Inc's Financials, Growth, and Valuation Metrics

Source: Alamy

As of August 28, 2023, BKNG held a market capitalization of $108.59 billion, derived from its closing share price of $3,042.51 on NASDAQ. Notably, BKNG reported a remarkable 51% rise in net income, reaching $1.3 billion in the second quarter of 2023 compared to the corresponding period in 2022. Impressively, the net income for the first half of 2023 amounted to $1.6 billion, indicating an 891% surge compared to the same period in 2022. The company's total revenues also exhibited growth, with the second quarter of 2023 registering $5.5 billion, marking a 27% increase from 2022.

The initial half of 2023 saw total revenues of $9.2 billion, reflecting a substantial 32% upswing from the first half of 2022. Noteworthy improvements in profit margins got observed, evident in BKNG's net income as a percentage of total revenues, which stood at 23.6% for the second quarter of 2023 and 16.8% for the first half of 2023, in contrast to the corresponding periods in 2022, which reported figures of 20% and 2.2% respectively. Further emphasizing the company's growth, the return on equity (ROE) surged to 194% and 234% for the second quarter and the first half of 2023, respectively, whereas the comparable figures for 2022 were 43% and 6%.

Balance Sheet Strength and Implications

As of June 30, 2023, BKNG showcased a formidable financial position, featuring $14.6 billion in cash and cash equivalents and $1.1 billion invested in both short-term and long-term holdings. The company's operational cash activities yielded $4.6 billion in net cash for the initial half of 2023, reflecting a 6% increase from the same period in 2022. Additionally, BKNG's free cash flow, calculated by deducting capital expenditures from net cash provided by operating activities, amounted to $4.4 billion for the first half of 2023, marking a 6% growth from the corresponding period in 2022.

In terms of debt, BKNG carried a total debt load of $14 billion as of June 30, 2023, which encompassed $855 million in short-term debt and $13.2 billion in long-term debt. Notably, the debt-to-equity ratio stood at -21 as of June 30, 2023, contrasting with -4 as of December 31, 2022. BKNG strategically employed its cash flow and debt reserves to execute share repurchases and acquisitions. The company directed $5.2 billion towards repurchasing its common stock during the first half of 2023, a notable increase from the $2.3 billion recorded in the first half of 2022. Furthermore, BKNG ventured into acquiring various enterprises within the online travel and related services sector, amounting to a total consideration of $131 million for the first half of 2023.

Key Financial Ratios and Metrics

Source: Alamy

As of June 30, 2023, and trailing twelve months (TTM) earnings per share (EPS), BKNG held a price-to-earnings (P/E) ratio of 54. This exceeded Expedia Group (EXPE) at 34 and TripAdvisor (TRIP) at 40 but was below the industry average of 60. Regarding price-to-sales (P/S), BKNG's 10 was higher than EXPE's 4 and TRIP's 7, yet below the industry average of 12. Evaluating price-to-book (P/B) based on the book value per share (BVPS) as of June 30, 2023, BKNG's ratio was -174, lower than EXPE's 9 and TRIP's 6, but higher than the industry's -200.

Additionally, utilizing enterprise value (EV) as of June 30, 2023, and TTM earnings before interest, taxes, depreciation, and amortization (EBITDA), BKNG's EV/EBITDA ratio stood at 32, surpassing EXPE's 23 and TRIP's 28, while trailing the industry average of 35. Overall, BKNG's valuation indicates a balanced positioning compared to peers and the industry, with premiums and discounts across metrics. However, these ratios offer only a partial view of BKNG's financial health, growth potential, competitive advantages, and future prospects. Thus, a comprehensive evaluation should encompass market share, customer loyalty, innovation, diversification, and profitability.

BKNG Stock Performance Analysis

BKNG, formerly Priceline Group, debuted on NASDAQ on March 31, 1999, with the ticker PCLN, pricing its initial public offering (IPO) at $16 per share and amassing $88 million. On February 27, 2018, the company rebranded as Booking Holdings Inc. with the ticker BKNG. NASDAQ, the world's second-largest stock exchange by market capitalization, situated in New York City, USA, is where BKNG is listed, operating in US dollars (USD). Standard trading hours for BKNG span 9:30 a.m. to 4:00 p.m. Eastern Time (ET) on weekdays, barring US market holidays. BKNG premarket and after-market sessions span from 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET, respectively, expanding trading beyond regular hours. Remarkably, BKNG has not executed any stock splits since its IPO and does not allocate dividends to its shareholders.

BKNG Stock Price Performance since its IPO

BKNG's stock price trajectory has had notable growth since its IPO, soaring to a historical peak of $2,469.36 on July 26, 2021, while encountering fluctuations, dipping to $6.30 on October 8, 2002. Presently, as of August 27, 2023, BKNG's closing price reached $3,123.50, indicating a 0.76% increase from the preceding day. Impressively, the stock has escalated by 26.5% year-to-date and an impressive 42.7% over the past year. This price movement is underscored by a volatility measurement, with a beta coefficient of 1.18 as of August 27, 2023, denoting a tendency for BKNG stock to exhibit more pronounced shifts compared to market norms.

Key Drivers of BKNG Stock Price

Several key factors drive BKNG stock price performance:

- Financial Performance and Growth Prospects: BKNG exhibited robust Q2 2023 results, surpassing analyst predictions in revenue and earnings. A sanguine outlook for Q3 2023 got provided, projecting a 32% to 37% YoY revenue growth.

- Competitive Edge and Market Dominance: With a diverse portfolio serving various online travel market segments and global regions, BKNG boasts an extensive network of supply partners, including millions of accommodation listings and rental car locations worldwide. The company's strong foothold in Europe and Asia-Pacific, regions anticipated to outpace others in online travel booking growth, adds to its strength.

- Emphasis on Innovation and Customer Fidelity: Significant R&D investment enhances BKNG's offerings and user experience. Utilization of data and AI drives personalized suggestions and dynamic pricing. BKNG's impressive customer base, with over 100 million active and 40 million subscribed customers as of August 28, 2023, underscores its customer loyalty.

BKNG Stock Forecast

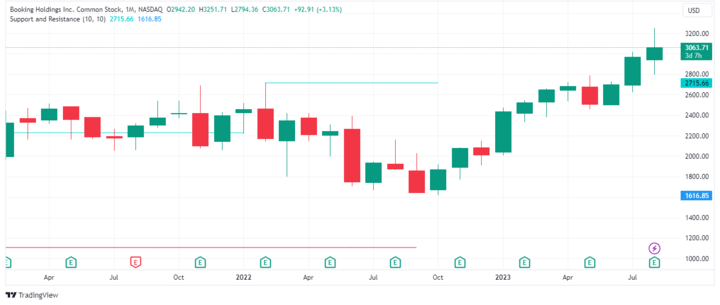

Based on TradingView's insights, notable resistance and support benchmarks delineate BKNG's potential trajectory:

Source: TradingView

- Resistance Level 1: $3,060.44: This level coincides with the pivot point 1st level resistance and the 14-3 day raw stochastic at 20%, indicating a possible reversal point for the bullish trend.

- Resistance Level 2:$3,104.56: It aligns with the pivot point 3rd level resistance and the 14-3 day raw stochastic at 80%, signifying an overbought status and a potential pullback point for the uptrend.

- Support Level 1: $3,016.32: Corresponds with the pivot point 1st level support and the price 2 standard deviations support, highlighting a strong support zone for the uptrend.

- Support Level 2: $2,972.20: This level matches the pivot point 3rd level support and the 61.8% Fibonacci retracement from the four-week high/low range, emphasizing a critical support zone for the uptrend.

These markers influence BKNG's potential trajectory, offering insights into possible resistance and support dynamics. However, market trends are multifaceted, and these levels do not encompass the variables influencing stock behavior.

Consensus Analyst Recommendations

According to consensus analyst recommendations, Booking Holdings stock gets categorized as a "buy." Among 32 analysts, 23 hold a buy rating, 8 suggest a hold rating, and 1 advises a sell rating. Moreover, the average price target of $3,275.97 indicates a potential upside of 4.9% compared to the present stock price of $3,123.50.

Technical Analysis: By analyzing technical aspects, BKNG stock is also deemed a "buy." With an evident uptrend and a successful breakthrough of the $3,100 resistance level, the stock's trajectory is positive. While possible resistance could arise at $3,200 and $3,400, support levels might emerge at $3,000 and $2,800. The relative strength index (RSI) above 50 denotes a more substantial buying pressure than selling.

Fundamental Analysis Outlook: From a fundamental analysis stance, BKNG stock retains a "buy" status. The company exhibits robust financial performance, growth prospects, competitive strengths, market share, innovation initiatives, and customer loyalty. Additionally, BKNG is strategically poised to leverage the resurgence of travel demand post-COVID-19 and the flourishing online travel sector in emerging markets.

Collectively, the consensus of analyst recommendations, technical analysis, and fundamental analysis points towards a "buy" outlook for BKNG stock. However, remember that investing decisions should consider a broad range of factors, including risk tolerance, investment goals, and the evolving market landscape.

Challenges and Opportunities

Source: Alamy

BKNG faces intense competition from other online travel agencies (OTAs) such as Expedia Group, Airbnb, Trip.com Group, and Traveloka. These competitors offer similar or alternative products and services, such as accommodation, transportation, activities, and packages. They also have strong brand recognition, customer loyalty, and global presence. BKNG needs to constantly innovate and differentiate itself from its rivals to maintain its competitive edge.

Some of the competitive advantages of BKNG are:

- Its diversified portfolio of brands that cater to different segments and regions of the online travel market

- Its extensive network of supply partners, including over 28 million accommodation listings and over 2 million rental car locations worldwide

- Its investment in research and development to enhance its products and services and provide a better user experience for its customers

- Its leverage of data and artificial intelligence to offer personalized recommendations and dynamic pricing to its customers

Other Risks

- Regulatory and legal uncertainties in different jurisdictions, especially regarding taxation, consumer protection, data privacy, and antitrust issues

- Macroeconomic and geopolitical factors that affect travel demand, such as the COVID-19 pandemic, natural disasters, political instability, and terrorism

- Cybersecurity threats and data breaches that could compromise its systems, operations, reputation, and customer trust

- Operational challenges such as system failures, network disruptions, human errors, fraud, and intellectual property infringement

Growth Opportunities

Source: Alamy

BKNG has several growth opportunities, such as:

- Expanding into new markets, especially in emerging regions such as Asia-Pacific, Latin America, and Africa, where online travel penetration is still low

- Diversifying its product offerings to include more non-accommodation services, such as flights, car rentals, activities, packages, and insurance

- Enhancing its loyalty programs and customer retention strategies to increase repeat bookings and referrals

- Partnering with other players in the travel ecosystem, such as airlines, hotels, car rental companies, attractions, and local operators

- Adopting new technologies and trends, such as blockchain, virtual reality, voice search, and social media.

Future Outlook and Expansion

BKNG has a positive future outlook and expansion plan. The company expects to benefit from the recovery of travel demand after the COVID-19 pandemic and the growth of online travel bookings in emerging markets. The company also plans to invest more in product development, marketing, customer service, and strategic partnerships. BKNG aims to become the leading online travel platform that offers comprehensive solutions for travelers worldwide.

The company expects to see higher gross bookings and earnings as travel demand defies weak economy. BKNG's optimistic forecast signals its confidence in the recovery of the travel industry and its competitive position in the online travel market. Moreover, BKNG is expanding its presence in the vacation rental market, especially in the U.S., where it faces competition from Airbnb and Expedia. The company said alternative accommodation nights grew faster than traditional hotel nights in the second quarter. BKNG offers more than 6 million listings of homes, apartments, villas, and other types of properties on its platform. The company is also enhancing its user experience by providing features such as flexible cancellation policies, instant booking, and loyalty rewards.

Trading Strategies for BKNG Stock

1. CFD Trading

An effective strategy for BKNG stock is CFD trading, utilizing contracts for difference to speculate on price movements without owning the asset. CFD trading allows for long and short positions on Booking Holdings stock, enabling gains from upward and downward market trends. Traders can leverage margin to open larger positions with less capital. The strategy provides access to a wide range of markets, including forex, commodities, indices, and crypto. Its mobile app and web platform ensure flexibility and convenience for trading anytime and anywhere.

2. Trend Following

Another viable BKNG stock strategy is trend following, involving tracking and capitalizing on market direction changes. By identifying and following the dominant market trend, trend following captures substantial BKNG stock price movements over time. This method reduces noise and emotional strain, focusing solely on core trend signals. It adapts to varying market conditions, employing diverse indicators, time frames, and risk management tools. Furthermore, it diversifies the portfolio by applying the same strategy across different markets.

3. Swing Trading

Swing trading presents a third strategy for BKNG stock, capturing short-term price shifts within a larger trend. Exploiting BKNG stock volatility due to various market influencers, swing trading leverages the company's price dynamics. Consistent profits result from seizing multiple weekly or monthly trading opportunities. The strategy balances risk and reward through technical and fundamental analysis alongside news events to determine entry and exit points. With adaptable time horizons and risk preferences, swing trading suits diverse trading styles.

Trade BKNG Stock CFD with VSTAR

If you're considering trading BKNG stock CFDs, VSTAR presents itself as a prospective trading partner offering a range of benefits and advantages:

- Competitive Trading Costs: VSTAR boasts the industry's lowest trading costs, marked by zero commission, exceptionally tight spreads, and minimal swap fees.

- High-Quality Liquidity: VSTAR stands out with top-tier deep liquidity in the market, ensuring dependable and swift order execution while minimizing slippage.

- User-Friendly Platform: VSTAR caters to seasoned traders and beginners through a user-friendly app characterized by an intuitive interface. The platform welcomes traders with a low minimum deposit of just $50, provides negative balance protection, and facilitates risk-free practice through a demo account.

- Regulated and Secure Environment: With multiple licenses from regulatory bodies like CySEC and FSC, VSTAR offers a globally controlled and secure trading environment. Additionally, membership in the Cyprus Investor Compensation Fund bolsters traders' confidence.

Conclusion

Booking Holdings is one of the leading online travel companies in the world, with a diversified portfolio of brands, products, and services. BKNG has strong financial performance and growth prospects, competitive advantages and market share, innovation, and customer loyalty. BKNG also faces some challenges and risks, such as competition, regulation, macroeconomic factors, and cybersecurity. BKNG has several opportunities to expand its business, such as entering new markets, diversifying its offerings, enhancing its loyalty programs, partnering with other players, and adopting new technologies. BKNG stock is a buy, according to analysts' consensus, as it has a positive price trend, high earnings growth, and attractive valuation. Booking Holdings stock get traded with different strategies, such as CFD trading, trend following, and swing trading. Check out VSTAR if you would like to trade Booking stock CFDs.