作为航空航天业的主导力量,波音为交易者提供了一个令人信服的机会来扩大他们的投资组合并使他们的投资取得成功。探索为什么投资波音可以释放你在充满活力的金融世界中的交易潜力。如果你想了解波音公司(纽约证券交易所股票代码:BA)的交易机会,请继续阅读本文。

一、波音公司概况

波音公司是一家美国跨国公司,以设计、制造和销售飞机、卫星、火箭等而闻名。它是航空航天业的主要参与者,截至2023年6月8日,其市值为1269亿美元。

该公司由William E. Boeing于1916年创立,取得了重要的里程碑,包括在1933年推出第一架全金属客机和在1947年推出第一架商用喷气式客机。波音的结构分为商用飞机、国防、太空与安全等部门、全球服务和资本。戴夫·卡尔霍恩(Dave Calhoun)自2021年1月起担任首席执行官,带来了他作为通用动力公司前首席执行官的专业知识。

二、波音公司的商业模式和产品/服务

A.商业模式

波音公司是航空航天业的知名企业,其强大的商业模式以商用飞机、国防产品和航空航天技术的设计、制造和销售为中心。此外,该公司还为其范围广泛的产品提供全面的售后支持、培训和服务。

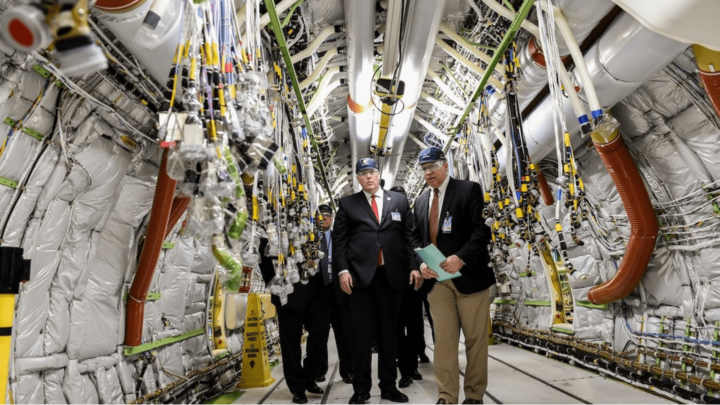

作为全球最大的商用飞机部门,波音拥有超过50%的市场份额。他们的商用飞机产品组合包括备受追捧的机型,例如737 MAX、787梦想飞机和777。在国防产品领域,波音公司也占有重要地位,专门生产战斗机、轰炸机和导弹。该领域的著名产品包括F-15 Eagle、F-18 Hornet和AH-64 Apache。

B.主要产品/服务

公司的产品和服务产品中包含许多基本项目。商用飞机部门负责737和787等商用飞机的设计、开发和制造。国防、航天和服务部门为政府部门的客户提供服务,为他们提供种类繁多的产品和服务。服务,其中一些例子是战斗机、武器、卫星和空间/技术服务。除此之外,波音金融公司还是商用飞机、国防设备和太空系统各种融资方案的全球供应商。

来自150多个不同国家的客户,包括航空公司、政府和国防承包商,都在使用波音公司提供的广泛产品组合。对创新的不懈追求是支撑公司商业模式的基本理念之一。这有助于确保公司的产品和服务始终处于各自行业发展的前沿。此外,波音公司非常重视质量,优先提供满足或超过行业最严格标准的产品和服务。

波音的商业模式以创新、质量、安全和可持续发展为驱动力,通过响应公司国际客户的各种需求,不断巩固公司在航空航天业的领先地位。

三、波音公司的财务、增长和估值指标

A.波音公司的财务报表

波音公司的财务账目提供了对公司运营及其未来前景的宝贵信息。波音在过去五年的收入年增长率为3.5%,证明了公司收入的持续增长。该公司一直能够保持其利润率相对稳定,目前他们的净利润率约为8%,正在产生稳定的利润。

在过去五年中,波音的运营现金流显示出正增长,在此期间复合年增长率为6%。公司的经营现金流一直在持续改善,这表明公司财务状况良好,有能力产生现金。

B.关键财务比率和指标

波音的一项显著优势是其强劲的资产负债表,从0.5的债务权益比率可以看出。这表明该公司的资产多于负债,这提供了坚实的基础和财务稳定性。

然而,与空客和巴西航空工业公司等同行相比,波音的收入和盈利增长似乎较慢。此外,波音的远期市盈率(P/E)高于同行,表明市场预计该公司未来将实现更快的增长。

考虑到这些因素,目前看来波音可能被低估了。凭借强劲的资产负债表以及加速收入和盈利增长的潜力,该公司充满希望。然而航空航天业是具有周期性的,波音的股价在短期内可能会出现波动。

在评估波音的估值时,必须考虑其他因素。此外,电动飞机和自动驾驶飞机等新技术的出现,对波音的商业模式构成了潜在威胁。

四、波音股票表现

A.BA股票交易信息

自1916年3月15日起,波音公司(BA)一直是纽约证券交易所(NYSE)的上市公司,在航空航天行业保持着显赫地位。波音公司的股票在纽约证券交易所(NYSE)以美元交易,股票代码为BA,纽约证券交易所是该公司的主要交易所。

在纽约证券交易所(NYSE)的交易时间内,即东部时间(ET)上午9:30至下午4:00,投资者可以进行涉及BA股票的交易。盘前交易时段从东部时间(ET)凌晨4:00开始,而盘后交易时段则延长至东部时间晚上8:00,让投资者在整个交易日有更多的交易机会。

波音最近的一次股票拆分是在2019年,当时公司的股票以2:1的比例进行拆分。总而言之,波音公司在其历史进程中经历了十次股票拆分。自1934年以来,波音公司一直向股东派发股息。公司目前的股息收益率为0.8%,这对所有者来说是一个额外的潜在利润来源。

B.BA股票表现概览

对过去几年波音股票表现的深入调查发现,该股票一直受到大幅波动的影响。自2018年创下历史新高以来,股价已下跌超过50%。截至2023年6月12日,波音股票的交易价格为每股217.31美元。这比每股446.01美元的历史高点下跌了50%以上。

在过去几年中,有许多因素导致了波音股价的波动。这些因素包括:

产品召回:波音公司近年来被迫召回了多款飞机,包括737 MAX和787梦想飞机。这些召回损害了波音的声誉,并导致对其飞机的需求下降。

贸易战:美国和中国之间持续的贸易战损害了波音的业务,因为它使该公司更难向中国航空公司出售飞机。

C.BA股价的主要驱动因素

几个关键因素显著影响波音公司(纽约证券交易所代码:BA)的股价和整体业绩。这些因素包括公司的财务业绩、市场对波音产品和服务的需求、航空航天业的竞争、经济状况以及影响该行业的地缘政治事件。

为了对波音股票做出明智的决定,投资者和交易员应该密切关注航空航天业的发展。这需要评估波音公司的财务业绩,跟踪市场对飞机的需求,分析波音公司的竞争格局和战略举措,考虑全球经济状况,并及时了解可能影响航空航天业的地缘政治事件。

通过保持警惕和进行彻底的分析,投资者和交易者可以做出明智的决定,并有可能利用波音股票提供的机会。这种方法允许进行有效的风险管理,并使他们能够驾驭航空航天业的动态特性。

D.BA股票未来前景分析

在分析未来几年BA股票的潜在结果时,有很多问题没有得到解答。除了必须适应新技术发展的要求外,波音还必须应对来自空客公司日益激烈的竞争、中美之间可能继续存在的贸易争端以及其他挑战。尽管如此,波音作为航空航天领域重要参与者的稳固地位,以及该公司长期以来对创新的奉献,表明该公司存在可能的增长机会和韧性。如果以最有效的可行方式克服这些挑战,从长远来看,股票的表现有可能会向好的方向发展。

五、风险与机遇

A.波音公司面临的潜在风险

来自竞争对手的威胁:有许多竞争对手的航空航天公司,包括空客、庞巴迪和巴西航空工业公司,对波音的市场份额构成威胁。作为世界上最大的商用飞机制造商,空客尤其对业内其他企业构成了严重威胁。由于波音和空中客车之间的持续竞争,市场份额发生了变化,因此,波音需要不断创新以保持其对竞争对手的优势。

声誉风险:最近发生的事件,包括737 MAX飞机的停飞和COVID-19流行病的影响,对波音的声誉造成了影响,并因此受到影响。该公司不仅因737 MAX停飞而遭受财务损失,而且客户对该品牌的信任和信心也有所下降。COVID-19大流行对波音的业务产生了进一步的负面影响,因为它导致航空旅行大幅减少,进而影响了对航空业相关飞机和服务的需求。

公司财务状况面临的风险:波音公司的财务业绩受到股价下跌等直接情况的负面影响。此外,公司还面临着与技术投资相关的更高支出问题,并且需要为遵守法规而努力。

B.增长和扩张的机会

尽管困难重重,波音仍然能够利用其巨大的增长前景。由于其强大的市场地位,波音有望在未来几年从全球航空旅行业的预期扩张中获得巨额利润。波音还能够满足其客户不断变化的需求,并通过维持多样化的商用飞机组合来确保更高的市场份额。这些优惠包括未来的777 X以及非常成功的787梦想飞机。

技术机会:波音公司意识到,电动和自主飞机等技术的开发有可能从根本上改变航空航天领域。波音希望通过投资研发并利用这些投资带来的技术进步来促进创新、提高效率并扩大其产品供应。由于公司重视技术进步,目前在行业演进中处于领先地位。

军事机会:波音公司除了是商用航空领域的领导者外,还是军用市场的重要参与者。由于其提供的国防设备种类繁多,其中包括军方使用的战斗机和直升机,该公司在该领域的扩张前景广阔。全球军事工业的预期扩张为波音公司提供了一个额外的机会来扩大其国防相关业务并获得世界各国政府的合同。

总的来说,波音存在重大风险和问题,但该公司也有可能利用的增长和扩张机会。为了公司未来的成功,他们绝对有必要成功驾驭竞争格局,恢复声誉,并有效地管理他们面临的财务风险。通过利用全球航空旅行市场的增长机会、采用新兴技术并利用其在国防工业中的地位,波音可以为自己的长期增长和盈利能力做好准备。

六、如何投资BA股票

A.投资BA股票的三种方式

1.持有股份:投资者可以通过购买BA股票并持有这些股份成为公司的部分所有者。投资者只要持有公司股份,就可以参与公司的资产和利润分成。如果波音表现良好,这可能会导致股价上涨,但如果表现糟糕,则可能导致股价下跌。

2.期权是提供在特定日期或之前以预先确定的价格购买或出售一定数量的BA股票的权利(而非责任)的合同。期权是一种衍生金融工具,是比普通持股更难理解的资产,因此可能并不适合所有投资者。

3.差价合约(CFD):CFD是一种金融衍生品,让投资者能够在不实际拥有股票本身的情况下,对BA股票的价格波动进行投机。差价合约提供杠杆作用,使投资者能够以与最初投资相同的资本持有更多头寸。尽管差价合约(CFD)有可能产生利润,但它们也带来重大风险并需要仔细评估。

B.为什么使用VSTAR交易BA股票CFD

VSTAR是一家领先的CFD供应商,为交易BA股票提供多项优势:

1.有竞争力的定价:VSTAR提供具有竞争力的BA股票差价合约定价,使投资者能够最大化潜在利润。

2.广泛的资产选择:VSTAR提供多元化的交易资产选择,包括股票、指数、商品和货币,为投资者提供全面的交易组合。

3.先进的交易平台:VSTAR提供配备各种工具和功能的先进交易平台,可增强交易体验并做出明智的决策。

4.出色的客户支持:VSTAR确保了出色的客户支持,全天候24小时可用,以解决交易者在交易过程中可能遇到的任何疑问或疑虑。

C.如何使用VSTAR交易BA股票CFD

1.开户:首先在VSTAR开户并将资金存入你的交易账户。

2.登录并选择交易产品:登录你的VSTAR账户后,导航至“交易”选项卡。

3.搜索BA股票CFD:使用搜索栏查找BA股票CFD并从搜索结果中选择它。

4.输入交易详情:确定要交易的BA股票CFD的所需数量,并在“买入”或“卖出”之间进行选择。

5.执行交易:VSTAR将执行交易,你可以在你账户的“我的交易”部分监控你的交易表现。

注意:差价合约交易涉及风险,在进行差价合约交易之前了解相关风险至关重要。仔细评估你的风险承受能力,并在需要时考虑寻求专业建议。

七、结论

波音公司是航空航天业的佼佼者,在市场上占有一席之地。随着全球航空旅行市场有望在未来几年扩大,波音公司已做好充分准备利用这一增长。公司对777 X和787梦想飞机等新型飞机的开发进一步增强了其成功的潜力。

然而,波音也不能幸免于竞争挑战。来自长期竞争对手空客公司的竞争加剧构成了重大威胁。空客一直在稳步扩大市场份额,目前拥有全球最大商用飞机制造商的称号。美国和中国之间持续的贸易战也是一个障碍,可能会影响波音对中国航空公司的销售并影响收入流。

将波音作为投资选择的投资者应谨慎行事并进行彻底研究。要认清与公司竞争格局、贸易紧张局势和技术进步相关的风险。始终建议咨询财务顾问,以全面了解投资环境并做出符合个人财务目标的明智决策。

*免责声明:本文内容仅供学习,不代表VSTAR官方立场,也不能作为投资建议。