Trong bối cảnh hỗn loạn của thị trường tài chính, một nhà cung cấp thực phẩm ăn nhanh bình dân của Mexico đã thu hút sự chú ý với hiệu suất đáng kinh ngạc vào năm 2023. Chipotle Mexican Grill (CMG 0,20%) đang trên đà thắng lợi, khiến nhiều nhà đầu tư băn khoăn liệu đây có phải chỉ là khởi đầu cho một hành trình phi thường hay không.

Năm nay không có gì đáng chú ý đối với Chipotle khi cổ phiếu của công ty này tăng ấn tượng 49%, vượt mức tăng gấp 4 lần của S&P 500. Sự hồi sinh ngoạn mục này đánh dấu một sự thay đổi đáng kể so với năm trước khi công ty phải đối mặt với sự sụt giảm đáng kinh ngạc 21% về giá trị cổ phiếu.

Thúc đẩy sự phấn khích này là việc công ty công bố kết quả tài chính vào ngày 25 tháng 4, vượt quá mong đợi và cung cấp một minh chứng mạnh mẽ cho nhu cầu không ngừng nghỉ đối với "thực phẩm liêm chính" của Chipotle.

Tuy nhiên, mặc dù màn trình diễn này có vẻ hấp dẫn nhưng các nhà đầu tư đã bỏ lỡ đợt tăng giá vừa qua của Chipotle giờ đây phải đối mặt với một quyết định quan trọng. Họ nên nắm bắt thời cơ và mua khi đang phấn khích, hy vọng đợt phục hồi sẽ kéo dài hơn nữa hay họ nên thận trọng? Suy cho cùng, định giá cổ phiếu có thể bị thổi phồng và nền kinh tế nói chung vẫn phải vật lộn với tình trạng không chắc chắn.

Trong bài viết này, chúng ta sẽ đi sâu vào những điểm phức tạp trong quá trình phát triển vượt bậc của Chipotle, phân tích các yếu tố thúc đẩy thành công của nó cũng như những thách thức tiềm ẩn phía trước.

Tổng quan về Chipotle Mexican Grill Inc.

Được thành lập dựa trên tầm nhìn phục vụ "món ăn ngon một cách toàn vẹn", Chipotle Mexican Grill đã tự khẳng định mình là lực lượng tiên phong trong ngành nhà hàng ăn nhanh bình dân. Là sản phẩm trí tuệ của người sáng lập Steve Ells, hành trình bắt đầu với một nhà hàng duy nhất vào ngày 13 tháng 7 năm 1993. Ngày nay, công ty đã đứng vững, có trụ sở chính tại trung tâm sôi động của Newport Beach, California.

Từ khởi đầu khiêm tốn, Chipotle đã mở rộng sự hiện diện của mình tới hơn 2.600 địa điểm trên khắp Hoa Kỳ, Canada, Vương quốc Anh, Đức và Pháp. Với cam kết tìm nguồn cung ứng nguyên liệu bền vững và hỗ trợ nông dân địa phương, công ty đã trở thành biểu tượng của việc ăn uống có ý thức.

Nguồn ảnh: Istock

Dưới sự lãnh đạo sắc sảo của Giám đốc điều hành Brian Niccol, người đã nắm quyền lãnh đạo vào tháng 3 năm 2018. Brian Niccol, một người có tầm nhìn xa trông rộng, đã đưa công ty hướng tới những tầm cao mới của thành công, trong khi quyền sở hữu 0,085% cổ phần của công ty, trị giá đáng kinh ngạc là 49,00 triệu USD, phản ánh cam kết vững chắc của ông đối với sự phát triển của nó.

Bên cạnh chuyên môn của ban quản lý là một đội ngũ tận tâm, thể hiện sự tập trung của công ty vào việc nuôi dưỡng tài năng và nuôi dưỡng văn hóa đổi mới. Các cổ đông và nhà đầu tư hàng đầu như The Vanguard Group, Inc. và Capital Research and Management Company cũng đã đặt niềm tin vào hành trình của Chipotle, củng cố vị thế của công ty như một cơ hội đầu tư được săn đón.

Cam kết của Chipotle về chất lượng và tính bền vững được thể hiện rõ qua việc sử dụng nguyên liệu có nguồn gốc địa phương và hỗ trợ các hoạt động canh tác có trách nhiệm. Sự cống hiến này không chỉ giúp họ có được cơ sở khách hàng trung thành mà còn nhận được sự công nhận từ các chuyên gia trong ngành, trong đó Chipotle đã nhận được nhiều giải thưởng vì cam kết hướng tới sự xuất sắc.

Mô hình kinh doanh và sản phẩm của Chipotle Mexican Grill Inc

Nguồn ảnh: Istock

Cốt lõi của sự thành công lâu dài của Chipotle nằm ở mô hình kinh doanh mạnh mẽ và có khả năng thích ứng được thiết kế để tạo tiếng vang với cơ sở người tiêu dùng không ngừng phát triển. Nó không chỉ là món bánh burritos thơm ngon; đó là triết lý rằng mỗi phần ăn phải được cung cấp một cách có trách nhiệm, phản ánh cam kết của công ty đối với tính bền vững và thực hành đạo đức.

Mặc dù mô hình kinh doanh của Chipotle có thể thích ứng và gây được tiếng vang với người tiêu dùng, nhưng thành công lâu dài của nó cũng có thể là do các yếu tố như chiến lược tiếp thị hiệu quả và sự tiện lợi của trải nghiệm ăn uống bình dân, thay vì chỉ dựa vào triết lý bền vững và thực hành đạo đức.

Bằng cách điều hành hơn 2.900 nhà hàng Mexico bình dân, Chipotle tạo ra doanh thu từ nhiều dịch vụ đa dạng. Từ bánh burritos Mission có thể tùy chỉnh cho đến món tacos, salad và quesadillas ngon lành, thực đơn phục vụ nhiều khẩu vị khác nhau, đảm bảo luôn có thứ gì đó cho tất cả mọi người.

Nguồn ảnh: Istock

Ví dụ: chiến lược tiếp thị hiệu quả của Chipotle bao gồm quảng cáo được nhắm mục tiêu trên nền tảng truyền thông xã hội, khuyến mãi hấp dẫn và hợp tác với những người có ảnh hưởng phổ biến. Những nỗ lực này giúp thu hút nhiều đối tượng khách hàng, từ những cá nhân quan tâm đến sức khỏe đang tìm kiếm nguyên liệu tươi sống cho đến những sinh viên đang tìm kiếm một bữa ăn nhanh chóng và giá cả phải chăng. Sự tiện lợi trong trải nghiệm ăn uống bình dân nhanh chóng của Chipotle, với hệ thống gọi món hiệu quả và dịch vụ nhanh chóng, càng góp phần vào thành công của Chipotle bằng cách đáp ứng lối sống bận rộn của người tiêu dùng hiện đại.

Điều khiến Chipotle trở nên khác biệt là cách tiếp cận có tầm nhìn xa để nắm bắt doanh số bán hàng kỹ thuật số. Với thế giới đang thay đổi nhanh chóng, công ty đã nắm bắt cơ hội để nâng cao trải nghiệm của khách hàng thông qua các lựa chọn giao hàng và đón khách.

Sự cống hiến không ngừng nghỉ của Chipotle trong việc cung cấp các món ăn lấy cảm hứng từ Mexico, chất lượng cao đã gây được tiếng vang với người tiêu dùng xuyên biên giới bất chấp những khó khăn về kinh tế. Mở rộng phạm vi hoạt động của mình, công ty hiện tự hào phục vụ khách hàng quen không chỉ ở Hoa Kỳ mà còn ở Canada, Vương quốc Anh, Đức và Pháp.

Thông qua việc ra quyết định chiến lược và niềm đam mê đổi mới, Chipotle tiếp tục phát huy di sản thành công của mình.

Nguồn ảnh: Istock

Báo cáo và số liệu tài chính

1. Tăng trưởng doanh thu và sức mạnh tài chính

Doanh thu của Chipotle đã tăng vọt lên 8,98 tỷ USD, cho thấy mức tăng trưởng vượt trội khiến các đối thủ cạnh tranh phải ghen tị. Dòng doanh thu đáng kể này củng cố vị trí của nó trên thị trường. Hơn nữa, tỷ lệ nợ/vốn chủ sở hữu là 0% nhấn mạnh sức mạnh tài chính của công ty, mang lại cho công ty sự linh hoạt để nắm bắt các cơ hội khi chúng phát sinh.

2. Biên lợi nhuận và hiệu quả

Hiệu quả lão luyện của công ty được thể hiện rõ qua lợi nhuận tài chính của nó. Chipotle duy trì tỷ suất lợi nhuận gộp là 40,02%, nêu bật việc quản lý chi phí hiệu quả. Ngoài ra, tỷ suất lợi nhuận ròng 11,49% cho thấy khả năng chuyển đổi doanh thu thành lợi nhuận, giúp họ trở thành một đối thủ đáng gờm trong bối cảnh nhà hàng đầy cạnh tranh.

Số liệu định giá

1. Tỷ lệ giá trên thu nhập (P/E)

Tỷ lệ P/E là 46,5 của Chipotle cho thấy mức độ sẵn sàng trả gấp 46,5 lần thu nhập của công ty cho một cổ phiếu của công ty. Số liệu này nhấn mạnh niềm tin của thị trường vào tốc độ tăng trưởng thu nhập trong tương lai và hiệu quả tài chính tổng thể của Chipotle.

2. Tỷ lệ giá trên sổ sách (P/B)

Với tỷ lệ P/B là 19,00, giá cổ phiếu Chipotle được đánh giá ở mức gấp 19 lần giá trị sổ sách trên mỗi cổ phiếu. Tỷ lệ này biểu thị mức phí bảo hiểm mà các nhà đầu tư sẵn sàng trả cho một phần tài sản và tiềm năng tăng trưởng của công ty.

3. Tỷ lệ giá trên doanh thu (P/S)

Tỷ lệ P/S ở mức 20,42, cho thấy nhà đầu tư sẵn sàng đầu tư 20,42 USD cho mỗi đô la doanh thu của Chipotle. Số liệu này nêu bật sự thừa nhận của thị trường về khả năng tạo doanh thu của Chipotle.

4. Tỷ lệ giá trên dòng tiền (P/CF)

Với mức 22,40, tỷ lệ P/CF của Chipotle cung cấp cái nhìn sâu sắc về giá cổ phiếu liên quan đến dòng tiền hoạt động của nó. Số liệu này cho thấy khả năng tạo ra tiền mặt từ các hoạt động đang diễn ra của công ty.

So sánh bội số định giá của Chipotle Mexican Grill (CMG) với các công ty cùng ngành cho thấy tiềm năng định giá quá cao ở một số khía cạnh. Tỷ lệ P/E 46,5 lần cao hơn đáng kể so với mức trung bình ngành là 20,0 lần, cho thấy mức giá cao cho thu nhập.

Phân tích hiệu suất cổ phiếu Chipotle

Vào ngày 26 tháng 1 năm 2006, Chipotle Mexican Grill Inc., một nhà cung cấp thực phẩm ăn nhanh bình dân của Mexico, đã phát hành đợt chào bán cổ phiếu lần đầu ra công chúng (IPO) rất hấp dẫn. Nhà vô địch ẩm thực này, được niêm yết dưới ký hiệu "CMG" trên Sở giao dịch chứng khoán New York (NYSE), đã thu hút các nhà đầu tư bằng triển vọng tăng trưởng của mình. Có trụ sở tại Hoa Kỳ và được giao dịch bằng đô la ($), CMG Stock nhanh chóng trở thành hiện tượng toàn cầu. Giờ giao dịch của nó bao gồm trước giờ mở cửa Thị trường (4:00-9:30 sáng theo giờ ET) và sau giờ Thị trường (4:00-8:00 tối theo giờ ET).

Chia tách cổ phiếu Chipotle

Chipotle Mexican Grill (CMG) đã lập kỷ lục thanh toán cổ tức linh hoạt kéo dài hơn hai thập kỷ. Trong suốt lịch sử của mình, CMG chưa trải qua bất kỳ đợt chia tách cổ phiếu nào, duy trì quỹ đạo giá trị nhất quán. Phân tích lịch sử chia tách cổ phiếu từ khi thành lập cho đến ngày nay, lượng cổ phiếu nắm giữ ban đầu là 1000 cổ phiếu sẽ giữ nguyên quy mô ban đầu, duy trì sự ngang bằng với số lượng cổ phiếu ngày nay.

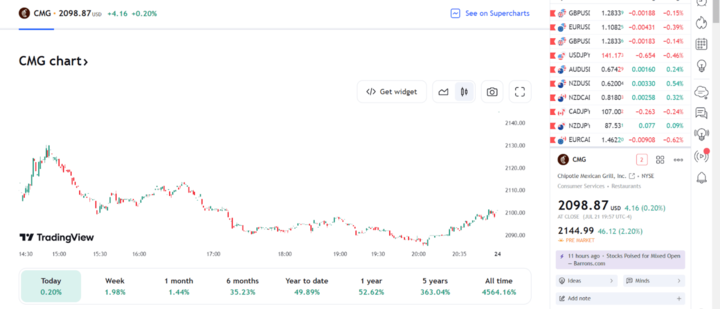

Trong 52 tuần qua, cổ phiếu CMG đã hoạt động rất tốt, với mức cao nhất là 2.175,01 USD và mức thấp nhất là 1.291,63 USD. Phạm vi này cho thấy cổ phiếu Chipotle có thể thích ứng với những thay đổi của thị trường và vẫn có sức hấp dẫn đối với các nhà đầu tư.

Giá cổ phiếu Chipotle

Mức giá cao hiện tại của cổ phiếu là khoảng 2.098,87 USD phản ánh sức hấp dẫn thường xanh của nó trên thị trường và mang lại lợi ích cho các nhà đầu tư.

Mặc dù cổ phiếu CMG có lúc thăng lúc trầm, nhưng mức biến động hàng tuần khoảng 4% trong năm qua đã mang lại cho các nhà đầu tư cảm giác ổn định. Các động lực chính thúc đẩy giá cổ phiếu CMG bao gồm tin tức về Chipotle, tình hình tài chính ấn tượng, tốc độ tăng trưởng doanh thu, tỷ suất lợi nhuận cao, tâm lý thị trường và một loạt đổi mới, tất cả đều góp phần tạo nên vị thế dẫn đầu thị trường của công ty.

Dự báo cổ phiếu CMG

Đối với dự báo cổ phiếu CMG, các nhà phân tích nhất trí khuyến nghị "Mua vừa phải", với 19 nhà phân tích xếp hạng cổ phiếu là "Nên mua" và 7 người chọn khuyến nghị "Giữ". Theo biểu đồ của Tradingview, cổ phiếu CMG phải đối mặt với ngưỡng kháng cự khoảng 2.180 USD và 2.310 USD, trong khi các mức hỗ trợ có thể được tìm thấy ở khoảng 2.040 USD và 1.930 USD. Những người sành ăn ở Phố Wall dự đoán mục tiêu giá trung bình là 2.214,58 USD cho cổ phiếu CMG, với mức dự báo cao là 2.570,00 USD và mức dự báo thấp là 1.850,00 USD, mang lại tiềm năng tăng trưởng 5,51% hấp dẫn cho các nhà đầu tư.

Thách thức và cơ hội

Rủi ro cạnh tranh

Nguồn ảnh: Istock

Đối thủ cạnh tranh của Chipotle

Trong lĩnh vực đồ ăn nhanh bình dân, Chipotle Mexican Grill Inc. (CMG) là công ty dẫn đầu thị trường. Bối cảnh cạnh tranh của nó bao gồm các đối thủ chính: Qdoba Mexican Eats, Moe's Southwest Grill, Baja Fresh Mexican Grill và Rubio's Coastal Grill. Những đối thủ cạnh tranh này nhằm mục đích nắm bắt khẩu vị của những khách hàng đang tìm kiếm trải nghiệm ẩm thực lấy cảm hứng từ Mexico.

Giữa cuộc cạnh tranh này, Chipotle tạo nên sự khác biệt nhờ triết lý "thực phẩm trung thực". Cam kết này nhấn mạnh việc sử dụng nguyên liệu tươi, có nguồn gốc có trách nhiệm, gây được tiếng vang với những khách hàng quan tâm đến sức khỏe đang tìm kiếm một bữa ăn bổ dưỡng. Ngoài ra, sự chú trọng của Chipotle vào việc tùy chỉnh sẽ tạo thêm nét độc đáo, cho phép thực khách chế biến các món ăn được cá nhân hóa phù hợp với sở thích cá nhân.

Trong khi cạnh tranh trực tiếp với các cơ sở kinh doanh ăn nhanh này, Chipotle cũng tham gia vào một cuộc cạnh tranh tinh vi hơn với Taco Bell. Mặc dù cả hai đều cung cấp ẩm thực Mexico nhưng cách tiếp cận của họ khác nhau. Chipotle ưu tiên trải nghiệm ăn nhanh bình dân, nêu bật chất lượng và sự lựa chọn, trong khi Taco Bell phát triển mạnh trong lĩnh vực dịch vụ nhanh chóng, định hướng giá trị.

Những lợi thế chiến lược của Chipotle, bắt nguồn từ sự cống hiến cho chất lượng và sự tùy biến, đã củng cố vị thế của nó như một điểm đến ăn uống được săn đón. Khi thị trường tiếp tục phát triển, cam kết vững chắc của Chipotle trong việc mang lại trải nghiệm ăn uống khác biệt và hấp dẫn vẫn là một thế lực mạnh mẽ trong lĩnh vực đồ ăn nhanh thông thường.

Rủi ro khác

Nguồn ảnh: Istock

Những lo ngại về an toàn thực phẩm

Bất kỳ sự cố nào liên quan đến bệnh tật do thực phẩm đều có khả năng gây tổn hại nghiêm trọng đến danh tiếng của Chipotle và khiến khách hàng không muốn đến nhà hàng. Để giảm tác động của mối đe dọa này, công ty phải tiếp tục hết sức cảnh giác trong việc duy trì các quy trình an toàn thực phẩm nghiêm ngặt.

Chi phí nhân công

Chipotle phải đối mặt với những thách thức trong việc duy trì khả năng sinh lời trong khi cung cấp mức lương và phúc lợi cạnh tranh cho lực lượng lao động của mình khi chi phí lao động tiếp tục tăng, đặc biệt là trên thị trường lao động sau đại dịch.

Cơ hội tăng trưởng

Khai trương cửa hàng mới

Chipotle có cơ hội phát triển đáng kể dưới hình thức mở rộng quy mô nhà hàng của mình bằng cách mở các cửa hàng mới tại các địa điểm được lựa chọn chiến lược. Nhắm mục tiêu vào các khu vực địa lý có mật độ dân số cao và nhu cầu tiêu dùng mạnh mẽ có thể thúc đẩy tăng trưởng doanh thu hơn nữa.

Công suất cao hơn và doanh số bán hàng kỹ thuật số

Tăng sản lượng tại các địa điểm hiện tại đồng thời tập trung vào bán hàng và giao hàng kỹ thuật số là một cách để tăng năng suất và mở rộng phạm vi cơ sở khách hàng của một người. Việc tăng thị phần của một người có thể được thực hiện bằng cách đầu tư vào các quan hệ đối tác phân phối khác nhau và tiến bộ công nghệ.

Triển vọng và mở rộng trong tương lai

Nguồn ảnh: Istock

Sự mở rộng quốc tế

Những nỗ lực mà Chipotle đang thực hiện để mở rộng ra quốc tế mang đến một cơ hội thú vị và có khả năng mang lại kết quả cho sự phát triển của công ty. Công ty có thể giới thiệu thương hiệu đặc biệt của mình tới những khán giả mới đồng thời thích ứng với sở thích khu vực bằng cách tập trung nỗ lực vào các thị trường trọng điểm ở Châu Âu và Châu Á.

Đổi mới thực đơn

Việc liên tục cập nhật thực đơn với các món mới và đa dạng cho phép doanh nghiệp đáp ứng sở thích luôn thay đổi của khách hàng và thu hút lượng khách hàng lớn hơn. Một cách để đạt được lợi thế cạnh tranh là tập trung vào các lựa chọn dựa trên thực vật và phục vụ các sở thích ăn kiêng.

Cổ phiếu CMG: Cơ hội hấp dẫn cho các nhà giao dịch trong bối cảnh đồ ăn nhanh bình dân

Nguồn ảnh: Istock

CMG cung cấp cho các nhà đầu tư đang tìm kiếm cơ hội đầu tư một số lý do thuyết phục để xem xét công ty. Sự tăng trưởng doanh thu ổn định của công ty chứng tỏ tiềm năng tăng trưởng lâu dài bền vững. Việc mở rộng phạm vi cửa hàng, lượng hàng thông qua tăng lên và doanh số bán hàng kỹ thuật số cao hơn đều góp phần vào sự tăng trưởng này. Khả năng công ty vượt qua những trở ngại, chẳng hạn như những lo lắng trước đây về an toàn thực phẩm, là bằng chứng về khả năng phục hồi của công ty và sự vững chắc trong mô hình kinh doanh của công ty. Ngoài ra, CMG đảm bảo rằng nó sẽ tiếp tục phù hợp trong bối cảnh thị trường không ngừng thay đổi bằng cách nhấn mạnh vào đổi mới, đa dạng hóa thực đơn và thích ứng công nghệ.

Khi giao dịch cổ phiếu CMG, nhà giao dịch có thể khám phá nhiều chiến lược khác nhau để tận dụng tiềm năng của nó. Giao dịch CFD (Hợp đồng chênh lệch) cho phép suy đoán biến động giá mà không cần sở hữu cổ phiếu thực tế, mang lại sự linh hoạt để kiếm lợi nhuận từ cả xu hướng tăng và giảm. Các nhà giao dịch có tầm nhìn dài hạn có thể chọn đầu tư trực tiếp vào cổ phiếu CMG, tận dụng quỹ đạo tăng trưởng và vị trí dẫn đầu thị trường của nó. Phân tích kỹ thuật cung cấp những hiểu biết sâu sắc về dữ liệu lịch sử giá và các mẫu biểu đồ, hỗ trợ các nhà giao dịch đưa ra quyết định sáng suốt dựa trên các xu hướng trong quá khứ.

Để tạo điều kiện thuận lợi cho giao dịch CFD cổ phiếu CMG, các nhà giao dịch có thể chuyển sang VSTAR, một nền tảng cung cấp quyền truy cập thân thiện với người dùng vào các công cụ tài chính đa dạng, bao gồm cả CFD cổ phiếu CMG. Với các công cụ giao dịch tiên tiến, tính năng biểu đồ và dữ liệu thời gian thực, VSTAR trao quyền cho các nhà giao dịch tiến hành phân tích thị trường chuyên sâu để đưa ra quyết định sáng suốt. Ngoài ra, VSTAR cung cấp các tùy chọn giao dịch đòn bẩy và ký quỹ, tăng lợi nhuận tiềm năng, nhưng các nhà giao dịch nên thận trọng và quản lý rủi ro một cách hiệu quả.

Lời kết

Chipotle Mexican Grill Inc. (CMG) tỏa sáng với tư cách là công ty dẫn đầu thị trường trong lĩnh vực thức ăn nhanh bình dân. Công ty thu hút các nhà giao dịch nhờ vị thế vững chắc trên thị trường và mức tăng trưởng ổn định. CMG tạo sự khác biệt so với các đối thủ cạnh tranh chính bằng cách duy trì sự cống hiến của mình trong việc cung cấp "thực phẩm toàn vẹn" và bằng cách cung cấp các lựa chọn dịch vụ được cá nhân hóa. Các nhà đầu tư có lý do thuyết phục để xem xét cổ phiếu CMG, bao gồm khả năng phục hồi, đổi mới và tiềm năng tăng trưởng dài hạn của công ty. Các nhà giao dịch có thể tận dụng điểm mạnh của CMG bằng cách sử dụng nhiều chiến lược khác nhau, chẳng hạn như giao dịch CFD và thực hiện phân tích kỹ thuật. Việc chọn VSTAR làm nền tảng giao dịch bạn chọn sẽ cấp cho bạn quyền truy cập vào CFD cổ phiếu CMG ngoài việc cung cấp cho bạn các tính năng thân thiện với người dùng và các công cụ tinh vi. Khi nói đến việc khai thác toàn bộ tiềm năng của cổ phiếu CMG cho các nhà giao dịch, sự siêng năng, quản lý rủi ro và có chiến lược được xác định rõ ràng là những yếu tố cần thiết.

FAQ

1. Nên Mua hay Bán cổ phiếu CMG?

Mua. Hơn 80% nhà phân tích đánh giá cổ phiếu CMG ở mức Mua do tăng trưởng mạnh.

2. Chipotle có phải là cổ phiếu tốt để mua lúc này không?

Phải. Chipotle đang hoạt động rất tốt và có dư địa đáng kể để mở rộng và đạt được lợi nhuận từ doanh số bán hàng kỹ thuật số.

3. Cổ phiếu CMG có đáng mua không?

Có. Mức xếp hạng đồng thuận của nhà phân tích đối với cổ phiếu CMG là Tăng tỷ trọng/Nên mua. Họ nhận thấy sự tăng trưởng liên tục được thúc đẩy bởi các cửa hàng mới, khối lượng bán hàng, tỷ suất lợi nhuận và thương mại điện tử cao hơn.

4. Chipotle có phải là cổ phiếu được giao dịch công khai không?

Có, CMG được giao dịch công khai trên Sở giao dịch chứng khoán New York.

5. Ai sở hữu nhiều cổ phiếu CMG nhất?

Các cổ đông tổ chức lớn nhất là BlackRock, Vanguard Group, Wells Fargo và những người khác. Đồng giám đốc điều hành Brian Niccol sở hữu 1,8% cổ phần.

6. Thu nhập của Chipotle có ổn không?

Có. Chipotle đã có lợi nhuận cao trong những năm gần đây. Lợi nhuận liên tục tăng.

7. Tương lai của cổ phiếu Chipotle là gì?

Các nhà phân tích nhận thấy tiềm năng tăng trưởng đáng kể trong tương lai nhờ doanh số bán hàng kỹ thuật số, cửa hàng mới và tỷ suất lợi nhuận cao hơn trên toàn bộ hoạt động kinh doanh. Triển vọng dài hạn có vẻ tích cực.