I. Introduction

Coinbase (Nasdaq: COIN), one of the leading cryptocurrency exchanges globally, has recently experienced solid stock performance, punctuated by its position as a trusted leader in the crypto space. The article delves into the recent stock performance of Coinbase and provides insights into expert forecasts for its price trajectory in 2024, 2025, and 2030, alongside an exploration of the driving factors behind its success.

Source: Shareholder-Letter-Q4-2023

A. Recent Coinbase Stock Performance

In recent months, Coinbase's stock performance has been notable, reflecting the growing significance of cryptocurrencies in the financial landscape. The stock has witnessed substantial fluctuations, with significant increases in its price. For instance, over the past year, COIN's price performance surged by 218%, significantly outpacing the sector median. Such momentum underscores the increasing investor interest and confidence in Coinbase's future prospects.

Source: stockcharts.com

Several key factors have influenced Coinbase's stock performance. Firstly, its strategic approach to compliance and regulatory adherence has distinguished it from competitors. Despite facing regulatory scrutiny, Coinbase has consistently prioritized compliance, garnering trust among investors and users alike. This commitment to regulatory compliance not only mitigates risks but also fosters long-term sustainability and legitimacy in the crypto industry.

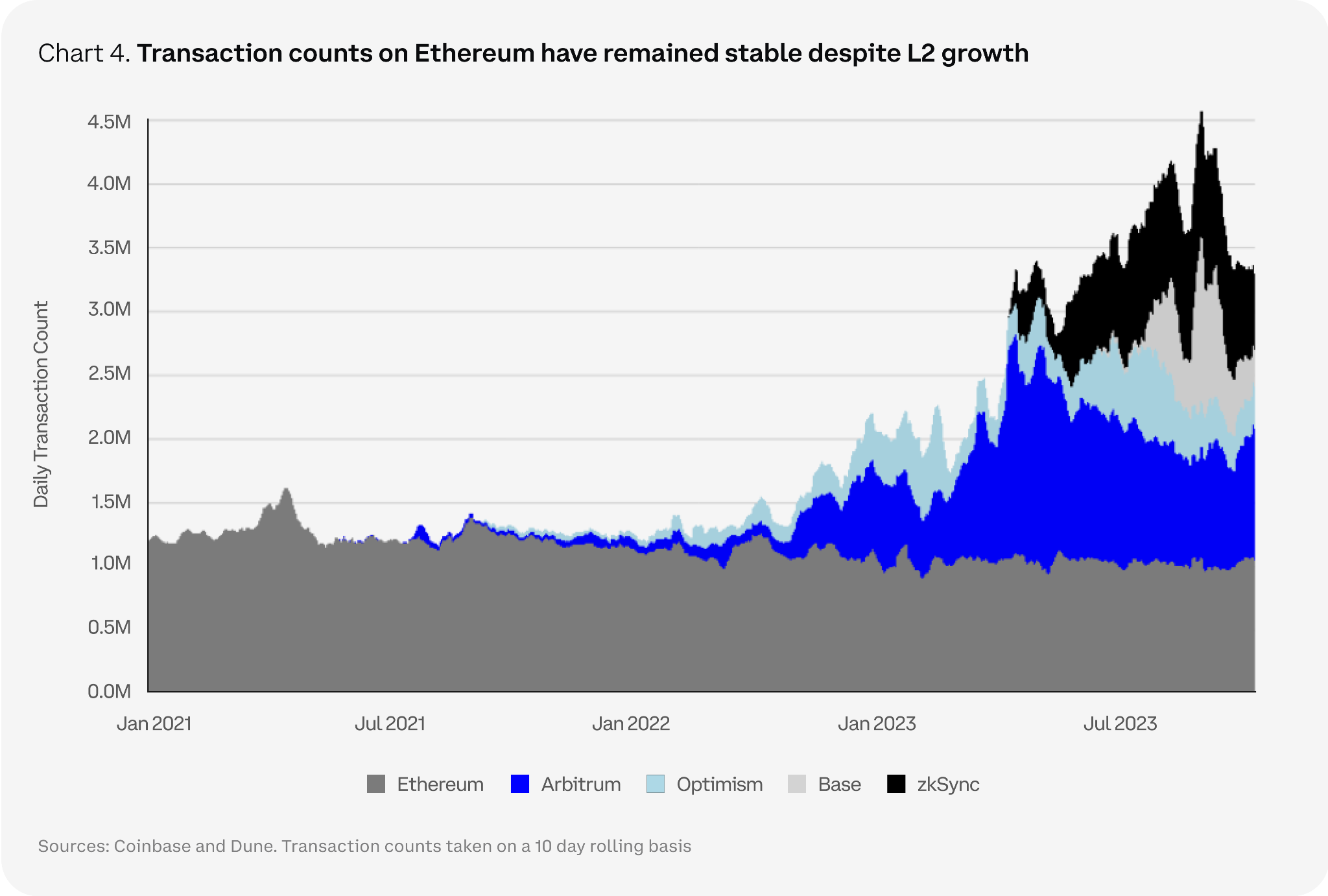

Moreover, Coinbase's expansion efforts, both domestically and internationally, have contributed to its robust stock performance. The company's initiatives to launch derivatives trading globally, obtain licenses in various jurisdictions, and enhance its institutional trading products have broadened its market reach and diversified revenue streams. Additionally, its focus on product innovation, exemplified by the introduction of Coinbase Financial Markets and Base, its Layer 2 solution, reflects its agility and adaptability in meeting evolving market demands.

However, it's important to note that despite its impressive performance, Coinbase faces challenges, including regulatory uncertainties and market volatility inherent in the cryptocurrency space. These factors could potentially impact its stock performance in the future, necessitating continued vigilance and strategic planning.

B. Expert Insights on COIN Price Forecast for 2024, 2025, 2030, and Beyond

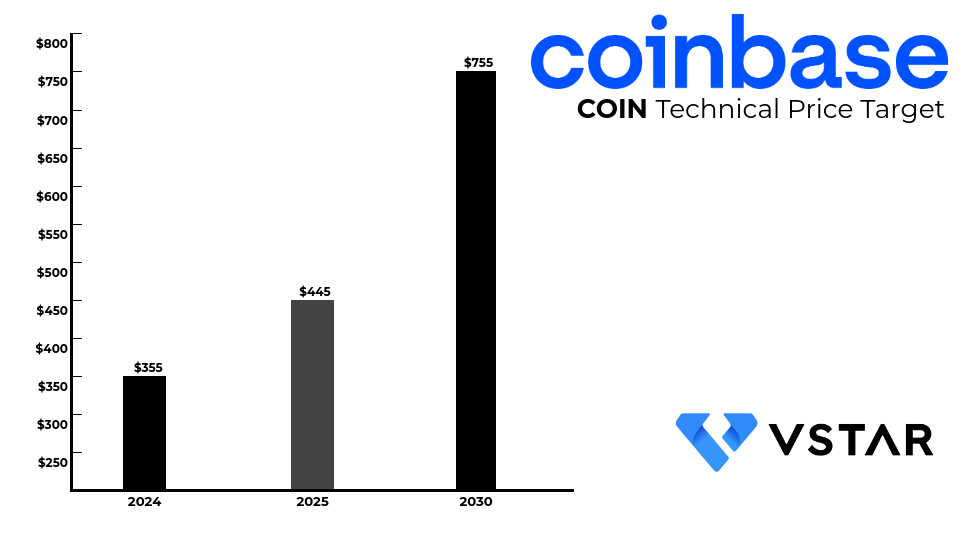

Technically, Coinbase stock is projected to experience substantial growth over the coming years. In 2024, the target price for COIN stands at $355, reflecting optimistic sentiments regarding its performance. By 2025, experts anticipate further appreciation, with the target price reaching $445, driven by anticipated market expansion and revenue growth. Looking ahead to 2030, the forecasted target price climbs to $755, underscoring confidence in Coinbase's long-term trajectory and its pivotal role in shaping the future of finance.

The forecast is underpinned by several factors. Firstly, Coinbase's strong financial performance, evidenced by positive net income, robust adjusted EBITDA, and steady revenue growth, instills confidence in its ability to generate sustainable returns for investors. Additionally, the company's strategic initiatives to drive revenue growth, enhance utility in crypto, and advocate for regulatory clarity further bolster its long-term outlook.

Furthermore, the increasing mainstream adoption of cryptocurrencies and blockchain technology provides a favorable macroeconomic backdrop for Coinbase's growth. As cryptocurrencies become increasingly integrated into traditional financial systems and as their utility expands beyond trading to encompass diverse financial services and applications, Coinbase is poised to capitalize on this burgeoning market opportunity.

Source: Analyst's compilation

II. Coinbase Stock Forecast 2024

The stock price of Coinbase may hit $355 by the end of 2024. Technically, the current momentum of higher highs and Fibonacci retracement levels suggests attainment of this level is highly probable. On the upside, $289 emerged as a major resistance. However, the stock price has already breached the immediate resistance zone of $186-$180. So $289 may not be able to stop the upward momentum of the stock. The upward trend can be observed in the trend line (purple-black).

Looking at the Relative Strength Index (RSI), at 76, it indicates an overbought state of the stock price. However, this could lead to a minor correction in the stock to retest $186-$180 as a support. Also, there is a bearish divergence emerging in RSI, further supporting a correction. But after establishing a change of polarity at the $186-$180 zone, the stock may resume its upward momentum as the RSI is well above the regular bullish level (53).

On the downside, $138 serves as a pivot of the current swing. Similarly, $96.7-$90.7 serves as an immediate support zone.

Source:tradingview.com

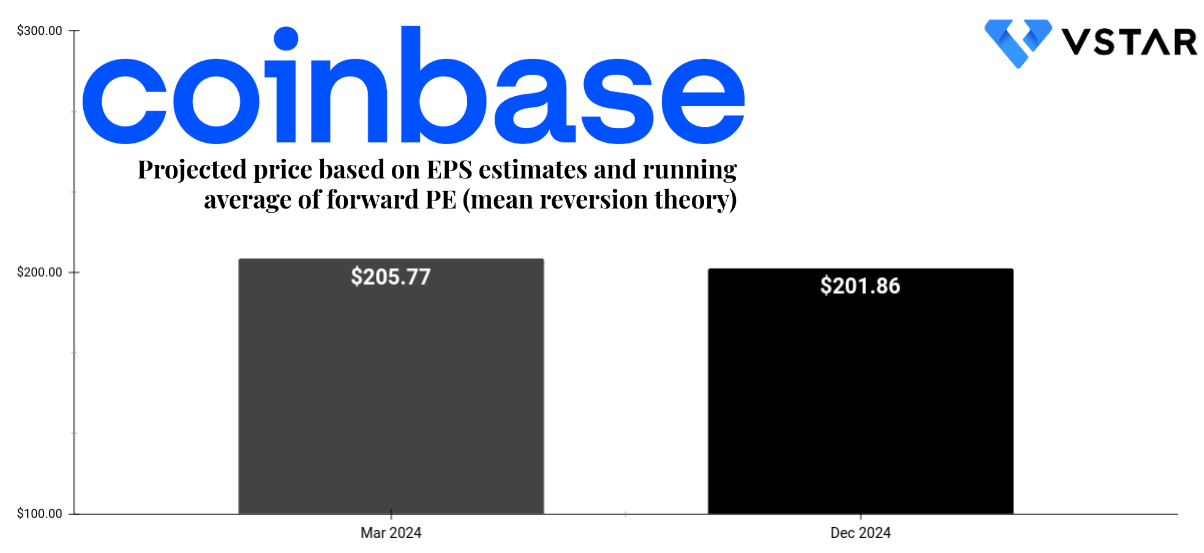

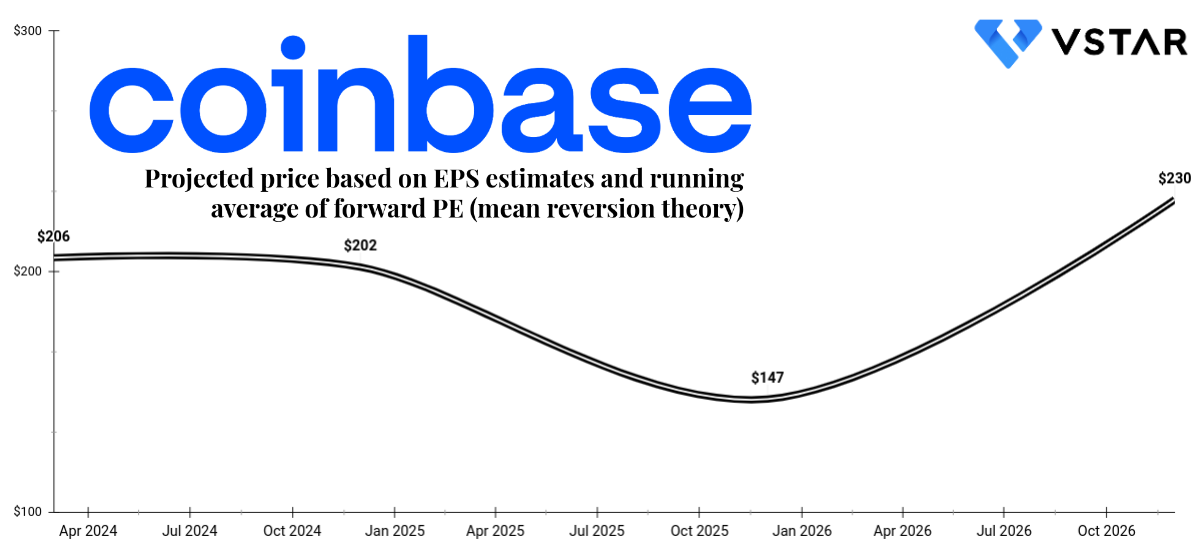

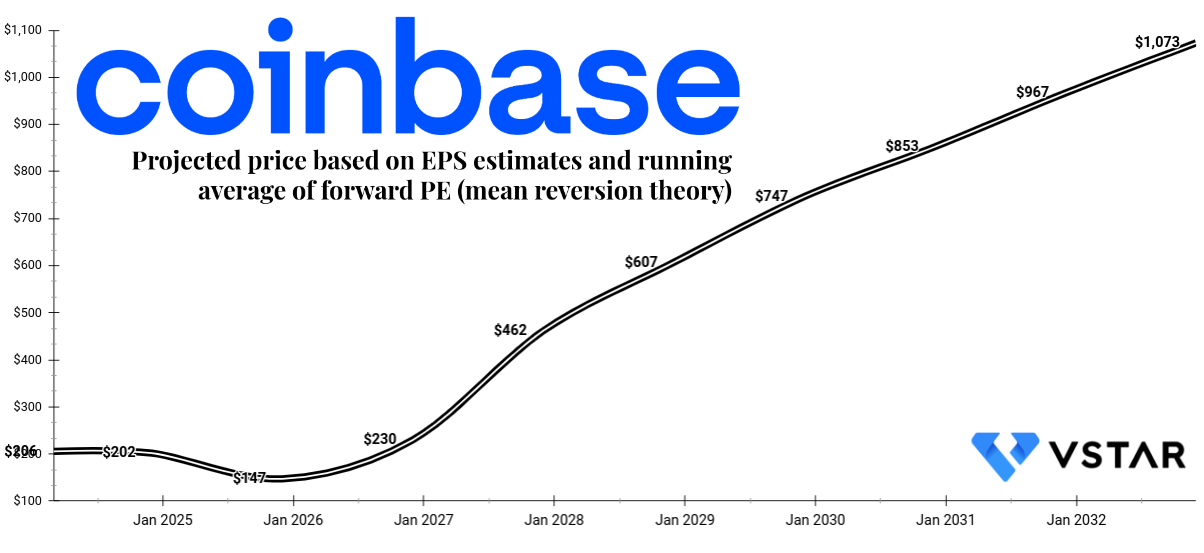

Based on analysts' EPS estimates and running average of forward PEs the price is estimated to reach $202 by the end of 2024. This is a conservative projection based on the high volatility in the crypto ecosystem. Notably, there is limited theoretical downside suggested by the estimate. Also, this indicates a sideways trend in the stock price for the year.

Source: Analyst's compilation

Coinbase's 2024 stock forecasts vary between coinpriceforecast.com, projecting $300 by mid-year and $323 by year-end, and tradersunion.com, suggesting $341.06 by 2024's close. While both predict growth, tradersunion.com's forecast is more bullish.

A. Other Coinbase Stock Price Prediction 2024 Insights

There is a spectrum of opinions on Coinbase's stock performance, showcasing the divergence in analysts' forecasts. Mizuho has a downgraded forecast from $60.00 to $84.00 that implies a pessimistic outlook, suggesting a potential decline of 50.58% from the initial projection. Conversely, Goldman Sachs maintains a sell rating with a slight upward revision from $124.00 to $170.00, indicating a modest expected increase of 0.65%.

On the bullish end, JMP Securities and HC Wainwright both express confidence in Coinbase's future, with JMP Securities maintaining its market outperform rating and increasing the target price from $200.00 to $220.00, projecting a gain of 20.11%. HC Wainwright's upgrade from $115.00 to $250.00 suggests the most optimistic outlook, anticipating a significant surge of 32.87%.

Piper Sandler and Wedbush, on the other hand, maintain more conservative stances. Piper Sandler's neutral rating with a decrease in target price from $125.00 to $165.00 hints at a potential decline of 13.82%. Wedbush remains bullish but with a more tempered optimism, as they maintain their outperform rating while adjusting the target price from $180.00 to $200.00, signaling a gain of 9.93%.

These varied predictions underscore the inherent uncertainty surrounding Coinbase's future performance.

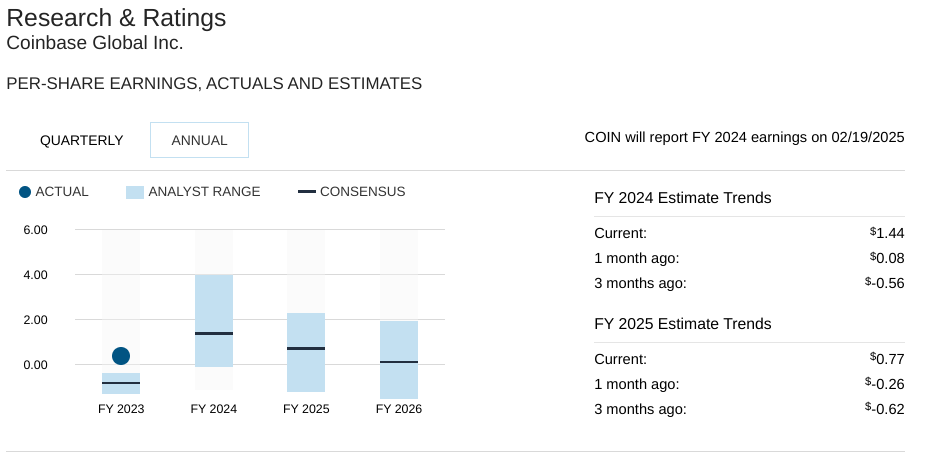

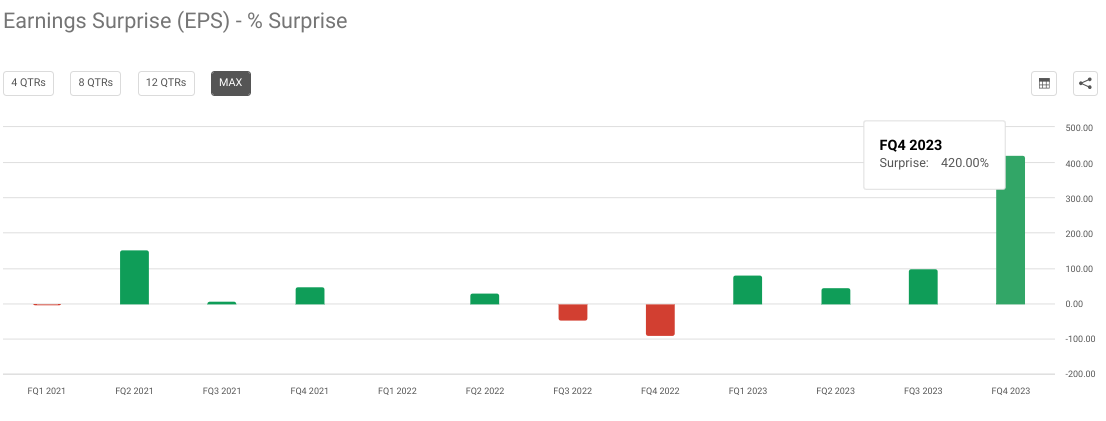

The high variability in Coinbase price prediction can be explained based on the unpredictability of the company's performance. This can be observed in the difference between the Wall Street Journal's estimates and actual data.

Source: wsj.com

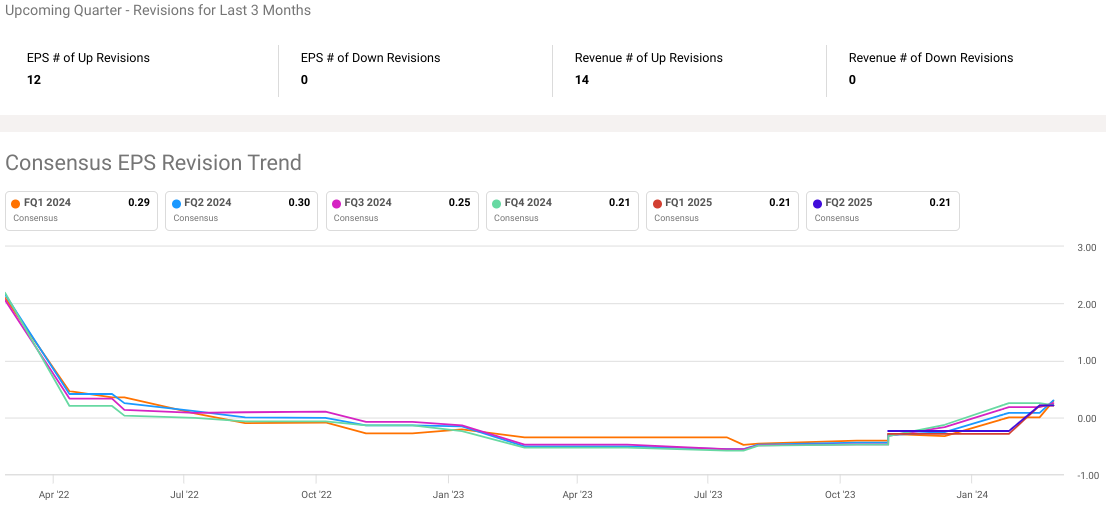

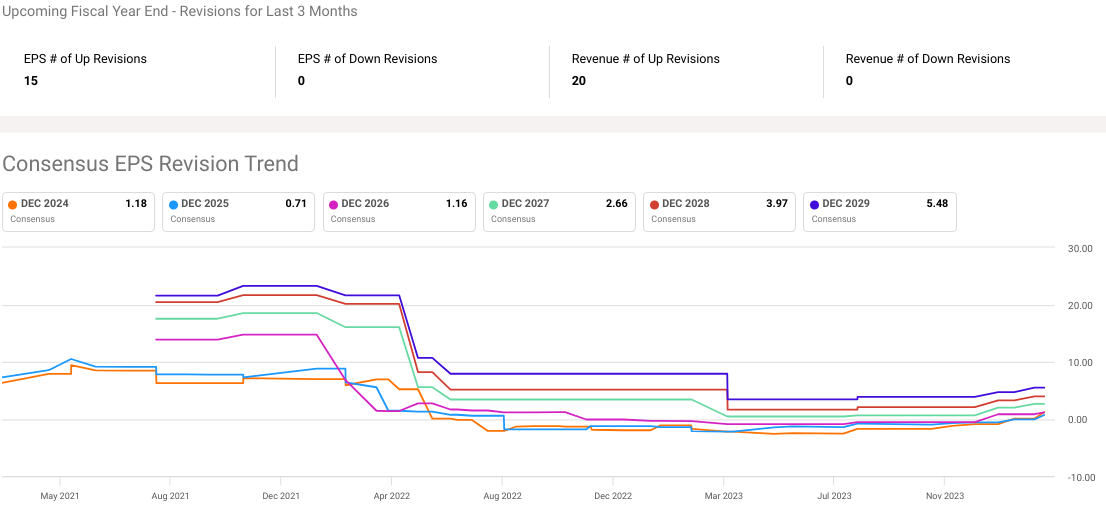

For 2024, upside potential in the stock price can be justified by the total upward revisions in Coinbase's expected performance (topline and bottomline) in the last 3 months. This suggests optimism for the company's valuations in the market.

Source: seekingalpha.com

B. Key Factors to Watch for Coinbase Stock Price Prediction 2024

Coinbase stock forecast for 2024 is influenced by several key factors, including recent financial performance, market sentiment, and industry developments.

Coinbase Stock Price Prediction 2024 - Bullish Factors

Cryptocurrency Market Growth: The surge in Bitcoin's price, reaching over $65K, indicates renewed investor interest in cryptocurrencies. Coinbase, as a leading cryptocurrency exchange, stands to benefit from increased trading activity and transaction fees.

Institutional Adoption: BlackRock's iShares Bitcoin Trust exceeding $10 billion in assets under management highlights growing institutional interest in cryptocurrencies. Institutional adoption could drive higher trading volumes on Coinbase's platform and increase revenue from institutional clients.

Positive Financial Performance: Despite regulatory challenges, Coinbase has reported strong financial results, with revenue estimates for 2024 ranging from $3.70 billion to $6.33 billion. Continued revenue growth signals the company's ability to capitalize on the expanding cryptocurrency market.

Source: stockcharts.com

Coinbase Stock Price Prediction 2024 - Bearish Factors

Regulatory Uncertainty: The recent ruling in the SEC's lawsuit against Coinbase's employee highlights regulatory challenges facing the cryptocurrency industry. Regulatory scrutiny and potential enforcement actions could disrupt Coinbase's operations, leading to increased legal expenses and reputational damage.

Market Volatility: Cryptocurrency prices are highly volatile, influenced by factors such as regulatory announcements, market sentiment, and macroeconomic conditions. Sudden price fluctuations could affect Coinbase's trading volumes and revenue, impacting its stock price.

Competition and Margin Pressure: Coinbase faces competition from other cryptocurrency exchanges and trading platforms, which could lead to pricing pressure and reduced profit margins. Additionally, the commoditization of cryptocurrency trading services may limit Coinbase's ability to differentiate itself in the market.

III. Coinbase Stock Forecast 2025

By the end of 2025, the Coinbase stock price may hit $445. The projection is based on the current higher-high momentum and Fibonacci retracement. The stock price has already breached the current price channel and is moving up towards $350 resistance.

The 2025 COIN price target is highly attainable as the momentum is strong, as the RSI has just reached above 70 and there is no divergence emerging. At the same time, the trendline (purple) is yet to cross the baseline (black).

On the downside, $201-$192 may serve as critical support, if the stock forms a change in polarity.

Source: tradingview.com

Again, based on analysts' EPS estimates and running average of forward PEs, the price is estimated to reach $147 by the end of 2025. This is a negative projection based on the mid-term uncertainty in the crypto ecosystem. Notably, there is still a theoretical upside suggested by the estimate. Also, these estimates indicate a considerable downside in 2025.

Source: Analyst's compilation

The Coinbase stock forecast for 2025 varies across different sources. Coinpriceforecast.com anticipates a notable surge, projecting a year-end price of $573, representing a +1.5X increase from the current price.

Conversely, coincodex.com's forecast, based on historical trends, predicts a more modest rise to $370 by year-end, indicating over 50% increase from the current price. Tradersunion.com provides an intermediate prediction, estimating a price $471 for 2025. These forecasts reflect diverse perspectives on Coinbase's future performance, considering factors like market dynamics, regulatory developments, and cryptocurrency trends.

A. Other Coinbase Stock Price Prediction 2025 Insights

The Coinbase stock price prediction for 2025 from various sources reflects differing perspectives on the company's future performance. Morningstar offers a fair value estimate of $110.00 with a 2-star rating, indicating overvaluation compared to their assessment. They highlight the volatility inherent in Coinbase's business, which is heavily correlated with cryptocurrency prices, and the uncertainty surrounding the longevity of a cryptocurrency rally.

Morningstar emphasizes the risk-reward dynamic, cautioning that the stock's current price is trading significantly above their fair value estimate, implying a potentially unsustainable valuation. They underscore the dependency of Coinbase's revenue growth on trading fees, tethered to the size and stability of the cryptocurrency market.

The absence of an economic moat rating from Morningstar underscores the speculative nature of Coinbase's position, despite its reputation as a reliable and compliant platform in the cryptocurrency exchange industry. They acknowledge Coinbase's competitive advantages but express skepticism about the long-term viability of cryptocurrency as an asset class, raising concerns about the company's returns on invested capital.

However, the price projection ($445) seems attainable based on the company's long history of the considerable surprises over the consensus estimates. These surprises may decisively push up the stock price near the Coinbase earnings releases, supporting the mid-term price trajectory of the stock.

Source: seekingalpha.com

B. Key Factors to Watch for Coinbase Stock Price Prediction 2025

Coinbase Stock Price Prediction 2025 - Bullish Factors

Institutional Crypto Adoption:

There is an accelerating trend of institutional adoption of cryptocurrencies, particularly Bitcoin. With more traditional macro funds and ultra-high net worth individuals entering the crypto space, there's a potential for increased trading activity on Coinbase's platform. This institutional participation could translate into higher trading volumes and transaction fees, contributing to revenue growth for the company. Additionally, the availability of spot Bitcoin ETFs in the US may attract more institutional clients to Coinbase, further bolstering its position in the market.

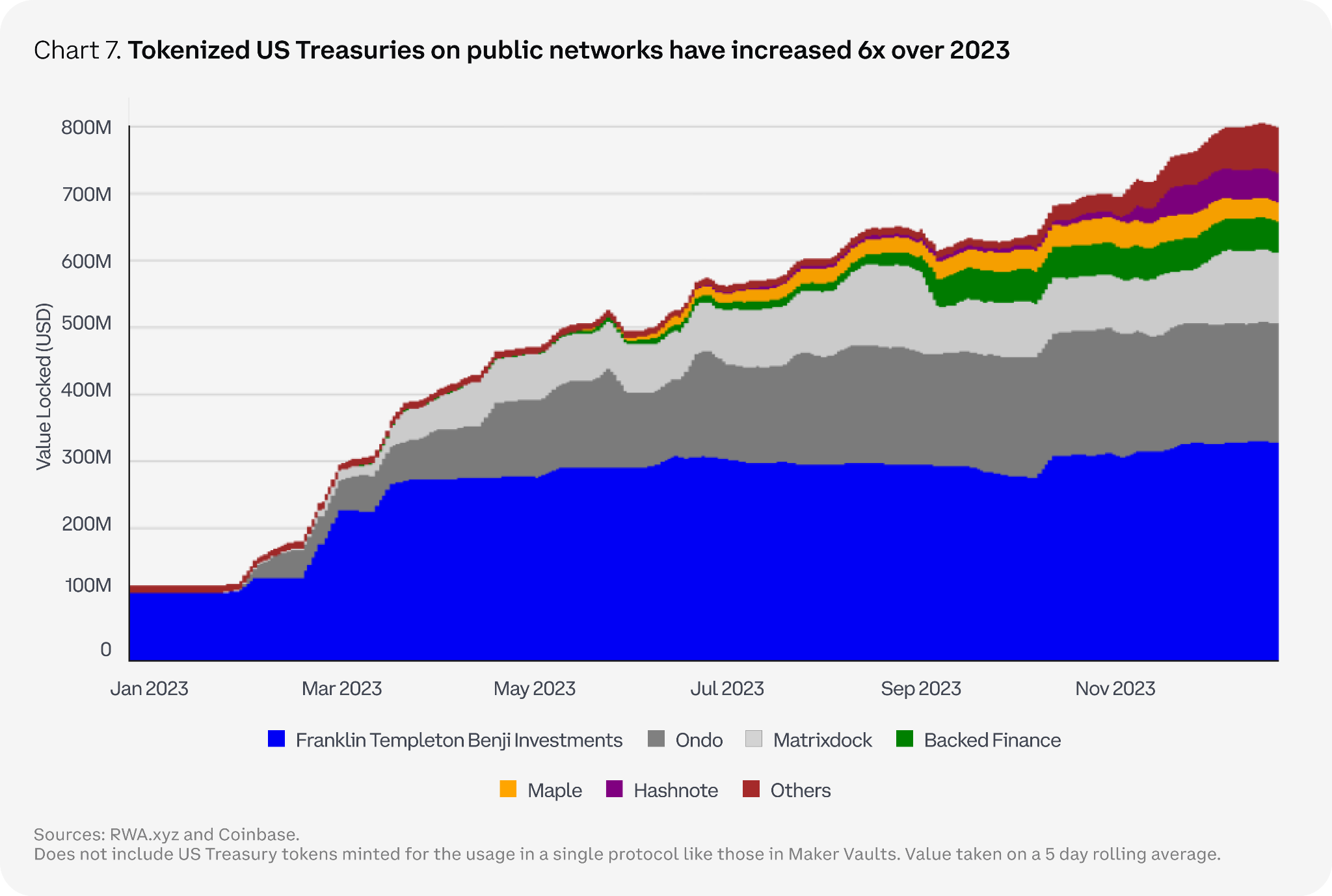

Tokenization Theme and Revenue Opportunities:

The resurgence of the tokenization theme presents revenue opportunities for Coinbase. As traditional financial players explore tokenizing assets like bonds and capital market instruments, Coinbase can leverage its platform to facilitate the trading of tokenized assets. The economic reality of higher opportunity costs post-pandemic makes instantaneous settlement on tokenized assets more appealing, potentially driving demand for Coinbase's services. Diversifying revenue streams through tokenization-related services could mitigate the impact of declining revenue from traditional trading activities.

Source: coinbase.com

Coinbase Stock Price Prediction 2025 - Bearish Factors

Weaker Financial Forecast:

The financial forecast for 2025 indicates negative YoY growth in both EPS and revenue. Specifically, EPS is projected to decrease by 40% compared to the previous year, while revenue is forecasted to remain flat. Despite the slight decline in revenue, the significant drop in EPS suggests potential profitability deterioration and operational efficiency losses for Coinbase. Investors typically view high earnings decline negatively, which could drive downward momentum in the stock price.

Regulatory Uncertainty and Compliance Risks:

Regulatory ambiguity, particularly in the US, poses a significant risk to Coinbase's operations. There are challenges related to regulatory clarity and compliance requirements, which could hinder Coinbase's ability to onboard new customers and expand its offerings. Increased regulatory scrutiny or unfavorable regulatory developments may result in compliance challenges, fines, or even operational restrictions for Coinbase. Investors may perceive regulatory uncertainty as a barrier to long-term growth, resulting in downward movement in the stock price.

Market Volatility and Economic Uncertainty:

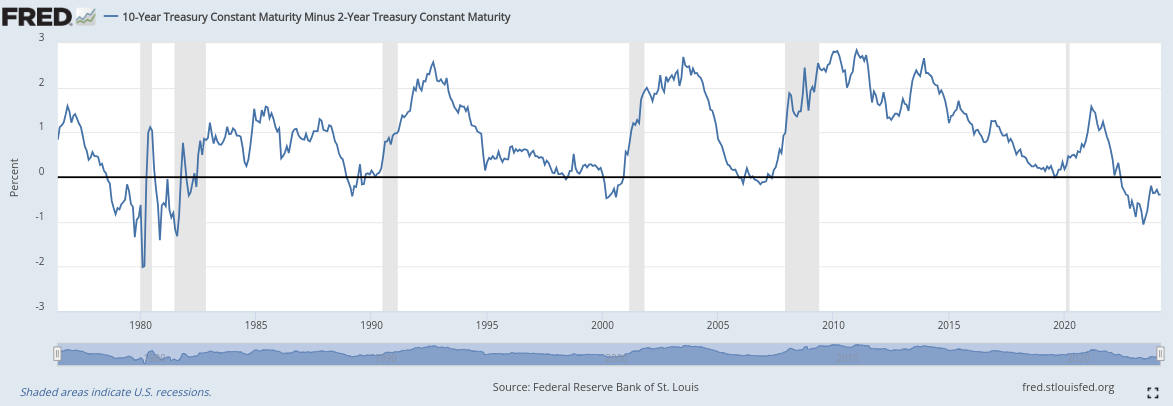

Economic recessions or periods of heightened market volatility could negatively impact Coinbase's stock price. There is a possibility of an economic recession in H2 2024 (see the chart below) due to the lagged impact of FED rate hikes, which may lead to reduced trading activity and investor uncertainty. Increased market volatility, coupled with concerns about global macroeconomic conditions, could create headwinds for Coinbase's revenue and profitability. Investors may adopt a risk-averse stance in uncertain economic environments, leading to downward pressure on the stock price.

Source: fred.stlouisfed.org (see the dips below zero, a recession thereafter)

Technological Challenges and Scalability Issues:

Rapid technological innovation in the crypto space presents both opportunities and risks for Coinbase. There may be scalability challenges and platform outages during periods of high trading activity, which could erode customer trust and satisfaction. Failure to address technological issues or adapt to emerging technologies may result in loss of market share to more technologically agile competitors. Investors may view technological risks as a barrier to sustainable growth, particularly if Coinbase struggles to maintain a reliable and scalable platform.

Source: coinbase.com

IV. Coinbase Stock Forecast 2030 and Beyond

By the end of 2030, the stock price may reach $755. The projection is based on the current higher-high momentum and Fibonacci retracement. The stock price has already breached the current resistance zone ($181-$173) in a 3-month timeframe and is moving up towards $481 resistance.

The 2030 Coinbase price target seems feasible and attainable as the bullish momentum is just getting strong towards bullishness, RSI (at 37) has just begun its uplift and is far from reaching above 70.

On the downside, $181-$173 may serve as immediate support if the stock forms a change in polarity. However, the long-term pivot is at $120, which is less likely to hit over the long-term.

Source: tradingview.com

Using analysts' EPS estimates and the running long-term average of forward PEs, the price is estimated to hit $747 by the end of 2030 and $1073 by 2032. This is a highly progressive projection based on the long-term market expectations in the crypto ecosystem and mean reversion. Notably, there is a massive upside of 5X return suggested by the estimate.

Source: Analyst's compilation

The Coinbase stock forecasts for the years beyond 2030 exhibit significant disparity, reflecting the inherent uncertainty in long-term projections influenced by various factors. Coinpriceforecast.com provides a relatively conservative estimate, projecting a gradual rise in stock value. According to their prediction, the stock is anticipated to reach $1,073 by 2035, indicating a substantial but more modest 421% increase from its initial value.

In contrast, coincodex.com offers a much more bullish outlook, forecasting the stock to surge to $4,032.87 by 2030, marking an extraordinary 1,659.92% increase. However, this optimistic forecast might be subject to considerable volatility and risk.

Tradersunion.com provides a middle ground, offering a range of estimates. Their predictions suggest the Coinbase stock could trade between $1,620.35 and $1,887.71 by 2030, providing investors with a more moderate yet potentially profitable projection.

A. Other Coinbase Stock Price Prediction 2030 and Beyond Insights

ARK Invest's Cathie Wood has a bullish price prediction for Bitcoin, reaching $1.5 million by 2030, suggesting a favorable outlook for Coinbase and the broader cryptocurrency market. Wood's revised forecast, driven by the SEC approval of spot Bitcoin ETFs, reflects growing institutional interest and confidence in the crypto sector.

Additionally, Standard Chartered Bank's prediction of Bitcoin reaching $200K by the end of 2025 suggests the positive mid-to-long-term sentiment surrounding digital assets. Increased Bitcoin prices could translate into higher trading volumes and transaction fees for Coinbase, driving revenue growth.

Also, there is a complete shift among the analysts toward the top and bottomline performance of Coinbase. This signals an initiation of the long-term progressiveness of market expectations towards the company's prospects.

Source: seekingalpha.com

B. Key Factors to Watch for Coinbase Stock Price Prediction 2030 and Beyond

Coinbase Stock Price Prediction 2030 and Beyond - Bullish Factors

Strong EPS Growth Trajectory:

The EPS estimates for Coinbase demonstrate a robust growth trajectory, with consistent year-over-year increases expected through 2032. For instance, the EPS estimate for 2030 is $6.94, representing a substantial 26.64% YoY growth. This trend indicates potential profitability improvements and operational efficiency gains, which could positively impact investor sentiment and support a higher stock price.

Steady Revenue Growth Potential:

Despite short-term fluctuations, Coinbase's revenue estimates suggest a promising outlook for future growth. While revenue is projected to dip in 2025, long-term forecasts indicate significant year-over-year growth rates from 2029 to 2032. For example, revenue is forecasted to reach $10.22 billion by the end of 2032, reflecting an 11.26% YoY increase. This sustained revenue growth reflects expanding market opportunities and increasing adoption of cryptocurrency trading, which could drive stock price appreciation.

Tokenization and Decentralization Trends:

Coinbase's strategy aligns with emerging trends in tokenization and decentralization, which could present new growth opportunities. The expansion of tokenization to various market instruments, as indicated by the forecast, suggests increased demand for higher-yielding products and diversified sources of return. Additionally, Coinbase's involvement in facilitating decentralized infrastructure networks (DePIN) and decentralized compute (DeComp) positions the company to capitalize on advancements in blockchain technology, driving long-term value creation and potentially boosting investor confidence.

Coinbase Stock Price Prediction 2030 and Beyond - Bearish Factors

Regulatory Uncertainty and Compliance Risks:

Regulatory ambiguity poses a significant risk to Coinbase's future prospects. While the company aims to leverage tokenization and decentralized finance (DeFi) opportunities, regulatory challenges may hinder its ability to expand offerings or operate across different jurisdictions. Compliance risks associated with evolving regulatory requirements could increase operational costs and impact Coinbase's growth potential, leading to uncertainty among investors and potential downward pressure on the stock price.

Market Volatility and External Factors:

The cryptocurrency market's inherent volatility presents a challenge for Coinbase's revenue stability and investor confidence. Fluctuations in cryptocurrency prices and market sentiment could impact trading volumes, transaction fees, and overall financial performance. Additionally, external factors such as macroeconomic conditions, geopolitical events, and technological developments may influence market dynamics, posing risks to Coinbase's operations and financial outlook. Heightened market volatility and uncertainty could lead to increased stock price volatility and investor caution.

Adoption Challenges in Web3 Gaming and Decentralized Identity:

While Coinbase explores opportunities in Web3 gaming and decentralized identity, adoption challenges and user preferences may present hurdles. Skepticism from mainstream gamers regarding Web3 integration and resistance to NFT-based models could limit the success of Coinbase's initiatives in the gaming sector. Similarly, achieving widespread adoption of decentralized identity solutions may require overcoming technical barriers and addressing privacy concerns. Delays or setbacks in these initiatives could impact Coinbase's revenue diversification efforts and long-term growth prospects.

V. Coinbase Stock Price History Performance

Coinbase has seen a dynamic and often volatile trajectory in its stock price since its public listing, reflecting the rapidly evolving cryptocurrency market and broader economic factors.

Coinbase Stock Key Milestones

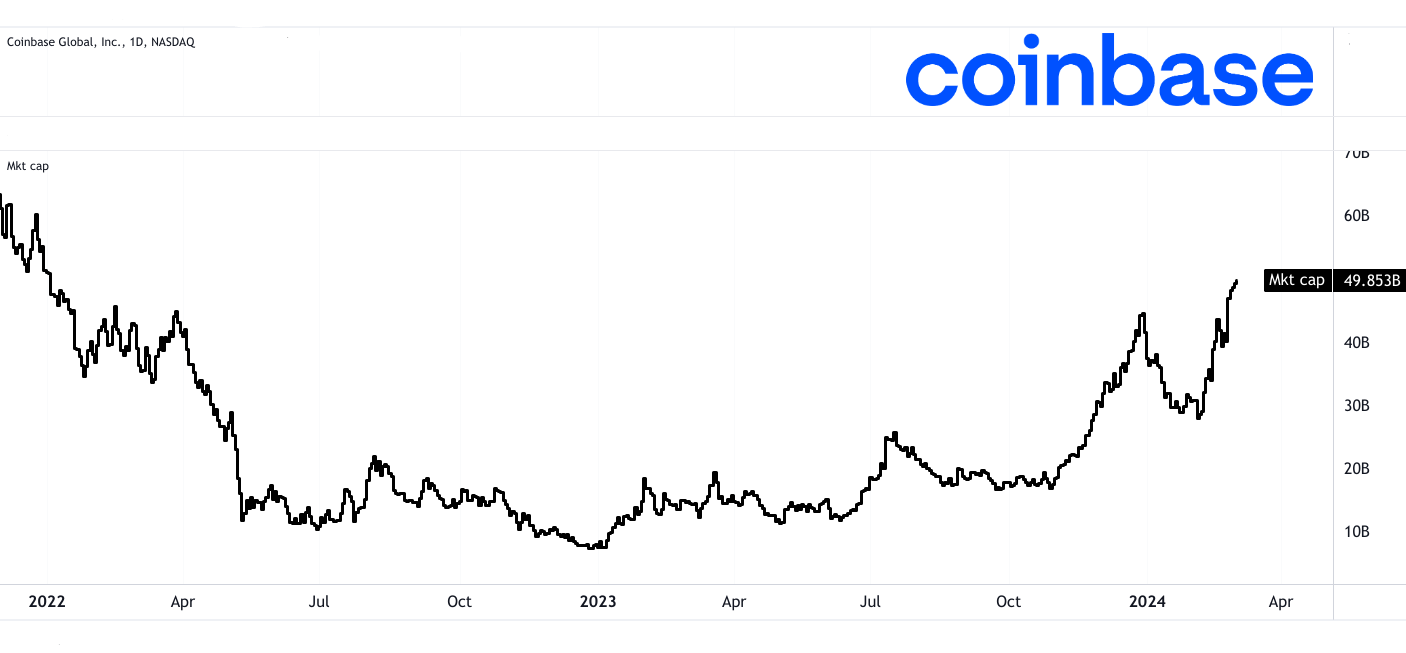

2021 - Initial Public Offering (IPO): Coinbase made its highly anticipated debut on the Nasdaq stock exchange on April 14, 2021. The IPO marked a significant milestone for the cryptocurrency industry, as Coinbase became the first major cryptocurrency exchange to go public. The listing was met with immense investor interest and enthusiasm, driving Coinbase's market capitalization to approximately $54.31 billion by the end of the year.

2022 - Price Volatility and Correction: Following its IPO, Coinbase experienced heightened price volatility, characteristic of the cryptocurrency market. The stock price reached both highs and lows as it navigated fluctuations in the prices of major cryptocurrencies like Bitcoin and Ethereum. However, amidst regulatory concerns and market uncertainties, Coinbase's stock witnessed a significant correction, leading to a decline in its market capitalization to $9.26 billion by the end of the year.

2023 - Market Recovery and Growth: Despite the challenges in 2022, Coinbase rebounded strongly in 2023, reflecting renewed investor confidence and a broader market recovery. The company's strategic initiatives, including international expansion and product innovation, contributed to its resurgence. Coinbase's stock price surged, and its market capitalization soared to $41.60 billion by the end of the year, marking a substantial recovery from the previous year's lows.

2024 - Continued Growth and Expansion: In 2024, Coinbase continued its growth trajectory, fueled by sustained market demand for cryptocurrencies and the company's strategic initiatives. The stock price exhibited positive momentum, with Coinbase's market capitalization reaching $49.85 billion as of now, reflecting a further increase in investor confidence and market valuation.

Source: tradingview.com

COIN Stock Price Return and Total Return

One-Week (1W) Performance: Coinbase's price return over the past week stands at 23.97%, outperforming the S&P 500's return of 0.95%. This indicates significant positive price momentum for Coinbase relative to the broader market in the short term.

One-Month (1M) Performance: Over the past month, Coinbase's price return of 59.57% surpasses the S&P 500's return of 4.71%, highlighting substantial outperformance by Coinbase within a relatively short period.

Six-Month (6M) Performance: Coinbase's price return of 163.84% over the past six months significantly exceeds the S&P 500's return of 13.76%. This indicates sustained strong performance by Coinbase compared to the broader market over a medium-term horizon.

Year-to-Date (YTD) Performance: Coinbase's year-to-date price return of 18.31% demonstrates positive growth, albeit at a slower pace compared to its longer-term performance. In contrast, the S&P 500 has posted a YTD return of 7.70%, indicating Coinbase's outperformance over the broader market in the current calendar year.

One-Year (1Y) Performance: Over the past year, Coinbase's total return of 218% significantly outpaced the S&P 500's return of 32%. This substantial outperformance underscores Coinbase's exceptional growth trajectory and market dominance within the cryptocurrency sector.

Source: morningstar.com

VI. Conclusion

In conclusion, Coinbase has emerged as a prominent player in the cryptocurrency exchange sector, attracting significant attention from investors due to its strategic positioning and solid financial performance. As we navigate through 2024, 2025, and project towards 2030, understanding the price forecasts and key factors influencing Coinbase's stock performance becomes imperative for investors seeking to capitalize on potential opportunities in the market. Additionally, trading Coinbase Stock CFDs with VSTAR offers an avenue for investors to leverage market opportunities with lower trading costs and access to global stock markets.

Coinbase Stock Price Prediction

COIN Stock Price Prediction for 2024:

Forecasted Price Range: $300 to $341.06 by various sources.

Expert Insights: Analysts project a target price of $355 by the end of 2024, driven by positive financial performance and market expansion efforts. However, regulatory uncertainties and market volatility remain potential challenges.

COIN Price Forecast 2025:

Forecasted Price Range: $370 to $573.

Expert Insights: The stock price is anticipated to reach $445 by the end of 2025, supported by strong momentum and revenue growth. Analysts highlight the importance of institutional adoption and tokenization trends in driving future performance.

COIN Stock Forecast for 2030:

Forecasted Price Range: $747 to $4,032.87.

Expert Insights: Long-term projections suggest the stock could reach $755 by 2030, with potential for significant upside driven by EPS growth and revenue opportunities. However, regulatory uncertainty and market volatility remain key risks to monitor.

Key Factors Influencing Coinbase Stock Forecast

Bullish Factors:

Cryptocurrency Market Growth: Increased interest in cryptocurrencies and institutional adoption contribute to higher trading volumes and revenue for Coinbase.

Institutional Adoption: Growing institutional interest in cryptocurrencies, highlighted by BlackRock's iShares Bitcoin Trust, could drive revenue growth and market expansion.

Tokenization and Revenue Opportunities: Coinbase's involvement in tokenization and decentralized finance presents revenue opportunities, diversifying its revenue streams.

Bearish Factors:

- Regulatory Uncertainty: Regulatory challenges and compliance risks pose threats to Coinbase's operations and market expansion efforts, potentially impacting revenue growth.

- Market Volatility: Cryptocurrency market volatility and external factors like economic uncertainty could affect trading volumes and revenue, leading to stock price fluctuations.

- Adoption Challenges: Skepticism and adoption challenges in Web3 gaming and decentralized identity initiatives could hinder Coinbase's revenue diversification efforts and long-term growth prospects.

Investment Recommendations:

- Long-Term Investment: Given the bullish long-term outlook and potential for significant upside, investors with a high-risk tolerance may consider holding Coinbase stock for the long term.

- Diversification: Given the inherent volatility and risks in the cryptocurrency market, investors should diversify their portfolios to mitigate risk.

- Monitor Regulatory Developments: Stay informed about regulatory developments and their potential impact on Coinbase's operations and financial performance.

- Consider Trading CFDs with VSTAR: Utilize VSTAR's platform to trade Coinbase Stock CFDs with leverage, lower trading costs, and access to global stock markets.

FAQs

1. Is Coinbase a Buy, Sell or Hold?

At the current price, which is near the upper end of its 52-week range, Coinbase could be considered a hold or potentially a sell for investors looking to lock in recent gains. However, long-term investors bullish on crypto may consider it a buy.

2. What is the 12-month forecast for Coinbase stock?

The average analyst 12-month price target for Coinbase is around $200, suggesting that the stock could pull back from current levels over the next year, according to consensus forecasts.

3. What will Coinbase be worth in 2025?

Based on Coinbase's current share price and analyst projections that account for continued crypto adoption, a reasonable estimate for Coinbase stock price in 2025 could be around $350 per share.

4. What is the 5-year forecast for Coinbase?

Analysts modeling long-term crypto adoption see significant upside potential for Coinbase stock if it maintains its leadership position, with some projecting valuations above $500 per share.

5. What is the Coinbase stock price prediction in 2040?

Assuming Coinbase maintains a leadership position in crypto exchanges as the space matures, a potential stock price target for 2040 could be around $1,000 per share.