I. Introduction

A. Recent Crowdstrike Stock Performance

Acquisition of Government Clients

The increase in market share, the procurement of new government clients, and the expansion of its XDR (extended detection and response) platform with enhanced generative AI capabilities contributed to the acceleration. As of the conclusion of the fiscal year 2024, 43% of its clientele had implemented a minimum of six of its cloud-based modules, representing an increase from the initial four modules (39% at the end of the fiscal year 2023). 27% of clients now utilize a minimum of seven modules, up from 22% previously.

Source: crowdstrike.com

CrowdStrike's expansion strategy consists of acquisitions. It recently disclosed the undisclosed amount at which it acquired Flow Security, a provider of cloud data runtime solutions. The agreement is anticipated to be finalized during the initial quarter of the fiscal year 2025. During the conference call, CEO George Kurtz stated that integrating Flow's tools would strengthen Falcon's capability to prevent data intrusions at both the "device to cloud" and "code to application" levels, as well as its native data protection module.

Impressive Compound Annual Growth Rate (CAGR)

Source: finance.yahoo.com

Many cybersecurity companies continue to depend on on-premises appliances, which often require considerable physical space and ongoing maintenance and incur considerable expenses for expansion. In contrast, CrowdStrike confronts these obstacles directly with Falcon, an endpoint security platform native to the cloud, and obviates the necessity for any appliances located on-site.

The groundbreaking methodology has propelled CrowdStrike's impressive expansion since its initial public offering in 2019. The company experienced a revenue growth rate (CAGR) of 65% from fiscal 2019 (which concluded in January 2019) to fiscal 2024. Additionally, its ending annual recurring revenue (ARR) increased at a CAGR of 62% during the same period.

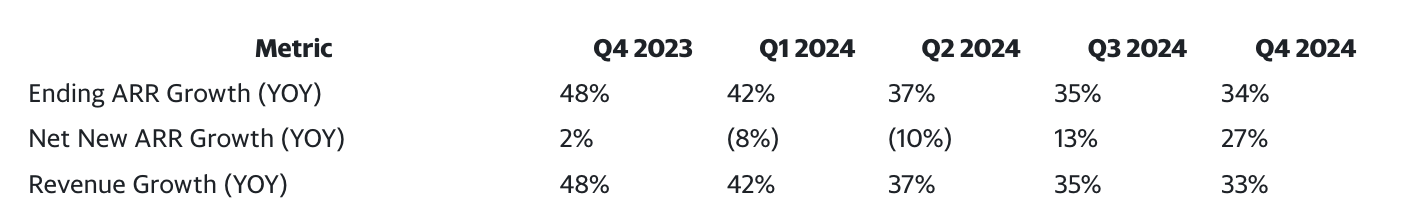

In contrast, revenue increased by 36% in fiscal 2024, a substantial decrease from the 54% and 66% growth rates observed in fiscal 2022 and 2023, respectively. The primary factor contributing to this deceleration was macroeconomic headwinds, which presented obstacles in acquiring new clients. The result was a year-over-year decline in the net new ARR from new consumers during the initial six months of fiscal year 2024.

Upbeat Performance Than S&P 500

The S&P 500 showed positive performance in 2023, providing a 33.45% gain, as shown in the above image. Meanwhile, the CrowdStrike Stock (CRWD) outperformed the index by providing a 206% gain, which is 6X higher than the particular index.

As per analysts' opinion, the ongoing surge in post-COVID activity online increased the concern about cybersecurity. As a result, companies like CrowdStike showed decent revenue outcomes.

B. Expert Insights on CRWD Stock Forecast for 2024, 2025, 2030, and Beyond

Based on the ongoing market structure and analysts' opinion, CrowdStrike Stock (CRWD) is more likely to continue the upward pressure.

The recent price action from the middle of 2021 came with a valid ABCD correction, which could be a crucial factor. Moreover, the fundamental outlook of Crowdstrike stock is positive as shown by recent earnings reports. The fiscal 2023 Crowdstrike earnings report showed the earnings per share at $3.09, which maintained the upbeat forecast that had started six years ago.

Let's see analysts' opinions about CRWD stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$564 |

$739 |

$1,279 |

|

Coincodex |

$ 430.23 |

$ 524.22 |

$ 5,916.59 |

|

Stockscan |

$386.55 |

$657.88 |

$1,064.49 |

II. CRWD Stock Forecast 2024

Considering the fundamental structure and market trend, CrowdStrike Stock (CRWD) could reach the 427.00 level before the end of 2024.

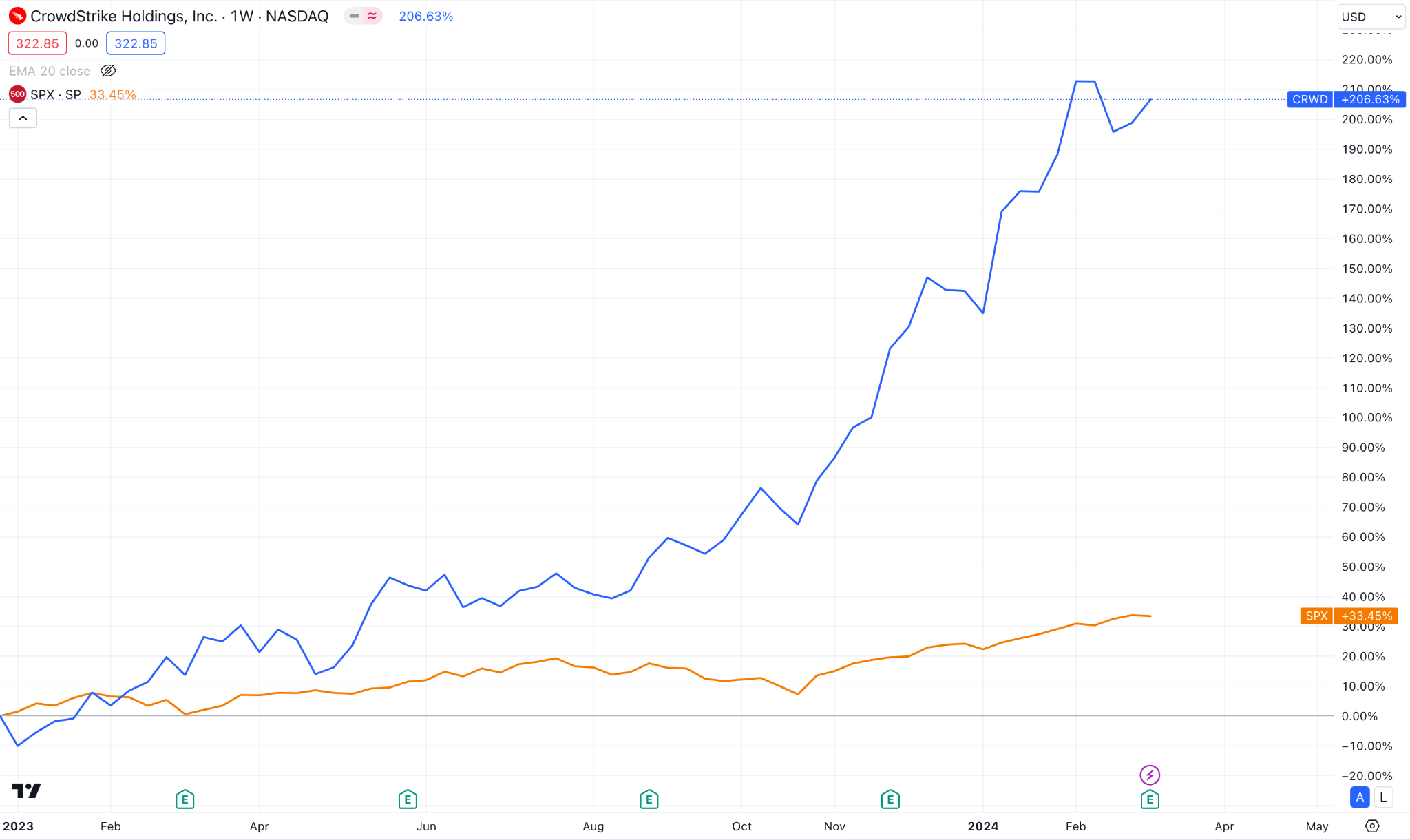

As per the above weekly CRWD chart, the dynamic 20-week Exponential Moving Average is the immediate support. Moreover, the rising MA line with the ongoing buying pressure above the 299.06 static line could be a valid long signal for CRWD stock.

In the secondary window, the 14-week Relative Strength Index (RSI) showed an overbought condition as it remained steady above the 70.00 overbought line.

Based on the weekly forecast for CrowdStrike Stock (CRWD), the ongoing price action is bullish, where the next resistance is the 161.8% Fibonacci Extension level from the existing swing.

Therefore, the price has a higher possibility of continuing higher and reaching the 427.16 level before the end of 2024. However, a considerable downside correction might happen toward the dynamic 20-week EMA from where another long opportunity might come.

Let's see what other technical indicator says about the CRWD stock forecast for 2024:

- MACD: The current MACD Histogram is in the neutral zone after finding a peak. It indicates buyers' weakness in the market as a correction to the bull market.

- Ichimoku Cloud: The future cloud in the Ichimoku Indicator shows steady buying pressure as the recent Senkou Span A is above the Senkou Span B. Moreover, the Tenkan Sen and Kijun Sen lines are below the current price with a bullish slope, suggesting a bullish continuation signal.

- Average Directional Index (ADX): The current ADX line is corrective above the 50.00 level, indicating an ongoing market buying pressure. However, a downside correction is potent but the ADX line might rebound from 30.00 to 20.00 zone.

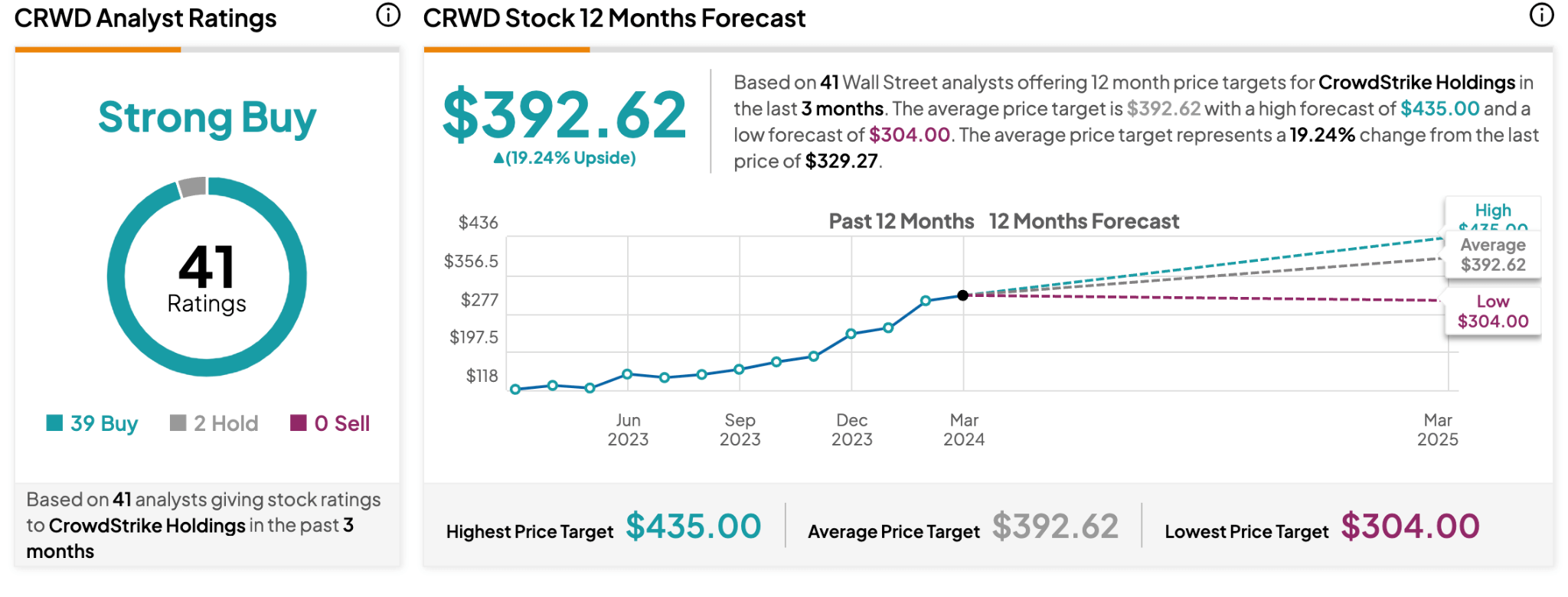

A. Other Crowdstrike Stock Forecast 2024 Insights: CrowdStrike stock Buy or Sell?

According to a report from Tipranks, The expected revenue for CRWD in the forthcoming quarter is estimated to be $904.59 million. In comparison, sales for the preceding quarter amounted to $845.34 million. During the previous twelve months, CRWD consistently outperformed its sales projections, attaining a success rate of 100 percent. In comparison, the industry only managed to surmount estimates 66.35 percent of the time during the same time frame.

Based on this, CRWD stock might increase towards the $392.63 level by the end of 2024.

Another report from Marketbeat suggests a moderate buy signal for CRWD stock in 2024, based on 38 analysts' projections. Based on the available data, the stock price might increase toward the $371.50 level by the end of 2024.

B. Key Factors to Watch for CRWD Stock Price Prediction 2024

Growth and Profitability

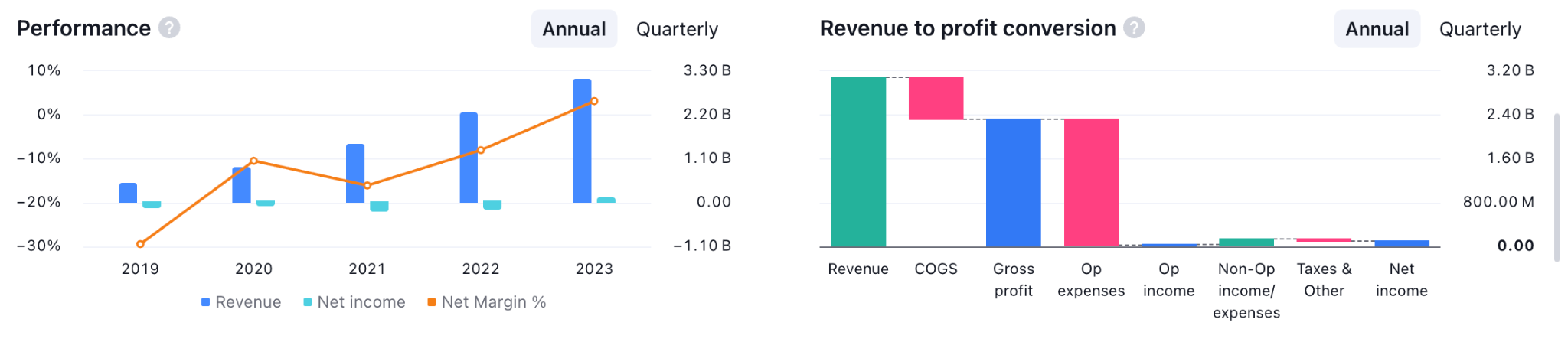

The profitability is a crucial factor in gauging the future price of a stock. For CrowdStrike, the recent reading shows a positive outlook as the revenue keeps showing an upward trend in the last 5 years.

Moreover, the Cost of Goods sold is minimal, which suggests a higher profitability upon controlling the operating expense.

CrowdStrike Revenue Forecast

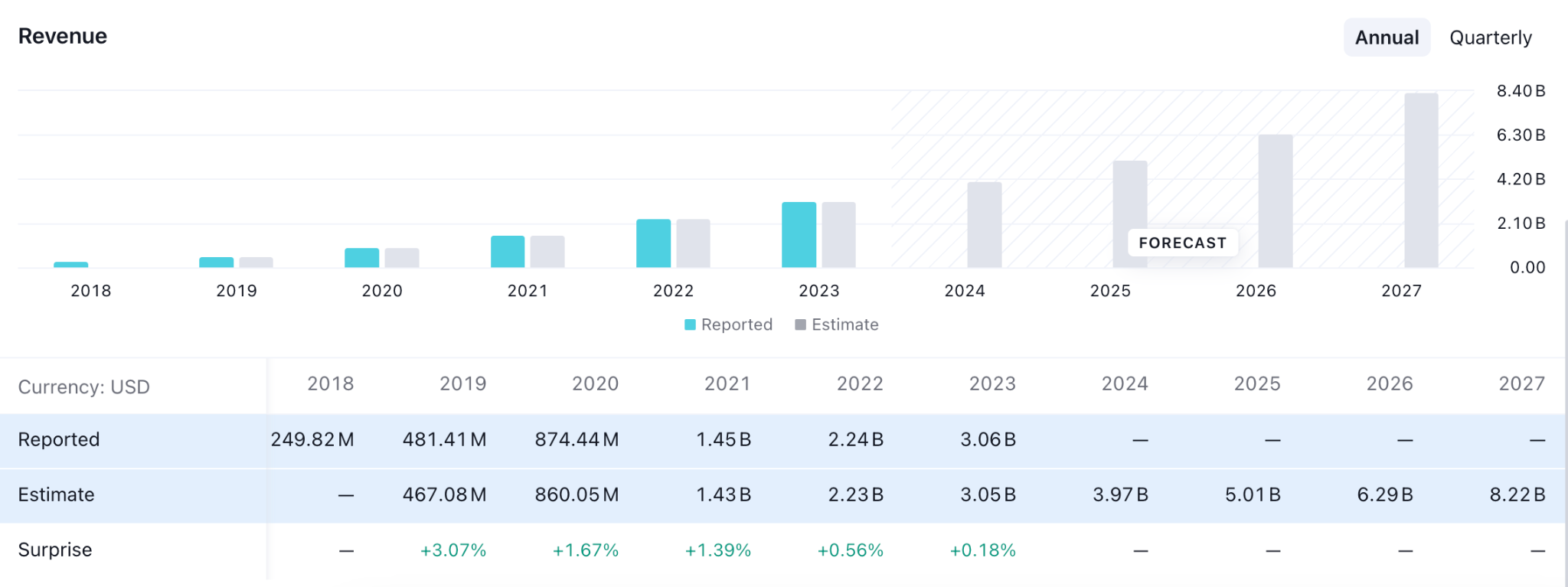

Since Q1 2022, the quarterly CRWD stock earnings have kept showing upward traction. Moreover, the current quarterly forecast for 2024 suggests a positive outlook, as shown in the above image.

Investors should closely monitor the upcoming earnings reports, where any upbeat result could work as a bullish factor for CRWD stock.

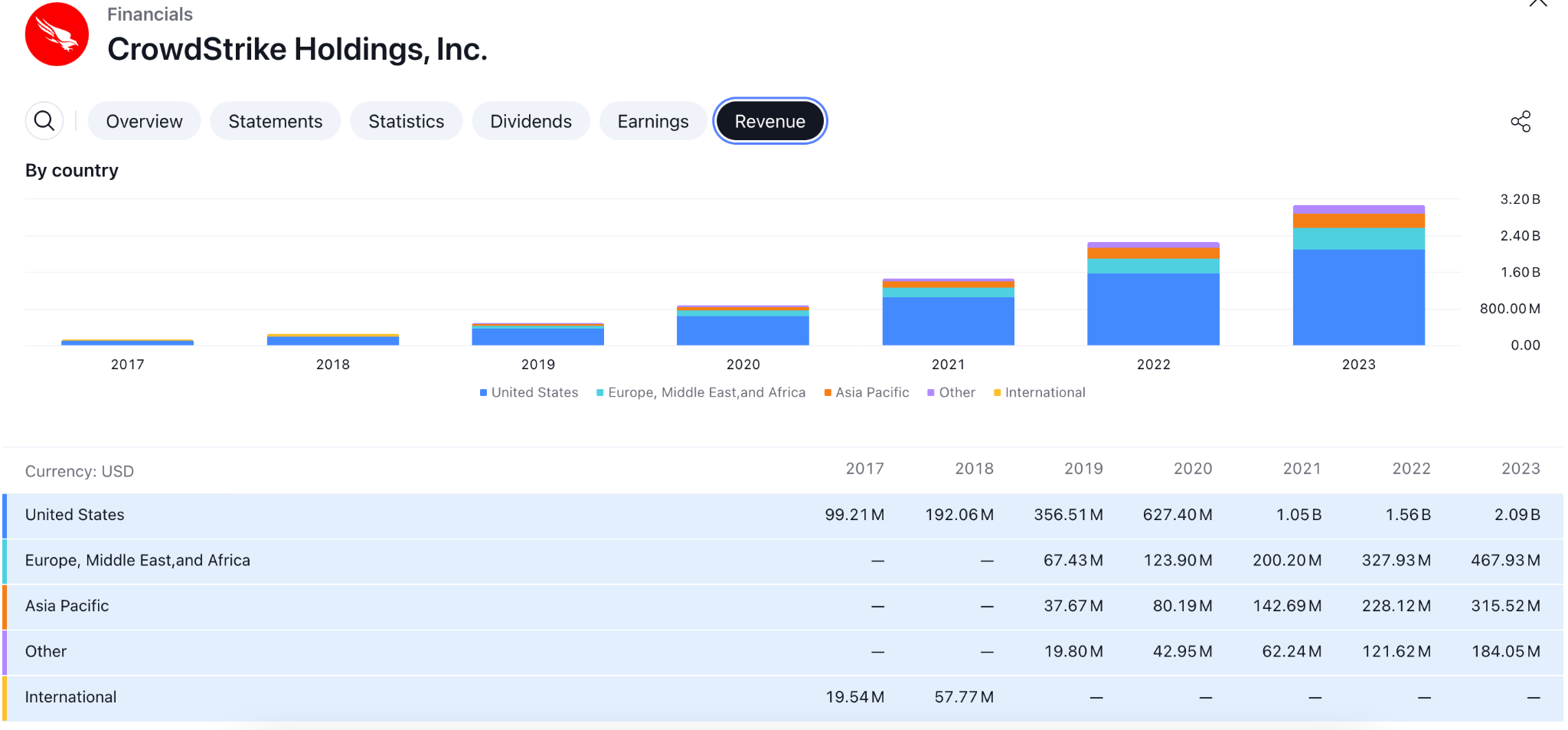

By Country Revenue

Among revenue segments, the latest data suggests that over $2 billion revenue has come from the United States, which is higher than cumulative revenues from other continents.

Therefore, in the CRWD stock forecast for 2024, investors should closely monitor how the revenue is generated from the US, as it is the major earning zone. Also, the geopolitical and macroeconomic environment of the US could affect the revenue of the company.

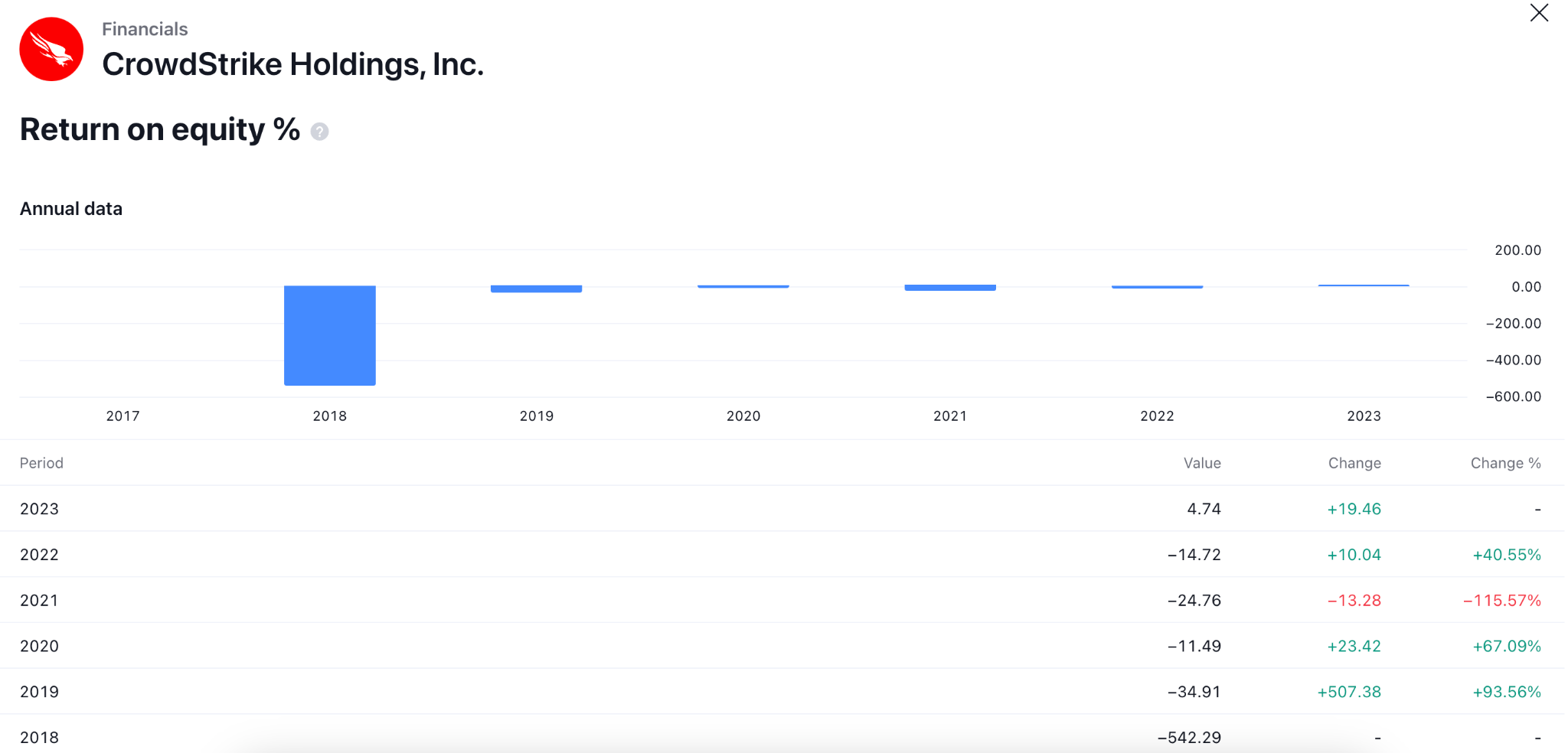

Return on Equity

Return on Equity (ROE) is a profitability indicator which is calculated by dividing a company's net income by its shareholders' equity. This metric functions as a dual-purpose indicator, assessing the profitability and efficiency of profit generation for a given corporation.

As per the recent reading, the R/E ratio shows a positive outcome as there are no significant fluctuations in the number. If the company maintains this stability, stock growth is possible in 2024.

(1) CRWD Stock Forecast 2024 - Bullish Factors

The upbeat revenue growth is a crucial factor for Crowdstrike stock. Investors have experienced a significant flow in revenue in the latest quarterly earnings reports. Moreover, analysts have anticipated an upbeat forecast in revenue, which might grab massive buyers' attention.

Investors should closely monitor how the upcoming revenue reports are coming. The primary anticipation is to look for better-than-expected quarterly reports to anticipate stock growth in 2024.

Operational efficiency enhancements and cost-saving initiatives could improve profitability margins, positively impacting investor sentiment and stock performance. Based on the recent findings, the gross profit margin of this company is impressive, where major expenses are seen in operations. Lowering costs by making the best use of resources could be a bullish factor for CRWD stock.

(2) CRWD Stock Forecast 2024 - Bearish Factors

Stricter regulatory requirements or changes in compliance standards may impose additional costs and operational burdens on CRWD, impacting its profitability. Therefore, investors should closely monitor the regulatory environment for the cybersecurity industry.

As we anticipate a cyber-secure 2024, it is crucial to acknowledge that amidst the obstacles, there are abundant prospects, along with a growing collection of instruments to counter impending dangers. A secure digital future can be achieved through the effective mitigation of risks, promotion of global cooperation, and emphasis on cybersecurity education and awareness, all of which are achieved through the utilization of advanced technologies.

III. CRWD Stock Forecast 2025

The ongoing buying pressure with an upbeat earnings forecast could take the CRWD stock price towards the $600.00 level within 2025.

In the weekly price of CRWD, an ongoing bullish trend is visible, where the most recent price trades are volatile above the existing high. It is a sign that bulls are still active in the market, but a downside correction is pending.

A similar signal is visible from the dynamic line, where the gap between the current price and the dynamic 50-day EMA has extended. It indicates that the valid bullish trend might extend once the downside correction is completed.

Moreover, a bullish crossover is visible among dynamic 50-day EMA and 200-day SMA levels, which suggests a Golden Cross formation. Therefore, any bullish reversal from the 240.00 to 200.00 zone could be a valid long signal targeting the 600.00 level.

According to the weekly chart with Bollinger Bands, the current price trades are volatile after reaching the upper Bands level. However, recent candlesticks show a corrective movement, which indicates possible downside pressure. However, a rebound is possible from the 271.57 support level before tapping into the 205.14 level.

Below this line, the next support level is at the 150.00 level, which could be the CRWD stock price target of the bearish signal.

A. Other Crowdstrike Stock Forecast 2025 Insights: Is CrowdStrike a good stock to buy?

Walletinvestor, an analytical source, affirms with certainty that Crowdstrike stock has favorable investment potential. They rank Crowdstrike as an "awesome" long-term investment opportunity, assigning a median CRWD price target of $366.86 for the following 12 months. Moreover, their Crowdstrike stock price prediction for 2025 predicts a substantial increase, with the share price expected to reach $1,053.59.

Another report from Simplywall.st suggested that the CrowdStrike Holdings revenues could reach $3.97 billion in 2025, representing a substantial 30% increase over the previous year. It is anticipated that the statutory earnings per share will increase by 126%, reaching $0.84.

At this time, the analyst with the lowest opinion values CrowdStrike Holdings at US$196 per share, whereas the most optimistic analyst values it at US$540 within 2025. The substantial discrepancy in estimations indicates that analysts are conceptualizing a variety of possible results for the organization.

B. Key Factors to Watch for Crowdstrike Stock Price Prediction 2025

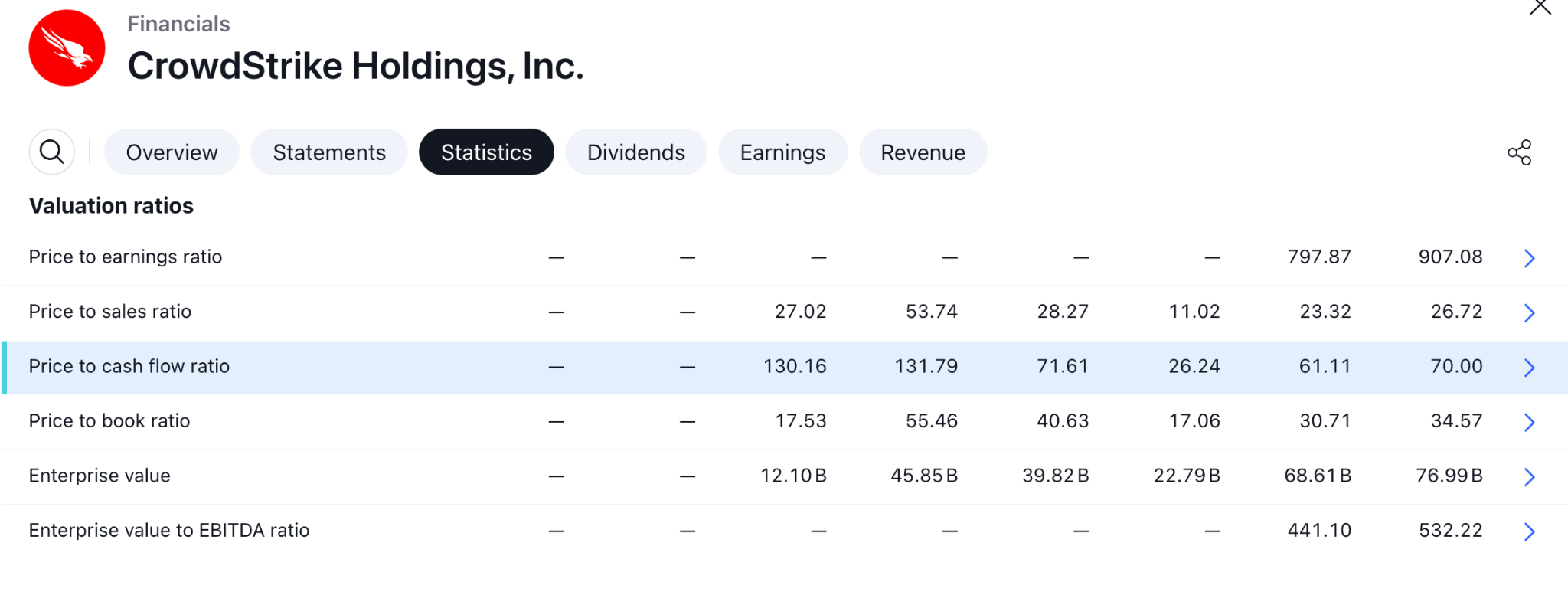

CrowdStrike Valuation Report

The valuation assessment is an essential component that must not be disregarded when formulating investment strategies. It is crucial to evaluate the current price behavior of a company's intrinsic value and growth potential to forecast its future price performance.

By analyzing the valuation multiples of a company, including price-to-sales (P/S), price-to-earnings (P/E), and price-to-cash flow (P/CF) relative to its past values, one can ascertain whether the stock is undervalued overvalued, or fairly valued.

As per the latest reading, the price-to-earnings ratio remains at 907.08, which is higher than last year's value of 797.87. Moreover, the price-to-cash flow ratio suggests 70.00 in 2023, which is higher than last year's value of 61.1.

CrowdStrike EPS Growth

The earnings forecast signifies a significant increase of 30% compared to the previous fiscal year. It is expected that statutory earnings per share will increase by 126% to $0.84.

Analysts had projected revenues of $3.95 billion and earnings per share (EPS) of $0.75 for 2025 prior to the release of this CRWD earnings report. Although revenue estimates remained relatively stable, analysts demonstrated a more positive perspective on earnings.

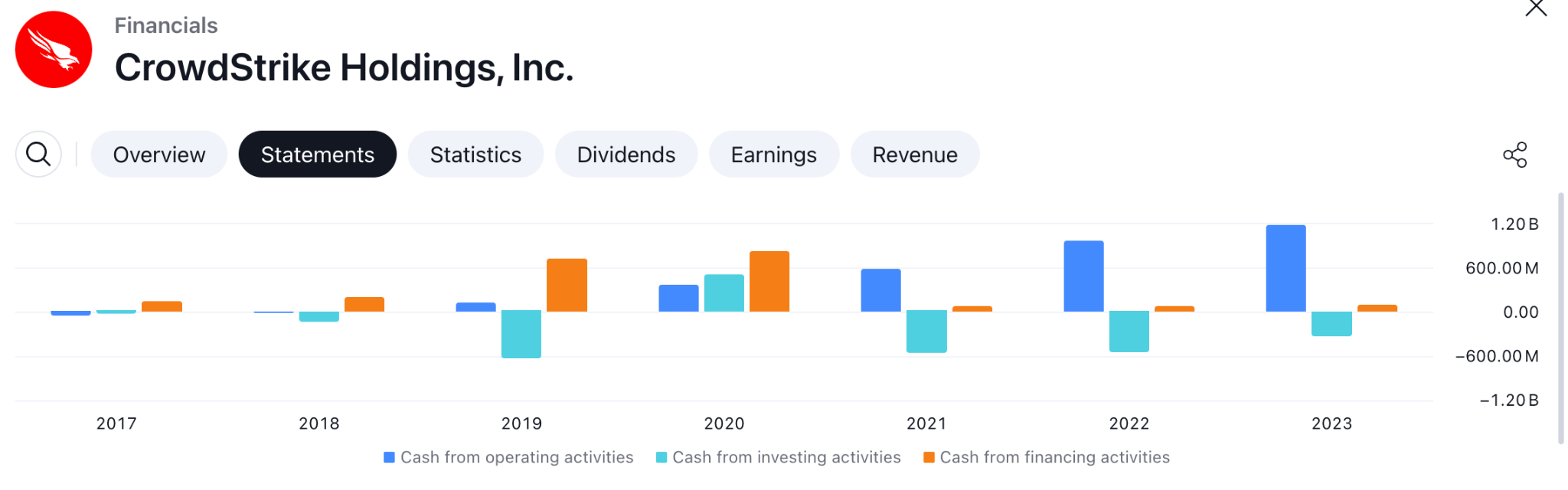

CrowdStrike Cash Flow Outlook

According to the recent report, the Cash flow from operating activity showed a 23% increase to $1.17 billion in 2023. Moreover, the investing activity shows a similar result of an increment of 39.06% to 332.52 million.

As a result, the free cash flow stayed at $940 million, which indicates a stable cash position for the company. With this cash and cash equivalent structure, any upbeat earnings report could be a potential long opportunity in Crowdstrike stock.

(1) CRWD Stock Price Prediction 2025 - Bullish Factors

With the forward-thinking and nimble strategy, CrowdStrike has increased its subscription customer base by approximately four times, from 5,431 at the end of the 2020 fiscal year to 21,146 in the third quarter of the 2023 fiscal year.

Furthermore, since its initial public offering, the organization has consistently upheld a dollar-based net retention rate surpassing 120%. This figure signifies substantial revenue growth per existing consumer on an annual basis.

In order to maintain its elevated client retention rate, CrowdStrike employs a strategic approach to cross-selling supplementary cloud-based modules. 60% of its customers had implemented five or more modules by the end of the third quarter of fiscal year 2023, representing consistent growth from 59% in the previous quarter and 55% a year ago.

In addition, the subscription gross margin of the organization has increased consistently over the past two fiscal years, from 75% in 2020 to 79% in 2021 and 2022. Despite a marginal decline to 78% during the initial nine months of fiscal year 2023, CrowdStrike continues to possess significant pricing leverage within the market for cloud-based cybersecurity.

Finally, the stock valuation of CrowdStrike seems rational, as it is currently trading at 45 times forward adjusted earnings and 7 times revenues from the following year.

(2) CRWD Stock Forecast 2025 - Bearish Factors

Following a 93% increase in revenue during fiscal year 2020, CrowdStrike experienced subsequent 82% and 66% increases in fiscal years 2021 and 2022, respectively.

Even though analysts anticipate a 34% increase in revenue for fiscal year 2024, CrowdStrike must generate more revenue from existing clients to meet its goals. The current deceleration is anticipated to endure, as fiscal year 2025 is projected to witness a mere 30% growth.

CrowdStrike will probably continue to incur losses in the foreseeable future, as defined by generally accepted accounting principles (GAAP). As interest rates increase, this deficit is primarily caused by stock-based compensation (SBC) expenses consuming 23% of revenue in the first nine months of fiscal year 2023.

IV. CRWD Stock Forecast 2030 and Beyond

Based on the current market outlook and possible business expansion, CRWD has a higher possibility of moving beyond the 1000.00 threshold within 2030, reaching the 1060.59 resistance level.

In the monthly time frame, the broader outlook of CRWD stock is bullish as the most recent bullish swing made a new higher high. Moreover, the dynamic 20-month Exponential Moving Average remains below the current price. It is a confluence of support to bulls, where the main aim would be to extend the buying pressure in the coming years.

The MACD Histogram suggests a bullish continuation opportunity in the secondary indicator window, where the latest reading remains stable above the neutral line.

Based on the monthly candlestick pattern of CRWD stock, investors should closely monitor how the price reacts to near-term Fibonacci Extension levels. In the coming years, the 431.20 level would be a strong barrier to bulls. If the price can overcome this line, the bullish trend is more likely to extend above the 1000.00 level by the end of 2030.

Let's see what other technical indicators state about the CRWD stock forecast for 2030:

- Relative Strength Index (RSI): The ongoing buying pressure is potent from the Relative Strength Index, where the latest reading suggests an overbought condition above the 70.00 line. Although a minor downward correction is pending, the buying momentum is valid as long as the price trades above the 50.00 RSI line.

- Ichimoku Cloud: The future cloud looks solid for CRWD stock, where the current Senkou Span A is at the 245.87 level. Meanwhile, dynamic Tenkan Sen and Kijun Sen lines are below the current price, with a strong gap, which suggests pending downside correction as a mean reversion.

- Average Directional Index (ADX): The monthly ADX is optimistic for Crowdstrike stock as the latest reading showed a rebound from the 20.00 line and hovers above the 30.00 are for a considerable time.

A. Other Crowdstrike Stock Forecast 2030 and Beyond Insights: Is CRWD a Buy?

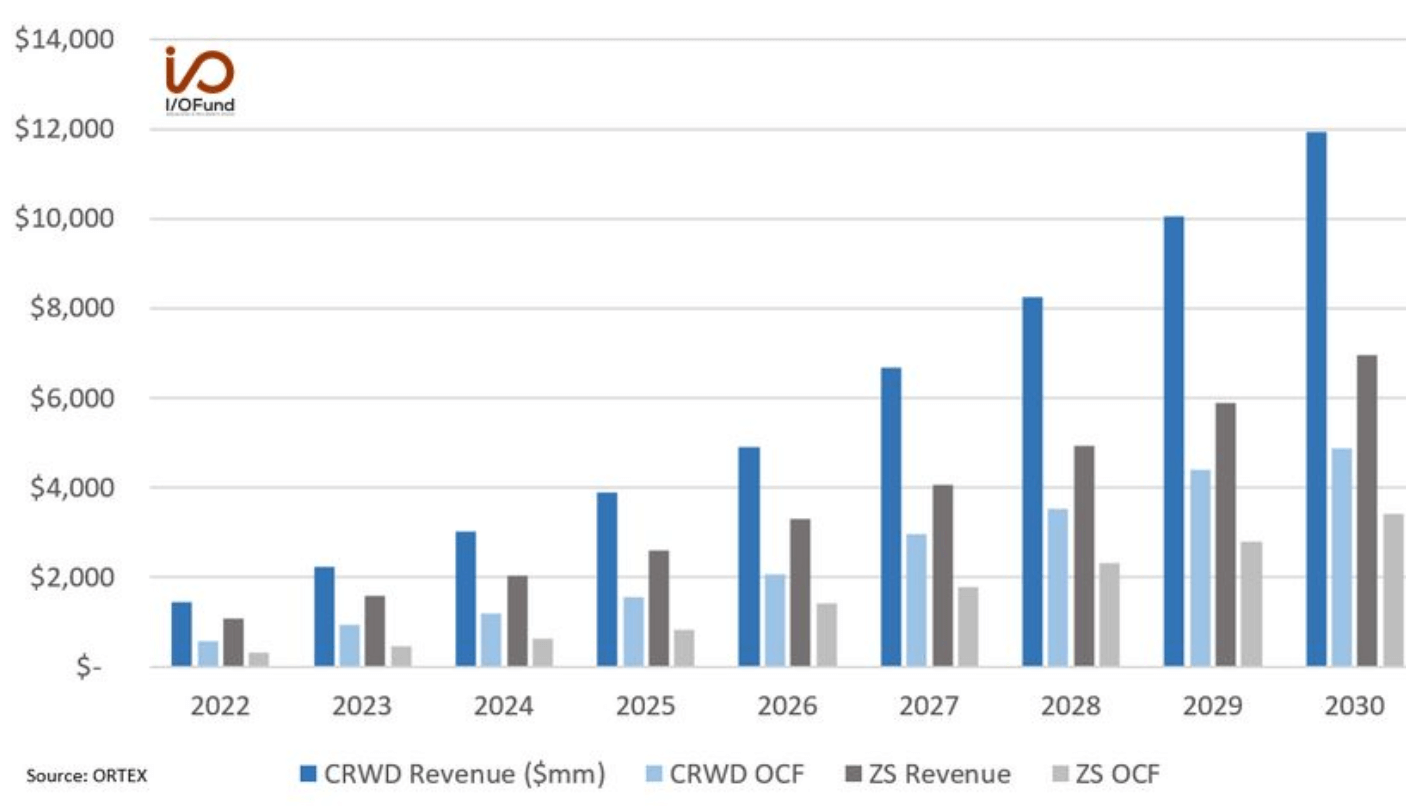

A report from MotleyFool suggests that CrowdStrike sustains a Compound Annual Growth Rate (CAGR) of 25% between fiscal 2026 and fiscal 2030; the company's revenue could potentially exceed $12 billion by the conclusion of that timeframe. Moreover, it is anticipated that the organization will continue to enhance its assortment of cloud-based services via astute acquisitions. As a result, the stock price could become 3 times higher than the current price, which is nearly $1000.00 by the end of 2030.

Another report from WalletInvestor suggests continuous growth in CrowdStrike's business, which could lead the Crowdstrike price target to the $886.073 level before 2030.

B. Key Factors to Watch for CrowdStrike Stock Price Prediction 2030 and Beyond

CrowdStrike Revenue Forecast For 2030

According to analysts' projections, CrowdStrike's revenue could reach nearly $12 billion, with an operating cash flow of $4.9 billion. Moreover, another forecast from Zscaler suggests that the revenue of the company could reach up to the $7 billion mark in 2030, with a cash flow of $3.4 billion.

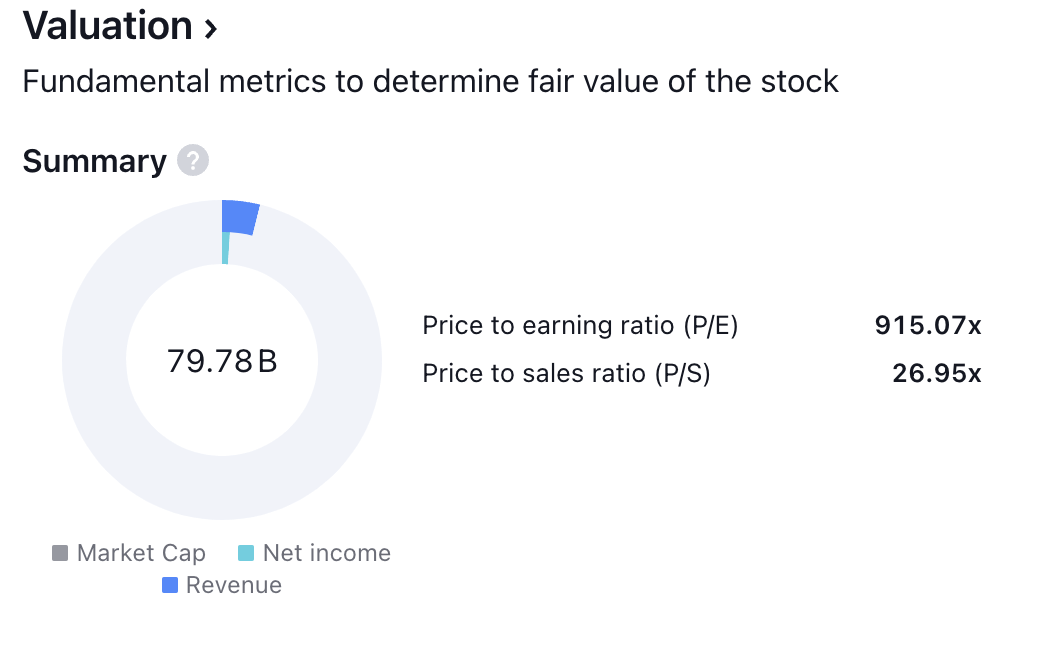

$1 Trillion Crowdstrike Market Cap Within 2030

As of the writing of this article, CrowdStrike has a market valuation of almost $ 79.78 billion. Reaching a $1 trillion valuation would need a nearly seventeen-fold growth in value in just six years. In theory, a market valuation of about $310 billion might be attained by the end of the decade if CrowdStrike manages to reach $10 billion in Annual Recurring Revenue (ARR) by 2030 and keeps its five-year average price-to-sales (P/S) multiple of about 31.

Although the company's future looks bright, there's a chance that its development trajectory may eventually slow down as it becomes a more established business. Its valuation multiples would probably normalize to lower levels at this point, making it very difficult to reach the desired $1 trillion valuation.

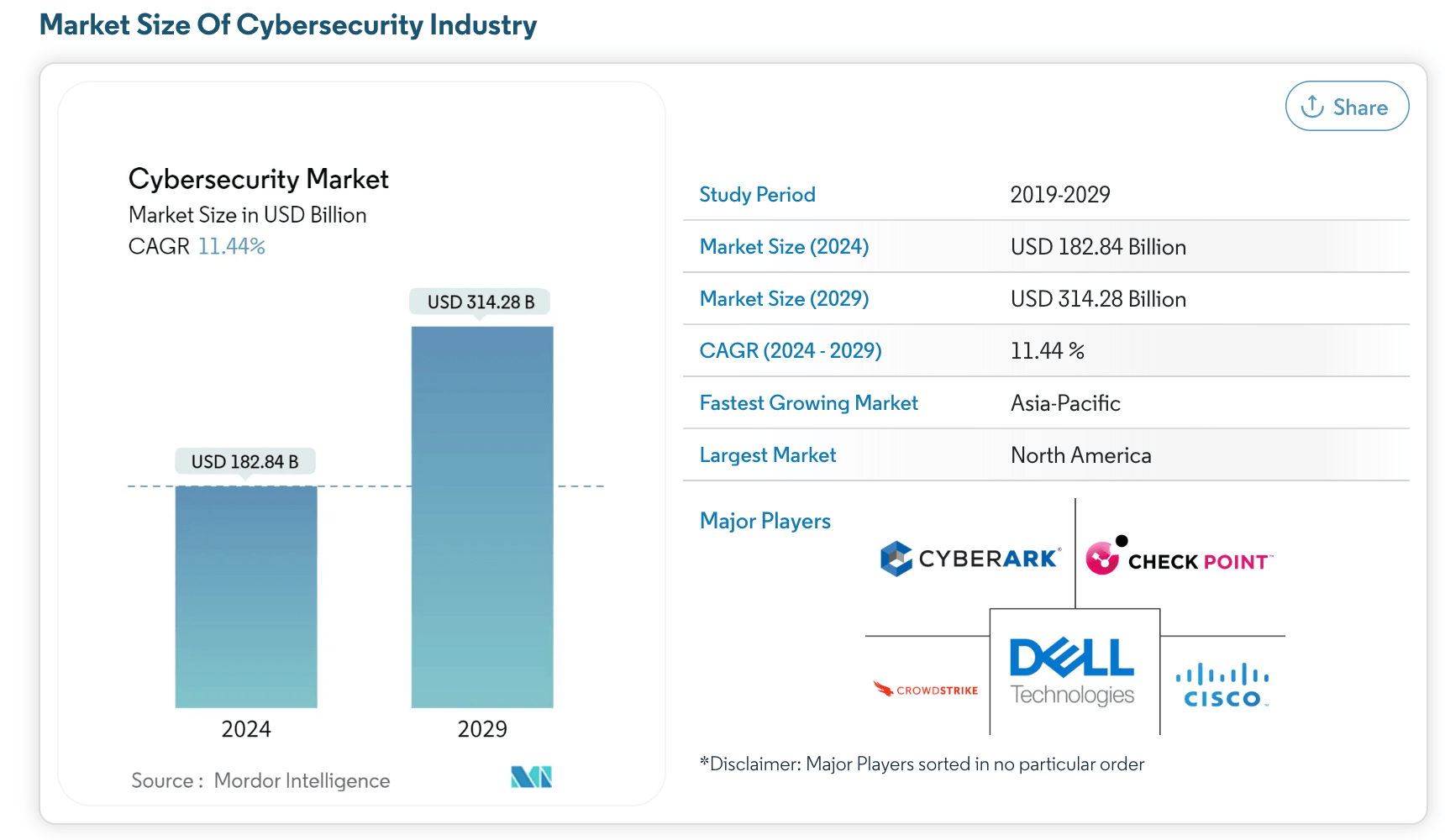

Cybersecurity Market Size

Source: mordorintelligence.com

The global Cybersecurity market size is more likely to expand in the coming years and could reach $314.28 billion before 2030. As long as CrowdStrike remains a part of the industry, continuous business growth and revenue expansion could be a strong bullish factor for CRWD stock.

(1) CRWD Stock Forecast 2030 and Beyond - Bullish Factors

Investors should closely monitor how the company performs in the coming year, where some crucial factors need to be observed to find the buying possibility

- Market Growth: The overall cybersecurity market is expected to experience significant growth in the coming years due to the increasing reliance on digital technologies and the evolving threat landscape. Investors should keep a close eye on macroeconomic factors and industry news to remain up to date about the broader context.

- Customer Acquisition and Retention: Investors should analyze CrowdStrike's ability to acquire new customers and retain existing ones. Building a new customer base and keeping existing customers attentive could be crucial factors.

- Product Development and Innovation: Evaluate CrowdStrike's commitment to research and development (R&D) and its ability to continuously innovate and introduce new security solutions that address emerging threats. Look for news articles or press releases about new product launches and partnerships.

(2) CRWD Stock Forecast 2030 and Beyond - Bearish Factors

Let's see key bearish factors for CrowdStrike for 2030:

- Cybersecurity Competition: The cybersecurity landscape is crowded with established players and new entrants. Analyze CrowdStrike's competitive advantage and its ability to differentiate itself from competitors in the market. Pay attention to news about mergers and acquisitions in the cybersecurity space.

- Tech Sector Volatility: The technology sector, including cybersecurity stocks like CrowdStrike, can be highly volatile due to factors such as changing investor sentiment, macroeconomic conditions, and shifts in technology trends. Market volatility could lead to significant fluctuations in CrowdStrike's stock price.

- Dependency on Cloud Infrastructure: CrowdStrike relies heavily on cloud infrastructure to deliver its services, which exposes the company to risks such as service disruptions, data breaches, or outages. Any disruptions to cloud services could impact CrowdStrike's ability to deliver its products effectively.

V. CRWD Stock Price History Performance

A. Crowdstrike Stock Price Key Milestones

Here are some key milestones in CrowdStrike stock price from 2019 to 2024, along with brief analysis of the factors influencing these movements:

- 2019 - CrowdStrike went public on June 12, 2019, with an initial offering price of $34 per share. IPOs often generate excitement and investor interest, leading to an initial surge in stock price as investors speculate on the company's growth potential. Overall, the stock ended the year with an 11% gain.

- 2020 - In March 2020, as the COVID-19 pandemic triggered widespread market volatility and uncertainty, CrowdStrike's stock price experienced a significant dip, falling to around $40 per share. Overall, the stock ended the year with a 328% gain.

- 2021 - CrowdStrike stock price recovered and steadily climbed to new highs, surpassing $200 per share in mid-2021. Strong financial performance, increasing demand for cybersecurity solutions due to remote work trends, and positive earnings reports contributed to the stock's growth. Overall, the stock ended the year with a 0.3% gain after showing a 48% surge.

- 2022 - As concerns about inflation, rising interest rates, and potential tightening of monetary policy intensified, CRWD stock price experienced volatility and corrected. Overall, the stock ended the year with a 43% loss.

- 2023 - Despite the market challenges, CrowdStrike's stock price gradually recovered and continued to demonstrate resilience, reaching new highs above $300 per share in 2022 and beyond. Overall, the stock ended the year with a 159% gain.

- 2024 - Strong earnings reports, ongoing product innovation, strategic acquisitions, and the company's solid cybersecurity market position contributed to the stock's continued growth.

B. Crowdstrike Stock Price Return and Total Return

Based on the current market data, CRWD stock is trading at the $328.44 level. Considering this, the return to investors is as follows:

|

Timeframe |

Return |

|

1 week |

+3.01 |

|

1 month |

+2.76 |

|

6 months |

+84.74 |

|

Year to date |

+30.20 |

|

1 year |

+155.43 |

If we compare the last 1 year's data with the S&P 500, we would see a decent profit provided by CRWD stock, which is 159.96%. In the meantime, the S&P 500 generated a 27.23% gain.

VI. Conclusion

The CrowdStrike (CRWD) stock forecast shows potential growth driven by the ever-increasing demand for robust cybersecurity solutions in our digital world. The company's impressive revenue growth, customer acquisition, and strong financial performance with consistent profitability indicate a solid foundation.

However, the landscape isn't without challenges. The cybersecurity market is fiercely competitive, demanding CRWD constantly adapt and differentiate itself. The technology sector's inherent volatility and CRWD's dependence on cloud infrastructure present potential risks.

For investors, close attention should be paid to CRWD's customer acquisition strategies, product development efforts, and the broader cybersecurity industry trends. Consulting with a financial advisor and understanding individual risk tolerance are crucial steps before making any investment decisions.

Moreover, finding a trustworthy and regulated platform to buy or sell a stock is a crucial factor to look at. Top-notch brokers Like VSTAR could be the perfect example of what type of broker an investor needs to expand the stock portfolio.

In VSTAR, the following characteristics could grab investors' attention:

- Minimum spread with no hidden costs.

- Deep Liquidity

- Super fast market execution

- Multiple regulations to offer the highest funds safety.

- Portfolio diversification among stocks, cryptocurrencies, indices, commodities, and forex

- The trading platform is the most portable and available on mobile and web-based platforms.

Overall, investing in a stock company has some inherent risks. Therefore, investors should understand the risk management system and take part in this market with a proper understanding of the technical and fundamental outlook of a stock.

FAQs

1. Is CrowdStrike a Buy, Sell or Hold?

CrowdStrike could be a buy as analysts are bullish on the stock in the short term, with some suggesting a potential upside of over 35% in the next year. However, the stock is currently near its 52-week high, so some may want to wait for a pullback before buying.

2. What does the future hold for CRWD stock?

The future of CRWD stock appears promising, as the cybersecurity industry is expected to experience significant growth due to the ever-increasing threat of cyberattacks. This trend could benefit CrowdStrike as a leader in cloud-based security solutions.

3. What is the 12-month forecast for CRWD stock?

The 12-month price forecasts for CRWD range from $315 to $435, with an average target of $394.36.

4. What is the 5-year forecast for CrowdStrike?

Analysts are cautiously optimistic. The cybersecurity industry's growth and CrowdStrike's strong performance are positive signs. However, the overall market conditions and CRWD's ability to maintain its leadership position will also impact the stock price.