在原油市場,供給、需求和市場錯綜複雜的動態相互作用描繪出一幅充滿波動可能性的成熟景象。 最近的環境影響評估數據 揭示了煉油廠運營、庫存水平和價格變動的重要見解,預示着錯綜複雜的大宗商品世界的潛在變化。了解這些細微差別對於解讀原油差價合約的未來軌跡至關重要。

- 煉油廠運營和生產:煉油廠投入的增加和汽油/餾分油產量的增加暗示着原油加工需求的增加。

- 進口和庫存:原油進口激增,庫存下降略低於五年平均水平,表明供應動態平衡但敏感。

- 石油庫存和產品供應:汽油/餾分油庫存與其五年平均水平的不平衡可能會影響原油價格波動。

- 價格走勢:原油、汽油和柴油價格下跌表明市場因潛在供應過剩或需求減少而調整。

環評數據解讀

煉油廠運營和生產

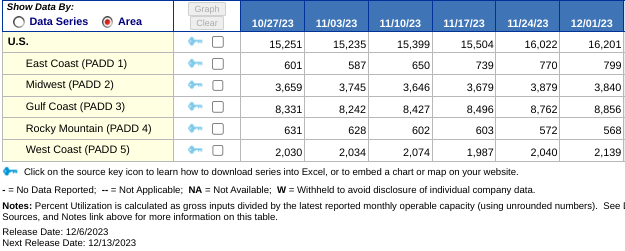

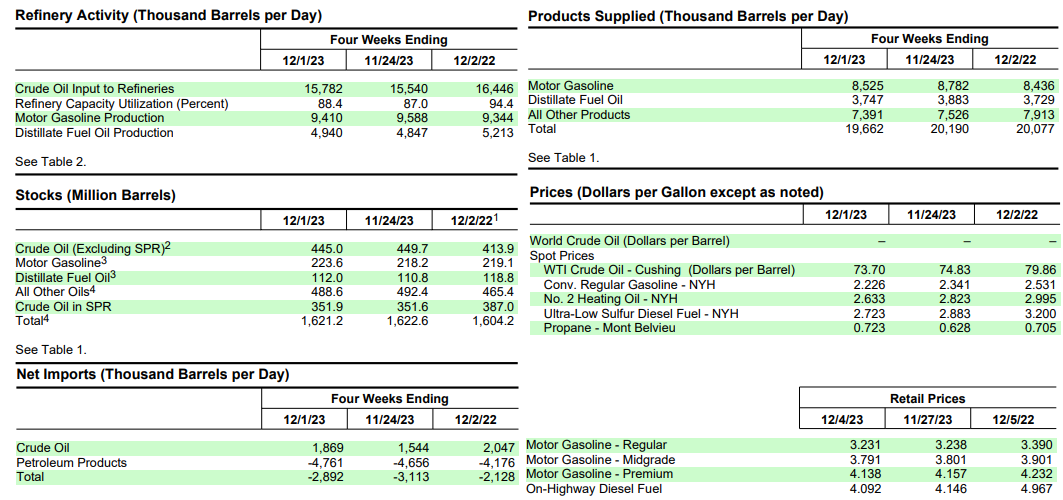

原油輸入量和產能:

煉油廠投入小幅增加至 1620萬 截至 2023 年 12 月 1 日當周,日產量增加 17.9 萬桶。較前一周日產量增加 17.9 萬桶,表明原油加工需求略有激增。煉油廠開工率達到90.5%,表明煉油廠正在積極利用資源來滿足日益增長的成品油需求。

資料來源:eia.gov

汽油和餾分油生產:

上周汽油和餾分油產量均有所增加,平均分別為每天 950 萬桶和 510 萬桶。產量的增加表明消費者對這些精煉產品的需求潛在增長或預期消費量增加,這可能是由於季節性變化或經濟活動造成的。

原油進口和庫存

進口:

上周美國原油進口量飆升至日均750萬桶,較前一周增加170萬桶。進口激增表明需要補充國內供應以滿足需求或解決現有庫存水平的短缺。

庫存:

商業原油庫存較前一周減少460萬桶,表明庫存有所減少。然而,儘管有所減少,但庫存仍比每年這個時候的五年平均水平低約 1%。汽油庫存顯着增加 540 萬桶,但仍比五年平均水平低約 1%。餾分油庫存雖然增加了 130 萬桶,但仍比五年平均水平低約 13%。

石油庫存和產品供應

汽油和餾分油庫存:

儘管汽油庫存增加,但餾分油庫存仍明顯低於五年平均水平。這種不平衡可能意味着餾分油領域的需求強勁或供應鏈中斷,從而影響未來的定價動態。

商業石油庫存總量:

上周商業石油庫存總量減少 170 萬桶。儘管下降幅度不大,但表明整體石油供應形勢可能趨緊,這可能會影響市場情緒和價格波動。

提供的產品總數:

過去 4 周內產品供應總量平均為 1,970 萬桶/日,較去年同期下降 2.1%。然而,車用汽油產品供應等特定細分市場與去年同期相比略有增長1.1%。供應產品的這些變化表明消費者行為或經濟活動的變化,影響需求,進而影響原油差價合約價格。

價格變動

原油價格:

2023年12月1日,西德克薩斯中質原油(WTI)價格跌至每桶73.70美元,較前一周下跌1.13美元,較一年前下跌6.16美元。價格下跌可能是由於市場情緒、地緣政治緊張局勢、供需動態和全球經濟狀況等多種因素影響原油差價合約價格。

資料來源:eia.gov

汽油和柴油價格:

紐約港汽油和取暖油現貨價格與去年同期相比有所下降。這些價格的下跌可能表明供應過剩或消費者需求疲軟,這可能會影響原油差價合約的未來價格方向。

全國零售價:

2023 年 12 月 4 日,全國普通汽油平均零售價降至每加侖 3.231 美元。較前一周下降 0.007 美元,比去年價格低 0.152 美元,表明消費者行為或市場動態的潛在變化可能會影響差價合約的價格軌跡關於原油。

對價格的可能影響

需求和產量增加

煉油廠作業的小幅增長以及汽油和餾分油產量的增加意味着需求的增長或消費增加的預期。由於預計對原油原材料的需求增加,這可能會給原油差價合約價格帶來上行壓力。

進口和庫存水平

原油進口顯着增加,加上商業原油庫存減少,表明要努力滿足國內需求或補充庫存水平。儘管庫存減少,但水平仍略低於五年平均水平,表明供應狀況平衡但可能敏感,影響了原油差價合約的價格波動。

石油庫存和產品供應

由於供應緊張,汽油和餾分油庫存相對於五年平均水平的不平衡可能會導致原油差價合約價格波動。商業石油庫存總量的減少可能會進一步影響市場情緒和價格走勢。

價格變動和消費者趨勢

原油、汽油和柴油價格的下跌表明,市場可能會因供應過剩或需求減少而調整。由於市場看法和消費者行為影響未來需求預測,這些價格走勢可能會在短期內對原油差價合約價格產生下行壓力。

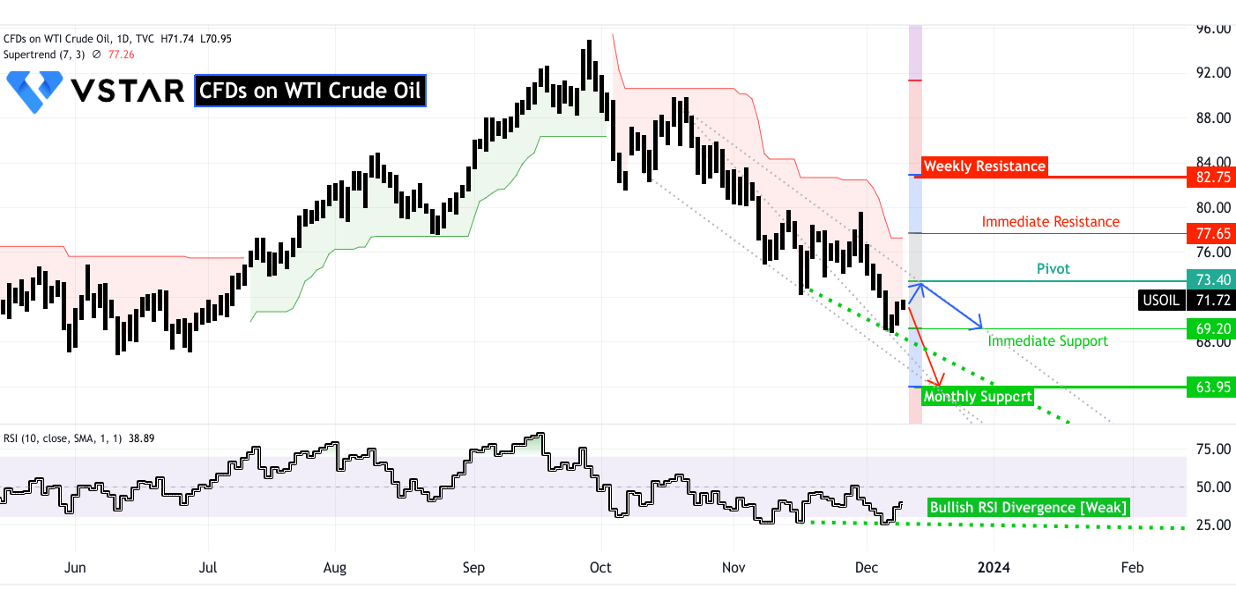

原油差價合約:技術分析

原油差價合約價格在 69.20 美元處站穩腳跟,似乎將在一段相對穩定的時期內保持穩定。相對強弱指數(RSI)顯示,繼上周看漲背離之後,該指數略有上升,但強度較弱。預計價格將向上移動(藍色路徑)至 73.40 美元的樞軸點,有可能重新測試 69.20 美元的關鍵支撐位,表明橫盤走勢。

資料來源:tradingview.com

然而,下行風險迫在眉睫,如果需求無法抵消供應增加的影響,價格可能會跌至 63.95 美元(紅色路徑)。儘管如此,進口增加和庫存水平減少緩解了進一步下行的潛力。

總之,數據表明了一種混合情況,其中一些指標表明需求和消費增加(煉油廠運營、生產),而其他指標則反映了潛在的擔憂(庫存水平、產品供應減少)。