Crowdstrike (NASDAQ: CRWD) has grabbed the attention of many investors looking for the best cybersecurity stocks to buy in 2023. At about $144 currently, CRWD stock price is up 40% so far this year, trouncing other cybersecurity stocks such as Zscaler (NASDAQ: ZS), SentinelOne (NYSE: S), and Gen Digital (NASDAQ: GEN).

Although Crowdstrike has been on the rise, it still remains 30% off its 52-week high of $205 and 50% below its $293 all-time high.

Should you buy Crowdstrike (NASDAQ: CRWD) stock? What is Crowdstrike stock forecast? If you’ve questions like these, read on to find out if CRWD stock could be a good investment for you.

Crowdstrike (NASDAQ: CRWD) Stock Overview

Source: Pixabay

Crowdstrike is an American cybersecurity company founded in 2011. The company is headquartered in Austin, Texas. Crowdstrike has specialized in cloud security, a rapidly growing segment of the cybersecurity industry.

With a market cap of about $35 billion, Crowdstrike is one of the largest cybersecurity providers.

Crowdstrike co-founder and CEO George Kurtz previously served as the chief technology officer of McAfee – once a top antivirus brand.

Key Milestones in Crowdstrike’s History

|

Year |

Milestone |

|

2013 |

Crowdstrike launched its first product – Falcon. |

|

2015 |

Google invested in Crowdstrike. |

|

2017 |

Crowdstrike’s valuation surpasses $1 billion. |

|

2019 |

Crowdstrike stock IPO. |

Crowdstrike Business Model and Services

How Crowdstrike Makes Money

Crowdstrike provides cloud-based cybersecurity solutions encompassing endpoint protection and threat detection and response. Its solutions are targeted at business customers. Crowdstrike offers its solutions to customers on a subscription basis, a business model that generates recurring revenue.

Crowdstrike’s Services

Crowdstrike Falcon: This is a cloud-based platform through which Crowdstrike delivers its security solutions. Falcon offers a variety of service options, allowing customers the flexibility to choose the security features they need and pay only for what they use.

Crowdstrike Charlotte AI: This is a generative artificial intelligence (AI) tool. It helps Falcon users to get quick answers to their security questions. Crowdstrike calls its Charlotte AI a virtual security analyst that can help stop breaches faster and reduce costs for its customers.

Crowdstrike (NASDAQ: CRWD) Financials

Smart investors know that earning reports and the balance sheet condition have huge impacts on stock prices. Therefore, it helps to assess a company’s financial performance and balance sheet strength before investing in it. With that in mind, let’s explore Crowdstrike’s financials to see what is there.

To avoid any confusion, keep in mind that Crowdstrike’s financial year doesn’t align with the calendar year that starts in January and ends in December. Instead, Crowdstrike’s fiscal year begins in February and ends in January. As a result, the company is currently in its fiscal 2024. Consequently, Crowdstrike’s fiscal 2024 first quarter ended on April 30. With that out of the way, let’s dive into the numbers.

Revenue

Crowdstrike’s Q1 revenue jumped 42% year-over-year to $692.6 million, beating Wall Street expectation of $676.4 million. For Q2, the company is anticipating revenue in the range of $717.2 million - $727.4 million, implying potential revenue growth of as much as 35% year-over-year.

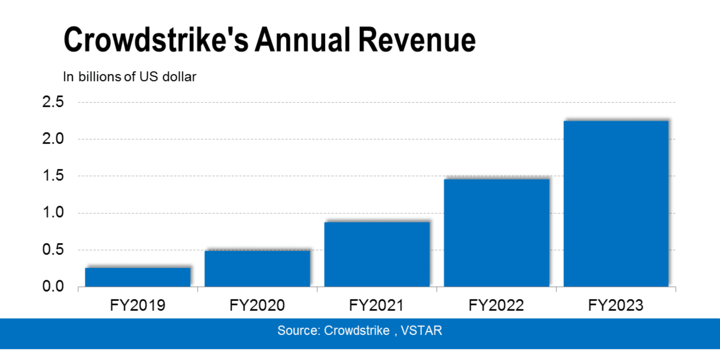

Crowdstrike anticipates fiscal 2024 revenue in the band of $3 billion - $3.04 billion, suggesting up to 35% growth. The company’s annual revenue has increased from just $250 million in fiscal 2019 to over $2.2 billion in fiscal 2023, representing a strong compound annual growth rate of 55% over the past 5 years. The chart below illustrates Crowdstrike’s annual revenue trend.

Net Income

In a strong sign of Crowdstrike’s improving fortunes, the company swung to a profit of $0.5 million in Q1 after a string of quarterly losses. The company’s adjusted EPS of $0.57 exceeded the consensus estimate of $0.51.

In fiscal 2023, Crowdstrike’s loss narrowed sharply to $183 million, compared to $235 million in the previous year.

Profit Margins

Crowdstrike’s Q1 profit came at a modest net profit margin of 0.07%. But that represented a huge improvement from a profit margin of -7.45% in the previous quarter and -6.46% a year ago.

In fiscal 2023, the company’s net profit margin improved to -8.18% from -16.18% the previous year.

Growing revenue and tightening cost controls can drive margin improvements and bring Crowdstrike to annual profits faster than expected.

Cash Position and Balance Sheet Condition

Crowdstrike generated $300 million in cash flow from operations in Q1. It achieved $227.4 million in free cash flow in the quarter. Consequently, Crowdstrike finished the quarter with $2.9 billion in cash and short-term investments.

The company’s balance sheet shows $5.1 billion in assets and only $741 million in long-term debt. With a current ratio of 1.78 and debt-to-equity ratio of 0.49, Crowdstrike’s balance sheet looks solid.

Crowdstrike (NASDAQ: CRWD) Stock Analysis

CRWD Stock Trading Information

Crowdstrike stock is listed on the Nasdaq exchange where it trades under the “CRWD” ticker symbol.

Regular trading in CRWD stock begins at 9:30 a.m. and runs until 4 p.m. ET on weekdays. Investors seeking more time in the market can take advantage of extended trading hours.

Premarket trading in Crowdstrike stock starts at 6.30 a.m., offering extra three hours for trading before the regular session begins. The Post-market session kicks off right after the close of regular trading and runs until 8 p.m., offering extra four hours of trading after the closing bell.

Crowdstrike (CRWD) stock split: Crowdstrike hasn’t had a stock split since the IPO. Companies typically split their stock to make them more affordable to retail investors. That can boost demand for the stock and lift its price.

Crowdstrike (CRWD) dividend history: Crowdstrike doesn’t pay dividends yet. Instead, the company plows back the money it makes into its business to fund R&D efforts and sales and marketing campaigns.

Crowdstrike (NASDAQ: CRWD) Stock Performance

Investors showed strong interest in Crowdstrike stock from the onset. The stock was priced at $34 per share for the June 2019 IPO. That was well above the marketed range of $28 - $30, which had already been boosted from a prior range of $19 - $23 as demand for the shares soared ahead of the public listing.

Crowdstrike’s IPO stock popped up more than 70% on its first day of trading to close at $58. The stock kept rising, hitting an all-time high of $293 in 2021 as you can see in the chart above.

Although CRWD has retreated steeply from its peak, it has been on the rise in 2023. As you can see in the chart above, Crowdstrike stock is outperforming many other cybersecurity stocks and the broader S&P 500 Index.

After breaking through the long-standing resistance point of $140 in May, CRWD stock has gone on to hit new highs as you can see in the chart above. The stock has established a firm support level at $140 and now faces a new resistance point at $162.

Why Is Crowdstrike Stock Going Up?

A confluence of factors is driving Crowdstrike stock. These are some of the reasons some investors are eager to buy CRWD stock:

Big upside potential: Even after Crowdstrike’s sharp rise this year, many investors continue to see a long runway ahead for the stock. For example, investors see huge upside potential for CRWD stock as it bids to retake its all-time high.

Hedge funds are in: Many retail investors follow the moves of elite investors like hedge funds. Hedge funds bought more than 1 million shares of Crowdstrike in the past quarter. That is a big vote of confidence that seems to be exciting other investors to follow suit.

Crowdstrike (NASDAQ: CRWD) Stock Predictions

If you’re wondering whether Crowdstrike stock will keep rising or pull back, look at CRWD stock price predictions.

Dozens of Wall Street analysts have weighed on Crowdstrike stock outlook, providing varied price targets. The average Crowdstrike stock forecast of $177 implies more than 20% upside potential. The peak Crowdstrike stock target of $235 suggests over 60% upside. The base price target of $128 implies 10% downside.

Crowdstrike’s Challenges and Opportunities

Companies must contend with various challenges as they pursue their goals. Success comes from overcoming challenges and making the most of the opportunities. Crowdstrike (NASDAQ: CRWD) has its fair share of challenges as it seeks to increase its sales and turn a profit. Let’s explore the company’s challenges and opportunities.

Source: Pixabay

Crowdstrike’s Weakness and Challenges

Regulations: Crowdstrike’s cybersecurity solutions are powered by artificial intelligence technology. AI systems require large amounts of data to improve their performance. Therefore, regulatory measures that restrict data access can deal a heavy blow to Crowdstrike’s business.

Macroeconomic headwinds: Businesses typically rush to cut their spending during economic downturns. High interest rates can also make access to funding more difficult for businesses. IT budget cuts in response to challenging economic times can limit Crowdstrike’s revenue growth.

Competition: Since cybersecurity is considered a lucrative business, many companies are gunning for a share of the market. Crowdstrike faces competition from both established IT companies and new entrants. These are some of Crowdstrike’s main competitors and the challenges they present:

|

Competitor |

Threat |

|

Crowdstrike vs. Microsoft |

Microsoft offers built-in security features with its software products. Its Microsoft Defender competes with Crowdstrike in the endpoint protection space. |

|

Crowdstrike vs. VMware |

VMware offers Crowdstrike-like cloud-based endpoint protection through its Carbon Black brand. |

|

Crowdstrike vs. SentinelOne |

SentinelOne is a small but strong competitor to Crowdstrike in the endpoint protection market. |

Crowdstrike’s Competitive Advantages

Strong financial position: Crowdstrike has substantial cash to fund its R&D and marketing budgets. Moreover, the company’s tiny debt means that rising interest rates don’t pose a serious debt servicing headache.

Cutting-edge technology: Despite increasing competition, Crowdstrike is regularly ranked the best endpoint protection provider. As a result, company has won many awards for its outstanding solutions.

Vast cybersecurity experience: Crowdstrike is considered a pioneer in the cloud-based AI-powered cybersecurity market. Consequently, the company has accumulated vast experience and market share that its competitors can’t match easily.

Strategic partnerships: Crowdstrike has forged strategic partnerships with some of the leading IT vendors, including Cisco and Dell Technologies. These relationships provide Crowdstrike with rare opportunities to reach new customers and markets.

Crowdstrike’s Opportunities

An increasing number of companies are digitizing their operations and shifting their workloads to the cloud. At the same time, cyberthreats are increasing. Companies can lose sensitive data and face heavy fines if their systems are breached.

Breaches can also cause lasting reputational damage to a business. Consequently, many companies are investing heavily in cybersecurity to protect their systems. That means more business for cybersecurity providers like Crowdstrike.

The global spending on cybersecurity services is forecast to increase from $153 billion in 2022 to $172 billion in 2023 and over $425 billion in 2030.

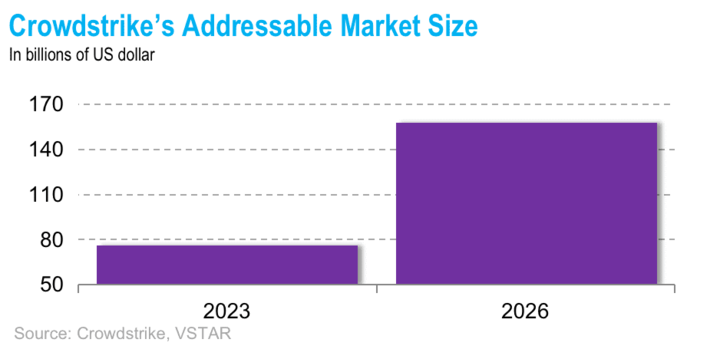

Crowdstrike specifically targets the cloud security segment that is growing even faster than the broader cybersecurity market. The company estimates its addressable market opportunity at $76 billion in 2023 and it sees it growing to $158 billion by 2026.

With Crowdstrike expecting revenue of just over $3 billion this year, which represents less than 5% of the addressable market, the company’s growth opportunity remains enormous.

Crowdstrike’s fast-expanding customer base, high customer retention rate, and the opportunity to upsell customers set it up for long-term success. Moreover, the company can leverage the AI technology to both make its services more attractive to customers and improve its own operational efficiency.

Crowdstrike (NASDAQ: CRWD) Stock Investing Strategies

Depending on how much money you have to invest and how long you’re willing to wait for the returns, there are two main methods you can make money with CRWD stock. Let’s explore these investing options, the tips you may apply to maximize your profit, and their pros and cons.

1. Buying and Holding Crowdstrike Shares

This is the traditional investing method. It involves purchasing Crowdstrike shares and holding them in your brokerage account for usually several years. This strategy appeals most to people with long investing timelines, such as those saving for retirement, home purchase, or children’s education fund.

Crowdstrike Shares Investing Tips

● Diversifying your portfolio by holding Crowdstrike shares alongside other stocks.

● Apply the dollar-cost averaging method to grow your portfolio steadily over time.

● Rebalance your portfolio regularly to align it with your risk tolerance and adjust to other changes.

Pros of Holding Crowdstrike Shares

● You can vote at shareholder meetings.

● You become eligible for future dividends.

Cons of Holding Crowdstrike Shares

● You require a large initial capital.

● You may wait long before you see the desired returns.

● You only profit when CRWD stock price is going up.

2. Trading Crowdstrike Stock CFD

CFD trading is a lightweight method to get exposure to Crowdstrike stock. Instead of buying and holding Crowdstrike shares that require a large initial outlay, CFD trading only involves predicting the direction of price movements. This investing strategy appeals to those looking to capture profits from short-term CRWD stock price fluctuations.

Crowdstrike Stock CFD Trading Tips

● Use risk management features such as stop-loss and take-profit and minimize potential losses and conserve gains.

● Apply the 1% asset allocation rule to shield your account from getting wiped out if the market moves against you.

Pros of Trading Crowdstrike Stock CFD

● Requires minimal starting capital and you can use leverage to boost your trades.

● You can profit whether CRWD stock is going up or down.

● You can capture profits over short timelines such as over an hour, day, or week.

Cons of Trading Crowdstrike Stock CFD

● You can’t vote at the company’s shareholder meetings.

● You aren’t eligible for potential dividends.

Trading Crowdstrike Stock CFD with VSTAR

If you have decided to trade Crowdstrike stock CFD, the first thing you want to do is choose a good CFD broker. It is important to select your CFD trading platform carefully to avoid scams or excessive fees and restrictions. Your best bet is a regulated platform with positive reviews and low trading costs. If that is the case, consider trading Crowdstrike CFD with VSTAR.

Built for high-speed, frequent traders, VSTAR has no commission fees on standard accounts and offers tight spreads. The platform is fully licensed and regulated and has received highly positive Trustpilot reviews.

You can start trading CFDs on VSTAR with as little as $50 and use leverage to boost your positions. Moreover, the platform offers highly effective risk management features and timely customer support.

VSTAR offers a $100,000 demo account for new traders to practice their strategies before they start investing real money. Open your free VSTAR account today and start trading Crowdstrike CFD. The platform supports all the popular deposit and withdrawal methods.

Final Thoughts

Crowdstrike (NASDAQ: CRWD) stands a great chance to profit from the booming demand for cybersecurity services. The company has highly effective products, solid balance sheet, and continues to forge highly beneficial partnerships to grow its customer base.

As a result, Crowdstrike has become an investors’ favorite cybersecurity stock. You may purchase and hold Crowdstrike shares for long-term profit or trade Crowdstrike CFD for short-term profit opportunities.