- Datadog exhibits robust financial performance in Q3 2023, boasting a 25% YoY revenue increase and strong free cash flow of $138 million.

- The company's platform adoption strategy sees 82% of customers using multiple products, fueling growth and customer engagement.

- Achievement of significant ARR milestones across Infrastructure Monitoring, APM Suite, and Log Management underscores Datadog's diverse product offerings and market positioning.

- Datadog's innovation in AI integration and DevSecOps solutions, coupled with customer-centric success stories, solidify its leadership in observability and security solutions.

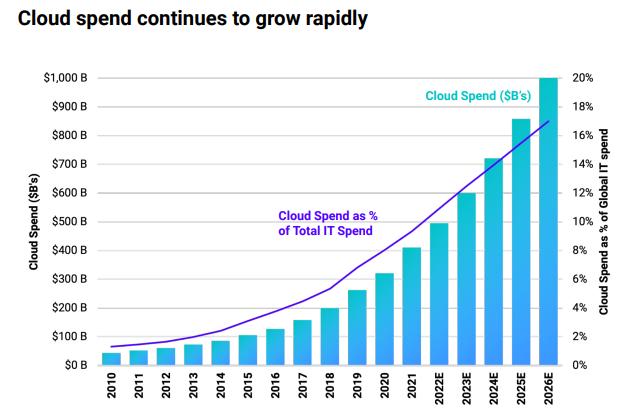

Datadog, Inc. (DDOG) is a company renowned for its prowess in providing cloud-based monitoring, analytics, and security solutions. Analyzing Datadog's fundamental strengths as of Q3 2023 reveals a multi-faceted approach that propels its rapid growth potential. From strategic market positioning to technological innovation and financial stability, the company's distinct strengths form a robust foundation for its sustained expansion.

Robust Financial Performance and Growth Metrics

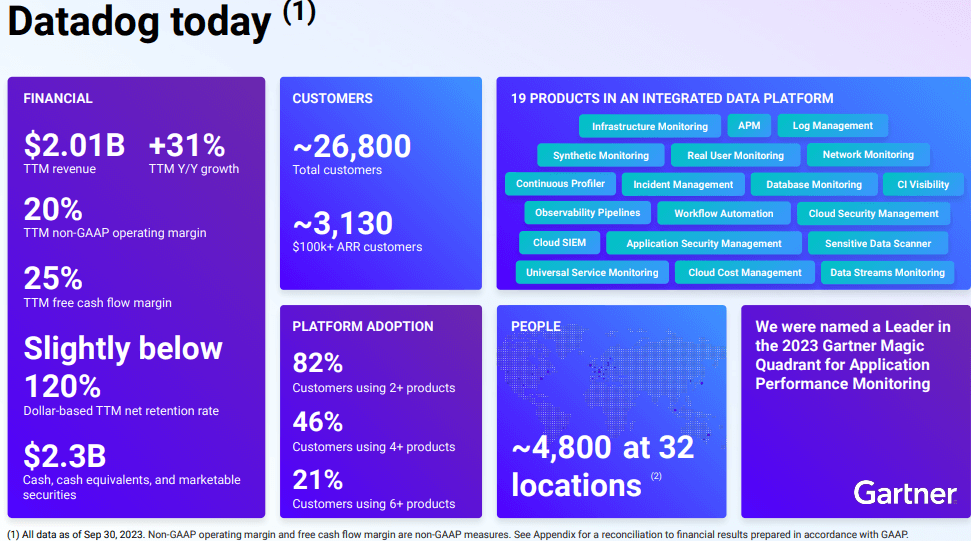

Datadog's financial performance serves as a testament to its growth trajectory. In Q3, the company reported a revenue increase of 25% year-over-year, surpassing the high end of its guidance range to reach $548 million. The continuous expansion of its customer base, growing from about 22,200 to 26,800, coupled with an increase in customers with an Annual Recurring Revenue (ARR) of $100,000 or more, from approximately 2,600 to 3,130, highlights its ability to acquire and retain clients effectively.

Profitability is a significant strength, evident from its impressive free cash flow of $138 million with a 25% free cash flow margin. This underscores Datadog's operational efficiency and scalable business model, contributing to its financial stability and ability to reinvest in innovation and growth.

Source: Earning Presentation

Platform Adoption and Diversification

Datadog's strategy to penetrate its market with a comprehensive platform offering has been instrumental in driving growth. The increase in the percentage of customers using multiple products is indicative of the success of its platform strategy. With 82% of customers using two or more products (up from 80% a year ago), 46% using four or more products (up from 40%), and 21% using six or more products (up from 16%), the company demonstrates strong customer engagement and cross-selling capabilities.

Product Offerings and Market Positioning

The achievement of significant Annual Recurring Revenue (ARR) milestones in various product categories is a testament to Datadog's diverse offerings and market strength. The Infrastructure Monitoring ARR exceeding $1 billion, the APM Suite surpassing $500 million, and the Log Management product exceeding $500 million in ARR underscore the company's position as a comprehensive observability platform catering to diverse customer needs.

Datadog's emphasis on creating a unified platform that addresses end-to-end use cases across datasets, products, and team boundaries is a distinct competitive advantage. These ARR milestones across different pillars of observability validate Datadog's unique position within the cloud industry, showcasing its ability to deliver comprehensive value to customers.

Source: Earning Presentation

Innovation and Technological Advancements

Datadog's commitment to innovation and integration of advanced technologies, such as Artificial Intelligence (AI), sets it apart. The company's focus on leveraging AI capabilities for AI-native customers and the introduction of AI-driven features like the Bits AI assistant, AI-generated synthetic tests, and AI-led error analysis and resolution highlights its forward-thinking approach.

Expanding into DevSecOps solutions, including offerings like Cloud Infrastructure Entitlement Management (CIEM) and packages for Infrastructure DevSecOps and APM DevSecOps, aligns with evolving market trends and positions Datadog as a comprehensive observability and security solution provider.

Customer-Centric Approach

Datadog's success stories with prominent clients across various industries illustrate its commitment to addressing specific pain points and delivering tangible benefits. For instance, securing multi-million-dollar contracts with a major American chain of convenience stores, a leading provider of dental care, a South American FinTech company, and others, showcases its ability to alleviate customer challenges and improve operational efficiency.

Financial Discipline and Guidance

The company's financial discipline is evident in its ability to control costs, optimize operations, and achieve improved margins. Datadog's conservative guidance approach, based on observed growth trends while applying conservatism, demonstrates its prudent assessment of market conditions and business outlook. This balance between growth investments and maintaining profitability indicates a strategic and cautious approach to sustained expansion.

Specific Downsides

Market Competition: Intense competition in the cloud monitoring and observability space poses a risk. Other tech giants or emerging startups might introduce similar or more advanced solutions, impacting Datadog's market share and pricing power.

Dependency on Technology Trends: Rapid technological advancements and changes in cloud infrastructure could render Datadog's existing solutions outdated or less relevant. Failure to adapt or innovate in line with evolving technology trends may affect its competitiveness.

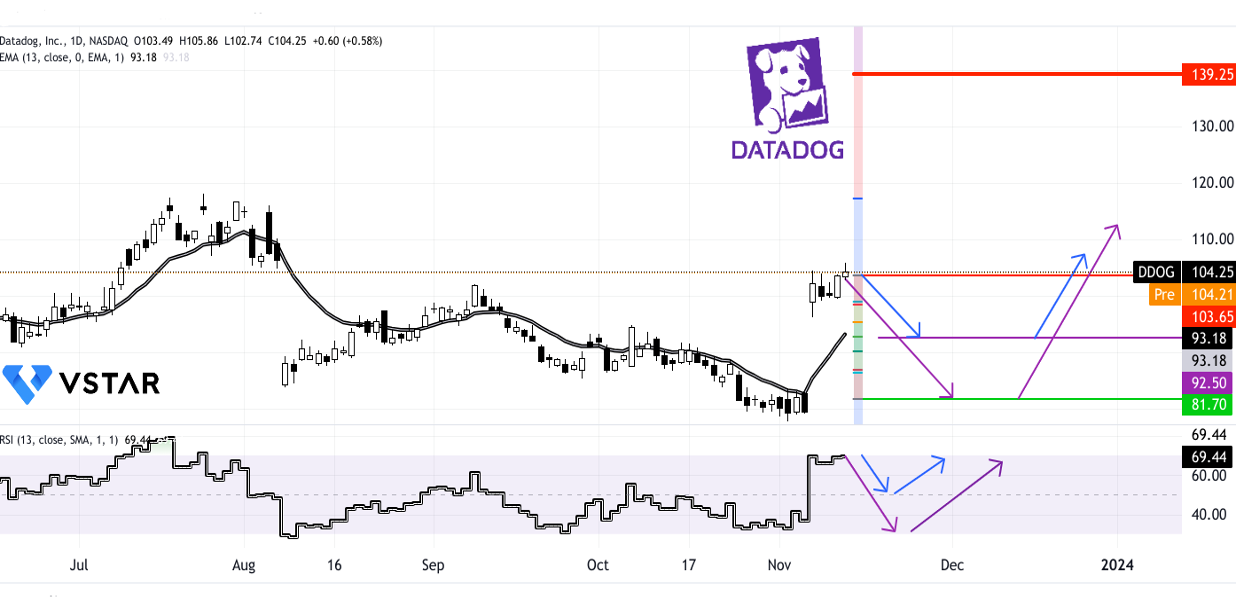

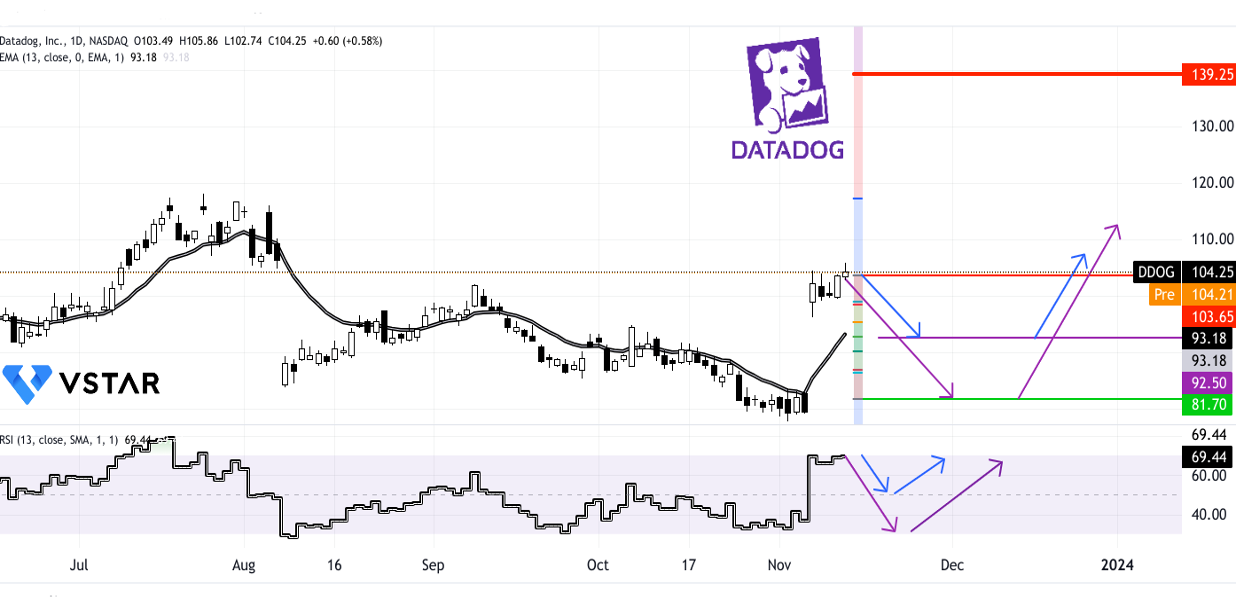

Datadog Stock (DDOG) Technical Take

Source: tradingview.com

The recent surge in DDOG stock price indicates an upside price gap that may be filled in the upcoming days. To achieve this, the stock might revert to its pivot point at $92.50 or test support around $81.70. Despite these short-term fluctuations, the long-term outlook for Datadog remains bullish. An opportune price range can be considered $92.50 and $81.70 to establish long positions within the stock, with the pivot and support levels indicating favorable entry points.

Monitoring the Relative Strength Index (RSI) can provide guidance through these fluctuations. The purple path signifies a highly probable price movement trajectory, while an alternative (blue) path is also plausible in the near term. On the upside, $139.25 stands as a significant short- to mid-term target (key resistance), with $117 potentially acting as a minor resistance in the short term.