EURUSD

Fundamental Perspective

The upcoming economic calendar for the week is filled with significant events that could greatly impact the U.S. dollar. Among these, the most crucial ones that might shape its short-term trajectory are the release of the November U.S. consumer price index report on Tuesday morning and the Federal Reserve's monetary policy announcement scheduled for Wednesday afternoon.

In the past month, there has been a noticeable shift in the Federal Reserve's interest rate outlook towards a more dovish stance. Markets are currently factoring in approximately 100 basis points of easing over the next 12 months. Despite strong data, like last month's employment numbers, which don't suggest an economy in urgent need of central bank support, traders have maintained their belief that substantial rate cuts are imminent.

Technical Perspective

Source: TradingView

As per the weekly chart, EURUSD is currently residing above the 1.0755 - 1.0655 demand area. After an impulsive bearish pressure, the price found support in the weekly demand zone area and had a weekly close above it.

In the daily timeframe, EURUSD had a selling pressure above the weekly demand zone, which could make a new low after getting enough momentum from upcoming fundamental releases. As per the current situation, if the price can rebound above the dynamic level of 20 EMA with a bullish candle close, bulls may regain momentum and continue higher toward the 1.0995 neckline area in the coming days.

On the bearish side, if the price can break below the demand zone area with a daily bearish candle close, the bears may continue lower toward the 1.0500 support area. Moreover, the RSI indicator remains below the 50.00 line, which also indicates a bearish continuation.

GBPJPY

Fundamental Perspective

The final data for Japan's Q3 has been revised lower, indicating that inflation is negatively affecting spending in the region. Despite inflation being above the Bank of Japan's (BoJ) 2% target for over a year, officials are cautious and want more evidence before ending years of stimulus, including negative interest rates.

BoJ Governor Kazuo Ueda has consistently mentioned the prerequisites for considering a change, emphasizing the need for inflation to be stably and consistently above the 2% target, with an expectation for this trend to continue. Another condition involves wage growth, which also needs to exhibit persistence. Initially, Ueda was confident that by the end of the year, there would be enough data to decide on the possibility of withdrawing negative interest rates.

However, recent comments suggest this decision may be postponed to Q1 of the next year, after wage negotiations have concluded.

Technical Perspective

Source: TradingView

In the weekly chart, GBPJPY closed with a bearish candle followed by a bearish two-bar reversal. After being rejected from the weekly bullish channel’s resistance level, bears pushed the price down quite impulsively and hit the support of the bullish channel.

In the daily timeframe, GBPJPY had strong exhaustion at the channel support, which could mitigate some loss in the coming days. As per the current price action context, the price may continue higher toward the 184.00 price area.

On the bearish side, a bearish daily candle close below the channel support could push the price down to the 178.00 level.

Nasdaq 100 (NAS100)

Fundamental Perspective

The upcoming Federal Reserve monetary policy meeting and the release of a U.S. inflation report in the next few days will likely challenge a stock market rally that some consider stretched after weeks of gains.

The belief that the Fed might start cutting interest rates sooner than anticipated has driven a surge in U.S. equities, supported by a rapid decline in Treasury yields. The S&P 500 has climbed almost 20% in 2023, with its largest monthly gain of the year occurring in November.

However, some investors are cautious, thinking that the recent stock market rise has made it more susceptible to reversals if consumer prices don't continue to cool down or if the Fed is less dovish than expected.

Technical Perspective

Source: TradingView

In the weekly chart, NAS100 closed with a bullish fakey formation. Moreover, bulls are still optimistic and holding the price above the $15790.0 neckline area after breaking it last month.

In the daily timeframe, the price had an impulsive daily bullish candle close after bouncing from the dynamic level of 20 EMA. As per the current scenario, the price may sustain the bullish pressure towards the $16600.0 psychological key area in the coming days.

On the bearish side, if the price continues higher toward the $16600.0 resistance area and rejects with an impulsive daily bearish close, bears may regain momentum and push the price down to the $15790.0 neckline area in the days ahead.

SP500 (SPX500)

Fundamental Perspective

U.S. stocks ended the week on a high note, with both the S&P 500 and Nasdaq reaching their highest closing levels since early 2022. This surge followed a strong U.S. jobs report, fueling optimism among investors about a gentle economic landing.

After the Labor Department's report revealed that nonfarm payrolls increased by 199,000 jobs in November (surpassing the expected 180,000), investors scaled back expectations of a Federal Reserve interest rate cut in March. The unemployment rate also dipped to 3.7%, and average earnings showed a monthly increase of 0.4%, exceeding the anticipated 0.3% growth.

The CME FedWatch tool indicates that interest rate futures reflect a widespread expectation that the Federal Reserve will maintain current interest rates at its upcoming meeting. However, futures prices now suggest that traders are leaning towards anticipating a Fed rate cut in May, a shift from the earlier expectation of a cut in March that many investors had been betting on in recent days.

Technical Perspective

Source: TradingView

In the weekly chart, the SP500 ended the NFP-packed week with a bullish candle but failed to break above the $4611.75 psychological resistance. However, the $4611.75 is a very strong resistance level because the price has rejected this price area many times in the near past.

In the daily chart, if the price breaks above the $4611.75 psychological resistance area with a daily bullish candle close, bulls may sustain the bullish pressure toward the $4750.00 price area in the coming days.

On the bearish side, if the price rejects the $4611.75 price area with a daily bearish candle close, bears may regain momentum and push the price down to the $4400.00 support area. Furthermore, the MACD lines had a bearish crossover above the 0.00 line, which indicates that bears may regain momentum in the days ahead.

Hang Seng Index (HK50)

Fundamental Perspective

Hong Kong stocks experienced a dip on Friday, with the main index lingering near a 13-month low, as China's less-than-optimistic economic data cast a shadow on the outlook for corporate earnings. Tencent faced an early decline due to concerns about additional selling by its major shareholders.

At the market close, the Hang Seng Index fell by 0.1% to 16,334.37, marking a 3% loss for the week. The Hang Seng Tech Index also saw a 0.4% decrease, while the Shanghai Composite Index managed a slight 0.1% gain.

Tencent's shares dropped by 0.7% to HK$305.60 after Prosus sold 513,500 shares in the company on Thursday, sparking worries about more sell-offs. Chinese property developer China Resources Land retreated by 4.6% to HK$25.70, and its counterpart China Overseas Land and Investment tumbled by 3.9% to HK$12.96.

Technical Perspective

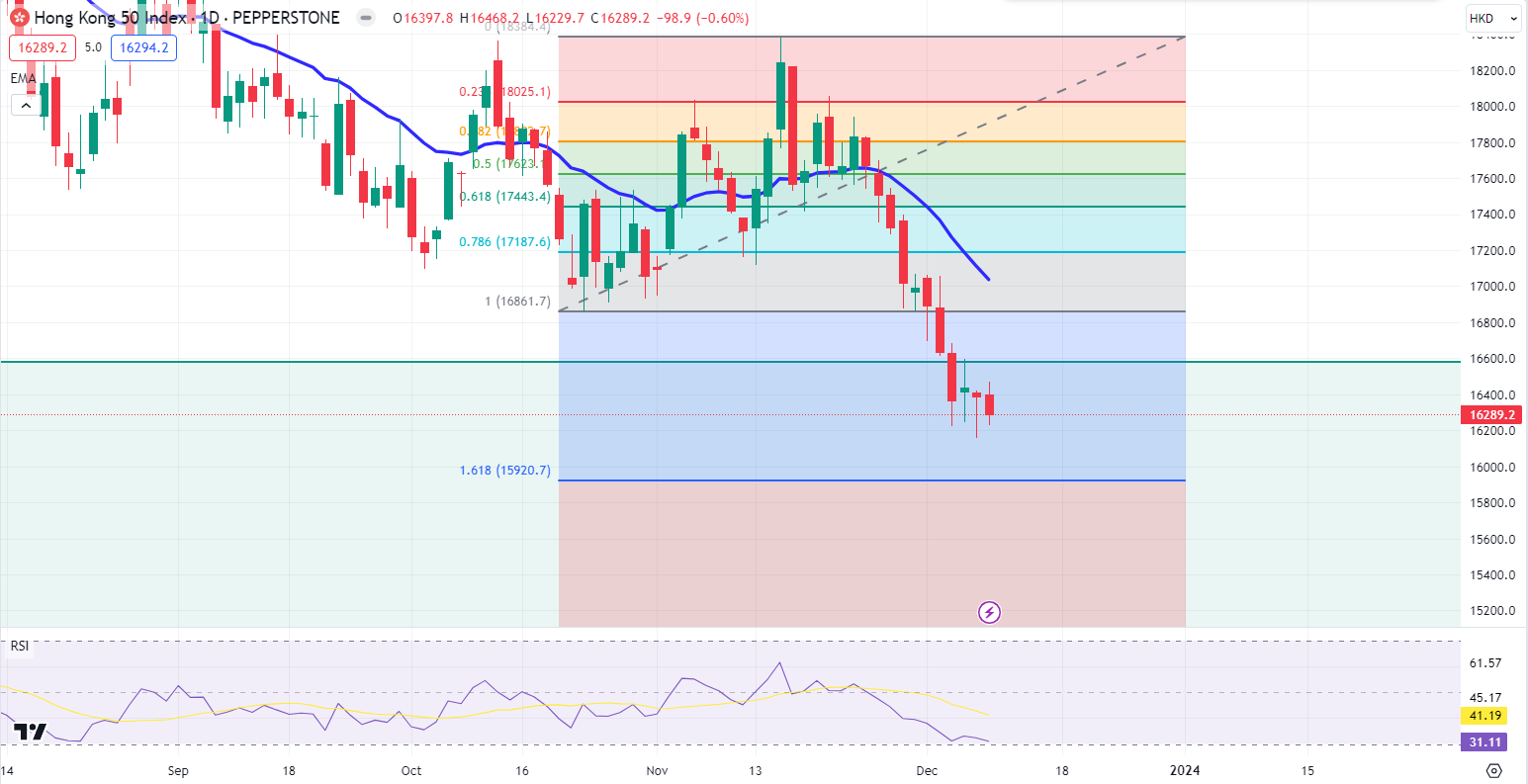

Source: TradingView

HK50 hit the weekly demand zone area last week, which is around $16565.0 - $14755.0 price area. However, the price is still residing below the dynamic level of 20 EMA on the weekly chart.

In the daily timeframe, HK50 may sustain the bearish pressure toward the 1.618 Fibo level. So, if the price continues toward the 1.618 Fibo level and has a daily bullish candle close, bulls may regain momentum and push the price higher toward the $17200.0 price area in the coming days. Also, the RSI indicator indicates an oversold situation in the market.

On the bearish side, if the price retraces toward the 0.786 to 0.618 Fibo level and has a daily bearish candle close, bears may sustain the bearish pressure toward the 1.618 Fibo level, which is around the $15920.0 price area.

Bitcoin (BTCUSD)

Fundamental Perspective

Bitcoin's recent winning streak, the longest since May, pushed the cryptocurrency beyond $44,000, raising speculation about whether this surge indicates a growing belief in the likelihood of the Federal Reserve adopting a more relaxed monetary policy.

Over six consecutive days, the leading digital asset experienced gains, amounting to approximately 16%, and it was in the process of consolidating these gains during early Asian trading on Wednesday. The cryptocurrency's recovery in 2023, following the previous year's crypto downturn, now sits at an impressive 165%.

Technical Perspective

Source: TradingView

In the weekly chart, BTC price hit the weekly supply zone, which is around the $44000 - $48200 price area. However, the last weekly candle close shows a sign of rejection from the supply zone.

In the daily timeframe, BTC had a daily bearish candle close last week Friday from the weekly supply zone. So, if the price can break below the $42800 swing level area with a daily bearish candle close, bears may regain momentum and push the price down to the $38500 price area. Also, the RSI indicator indicates a bearish divergence form in the market.

On the bullish side, if the price comes down to the $38500 support level and has a daily bullish candle close above it, bulls may sustain the bullish bias further upside toward the $46000 price area in the coming days.

Ethereum (ETHUSD)

Fundamental Perspective

The Ethereum whale's transaction history reveals a sequence of well-thought-out swaps and liquidity maneuvers, often dealing with significant amounts of Ethereum (ETH), stablecoins like USDC, and various other tokens. For instance, in multiple transactions, the investor is seen exchanging substantial amounts of ETH for USDC and vice versa, possibly taking advantage of market ups and downs.

This pattern of swaps indicates a strategy of entering and leaving positions in sync with market changes—buying when prices are lower and selling when prices are higher.

Technical Perspective

Source: TradingView

In the weekly chart, ETH price finally retraced to 0.50 Fibo level after an extended period of bearish momentum, which started in April 2022. However, the price is still residing below the $2461.0 weekly neckline.

In the daily chart, ETH price may retrace the downside toward the dynamic level of 20 EMA. So, if the price retraces toward the dynamic level of 20 EMA and has a daily bullish candle close above it, the price may continue higher toward the $2461.0 price area in the coming days.

On the bearish side, if the price continues higher toward the $2461.0 price area and rejects with an impulsive daily bearish candle close, bears may regain momentum and push the price down to the $2136.0 support level in the days ahead.

Tesla Stock (TSLA)

Fundamental Perspective

Tesla (NASDAQ: TSLA) Inc has defended its use of terms like "Autopilot" and "self-driving" for its driver assistance features. In response to a regulatory action by California, the company argues that the state agency implicitly approved these terms by not taking action in its previous investigations.

Last year, California's Department of Motor Vehicles accused the electric car company, led by billionaire Elon Musk, of falsely advertising its Autopilot and Full Self-Driving features as offering autonomous vehicle control.

The Department of Motor Vehicles is now seeking potential remedies, which could include suspending Tesla's license to sell vehicles in California (Tesla's largest U.S. market) and requiring the company to provide compensation to drivers.

Technical Perspective

Source: TradingView

In the weekly chart of TSLA stock, bulls are still holding the price above the dynamic level of the 20-week EMA and had a strong weekly candle close. However, the falling trend line still working as strong resistance, which needs to be overcome before forming a bullish trend continuation.

In the daily chart, if the price can break above the weekly bearish trend line with a daily bullish candle close, bulls may push the price higher toward the $268.00 price area in the days ahead. Also, the dynamic level of 20 EMA is carrying the price as strong support, which could work as a confluence bullish factor.

On the bearish side, if the price can break below the dynamic level of 20 EMA with a daily bearish candle close, bears may regain momentum and push the price down to the $225.00 price area.

GOLD (XAUUSD)

Fundamental Perspective

Even though the US Dollar was being sold off, the Gold price didn't see any gains. This was because US Treasury bond yields bounced back strongly from their multi-month lows, making the non-interest-bearing Gold less attractive.

The market is currently adjusting its positions in US government bonds and the US Dollar as traders aim to secure profits in anticipation of the Federal Reserve's (Fed) interest rate decision next week.

Technical Perspective

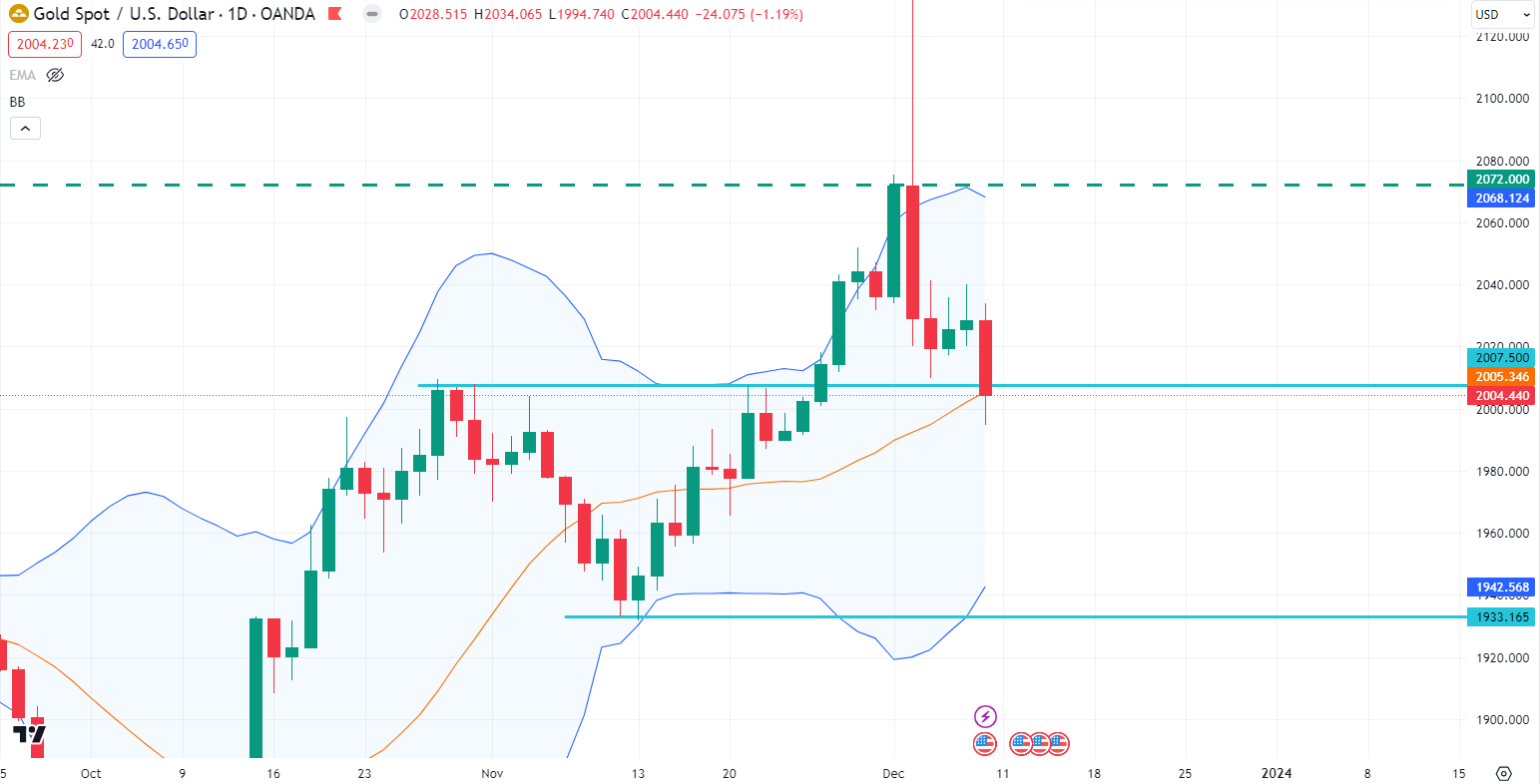

Source: TradingView

Gold has a strong weekly bearish candle close after hitting the all-time high $2150.00 price area. After breaking above the $2007.50 neckline, the price again came back to this level last week.

In the daily chart, the price is currently residing on the Bollinger Band’s middle band. So, if the price bounced higher from the Bollinger Band’s middle band and had a daily bullish candle close above the $2007.50 price area, Gold may recover upside toward the $2072.00 price area.

On the daily chart, if the price can break below the Bollinger Band’s middle band with a daily bearish candle close, bears may sustain the bearish pressure toward the $1933.20 price area in the coming days.

Crude Oil (WTI)

Fundamental Perspective

On Friday, oil prices climbed over 2% following U.S. data supporting expectations of increased demand. However, both benchmarks saw a seventh consecutive weekly decline, marking their lengthiest period of weekly drops in five years due to ongoing worries about oversupply.

Brent crude futures closed at $75.84 per barrel, showing a gain of $1.79 or 2.4%, while U.S. West Texas Intermediate crude futures settled at $71.23, up $1.89 or 2.7%.

Throughout the week, both benchmarks experienced a 3.8% decrease, reaching their lowest levels since late June on Thursday. This suggests that many traders perceive an oversupply in the market.

Technical Perspective

In the weekly chart, Oil price is currently residing inside the demand zone and had a rejection candle close last week.

Source: TradingView

In the daily chart, the RSI indicator formed a bullish divergence, which indicates that the price may retrace higher toward the $80.00 supply zone area in the days ahead. However, the dynamic level of EMA may work as strong resistance.

On the bearish side, if the price rejects the dynamic level of 20 EMA with an impulsive bearish candle close, bears may regain momentum and push the price down to the $67.55 psychological event area in the coming days.