Wednesday showed the fifth consecutive bullish day for the Dow Jones Industrial Average (DJIA), fueled by the upward reading of the US Q3 GDP. Simultaneously, US Treasury yields continued pushing down, with yields on tenures ranging from 2 years to 30 years dropping by more than 1%.

US Q3 GDP Supports DJIA Bulls

In addition to the optimistic Q3 GDP figures, the US PCE Price Index indicated lower inflation than the preliminary estimate for Q3. The second estimate for US GDP in Q3 revealed an annualized growth rate of 5.2%, surpassing the earlier estimate of 4.9%. Furthermore, anticipation for the Personal Consumption Expenditures (PCE) for October has increased. The Core PCE inflation estimate for Q3, arriving at 2.3%, is lower than the initial estimate of 2.4%.

Among Dow Jones stocks, Apple and Goldman Sachs have decided to end their partnership in the Apple Card over the next 12 to 15 months. Goldman constitutes 6.2% of the Dow Jones index, and Apple makes up around 3.5%, which indicates a significant player in this index.

Despite the separation, Goldman and Apple's stock prices rose on Wednesday. There are rumors that American Express (AXP) might take over Goldman's role as the issuer.

Core PCE Index In Focus

The upcoming Core PCE release could impact the markets, providing a trusted and comprehensive snapshot of US inflation. The current forecast for the Core PCE Price Index is 0.2% MoM growth, down from 0.3%, which could be a bullish factor for DJIA. Moreover, the weekly Unemployment claim could be another report to look at, where the current anticipation is 219K, up from 209K in the previous week.

Dow Jones Industrial Average (US30) Technical Analysis

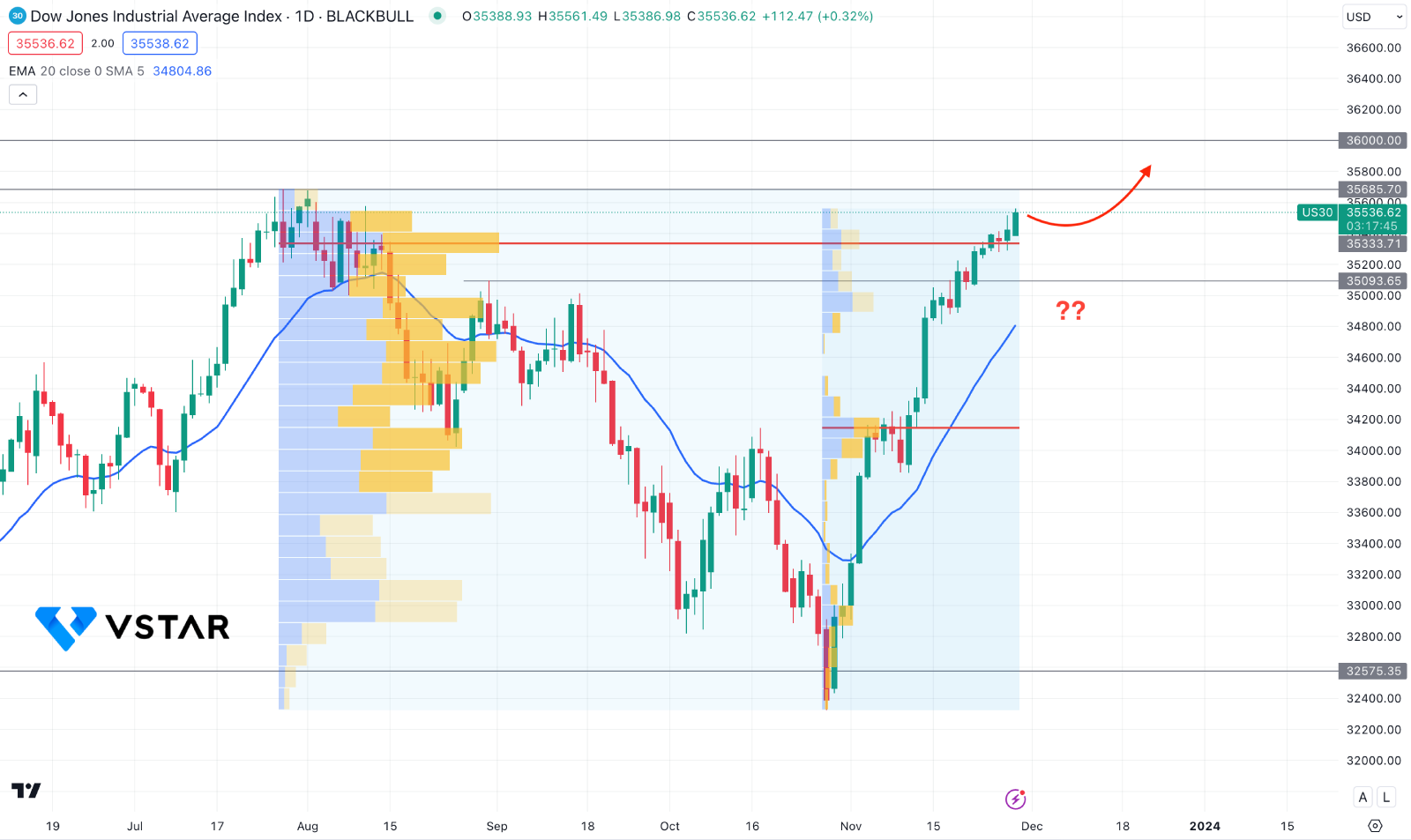

In the daily chart of Dow Jones, the broader market trend is bullish, where the current price trades below the 35,685.70 static resistance level.

In the volume structure, a bullish reaccumulation is visible as the current price trades above two critical high volume levels since July 2023. Moreover, the dynamic 20 EMA supports the buying pressure as it remains below the current price with an upward slope.

Based on the current price projection, DJIA bullish trend continuation could take the price above the 35685.70 resistance level. In that case, the momentum could reach towards the 36000.00 psychological level.

On the bearish side, a stable market is needed below the 35329.99 high volume level. Moreover, a daily candle below the 35093.68 support level could be a reliable short opportunity, aiming for the 34000.00 level.