The year 2024 in the cryptocurrency market is rife with anticipation, particularly surrounding Ethereum's bullish momentum and the prospects of the U.S. Securities and Exchange Commission (SEC) approving spot cryptocurrency ETFs. This critical analysis focuses on dissecting the dynamics that could influence the price of Bitcoin, given the prevailing Ethereum-centric market narrative, regulatory expectations, and expert predictions for the year.

Source: tradingview.com

Ethereum's Resilience and Market Position

Ethereum has asserted itself as a prominent altcoin alongside Bitcoin. Its recent resurgence above the psychologically significant $2,000 mark, coupled with bullish momentum approaching new 52-week highs, signals its resilience and enduring appeal among investors. Notably, Ethereum's performance, albeit positive at over 87% year-to-date (since 2023), trails Bitcoin's meteoric rise of 162% (over the same period), highlighting an interesting dichotomy in the altcoin landscape.

Key Catalysts for Ethereum's Price

The primary catalyst shaping Ethereum's trajectory revolves around the imminent possibility of the SEC's approval of spot cryptocurrency ETFs. This regulatory development has the potential to reshape investor participation, both institutional and retail, in the Ethereum market. The market's optimism hinges on the precedent set by Grayscale's legal triumph in transforming its Bitcoin Trust into a spot Bitcoin ETF, opening doors for similar approvals for Ethereum.

Furthermore, Ethereum's scalability remains a pivotal concern. The network's ability to handle increased transactions amidst growing dApp utilization is central to sustaining its market position. The impending activation of proto-danksharding/EIP-4844 and subsequent advancements aimed at scalability improvement are deemed crucial drivers for Ethereum's value in 2024.

Expert Forecasts and Market Sentiments

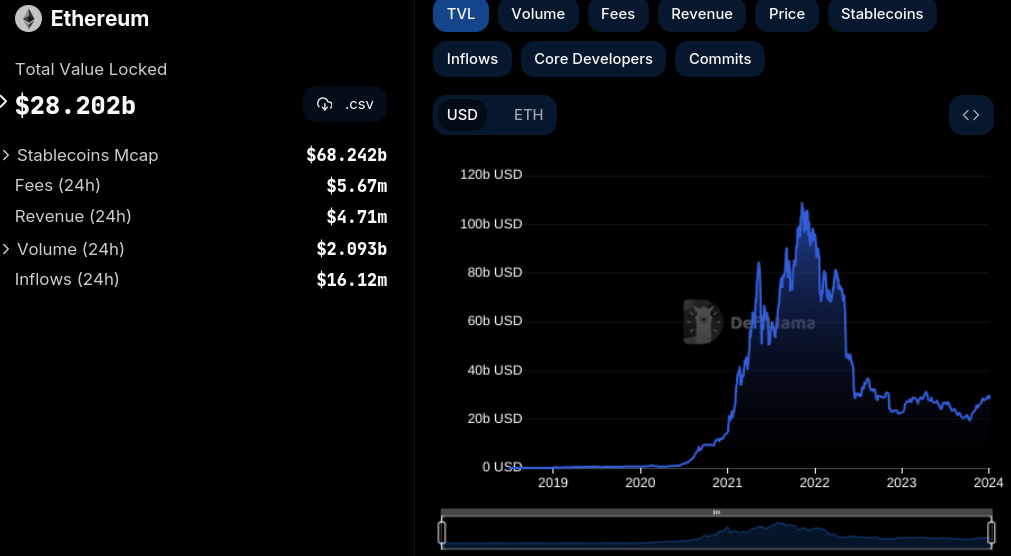

An array of expert predictions unveils a generally bullish sentiment for Ethereum in 2024. Analysts foresee a surge in Ethereum-based rollups' adoption, leveraging proto-danksharding advancements. The activation of these features is anticipated to drive substantial growth in Total Value Locked (TVL), bolstering Ethereum's value proposition.

Source: defillama.com

Moreover, the convergence of Artificial Intelligence (AI) and blockchain emerges as a pivotal trend. Ethereum, with its robust smart contract capabilities, could stand to benefit from this convergence, further elevating its utility and market demand. Analysts foresee Ethereum outperforming Bitcoin amid mounting speculation around the potential SEC approval of spot ETFs for both cryptocurrencies.

Risks and Challenges Ahead

Despite the prevailing optimism, Ethereum confronts several risks and challenges that could affect its trajectory. The inherent volatility within the crypto market remains a persistent threat. Regulatory uncertainties, especially surrounding SEC approvals, pose potential hurdles that could sway Ethereum's price dynamics.

Addressing scalability concerns is another critical obstacle for Ethereum. As dApp adoption grows, the network's ability to handle increased transaction volumes becomes paramount. Projects focused on enhancing Ethereum's scalability will play a pivotal role in determining its sustained growth and market relevance.

ETHUSD: Technical Take

The price of Ethereum (ETH) may hit $3,745 by 2024 (highly probable).

Ethereum's price has experienced solid bullish momentum since Q4 2023. However, the price may experience solid resistance at $3,105.

Looking at the Relative Strength Index (RSI), it indicates an overbought condition for ETH. Therefore, a correction can be expected. The price may correct to hit $1,750, which may serve as an ideal price to accumulate more ETHs.

Looking forward, the 13-week and 26-week exponential moving averages (EMA) are on a bullish trajectory. Here, the 13-week EMA position relative to the 26-week EMA serves as a vital navigator for the trend. Also, the 26-week EMA may serve as dynamic support for the trend.

Lastly, projecting the current momentum forward leads to a 2024 target of $3,745. On the way to hitting the target of $2,550, this may serve as a minor resistance. Meanwhile, at $1,345, the level may continue to provide critical mid-term support for 2024.

Source: tradingview.com

In conclusion, the landscape for Ethereum in 2024 appears buoyant, underpinned by pivotal catalysts such as potential SEC approvals for spot cryptocurrency ETFs and advancements in scalability. While expert predictions and market sentiments remain optimistic, challenges such as regulatory uncertainties and scalability concerns necessitate careful consideration.

Ethereum's resilience and enduring market position, combined with technological advancements and growing adoption, position it favorably for potential growth in 2024.