- Anticipation surrounds Ethereum's Dencun upgrade, promising enhanced scalability and efficiency, while potential SEC approval for Ethereum ETFs signals growing institutional interest and mainstream acceptance.

- Ethereum's recent price volatility saw a low of $3,836.16 and a high of $4,061.57 within 24 hours, indicating active trading and market uncertainty.

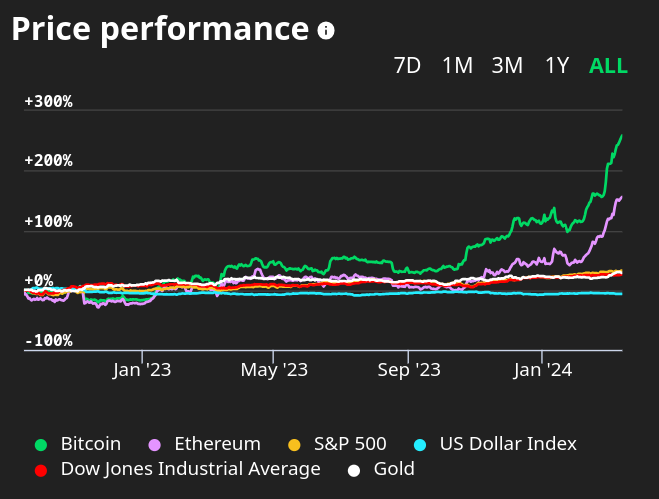

- Ethereum's 52-week price range from $1,522.92 to $4,092.90 underscores its market volatility and bullish momentum, with year-to-date returns at 77.11%.

- Ethereum's market capitalization of $484.74 billion solidifies its position as a leading cryptocurrency, highlighting its influence and significance.

As Ethereum price resembles a rollercoaster ride, with peaks and valleys mirroring the unpredictable nature of the crypto market, deciphering the underlying trends becomes imperative. From its tumultuous 24-hour swings to its staggering 52-week highs and lows, there are whispers of optimism and anticipation. The article explores the implications of the impending Dencun upgrade, promising to revolutionize Ethereum's scalability and efficiency. Meanwhile, it also explores the possibility of SEC approval for Ethereum ETFs that tantalizes the market with visions of institutional adoption and mainstream legitimacy.

Ethereum Price Movements

Ethereum price experienced significant volatility within the past 24 hours, with the low hitting $3,836.16 and the high reaching $4,061.57. This indicates substantial price fluctuations within a short timeframe, suggesting active trading and uncertainty in the market.

Historically, Ethereum's 52-week low of $1,522.92 and 52-week high of $4,092.90 illustrate the significant price range that Ethereum has experienced over the past year. This wide range reflects the volatility inherent in the cryptocurrency market, with Ethereum's price fluctuating dramatically over relatively short periods.

Additionally, Ethereum is currently trading close to its all-time high of $4,865.57, indicating strong bullish momentum in recent months. The year-to-date returns for Ethereum investors are particularly noteworthy, standing at an impressive 77.11%. This indicates that Ethereum has been a profitable investment over the course of the year, outperforming many other assets and investment opportunities.

Source: stockcharts.com

Ethereum Dencun Upgrade

Ethereum's Dencun upgrade, also known as Duncan or EIP-4844, represents a significant milestone for the Ethereum network. Scheduled for March 13th, this upgrade is expected to improve Ethereum's scalability and efficiency by making network data storage more efficient. The upgrade builds on Ethereum's transition from a proof-of-work to a proof-of-stake model in 2023, which aims to reduce energy consumption and improve scalability.

By further enhancing scalability and reducing settlement costs, the Dencun upgrade has the potential to address some of Ethereum's most pressing challenges, including slow transaction speeds, low throughput, and high costs for users. The Dencun upgrade could reduce Ethereum's settlement costs by an order of magnitude or more, fundamentally improving its scaling and efficiency.

Overall, Dencun upgrade could have a significant impact on Ethereum's price and market dynamics, potentially driving increased demand and adoption of the cryptocurrency.

Potential SEC Approval for Ethereum ETFs

Ethereum investors may receive positive news in the coming months if the SEC approves the first class of spot Ethereum ETFs. At least 10 firms, including Fidelity Investments and BlackRock (BLK), have applied to launch spot Ethereum ETFs, with the SEC facing a May deadline to rule on the applications.

The approval of spot Ethereum ETFs could signal increased institutional interest in Ethereum and provide investors with additional opportunities to gain exposure to the cryptocurrency. Ethereum is currently the only cryptocurrency other than Bitcoin whose futures contracts are traded on the Chicago Mercantile Exchange (CME), regulated by the Commodity Futures Trading Commission.

Optimism regarding the approval of spot Ethereum ETFs is fueled by the SEC's previous approval of spot Bitcoin ETFs, which occurred roughly two years after the approval of Bitcoin futures ETFs. While the approval process may take time, many Ethereum investors are hopeful that spot Ethereum ETFs will receive regulatory approval, potentially driving increased investment and price appreciation for Ethereum.

Eclipse Labs' Funding and Mainnet Debut

Eclipse Labs, a company building a blockchain to scale Ethereum using technology from Solana and other blockchains, recently raised $50 million ahead of its mainnet debut. The project aims to combine technologies from Ethereum and Solana to create a scalable solution for Ethereum, with the mainnet set to open to developers in the coming weeks.

Eclipse Labs' approach reflects a growing interest in scalability solutions for Ethereum, as the network continues to face challenges related to transaction throughput and cost. By leveraging technologies from multiple blockchains, Eclipse Labs seeks to address Ethereum's scalability issues while maintaining compatibility with existing Ethereum-based applications and protocols. The project's funding round and impending mainnet debut suggest confidence in Ethereum's long-term prospects and the potential for scalability solutions to drive growth and adoption of the network.

Impact of Meme Coin Frenzy

The recent frenzy surrounding meme tokens has driven increased network activity on Ethereum, resulting in higher transaction fees and revenue from network fees. Ethereum's revenue from network fees surged to nearly two-year highs, reaching $193 million, driven by speculation with meme tokens such as Pepe (PEPE), Shiba Inu (SHIB), and Floki (FLOKI). The increased network activity benefits Ethereum investors through token burning, which reduces the token's supply and can contribute to price appreciation over time.

However, the heightened activity has also made the Ethereum network more expensive for users, with average transaction costs reaching as high as $28. This high cost of using the Ethereum network can deter smaller investors and users, potentially limiting adoption and growth. Fees on layer 2 solutions, designed to scale the Ethereum network, have also surged, further highlighting the scalability challenges facing Ethereum. However, the upcoming Dencun upgrade is expected to address these challenges by lowering transaction costs on layer 2 solutions to cents, potentially making the Ethereum network more accessible and scalable in the future.

Market Statistics

Ethereum's market capitalization of $484.74 billion solidifies its position as one of the largest cryptocurrencies by market value. This substantial market cap highlights Ethereum's importance within the broader cryptocurrency ecosystem and its significant influence on the market as a whole.

Additionally, Ethereum's total supply of 120.09 million tokens indicates a finite supply model, with a predetermined limit on the number of tokens that will ever be created. This scarcity can contribute to Ethereum's value proposition as an investment asset, as limited supply can potentially lead to increased demand and price appreciation over time. Ethereum's 30-day volatility of 0.46784900 suggests that the cryptocurrency has experienced moderate price fluctuations over the past month.

While Ethereum's volatility is lower than that of some other cryptocurrencies, it remains higher than that of many traditional assets, reflecting the inherent risk and uncertainty associated with investing in cryptocurrencies. The 24-hour transaction count of 1.25 million highlights Ethereum's significant network activity, with millions of transactions occurring on the platform within a single day. This high level of activity underscores Ethereum's utility as a platform for decentralized applications and smart contracts, as well as its role as a medium of exchange for digital assets.

However, Ethereum's average transaction fee of $25.65 indicates that using the Ethereum network can be costly for users, particularly for smaller transactions. High transaction fees can present a barrier to entry for some users and limit the scalability of the Ethereum network, potentially hindering its adoption and growth over time.

Implications on Ethereum Price Direction

Long-Term Bullish Momentum:

Despite short-term volatility, Ethereum has exhibited strong long-term bullish momentum, with year-to-date returns of over 77%. Long-term bullish momentum can attract additional investment and drive further price appreciation over time.

Source: coindesk.com

Fundamental Factors:

Fundamental factors such as network upgrades, regulatory developments, and scalability solutions can have a significant impact on Ethereum's price direction. Positive developments such as the upcoming Dencun upgrade and potential SEC approval of spot Ethereum ETFs could drive increased demand and adoption of Ethereum, leading to higher prices.

Market Sentiment and Speculation:

Market sentiment and speculative trading activity can also influence Ethereum's price direction in the short term. The recent frenzy surrounding meme tokens and increased network activity on Ethereum highlight the role of speculation in driving price movements. While speculative trading can contribute to short-term price volatility, it may not necessarily reflect underlying value or fundamentals.

Scalability Solutions and Adoption:

The success of scalability solutions such as the Dencun upgrade and projects like Eclipse Labs could play a significant role in determining Ethereum's long-term price direction. Scalability is a critical issue facing Ethereum, and successful solutions that address scalability challenges could drive increased adoption and usage of the Ethereum network, leading to higher prices over time. Conversely, delays or setbacks in scalability solutions could hinder Ethereum's growth and adoption, potentially leading to lower prices.

ETHUSD Technical Take

The price of Ethereum may hit $4,500 by March 20. The projection is based on the current momentum of higher highs and Fibonacci retracement levels.

Looking at the relative strength index (RSI), there are no clear signs of any bearish divergence at the current level (>90). Logically, the price target of $4,500 is attainable as ETH price has taken support near $3,800 last week. Based on that major correction is less likely.

However the price may revert back towards the trend line (purple) $3,478-$3,500. Considering the inherent volatility of the cryptocurrencies in general, pivot at $3,154 should be in mind.

Source: tradingview.com

In conclusion, In the midst of Ethereum's price volatility and impending upgrades, the trajectory points towards a bullish direction. The anticipation of the Dencun upgrade and potential SEC approval for Ethereum ETFs fuels optimism, indicating a positive outlook for Ethereum's price direction. Despite short-term fluctuations driven by speculation, fundamental factors such as network upgrades and scalability solutions are poised to drive long-term growth. Technical analysis supports this sentiment, projecting a potential rise to $4,500 by March 20, underpinned by solid support levels. Overall, Ethereum's path seems set for upward movement amidst current market state and fundamentals.