On May 14th, Faraday Future Intelligent Electric Inc. (NASDAQ: FFIE) experienced unprecedented volatility in its stock price. The company's shares opened with a remarkable surge of 190%, closing at $0.285 per share, marking an extraordinary 367.21% increase by the end of the trading day.

This surge positioned Faraday Future as the second-highest gainer across the U.S. stock market for the day, elevating its market capitalization to $12.16 million.

Post-market activity continued the upward trend, pushing the stock to approximately $0.3699 per share, a level last seen three months ago.

Overview of Faraday Future (FFIE)

1. Market History and Valuation:

Faraday Future went public on the NASDAQ in 2021, at which time its market capitalization soared to over $4 billion. The stock price peaked at $4,980 per share on February 1, 2021. However, the company's valuation has since plummeted, hitting a low of $0.038 per share earlier this year - a staggering 99.99% decline.

2. Product Delivery and Financial Health:

In 2023, Faraday Future delivered 10 units of its FF 91 2.0 Futurist Alliance, including one owned by its founder Jia Yueting. Despite this milestone, the company's overall delivery volume remains minimal, and insufficient to achieve operational profitability. Faraday Future faces significant liquidity challenges, with its cash reserves dwindling to approximately $9 million by the end of the third quarter, according to FactSet.

3. Regulatory and Financial Reporting Issues:

In April, Faraday Future received a delisting notice from NASDAQ due to its precarious stock performance and has announced its intention to appeal the decision. In addition, the company has yet to file its 2023 annual report, raising concerns about its financial transparency and regulatory compliance.

Factors Contributing to the Surge in Faraday Future Stock Price

1. Meme Stock Phenomenon

The explosion in Faraday Future's stock price can largely be attributed to its classification as a meme stock, similar to GameStop (GME) and AMC Entertainment (AMC). Meme stocks are characterized by significant retail investor interest and high levels of social media discussion, resulting in dramatic price movements that are often disconnected from the company's fundamental financial health.

Faraday Future shares have been heavily shorted, with the short interest reaching an astounding 95%. This means that a significant portion of the company's available shares have been sold short. The spike in Faraday Future's stock price on May 14 coincided with the return of Keith Gill, known as "Roaring Kitty," to the social media platform X. Gill's previous involvement in the GameStop saga had galvanized retail investors, and his return sparked renewed interest in meme stocks, leading to aggressive buying and shorting across multiple stocks.

On the same day, both GameStop and AMC saw their stock prices skyrocket by 60% and 32%, respectively, following gains of 73% and 77% the previous day. This rally was driven by retail investors banding together, creating substantial upward pressure on the stock prices as short sellers rushed to cover their positions, further fueling the price increases.

2. Geopolitical Developments

Another significant factor contributing to the increase in Faraday Future's stock price was the U.S. government's announcement on May 14 that it would impose additional tariffs on Chinese electric vehicles and other products.. This geopolitical development had a direct impact on the market dynamics surrounding Faraday Future.

Faraday Future, being the only U.S.-based electric vehicle company with Chinese roots, stands in a unique position. The additional tariffs on Chinese electric vehicles potentially make Faraday Future a more attractive investment as it may be less affected by these tariffs compared to its Chinese competitors. This perceived advantage can enhance the company's value proposition, leading to speculative trading and increased interest from investors looking for opportunities in the electric vehicle market. The potential for Faraday Future to become a prime acquisition target due to its unique positioning may have also driven speculative trading, contributing to the stock's significant rise.

3. Jia Yueting's Efforts to Maintain Compliance and Protect Faraday Future's Listing Status

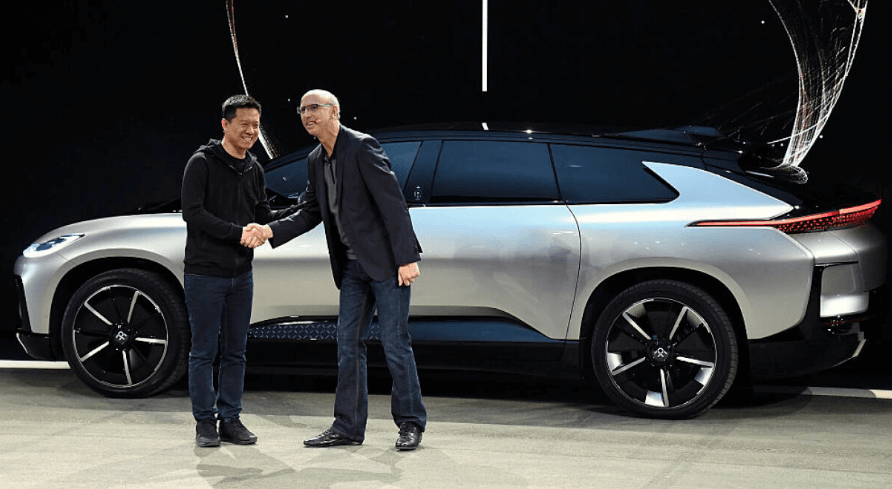

Another key factor influencing the recent surge in Faraday Future's stock price has been the proactive measures taken by the company's founder, Jia Yueting, to ensure that the company remains listed on the NASDAQ. Following the delisting notice in April, Jia embarked on a strategic campaign to leverage his personal brand for the benefit of the company.

On May 7, Jia Yueting, who also serves as Faraday Future's Chief Product and User Ecosystem Officer (CPUO), released a six-minute video on his social media platform. In the video, Jia announced his intention to commercialize his personal IP to generate additional revenue. He emphasized his commitment to taking a more active leadership role alongside Matthias Aydt as co-CEOs, sharing the responsibilities and challenges facing the company.

Jia outlined his plan to monetize his personal brand in order to raise funds quickly, with the dual purpose of paying down debt and injecting much-needed capital into Faraday Future to support vehicle production and overall operations. This initiative is designed to bolster investor and shareholder confidence by demonstrating a clear and actionable strategy to address the company's financial challenges and regulatory compliance issues.

FFIE Stock Forecast: Technical Analysis

Faraday Future (FFIE) recently broke through a significant horizontal resistance level, suggesting the potential for a rapid and robust upward movement. This type of breakout often leads to significant price gains, followed by potential corrections back towards the breakout line. In this case, $0.197 is seen as a key level, offering a "second chance" to potential buyers. It is crucial that trading volume supports this price movement to confirm the validity of the breakout, as a lack of volume could signal a false breakout, leading to a return to the previous trend.

According to the rectangular formation theory, FFIE stock price is expected to reach $0.354 within the next three months, reflecting a strong bullish sentiment.

FFIE Signals and Predictions

Farady Future stock currently holds buy signals from both short-term and long-term moving averages, contributing to a positive outlook. The alignment of short-term averages above long-term averages further reinforces this bullish signal. Key support levels during any downward correction are identified at $0.175 and $0.0898, with breaches below these levels indicating potential sell signals.

On May 2, 2024, a pivot bottom generated a buy signal that has led to an impressive 1,658.10% rise to date. Further upside is expected until a new pivot top is established. The Moving Average Convergence Divergence (MACD) indicator is also giving a buy signal, indicating continued bullish momentum.

Despite the upward price movement, a decline in volume on the most recent trading day indicates a divergence between volume and price, which can serve as an early warning of potential volatility. This warrants close monitoring of the stock.

FFIE Stock Forecast: Support, Risk, and Stop-Loss Considerations

The current cumulative volume does not provide support below today’s price level, indicating potential vulnerability if selling pressure increases. Given the stock's substantial daily volatility and wide Bollinger Band range, FFIE is classified as a "high-risk" investment. The stock's intraday movement of $0.592, or 152.38%, underscores its volatility. Over the past week, the average daily volatility has been 106.95%.

FFIE is also in an overbought condition with a Relative Strength Index (RSI14) of 98. Typically, such high RSI levels suggest a good selling opportunity; however, due to the recent trend breakout, the likelihood of a significant correction due to high RSI is minimized, as the stock should find support at the breakout levels.

Recommended Stop-Loss: Given the high daily volatility and risk associated with FFIE, a stop-loss at $0.687 is advised. This stop-loss level accounts for the stock's daily movement range and the elevated risk indicated by the RSI14 of 98.

Trade Expectations for Faraday Future Intelligent Electric Inc. (FFIE) on May 16th

For the upcoming trading day on May 16th, we anticipate Faraday Future Intelligent Electric Inc. to open at $0.691 per share. Based on a 14-day Average True Range, the stock is expected to fluctuate between $0.626 and $0.784 throughout the day, indicating a possible trading range of +/- $0.0792 (+/- 11.24%) from the previous closing price. If fully realized, this suggests a potential volatility of 22.47% between the day's lowest and highest trading prices.

Insider Trading Activity

Internal stakeholders have shown a notably bullish sentiment, purchasing more shares of Faraday Future Intelligent Electric Inc. than selling. Over the past 100 transactions, insiders bought 11.04 million shares and sold 1.68 million shares. The most recent transaction, conducted by Aydt Matthias 147 days ago, involved the purchase of 1 share. The higher volume of insider buying compared to selling indicates a belief among insiders in the company's potential for significant upside. Larger purchases may be attributed to stock option expiration dates in some cases.

Is Faraday Future Stock Worth Buying?

While Faraday Future Intelligent Electric Inc. exhibits some positive signals, we believe they are not sufficient to deem it a buy candidate at this time. At the current level, it should be viewed as a candidate for holding the position (hold or accumulate), while awaiting further developments.

Conclusion

In conclusion, Faraday Future's recent stock surge reflects a complex interplay of market dynamics, including retail investor sentiment, geopolitical factors, and internal strategic initiatives. While opportunities for growth exist, prudent risk management and a nuanced understanding of the company's fundamentals are essential for navigating the volatile landscape of FFIE stock.