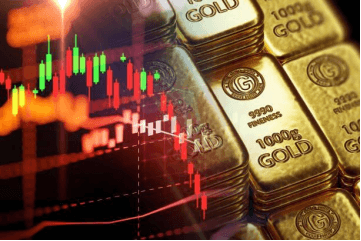

Vàng là một kim loại phổ biến được hầu hết mọi người trên thế giới biết đến, nhưng có một điều mà nhiều người không biết là khi nói đến đầu tư, vàng là kim loại quý phổ biến nhất. Tại sao lại như vậy? Đó là bởi vì luôn luôn có nhu cầu về vàng và nó hiếm khi giảm giá trị. Đây cũng là lý do mà một số người lưu trữ đồ trang sức và tài sản bằng vàng để bán sau này và kiếm được tiền lời so với số vốn đã đầu tư ban đầu.

Cổ phiếu vàng là chứng khoán được giao dịch công khai chủ yếu tập trung vào vàng, thường được áp dụng bởi nhiều ngành công nghiệp như công ty mỏ, công ty vàng, EFT tập trung vào vàng [quỹ giao dịch trao đổi] và nhiều ngành khác. Một số công ty cổ phiếu vàng hàng đầu là: Kinross Gold Corporation (NYSE: KGC), Barrick Gold Corporation (NYSE: GOLD) và Newmont Corporation (NYSE: NEM).

Nguồn: Pexels

Khi đưa ra quyết định đầu tư vàng, việc đầu tư vào cổ phiếu vàng là một lựa chọn thông minh để tối đa hóa lợi nhuận. Cổ phiếu vàng là một khoản đầu tư tuyệt vời bởi phần lớn các công ty vàng thường nhận được tổng lợi nhuận ấn tượng từ cổ phiếu vàng hơn là đầu tư vào vàng thật thông thường. Với cổ phiếu vàng, bạn có được giá vàng mà không cần phải sở hữu hoặc lưu trữ vàng thật như trước đây.

Kinross Gold Corporation (NYSE: KGC) - Đòn bẩy theo giá vàng nhưng hãy kiểm tra các quy tắc

Kinross Gold Corporation là một công ty khai khoáng và kim loại hàng đầu có trụ sở tại Canada, tập trung vào vàng và bạc, họ hiện đang vận hành sáu mỏ vàng đang hoạt động, giao dịch với mã KGC trên Sở giao dịch chứng khoán New York [NYSE] và dưới tên K trên Sở giao dịch chứng khoán Toronto[TSX].

Kinross Gold vận hành các mỏ ở Brazil, Mauritania và Hoa Kỳ. Vào năm 2022, công ty dự kiến 58% sản lượng vàng của họ sẽ đến từ các mỏ ở Mỹ. Mỏ của họ bao gồm: Fort Knox, Round Mountain, Bald Mountain, Paracatu, Tasiast, và Great Bear.

Vào tháng 5 năm 2023, công ty đã công bố báo cáo cho quý đầu tiên, họ tuyên bố rằng mình đang đi đúng hướng để đáp ứng mục tiêu định hướng chi phí và sản xuất hàng năm. Hội đồng quản trị Kinross tuyên bố 0,03 USD trên mỗi cổ phiếu phổ thông cổ tức hàng quý sẽ phải trả trước ngày 15 tháng 6 năm 2023. Họ cũng cho biết rằng mỏ Tasiat của họ đã đạt được hai sản lượng phá kỷ lục vào tháng 1 và tháng 3.

Source: Unsplash

Tính đến ngày 31 tháng 5 năm 2023, trên TSX: K cổ phiếu KGC ở mức 6,47 USD, trong khi NYSE: KGC là 4,75 USD với mức tăng lần lượt là 2,05% và 2,70% trong 24 giờ qua. Kinross đã báo cáo sản lượng và doanh thu tăng lên trong quý đầu tiên của năm nay so với sản lượng trong quý đầu tiên năm ngoái. Họ đã sản xuất 466.022 Au eq. oz. trong quý đầu tiên của năm 2023, trong khi quý đầu tiên của năm 2022 là 378, 421 Au eq. oz. Họ đã tạo ra 116.602 Au eq. oz. tăng doanh số bán hàng từ quý đầu tiên của năm 2023 so với năm 2022.

Triển vọng tương lai đối với cổ phiếu vàng Kinross có vẻ đầy hứa hẹn khi Chủ tịch và Giám đốc điều hành của công ty 'Paul Rollinson' tuyên bố họ đang có vị thế tốt và đang đi đúng hướng để đáp ứng mục tiêu định hướng chi phí và sản xuất hàng năm. Ông đề cập rằng công ty có kế hoạch duy trì sức mạnh tài chính và tính thanh khoản của mình.

Barrick Gold Corporation [NYSE: GOLD] - Tài sản cấp một và Dòng tiền mạnh hạn chế rủi ro

Barrick Gold Corporation là một công ty khai thác mỏ chuyên về vàng và đồng. Họ có 16 địa điểm hoạt động khác nhau tại hơn 13 quốc gia trên thế giới. Họ có trụ sở tại Canada, các điểm mỏ tại Argentina, Chile, Mali, Ả Rập Saudi và Tanzania, cùng nhiều nơi khác. Cổ phiếu Barrick Gold được giao dịch với mã ABX trên Sàn giao dịch chứng khoán Toronto [TSK] và mã GOLD trên Sàn giao dịch chứng khoán New York [NYSE]. Nó cũng là thành phần trong S & P/TSX 60.

Vào năm 2019, Barrick Golds có 71 triệu ounce trữ lượng vàng đã xác minh. Bất chấp lạm phát ảnh hưởng đến ngành vào năm 2022, Barrick Gold vẫn có thể tạo ra doanh thu hơn 11 tỷ USD, chúng ta có thể duy trì tỷ suất lợi nhuận EBITDA của họ ở mức trên 50%.

Tính đến ngày 31 tháng 5 năm 2023, GOLD(NYSE) ở mức 16,98 USD với mức tăng 1,22% trong 24 giờ qua. Họ tuyên bố chia cổ tức cho cổ đông năm 2023 ở mức 0,1 USD một cổ phiếu; cổ tức phù hợp với Chính sách Cổ tức Hiệu suất của công ty đã công bố vào năm 2022.

Nguồn: Unsplash

Là một "ông trùm trong ngành khai thác mỏ trên thế giới, họ có phần lớn tài sản ở Mỹ và được công nhận là công ty khai thác vàng lớn nhất thế giới cho đến năm 2019.

Trong triển vọng tương lai của Barrick Gold, công ty mong đợi "tiềm năng tăng thêm" liên quan đến Chính sách Cổ tức Hiệu suất của họ, họ cũng biết rằng tất cả "báo cáo nhận định tương lai" đều dựa trên một số ước tính và giả định có thể bị ảnh hưởng bởi nhiều các yếu tố khác.

Newmont Corporation(NYSE: NEM) - Khai thác Blue Chip sẵn sàng hoạt động vượt trội về quy mô/sự đa dạng

Newmont Corporation là một công ty khai thác vàng có trụ sở tại Mỹ. Đây là tập đoàn khai thác vàng lớn nhất thế giới, được thành lập vào năm 1921, có các mỏ vàng ở Úc, Ghana, Peru và Quebec, cùng nhiều nơi khác. Ngoài ra Newmont Corporation cũng khai thác đồng, bạc, kẽm và chì. Cổ phiếu Newmont giao dịch dưới dạng NEM trên Sàn giao dịch chứng khoán New York [NYSE] và là công ty vàng duy nhất trong S&P 500.

Sau khi mua lại nhiều công ty khác nhau, vào tháng 5 năm 2023, Newmont đã đồng ý với các điều khoản để mua lại Newcrest. Tính đến ngày 31 tháng 5 năm 2023, Cổ phiếu NEM ở mức 40,72 USD đối với sàn NYSE: NEM và ở mức 55,38 USD đối với sàn TSX: NGT, mức tăng lần lượt là 1,80% và 1,79%. Trong quý đầu tiên sản xuất năm 2023, Newmont đã sản xuất 1,27 triệu ounce vàng, họ cũng đang trên đà đạt được mục tiêu định hướng cho cả năm và đã tạo ra 481 triệu USD thu nhập từ hoạt động kinh doanh liên tục.

Về triển vọng tài chính trong tương lai của công ty, Chủ tịch ‘Tom Palmer’ nói rằng họ sẽ tiếp tục dẫn đầu lĩnh vực vàng trong việc sản xuất vàng bền vững và có lợi nhuận. Họ cũng tuyên bố rằng mình vẫn đang đi đúng hướng để đạt được tất cả những gì đã lên kế hoạch, ‘mang lại giá trị lâu dài một cách an toàn cho tất cả các bên liên quan thông qua khai thác bền vững và có trách nhiệm.'

So Sánh Ba Cổ Phiếu Vàng

Mặc dù cả ba công ty để đầu tư cổ phiếu vàng đều là những công ty khai thác vàng hàng đầu, nhưng họ cũng có những điểm mạnh và điểm yếu riêng, khiến thương hiệu của họ trở nên độc đáo và nổi bật so với mọi thương hiệu khác.

Điểm mạnh

Tập đoàn Newmont là tập đoàn khai thác vàng lớn nhất thế giới có rất nhiều điểm mạnh để xây dựng nên tên tuổi của mình, bao gồm việc họ là thành phần thuộc S & P 500 duy nhất trong ngành công nghiệp khai thác vàng. Họ cũng có hơn 30.000 nhân viên và các nhà thầu. Họ thường xuyên đo lường sức khỏe, sự an toàn và hiệu suất ngăn ngừa tổn thất của mình để đảm bảo sự cải thiện so với các hành động được lên kế hoạch và thực tế.

KGC nổi tiếng nhờ thành công trong việc thực hiện các dự án mới và tạo ra lợi nhuận tốt từ vốn bằng cách tạo ra các nguồn doanh thu mới. Họ có một mạng lưới phân phối rất mạnh có thể dễ dàng tiếp cận hầu hết thị trường của họ. Họ cũng có dòng tiền tốt giúp công ty có doanh thu để mở rộng các dự án mới.

Barrick Gold Corporation có các mỏ và nhiều dự án khác nhau trên cả năm châu lục. Họ có tuabin gió được đặt ở vị trí cao nhất thế giới ở Argentina và có khả năng vận hành rất xuất sắc dẫn đến việc họ đáp ứng được sản lượng vàng của mình. Họ cũng được biết đến là những người chi tiêu cao cho công nghệ, tạo ra niềm tin và giá trị tích cực từ các cổ đông.

Source: Unsplash

Điểm yếu

Là một tập đoàn rất lớn, Newmont Corporation cần phụ thuộc rất nhiều vào các nhà thầu để thực hiện phần lớn công việc mà họ phải làm. Trước đây Newmont đã từng bị buộc tội vô tình làm đổ xyanua tại một trong những mỏ vàng của mình, dẫn đến ô nhiễm nước và giết chết cá.

Cấu trúc của Kinross Gold ở dạng mà tổ chức của họ chỉ tương thích với các mô hình kinh doanh mới hạn chế việc mở rộng sang các phân khúc khác; Điều này cho phép họ đạt được thành công rất hạn chế ngoài hoạt động kinh doanh cốt lõi. So với các thương hiệu khác, họ phải chi nhiều hơn cho việc đào tạo và phát triển nhân viên vì tỷ lệ nghỉ việc cao.

Trước đây Barrick Gold Corporation cũng đã từng bị cáo buộc về một số vụ tràn hóa chất, bao gồm xyanua và thủy ngân. Sau những cáo buộc trước đó, họ đã bị loại khỏi một trong những quỹ đầu tư lớn nhất thế giới là Quỹ hưu trí chính phủ Na Uy.

Ba tập đoàn này khác nhau như thế nào?

Mỗi công ty trong số ba công ty này đều có những điểm nhấn tạo nên sự khác biệt, vì vậy, hãy cùng xem chúng khác nhau như thế nào về hiệu suất tài chính, xu hướng chứng khoán và hiệu suất tăng trưởng.

Barrick Gold đã thể hiện hiệu suất tài chính mạnh mẽ trong những năm qua. Với các hoạt động khai thác mở rộng và sản xuất quy mô lớn, công ty có nhiều loại chứng khoán, có thể hỗ trợ họ khi có sự thay đổi về giá vàng trên thị trường chứng khoán.

Không giống như Barrick gold, Kinross nhỏ hơn nhưng cũng là một công ty dẫn đầu trong ngành khai thác vàng. Hiệu suất tài chính của họ vừa tích cực vừa tiêu cực. Hầu hết các thách thức của họ liên quan đến việc kiểm soát chi phí, tăng trưởng sản xuất và hiệu quả hoạt động. Trong thời gian gần đây Kinross Gold đã nỗ lực cải thiện danh mục đầu tư và tình hình tài chính của mình.

Tuy nhiên trong những năm qua, Newmont đã chứng tỏ hiệu suất tài chính mạnh mẽ trong mối quan hệ tương tự với Barrick Gold. Họ đã liên tục tạo ra doanh thu đáng kể và giữ được tỷ suất lợi nhuận thuận lợi. Newmont Stock đã cho thấy một xu hướng tích cực khi họ tập trung vào các hoạt động khai thác bền vững và theo đuổi các cơ hội để tối ưu hóa sản xuất, giảm chi phí và nâng cao giá trị cho cổ đông.

Hiệu suất tài chính và xu hướng chứng khoán của cả ba công ty đều bị ảnh hưởng bởi các yếu tố tương tự như giá vàng, khối lượng sản xuất và động lực của ngành.

Đầu Tư Vào Cổ Phiếu Vàng

Nguồn: Pexels

Các cổ phiếu vàng là các công ty đại chúng khai thác, xử lý, tài trợ và kinh doanh vàng. Có ba cách chính để đầu tư vào Cổ phiếu Vàng,

- Nắm giữ cổ phiếu

- Mua quyền chọn

- Giao dịch CFD

Nắm giữ cổ phiếu

Khi nói đến đầu tư, khuyến nghị của các nhà phân tích thường là năm giữ cổ phiếu. Tức là đề cập đến việc nắm giữ hoặc duy trì quyền sở hữu chứng khoán trong một thời gian dài. Việc nắm giữ cổ phần sẽ giúp bạn vượt qua cả mức cao và mức thấp của thị trường, hưởng lợi từ các nhiệm vụ thấp hơn và chúng thường có xu hướng rẻ hơn. Tuy nhiên, việc nắm giữ cổ phần có thể khiến bạn gặp rủi ro thị trường và đòi hỏi một khoản vốn ban đầu lớn.

Mua quyền chọn

Quyền chọn cổ phiếu cho phép nhà đầu tư có quyền mua hoặc bán cổ phiếu ở một mức giá đã định trong một khung thời gian cụ thể. Điều này thường mang lại cho nhà đầu tư nhiều đòn bẩy hơn ở chỗ nó cho phép bạn kiếm được tiền lãi giống cổ phiếu trong khi đầu tư ít tiền hơn, nhưng phí lại cao hơn và có hao mòn thời gian.

Giao dịch CFD

CFD có nghĩa là hợp đồng chênh lệch, là hợp đồng thanh toán chênh lệch giá thanh toán giữa giao dịch mở và đóng, cho phép bạn đầu tư vào giá cổ phiếu vàng mà không cần sở hữu chúng. Ngày nay, CFD thường cung cấp cho bạn quyền truy cập vào cổ phiếu vàng với chi phí thấp hơn so với việc bạn cố gắng mua đứt. Ngoài ra CFD còn cho phép bạn thực thi lệnh một cách dễ dàng và cho bạn khả năng lựa chọn giữa việc mua hoặc bán.

Tại sao nên giao dịch CFD cổ phiếu vàng với VSTAR?

Nguồn: Unsplash

Bạn có thể thắc mắc tại sao lại là VSTAR; VSTAR là một trong những nền tảng tốt nhất để giao dịch CFD cổ phiếu vàng, đây là nền tảng giao dịch được quản lý và công nhận trên toàn cầu, cung cấp phí giao dịch thấp, thanh khoản nhanh và trải nghiệm giao dịch ở cấp độ tổ chức. Một điểm tốt hơn nữa là VSTAR cho phép bạn giao dịch CFD trên hơn 1000 thị trường, bao gồm tiền tệ, chỉ số, hàng hóa, tiền điện tử, chứng khoán US và HK. Một số cổ phiếu vàng CFD mà bạn có thể giao dịch trên VSTAR bao gồm; NYSE: KGC, NYSE: GOLD và NYSE: NEM.

Cách giao dịch CFD cổ phiếu vàng với VSTAR

Giao dịch CFD cổ phiếu vàng với VSTAR rất đơn giản. Thực hiện theo các bước sau:

- Tải app VSTAR và đăng ký tài khoản.

- Nạp tiền vào tài khoản của bạn bằng một trong các phương thức thanh toán được VSTAR hỗ trợ và công nhận, chẳng hạn như Visa, Mastercard, Tether, Skrill, Neteller, SticPay hoặc Perfect Money. Khoản tiền nạp tối thiểu chỉ có 50 USD.

- Chọn một quyền chọn cổ phiếu vàng mà bạn muốn giao dịch và mở một vị thế mua hoặc bán tùy thuộc vào quan điểm thị trường của bạn. Bạn có thể quyết định thiết lập lệnh cắt lỗ để chốt lãi và giúp bạn quản lý rủi ro cũng như lời lãi.

- Xác định chiến lược giao dịch bạn dự định sử dụng.

- Theo dõi giao dịch của bạn và đóng giao dịch khi bạn muốn chốt lãi hoặc lỗ. Bạn cũng có thể nắm bắt các cơ hội giao dịch theo thời gian thực bằng cách sử dụng tính năng thị trường.

- Phần tuyệt vời nhất là bạn có thể rút tiền bất cứ khi nào bạn muốn bằng cách sử dụng cùng một phương thức thanh toán mà bạn đã sử dụng để thực hiện nạp tiền vào ban đầu của mình.

Mẹo giúp bạn tăng khả năng sinh lời ròng

- Biết thời điểm bạn muốn chọn vị thế của mình: cố gắng duy trì thời gian giao dịch vàng mà bạn dự định sử dụng nói chung, vì điều này sẽ giúp bạn biết và chọn thời điểm tốt nhất để có nhiều hoạt động giá hơn.

- Luyện tập: bạn có thể sử dụng tài khoản demo để thực hành khi bắt đầu giao dịch, bạn sẽ biết cách điều hướng, đưa ra những ý tưởng và chiến lược mới.

- Tốt nhất là bạn nên theo dõi các tin tức, điều này sẽ luôn mang lại lợi thế cho bạn, đặc biệt là khi nói đến các kim loại quý như vàng, giá của chúng có thể được xác định bởi nhiều yếu tố.

- Luôn tham gia vào một giao dịch được nghiên cứu đầy đủ.

Lời kết

Ngành công nghiệp vàng là một trong những ngành năng động nhất trong nền kinh tế toàn cầu, với thị trường rộng lớn và tăng trưởng liên tục trong những năm qua. Trong bài viết này, chúng ta đã cùng tìm hiểu về 3 trong số các tập đoàn cổ phiếu vàng hàng đầu sẽ giúp ích cho bạn khi giao dịch Cổ phiếu Vàng và trả lời các câu hỏi về việc mua cổ phiếu vàng ở đâu, đầu tư như thế nào.

Các tập đoàn này đều là những tập đoàn hàng đầu trong ngành công nghiệp vàng và kim loại với lượng fan đông đảo và trung thành, nhượng quyền thương mại mạnh mẽ và nhiều công nghệ đổi mới. Họ cũng đã mang lại hiệu suất tài chính và tiềm năng tăng trưởng ấn tượng trong những năm qua. Hãy bắt đầu đầu tư vào cổ phiếu vàng ngay hôm nay. Để làm như vậy, bạn nên tìm hiểu về các cổ phiếu vàng khác nhau và sử dụng một nền tảng giao dịch đáng tin cậy như VSTAR để giao dịch CFD vàng