The conflict escalated when Palestinian militant group Hamas launched a multi-pronged attack on Israel, including land, sea, and air incursions. Thousands of rockets were fired from Gaza into Israel. While both Israel and Palestine are not major oil producers, the conflict is unfolding in a region critical to the world's oil supply. The following analysis assesses the current situation, potential scenarios, and their implications for crude oil prices.

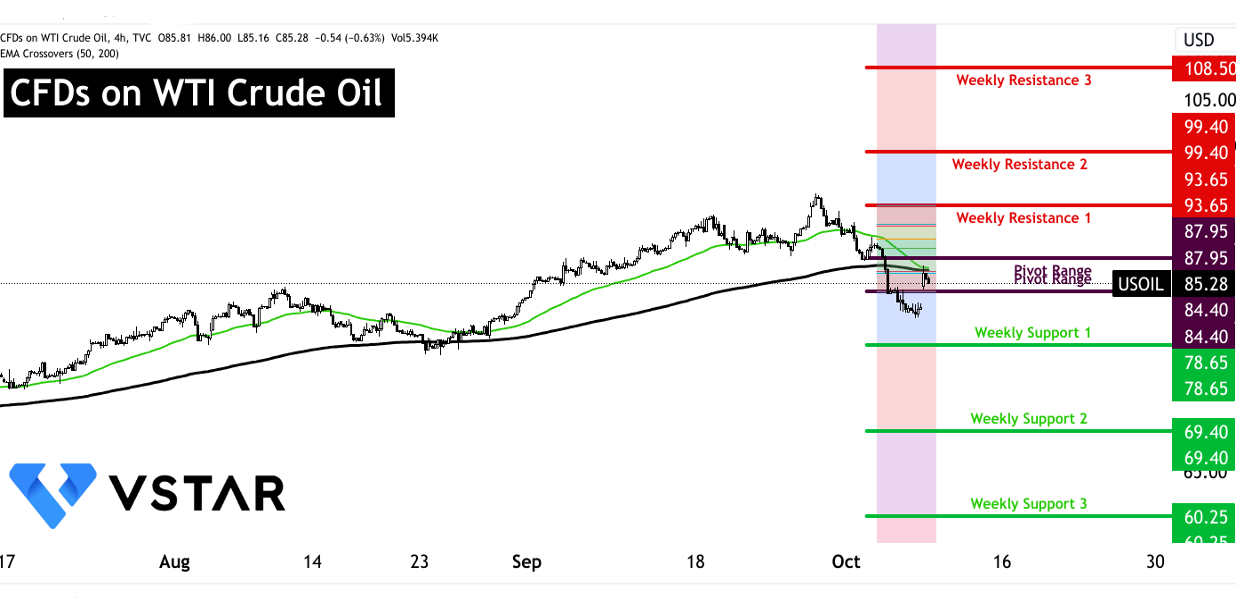

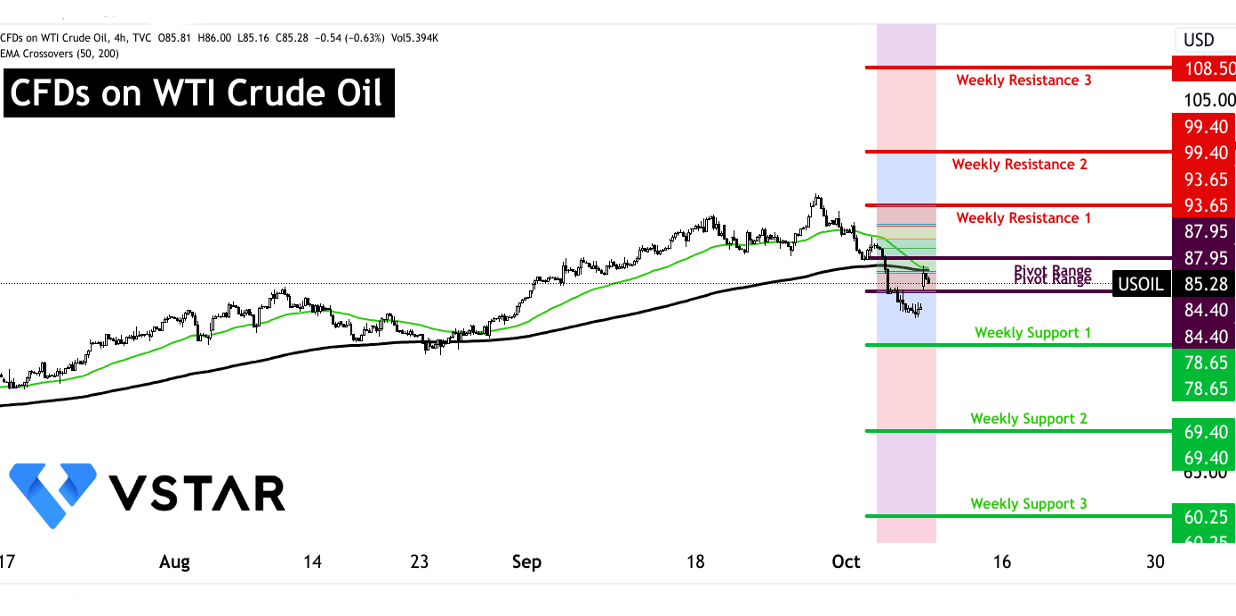

Current Crude Oil Price Levels

Before delving into the conflict's impact, let's review the current crude oil price levels:

- Weekly Resistance 3 (Extreme Volatility): $108.50

- Weekly Resistance 2 (Current Volatility): $99.40

- Weekly Resistance 1 (Immediate Price Reaction): $93.65

- Weekly Pivot Range: $87.95 to $84.40

- Weekly Support 1 (Immediate Price Reaction): $78.65

- Weekly Support 2 (Current Volatility): $69.40

- Weekly Support 3 (Extreme Volatility): $60.25

The continuous weekly technical developments can be observed on vstar.com.

Immediate Impact on Crude Oil Prices

A considerable reaction in crude oil prices may be possible due to the conflict. However, this reaction is likely to be temporary, primarily because neither Israel nor Palestine is a major oil producer. Israel has two oil refineries with minimal crude oil production, while the Palestinian territories do not produce oil.

Regional Concerns

The key concern lies in the conflict's proximity to oil-rich Iran, which could have far-reaching consequences. If Western countries officially link Iranian intelligence to the Hamas attack, Iran's oil supply and exports may face downside risks. Sanctions imposed by the U.S. in 2018 have already limited Iran's oil exports, but recent developments and secret nuclear talks have raised concerns about increased production.

Potential Escalation

The risk of regional escalation looms large. Hezbollah, a Lebanese militant group, launched attacks near the Lebanese-Syrian border and the Israeli-occupied Golan Heights. Should the conflict involve Hezbollah or lead to U.S. sanctions on Iranian exports, crude oil prices could spike. But technically, crude oil can become volatile in both directions.

Critical Chokepoint

The Strait of Hormuz, through which 40% of world oil exports pass, adds another layer of vulnerability. A conflict between Israel and Iran could disrupt this critical chokepoint, which may lead to a major price swing in oil prices. Additionally, if Hezbollah gets involved, the impact could be more severe.

Oil Market Resilience

Despite the immediate tensions, the overall impact on oil markets will likely remain limited as long as the conflict doesn't escalate into a broader regional war. While Israel and Palestine are not major oil players, the region's strategic importance cannot be ignored.

Long-Term Implications

While the conflict may result in short-term price spikes, it is unlikely to have a sustained impact on global oil markets unless it triggers a larger regional war involving major players like the US and Iran. Global oil inventories are relatively low, and production cuts by OPEC leaders Saudi Arabia and Russia are expected to lead to further inventory reductions in the coming months.

In conclusion, the Israeli-Palestinian conflict has the potential to create short-term volatility in crude oil prices, but its lasting impact depends on whether it escalates into a broader regional conflict. The world may be closely watching developments in the Middle East, as any significant disruption to oil supplies or transit routes could have far-reaching consequences for global energy markets. Investors, therefore, must remain vigilant and monitor the situation for potential market shifts.

The technical perspective on the weekly moves of CFDs on WTI crude oil can be comprehended as follows:

Source: tradingview.com