I. Recent Intel Stock Performance

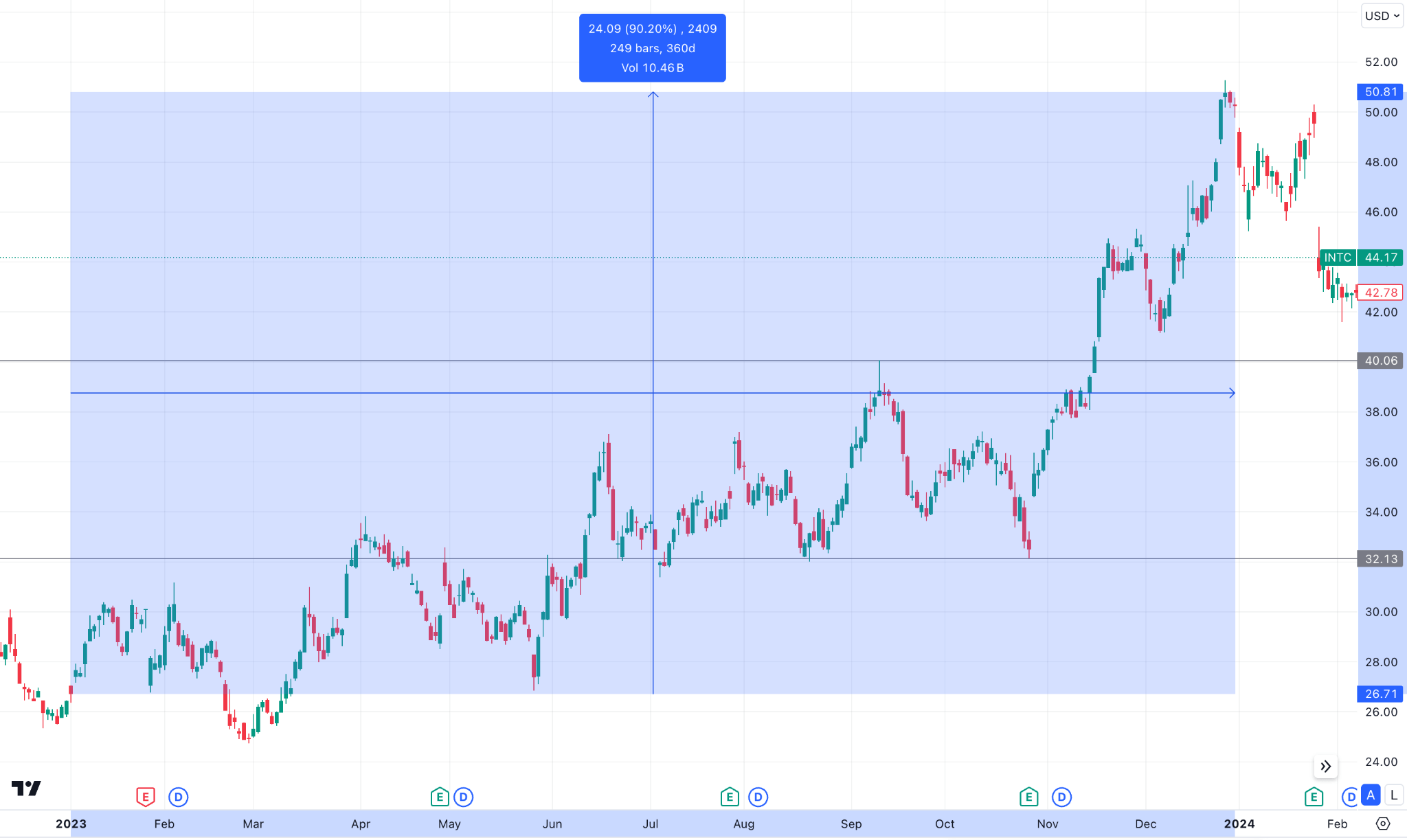

The shares of the semiconductor giant Intel (INTC 0.91%) increased by 90.1% in 2023, according to S&P Global Market Intelligence. This exceptional resurgence occurred subsequent to the stock stagnating at attractive prices due to economic uncertainties and intense competition. Furthermore, numerous Intel investors retained concerns regarding the organization's novel strategic trajectory.

On the contrary, 2023 emerged as a pivotal year for Intel, distinguished by a sustained surge in robust financial performance and the successful resolution of previous obstacles. The organization leveraged the expanding market for artificial intelligence (AI), which contributed to its continued prosperity.

Although Intel's stock price doubling within a year after a substantial decline may appear to be an unequivocal triumph, this performance must be viewed in context. Notwithstanding the noteworthy resurgence, the stock reverted to its levels from 2021, albeit with considerably more optimistic long-term outlooks.

Intel Stock (INTC) Insider Activity

CEO Patrick P. Gelsinger has recently engaged in substantial acquisitions of Intel stock.

He acquired an additional 3,000 shares of Intel stock on January 29, 2024, for a total of $130,080, at an average price of $43.36 per share. Following this transaction, he presently holds 28,475 shares, estimated to be worth $1,234,676. At this moment, insiders hold 0.04% of the company's stock. As of February 1st, 2024, he successfully bought 2,800 shares for a cumulative sum of $119,672 at an average price of $42.74 per share. Gelsinger now possesses 31,275 shares of the company, valued at $1,336,693.50, as a result of this acquisition. The document containing the disclosure of this transaction was submitted to the SEC.

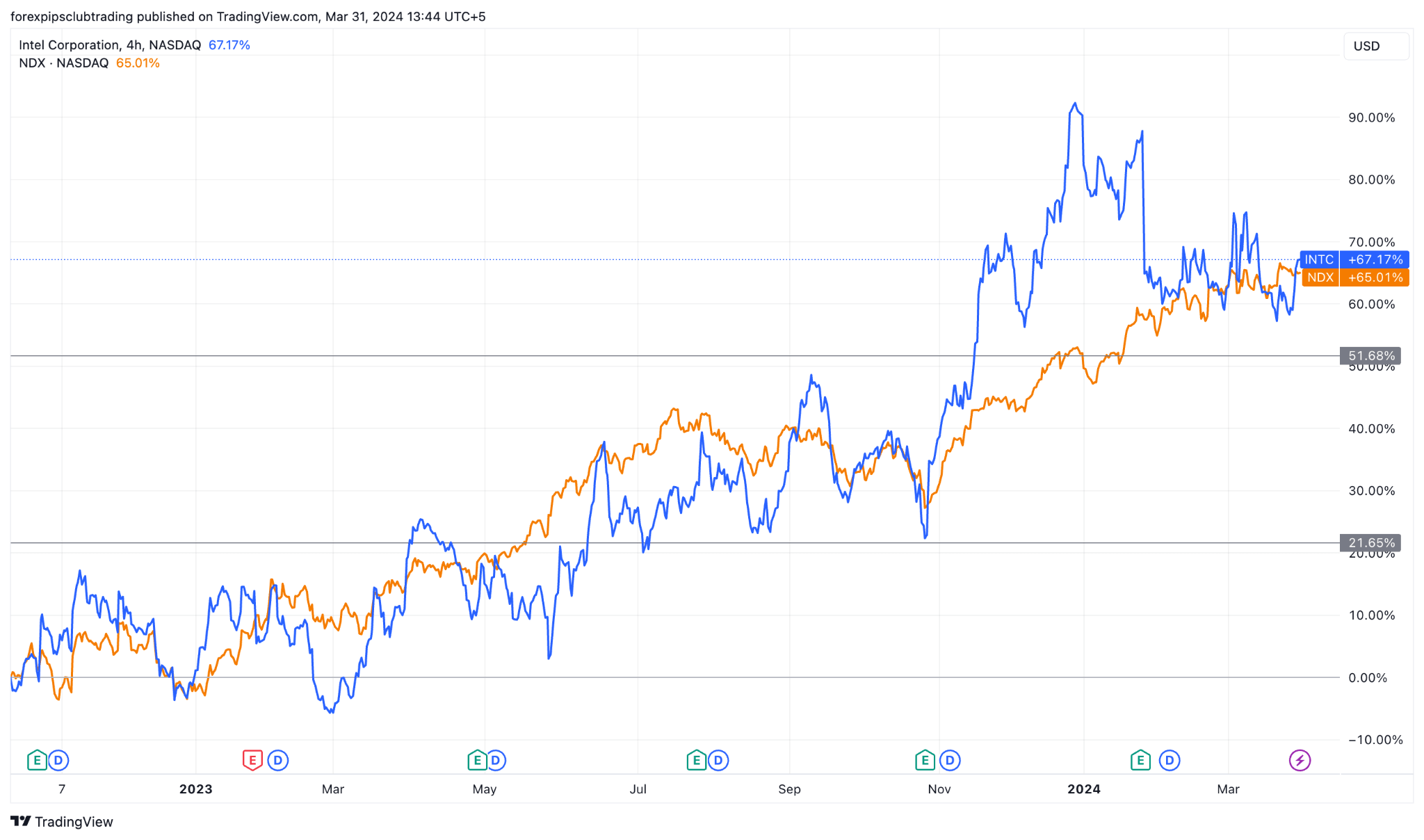

Intel Stock (INTC) Inline With Nasdaq 100

Intel Stock (INTC) provided a 67.17% gain in the last 365 days, which is slightly higher than the NASDAQ 100's 65.01% gain. However, the INTC reached a peak within 2023, showing an upbeat return compared to major indices.

Intel Stock (INTC) Key Product Developments

Following a phase competitive threat from Advanced Micro Devices, Intel now seems positioned to experience a resurgence. Following his inauguration as CEO in 2021, Gelsinger has established lofty objectives:

- Attaining technical parity with rivals by 2024

- Seizing the technical leadership position by 2025

December 2023 saw the introduction of Intel's most recent products, the Meteor Lake mobile processors and Emerald Rapids Xeon processors, in pursuit of these objectives. According to analysts, the performance of Intel's CPUs has not yet reached parity with AMD's offerings.

However, Emerald Rapids exhibits superior performance in specific domains for workloads involving artificial intelligence inference than its AMD counterpart. Furthermore, despite Meteor Lake's comparatively inferior CPU performance to AMD's, its integrated GPU (iGPU) exhibits potential in contrast to AMD's Ryzen 7040 Phoenix. These developments bring Intel closer to achieving its technical parity goals by 2024.

Expert Insights on Intel Stock Forecast for 2024, 2025, 2030, and Beyond

Considering the ongoing price action in INTC, investors might expect a surge in the coming years. Let's see the complete outlook of this stock based on technical and fundamental perspectives.

Before providing a further outlook on this stock, let's see the list of analysts' opinions based on different projections:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$44.79 |

$55.30 |

$98.71 |

|

Coincodex |

$42.15 |

$ 48.94 |

$ 81.74 |

|

Stockscan |

$59.87 |

$69.61 |

$69.94 |

II. Intel Stock Forecast 2024

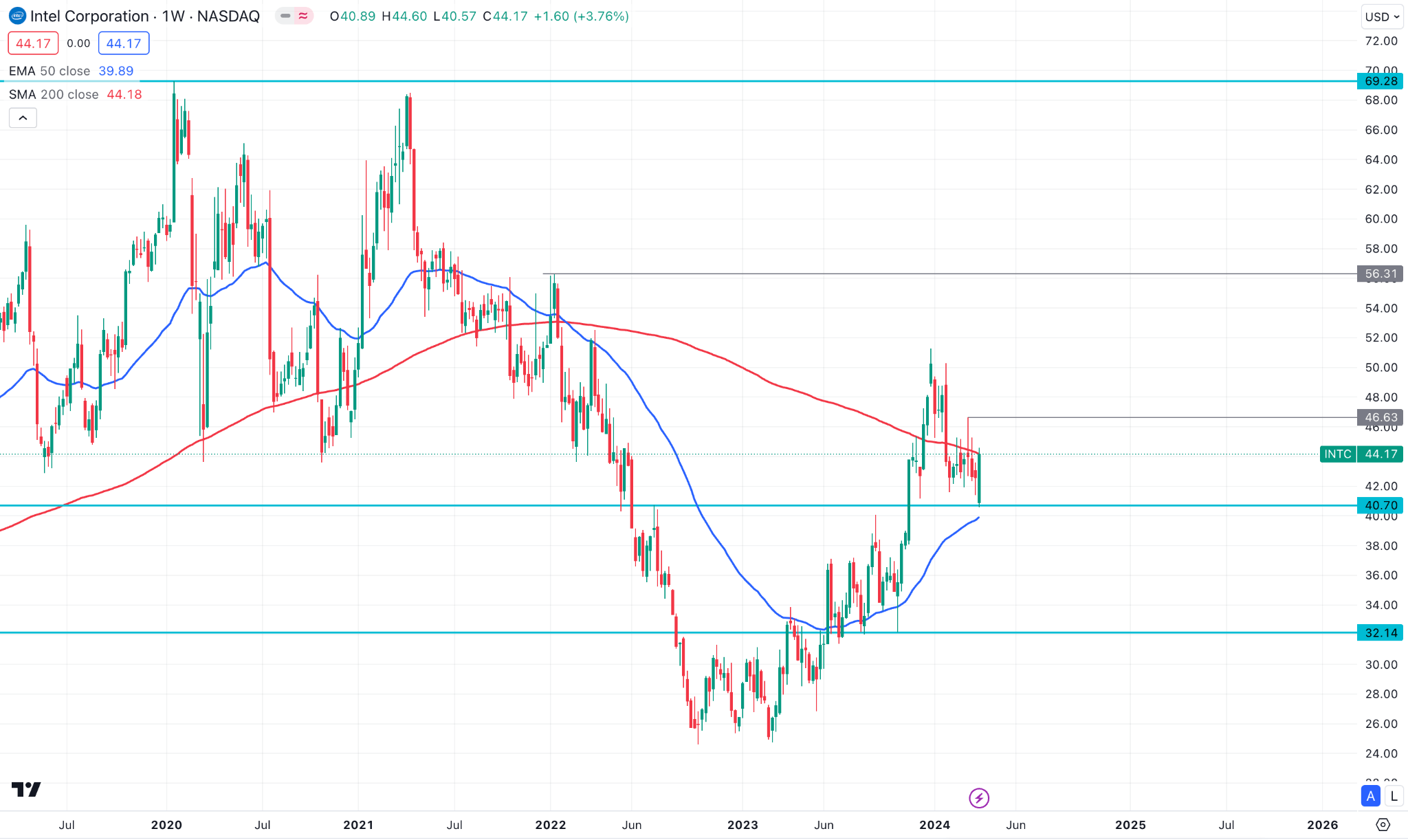

Intel Stock (INTC) showed a solid rebound from a valid bottom from where an upward continuation is potent. Following the ongoing price surge, investors might expect the price to reach the 64.00 psychological level by the end of 2024.

In the weekly chart of INTC, the existing selling pressure found a bottom at the 24.75 level before the end of 2023. Instead of making a bearish continuation, the price showed a rebound from the double-bottom pattern in 2024.

As a result, there was solid upside pressure with a stable market formed above the 20-week Exponential Moving Average level, suggesting a stable minor trend. Moreover, the 100-week SMA is also below the current price, working as a confluence support to bulls.

In the recent price, a bullish pennant pattern is visible, where the recent price hovers below the symmetrical triangle pattern. Therefore, a valid bullish continuation with a weekly candle above the 50.00 psychological line could work as a conservative long signal for Intel stock price prediction 2024, targeting the 68.00 level.

On the other hand, the conservative trading approach is to seek bearish opportunities, after having a valid selling pressure and a consolidation below the 40.04 event level.

Let's see what other technical indicators signal about the INTC stock forecast for 2024:

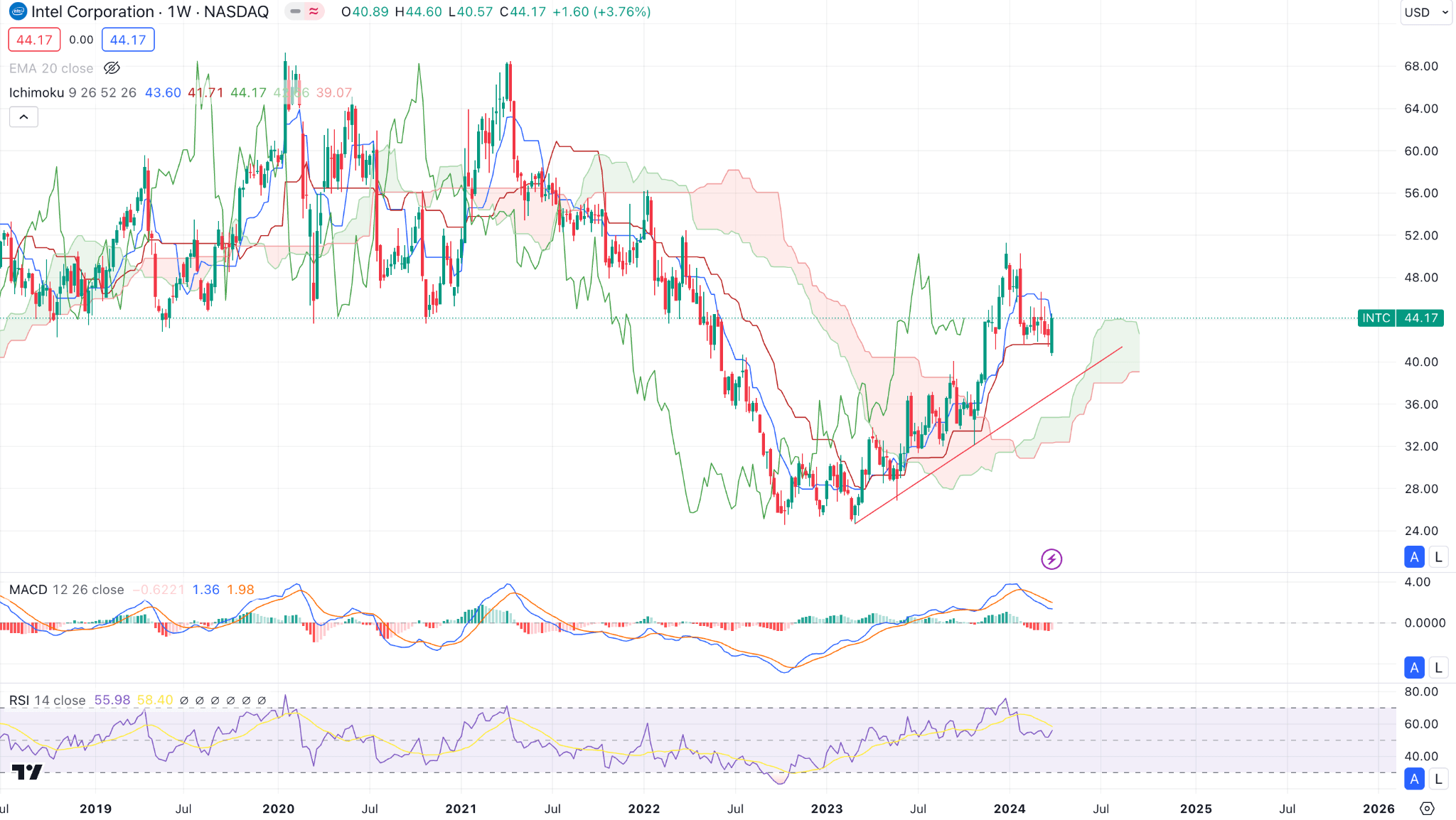

- MACD: On the weekly INTC chart, the MACD Histogram showed a bullish rebound above the neutral line, suggesting an ongoing bullish trend. Moreover, the signal line shows a bullish crossover below the neutral area, providing an additional bullish signal from the bottom.

- Ichimoku Cloud: The recent price trades are below the Ichimoku Cloud zone but are aimed higher above the dynamic Kijun Sen level. Moreover, the ongoing buying pressure took the price to the Cloud resistance, from where a bullish breakout is potent. Investors should closely monitor how the price trades at the 46.00 to 48.00 zone from where a bullish breakout could validate the trend reversal.

- Relative Strength Index (RSI): In the current reading, the Relative Strength Index (RSI) rebounded above the 50.00 line, showing bullish pressure in the broader market. Therefore, the buying pressure in this stock is potent as long as the RSI hovers above the 50.00 line, which can potentially reach the 70.00 to 80.00 area soon.

A. Other INTC Stock Forecast 2024 Insights: Is Intel a good stock to buy?

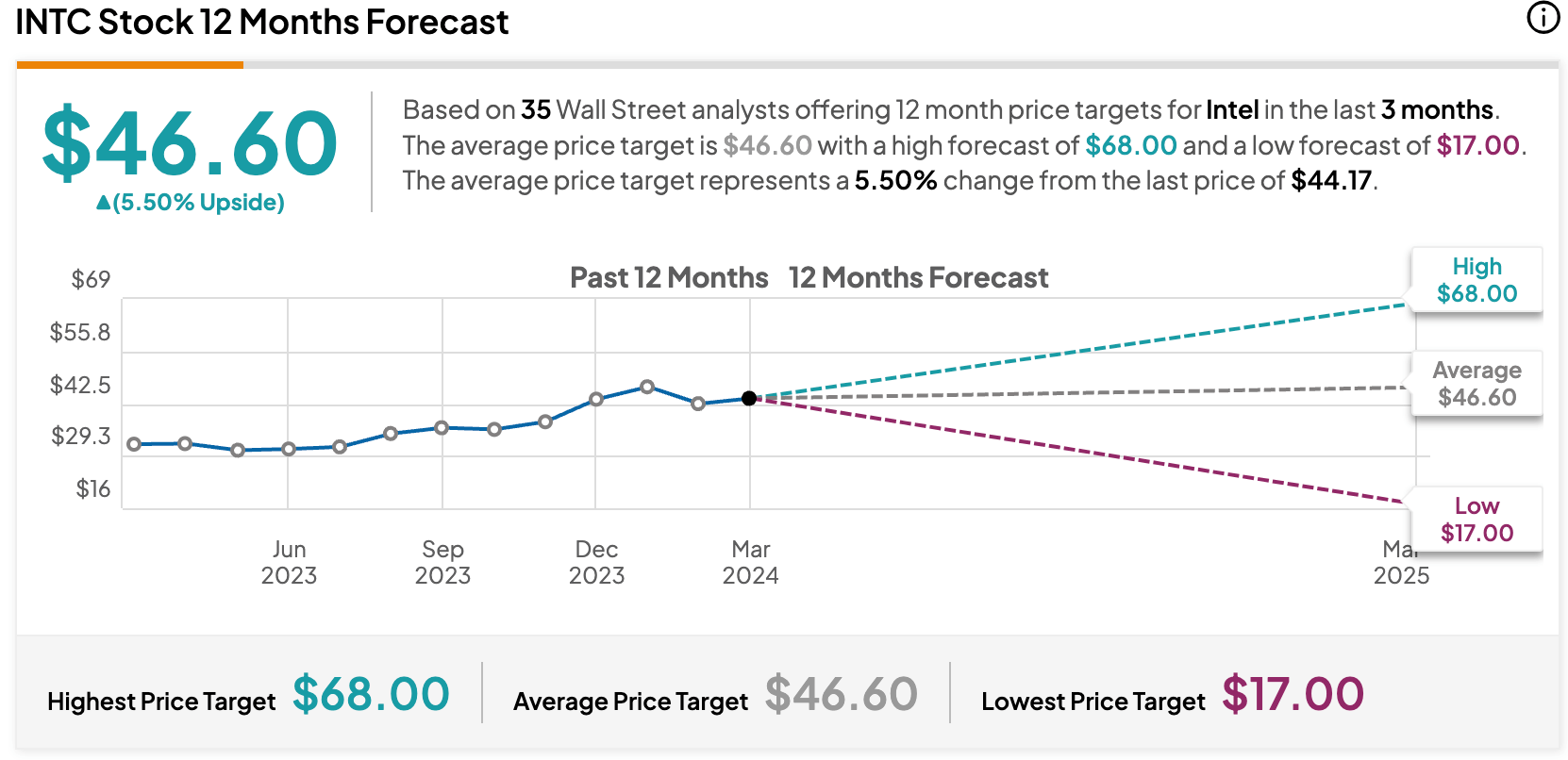

According to data compiled from 35 Wall Street analysts over the past three months, Intel's projected 12-month price targets have been assessed. The average INTC price target stands at $46.60, with a high INTC forecast of $68.00 and a low Intel forecast of $17.00. This average Intel stock price target indicates a 5.50% variance from the most recent price of $44.17.

Among other INTC Stock Forecast 2024 Insights, some remarkable analyses are:

- Gov Capital: Remains bullish about INTC and suggests a 120% gain from $36.2–$94.78.

- WalletInvestor: Suggests a bullish continuation throughout the year, with an aim to reach the $33.99-$43.18price area in 2024.

B. Key Factors to Watch for Intel Stock Prediction 2024

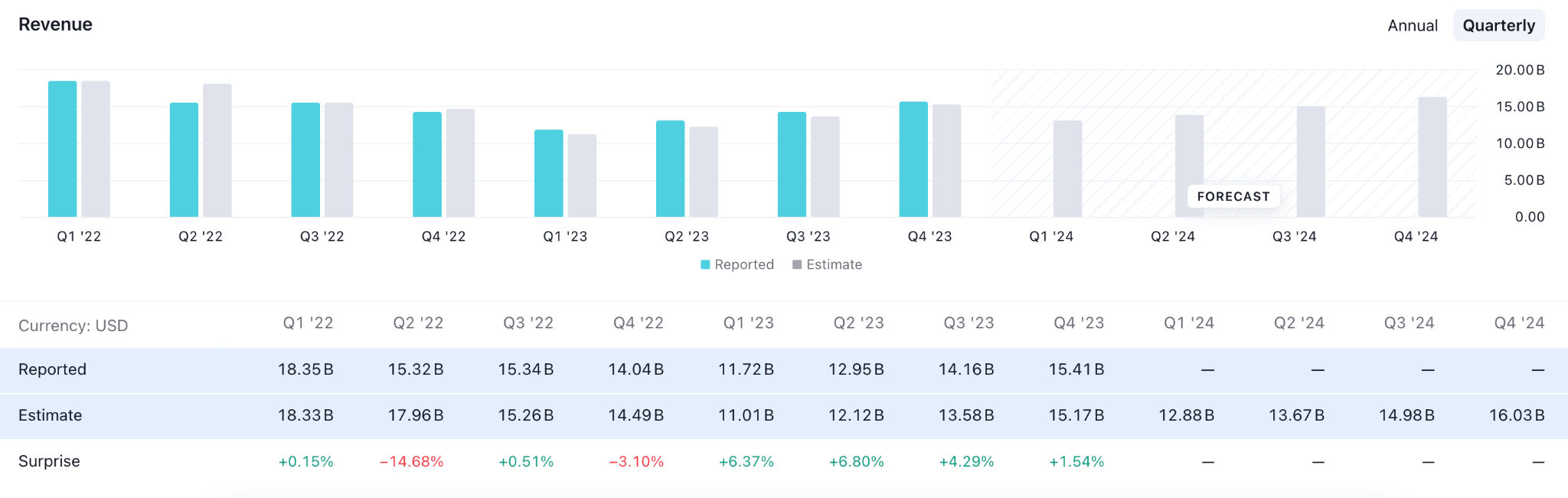

Intel Stock (INTC) Revenue Segment

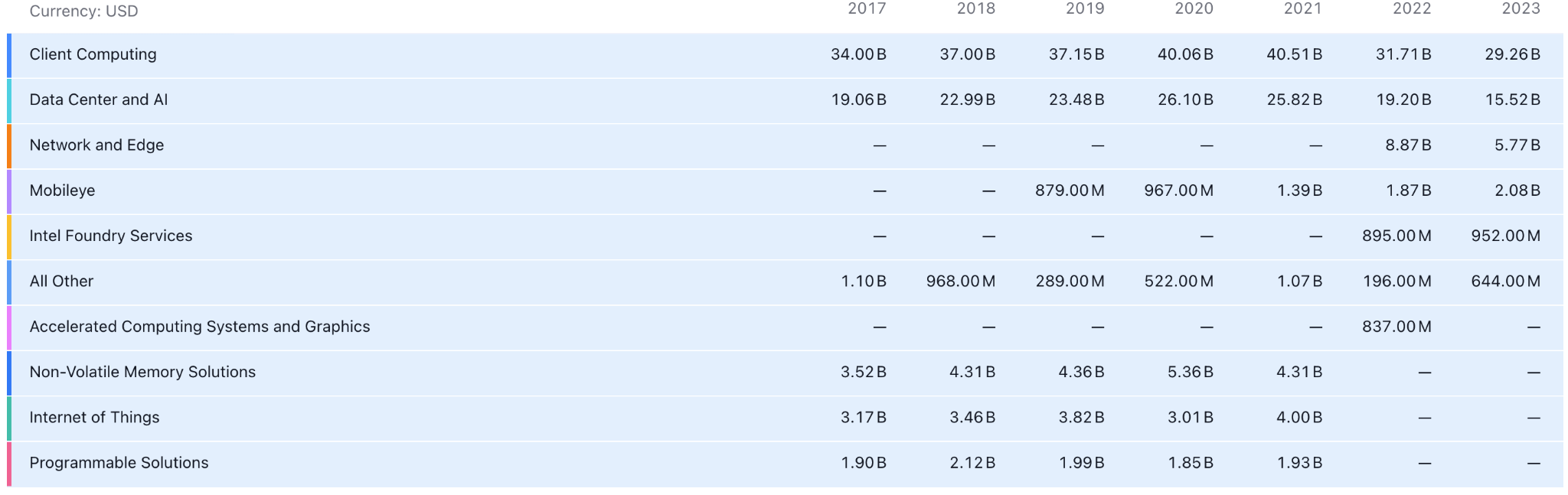

Client computing remains the key revenue generator for Intel Stock (INTC), where this segment's revenue came at $29.26 billion in 2023, down from $31.71 billion in 2022.

As per the above image, the revenue segment failed to show an optimistic outlook as no significant surge is needed in the recent quarters. If the company maintains this downbeat pressure, INTC might struggle to form a long signal in 2024.

INTC Earnings Forecast In 2024

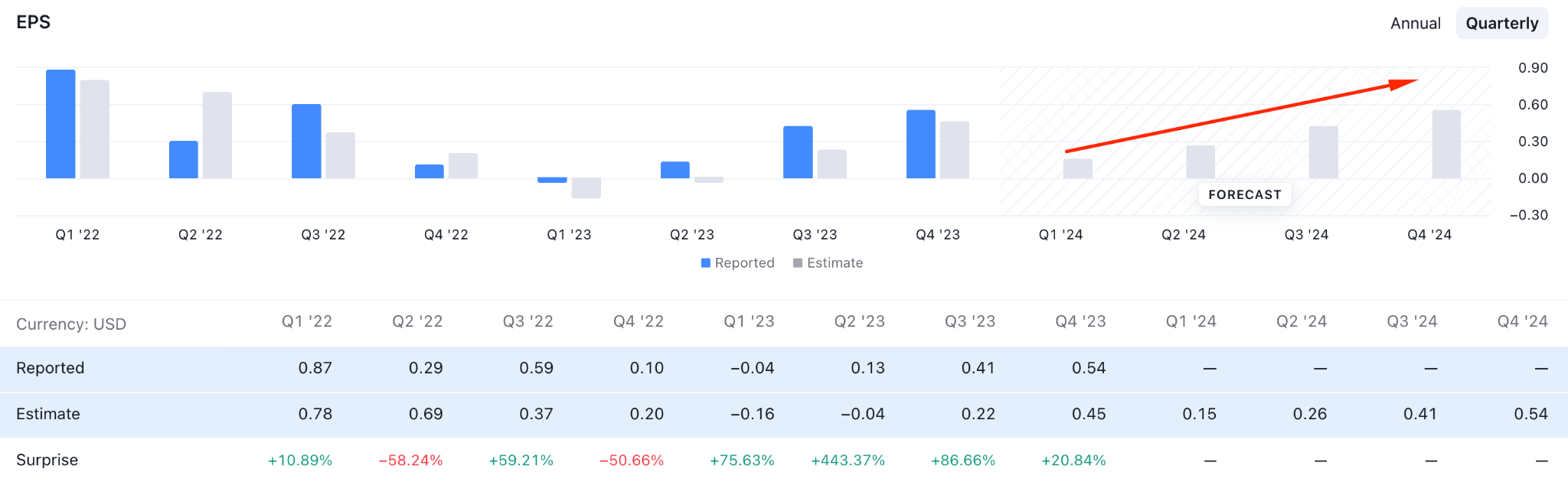

In the latest quarterly Intel earnings report, INTC showed a valid bottom in Q1 2023, from where an upbeat pressure in Earnings Per share is visible.

In Q2 2023, investors experienced a positive return at $0.13, surpassing the forecast of $-0.04. Following the trend, Q4 2023 showed a $0.54 in Earnings, which is an upbeat result of the $0.45 forecast.

In the NASDAQ:INTC financials forecast in 2024, the earnings report could maintain the upside momentum and provide $0.54 a share in Q4 2024.

Intel Stock (INTC) Liquidity Structure

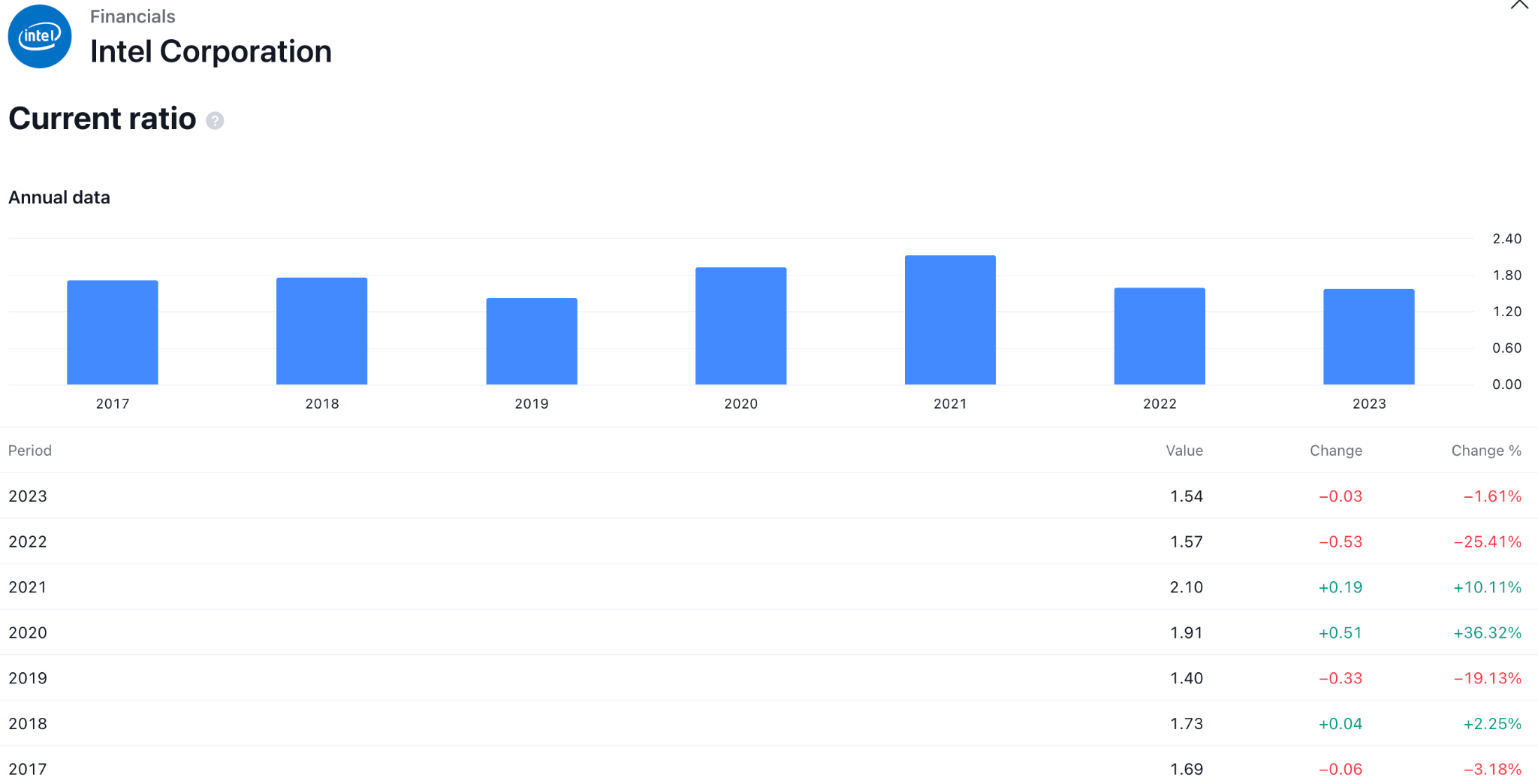

In the recent readings, Intel Stock (INTC) showed a stable business operation as its Current Ratio remained stable for a considerable time.

In the last four years, the Ratio peaked in 2021, reaching the 2.10 level and ending up in 2023 at 1.54.

As per the above image, INTC is more likely to remain a stable business as long as the Current ratio remains above the 1.00 satisfactory level. Moreover, the Quick Ratio in 2023 remains at 1.15 level, which is also in a satisfactory zone.

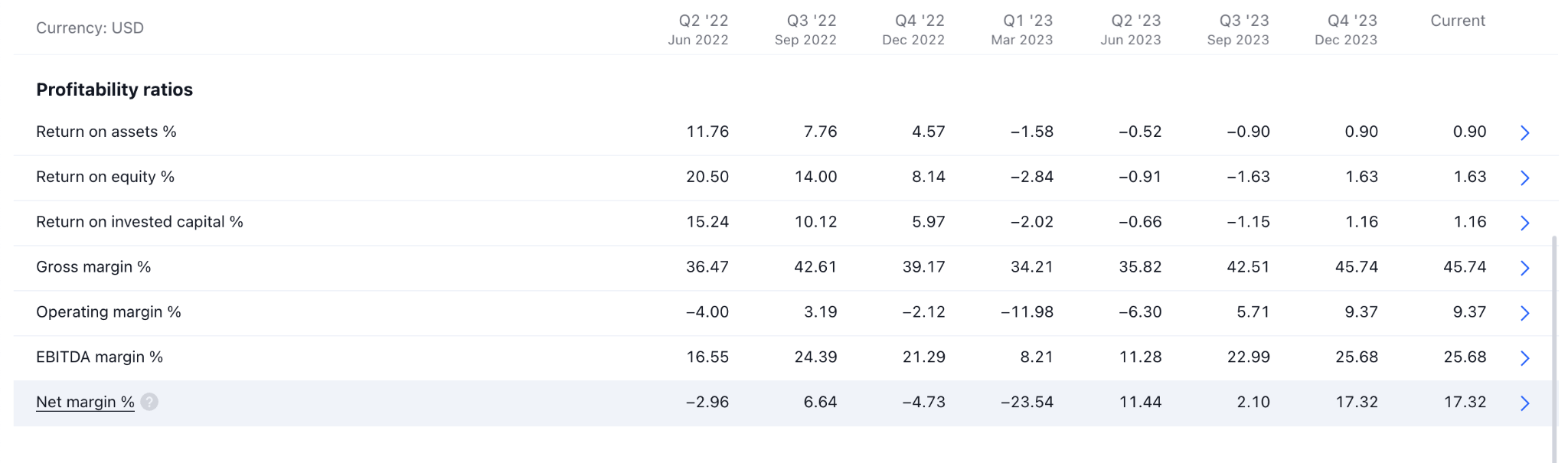

Intel Stock (INTC) Profitability Structure

Looking at the INTC profitability structure, the net profit margin rebounded in Q2 2023, as the number came at 11.44 after losing 23.54.

Following the trend, Q4 2023 showed a positive outlook, taking the net profit margin to $17.32 billion. Moreover, the Gross section remains stable above the 45% level in the last three quarters, possibly remaining upward in 2024.

In other profitability ratios, Return on Equity and Return on Assets remain above the 1.15 level, supporting the positive outlook about the company.

Intel Stock Forecast 2024 - Bullish Factors

Intel, among the select few chip design firms that possess substantial internal chip fabrication capabilities, has expanded its operations into the foundry sector by establishing Intel Foundry Services (IFS). Notwithstanding Intel's dependence on Taiwan Semiconductor (TSMC) for chip fabrication, the company's position as the leading domestic chip manufacturer in the United States confers strategic benefits in light of apprehensions surrounding Taiwan's preeminence in third-party chip manufacturing.

Significantly, IFS has been selected by Amazon and the U.S. Department of Defense for their manufacturing requirements.

In addition, Intel has made significant financial commitments towards the construction of manufacturing facilities in the European Union, Arizona, and Ohio, aided by government subsidies. By capitalizing on state-of-the-art manufacturing equipment supplied by ASML, Intel is positioned to present a future challenge to TSMC.

Intel's financial indicators indicate that the company may be undergoing a turnaround. The company encountered an initial nine-month revenue decline of 21% to reach $39 billion in 2023. However, this decline was reduced to 8% in the third quarter exclusively. Intel's net income of $297 million in the third quarter, which followed a loss of $980 million in the first three months, may indicate the company is nearing profitability again.

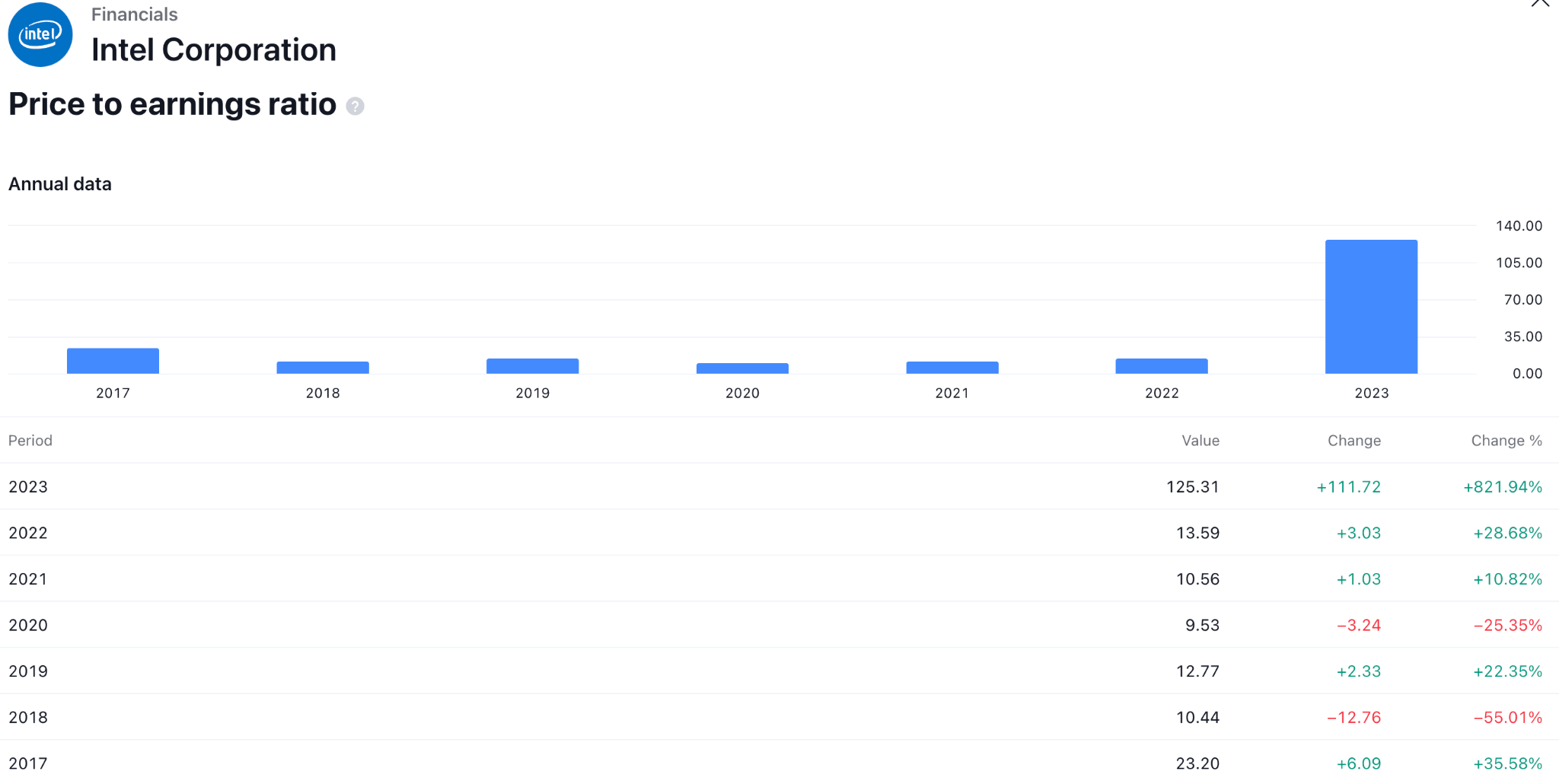

Intel PE Ratio

In response to the favorable market reaction, Intel's stock experienced a growth of around 70% in value compared to the previous year, resulting in a forward P/E ratio of 48. While the metric may have been exaggerated due to declining profits, Intel's price-to-sales (P/S) ratio of 4 indicates potential for additional expansion, especially if the company can restore positive revenue growth, in contrast to AMD's P/S of 10.

INTC Stock Forecast 2024 - Bearish Factors

The beta coefficient of Intel stock serves as a metric to assess the volatility exhibited by Intel stock compared to the systematic risk exhibited by the benchmark of your choice. Beta is defined mathematically as the incline of the regression line that is constructed using data points, with each data point representing the return of Intel stock relative to the specified market. In essence, the beta of 1.38 for Intel stock provides investors with an approximation of the potential risk that the stock might introduce to a pre-existing portfolio. Notwithstanding this, Intel exhibits exceptionally minimal volatility, as indicated by its skewness of -1.54 and kurtosis of 6.46.

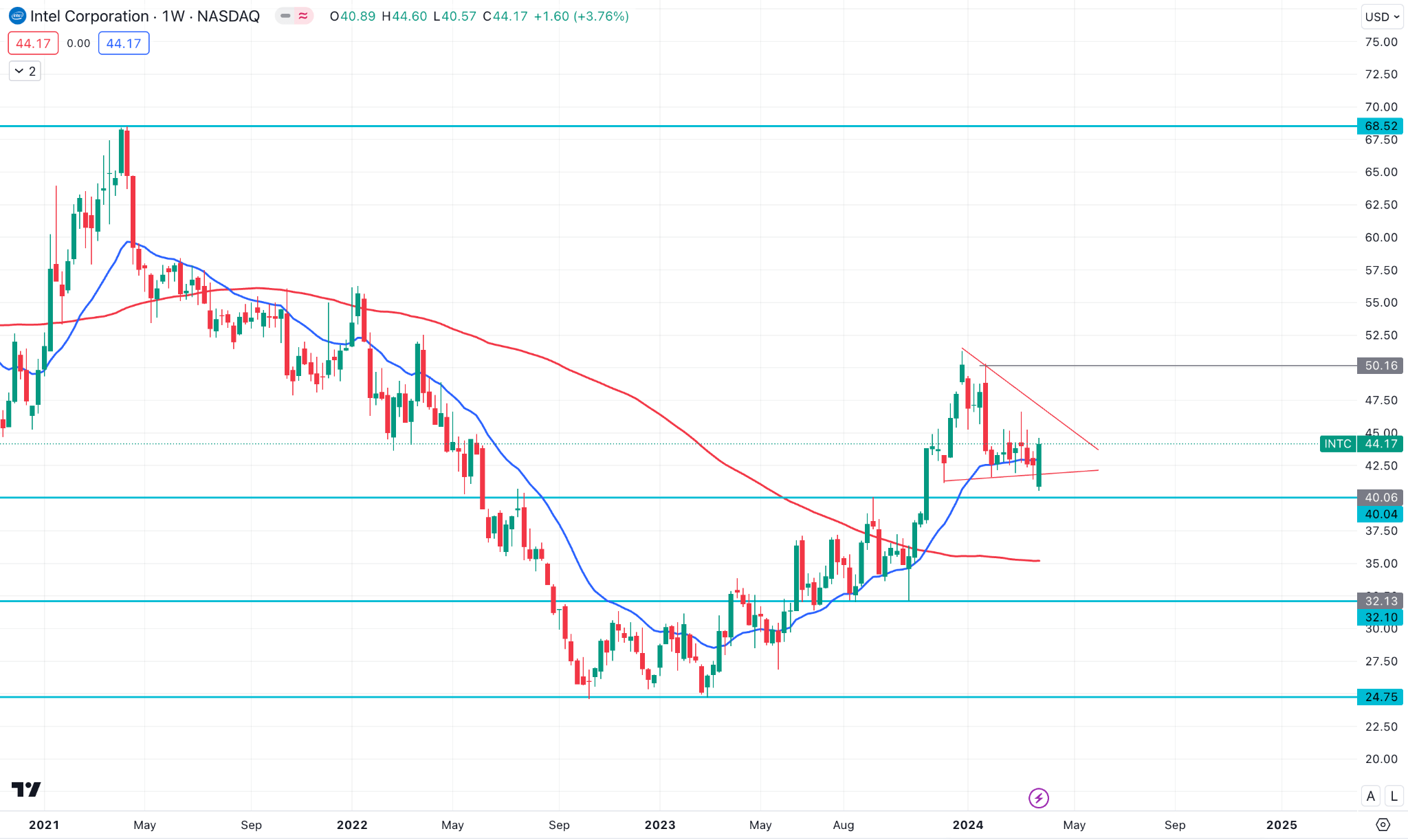

III. Intel Stock Forecast 2025

Intel stock trades sideways in the weekly price, where the dynamic 50-week EMA hovers below the current price. Following the ongoing bullish trend, a successful breakout with a Golden Cross formation can take the price toward the 70.00 high by the end of 2025.

In the weekly chart of INTC, the recent price consolidates at the top after creating a ceiling at the 51.20 high. As the current price hovers below this line, investors should closely monitor how it reacts at the resistance level.

The dynamic 200-week Simple Moving Average is still above the current price and is working as an immediate resistance. Moreover, the latest candle closed bullish after multiple doji formations, which could indicate a bullish reversal in the coming weeks.

Investors should closely monitor how the price trades below the 46.63 resistance level, which could work as a confluence bearish factor for this stock.

Based on the ongoing price action, a bullish surge with a weekly candle above the 47.00 level could be a valid long opportunity, targeting the 70.00 level. Beyond this level, the next crucial resistance to look at is the 100.00 psychological line.

Let's see the INTC Stock forecast for 2025, based on Ichimoku Cloud analysis:

According to the Ichimoku cloud, INTC trades are volatile above the Cloud area, suggesting buyers' presence in the market. However, the prolonged volatility at the top could result in a bearish reversal as the dynamic Kijun Sen is above the current price.

Based on this Intel stock outlook, a downside continuation is potent, where a valid bullish reversal from the dynamic Cloud zone could resume the existing trend at any time.

The alternative trading approach is to seek short opportunities after having a valid trend line breakout with a weekly close below the 32.00 level.

A. Other INTC Stock Forecast 2025 Insights: Intel stock buy or sell?

According to a report from Investorplace, Intel (INTC) has a strong position in high-end desktop chip making. Moreover, its presence in the hardware and data center could be a factor to consider this stock as a buy. Following the ongoing development, the price of INTC could move higher and reach the $85.00 level by the end of 2025.

Another report from Longforecast suggests that ongoing buying pressure might extend the price by 110%, tapping into the $94.63 level within 2025.

Among other INTC Stock Forecast 2025 Insights, some remarkable analyses are:

- Gov Capital: The approximate target area for Intel stock prediction 2025 is $67.12-$150.04, following the optimistic outlook with a 240% increase.

- WalletInvestor: Not a positive outlook - targeting the $25.192-$34.385 zone with a continued downward trajectory over a 30% decline.

B. Key Factors to Watch for Intel Stock Price Prediction 2025

Intel (INTC) Financial Position Analysis

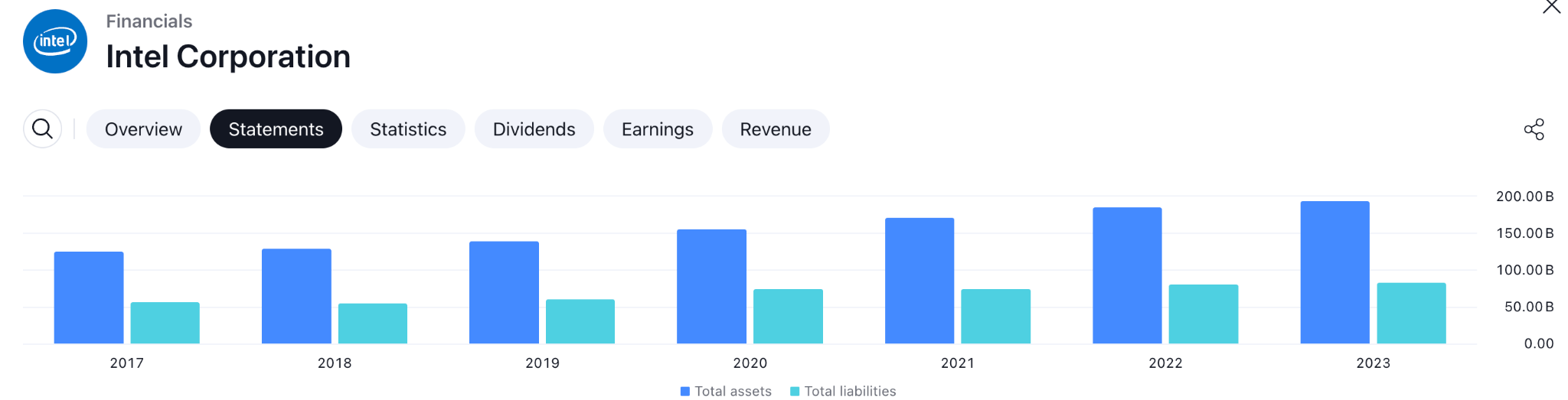

In recent years, Intel has maintained a stable asset position, where the ratio between asset and liability represents a positive outlook. The company had $123.29 billion in Assets, which increased to $191.52 billion in 2023.

On the contrary, the value of total liabilities increased from $54.23 billion in 2027 to $81.61 billion in 2023.

Considering the stability in the asset's position, the company is more likely to show business stability in 2025. Any uncertainty from the macroeconomic outlook might not affect the company's remaining insatiable.

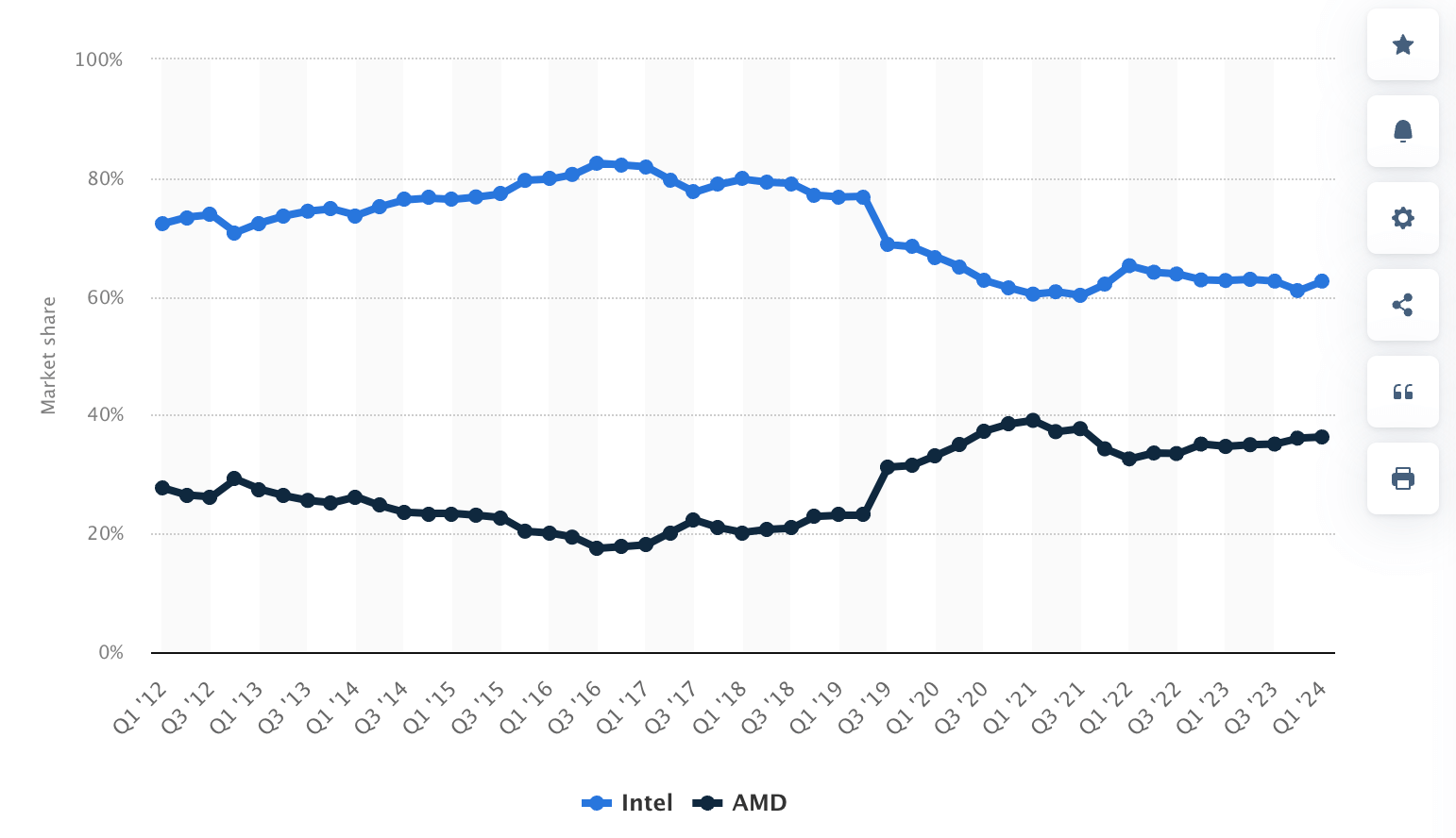

Intel's Presence In The CPU Market

Intel has a broader threat from AMD as the recent innovation suggests drawbacks of the company's increasing number of new generation CPUs.

Still, Intel holds 65% of the market share in the global CPU market, which indicates a clear market dominance.

"Arrow Lake" would be the next-generation CPU projected by Intel, which might work as a key price driver for Intel Stock (INTC). Investors should closely monitor how the company discloses its CPU launch, where any surprise regarding the size and speed could be a bullish signal.

Intel Takes The Lead In High-NA EUV

In a move marking its leadership in chipmaking technology, Intel became the first company to acquire a next-generation high-NA EUV (Extreme Ultraviolet) lithography tool from ASML in January 2024.

This technology boasts a significant advantage, like a 0.55 numerical aperture (NA) lens, compared to existing EUV tools (0.33 NA). This allows for even smaller features to be printed on processors, paving the way for denser and potentially more powerful chips.

Currently, Intel is assembling the high-NA EUV machine at their Oregon facility alongside ASML. While not yet in mass production, the technology is expected to be integrated into Intel's 18A process node sometime in 2025.

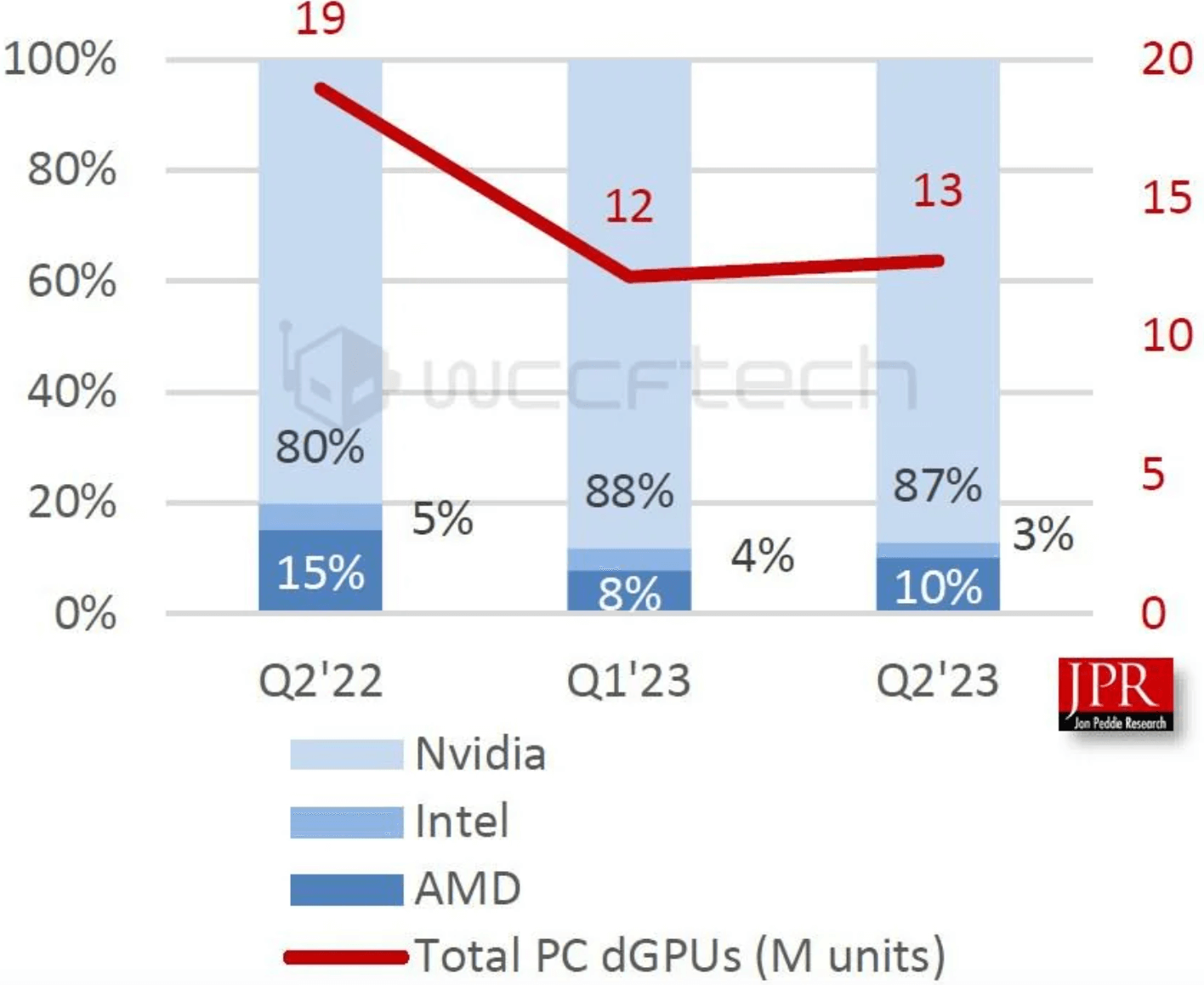

Can Intel (INTC) Dominate The GPU Market?

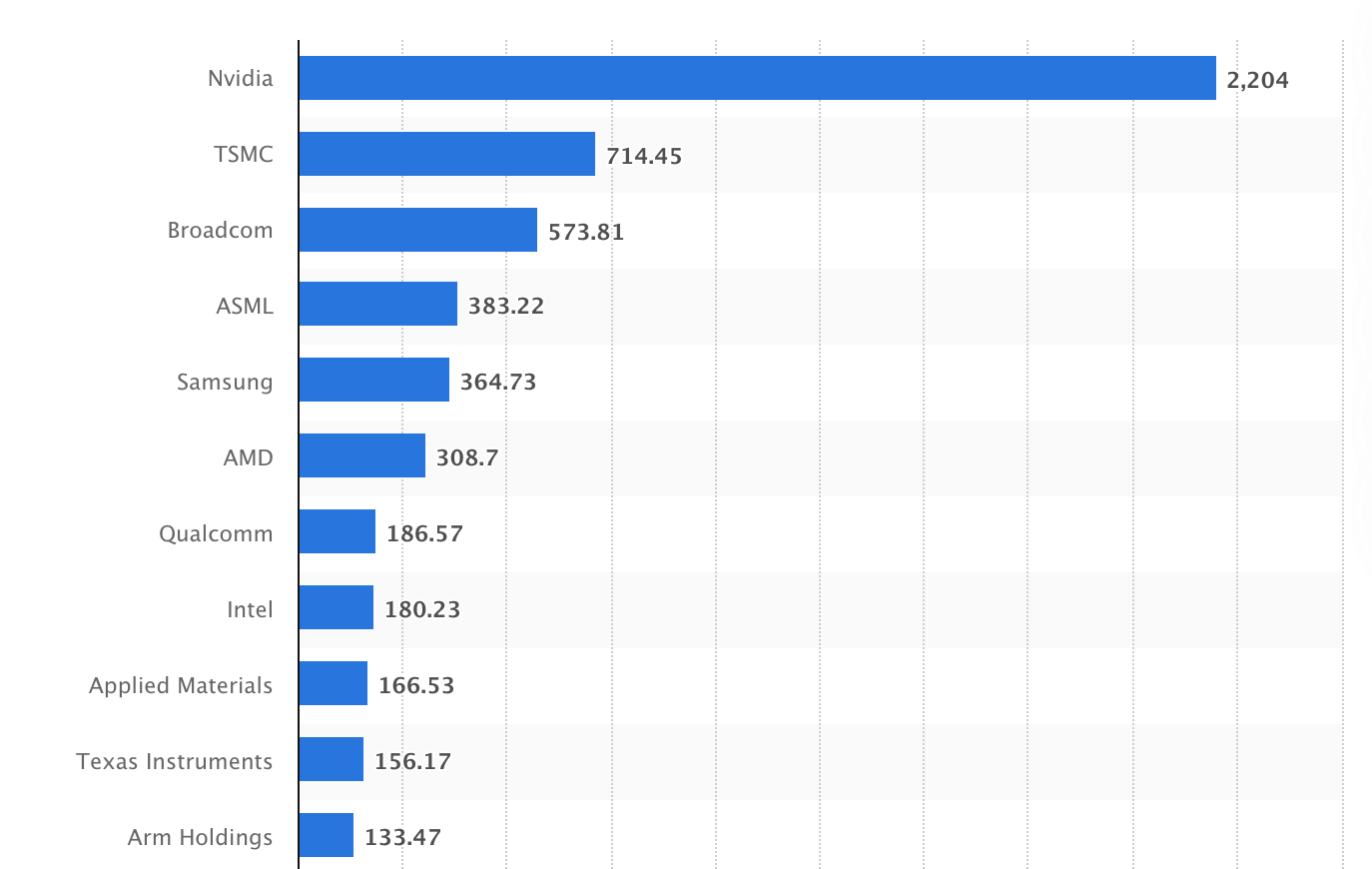

As per the latest news, Intel holds a 10% market share of the global GPU market, whereas Nvidia dominates the major at 87%.

Details regarding the "Battlemage"- codenamed next-generation Arc GPUs from Intel have surfaced. The prospective nature of these offerings in the second half of 2024 places them in the lower-end to mid-range category. Leaks indicate potential integration into forthcoming Lunar Lake mobile CPUs by the end of 2024 and enhanced performance.

Intel Stock Forecast 2025 - Bullish Factors

As predicted previously, Intel's procurement of Habana Labs in 2019 is playing a crucial role in establishing the company as a major contender in artificial intelligence (AI), albeit with a more protracted gestation period than originally anticipated.

Intel demonstrated the capabilities of its new Xeon chip, which was accompanied by the "new AMX (Advanced Matrix Extensions) AI accelerator engine," at a recent event.

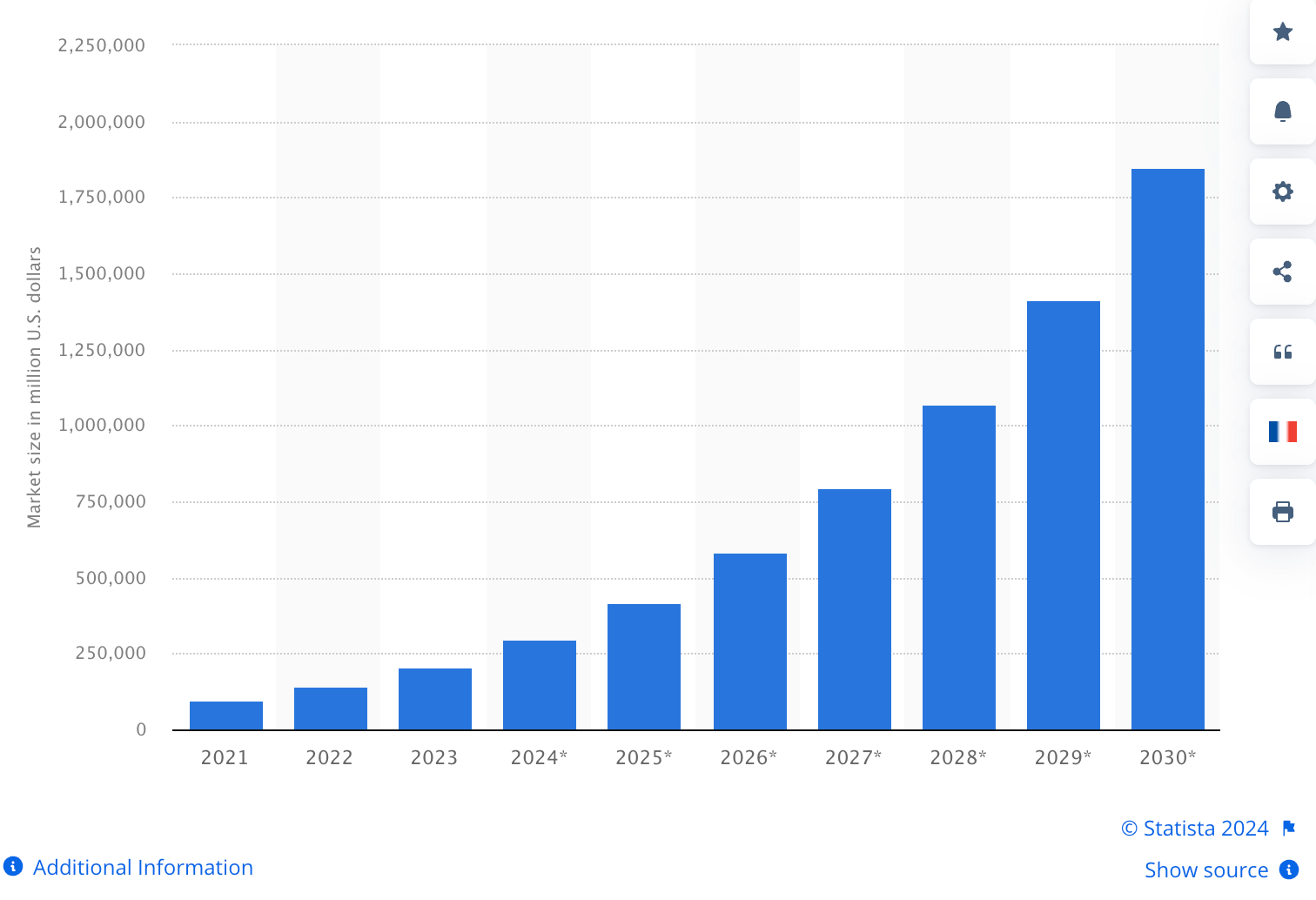

The enormous potential of artificial intelligence, along with its expected functionalities and real-world implementations, highlights a substantial advantage for the technology, consequently stimulating considerable demand.

According to projections by Statista, the value of the worldwide artificial intelligence (AI) market is expected to increase by over two-thirds from the present year to 2025, peaking at an estimated $420.5 billion in the latter portion of that decade.

Investors should closely monitor how Intel (INTC) shows its presence in Artificial Intelligence (AI), where any positive presence in this field could be a bullish factor for this stock.

Intel Stock Price Prediction 2025 - Bearish Factors

Advanced Micro Devices (AMD) presents a substantial challenge to Intel's prevailing position in the central processing unit (CPU) industry, particularly in high-performance computing and data centers. AMD's consistent market share gains may hinder Intel's growth trajectory; therefore, strategic responses are required to maintain competitiveness.

Intel encounters significant competition in the GPU market from well-established competitors such as Nvidia. Although Intel's Arc GPUs signify advancements, an inability to secure a portion of the market successfully could compromise the company's overarching GPU strategy.

In addition, manufacturing difficulties exacerbate Intel's competitive environment. The worldwide scarcity of chips, which is expected to abate by 2025, continues to impede manufacturing operations and may impede Intel's capacity to satisfy market requirements adequately.

Moreover, integrating cutting-edge technologies such as High-NA EUV by Intel, especially when combined with novel transistor architectures like GAAFET in the 18A process, presents potential obstacles in the form of delays or production complications.

These complications add to Intel's already complex manufacturing efforts and market positioning.

IV. Intel Stock Forecast 2030 and Beyond

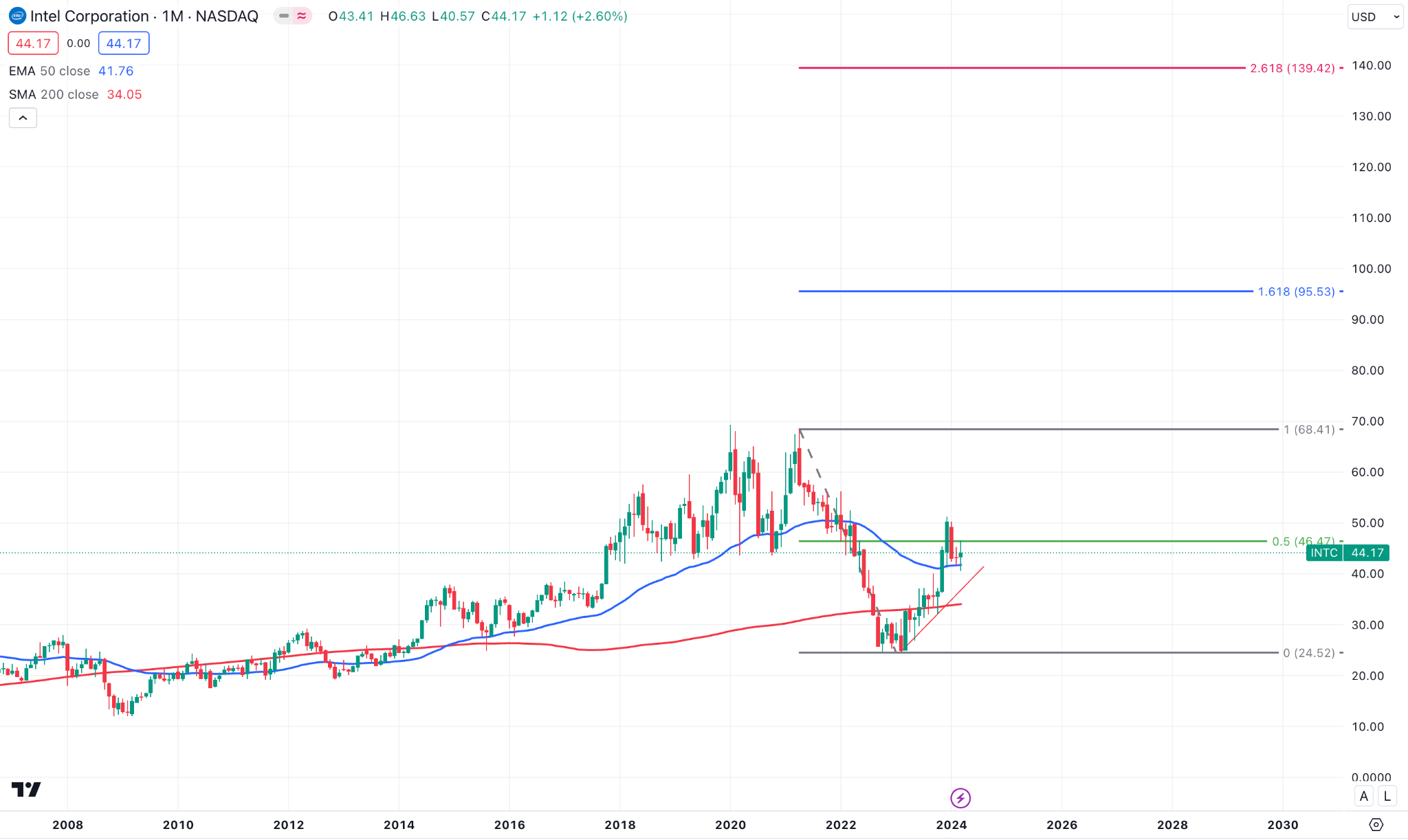

Intel Stock (INTC) remains range bound for a considerable time, suggesting a potential breakout possibility. Considering the ongoing bullish pressure, supported by the rising trendline support, could take the price toward the 139.42 level after a successful breakout above the 68.41 level.

In the monthly time frame, Intel Stock (INTC) remains bullish above the dynamic 20-month EMA, while the 100-month SMA is a major support.

Considering the prolonged selling pressure from the 68.41 high to the 24.52 low suggests a strong breakout possibility. A valid buying pressure above the 70.00 level could extend the upward momentum toward the 281.8% Fibonacci Extension level.

Let's see what other technical indicators signal about the INTC stock forecast for 2030 and Beyond:

- MACD: On the weekly INTC chart, the MACD Histogram remains stable above the neutral line after ten consecutive months, which suggests a stable bullish trend. Moreover, after forming a bottom, the signal line touched the neutral level, which might work as a bullish confluence factor.

- Ichimoku Cloud: The monthly chart shows a bullish correction, where the major trend remains bearish below the Cloud zone. A bullish crossover is visible from the Kijun Sen line, suggesting a minor upward pressure. However, a valid bullish trend might need a stable market above the 56.00 level with a cloud breakout.

- Relative Strength Index (RSI): The 14-month RSI shows a bullish rebound where the recent reading remains solid above the 50.00 line. A successful upward pressure above the 65.00 line could signal a stable market trend in the main chart.

A. Other INTC Stock Forecast 2030 and Beyond Insights: Is Intel a buy?

According to a recent report from 247wallst, Intel Stock (INTC) has a higher possibility of providing a positive outlook and reaching the $100.00 level by the end of 2030. However, bullish and bearish cases are potent from the analyst, suggesting a macro view as shown below:

- INTC Stock Forecast 2030 and Beyond (bull case): $186.00

- INTC Stock Forecast 2030 and Beyond (bear case): $109.00

Among other INTC Stock Forecast 2030 and Beyond Insights, some remarkable analyses are:

- WalletInvestor: The firm projects a bearish forecast of this stock, which might come below the $1 level before 2030.

B. Key Factors to Watch for Intel Stock Price Prediction 2030 and Beyond

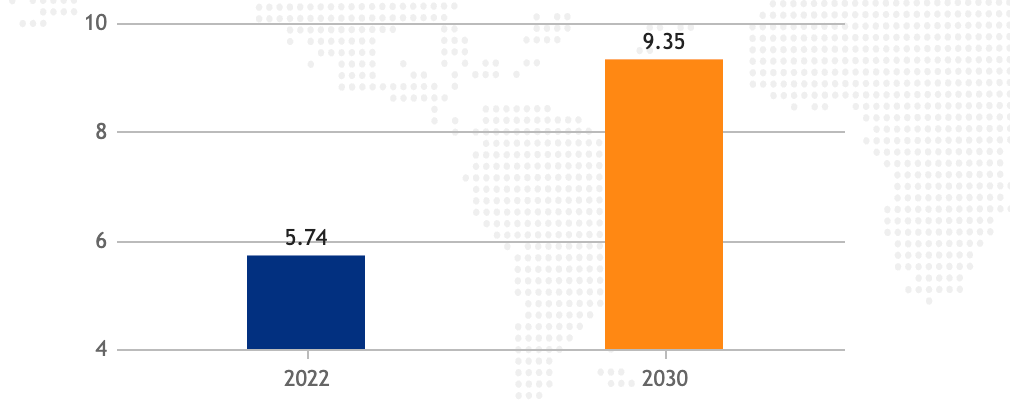

Intel's Dominance In Personal Computer (PC)

Intel's core business is the personal computer, where an upward surge has been visible in recent years. Following the 6.5% CAGR, investors might expect the PC market cap to reach $9.35 billion in 2030.

As Intel has a strong market cap in the personal computer sector, the expansion in the market cap could indicate a stable revenue from this field.

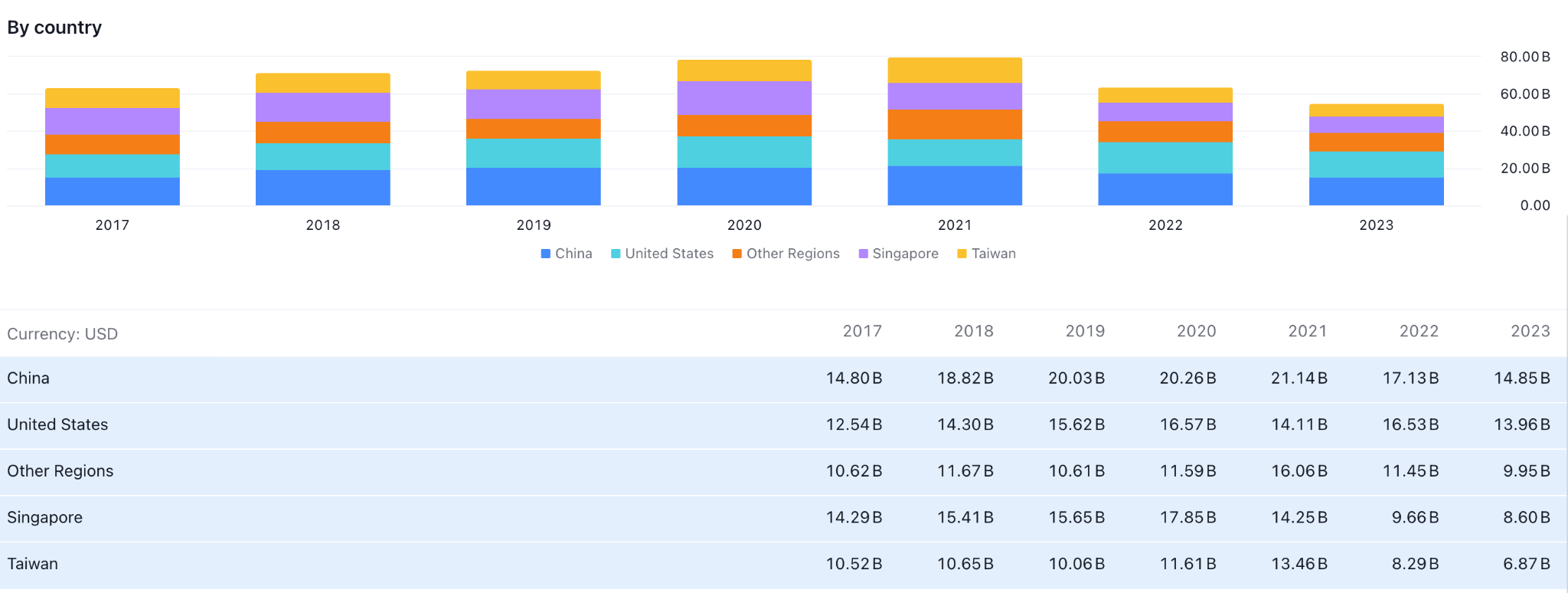

Intel's By Country Revenue

Intel (INTC) reached its peak in 2020 in terms of the by-country revenue, where the most revenue comes from China. Therefore, the economic condition in China could affect Intel revenue the most. Also, the US remains in the second position, where the 2023 revenue from this country was $13.96 billion, down from $14.85 billion for China.

Besides the economic condition of these countries, the macroeconomic outlook and geopolitical uncertainties could work as a key price driver for INTC.

Success on New Technology

Intel is a major player in the semiconductor industry, and they are continuously working to advance their technology. They often announce new processors, chipsets, and other innovations to improve computing performance, power efficiency, and other aspects of their products.

Let's see some key technologies that investors should look at:

- RibbonFET: A new transistor design that promises better performance and lower power consumption.

- PowerVia: A power delivery method that frees up space for more circuitry on the chip.

- Foveros & EMIB: Packaging technologies that allow Intel to combine multiple "chiplets" into a single powerful processor.

Intel Stock Forecast 2030 and Beyond - Bullish Factors

A positive outlook for Intel's stock price in 2030 and beyond hinges on several factors. Regaining manufacturing leadership through the IDM 2.0 strategy could lead to increased production capacity, improved chip profitability, and a stronger reputation for innovation, all attracting more customers and investors.

Success in new technology areas like AI and IoT could see widespread adoption of Intel's AI chips for data centers and leadership in connected devices, further boosting the company's position.

Additionally, a stabilized or even growing PC market, driven by high-performance PC demand, emerging market growth, and the rise of cloud-based services requiring powerful processors, would benefit Intel's data center business. Strategic acquisitions and partnerships that bolster AI and IoT capabilities, open new markets, or diversify revenue streams could also contribute to a bullish outlook.

Ultimately, Intel's financial performance, including debt reduction, consistent earnings growth, and increased shareholder value, will play a major role in shaping investor confidence and potentially driving the stock price upwards.

INTC Stock Forecast 2030 and Beyond - Bearish Factors

Underperformance in AI and IoT could see lackluster adoption of Ponte Vecchio chips, pushing Intel to fall behind in the connected device race.

Other key factors to look at are:

- A worsening PC market due to the rise of tablets, longer PC lifespans, and cloud-based services that don't require powerful PCs could erode Intel's core business.

- Poor acquisitions or partnerships could squander resources, create integration problems, and dilute shareholder value.

- A Heavy debt burden or inconsistent financial performance could limit R&D, discourage investors, and potentially lead to a stock price decline.

A comprehensive evaluation of these factors is crucial before making any investment decisions regarding INTC.

V. Intel Stock Price History Performance

A. INTC Stock Price Key Milestones

- 2020: Intel announces its 10nm Tiger Lake processors before the pandemic. The year started at around $63 and reached a high of nearly $77 in June. However, it dipped throughout the rest of the year, closing at around $53.

- 2021: Intel announces its Alder Lake processors with a hybrid core design, a potential boost for performance and efficiency, which took the stock price to a record high. However, it again experienced a decline throughout the rest of the year, finishing around $46.

- 2022: Intel announces plans to invest $20 billion in new chip factories in the US, signaling an intent to increase production capacity. During the year, the stock fluctuated between the highs and lows of $50 before closing at around $48.

- 2023: Intel unveils its Meteor Lake processors with integrated NPU, a potential step forward in AI capabilities. However, the supply-demand issue affected the business performance. The stock price has continued in a similar pattern to 2022, providing a 90% gain at the end of the year.

B. Intel Stock Price Return and Total Return

Based on the current market data, INTC is trading at the $44.17 level. Considering this, the return to investors is as follows:

|

Timeframe |

Return |

|

1 week |

+8.04% |

|

1 month |

+1.60% |

|

6 months |

+21.02% |

|

Year to date |

-6.30% |

|

1 year |

+21.10% |

VI. Conclusion

In summary, Intel's stock performance during the past few years has been characterized by substantial volatility, noteworthy achievements, and strategic transitions. The nearly 100-fold increase in the company's revenue in 2023 is evidence of a successful reversal led by CEO Patrick P. Gelsinger's strategic acquisitions and strong financial performance. Notwithstanding this remarkable recuperation, Intel's stock must be evaluated in the larger framework of its historical development and industry rivalry.

Regarding the future, expert opinions and projections for 2024, 2025, 2030, and subsequent years paint a complex picture, encompassing both favorable and unfavorable elements that impact Intel's perspective. Opportunities for future expansion are presented by technological advancements, strategic initiatives like Intel Foundry Services, and the potential expansion of the AI and IoT markets. However, significant risks are posed by obstacles such as manufacturing difficulties, competition from Intel competitors like AMD, and market dynamics.

In addition, the growth possibility of a stock depends on how investors manage the risk from a reliable trading platform like VSTAR. Low latency in trading execution, lower commission, and strong regulation could be factors to look at from a platform.

Open a trading account in VSTAR broker and expand your trading portfolio in stocks, indices, metals, and cryptocurrencies, and enjoy key features like these-

- High level of portability in trading through the VSATR mobile app.

- Expand the trading portfolio in different segments like forex, stocks, indices, commodities, and cryptocurrencies.

- Multi-regulated platform with ultra-fast execution.

- Deep market liquidity to ensure order matching.

- Regular market analysis, weekly outlook, and education resources.

In summary, the company's past achievements and strategic placement offer reasons for cautious optimism to ensure long-term investment success. Therefore, investors can easily take a part in the gain besides having a hassle-free trading environment from VSTAR.

FAQs

1. Is Intel stock a buy or sell?

Analysts have a consensus rating of "Hold" on Intel stock.

2. Is Intel stock expected to rise?

Yes, analysts predict a potential upside for INTC stock, with a forecasted increase of 19.0% from the current price to $42.48.

3. What will Intel stock be worth in 2025?

The average price prediction for Intel stock in 2025 is $45.00, with a high estimate of $68.00 and a low estimate of $17.00.

4. Who is the largest shareholder of Intel?

The largest shareholder of Intel is The Vanguard Group, Inc., with an ownership of 8.4%.