Intuit Inc, has transformed the way individuals, small businesses, and accounting professionals manage their finances. With a diverse range of products and services, Intuit simplifies complex financial tasks and empowers users with efficient solutions. In this article, we will explore the key highlights and offerings of Intuit Inc, providing you with all the essential information you need to know about this influential company.

I. Introduction

Intuit Inc, a leading financial software company, has made significant recent developments. These include launching the IDEAS program with the Los Angeles Urban League, committing to achieve net-zero greenhouse gas emissions by FY2040, and conducting a QuickBooks survey on key investment areas for businesses. These developments highlight Intuit's commitment to social impact, sustainability, and providing valuable insights to businesses. As a result, Intuit stock holds value for trading, investing, or buying due to its market leadership, strong product portfolio, sustainable growth opportunities, and innovative approach.

II. Intuit Inc's Overview

Intuit Inc was founded in 1983 by Scott Cook and Tom Proulx. The company is headquartered in Mountain View, California, USA.

Throughout its history, Intuit has achieved several key milestones. In 1984, the company introduced its flagship product, Quicken, which revolutionized personal finance management. In 1992, Intuit went public and began trading on the NASDAQ stock exchange. Over the years, Intuit expanded its product portfolio, introducing popular software such as QuickBooks for small businesses and TurboTax for tax preparation.

Source: Istock

Intuit is structured as a multi-divisional organization. The company operates in three segments: software, hardware, and services. The software segment focuses on developing and selling software products for businesses and consumers. The hardware segment designs and manufactures hardware products, including computers and printers. The services segment provides consulting, training, and support services to customers.

The CEO of Intuit is Sasan Goodarzi, who assumed the role on January 1, 2019. Goodarzi has a successful track record within the company, having previously held leadership positions in Intuit's Small Business and Self-Employed Group, Consumer Tax Group, and as Chief Information Officer. With his extensive experience and background in technology and leadership, Goodarzi leads Intuit in delivering innovative financial solutions and powering prosperity for individuals and businesses worldwide.

Source: Istock

III. Intuit Inc's Business Model and Products/Services

A. How Intuit makes money

Intuit operates through a business model based on providing financial management and tax preparation software and services. The company generates revenue by selling its software products, subscriptions, and services to individuals, small businesses, accounting professionals, and CPAs. Intuit's software solutions are designed to simplify and streamline financial processes, helping users manage their finances, track expenses, and prepare taxes efficiently.

Source: Istock

B. Main Products/Services

Intuit offers a range of popular products and services that cater to different financial needs. Some of its main offerings include:

QuickBooks: QuickBooks is Intuit's flagship product, designed for small businesses and accounting professionals. It provides a comprehensive suite of financial management tools, including bookkeeping, invoicing, payroll, and inventory management.

TurboTax: TurboTax is a leading tax preparation software that enables individuals and small businesses to prepare and file their taxes accurately. It guides users through the tax filing process, ensuring compliance with tax laws and maximizing deductions.

Mint: Mint is a personal finance app that helps individuals manage their money, budget, and track expenses. It provides a holistic view of users' financial accounts, allowing them to monitor their spending habits and set financial goals.

QuickBooks Online: QuickBooks Online is a cloud-based version of QuickBooks, offering small businesses the flexibility to manage their finances from anywhere. It provides features such as online invoicing, bank reconciliation, and financial reporting.

ProConnect: ProConnect is a suite of tax and accounting software solutions designed specifically for tax professionals and CPAs. It streamlines tax preparation and helps professionals deliver accurate and efficient services to their clients.

IV. Intuit Inc's Financials, Growth, and Valuation Metrics

A. Review of Intuit Inc's financial statements

Market Capitalization: As of July 2023 Intuit has a market cap of $130.04 Billion. This makes Intuit the world's 92th most valuable company by market cap.

Net Income: In fiscal year 2023, Intuit Inc. reported a net income of $2.35 billion, representing a 4.5% increase from the previous fiscal year.

Revenue Growth over the Past 5 Years: Intuit Inc.'s revenue has grown at a compound annual growth rate (CAGR) of 10.7% over the past 5 years. In fiscal year 2023, the company reported revenue of $13.8 billion.

Profit Margins: Intuit Inc. maintains a healthy profit margin of 17.2%. This indicates that the company generates $17.2 in net income for every $100 in revenue.

Cash from Operations (CFFO): In fiscal year 2023, Intuit Inc. generated $5.0 billion in cash from operations, highlighting its ability to generate cash from its core business activities.

Balance Sheet Strength and Implications: Intuit Inc. boasts a strong balance sheet, with a current ratio of 1.5 and a debt-to-equity ratio of 0.3. These figures indicate the company's ability to cover its liabilities and its conservative approach to leverage.

Valuation Metrics

Price-to-Earnings Ratio (P/E): Intuit Inc.'s P/E ratio is 56.6x, indicating that investors are willing to pay a higher price for each dollar of earnings compared to the average P/E ratio for the software industry.

Price-to-Book Ratio (P/B): Intuit Inc.'s P/B ratio is 10.6x, signifying a higher valuation in terms of book value compared to the software industry average.

Enterprise Value-to-EBITDA (EV/EBITDA): Intuit Inc.'s EV/EBITDA ratio is 34x, suggesting that investors are willing to pay a higher price for each dollar of EBITDA compared to the average EV/EBITDA ratio for the software industry.

B. Key financial ratios and metrics

Source: Unsplash

When comparing Intuit Inc. to its largest peers in terms of financial ratios and metrics, several key factors come into play. First, Intuit's revenue growth over the past five years has been at a compound annual growth rate (CAGR) of 11.7%. While this growth is respectable, it falls behind the robust revenue growth rates of companies like Salesforce and Adobe, which have achieved CAGRs of 21.2% and 20.7% respectively. Microsoft also shows strong revenue growth at 18.3%, while Oracle lags with a CAGR of 4.8%.

In terms of earnings growth, Intuit has reported a 5-year CAGR of 17%, indicating consistent profitability. However, both Salesforce and Adobe surpass Intuit with earnings growth rates of 25.2% and 22.8% respectively. Microsoft follows closely with a 5-year CAGR of 19.1%, while Oracle trails behind with 10.6% earnings growth.

The forward price-to-earnings (P/E) ratio is another crucial metric to consider when evaluating a company's valuation. Intuit's forward P/E ratio stands at 56.6x, which is significantly higher than the ratios of its peers. Salesforce has a forward P/E ratio of 32.4x, Adobe at 30.8x, Microsoft at 27.8x, and Oracle at 20.2x. The higher forward P/E ratio of Intuit suggests that the market has priced in strong growth expectations for the company, potentially indicating a higher valuation.

V. INTU Stock Performance

A. INTU Stock trading information

Listing: Intuit Inc. (INTU) was listed on the Nasdaq Global Select Market, a primary exchange, on March 17, 1993.

Ticker: The company's ticker symbol is "INTU."

Country and Currency: Intuit is based in the United States, and its stock is traded in US dollars (USD).

Trading hours: INTU stock trades during regular trading hours from 9:30 AM to 4:00 PM Eastern Time (ET) on weekdays. In addition, there are pre-market trading hours from 4:00 AM to 9:30 AM ET and after-market trading hours from 4:00 PM to 8:00 PM ET.

Stock splits: Intuit has experienced three stock splits since its initial public offering. These include a two-for-one stock split on August 21, 1995, a three-for-one stock split on September 30, 1999, and a two-for-one stock split on June 21, 2006. Stock splits adjust the number of shares outstanding without affecting the overall value of investors' holdings.

Dividends: Intuit has announced a cash dividend of $0.78 per share with an ex-dividend date of July 7, 2023. Dividends are cash payments made by the company to its shareholders as a distribution of profits.

B. Overview of INTU Stock Performance

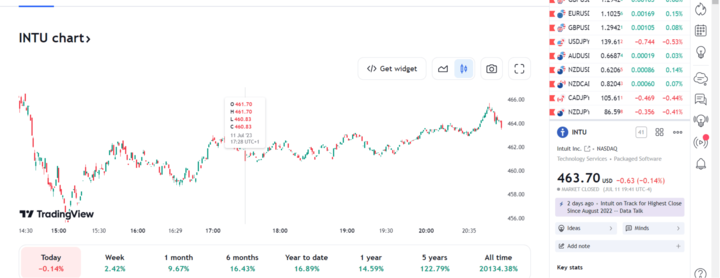

Intuit Inc.'s stock has experienced both highs and lows in its trading history. The stock reached its highest point at $459.12 on September 8, 2022, reflecting strong investor confidence. On the other hand, the stock dipped to a low of $276.46 on March 8, 2020, during a period of market volatility. As of June 27, 2023, the stock is trading at $454.99, indicating a positive trend.

The current stock price of $454.99 represents a 1.6% increase from the previous day's closing price of $449.37. Intuit Inc.'s stock has shown some volatility in recent months, with its 52-week range spanning from $276.46 to $459.12.

Several factors influence the stock price of Intuit Inc. These include the company's financial performance, overall market conditions, economic factors, competition within the software industry, product innovation, and strategic acquisitions or divestitures.

Looking ahead, Intuit Inc. has promising prospects. The company has a strong track record of financial performance and is a market leader in cloud-based software solutions. Analysts hold a generally positive outlook on the stock, with an average "Buy" rating and a price target of $500.0.

VI. Risks/Challenges and Opportunities

Intuit Inc. faces several risks and challenges in the competitive landscape of the software industry. One of the key risks is the presence of strong competitors in the market. Intuit's main competitors include companies in the Application Software industry such as Palantir Technologies (PLTR), Adobe Inc. (ADBE), Marathon Digital Holdings (MARA), Zoom Video Communications (ZM), Salesforce.com Inc. (CRM), Digital Turbine Inc. (APPS), and Unity Software Inc. (U), among others. These competitors pose a threat to Intuit's market share and customer base.

Analysis of Competitors

MARA (Marathon Digital Holdings Inc.)

MARA is a digital asset technology company that focuses on mining cryptocurrencies, particularly Bitcoin. While MARA operates in a different industry segment than Intuit, it can still be considered a competitor due to the increasing popularity of cryptocurrencies and their potential impact on the financial industry.

Threats:

Technological Disruption: The rising adoption of cryptocurrencies could disrupt traditional financial management systems, including tax preparation software offered by Intuit. MARA's expertise in mining and managing cryptocurrencies gives them an advantage in this emerging market.

Market Volatility: The cryptocurrency market is known for its volatility, which can impact the profitability and sustainability of MARA's operations. However, this also presents an opportunity for Intuit to provide services that help individuals and businesses navigate the complexities of cryptocurrency taxes.

ZM (Zoom Video Communications Inc.)

ZM is a leading provider of video conferencing and collaboration solutions. While not a direct competitor in terms of financial management software, ZM can still be considered a threat to Intuit's business due to its expansion into other communication and collaboration tools.

Threats:

Diversification: ZM has been expanding its product offerings beyond video conferencing, venturing into areas such as team messaging, cloud phone systems, and virtual events. This diversification could potentially encroach upon Intuit's market share in certain areas, such as communication tools for small businesses.

Integration: ZM has been investing in integrations with third-party applications and services, allowing users to seamlessly connect and collaborate across different platforms. This integration capability could potentially position ZM as a competitor to Intuit if they develop or acquire financial management tools that compete directly with Intuit's offerings.

Comparison with PayPal Holdings Inc.:

PayPal is a global leader in online payments, offering a wide range of services for individuals and businesses. While both Intuit and PayPal operate in the financial technology industry, they have distinct areas of focus.

Threats:

Established Global Presence: PayPal has a well-established global footprint, serving customers in over 200 countries and supporting transactions in multiple currencies. This extensive reach gives PayPal an advantage in cross-border transactions and international markets.

Strong Brand Recognition: PayPal is a trusted and recognized brand in the online payments industry. Its widespread adoption and acceptance make it a preferred choice for individuals and businesses seeking secure and convenient payment solutions.

Intuit's Competitive Advantages

Source: Unsplash

Leadership in Tax and Financial Management: Intuit's flagship product, TurboTax, is the market leader in tax preparation software. It enjoys a strong reputation and customer loyalty, giving Intuit a significant advantage in the tax industry.

Integrated Ecosystem: Intuit's suite of financial management tools, including QuickBooks and Mint, offers seamless integration and convenience for individuals and small businesses. This integrated ecosystem provides added value to customers and enhances their experience.

In addition to competitive risks, Intuit faces other challenges. Switching costs can be a barrier for customers looking to transition to a different software provider. Data privacy regulations, such as the General Data Protection Regulation (GDPR), pose compliance challenges and may require investments in data security measures. Furthermore, changes in small business tech budgets can impact the demand for Intuit's products and services, as businesses may prioritize their spending on essential technologies.

Despite these risks, Intuit has significant growth opportunities. The emerging fintech landscape offers avenues for expansion. By diversifying into digital payments and lending solutions, Intuit can tap into the evolving needs of businesses and individuals. As the digital economy expands, Intuit can leverage its expertise in financial management software to provide innovative solutions that meet the demands of a changing market.

Looking to the future, Intuit's outlook and expansion prospects are promising.

Source: Istock

Small Business Empowerment: Intuit's strategic focus on empowering individuals and businesses aligns with the growing demand for financial tools and resources. By providing comprehensive solutions tailored to the needs of small businesses, such as accounting, payroll, and financial planning, Intuit can continue to capture market share and build long-term customer loyalty.

Enhanced Mobile Solutions: As mobile technology continues to advance, Intuit has the opportunity to further enhance its mobile applications and solutions. Mobile devices play a crucial role in the lives of individuals and businesses, and by providing intuitive and feature-rich mobile experiences, Intuit can cater to the evolving needs of its customers and drive engagement.

AI and Automation Integration: Intuit can leverage the power of artificial intelligence (AI) and automation to streamline financial processes and deliver more personalized experiences. By incorporating AI-driven features, such as automated data entry, smart categorization, and personalized insights, Intuit can improve efficiency, accuracy, and overall customer satisfaction.

Expansion into New Verticals: Intuit has the potential to expand beyond its core offerings and enter new verticals within the financial technology space. By identifying emerging trends and customer needs, Intuit can develop or acquire complementary products and services that address these gaps, allowing the company to diversify its revenue streams and reach new customer segments.

VII. Trading Strategies for INTU Stock

When it comes to trading Intuit Inc. (INTU) stock, it's essential to have a well-defined strategy and be aware of key resistance and support levels. These levels can provide valuable insights into potential price movements and help traders make informed decisions. In the case of INTU stock, the key resistance level to watch is $492, while the support level is $352.

Resistance and Support Levels

The resistance level at $492 represents a price point where the stock has historically faced selling pressure and struggled to break through. Traders should closely monitor INTU's price action around this level, as a sustained break above it could indicate a bullish trend and potentially lead to further upside momentum.

On the other hand, the support level at $352 is a critical price level where buying interest has historically emerged, preventing the stock from declining further. If INTU approaches or reaches this support level, traders may consider it a potential buying opportunity, as there could be a higher probability of a bounce-back in price.

Profit Strategies for INTU Stock

Source: Istock

a) Contract for Difference (CFD) Trading: One profit strategy that traders can consider for INTU stock is CFD trading. CFDs allow traders to speculate on price movements without owning the underlying asset. This can offer advantages such as leverage, enabling traders to amplify their potential profits. However, it's important to note that leverage can also magnify losses, so risk management is crucial when employing this strategy.

b) Technical Analysis: Utilizing technical analysis tools and indicators can help traders identify trends, patterns, and potential entry or exit points for INTU stock. Techniques such as chart patterns, moving averages, and oscillators can provide insights into the stock's price momentum and potential trading opportunities.

c) Fundamental Analysis: Fundamental analysis involves evaluating a company's financial health, competitive position, and industry trends to assess its value. Traders can analyze INTU's financial statements, earnings reports, and news updates to make informed trading decisions. Factors such as revenue growth, profit margins, and market share can impact the stock's performance.

d) Diversification: As with any investment strategy, diversification is essential. Traders should not solely focus on INTU stock but also consider building a diversified portfolio with a mix of different assets, sectors, and geographies. This can help mitigate risk and potentially enhance returns by spreading investments across multiple opportunities.

VIII. Trade INTU Stock CFD at VSTAR

If you are interested in trading Intuit Inc. (INTU) stock, VSTAR provides a convenient and feature-rich platform to engage in Contract for Difference (CFD) trading. Here are some reasons why you might consider choosing VSTAR for trading INTU stock CFDs:

Wide Range of Markets: VSTAR offers access to a diverse range of markets, including currencies, stocks, indices, gold, and oil. With over 1000 markets available, including major FX pairs, CFD indices, and popular shares like INTU, you can easily diversify your trading portfolio and explore various trading opportunities.

Low Trading Costs: VSTAR is designed to provide users with a cost-effective trading experience. The platform offers low trading fees and does not charge any commissions on trades. This means you can trade INTU stock CFDs without worrying about excessive costs eating into your profits.

Competitive Spreads: VSTAR ensures super tight spreads, which is the difference between the bid and asks price. This can significantly impact your trading outcomes, as tighter spreads reduce the cost of entering and exiting positions. With VSTAR's institutional-level trading experience, you can take advantage of favorable spreads on INTU stock CFDs.

Reliable and Fast Execution: VSTAR prioritizes reliable and fast order execution. The platform leverages deep liquidity to ensure that your trades are executed swiftly and efficiently. This is crucial in volatile markets, where timely execution can make a difference in capturing trading opportunities.

Regulatory Compliance and Security: VSTAR is a regulated trading platform authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), providing a level of regulatory oversight and protection. As a member of the Cyprus Investor Compensation Fund, VSTAR offers additional security for client funds. The platform is also compliant with the European Regulatory Framework of MiFID II, ensuring adherence to industry standards.

User-Friendly Interface: VSTAR's user-friendly app caters to both seasoned traders and beginners. The platform features an intuitive interface that makes it easy to navigate and execute trades. With a minimum deposit requirement starting from only $50, VSTAR offers accessibility to traders of various experience levels.

Risk Management Tools: VSTAR prioritizes risk management by offering negative balance protection. This means that your account balance will not go below zero, protecting you from excessive losses. Additionally, VSTAR provides a $100,000 risk-free demo account, allowing you to practice and familiarize yourself with the platform before trading with real funds.

IX. Conclusion

In conclusion, Intuit Inc. (INTU) is a global technology company that provides financial management and tax preparation software and services. With a strong track record of financial performance and a leading position in tax and financial management software, Intuit has established itself as a key player in the industry. The company has experienced consistent revenue growth and has a solid balance sheet, indicating its stability and potential for future growth. While Intuit faces competitive risks from other software companies and challenges such as data privacy regulations and impacts on small business tech budgets, it also has numerous growth opportunities, including emerging fintech possibilities and diversification into digital payments and lending solutions. The future outlook for Intuit Inc. appears promising, with analysts being bullish on the stock and predicting continued growth. Trading Intuit stock CFDs at VSTAR, a regulated and secure trading platform, offers advantages such as low trading fees, competitive spreads, reliable order execution, and a user-friendly interface. Traders can leverage VSTAR's features and the potential of INTU stock to capitalize on trading opportunities.