- Crude Oil Inventories: Increased by 8.7 million barrels, indicating oversupply.

- Mixed Inventory Trends: Gasoline up by 0.7 million barrels, distillate fuel down by 1.0 million barrels.

- Production Fluctuations: Gasoline production decreased; distillate fuel production increased.

- Price Trends: WTI crude price declined, retail gasoline prices fell, impacting market sentiment.

In a landscape where every barrel counts, the recent surge in crude oil inventories as per the recent Weekly Petroleum Status Report by U.S. Energy Information Administration (EIA) , coupled with nuanced shifts in production and price trends, unveils a compelling narrative. Exploring these dynamics offers a key to deciphering the potential impact on global markets and investor sentiment, steering the course of Crude Oil Contract for Difference (CFD) prices.

Interpretation of Data

Refinery Inputs and Capacity Utilization

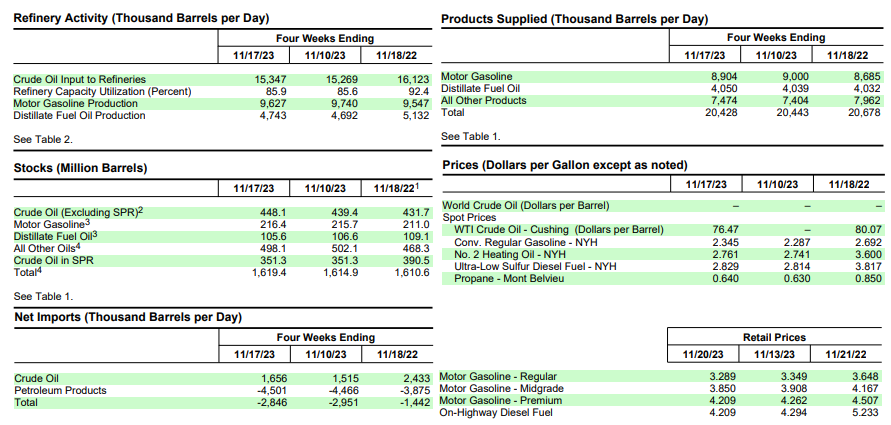

Crude Oil Refinery Inputs: Averaged 15.5 million barrels per day, slightly higher than the previous week. This indicates a steady demand for crude oil by refineries. An increase in inputs typically signifies potential higher demand for refined petroleum products.

Refinery Capacity Utilization: Operating at 87.0% of capacity, which suggests a high operational level. This might indicate the potential for increased demand or readiness to produce more, affecting the supply of refined products in the market.

Source: eia.gov

Production and Imports

Gasoline Production: Decreased to 9.4 million barrels per day. A decline in production might indicate a potential reduction in gasoline supply, which could impact pricing.

Distillate Fuel Production: Increased to 4.9 million barrels per day. This rise could reflect an uptick in demand for diesel and heating oil, potentially impacting their prices.

Crude Oil Imports: Averaged 6.5 million barrels per day, showing a slight increase from the previous week. Imports contribute significantly to supply levels, affecting the overall market balance.

Inventory Levels

Crude Oil Inventories: Increased by 8.7 million barrels, surpassing the five-year average by 1%. This rise suggests a buildup in crude oil supply within the U.S. market, potentially putting downward pressure on prices.

Gasoline and Distillate Fuel Inventories: Show mixed trends. Gasoline inventories rose by 0.7 million barrels but remain below the five-year average. Conversely, distillate fuel inventories decreased by 1.0 million barrels and stand considerably below the five-year average. These contrasting trends might impact price direction differently for gasoline and distillate fuel.

Product Supplied

Total Products Supplied: Down by 1.2% compared to the same period last year. A decrease in overall product supplied might suggest a potential reduction in demand, which could influence prices downward.

Gasoline and Distillate Fuel Product Supplied: Gasoline product supplied increased by 2.5%, while distillate fuel product supplied had a marginal 0.5% increase. These shifts in demand for specific products could affect their respective prices.

Price Trends

West Texas Intermediate (WTI) Crude Oil Price: Stood at $76.47 per barrel, marking a $3.60 decrease compared to the previous year's price. Lower prices could be due to increased supply levels impacting the market.

Gasoline and Heating Oil Spot Prices: Fluctuated but generally lower compared to the previous year's prices. This trend could influence consumer behavior and, subsequently, the demand for crude oil.

National Average Retail Prices: Both regular gasoline and diesel fuel prices decreased compared to the previous week and significantly lower than prices from the prior year. Decreasing retail prices might signal weaker consumer demand, potentially impacting crude oil prices.

Possible Implications on Price of CFDs on Crude Oil (Focus on Price Direction)

Supply and Inventory Factors

Crude Oil Inventories: The notable increase in crude oil inventories by 8.7 million barrels suggests an oversupply situation within the U.S. market. Typically, higher inventory levels exert downward pressure on prices due to the abundance of supply. This surplus might lead to a decline in the price of CFDs on Crude Oil in the short term.

Gasoline and Distillate Fuel Inventories: The rise in gasoline inventories by 0.7 million barrels, albeit below the five-year average, might alleviate immediate concerns about scarcity and put some downward pressure on gasoline-related CFD prices. Conversely, the notable decrease in distillate fuel inventories by 1.0 million barrels, significantly below the five-year average, might exert upward pressure on distillate fuel-related CFD prices.

Production, Demand, and Consumption

Gasoline Production Decline: The reduction in gasoline production might indicate lower demand or an adjustment in production levels based on market dynamics. This decrease could potentially affect the price of gasoline-related CFDs, hinting at a possible downward direction.

Distillate Fuel Production Increase: The uptick in distillate fuel production indicates a rise in demand or preparation for increased demand. This increase might elevate the demand for distillate fuel-related CFDs, possibly pushing their prices upward.

Price Trends and Consumer Behavior

WTI Crude Oil Price Decline: The decrease in the WTI crude oil price compared to the previous year might influence market sentiment, impacting CFD prices downward. Lower prices may discourage investment, leading to a potential decline in CFD prices on Crude Oil.

Spot Prices and Retail Prices: Lower spot prices for gasoline and heating oil compared to the previous year, coupled with decreasing retail prices, suggest weakened consumer demand. This trend may further depress crude oil prices, influencing CFD prices downward as well.

Market Sentiment and Future Trends

Market Uncertainty: The mixed signals in inventory levels, production shifts, and demand changes could create uncertainty in the market. Investors might adopt a cautious approach, affecting CFD prices on Crude Oil.

Geopolitical Factors and External Influences: Factors such as geopolitical tensions, international supply disruptions, or shifts in global demand could swiftly alter market dynamics. Any unexpected changes might sway CFD prices on Crude Oil in unforeseen directions.

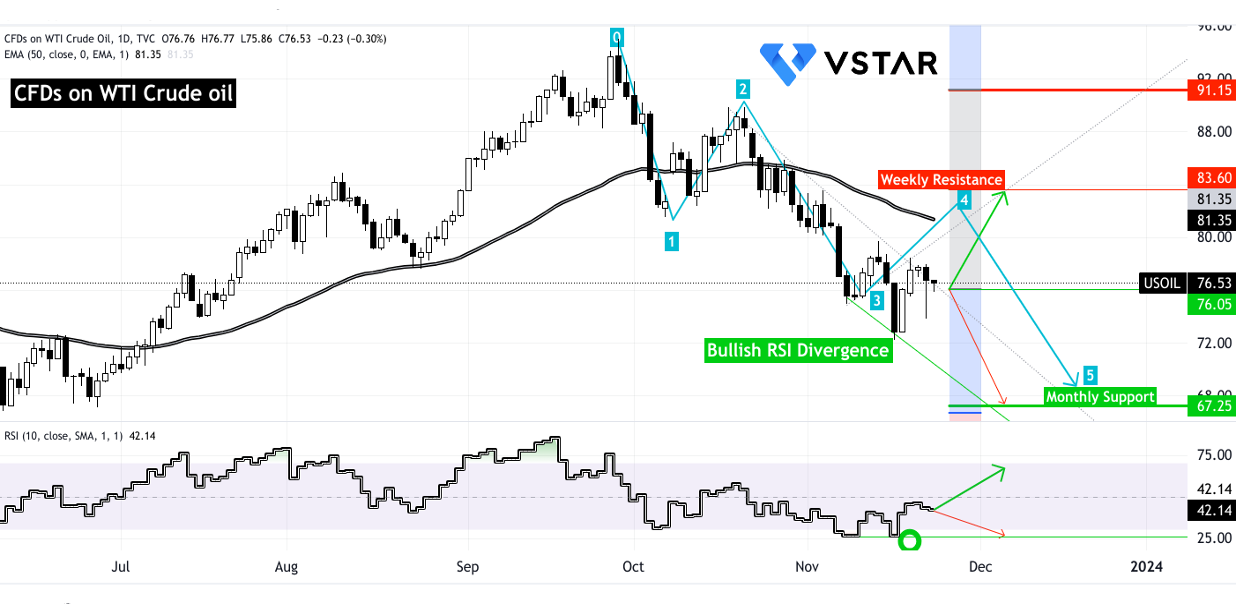

WTI Crude Oil Technical Take

Crude oil CFD prices seem poised for a final downward movement, aligning with the Elliott Wave Theory's last impulsive wave (Blue line), targeting a monthly support at $67.25. Conversely, a bullish divergence, indicated by the relative strength index (RSI) (green circle), might offer support at $76.05. This could lead to an upward movement, aiming for a weekly resistance level of $83.60. Yet, heightened volatility might propel prices toward $91.15, albeit less likely. Neutral indications by RSI signifies the possibility of both scenarios (green and red arrows).

Source: tradingview.com

In conclusion, the increased crude oil inventories indicate a surplus supply, which might put downward pressure on crude oil prices and subsequently affect CFD prices. However, the contrasting trends in gasoline and distillate fuel inventories, production levels, and consumer behavior introduce uncertainties that could mitigate or counteract these effects.

In the weekly timeframe, the overall outlook tends toward a potential downward trajectory in CFD prices on Crude Oil due to surplus inventory levels and weakened demand indicators. However, caution is warranted as unforeseen events or geopolitical factors could swiftly alter this direction.