iQiyi is one of the largest streaming platforms in the world and when it finally went public in 2018, it was hailed as the “Netflix of China” but things didn’t play out as expected with iq stock trading below 70% of its IPO price. However, things are starting to turn around for the streaming giant of China and traders can’t just look away.

Its revenue for 2022 came as a surprise to Wall Street analysts and showed no signs of slowing down this year either with impressive Q1 2023 results. iQiyi stock forecast for 2023 is looking better than ever so if you’ve been asking “Should I buy iQiyi stock” this might be the best time to make that decision.

How iQiyi Started

iQiyi was officially launched in April 2010 with the name Qiyi by Baidu, the company in charge of China’s largest search engine. In November 2011, it changed its name to iQiyi and began to expand by buying other online video platforms likePPStream Inc. It also collaborated with overseas peers to co-produce movies and purchase new releases.

By 2014, the streaming platform already had plans in place to double its production of original videos and continued to purchase the streaming rights to the top entertainment shows in not only China but other countries like Taiwan, and South Korea.

Source: CYBER ERA

In 2017, iQiyi started to have a steady foothold on the international market after it reached a licensing deal with Netflix to make some Netflix original shows available on the platform with their premieres worldwide. It later launched iq.com for its international users and expanded its language option on the iQiyi app to include English, Thai, Vietnamese, Indonesian, and Malay language.

Once again, they partnered with other streaming platforms in Ireland and the United Kingdom hoping to reach an even bigger audience. And their plans so far have been working with their average daily total subscribers reaching 128.9 million this year.

Business Model and Services

Like Netflix, iQiyi is a video streaming platform that majorly serves China and Asia. It produces original videos ranging from documentaries and dramas to blockbusters and contemporary art films. However, it also purchases movies from other providers. iQiyi business model is called freemium which means that it provides some of its services free for users but to get more use out of the platform, they would need to pay a monthly subscription fee. However, unlike Disney and Netflix, it doesn’t fully rely on subscriptions to make money.

The Netflix of China also generates revenue from e-commerce, advertising, and gaming businesses. The adverts are mostly shown to its free users and would have to pay if they wanted an ad-free experience.

Source: iQiyi

Products and Services

iQiyi offers a wide range of content and doesn’t limit itself to just TV series and films. It releases sports content, cartoons, news, anime, variety shows, and more. From the iQiyi app, users also have access to a variety of games- something that its competitors like Disney and Netflix don’t offer.

In addition, it offers advertising services to advertisers and partners with production companies to distribute their content. iQiyi also manages a talent agency and provides IP licensing services.

Apart from providing iQiyi original content, the platform also focuses on using artificial intelligence to improve its user-interface experience and recommendation system through image recognition as well as natural language processing.

iQiyi Financial Health

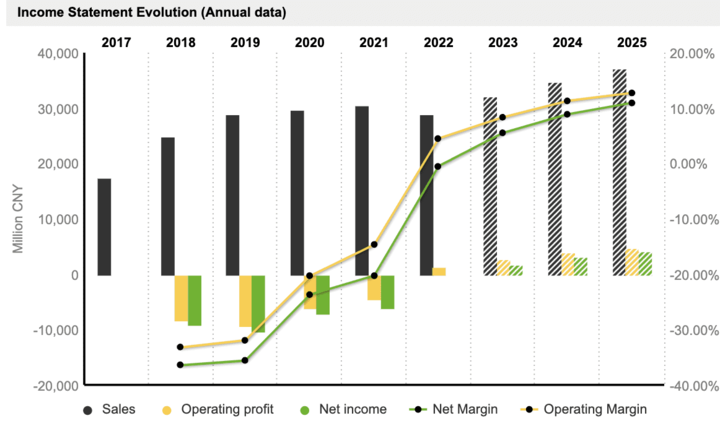

The analysis of iQiyi earnings indicated that the company has struggled to be profitable but 2022 was its turnaround year, especially its Q4 2022. For the last fiscal year, China video streaming giant brought in $4.2 billion in revenue which was a 5% decrease compared to 2021.

However, Q4 2022 alone provided much better results with an increase of 3% YoY and $1.1 billion in revenue. Its main source of revenue was membership subscriptions because other revenue streams went down significantly due to macroeconomic events in China. Its Q1 2023 also indicated that the platform might have finally become profitable as its total revenue reached $1.2 billion, increasing 15% year over year. In addition, iQiyi spending also dropped due to the company’s aggressive production costs.

Source: Market Screener

Key Financial Ratios and Metrics

IQ has a P/S ratio of around 1.1. Bilibili and Tencent, two similar streaming platforms popular in China also have a P/S ratio of 1.9 and 5.2 respectively. iQiyi's 14.73% YoY revenue growth is more significant than that of Tencent and Bilibili at 10.71% and 0.31% respectively. Compared to its current share price of $5, the company appears to be slightly undervalued.

How is IQ Stock Doing?

A. Trading Information

Primary exchange & Ticker: NASDAQ: IQ

Country & Currency: CNY(CN)

First listed: 2018 at $18 per share

Trading Hours: Pre-market (4:00 – 9:30 am ET) and After Hours Market (4:00 – 8:00 pm ET)

Stock Splits: N/A

Dividends: N/A

B. Overview of IQ Stock Performance

iQiyi investors have been on a rollercoaster since the company went public in 2018 but this year, iQiyi stock price has seen major progress. It rose by 15.4% in February after the Chinese streaming platform reported higher fourth-quarter earnings for 2022. Its Q1 2023 earnings report also increased investor sentiment as it delivered record-setting results with analysts adjusting their predictions for 2023.

However, there is still some doubt among analysts about the future of the stock due to China’s implementation of its policy. The stock along with other Chinese streaming stocks has also shown high volatility this year as it peaked at $40 but later fell to $2. It also doesn't help that iq stock is still trading 87% below its IPO price at $5 at the time of writing.

C. Key Drivers of IQ Stock Price

Partnerships with Alipay+ and E-Wallet

iQiyi will be partnering with popular Asian e-wallets to help it continue to expand and reach young middle-class consumers who want to pay for iQiyi membership and gain access to premium content.

IP-based VR Project

iQiyi is always looking for ways to innovate and this time, the platform has launched the Luoyang Virtual Reality Project in Shanghai which attracted over 5,000 players. The VR project will also move to Beijing, Luoyang, and Henan provinces later this year.

Strong growth in subscribers and revenue

iQiyi’s average daily total subscribers increased to 128.9 million in the first quarter of 2023 compared to 101.4 million for the same quarter in 2022. Its overall revenue also increased by 15% YoY to reach $1.2 billion in Q1 2023 making it one of the top companies in the Chinese streaming industry.

D. Analysis of Future Prospects for IQ Stock

iQiyi streaming platform started out well by diversifying its products and services giving it enough avenues to grow in the future and investors are optimistic about the future of the company.

iQiyi stock analysis for the 12-month period puts it at a median price of $8.28 and could possibly reach $11.80. If the stock does fall, investors estimate that it could go as low as $2.80. In addition, iQiyi's buy or sell recommendation has it as a BUY and it will most likely remain steady for the rest of the year.

Risks and Opportunities

Competitive Risks

Main Competitors: iQiyi competitors include companies like Tencent Video, Bilibili, and Youku which are major tech companies in China. Internationally, they also have to deal with the popularity of Netflix and Disney.

Content Costs: iQiyi content costs have risen in recent times as the company focuses on producing more original content.

Economic Slowdown: One of the risks of investing in Chinese streaming companies is reduced consumer interest due to the economic slowdown. The increased cost of living may make consumers rethink spending on online entertainment and these platforms have to think of creative ways to incentivize their users.

Growth Opportunities

Virtual Reality: iQiyi got into the VR space in 2021 and continues to harness the full potential of VR technology.

Increased interest in online content: Streaming platforms gained more prominence in 2020 and the interest in online videos hasn’t died down because people have become accustomed to consuming content this way.

Original Content: Producing original content is iQiyi’s main strength and having such exclusive content has been a good strategy for attracting and retaining paying customers.

What does the future look like for iQiyi?

2022 was iQiyi’s first profitable year despite having to deal with volatile market conditions. This year, it is laying down the foundation for AI-generated content and plans to adopt ChatGPT-like features in the future. In addition, it is ramping up its production capabilities with over 270 new films, variety shows, drama series, and other forms of entertainment on the way. The company will also continue to vigorously promote its content in those countries while providing subscription options in other continents like Africa.

Source: CNBC

So is iQiyi a good stock to buy? The continuous growth of iQiyi is a good indicator of the future of China streaming industry in general and despite the hurdles, experts agree that it is one of the top Chinese tech stocks to buy. iQiyi stock buy or sell signals indicate that the stock is a good buy.

Trading Strategies for IQ Stock

Long-term investment strategy

If you believe in iQiyi stock's future growth, then it is advisable to hold it long-term. Depending on how soon you need the money, you can hold iq stock for at least 5 years but this can still be extended to 30 years and even more. It is advisable to invest a portion of your intended capital first and watch how the market moves first before investing more. Plus when you do invest, look at key details like balance sheet, earnings report, development plans, and iQiyi stock news. It will not only tell you much about the company but teach you how to value Chinese streaming media companies.

In addition, ensure that you diversify your portfolio to reduce the impact of the stock’s volatility.

Short-term trading strategy

By trading iq stock short-term, you’ll have to focus more on price action than the long-term fundamentals of the stock. The stock rallied significantly earlier this year due to the positive 2022 earnings report along with other positive developments and may continue to increase steadily throughout the year.

Along with employing risk management tools, it is advisable to trade with care during pre-market hours because iq stock tends to be more volatile during that period because of lower volume.

Source: Fidelity Investments

Dollar-cost averaging strategy

Dollar-cost averaging is a technique for building your position in a stock over time while minimising the risks involved in it. It removes the element of emotion in investing because you are breaking your investment into manageable pieces. For instance, if you want to invest $5,000 into iq stock, you can spread it across 5 months by investing $1000 every month.

Stop loss strategy for minimising losses

Stop-loss orders are used to reduce losses if the market moves against the position entered by the trader. Using stop-loss strategies to trade is a personal choice but it doesn’t hurt to have that extra layer of protection.

When trading iQiyi stock, it is important to determine how much you want to set in a stop loss order. This ensures that the order doesn’t cut you out of a potentially profitable trade while protecting your position. It is preferable to set the stop loss to 10% of your order to ensure that no huge loss occurs. Another strategy is to set the stop loss at the most recent swing low or swing high. This means placing the stop loss where the trend is expected to bounce back from either an uptrend or a downtrend.

Trade IQ Stock CFD at VSTAR

Enhance your profit potential by trading IQ stock CFD with VSTAR. With VSTAR you can:

● Increase your position with leverage of up to 1:200

●Trade at a super low cost

● Fund your CFD trading account using any of the 50+ methods available

● Enjoy top-tier liquidity to match your order with the best price.

And if you want to test the market, you can access real trading conditions in under 10 seconds using a demo account.

Ready to make profits? Sign up and start trading now!

Conclusion

Although iQiyi just had its first profitable year, it is not out of the woods just yet because the company has to show that it can sustain such growth. However, there are a lot of factors working in their favour and with such a strong start to 2023, the company has a lot of potential for growth this year.

It has already shown its ability to generate revenue in different ways and has employed aggressive cost-cutting techniques in production while delivering high-quality content. There are still a lot of hiccups on the way short-term but this doesn’t stop iQiyi from being a viable investment opportunity.