These days, all eyes are on the EV market as legacy automakers are transitioning to electric vehicles and small EV start-ups have entered the race to bring with them their vision of what an electric car should look like. Although it went public 2 years ago, Lucid Group has already won several accolades for its unique cars and innovative products and Lucid stock soared as soon as the company went public .

While investing in Lucid can bring major returns in the future, there is still a degree of risk associated with it that you cannot ignore.

Lucid's Financial Performance

As an emerging automotive company, Lucid is not yet as profitable as it could be. Like the rest of the EV industry in 2022, Lucid experienced some supply and manufacturing issues in producing its vehicles as it only produced 7000 vehicles and delivered a little over 4,000 vehicles compared to Tesla’s 1.3 million vehicles that same year.

The prices of EV materials have increased significantly over the years putting more pressure on small EV companies like Lucid. To make things a bit harder, thousands of customers cancelled their orders for a Lucid EV and because of the manufacturing issues the company had which led to long wait times, very few people were willing to place new orders.

Although the company still announced that it had more than 28,000 reservations, this is very different from the over 34,000 reservations they had in November last year. As a result, the EV maker fell below expectations for the fourth quarter of 2022, only generating $257 million in revenue and losing $472 million.

By the end of 2022, the company was already looking for additional cash and sold about 86 million shares privately to Saudi Arabian investors and generated $1.5 billion from the sale to offset the rising inflation and cost of materials. Combined with the cash they had in reserves, Lucid entered 2023 with around $4.4 billion in cash and $500 million which is enough to cover the company’s operations to the first quarter of 2024. The company’s market cap is around $40.6 billion, outperforming competitors like Nikola Motors and Fisker Inc. For 2023, analysts are confident in Lucid’s growth expecting it to generate $722 million in revenue with a net loss of $1.78 billion.

However, compared to other EV startups, Lucid is in a better position and is primed to increase revenue once they improve their production this year and can successfully deliver 10,000 to 14,000 vehicles this year.

Analysis of Lucid's position in the market

There have been many proposed Tesla killers over the years, but Lucid Group is one company that investors are betting on to do better than Tesla or at least rival it in the years to come. Like Tesla, the EV maker produces its core EV technology at its powertrain facility in Arizona and the components made are sent to the company’s car factory in Casa Grande Arizona.

Since the CEO of Lucid was a former chief engineer at Tesla, the company is largely following Tesla’s playbook but differentiating itself from the EV leader in terms of automated driving systems, advertising, and charging stations. Unlike Tesla’s push to become a mass-market brand, for now, Lucid is focused on maintaining its position as a luxury brand selling expensive EV vehicles. For instance, Lucid Air starts at over $100,000 meanwhile Nio’s flagship vehicle like the ET7 performance sedan starts at $60,000.

Lucid designs its cars with car sharing in mind and is aiming to accommodate both driverless driving and the present need for drivers. It is one of the first EV companies manufacturing cars to accommodate the possibility of car sharing and increasing the maximum range on a single charge. The Lucid Air offers up to 516 miles, almost 30% more than Tesla’s highest range of 405 miles on the Model S. Lucid’s lowest option of 410 miles is still higher than Tesla’s 396 miles.

Although Lucid Group is not short on capital, the lack of good news is hardly doing any good in improving investor settlement. The company’s electric vehicles got excluded from the $7500 tax break and rumours are going about of a possible buyout now that Saudi Arabia’s Public Investment Fund, owns 62% of Lucid. The next major event in store for Lucid is the quarterly earnings release on May 9th which will determine how much further the company falls or rises.

Analysis of Lucid Stock Price Performance

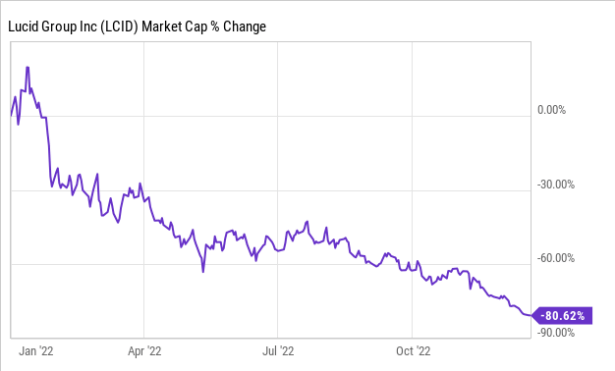

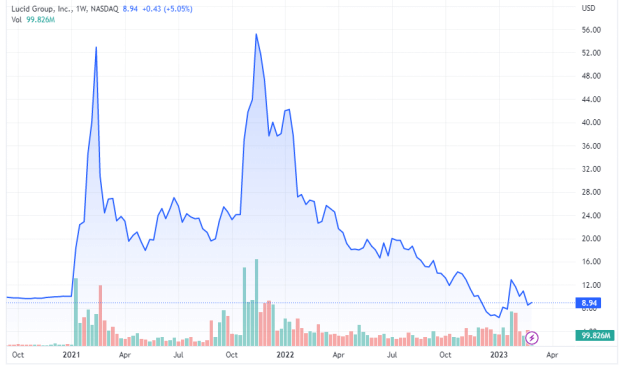

Lucid stock (NASDAQ: LCID) soared soon after the company went public in 2021 earning the company $4.5 billion in the process. But in 2022, the stock lost most of its value and continues to drop. Lucid stock price now sits at $7.94 as it has lost 66% of its value in 12 months. But what’s causing the persistent decline in Lucid share price?

The company’s main problem is its failure to meet up with delivery estimates and its massive losses. The company produced 7,000 vehicles in 2022 but was only able to deliver 4,369 of those vehicles even though the company promised that it would produce 20,000 vehicles.

In addition, the luxury and elegance of Lucid’s vehicles might not translate to sales as inflation-saddled customers worrying about a possible inflation will look more for affordability rather than luxury. Meanwhile, Lucid is hell-bent on pushing itself as a luxury brand which might not work well short-term.

But everything is not over yet. As a pure EV company, Lucid has the opportunity to build its brand up from scratch and with Saudi Arabia backing it, the investors could leverage some of their influence to see the company grow. They already placed an order for 100,000 Lucid EVs which the company will deliver over time.

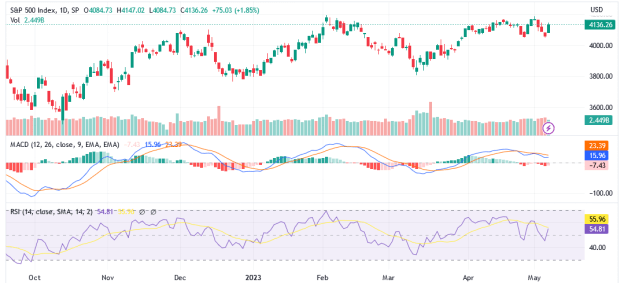

The current LCID stock price forecast for 2023 will be within the range of $13 to $18. The average Lucid stock prediction among Wall Street analysts is that Lucid share price would remain steady around $10 to $15 as Lucid stock analysis using indicators like the MACD and Relative Strength Index, give different signals with the RSI giving a buy signal and the MACD giving a sell signal.

When the RSI levels of a stock is below 30 it means that the stock is undervalued and there are still good buying opportunities. However, when the RSI level is above 70, it means the stock is overvalued. Here, Lucid’s RSI is at 14 meaning that the asset is a strong buy. Seeing as both the MACD and signal line have crossed below the histogram, the MACD indicator is giving a strong sell signal for the Lucid stock.

Is Lucid a good stock to buy?

The stock market as a whole has been facing major challenges and as a growth company, Lucid has struggled against the headwinds. But it remains one of the most viable EV stocks to invest in. Lucid is not short on demand as it has potential sales of up to $3.5 billion once it delivers vehicles to its current 37,000 reservations. With its knowledge in EV technology and vehicle design, investing or trading in Lucid could bring substantial value and profit as the stock price is expected to rise despite the challenges the company is currently facing.

But the present volatility of the stock and the fact that the company is suffering from massive losses and production issues makes it a risky stock to invest in. Lucid Nasdaq performance has not been encouraging investors either as the stock is underperforming the index by 66%. So, is Lucid stock a good buy? At the moment, the short-term headwinds don’t make it a strong buy but it is worth the investment depending on your goals and investing style.

If you plan on holding long-term, have a good risk appetite, and want to diversify your portfolio, Lucid is a solid investment opportunity. For traders, it will be more profitable to trade Lucid as a stock option or CFD and take advantage of the rapid price changes.

How to Trade and Invest in Lucid Stock and its CFDs

Here’s what you need to know about how to trade Lucid stock and invest in it for profits:

1. Holding LCID stock long-term

This is perhaps one of the best and safest Lucid stock investment strategies because you get to bypass the short-term obstacles and benefit from the potential dividends and growth. Lucid stock is regarded as a growth stock and the company is well-positioned in the EV market. If you are thinking of how to buy Lucid stock, you first need to open an account with a trusted investment platform that offers Lucid stock. Then break the total amount of your investment into smaller sizes and invest at regular intervals. This way, you can manage the risk and still have a good position for profits.

2. Trading Lucid stock options

LCID stock options trading, serves as a hedge against risk and decreases the volatility of your portfolio. Opening a call option allows the trader to make a profit if the price of the stock goes up. On the other hand, put options are used in case the price of the asset decreases.

Regardless of what Lucid trading option strategies you use, it is important to use the option chain before you execute a trade. This way you can see all available options contracts and use the information to decide on the best time to enter the market. The Lucid option chain gives valuable insight into the option contracts opened by other trades. Meaning that you can see all available call and put contracts including the pricing information and expiration dates of the contracts. Comparing the information provided by different options contracts will be useful in improving your market timing. Combined with accurate Lucid technical analysis, you will have a better chance of success when trading.

3. Trading Lucid Stock CFDs

LCID stock CFD is a leveraged product meaning that you only need to deposit a small portion of your actual capital to trade. When trading CFDs, you do now own any part of the underlying asset but will still benefit from the price changes. Here are some Lucid CFD trading tips to increase your success in the market:

Choose the right broker: It is important to choose the best broker for Lucid CFD trading because they will provide the tools and platform you need for success. For instance, if you are convinced that Lucid stock is going to drop and figuring out how to short Lucid stock to make a profit, you will need to be able to open a margin account with your broker. Then, you can enter your short order and your broker sells them for you on the open market.

Use a CFD trading calculator: The CFD trading calculator gives a better understanding of the specifics of your trade before you even open a position. With it you can estimate your loss or profit, calculate the margin required for your position, and compare the results from different trading days.

Pay attention to the news: Some global economic events, market-specific news, and government policies could affect the direction of the market and probably work against your position if you are not careful.

Remember that CFDs are complex instruments and involve a lot of risk mostly due to the use of high leverage. So, before trading CFD, take time to understand how it works and what you can do to manage risk.

Why trade Lucid Stock CFD with VSTAR

Trade Lucid stock CFD with zero commissions on tight spread bets and take advantage of the rising and falling markets. Using VSTAR’s CFD global regulated platform, CFD traders gain access to over 1000+ markets and can start trading with a minimum deposit of $50.

Conclusion

Lucid stock is still a worthwhile buy as a speculative growth stock in the EV market because the company has the potential to make a name for itself in the industry if it can overcome its current challenges. But right now, there is a lot of uncertainty surrounding the company due to its habit of overpromising and not meeting up to expectations. It is an investment that requires you to be patient and remain alert about the possible changes in the market that could affect its growth.