I. Introduction

JD.com (JD), a leading Chinese e-commerce company, has recently made headlines with its impressive sales performance during China's mid-year shopping festival, signaling robust consumer demand and market strength. Moreover, JD.com has also announced the appointment of Sandy Ran Xu as its new CEO, bringing in fresh leadership and strategic expertise to drive future growth. With these latest developments, JD.com presents compelling investment opportunities and a promising outlook for investors and traders.

The strong sales performance during China's mid-year shopping festival reflects JD.com's ability to capitalize on consumer demand and maintain a competitive edge in the e-commerce market. This achievement highlights the company's robust infrastructure, extensive product offerings, and effective marketing strategies.

Considering these developments, JD stock presents compelling reasons for trading, investing, or buying:

Growth Potential: JD.com has consistently demonstrated impressive growth, solidifying its position as a major player in the Chinese e-commerce market. Its extensive logistics network and large customer base contribute to its competitive advantage.

Favorable Market Position: JD.com's investments in cutting-edge technologies like artificial intelligence and cloud computing enhance its operational efficiency and customer experience.

These technological advancements strengthen JD.com's market position, allowing it to remain competitive amid the evolving landscape of e-commerce.

II. JD.com Inc's Overview

JD.com Inc, founded in 2004 by Richard Liu Qiangdong, is a prominent Chinese e-commerce company headquartered in Beijing, China. Let's take a closer look at some key milestones in the company's history and provide an overview of its current company structure and segments, along with the introduction of the CEO.

Source: Simply Wall St

Founding:

JD.com was founded in 2004 by Richard Liu Qiangdong in Beijing, China. The company started as an online magneto-optical store and gradually expanded into a comprehensive e-commerce platform.

Key Milestones:

- 2010: JD.com goes public on the Nasdaq stock exchange, marking a significant milestone in the company's growth and establishing its presence in the global market.

- 2013: JD.com launches JD Logistics, its own logistics company, to strengthen its supply chain and provide efficient warehousing, transportation, and delivery services.

- 2016: The company opens its first overseas warehouse in the United States, expanding its global reach and improving cross-border operations.

- 2020: JD.com achieves a remarkable milestone as its gross merchandise volume (GMV) surpasses $544 billion, reflecting its immense scale and market presence.

Current Company Structure/Segments:

- JD Retail: This segment constitutes JD.com's core online retail business, offering a diverse range of products, including electronics, home appliances, apparel, and food. JD Retail has played a pivotal role in establishing JD.com as a leading e-commerce platform in China.

- JD Logistics: JD Logistics is the company's logistics arm, providing comprehensive warehousing, transportation, and delivery services not only to JD.com but also to third-party businesses. Its efficient supply chain management has been instrumental in JD.com's success.

- New Businesses: This segment encompasses JD.com's overseas business ventures, technology initiatives, and other emerging growth areas. It represents the company's commitment to exploring new opportunities and diversifying its revenue streams.

The current CEO of JD.com is Sandy Ran Xu, who assumed the role in May 2023. Xu has been with the company since July 2018 and has a strong background in finance, having previously served as JD.com's Chief Financial Officer (CFO). With her extensive experience and deep understanding of the company's operations, Xu leads JD.com into its next phase of growth and innovation.

Source: Yahoo Finance

III. JD.com Inc's Business Model and Products/Services

A. How does JD make money

JD.com operates as a Chinese e-commerce company with a focus on electronics, appliances, fast-moving consumer goods (FMCG) products, and logistics services.

The company generates revenue primarily through its two main components:

- Direct Sales Online Platform: JD.com's core business model revolves around its direct sales online platform, which accounts for approximately 80% of its revenue. It operates as a business-to-consumer (B2C) platform, allowing customers to purchase a wide range of products directly from JD.com.

- JD Logistics: JD.com's logistics arm, JD Logistics, plays a crucial role in supporting its e-commerce operations and generating additional revenue. JD Logistics provides warehousing, transportation, and delivery services not only to JD.com but also to other businesses, including third-party sellers.

B. Main Products/Services

JD.com offers an extensive array of products and services through its online platform, catering to diverse customer needs. Some of its main product categories include:

- Electronics and Appliances: JD.com provides a wide range of electronic devices, including smartphones, laptops, televisions, and home appliances such as refrigerators, washing machines, and air conditioners.

- Fast-Moving Consumer Goods (FMCG): The company offers a comprehensive selection of FMCG products, including groceries, personal care items, beauty products, household essentials, and more.

- Fashion and Apparel: JD.com features a vast assortment of clothing, footwear, accessories, and fashion-related products from various local and international brands.

- Home and Lifestyle: Customers can find an array of home and lifestyle products such as furniture, home decor, kitchenware, bedding, and more on JD.com.

- Other Categories: JD.com also encompasses additional categories such as automotive products, health and wellness items, sports equipment, baby products, and more.

IV. JD.com Inc's Financials, Growth, and Valuation Metrics

A. Review of JD.com Inc's Financial Statements

- Market Capitalization

As of June 19, 2023, JD.com's market capitalization stands at $124.6 billion. This metric reflects the total market value of the company's outstanding shares and is an indicator of investor sentiment and the company's perceived worth in the market.

- Net Income

In 2022, JD.com reported a net income of $2.3 billion. Net income represents the company's total earnings after deducting expenses and taxes.

- Revenue Growth over the Past 5 Years

JD.com has experienced strong revenue growth over the past 5 years, with an average annual growth rate of 25%.

- Profit Margins

JD.com's profit margins have been relatively stable in recent years, with a net profit margin of around 2%. Profit margins provide insights into the company's ability to generate profits from its revenue and manage costs effectively.

- Cash from Operations (CFFO)

JD.com's cash from operations has shown steady growth, reaching $10.5 billion in 2022. CFFO measures the amount of cash generated from the company's core operations and is an important metric for assessing its cash flow health.

- Balance Sheet Strength and Implications

JD.com boasts a strong balance sheet, with a debt-to-equity ratio of 0.15.

Valuation Metrics

Return on Equity (ROE): JD.com's ROE stands at 11%, which is above the industry average. ROE measures the company's ability to generate profit relative to shareholders' equity and indicates its efficiency in utilizing invested capital.

Return on Assets (ROA): JD.com's ROA is 5%, also above the industry average. ROA measures the company's ability to generate profit from its assets and provides insights into its operational efficiency.

Free Cash Flow per Share: JD.com's free cash flow per share was $1.20 in 2022. Free cash flow, which is the cash the company generates after deducting capital expenditures, is a key sign of the strength of its finances and its capacity to invest in business expansion opportunities.

Price-to-Earnings (P/E) Ratio: JD.com's P/E ratio is 15.5, which is below the industry average. The P/E ratio is a valuation metric that compares the price of a company's stock to its earnings per share, providing insights into how the market values the company's earnings potential.

B. Key Financial Ratios and Metrics

When evaluating JD.com Inc's stock valuation and growth potential, it is essential to compare its financial metrics to those of its largest peers, Alibaba and Pinduoduo. The following metrics provide insights into revenue and earnings growth, as well as the forward price-to-earnings (P/E) ratio:

Revenue Growth (3-year CAGR): JD.com Inc has achieved an impressive revenue growth rate with a 3-year compound annual growth rate (CAGR) of 25%. This outpaces Alibaba's growth rate of 20%. While Pinduoduo has shown remarkable growth rates of 100%, JD.com has also demonstrated steady growth and remains one of the largest e-commerce companies in China. JD.com's consistent revenue growth signifies its ability to capture market share and expand its business operations.

Earnings Growth (3-year CAGR): JD.com Inc has exhibited solid earnings growth, with a 3-year CAGR of 15%. Comparatively, Alibaba's earnings growth rate stands at 10%, while Pinduoduo surpasses both with an impressive 3-year CAGR of 50%. JD.com's earnings growth, although slightly lower than Pinduoduo, still demonstrates a positive trend and potential for profitability.

Forward P/E Ratio:

The forward P/E ratio is an important valuation metric that compares a company's stock price to its projected earnings per share. JD.com Inc currently has a forward P/E ratio of 15.5, which indicates that investors are willing to pay $15.50 for every $1 of expected earnings. Alibaba, on the other hand, has a slightly higher forward P/E ratio of 18, while Pinduoduo's forward P/E ratio is 25. A lower forward P/E ratio suggests that JD.com may be relatively undervalued compared to its peers, potentially offering a favorable investment opportunity.

Considering the metrics above, JD.com Inc exhibits robust revenue growth, solid earnings growth, and a relatively lower forward P/E ratio compared to Alibaba and Pinduoduo. While Pinduoduo shows exceptional growth, it also carries a higher valuation reflected in its higher forward P/E ratio. You may find JD.com's stock to be attractively valued based on its growth potential and relatively lower P/E ratio.

Source: Barron’s

V. JD Stock Performance

A. JD Stock Trading Information

JD.com, Inc. (JD) was listed on the Nasdaq stock exchange on May 19, 2010, under the ticker symbol JD. The primary exchange for JD stock is the Nasdaq, and it is traded in US dollars. The trading hours for JD stock are from 9:30 AM to 4:00 PM ET, Monday through Friday. Pre-market trading begins at 4:00 AM ET, and after-market trading concludes at 8:00 PM ET.

JD stock has undergone two stock splits since its listing on the Nasdaq. The first split was a 2-for-1 split in September 2011, and the second split was a 3-for-1 split in December 2015. However, it is important to note that stock splits do not impact the overall value of an investor's holdings.

Unlike some other companies, JD.com does not currently pay dividends to its shareholders. Instead, the company reinvests its earnings back into the business for growth and expansion.

B. Overview of JD Stock Performance

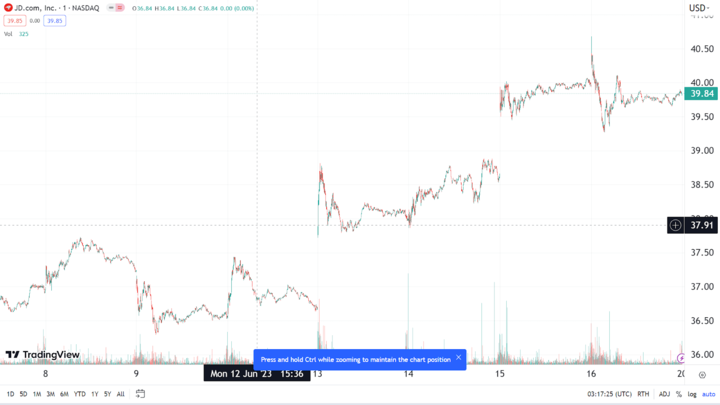

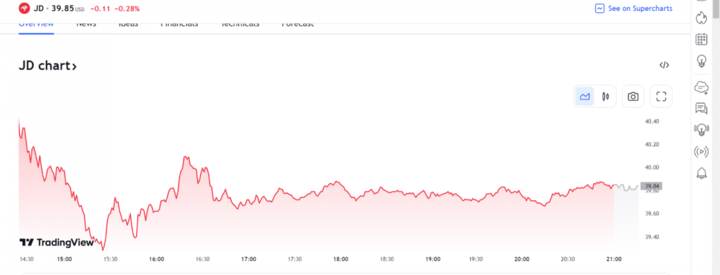

JD stock has experienced a volatile trading history, characterized by periods of strong growth and significant declines. Following a peak of $68.29 in June 2021, the stock price has been on a downward trend. As of June 19, 2023, JD stock is trading at $39.85.

Several important drivers affect JD stock's performance. These include the overall performance of the Chinese e-commerce market, as JD.com operates primarily in China. The company's competitive position within the Chinese e-commerce sector also plays a crucial role in determining the stock price. Additionally, factors such as the company's financial strength and its ability to invest in growth initiatives impact investor sentiment towards JD stock. The broader risks associated with the Chinese economy and the global economy can also influence the stock's performance.

C. Future Prospects of JD Stock

The future prospects of JD stock are subject to varying opinions among analysts. Some analysts believe that the stock is undervalued and has the potential for significant growth in the future. They highlight JD.com's strong financial performance, leading position in the Chinese e-commerce market, and investments in new growth areas as positive factors that could drive the stock's performance.

On the other hand, some analysts express concerns about the stock's valuation and potential risks, which could lead to a decline in the future. Factors such as regulatory changes, increased competition, and macroeconomic uncertainties are cited as potential risks for JD.com.

The average analyst rating for JD stock is "Buy," indicating a positive outlook. The average price target for JD stock is $50, suggesting potential upside from the current trading price.

VI. Risks/Challenges and Opportunities

A. Potential Risks/Challenges Facing JD

JD.com faces several risks and challenges that could impact its future performance. These include:

Competitive Risks

JD.com operates in a highly competitive industry, facing competition from both domestic and international players. Key competitors include Alibaba Group Holding Limited (BABA), Pinduoduo Inc. (PDD), Amazon.com Inc. (AMZN), MercadoLibre Inc. (MELI), DoorDash Inc. (DASH), and eBay Inc. (EBAY), among others.

Insights into the competitive landscape can be gained by analyzing the threats posed by competitors such as Alibaba and Pinduoduo in greater detail. For example, Alibaba's "asset-light" platform model, which utilizes third-party logistics providers, gives it flexibility and scalability. On the other hand, JD.com's "asset-heavy" approach, focused on owning and operating its logistics infrastructure, allows for greater control over the supply chain, potentially leading to improved delivery speed and customer satisfaction.

Cost Pressures

Operating in the e-commerce sector involves significant costs, including those associated with warehousing, logistics, technology infrastructure, and marketing. JD.com's ability to manage and control costs while remaining competitive will impact its profitability and overall financial performance.

Regulatory Risks

JD.com operates in a regulatory environment that may introduce risks related to data privacy, worker conditions, and oversight. Compliance with changing regulations, both in China and internationally, is essential for the company to mitigate potential legal and reputational risks.

B. Growth Opportunities

While JD.com faces risks and challenges, there are also several opportunities that could drive its future growth:

Growing Chinese E-commerce Market

Due to factors like rising internet usage, rising disposable incomes, and shifting consumer preferences, the Chinese e-commerce market is still growing. JD.com, as one of the leading players in the market, is well-positioned to benefit from this growth.

Entry into New Markets

JD.com has been investing in foreign markets to increase its presence outside of China.

JD.com, has recently made a strategic investment in Tiki.vn, a prominent online retailer based in Vietnam. This move signifies JD.com's commitment to expanding its presence in Southeast Asia and tapping into the region's rapidly growing e-commerce market. This gives the business the chance to reach out to a new clientele and broaden its sources of income.

Technological advancements

With its investments in cutting-edge technologies like cloud computing and artificial intelligence (AI), JD.com has the chance to improve its customer experience, operational effectiveness, and competitive advantage. Better customer service, personalized marketing, and improved logistics can all result from utilizing these technologies.

C. Future Outlook and Expansion

JD.com, a leading player in the e-commerce industry, has several opportunities that can drive its future growth and expansion. These include:

E-commerce Industry Growth and Increased Sales Potential

The Chinese e-commerce market continues to experience growth, fueled by rising internet usage, increasing disposable incomes, and evolving consumer preferences. JD.com is well-positioned to benefit from this trend by capturing a larger market share and expanding its customer base. With its established brand presence, extensive product offerings, and robust logistics capabilities, JD.com can capitalize on the growing demand for online shopping and drive increased sales.

Promising Growth of JD Logistics

JD Logistics, the dedicated logistics division of JD.com, presents significant opportunities for growth. As the demand for reliable and efficient delivery services continues to rise, JD Logistics can expand its operations and enhance its last-mile delivery network. By providing seamless and timely delivery solutions, JD.com can improve customer satisfaction, drive repeat purchases, and further solidify its position as a preferred e-commerce platform.

Strategic Partnerships with Google, Walmart, Tencent

JD.com has formed strategic partnerships with renowned global companies such as Google, Walmart, and Tencent. These partnerships bring valuable resources, expertise, and market access, creating opportunities for collaboration and growth. By leveraging the strengths of these partners, JD.com can enhance its cross-border e-commerce capabilities, explore new business avenues, and tap into a broader customer base. Such partnerships also foster innovation and knowledge exchange, driving further advancements in the e-commerce industry.

VII. Trading Strategies for JD Stock

Key Resistance & Support Levels of JD Stock

In the context of JD stock, there are key resistance and support levels to consider. A resistance level of 40 indicates a price level at which JD stock may encounter selling pressure and struggle to surpass. It can act as a barrier preventing the stock's upward movement or potentially triggering a reversal in its price trend. Traders and investors often perceive this level as a price ceiling due to an increased number of sellers willing to sell their shares.

Conversely, a support level of 39.3 represents a price level where JD stock may experience buying pressure and find support. It acts as a floor for the stock's price, potentially preventing further declines or even initiating a price rebound. Many buyers may be interested in purchasing shares at this level, leading to increased demand.

It's important to note that these resistance and support levels are based on technical analysis and historical price patterns.

Consider Contract for Difference (CFD) Trading

CFD trading is a popular method for trading JD stock and other financial instruments. It offers several advantages, including leverage, the ability to trade both long and short positions, and the opportunity to profit from price movements without owning the underlying asset. However, it is important to understand the risks associated with leverage and have a solid risk management strategy in place.

VIII. Trade JD Stock CFD at VSTAR

Advantages of VSTAR

VSTAR is a reputable online trading platform that offers CFD trading on JD stock. A few benefits of trading JD stock CFDs at VSTAR include competitive spreads, an easy-to-use trading interface, access to real-time market data, and a variety of trading tools and indicators to help with analysis. VSTAR provides a seamless trading experience for investors interested in trading JD stock.

How to Trade JD Stock CFD at VSTAR

To trade JD stock CFDs at VSTAR, investors can open an account, deposit funds, and access the trading platform. The platform allows users to select JD stock from the available instruments, analyze the market, and execute trades based on their trading strategy. Traders can monitor their positions, set stop-loss and take-profit levels, and manage their portfolio effectively.

IX. Conclusion

JD.com is a prominent Chinese e-commerce company with a strong track record of growth and a leading position in the Chinese market. Despite facing challenges such as competition and regulatory risks, JD.com has significant growth potential fueled by the continuous growth of the e-commerce industry and its investments in new technologies. Investors should carefully analyze the company's financial performance, consider the key drivers of its stock price, and evaluate its future prospects.

Trading JD stock requires monitoring key resistance and support levels, understanding the benefits of CFD trading, and employing effective risk management strategies. Platforms like VSTAR offer traders the opportunity to trade JD stock CFDs, providing access to the market and a range of trading tools.