In the realm of agricultural excellence, Deere & Company (NYSE: DE) stands as an influential pioneer, constantly innovating to steer through shifting industry tides. Embarking on an in-depth exploration of Deere's fiscal year 2023 unveils a tale of financial prowess, strategic market maneuvers, and technological innovations in a dynamic agricultural sphere. Amidst a world witnessing profound transformations, Deere's resilience shines through as it navigates challenges while capitalizing on opportunities.

This article delves into the heart of Deere's fiscal landscape, deciphering the company's stellar financial performance, operational triumphs, global market insights, groundbreaking technological advancements, and astute fiscal strategies. As Deere encounters market fluctuations, geopolitical complexities, and technological disruptions, its ability to adapt, innovate, and maintain resilience amid uncertainty impacts its path toward sustainable growth and prominence in the agricultural domain.

Financial Performance and Operational Excellence

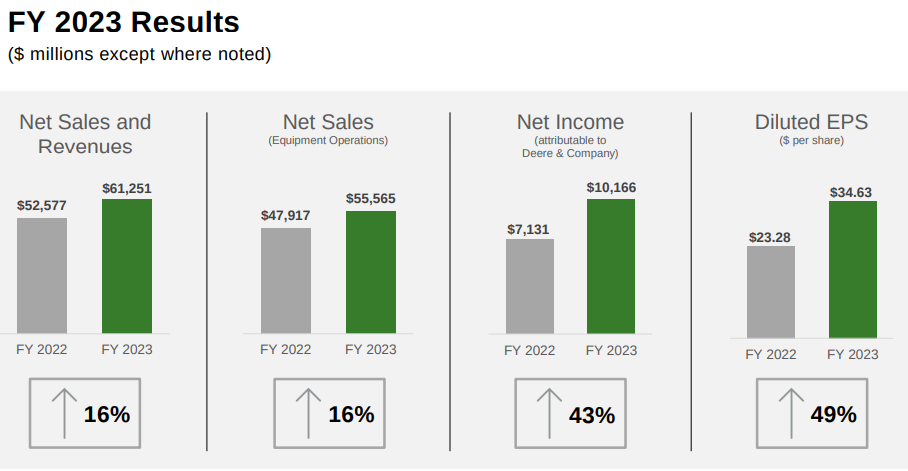

Deere exhibited commendable financial performance throughout the fiscal year 2023, marked by substantial revenue growth and impressive operating margins. The company achieved a 16% increase in net sales and revenues, reaching $61.3 billion. Equipment operations, a core segment for Deere, also experienced a matching 16% surge, amounting to $55.6 billion in net sales. This robust top-line growth was backed by operating margins close to 22%, resulting in nearly $12 billion in operating cash flow.

The fourth quarter stood out with an excellent finish, despite a slight decline in net sales and revenues by 1% to $15.4 billion. Equipment operations experienced a 4% decrease to $13.8 billion in net sales. However, net income attributable to Deere & Company surged to $2.4 billion or $8.26 per diluted share, indicating strong profitability amidst a challenging quarter.

Operational excellence was highlighted by the effective execution of production schedules, as mentioned by Brent Norwood, ensuring consistent delivery against backlog orders. The resumption of normal seasonal shipment patterns in factories showcased disciplined inventory management. Additionally, maintaining strong pricing amid inflationary pressures demonstrated the company's adeptness in navigating market challenges.

Source: Earnings Call

Market Insights and Geographic Analysis

a. North America

Despite the anticipated decline in agricultural equipment demand in 2024 due to moderating farm fundamentals and high-interest rates, Deere's insights suggest that customers remain profitable. Healthy farm balance sheets, bolstered by increased farmland values, contributed to this profitability.

Efficient management of inventory levels, specifically highlighting the low levels of new inventory for large ag equipment compared to previous years, positions Deere well to produce in line with retail demand in 2024.

Understanding seasonal trends and production cycles further indicates a proactive approach to aligning operations with market conditions.

b. South America

Challenges faced in 2023 due to political uncertainty, interest rates, and adverse weather conditions led to a significant decline in demand. Deere's strategy for 2024 involves adjusting inventory levels to meet anticipated demand, aiming to restore inventory to target levels and align production accordingly.

c. Europe

A relatively stable market is expected in 2024, with orders estimated to match industry demand. Deere's commitment to executing business strategies in Europe, particularly focusing on offering differentiated value through precision tech adoption, indicates a strategic approach to maintain market stability.

Technological Innovation and Strategic Investments

a. Precision Ag Technologies

Investment in solutions like See & Spray and autonomy reflects the company's emphasis on enhancing productivity and offering value-added solutions to customers. The successful launch of See & Spray Ultimate for model year 2024 and the introduction of retrofit kits demonstrate a progressive approach to technology adoption across different equipment vintages.

The autonomy journey shows significant progress, with plans for acreage expansion through paid pilots in 2024. Improved metrics, such as uptime without intervention and reductions in false positives, indicate advancements in technology performance and readiness for broader commercialization.

b. Gen-5 Display Operating Systems

Deere's innovation extends to accessibility by introducing Gen-5 display operating systems, allowing farmers to unlock productivity gains in older equipment. This initiative aligns with the company's commitment to providing solutions that cater to diverse customer needs, irrespective of equipment age.

Cost Management and Efficiency Strategies

a. Inflationary Cost Mitigation

Efforts to manage direct and indirect material costs, logistics expenses, and overheads amid rising inflationary pressures have been a focus. The company's ability to reduce production costs, as reflected in the positive trend for production and precision ag costs, showcases proactive measures to counter inflationary impacts.

b. Operational Efficiency and Lean Management

Deere's ability to maintain lean operations and adapt quickly to changing environments while focusing on customer satisfaction has been instrumental in managing costs effectively. The continuous improvement efforts across teams contribute to a streamlined and efficient operational framework.

Cash Flow Management and Capital Allocation

Deere's strong cash flow position and prudent capital allocation strategies underline financial stewardship:

a. Strong Cash Flow Conversion

The company's robust cash flow in 2023 facilitated various priorities, including maintaining liquidity, reinvesting in the business, increasing dividends, and conducting significant share repurchases. This reflects efficient cash flow management and the ability to execute strategic initiatives.

b. Balanced Capital Allocation

Deere's commitment to disciplined use of cash, evident in its balanced approach to capital allocation, includes investments in R&D to drive innovation, returning value to shareholders through dividends, and conducting share buybacks. This balanced allocation aims to support business growth while rewarding shareholders.

DE Stock Technical Take

John Deere's current stock price appears to have factored in its financial performance, portraying robust fundamentals for the long haul. Presently, the stock rests at a support level, boasting an RSI of 43, indicating restricted potential downside. Yet, in the event of unfavorable economic shifts or adverse weather predictions, the stock might dip towards $314, testing its long-term support (depicted by the red path).

However, the prevailing likelihood suggests a lateral movement in the coming weeks, followed by an upward trajectory, possibly reaching the pivot point near $399.

Source: tradingview.com

Specific Risks

- Market Volatility: Fluctuations in agricultural and construction markets may impact demand for equipment, leading to sales volatility and potential revenue decline.

- Geopolitical Factors: Political uncertainties, trade tensions, or regulatory changes in regions like South America or Europe may affect market access, impacting sales and operations.

- Interest Rate Impact: Higher interest rates could reduce customers' purchasing power, influencing their decisions on discretionary equipment investments.

- Technological Disruption: Rapid advancements in technology may render existing equipment obsolete, necessitating increased R&D expenditure to stay competitive and avoid product obsolescence.

In conclusion, Deere's fundamental strengths encompass strong financial performance, operational excellence, market insights across diverse geographies, technological innovation, efficient cost management, and prudent capital allocation. These strengths collectively position the company for sustained growth potential despite anticipated market challenges in 2024. Deere's ability to navigate market dynamics, leverage technological advancements, and maintain operational efficiency underscores its resilience and adaptability in a competitive landscape.