Kraft Heinz established a reputation for itself as a consumer goods company with a wide range of products that can be found in any home. But over the last 5 years, Kraft Heinz stock has taken a beating. Since 2017, KHC stock has delivered over -42% to investors while S&P 500 has returned 80% in the same period. The company's balance sheet also leaves much to be desired. But in the face of near and medium-term challenges, Kraft Heinz & Co. is focused on innovation.

Its CEO Miguel Patricio stepped down from the role to be replaced by Carlos Abrams-Rivera the President of its North American branch who successfully managed the business during the pandemic. Plus, it announced plans to build a $400 million automated consumer packaged goods distribution center to increase its supply volume to customers. In response to customers' desire for cheaper products, KHC has paused the price hikes and will influence consumers to stick with the brand. Will this be enough to turn the tide in 2023? Let's take a look.

How Kraft Heinz Started

Kraft Heinz Company is the fifth largest food and beverage company in the world and is a result of years of acquisitions and takeovers. At the start, Kraft Heinz was two separate companies created by James Lewis Kraft and Henry John Heinz in 1903 and 1869 respectively. Kraft focused mainly on selling cheeses in the beginning and later expanded its product range to include popular products like Toblerone chocolate, Oscar Mayer meats, Jacobs and Maxwell House coffees, and Cadbury Dairy Milk chocolates. Heinz on the other hand, sold meals, baby food, sauces, the iconic ketchup, and snacks. The two companies merged in 2015 with headquarters in both Chicago, Illinois, and Pittsburgh, Pennsylvania.

So who owns Kraft Heinz now? Kraft Heinz is owned and controlled by institutional investors. Berkshire Hathaway holds the largest stake in the company with 26.65% followed by 3G Capital, Vanguard, and BlackRock Fund Advisors.

Source: Seeking Alpha

Business Model and Services

To continue to grow in the consumer goods market, Kraft Heinz targets food service providers, households, and industrial customers with high-quality but convenient food options. Kraft Heinz products are sold at an affordable range and made easily accessible to a wide range of customers across the globe through the company's distribution channels.

Moreover, KHC has focused on making strategic acquisitions and takeovers that enable it to expand its business segments and provide a wider variety of products to customers. At the same time, the company has forged meaningful relationships with research firms to continuously focus on product development and bring new offerings to the market regularly.

Products and Services

These are the products under the umbrella of Kraft Heinz & Co:

Source: My Food and Family

The Kraft Heinz Company's Financials

Kraft Heinz's brand reputation and strong portfolio allowed it to raise its prices without taking a significant hit to sales. This helped it to stay financially viable in 2022 with a market cap of $40.17 billion. In the final quarter of 2022, the group reported a 10.02% increase in revenue to $7.38 billion and the same trend has continued into 2023. For Q1 2023, revenue and net income grew by 7.34% and 7.73% year over year respectively to $6.49 billion and $836 million. These numbers improved in Q2 2023 as net income had risen to $1 billion and revenue to $6.72 billion. During its second-quarter earnings release, KHC noted that its adjusted EBITDA of $1.6 billion was up 6% while its adjusted EPS increased by up to 13% from last year.

But despite the numbers, Kraft Heinz is feeling the pressure from the price hikes. Enough customers are sticking with Kraft Heinz to keep its revenue and profit stable but others are turning to cheaper alternatives resulting in a 7% drop in sales volume for Q2 2023.

KHC Balance Sheet

After the merger, Kraft Heinz focused on cost-cutting measures to improve its balance sheet and succeeded in doing just that. By 2022, long-term debt was down to $19.82 billion from $28.55 billion in 2020. Its total liabilities and shareholder equity also reduced from $99.83 billion to $90.51 billion in the same period. However, its debt is still high enough to make the company fragile in the face of worsening economic conditions.

Moreover, KHC's total assets have been steadily declining since 2018 from $103.46 billion to $90.95 billion at the end of Q2 2023 which indicates that assets are being sold. For example, Kraft Heinz sold its B2B powdered cheese business to Kerry Group last year and is selling its baby food business in Russia to snacks maker Chernogolovka. In 2019, its Canadian natural cheese businesses and Indian beverage brands were also sold. Plus, KHC did away with its nuts-based brand Hormel in 2021 all in a bid to reduce its debt.

Key Metrics and Ratios

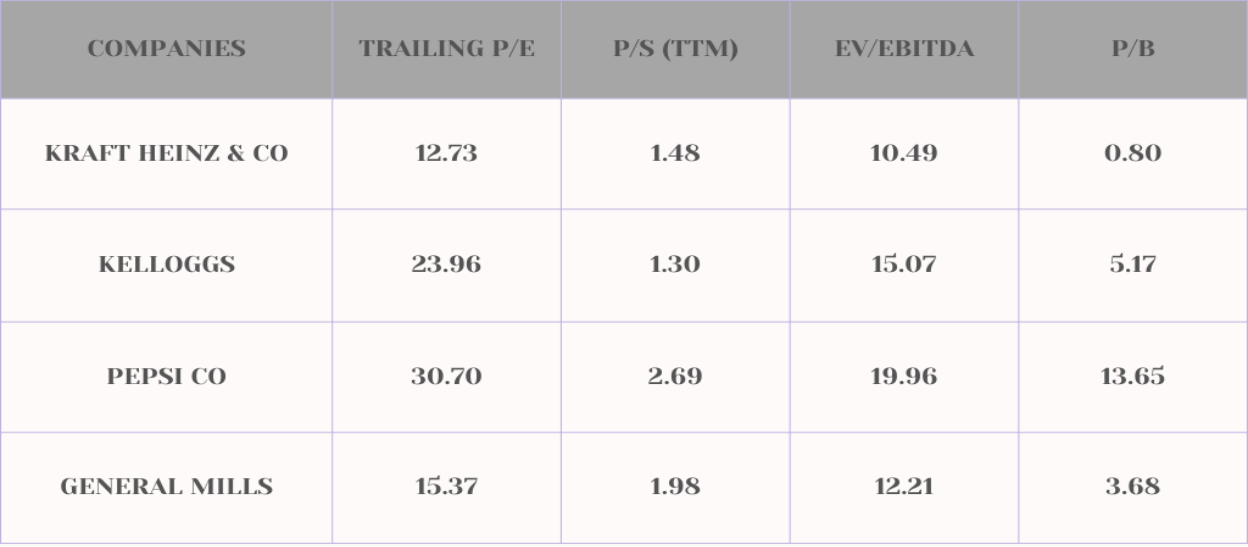

Let's look at Kraft Heinz's key metrics compared to its competitors:

Based on these valuation metrics, KHC stock is reasonably valued compared to its competitors. The company is facing some near-term challenges which affects Kraft Heinz stock price and its valuation.

Is KHC Stock Worth It?

KHC Stock Trading Information

Primary Exchange & Ticker: NASDAQ: KHC

Country & Currency: USA(USD)

Trading Hours: Investors may trade in the Pre-Market (4:00 - 9:30 am ET) and After Hours (4:00 - 8:00 pm ET) Market

KHC Stock Splits: N/A

KHC Dividend: Kraft Heinz pays a quarterly dividend of $0.40 at a 4.92% annual dividend yield.

KHC Stock Performance Since IPO

After its incorporation in 2015, KHC stock started trading under NASDAQ at $51 per share and rose by 3.5% when other stocks in the market were posting declines. By February 2017, it peaked at $96.65 but couldn't continue its upward trajectory. Its struggle to grow sales and profit took a toll on its stock price and hasn't been able to make a quick turnaround.

In 2019, KHC stock price fell to a record $35 after the company reported a loss of $10.2 billion for the previous year. The stock crashed again by more than 20% after the company announced that it wrote down the value of two of its most valuable brands Oscar Meyer and Kraft resulting in a net loss of $12 billion. Investors' sentiment also took a nosedive as Kraft Heinz slashed their dividend to 40 cents per share from 62.5 cents.

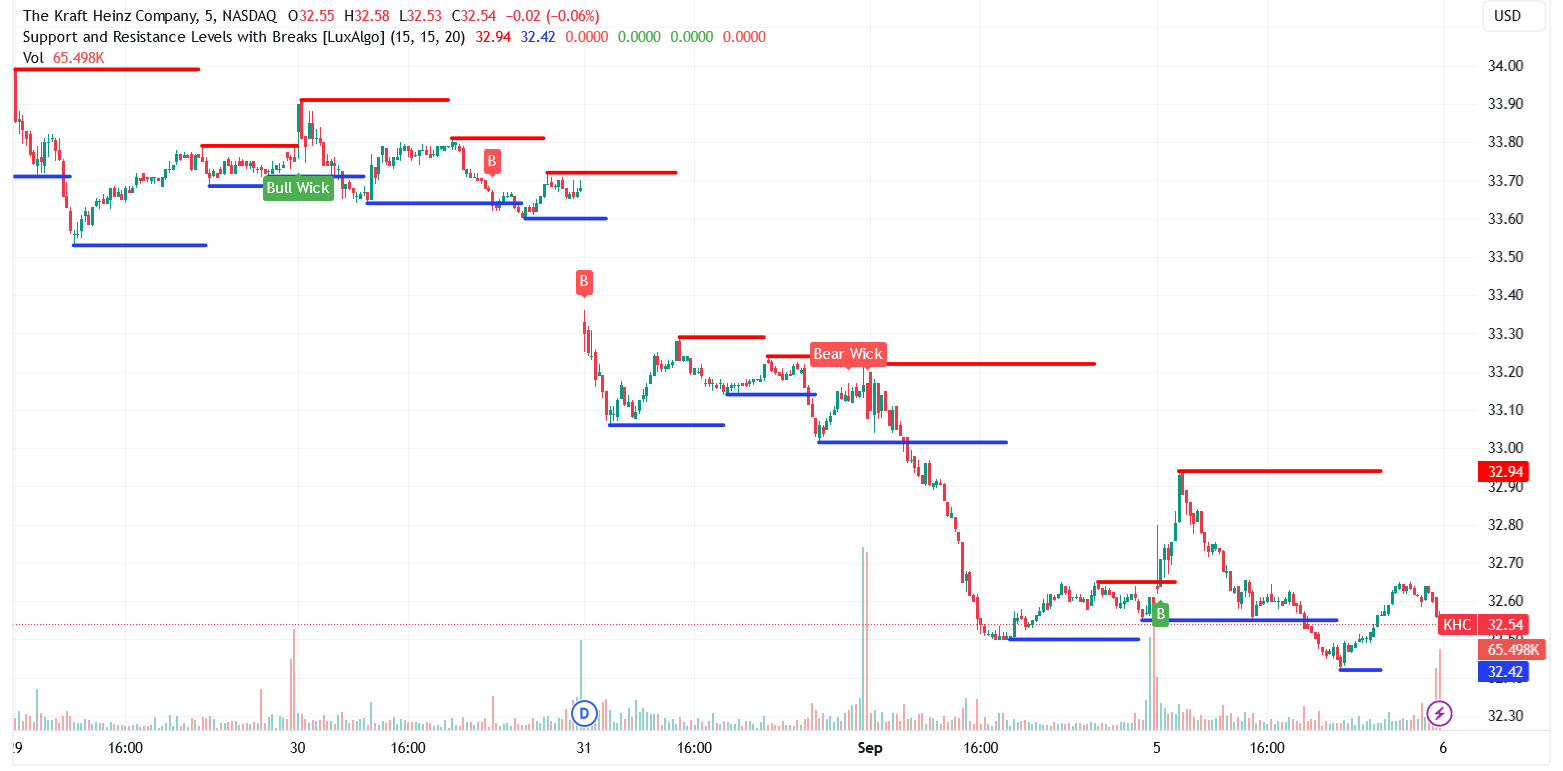

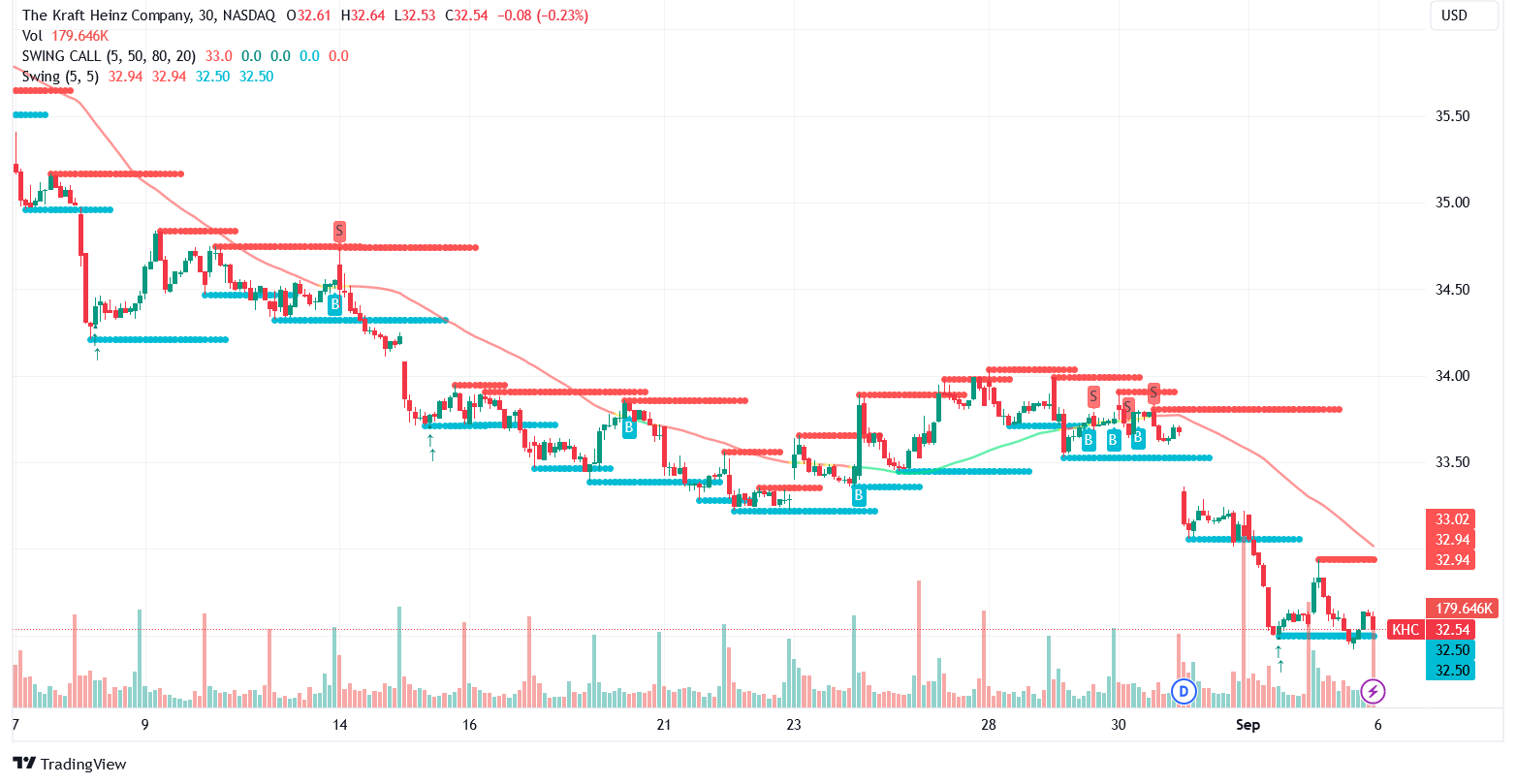

Since its merger in 2015, Kraft Heinz stock has been in a downtrend, falling by 54.15%. The stock has also dropped by 19.69% this year from $40.78 in January to $32.55 in September 2023. Its 52-week high is $42.80 which is 31.49% above the current stock price. Plus, KHC stock is trading 0.4% above its 52-week low of $32.42 and 15.85% below its 52-week average price of $37.71.

KHC Stock Forecast

KHC stock dividend yield makes it attractive to investors but investment analysts are neutral given its current struggles. The current consensus among 22 analysts is to hold Kraft Heinz stock for now. KHC stock price is still trading within its support and resistance range of $32.42 and $34 indicating that no major price changes will be happening soon.

Analysts are predicting a median price target of $40 which represents a 22.93% increase from its current stock price and a low estimate of $37.90. If the stock does rally this year, analysts project that KHC stock price could climb as high as $48 by the end of the year.

Challenges and Opportunities for Kraft Heinz

Competitive Risks

- Strong competitors: KHC is competing with lower-priced alternatives like Costco's Kirkland Signature, and Walmart's Great Value. It still has to compete with large-scale companies such as General Mills, Nestle, and Kellogg.

- Inflation: Kraft Heinz passed off the cost of raw materials to customers by gradually adjusting their prices. This allowed it to maintain its profit margins but competition in the consumer goods industry is high. Consumers are switching from Kraft Heinz products to cheaper alternatives with similar quality.

- High dependence on North American sales: The North American market accounts for close to 80% of its sales. Such exposure makes Kraft Heinz open to any disruptions in the economy as well as changing consumer tastes and preferences.

Source: Food Navigator

Growth Opportunities

- Brand reputation: Kraft Heinz is a global brand with a portfolio of popular products that have been a staple in households and grocery stores for years. These products have allowed Kraft Heinz to benefit from strong customer loyalty and economies of scale due to the scale of its operations.

- Investing in new products: The Chicago-based manufacturer plans to roll out more plant-based products to compete with Beyond Meat and Impossible Foods along with a set of sauces. In addition, it is partnering with chefs and chicken brands to boost its packaged foods products and attract more customers.

- Strategic acquisitions: Kraft Heinz still acquires companies that increase its reach in emerging markets. For instance, its acquisition of Hemmer, a 107-year-old company, gave it access to the Brazilian seasonings market. It also recently expanded its European acquisition Just Spices to the US market.

Future Outlook and Expansion

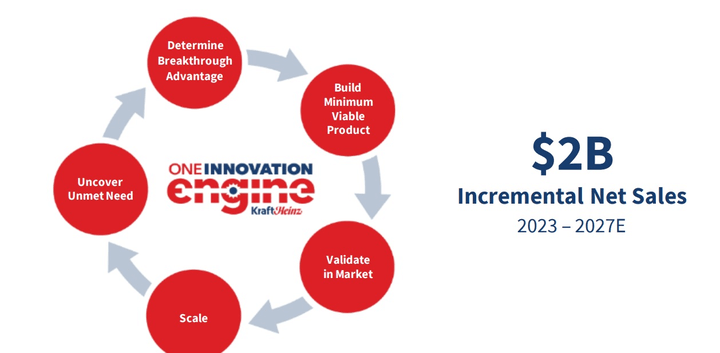

KHC has succeeded in growing earnings per share (EPS) by 9.9% for the last 3 years and it plans to continue by consistently predicting consumer trends 10 years into the future. Former CEO Miguel Patricio noted that Kraft Heinz already has 124 employees working on disruptive innovations to move the company in the right direction and expand its position in emerging markets. To this end, Kraft Heinz has partnered with BEES to increase its distribution points in Columbia, Mexico, and Peru and increase the products available to retailers in the region. KHC also expects food service to be a global driver for growth and is laying the groundwork. For instance, the company is engaging in quick service restaurant (QSR) partnerships and a Chef-led foodservice sales model to capture market share in the North American market and abroad which could increase annual net sales by 10% over the next 4 years.

Source: Bright Green Partners

The plant-based food industry as a whole is projected to increase to $35.9 billion by 2023 and is one that most food companies want to get into including Kraft Heinz. In the next couple of years, KHC will release new products like meat-free nuggets, burgers, soups, frozen meals, and mince all made with a variety of beans ranging from black beans and kidney beans to cannellini. Its partnership with tech startups StartLife and TheNotCompany will also push forward in the plant-based food sector to produce plant-based versions of its most popular products at the same quality and taste.

As Kraft Heinz realizes its plans, analysts project that its revenue and EPS will increase to $28.43 billion and 3.38 respectively in 2026. That's not a lot of growth from its estimated revenue and EPS of $27.08 billion and 2.90 for 2023 but what Kraft needs is to show consistent growth over the long-term.

Trading Strategies for KHC Stock

Swing trading: To swing trade KHC stock, you'll need to open a position for days or even months to profit from a predicted price trend. Opening a position for such a long time will leave you exposed to overnight and weekend risks because the trend can change overnight. However, when done correctly, swing trading can be very profitable, bringing in 5-10% profit in a single trade.

CFD trading: CFD trading is just as profitable as swing trading when done with the right broker and tools. With this trading strategy, you don't have to own Kraft Heinz stock to benefit from it. Instead, you trade on the rise and fall of KHC stock price over a specified period.

Most CFD trading contracts usually last less than a day but while it lasts, you get great exposure to the market by using leverage to trade. However, like other trading strategies, CFD trading comes with a degree of risk. Therefore, it is important to implement CFD risk management techniques when trading.

Day trading: Day trading is perhaps the most popular way to trade Kraft Heinz stock. Using this trading strategy, you can buy and sell KHC stock within 24 hours and make small profits throughout the day. Most traders choose to do this part-time as an additional source of income.

The best time to day trade is in the first few hours and the last hour of the trading day because of how busy the stock market gets. If you are not quite ready for day trading, you can always build on your skills by using a demo platform with real-time data provided by a broker like VSTAR.

Trade KHC Stock CFD with VSTAR

Trading KHC stock CFD with VSTAR reduces the barrier of entry by enabling traders to capitalize on the lucrative market with as low as $50. But regardless of your capital, VSTAR charges nothing whenever you trade while providing trading tools to help you make accurate predictions.

For traders to expand their knowledge of the market, VSTAR covers a wide variety of trading topics through its podcast and educational content all free of charge.

Ready to take your trading potential to the next level? Get started in 5 easy steps:

- Visit the VSTAR website to open an account or download the app.

- Fill in your email and phone number

- Verify your identity by uploading the required documents

- Deposit funds using any of its payment platforms: Skrill, Visa, Mastercard, Tether, and Perfect Money

- Select KHC Stock CFD as your preferred trading instrument and start trading!

Conclusion

The past 5 years have tested Kraft Heinz's strength as a company. Its stock price has been in a constant decline, revenue growth is quite stagnant, and investors' sentiment is relatively neutral. This was fueled by inflation which caused consumers to move away from Kraft Heinz products and seek more affordable alternatives. Still, Kraft Heinz has a solid brand with trustworthy products. The company succeeded in raising its prices without much backlash and its cost-cutting measures showed some results as its balance sheet improved. It is also a dividend-paying stock which is something you might want to consider when making any investment decisions.

However, it is advisable to hold off on any significant investment until the company gets a handle on its short-term challenges and starts to execute its plans for innovation.