- Coca-Cola demonstrates effective global scale utilization in Q1, reflecting volume momentum in key markets like Japan, South Korea, and China.

- Strong revenue growth (11% organic) is driven by innovative initiatives, including new products and refining existing ones like Coke, Sprite, and Fanta, alongside consumer-targeted campaigns like Coke Space and K-Wave, enhancing brand relevance.

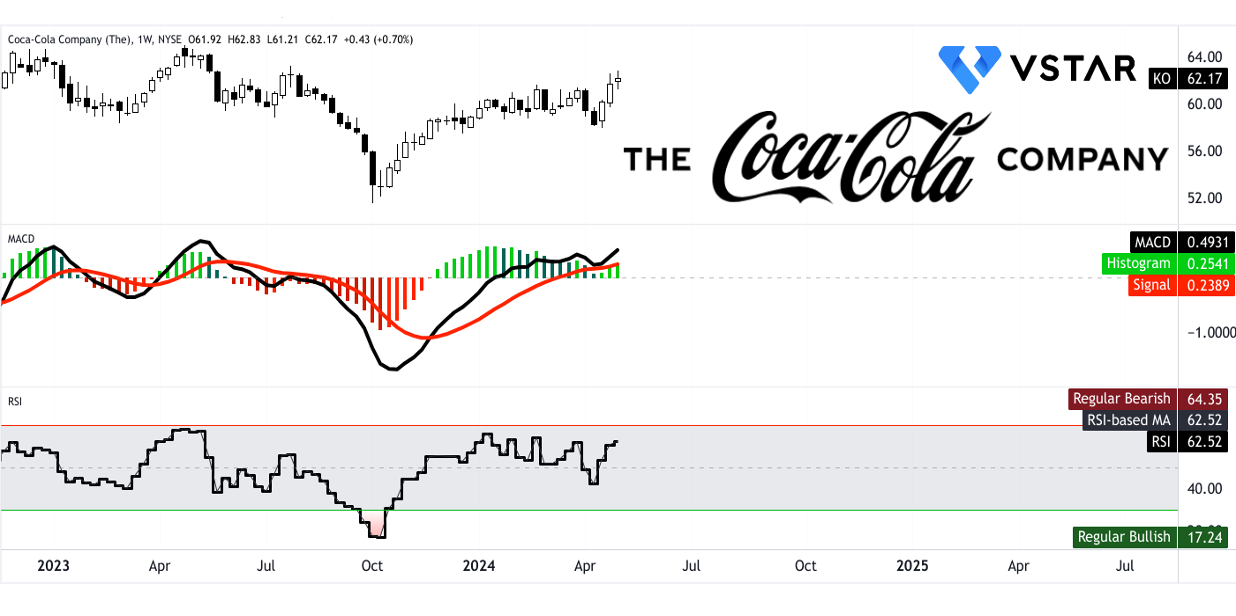

- Technical analysis indicates a bullish outlook for Coca-Cola's stock.

The analysis delves into the moat and downsides of Coca-Cola's financial standing and market edge. From global market penetration to stock performance, explore the iconic beverage giant's Q1 2024 performance and 2024 stock price prospects.

Coca Cola Market Moat

Revenue Growth and Pricing Power:

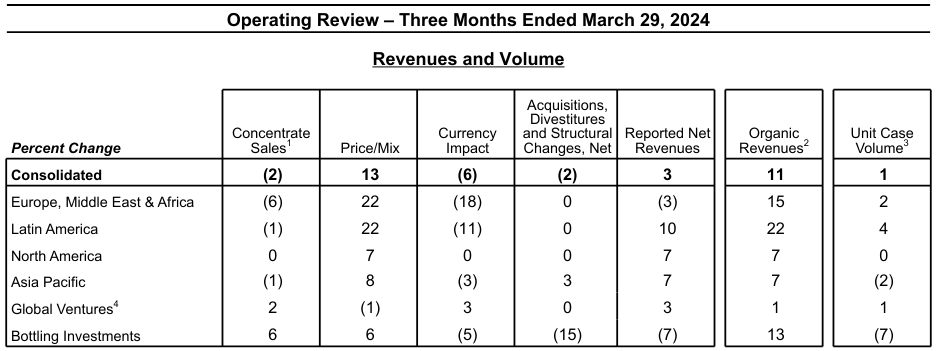

Coca-Cola's Q1 performance highlights its ability to achieve revenue growth despite challenges such as currency headwinds and inflationary pressures. In Q1, the company reports a significant 11% growth in organic revenues, driven by a 13% increase in price/mix. This indicates Coca-Cola's strong pricing power, as it effectively implements pricing actions to offset currency devaluation and inflation in certain markets. Additionally, the 3% growth in net revenues reflects the company's overall revenue performance, showcasing its resilience and ability to drive top-line growth.

Source: 2024 Q1 Earnings

Global Market Presence and Scale Utilization:

Coca-Cola's Q1 performance demonstrates its effective utilization of global scale. For instance, in Q1, the company reports growth across various regions, including Asia Pacific, Africa, Latin America, and Europe. Specific indicators include volume momentum in Asia Pacific, with markets like Japan, South Korea, and China contributing positively. Additionally, Africa and Latin America show continued volume growth, despite challenges like currency devaluations.

Brand Strength and Innovation:

Coca-Cola holds brand strength and innovative initiatives. For instance, the company introduces new products and refines existing ones to meet consumer preferences. This reflects in the 11% organic revenue growth in Q1, driven by strong performance across iconic brands like Coke, Sprite, and Fanta. Initiatives like Coke Space and K-Wave, targeting specific consumer segments like Gen Z, contribute to brand relevance and consumer engagement. Moreover, the company's focus on taste improvements, as seen in the strong performance of Fanta in various markets, reflects its focus on product advancement.

Financial Stability and Cash Flow Generation:

Despite challenges like currency headwinds and increased marketing investments, the company achieves a 60 basis points expansion in comparable operating margin in Q1. This expansion is driven by strong top-line growth and the successful re-franchising of bottling operations. Coca-Cola holds financial stability and robust cash flow generation. In Q1, the company reported a significant increase in cash flow from operations, driven by strong business performance and working capital initiatives. The net debt leverage ratio below the targeted range indicates prudent management and provides flexibility for investments and strategic initiatives.

Coca Cola Performance Downsides

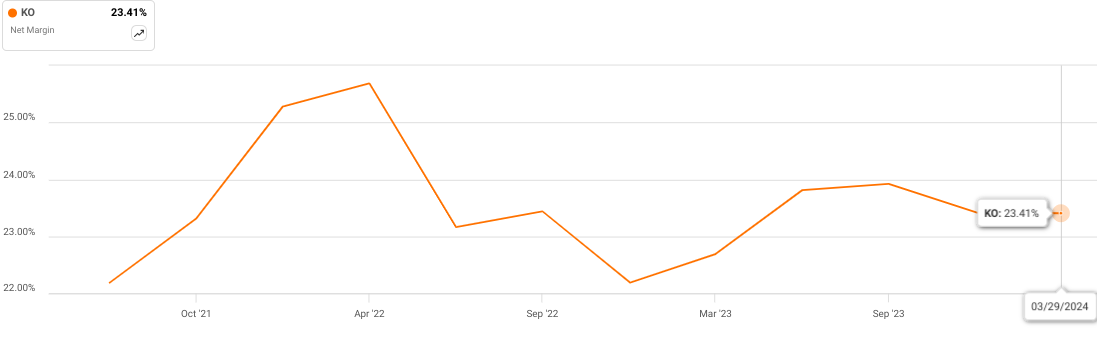

The decline in Coca-Cola's operating margin from 30.7% to 18.9% year-over-year is a significant concern. This sharp drop indicates a fundamental weakness in the company's ability to maintain profitability. Despite a slight expansion in comparable operating margin (non-GAAP) from 31.8% to 32.4%, the notable decline in reported operating margin suggests underlying challenges impacting performance. However, there is a stable net margin on a trailing twelve months basis.

Source: seekingalpha.com

Notably, the impact of certain items affecting comparability, including a $765 million charge related to the fairlife acquisition and a $760 million non-cash impairment charge related to the BODYARMOR trademark, further exacerbates this weakness. These charges not only affect current financial performance but also raise concerns about the effectiveness of the company's acquisition strategy and brand management. The substantial decline in operating margin indicates inefficiencies or increased costs that could hinder Coca-Cola's ability to achieve sustainable growth.

Additionally, with EPS growing only 3% to $0.74 and comparable EPS (non-GAAP) growing 7% to $0.72, the growth rates fall short of impressive figures against 11% organic revenue growth. Despite efforts to manage currency headwinds, the growth rates are below the targeted levels, indicating challenges in driving bottom-line profitability and shareholder value.

Ko Stock Forecast 2024

By the end of 2024, the average price target for Coca Cola stock is projected to reach $72.95. This projection is based on the momentum of change-in-polarity over the short-term, extrapolated over Fibonacci retracement/extension levels. Additionally, there's an optimistic price target of $77.50, derived from the price momentum of the current swing over the short-term, also projected over Fibonacci retracement/extension levels. These targets indicate a bullish outlook for KO stock price in the foreseeable future.

The current stock price of Coca-Cola (NYSE: KO) stands at $62.17, showing an upward trend according to the modified exponential moving average. The trendline, at $59.66, and the baseline, at $59.58, further affirm this upward trajectory. The modified exponential moving average indicates that the stock price has been consistently rising, suggesting a bullish sentiment in the market.

The primary support level is identified at $61.23, indicating a level where buying interest could potentially increase. The pivot of the current horizontal price channel is $60.01, with resistance levels of $67.34 and $63.88. Core support and resistance levels are also identified at $58.79 and $56.14, respectively. In cases of heightened volatility, support levels drop to $58.79 and $52.68.

Source: tradingview.com

The Relative Strength Index (RSI) value is currently at 62.52, indicating a moderately bullish sentiment. This value falls within the regular bullish level range, suggesting that the stock is neither oversold nor overbought. The absence of bullish or bearish divergences further supports the upward trend. The RSI line trending upward indicates increasing buying pressure, aligning with the overall bullish sentiment.

The Moving Average Convergence/Divergence (MACD) indicators show a bullish trend with the MACD line at 0.493 and the signal line at 0.239. The MACD histogram, at 0.254, indicates increasing bullish momentum. The strength of the trend is assessed as increasing, further corroborating the bullish outlook for Coca Cola stock price.

Source: tradingview.com

Conclusion

Coca-Cola's solid financials underscore global market strength and innovation but face challenges in operating margin and EPS growth. Despite setbacks, technical analysis suggests a bullish outlook for its stock, with key support and resistance levels guiding investment decisions. Overall, while facing headwinds, Coca-Cola remains poised for sustained growth in valuation.