In its latest earnings report, Lenovo, the world's largest PC maker, saw its revenue fall for the third consecutive quarter. That's because global demand for PCs continues to decline, and industry experts don't see that trend changing anytime soon, but Lenovo isn't too worried.

The Chinese tech giant is maintaining its partnerships with Formula 1, Ducati Corse and DreamWorks, and still plans to release new PCs and phones. There are also plans to enter the handheld PC gaming arena with its new Legion Go device. It will be similar to other products already on the market such as the ASUS ROG Ally and Steam Deck. In addition, the company is expanding its non-PC revenue streams by going all-in on AR with its new Project Chronos device.

But how is Lenovo stock doing, and is Lenovo a good stock to buy? Let's take a look at some reasons why you might want to add it to your portfolio.

Lenovo's Background

Since its founding in Beijing in 1984 by Danny Lui and Liu Chuanzhi, Lenovo Group Limited has enjoyed a remarkable rise to become one of the top technology companies in the world. In the beginning, the company only specialized in televisions, but eventually diversified its business by manufacturing computers. In 1990, the company found great success in selling computers, with the KT8920 mainframe computer becoming its shining product.

In 1994, Lenovo went public and raised nearly $30 million from its IPO because of its popularity in the Chinese market. The company used the funds from the IPO to open offices in North America, Europe, and Australia and expand its reach. One factor that accelerated Lenovo's expansion into foreign markets was its acquisition of IBM's personal computer division in 2005, which made Lenovo the world's third-largest computer maker by volume.

Source: GSMArena.com

The current Chairman and CEO is Yang Yuanqing, and Lenovo has operational headquarters in Beijing and North Carolina, United States.

Business Model and Services

Lenovo's growth has been fueled by a strategy known as protect and attack. This strategy was set in motion by its CEO, Yang Yuanqing, and combines both offensive and defensive attributes. Lenovo continues to build and protect its dominant position in China and the rest of the world as the top PC maker. Then it will continue to grow internationally by acquiring assets and increasing sales in emerging markets. For this strategy to be successful, Lenovo relies on two business models.

The first, the transactional model, focuses on selling to consumers and small and medium-sized businesses. This is done directly through Lenovo's online and physical stores or indirectly through distributors and resellers. The relationship model is the second business model used and it targets large enterprises and corporations such as government and educational institutions. The services provided under this model are more personalized to the needs of the customer.

Products/Services

Lenovo manufactures televisions, PCs, smartphones and portable devices; its PC line includes, ThinkPad, IdeaPad, Yoga, Legion and Xiaoxin. The ThinkPad brand has been expanded to include tablets such as ThinkPad 8, ThinkPad Helix, ThinkPad Twist and ThinkPad Tablet 2.

Another division is Data Center. Through this division, Lenovo markets and sells servers and storage devices to consumers and businesses. It also provides business solutions and cloud computing services to enterprises.

Source: Arrow Electronics

Lenovo Financial Performance

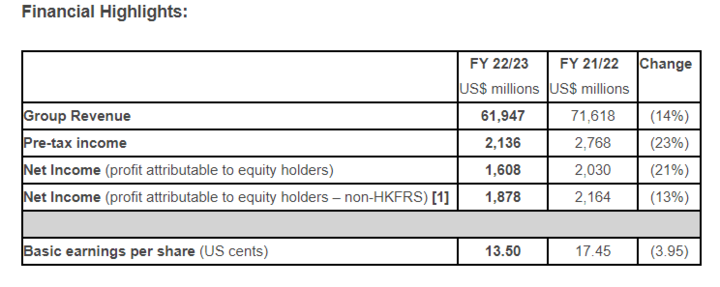

With a market cap of $13.66 billion, Lenovo is one of the most valuable companies in China and holds a strong position in the global market. Currently, its profitability is relatively stable, with operating income and net income margins of 4.31% and 2.60%, respectively. According to its fiscal 2023 report, Lenovo's net profit stands at $1.6 billion, but its revenue took a hit, falling 24% year-over-year to $12.6 billion.

However, the company's balance sheet and cash position remain healthy. Its total liabilities are quite high at $32.8 billion, but they can be easily covered as its total assets stand at $38.9 billion. Its healthy liquidity gives Lenovo the opportunity to improve its core competencies while investing in research and development around new technologies.

Key Metrics

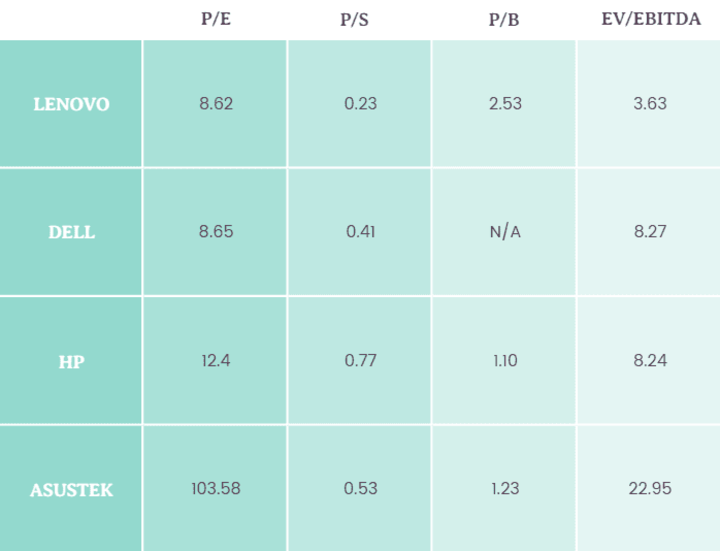

Compared to its peers, Lenovo Group is slightly undervalued and its stock is trading cheaper than it should. However, the low valuation could be a reflection of current market conditions.

How is Lenovo Stock Doing

A. Trading Information

Primary exchange & Ticker: HKSE (992.HK). Lenovo Group is still listed on the NASDAQ (LNVGF).

Country and Currency: Hong Kong (HKD - USD)

Trading Hours: You can trade Lenovo stock on the HKSE during the morning session (9:30 am - 12:00 pm HKST) and the afternoon session (12:00 pm - 1:00 pm HKST).

Stock Splits: Lenovo has only had one four-for-one stock split in 2000.

Dividends: Lenovo pays dividends twice a year in August and December with a dividend yield and payout ratio of 4.06% and 35.14%, respectively.

B. Lenovo Stock Performance

Trading at $21.8 (HKD 8.6), Lenovo's stock has risen 130.87% since 2000 and 34.82% this year alone. The 52-week high was $23 and the 52-week low is $13.51. Lenovo's exposure to the PC market makes it volatile, and investor sentiment toward the stock is affected by the trend in PC demand. Another element driving Lenovo's stock price is its innovative releases and entry into profitable emerging markets such as AR and AI. It also has the structure and liquidity to reasonably expand its position in these markets.

C. Lenovo Stock Price Forecast

So, what is the future of Lenovo stock? Lenovo stock analysis from Wall Street analysts suggests that Lenovo is still a hold despite its near-term struggles. Lenovo stock target price for the year sees it reaching $28.98 with an average price of $22.96. If the PC trend continues and investors' sentiment turns sour, the stock could fall to at least $14.20.

Challenges and Opportunities for Lenovo

Challenges

Lenovo faces the following challenges as it tries to expand further in the international market:

- Weak brand recognition: Lenovo has made some lucrative acquisitions internationally, but it is still poorly perceived. International customers see its products as low quality compared to other technology companies such as Apple. Its high number of product recalls has only served to further damage its reputation by reducing consumer confidence.

- Global PC market decline:Just because Lenovo isn't worried about the decline in PC demand doesn't mean it isn't affected by it. The decline began in the July-September quarter of last year, and as a result, Lenovo's revenue fell 24% last year. The tech giant remains at the top of the market, but its stability is largely due to its diverse portfolio rather than PC sales.

Source: Techloy

- Strong Competition:To maintain its relevance in the international market, Lenovo has to face other well-established brands. In the PC space, Acer, Asustek, and HP are their main competitors. For its smartphones, tablets, and wearables, it faces innovative brands like Apple and Samsung.

Opportunities

- Global position: Lenovo remains the PC market leader with 23.1% of the market. Its leadership position gives it a strong competitive advantage as it pursues its international goals.

- Expansion into emerging markets: The use of smartphones is likely to continue to grow in the coming years, and Lenovo is already taking advantage of this. It is also making strides in AR, which is another market with a lot of potential in the future. Lenovo stock predictions 2025 sees the stock rising after the release of its Legion Go handheld gaming system.

- Strategic acquisitions: Over the past few years, Lenovo has made some interesting acquisitions to expand its products. An important acquisition was the purchase of Google's Motorola Mobility, which allowed it to become a major player in the smartphone market.

What does the future look like?

Global PC shipments fell 15% year-on-year this year, and despite its position in the market, Lenovo still suffered an 18% year-on-year decline as demand weakened in some markets. But the company is still pushing ahead with its expansion plans.

Source: Businesswire

Lenovo is expanding its existing AI capabilities by investing $1 billion over the next three years to accelerate the use of AI in businesses around the world. The investment will support the use of generative AI and its application in manufacturing, retail, healthcare and finance. Still driven by the need to improve AI applications, Lenovo is working with Baidu, another tech giant, to launch the ICT industry's first AI customization service to enhance user experience. By actively promoting the research and application of AI, Lenovo is exploring new opportunities in 3 business areas: Smart Internet of Things, Smart Infrastructure and Smart Industry.

But it's not just AI that has the company's attention. As electric vehicles continue to grow in the auto industry, the tech giant is developing devices that will help these smart cars become more functional. It recently demonstrated a series of domain controllers for smart driving and smart cockpits, along with integrated electronics for driving. Back at home, it plans to partner with CPU architectures such as Haiguang and Feiteng to provide support platforms for AI.

The impact of Lenovo's exposure to the PC market is greatly suppressed by the stable growth of its non-PC businesses, and the company will focus on further diversifying its product offerings in the coming years.

Should I buy Lenovo Stock?

Lenovo Group is facing some headwinds, but there are plenty of reasons to buy it. The company still gets more than half of its revenue from the PC market, and that drives traders' sentiment toward the stock. But Lenovo has done some impressive things over the years. It has done a good job of maintaining its market share and continues to diversify its portfolio to remain resilient to market conditions. It does have thin margins, but that is steadily improving with its diversification, which keeps traders positive about Lenovo stock.

Source: Counterpoint Research

Another thing to keep in mind is that the market decline won't last forever. Lenovo is confident that the trend will be reversed by the end of the year, and if that happens, Lenovo's share price forecast for 2023 will change significantly. But even if the trend does not change this year, Lenovo will still benefit greatly from the PC business in the long run. Moreover, Lenovo is trading at a bargain because there is no reason for the low stock price based on its fundamentals.

Trading Strategies for Lenovo Stock

There are different ways you can trade and profit from Lenovo stock:

- Scalping: This method allows you to profit from the Lenovo stock price by trading within a few minutes or seconds. It is a good strategy for traders who want to maximize short-term price movements. The disadvantage is that you have to be fast because you are trading within a short time frame and you need to know when to buy Lenovo stock to maximize profits.

- Positions Trading:Instead of trading within a matter of minutes, position trading allows you to hold a specific position in a stock for weeks or months. For example, you can hold a buy position in Lenovo stock for a month or more. It is less stressful than scalping, but it takes a lot of discipline and patience to pull it off.

Source: RoboForex

- Options trading:With options trading you are simply betting on the future direction of Lenovo stock without having to own the asset directly. You can do this by opening an options contract. If you believe that Lenovo Group stock will rise within a certain period of time, you can open a call option, but if it's going to fall, you can open a put option.

- CFD trading: CFD is a derivative contract like options because you are betting on the price of the asset without buying the asset directly. It is popular among traders for trading stocks because you can speculate on price movements in any direction and use leverage to increase your position. However, to use this strategy effectively, your technical analysis of Lenovo stock must be accurate because you could lose money if your speculation isn't correct.

Trade Lenovo Stock CFD with VSTAR

Trading Lenovo Stock CFD at VSTAR is a simple process. VSTAR is an experienced broker and provides the right foundation for a smooth trading experience. Once you've opened your trading account, all you need to do is:

- Make a deposit as low as $50 to get started

- Select Lenovo stock CFD

- And start trading!

Should I Invest in Lenovo Stock?

Lenovo has spent years growing and maintaining profitability in both its core and emerging markets. It has seen more revenue declines and weakness due to PC headwinds, and its efforts in AI haven't paid off yet.

On the bright side, Lenovo's non-PC business is thriving and the company is putting more effort into making those profit streams more attractive. Is Lenovo stock a buy now? Yes, it is. Wall Street investors are bullish on Lenovo stock because they believe the company has what it takes to remain profitable. The PC market may continue to decline for a few more quarters, so you should be cautious, but there are plenty of reasons to be optimistic.