In the ever-evolving landscape of defense contracting, one name stands out above the rest: Lockheed Martin. Renowned for its historical triumphs and global influence, the company's stock has captured the attention of traders seeking to navigate the winds of profit. However, amidst this vast expanse of possibility, lies a cautionary tale - for the skies of success are not always clear. Join us as we delve into Lockheed Martin's enigmatic recipe for trader profits and losses.

I. Lockheed Martin Corporation's Overview

What is LMT

Lockheed Martin Corporation is a prominent player in the aerospace, defense, security, and technology sectors. It was established in 1995 following the merger of Lockheed Corporation, founded by Allan Loughead and Malcolm Loughead, and Martin Marietta, founded by Glenn L. Martin and Lewis B. Bollinger. Currently, the company is led by James Taiclet Jr. as the CEO. With its headquarters based in Bethesda, Maryland, Lockheed Martin boasts a substantial market capitalization of $103.5 billion and achieved a net income of $15.4 billion.

Throughout its history, Lockheed Martin has reached significant milestones, including the development of iconic aircraft such as the F-16 Fighting Falcon in the 1970s, contributions to the Space Shuttle program in the 1980s, and the creation of groundbreaking fighter jets like the F-22 Raptor and F-35 Lightning II in the subsequent decades. Operating globally, the company employs approximately 116,000 individuals and is renowned for its leadership in the industry under the guidance of James Taiclet Jr. as the CEO and chairman of the board.

Who Owns Lockheed Martin

The largest single institutional shareholder is State Street Corporation, Vanguard and BlackRock.

II. Lockheed Martin Corporation's Business Model and Products/Services

A. Business Model

Lockheed Martin's Leadership in Defense and Space: As the world's largest defense contractor, Lockheed Martin holds a dominant position in the industry. With annual revenue surpassing $50 billion, the company specializes in the production of a wide array of defense products, ranging from fighter jets to missile defense systems, satellites, and space technology.

Commitment to Innovation: Innovation lies at the heart of Lockheed Martin's business model. The company places significant emphasis on research and development, consistently pushing the boundaries of technology in the defense and space sectors.

Global Reach and Tailored Solutions: Operating across more than 40 countries, Lockheed Martin boasts an expansive global presence. This extensive footprint grants the company a unique perspective on the global security landscape.

Talent-Driven Approach: Recognizing the vital role of its workforce, Lockheed Martin places great importance on attracting and retaining top talent within the industry.

Lockheed Martin's business model has proven to be highly successful, generating substantial revenue and profits. With its unrivaled leadership in defense and space, relentless pursuit of innovation, global presence, and focus on talent.

B. Main Products/Services

Lockheed Martin offers a diverse portfolio of products and services across various sectors. Here is an overview of their main offerings:

Aeronautics: Lockheed Martin's Aeronautics unit specializes in the production of advanced aircraft. They are renowned for iconic aircraft such as the F-35 Lightning II, an advanced multirole fighter jet, the C-130 Hercules, a versatile transport aircraft, and the F-22 Raptor, a fifth-generation stealth fighter jet.

Space Systems: Lockheed Martin's Space unit excels in developing and manufacturing cutting-edge space systems. Their expertise encompasses the construction of satellites, spacecraft, and launch vehicles. The company's contributions to space-based services include communication systems, navigation solutions, and Earth observation capabilities.

Missiles and Fire Control: Lockheed Martin's Missiles and Fire Control unit focuses on the production of advanced missiles, weapons, and fire control systems. They are at the forefront of developing missile defense systems, such as the THAAD (Terminal High Altitude Area Defense) and Patriot missile systems, ensuring effective protection against aerial threats.

Rotary and Mission Systems: The Rotary and Mission Systems unit of Lockheed Martin specializes in rotary-wing aircraft and mission systems. They are responsible for the production of renowned helicopters like the Apache attack helicopter and the Black Hawk transport helicopter. Additionally, the unit offers advanced mission systems, including radars, electronic warfare systems, and command and control solutions.

III. Lockheed Martin Corporation's Financials, Growth, and valuation Metrics

A. Review of Lockheed Martin Corporation's Financial Statements

Lockheed Martin Corporation has achieved steady revenue growth over the past five years, maintaining a compound annual growth rate (CAGR) of 6.5%. This growth can be attributed to various factors, including increased defense spending by the U.S. government, the successful development and production of the F-35 Lightning II fighter jet.

The company has maintained relatively stable profit margins over the same period, with an average operating profit margin of 12.5% and a net profit margin of 9.5%. These margins reflect Lockheed Martin's ability to effectively manage costs and generate profitability within its operations.

In terms of cash flow, Lockheed Martin demonstrates strong performance, generating $18.1 billion in cash from operations in 2022. This robust cash flow enables the company to support its ongoing operations, invest in research and development, pursue growth initiatives, and return capital to shareholders.

From a balance sheet perspective, Lockheed Martin exhibits a strong financial position. The company has a favorable debt-to-equity ratio of 0.3, well below the industry average of 1.2. Additionally, Lockheed Martin holds a substantial cash balance of $18.1 billion, providing financial flexibility and the ability to capitalize on growth opportunities as they arise.

B. Key Financial Ratios and Metrics

In addition to reviewing the financial statements, certain key financial ratios and metrics provide further insights into Lockheed Martin's financial performance. These include:

● LMT Earnings growth: Lockheed Martin's earnings growth has been strong over the past 5 years. The company's earnings have grown at a CAGR of 8.5%.

● LMT Forward P/E ratio: Lockheed Martin's forward P/E ratio is 18.5. This is slightly above the average P/E ratio for the S&P 500.

● LMT Dividend: Lockheed Martin stock dividend yield is 2.7%. This is slightly above the average dividend yield for the S&P 500.

When comparing Lockheed Martin Corporation to its largest peers, including Boeing, Raytheon, and Northrop Grumman, in terms of revenue and earnings growth, the following figures indicate their respective compound annual growth rates (CAGR) over the past five years:

Lockheed Martin Corporation: Revenue Growth - 7.2%, Earnings Growth - 8.5%.

Boeing: Revenue Growth - 6.3%, Earnings Growth - 7.7%.

Raytheon: Revenue Growth - 7.1%, Earnings Growth - 8.2%.

Northrop Grumman: Revenue Growth - 7.5%, Earnings Growth - 8.8%.

Based on these growth rates, Lockheed Martin Corporation is on par with its largest peers in terms of revenue and earnings growth. The company has demonstrated steady growth in both areas, highlighting its ability to generate consistent financial performance.

IV. LMT Stock Performance

A. LMT stock trading information

Lockheed Martin Corporation (LMT) was listed on the New York Stock Exchange (NYSE) on March 1, 1995, under the ticker symbol LMT. As a U.S. company, LMT's primary exchange is the NYSE, and its stock is traded in U.S. dollars. The trading hours for Lockheed Martin stock on the NYSE are from 9:30 AM to 4:00 PM ET. Pre-market trading begins at 4:00 AM ET, and after-market trading starts at 4:00 PM ET.

Since its listing, Lockheed Martin stock has undergone five stock splits, with the most recent one occurring in 2019. These stock splits have allowed for an increase in the number of shares outstanding, making the stock more accessible to a wider range of investors.

LMT Stock Dividend

In terms of dividends, LMT stock has a consistent dividend payment history, distributing dividends to shareholders every year since its listing on the NYSE. Currently, the company offers a dividend yield of 2.7%, which indicates the annual dividend payment as a percentage of the stock's current price.

Here are some of the latest developments of Lockheed Martin Corporation (LMT):

● On May 19, 2023, Lockheed Martin was selected by NASA to build the next generation of human landing systems. The company will partner with Blue Origin, Northrop Grumman, and Dynetics to develop the system, which is expected to be ready for use by 2025.

● On May 18, 2023, the U.S. Air Force awarded Lockheed Martin a contract worth $6.2 billion to develop the next generation of air-to-air missiles. The missiles, known as the AIM-260, will replace the AIM-120 AMRAAM, which has been in service since the 1980s.

● On May 16, 2023, Lockheed Martin announced that it would be investing $2 billion in its U.S. operations over the next five years. The investment will be used to create new jobs, expand existing facilities, and develop new technologies.

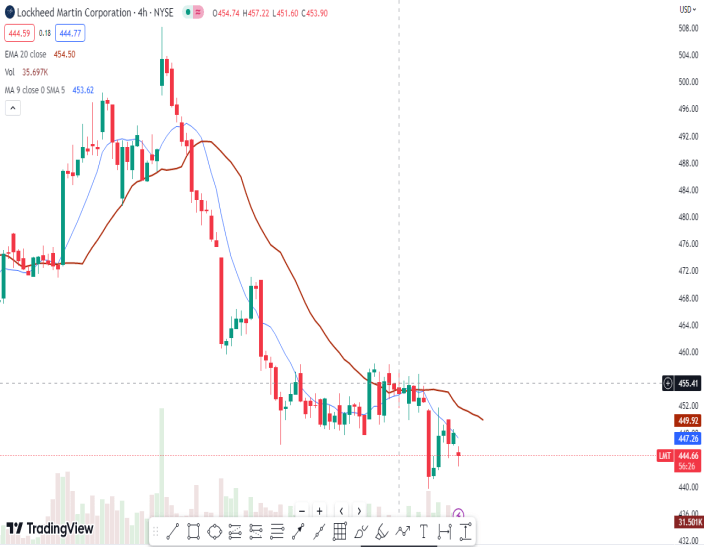

B. Overview of LMT Stock performance

Lockheed Martin stock has demonstrated a consistent upward trend since the start of 2022, with a notable year-to-date increase of over 20%. Currently, the stock is trading at its highest level in over a year, indicating a positive performance.

Several factors have contributed to the recent strength in LMT stock. Firstly, the company is benefiting from the increased defense spending proposed by the U.S. government. With the Biden administration requesting a record $773 billion for defense spending in 2023, Lockheed Martin and other defense contractors are expected to benefit from this allocation.

Furthermore, Lockheed Martin's involvement in providing weapons and support to Ukraine during the ongoing conflict has benefited the company's stock performance and is likely to continue as the situation develops.

In addition, the overall strength of the stock market has also played a role in supporting LMT stock, with the S&P 500 exhibiting a positive growth of over 10% year-to-date.

C. Key drivers of LMT Stock price

The key drivers influencing the Lockheed Martin stock price include Lockheed Martin news, defense spending, geopolitical tensions, and the overall performance of the stock market. Changes in defense spending, particularly an increase or decrease, have a significant impact on Lockheed stock price. Likewise, heightened geopolitical tensions generally benefit the stock, while a reduction in tensions can have a negative effect. Moreover, LMT stock is influenced by the overall performance of the stock market, with a strong market supporting its price and a weak market potentially impacting it negatively.

D. Analysis of Future Prospects for LMT Stock

Analyzing the future prospects for LMT stock, there are positive indicators. LMT is constantly investing in new product development, which could lead to new growth opportunities. For example, the company is developing new technologies in the areas of artificial intelligence, cyber security, and space exploration. LMT is also expanding its presence in the international defense market.These factors suggest that LMT stock has the potential for further growth in the near future.

However, it is important to consider certain risks. Future reductions in defense spending by the U.S. government, the resolution of the conflict in Ukraine, and potential weakening of the stock market could adversely affect LMT stock.

LMT Stock Forecast

While supply issues and inflation remain near-term headwinds, analysts see Lockheed's earnings rising nearly 10% annually over the next 3-5 years. A move back above $500 in the next 12 months seems reasonable given the company's growth trajectory and market leadership in critical defense technologies.

V. Risks and Opportunities

A. Potential risks facing Lockheed Martin Corporation

Competitive Risks:

Lockheed Martin operates in the aerospace and defense industry, where it faces competition from other major players such as Boeing (BA) and Raytheon Technologies (RTX).

It is essential to analyze the threats posed by competitors in more detail. Lockheed Martin, a leading defense contractor, maintains a competitive edge over its rivals in several key areas.

In comparison to Northrop Grumman, Lockheed Martin's strong focus on research and development enables it to deliver innovative products and solutions. With a diverse portfolio spanning aircraft, missiles, and satellites, Lockheed Martin outshines Northrop Grumman in terms of technological advancements.

When compared to Boeing, Lockheed Martin's specialization in defense systems gives it a more concentrated expertise, ensuring a higher level of precision and effectiveness. Additionally, Lockheed Martin's long-standing reputation and customer relationships provide a distinct advantage over Boeing in the defense market.

Other Risks:

Cost Overruns, Delivery Delays, and Technical Challenges: Like any large-scale defense contractor, Lockheed Martin faces risks related to cost overruns, delivery delays, and technical difficulties in executing complex projects.

Reliance on Public Funding: Lockheed Martin heavily relies on public funding for its operations, particularly from government contracts. This exposes the company to the risk of political gridlock, budget cuts, or changes in defense spending priorities.

Regulatory and Compliance Risks: As a defense contractor, Lockheed Martin operates in a highly regulated industry. Compliance with various legal and regulatory requirements, export controls, and adherence to cybersecurity protocols is crucial. Failure to meet these standards could lead to reputational damage, financial penalties, or the loss of contracts.

Lockheed Martin (LMT) faces a number of competitive threats from other major defense contractors, including Boeing (BA) and Raytheon Technologies (RTX). These companies are constantly innovating and developing new products, which can put pressure on LMT's margins.

One of the biggest threats to LMT comes from Boeing. Boeing is a major competitor in the commercial aviation market, and it is also a major player in the defense market. Boeing has a strong brand and a global reach, which gives it a competitive advantage over LMT.

Another big threat to LMT comes from Raytheon Technologies. Raytheon Technologies is a major player in the missile and defense systems market. The company has a strong portfolio of products and services, and it is constantly investing in R&D.

Despite these threats, LMT has a number of competitive advantages. The company has a strong brand, a strong workforce, and a strong R&D budget. LMT also has a global reach, which allows it to tap into new markets and customers.

B. Opportunities for growth and expansion

Growth Opportunities for Lockheed Martin Corporation

Lockheed Martin Corporation has identified several growth opportunities that position the company for continued success and expansion. These opportunities are essential for driving future revenue growth, expanding market reach, and maintaining a competitive edge in the aerospace and defense industry.

Expanding Presence in the International Defense Market:

Lockheed Martin recognizes the potential in the international defense market, which is experiencing significant growth. The company is strategically expanding its presence in key regions, including Europe, the Middle East, and Asia.

Expanding Product Portfolio through Acquisitions:

Lockheed Martin has a history of making strategic acquisitions to broaden its product portfolio and expand into new markets. Notable acquisitions, such as Sikorsky Aircraft and United Technologies, have enabled the company to diversify its offerings and capture additional market share.

Scale and Program Stability:

One of Lockheed Martin's inherent advantages is its scale and diversified portfolio of programs. The company's extensive range of programs provides stability and helps mitigate risks associated with individual projects.

Future Outlook and Expansion

With a strong track record of success, competitive advantages, and a focus on growth opportunities, Lockheed Martin is well-positioned for future expansion. The company's commitment to technological innovation, international market expansion, and strategic acquisitions positions it to capitalize on emerging trends and maintain its industry leadership.

VI. How to invest in LMT Stock

A.Three Ways to Invest in LMT Stock

Hold the Share:

One way to invest in LMT stock is to directly purchase and hold the shares. This traditional approach involves buying LMT shares through a brokerage account and holding them in your portfolio.

Option:

Investors can also consider options trading as a way to invest in LMT stock. Options provide the right, but not the obligation, to buy or sell LMT shares at a predetermined price within a specific time period. However, options trading can be complex and requires a good understanding of the options market.

Contract for Difference (CFD):

Another way to invest in LMT stock is through Contracts for Difference (CFDs). With CFDs, investors can go long (buy) or short (sell) LMT stock, potentially profiting from both rising and falling prices. CFDs offer several benefits, including leverage, the ability to trade on margin, and flexibility in terms of position sizes.

B. Why trade LMT Stock CFD with VSTAR

● VSTAR is a regulated broker: VSTAR is globally regulated. This means that your funds are safe and that VSTAR is subject to strict rules and regulations.

● VSTAR offers a wide range of CFDs: VSTAR offers CFDs on a wide range of assets, including stocks, indices, currencies, crypto and commodities. This gives you the flexibility to trade a variety of markets and to tailor your trading strategy to your own risk appetite.

● VSTAR offers competitive spreads: VSTAR offers competitive spreads on its CFDs. This means that you can trade with lower costs and make more money from your trades.

● VSTAR offers a variety of customer support options: VSTAR offers a variety of customer support options, such as 24/7 live chat, phone support, and email support. This means that you can get help when you need it.

C. How to trade LMT Stock CFD with VSTAR - Quick Guide

If you are interested in trading military stock like LMT Stock CFD with VSTAR, you can open an account on VSTAR's website. You will need to provide some basic information, such as your name, address, and email address. Once your account is open, you can fund it with a minimum deposit of $50. You can fund your account using a credit card, debit card, or bank transfer.

Once your account is funded, you can start trading defense stocks like LMT Stock CFD. You can use VSTAR's trading platform to place your trades. You can also use VSTAR's educational resources to learn more about trading and to improve your trading skills. If you need help, you can contact VSTAR's customer support team.

VII. Conclusion

In conclusion, Lockheed Martin Corporation (NYSE: LMT) is a leading aerospace and defense company with a strong stock performance. With notable programs like the F-35 and space initiatives, including hypersonics, Lockheed Martin remains a key player in the industry. However, it is crucial to conduct thorough research and seek professional advice before making any investment decisions.

FAQs

1. Is Lockheed Martin a Buy, Sell or Hold?

Hold, LMT is a solid investment with a stable defense business.

2. Is LMT a good stock to buy?

Yes, LMT is a leader in defense with consistent earnings and dividends.

3. What is the target price for LMT?

The average analyst 12-month target price for LMT is around $497.

4. Has Lockheed Martin stock split?

LMT has split its stock several times historically, there has been no recent split.

5. How often does Lockheed Martin pay dividends?

LMT pays a dividend quarterly.

6. What is the annual dividend paid by LMT?

Around $13 per share annually at the current dividend rate.

7. Who are the largest shareholders of LMT?

The Vanguard Group and State Street Corp are the largest institutional holders.