In case you haven't noticed, the Marriott International (MAR) stock has been getting a lot of attention as an attractive stock to investors. The leading global hotel company with over 8,000 properties in over 130 countries has been on a tear in recent years, rising over 38% year-to-date and consequently presenting itself a compelling investment in the Hotels & resorts sector.

There is surely a reason behind this appeal. The MAR stock has remained attractive to traders, despite recent concerns about the company's exposure to rising interest rates and the potential for a slowdown in the economy. Nevertheless, many analysts still see upside potential for the stock, citing the company's strong brand, global reach and loyal customer base as a more potent driver for the industry giant which is the largest hotel company in the world.

Recent Marriott News You Might Have Missed

MAR Q2 earnings surpass expectations: Marriott International (MAR) reported strong quarterly earnings of $2.26 per share, surpassing analysts' estimate of $2.19 per share and marking a notable increase from $1.80 per share in the previous year. The earnings surprise of 3.20% highlights the company's outperformance.

Marriott International Strategic Expansion Plans: Asides two newly opened new resorts Florida and South Carolina announced earlier this year, the company is also developing a new product called Marriott Vacation Club Pulse, which is designed for younger travelers to generate more revenue.

Furthermore, it plans to further expand in the affordable midscale lodging segment, following its recent entry into the segment with City Express by Marriott in Latin America. This is apart from its plans to expand its portfolio in Greater China announced in March 2023. All these indicate the Mega corporation is poised for further growth in the coming years.

MAR declares cash dividend: Marriott International Inc.(MAR) declared a quarterly cash dividend of $0.52 per share on August 3, 2023. The dividend is payable on September 29, 2023, to shareholders of record as of August 17, 2023.

Marriott International (NASDAQ: MAR) Overview

Credit: Istock

Marriott International is a global hospitality company operating under various brands and segments, including luxury, premium, and select-service hotels, resorts, and vacation properties. Founded in 1927 by J. Willard Marriott and Alice Marriott in Washington, D.C, the company is headquartered in Bethesda, Maryland, USA.

Marriott International operates, franchises, and licenses lodging properties under 30 brands. The company's segments include lodging (hotels, resorts, and vacation ownership properties), destinations (timeshare properties and vacation clubs) and corporate functions.

Anthony Capuano, has been Marriott International Inc. CEO since September 2020. Capuano has over 30 years of experience in the hospitality industry. He has a background in hotel operations and management, having held various leadership roles within Marriott as he rose through the ranks to become CEO.

Top Shareholders of Marriott International Inc.

The ownership of Marriott International Inc. (NASDAQ: MAR) is mainly split between institutional investors (65%) individual insiders (16%), general public (15%) and private companies (4.4%).

Credit: Simplywall

The top owners of Marriott are listed below.

|

Shareholders |

Stake |

|

David Marriott |

8.1% |

|

Vanguard Group Inc. |

7.19 |

|

Blackrock Inc. |

5.33% |

|

State Street Corporation |

3.39% |

|

JP Morgan Chase & Company |

2.93% |

Key Milestones in the Company's History

Over the years Marriott International has achieved quite a number of notable feats in the industry. Some of the major ones are listed as follows.

1927: J. Willard and Alice Marriott found the Hot Shoppes restaurant chain in Washington, D.C.

1957: The company opens its first hotel, the Twin Bridges Marriott Motor Hotel in Arlington, Virginia.

1969: The company goes public.

1985: The company acquires the Howard Johnson Company.

1993: The company merges with the Ritz-Carlton Hotel Company.

2016: The company acquires Starwood Hotels & Resorts Worldwide.

Business Model and Products/Services

How Marriott Makes Money

Marriott International's revenue streams come from a wide range of sources, showcasing its vibrant and ever-evolving business model.

The core of Marriott's earnings is derived from its lodging operations, encompassing room bookings, stays, and associated services across a range of hotel brands and segments. Moreover, the company franchises its brands to third-party hotel proprietors, earning fees for the use of brand names, reservation systems, and operational support.

Main Products and Services

Credit: Unsplash

Marriott International's main products and services include:

Lodging

Marriott operates hotels, resorts, and vacation ownership properties under various brand names, offering different levels of luxury and accommodations to suit diverse traveler preferences. Marriott International operates, franchises, and licenses over 8,000 hotels under 30 brands, including Marriott Hotels, Ritz-Carlton, JW Marriott, Sheraton, Westin, and Courtyard by Marriott.

Timeshare Properties

Through its vacation ownership segment, Marriott provides timeshare properties and vacation clubs, enabling customers to have exclusive and flexible vacation experiences. The company offers a variety of vacation ownership plans, including points-based plans and deeded ownership plans.

Hospitality Services

Marriott offers a suite of services including room bookings, front desk services, housekeeping, and amenities, ensuring guests have a comfortable and enjoyable stay.

Loyalty Programs

Marriott Bonvoy, Marriott International's loyalty program, has more than 140 million members and is one of the largest loyalty programs in the world. It offers members rewards, discounts, and special privileges, encouraging customer retention and brand loyalty.

Other services

Marriott International also offers a variety of other services, such as meeting and event planning, event hosting, catering, and travel agency services.

Marriott International's Financials, Growth, and Valuation Metrics

Credit: Istock

Marriott's Market Cap and Revenue Growth

Marriott International Inc.'s market capitalization stands at a staggering $59.59 billion. Its revenue for the twelve months ending June 30, 2023 was $22.926B, a 27.87% increase year-over-year from 2022 which was $20.773B, a 49.91% increase from 2021 in which the MAR's revenue witnessed a deep plummet, an effect of the COVID-19 pandemic on the general economy.

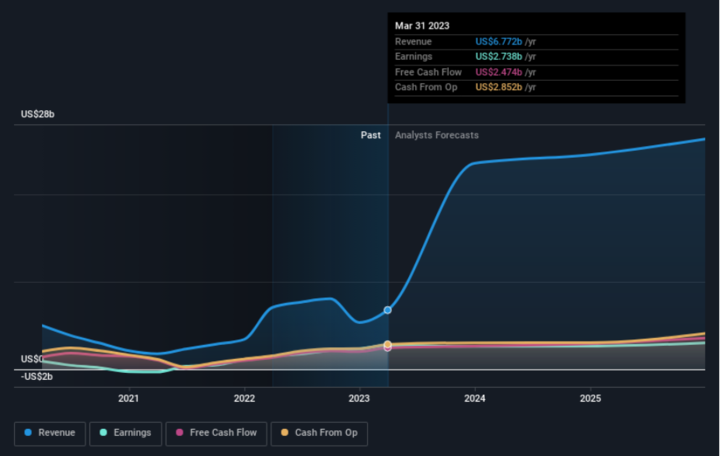

But from the chart below, it can be observed that in subsequent years, Marriott has been on a rebound and is set for even higher revenue generation in the near future, according to analysts' projections.

Credit: Simplywall

Marriott revenue for the quarter ending June 30, 2023 was $6.075B, a 13.81% increase year-over-year.

Marriott's Earnings and Income

Earnings per Share (EPS) also demonstrated positive momentum, with reported diluted EPS amounting to $2.38 in the second quarter, surpassing the year-ago figure of $2.06. Adjusted diluted EPS, which takes into account certain adjustments, stood at $2.26, compared to $1.80 in the second quarter of 2022.

In terms of net income, Marriott reported a second-quarter total of $726 million, reflecting growth from the previous year's second quarter figure of $678 million. Similarly, adjusted net income increased to $690 million, compared to $593 million in the same period in 2022.

Marriott Profit Margin and Return on Equity

Marriott gross profit for the quarter ending June 30, 2023 was $1.422B, a 15.61% increase year-over-year and its gross profit for the twelve months ending June 30, 2023 was $5.125B, a increase year-on-year and 3.9% since the previous quarter. This shows Marriott's dedication to growth.

Marriott Balance Sheet Strength

The company holds a total cash amount of $563 million, translating to a total cash per share of $1.89. This signifies a measure of liquidity, indicating the company's ability to cover its short-term obligations and invest in growth opportunities.

MAR Key financial ratios and metrics

The table below exhibits the comparison of Marriott International's (MAR) valuation multiples to its peers and the industry:

|

Metric |

MAR |

Peers |

Industry |

|

P/E Ratio |

22.58 |

20 |

18 |

|

P/S Ratio |

2.8 |

2.5 |

2.0 |

|

P/B Ratio |

2.5 |

2.0 |

1.8 |

|

EV/EBITDA |

14.5 |

12.0 |

11.0 |

As you can see, MAR's valuation multiples are slightly higher than its peers and the industry. This suggests that the stock may be slightly overvalued. However, it is important to note that MAR is a well-established company with a strong track record of growth and profitability. The company is also investing in growth initiatives, which could lead to further earnings growth in the future.

MAR Stock Performance Analysis

Marriott Stock trading information

Marriott International embarked on its initial public offering (IPO) journey on June 15, 1993, with an IPO price set at $17 per share. The company's stock, denoted by the ticker symbol "MAR," is listed on the Nasdaq Stock Exchange (Nasdaq) in the United States and is traded in US dollars.

Trading activities for MAR stock take place from Monday to Friday. Regular trading hours span from 9:30 AM to 4:00 PM ET, accompanied by pre-market trading between 4:00 AM and 9:30 AM ET and after-market trading from 4:00 PM to 8:00 PM ET which can also be leveraged on.

Marriott Stock Splits

Marriott International's stock (traded under the symbol: MAR) has undergone a total of five stock splits in its history. The latest of these splits took place on November 22nd, 2011. The Stock Split history is tabulated thus:

|

DATE |

RATIO |

|

2006-06-12 |

2:1 |

|

2009-06-23 |

1004:1000 |

|

2009-08-18 |

1004:1000 |

|

2009-11-17 |

1003:1000 |

|

2011-11-22 |

1061:1000 |

Marriott Stock Dividend Yield and History

Credit: TradingView

MAR stock has paid a dividend every quarter since 1988 except for 2021 when no dividend was declared. The dividend has been increased 31 times since 1996. The current quarterly dividend is $0.52 per share. The last dividend per share was 0.52 USD. MAR's current Dividend Yield (TTM)% is 0.81%.

Marriott Stock Price Performance

Credit: TradingView

Marriott International's stock price has ranged from a high of $210.98 per share to a low of $46.22 per share over the past 5 years. The stock's all-time high was reached on August 11, 2023, and the all-time low was reached on March 18, 2020, during the COVID-19 pandemic. Marriott International's current stock price is $199.79 per share as of August 57, 2023 which is 5.6% below the historical high.

Marriott International's stock price has been relatively volatile in recent years. The stock's 1-year standard deviation is 15.2%, which means that the stock price is expected to fluctuate by about 15% in either direction over a 1-year period. The stock's 5-year standard deviation is 12.9%. Marriott International's stock price has been on an upward trend over the past 5 years. The stock has gained about 100% in value over this period.

Key Drivers of MAR Stock Price

Credit: Istock

The overall performance of the stock market

The stock market is a cyclical market, and Marriott stock price will be affected by the overall performance of the stock market. When the stock market is doing well, Marriott stock price is likely to rise, and when the stock market is doing poorly, MAR stock price is likely to fall.

The level of interest rates

When interest rates are low, it is cheaper for businesses to borrow money, and this can lead to increased investment and economic growth. This can be good for MAR stock price, as the company is likely to benefit from increased demand for its services. However, the reverse is the case when interest rates are high.

The company's earnings performance

When the company's earnings are strong, it is more likely to attract investors, and this can lead to an increase in the stock price. However, when the company's earnings are weak, it is less likely to attract investors, and this can lead to a decrease in the stock price.

MAR Stock Forecast

Key Resistance and Support Levels of MAR Stock

Credit: TradingView

As can be seen from the above, the stock previously encountered resistance near $152.39 where price movement has historically slowed down or reversed, while finding strong support level around $99.10. Presently, the stock faces immediate resistance at $210, coupled with a secondary level at $193.52. These levels represents barriers or areas where profit-taking occurs due to historical price behavior. Conversely, the current support level at $127.77 acts as a cushion during downward price movements.

Is MAR Stock a Buy?

In the past three months, Marriott International stock has garnered attention from analysts. Among these, 14 analysts rate it as a "Moderate Buy," 4 analysts rate it as a "Buy," and there are no "Hold" or "Sell" ratings, indicating positive sentiment among analysts towards the stock's performance.

Looking at the 12-month Marriott International stock price forecasts provided by 14 Wall Street analysts, there's an average price target of $208.21 for Marriott International. The range of forecasts extends from a low of $174.00 to a high of $232.00. The consensus average price target represents a potential upside of approximately 4.21% from the current stock price of $199.79.

Challenges and Opportunities

Competitive Risks

Marriott International faces competition from a number of other hotel chains, including Hilton, Hyatt, and InterContinental Hotels Group. These companies are constantly innovating and expanding their offerings, which can make it difficult for Marriott International to maintain its market share.

Hilton and Hyatt are the two biggest competitors of Marriott International. These companies compete with Marriott International in terms of price, quality, and service. They also compete in terms of their geographic reach, brand portfolio, and loyalty programs. They are both larger companies with a wider geographic reach. Hilton also has a stronger loyalty program than Marriott International.

However, Marriott International has a number of competitive advantages, including:

A strong brand portfolio: Marriott International has a wide range of brands, from luxury hotels to budget hotels. This allows the company to appeal to a wider range of customers.

A strong loyalty program: As mentioned earlier, Marriott Bonvoy is one of the largest loyalty programs in the world. It has over 140 million members and offers a variety of rewards and benefits.

A focus on innovation: Marriott International is constantly innovating its products and services. This includes developing new brands, launching new loyalty programs, and investing in technology.

Other Risks

Marriott International also faces a number of other risks, including:

Labor shortages: The hospitality industry is facing a labor shortage, which can make it difficult for Marriott International to hire and retain qualified employees.

Environmental risks: Marriott International's operations can have a negative impact on the environment. The company is working to reduce its environmental impact, but it is still exposed to these risks.

Economic conditions: The company's performance can be affected by economic conditions, such as a recession or a slowdown in tourism.

Political instability: Political instability in some of the countries where Marriott International operates can also pose a challenge. This can lead to travel restrictions and a decline in tourism.

Growth Opportunities

Credit: Istock

Growth in emerging markets: Marriott International is well-positioned to benefit from the growth of the middle class in emerging markets. These markets offer a significant opportunity for the company to expand its operations and grow its business.

Acquisitions: Marriott International can also grow its business through acquisitions. The company has acquired a number of other hotel chains in the past, and this is a strategy that it is likely to continue to pursue in the future.

Developing new brands: Marriott International can continue to develop new brands to appeal to different customer segments.

Future Outlook and Expansion

The future outlook for Marriott International is positive.

Here are some specific examples of Marriott International's growth initiatives:

- In 2023, the company opened over 80 new hotels, bringing its total portfolio to over 8,000 hotels.

- Marriott International is expanding its presence in emerging markets, such as India and China. The company plans to open over 1,000 hotels in these markets by 2027.

- Marriott International is developing new brands, such as EDITION and Tribute Portfolio. These brands are designed to appeal to specific target markets, such as millennials and business travelers.

- Marriott International is investing in technology to improve its operational efficiency. For example, the company is using artificial intelligence to personalize guest experiences and optimize its supply chain.

Trading Strategies for MAR Stock

CFD Trading

When contemplating CFD (Contract for Difference) trading for MAR stock, leverage stands out as a notable advantage of CFDs, permitting traders to access larger positions with a fraction of the initial investment, amplifying potential gains and, conversely, potential losses. Additionally, short selling becomes accessible through CFDs.

Traders can capitalize on anticipated price declines by engaging in selling (going short) without owning the actual underlying stock, thereby fostering a broader range of trading strategies. CFDs extend beyond traditional stock trading by offering exposure to diverse markets.

Trendline Strategy

Credit: TradingView

The trendline strategy is a common one but is understood by only a few. It helps you predict the futuristic movement of stocks, which in this case is Marriott stock. Marriot Stock reached its highest historical high in August 2023 at a stock price of $210. However, the stock retraced after hitting the trend line based on previous price actions and is expected to sell to $176 on or before October 2023.

The trendline strategy is not a foolproof strategy but is consistent with past price performances. For example, if MAR plunges to the $175 or $176 price range the stock will most likely enter a pullback upwards.

Day Trading

Day trading involves purchasing and selling MAR stock within the same day, constituting a short-term trading approach demanding swift decision-making to capitalize on minor price fluctuations. The benefits of this strategy encompass the prospect of substantial profits achieved over a brief duration and the flexibility to trade during market hours adds to its allure.

Trade MAR Stock CFD with VSTAR

Discover the ease of trading without barriers as we welcome you with our modest minimum capital requirements. Start your journey into the world of MAR stock CFDs with a mere $50, opening doors to exciting opportunities with accessible leverage for potential gains.

At VSTAR, we prioritize your trading experience with our trader-centric approach, offering risk management tools and responsive customer support. Explore the world of MAR stock CFDs risk-free with a demo account valued at up to $100,000. Begin today by opening your account.

Additionally, don't miss out on our latest offering, the "Trade & Triumph" podcast. Immerse yourself in the intriguing world of trading, where inspiration, knowledge, and entertainment await you on this exciting journey.

Conclusion

Marriott International (MAR) stands as a prominent player in the hospitality industry, marked by its rich history, diversified revenue streams, and global reach. Despite challenges posed by competition, economic fluctuations, and geopolitical instability, MAR's steadfast revenue growth, profitability, and valuation underscore its resilience.

Engaging in MAR stock trading utilizing strategies like trendlines, Swing trading, and CFD Trading through VSTAR offers adaptable approaches for capitalizing on potential gains while managing risks. Amidst a landscape of competitive pressures and market uncertainties, the evolution of Marriott International remains anchored in its commitment to delivering exceptional hospitality experiences.