Traders looking for the best Chinese tech stocks that could make you rich should consider Meituan (3690.HK) stock.

If you take a quick look at the charts, you'll see that Meituan stock is down about 25% since January. While this may scare off some investors, it could actually be a rare opportunity for you to buy into one of China's best tech stocks at a steep discount.

Analysts have issued a range of price targets for Meituan stock, and Meituan stock's technicals are providing interesting signals for traders. Read on to find out if Meituan stock is a good investment now.

Source: Pixabay

Meituan (3690.HK) Stock News

- In an expansion move outside its home market in mainland China, Meituan has launched its food delivery service in Hong Kong. The Hong Kong-focused platform is called KeeTa. The launch of KeeTa marks Meituan's first foray into markets outside of mainland China. KeeTa has been launched in several districts of Hong Kong and plans to cover all of Hong Kong by the end of the year.

- Meituan acquired AI startup Light Years for US$233 million. Light Years aims to become China's OpenAI. OpenAI is the Microsoft-backed software developer behind the popular ChatGPT AI tool. Meituan gains AI technology and talent in Light Years acquisition.

Meituan (3690.HK) Stock Overview

Meituan is a Chinese technology services company. It is considered one of China's technology champions, along with Alibaba, JD.com and PDD Holdings. At an event in July, Chinese Premier Li Qiang pledged support for technology companies, including reducing compliance costs.

Founded in 2010, Meituan is headquartered in Beijing. Although Meituan is best-known for its food delivery service, the company offers a range of services, including travel booking and ticket sales.

Meituan co-founder and CEO Wang Xing attended Chinese and American universities, where he studied electronics and computer engineering. Prior to Meituan, Xing founded several startups, including the Chinese versions of Facebook and Twitter. Xing is a Chinese billionaire with a fortune of more than $10 billion, according to Bloomberg. He owns more than 9% of Meituan's shares.

Meituan's Top Shareholders

Meituan stock is a popular investment for some of the some of the world's top institutional investors. Meituan's top shareholders are:

|

Shareholder |

Stake |

|

Tencent |

20% |

|

Wang Xing |

9% |

|

Vanguard Group |

3.2% |

|

Sequoia Capital |

3% |

|

Baillie Gifford |

2.1% |

Key Milestones in Meituan's History

|

Year |

Milestone |

|

2010 |

Meituan raised US$12 million in seed funding from Sequoia Capital. |

|

2014 |

Meituan raised US$300 million in Series C funding from a group of investors led by General Atlantic. |

|

2015 |

Meituan merged with Dianping, resulting in the company's name change to Meituan-Dianping. |

|

2018 |

Meituan-Dianping shares listed in Hong Kong. |

|

2020 |

Meituan-Dianping is rebranded back to Meituan. |

|

2020 |

Meituan invests in Chinese electric car maker Li Auto. |

Meituan's Business Model and Services

Meituan provides a wide range of services to businesses and individuals. Its primary service is delivery. Meituan delivers food and other items for a fee. The delivery business accounts for more than half of Meituan's total revenue.

In addition to delivery services, commissions are another important source of revenue for Meituan. The company earns commissions from various technical services provided to companies that use its platform to run certain aspects of their business, such as ticket sales and travel booking.

Meituan also makes money by providing online marketing services. Companies can pay to be featured on various segments of Meituan's platform.

The company also offers on-demand transportation services, such as Uber-like ride-hailing and bicycle rental. In addition, Meituan runs a small lending business through which it earns interest on loans.

Meituan's Financial Performance

Examining Meituan's financials can help you determine whether this is the best Chinese tech stock to buy now. With that in mind, let's examine Meituan's financial performance and balance sheet.

Meituan's Revenue

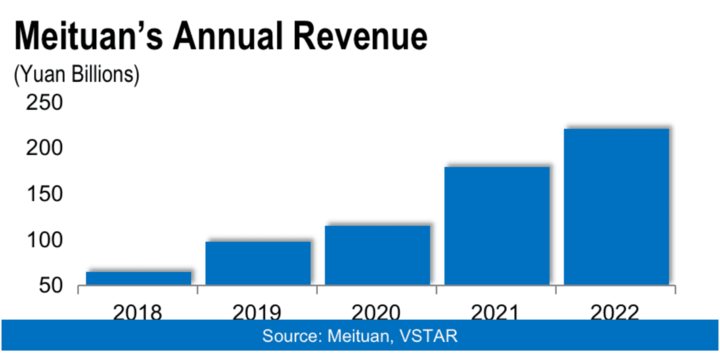

The company's most recent financial report is for the first quarter of 2023, which it released in May. It reported revenue of 58.6 billion yuan, up 27% from the same period in 2022, beating analysts' estimates of 56.5 billion yuan.

The chart above shows Meituan's annual revenue trend. With the strong start to 2023, Meituan appears to be on track for another year of impressive annual revenue growth. The company's revenue jumped from 179 billion yuan in 2021 to 220 billion yuan in 2022, an increase of 23%. Over the past 5 years, Meituan's revenue has grown at an impressive compound annual growth rate of approximately 30%.

Meituan's Net Income

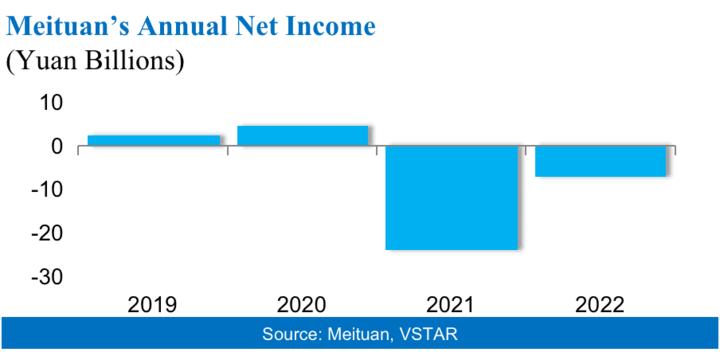

The company has been profitable on both a quarterly and annual basis. In the first quarter of 2023, it made a profit of 3.4 billion yuan, compared to a profit of 1.2 billion yuan in the previous quarter and a loss of 5.7 billion yuan in the same period of 2022.

On an annual basis, Meituan reported a loss of 6.7 billion yuan in 2022, which was a sharp decline from a loss of 23.5 billion yuan in 2021. Meituan had profitable years in 2020 and 2019, as you can see in the chart above.

Meituan's Profit Margins

The company's operating margin improved to 6.1% in the first quarter of 2023, compared to -1.2% in the previous quarter and -12.1% in the same period of 2022.

On an annual basis, the Company's operating margin improved to -2.6% in 2022, compared to -12.9% in 2021. Meituan has taken various cost control measures to try to strengthen its profit margins.

Meituan's Cash Position and Balance Sheet Condition

The company generated 8.1 billion yuan in cash flow from operations in the first quarter of 2023. It ended the quarter with a total cash balance of 26.9 billion yuan.

Meituan's balance sheet shows assets of 250 billion yuan against 33 billion yuan of outstanding long-term loans. The company's assets have increased from 244 billion yuan at the end of 2022. Meituan has an impressive current ratio of 1.87.

Meituan (3690.HK) Stock Analysis

Meituan Stock Trading Information

Meituan stock went public in 2018. The stock is listed on the Hong Kong Stock Exchange under the symbol “3690.HK”. The stock is traded in Hong Kong dollars.

On the average, more than 25 million shares of Meituan stock are traded each day. This makes Meituan one of the most actively traded Chinese technology stocks in Hong Kong.

Trading in Meituan stock begins at 9:30 a.m. and ends at 4:00 p.m. Trading is divided into morning and afternoon sessions. The morning session runs until noon, followed by a lunch break. Trading resumes at 1 pm for the afternoon session. You can continue trading Meituan stock during the lunch break by taking advantage of the extended morning session of the stock exchange.

Meituan Stock Split History

The Chinese food delivery giant hasn't split its stock since going public. Companies typically split their stock to make it more affordable for retail investors. A split can increase demand for a stock and drive up its price.

Meituan Stock Dividend Yield

With its up-and-down profits, Meituan hasn't started paying dividends yet. Instead, the company reinvests the money it makes to grow its business in hopes of generating more revenue and profit in the future..

Meituan (3690.HK) Stock Performance

Meituan priced its shares at HK$69. This was near the high end of the HK$60-$72 price range indicated prior to the stock's public debut, suggesting strong demand for the stock. Meituan shares soared on the debut, gaining more than 5% on the first day of trading.

As you can see in the chart above, the stock reached its all-time high of HK$460 in February 2021.

Over the past year, Meituan's stock price has been in the range of HK$110 - $200. At around HK$133, Meituan's stock price is currently 70% below its all-time high. Although Meituan stock has fallen sharply from its peak, it has remained well above its historic lows of around HK$45.

Meituan (3690.HK) Stock Forecast

Evaluating Meituan stock price forecasts can help you determine whether this Chinese tech stock is a good investment now. Nearly four dozen analysts have weighed in on the outlook for Meituan stock, providing a variety of rating recommendations and price targets.

The average Meituan stock price target of HK$196 implies an upside of more than 48% from the current price. The maximum target price of HK$275 implies an upside of more than 100%. The bottom price target of HK$115 implies a modest 13% downside.

A total of 44 analysts have a Buy rating on Meituan stock and 2 analysts have a Hold rating on the stock. Only one analyst has a sell rating on the stock. The stock has a consensus recommendation of Buy.

Meituan (3690.HK) Stock Technical Analysis

Traders use technical indicators to determine the right time to buy or sell a stock for the maximum profit. Let's explore Meituan stock's technical signals to see what you can expect from the stock from here.

The above chart shows the price movement of Meituan stock in the upper section. The middle section shows the MACD indicator and the Relative Strength Index (RSI) reading is in the lower section.

Analyzing Meituan Stock MACD Indicator

In the MACD section of the chart, the blue line represents the MACD line and the orange line represents the signal line. As you can see in the chart, the MACD line crossed below the signal line in June. If you look at the price action section, you can see that the price of Meituan stock started to fall. This is what is expected when the MACD line crosses below the signal line.

Around July 10, the MACD line crossed above the signal line. If you look closely, the crossing occurred below the middle zero line. When the MACD line makes this type of upward crossover, it signals that the stock is likely to go up.

Analyzing Meituan Stock RSI Reading

The RSI value ranges from 0 to 100. A reading above 70 indicates that a stock is overbought and may fall soon. On the other hand, a reading below 30 indicates that a stock is oversold and may rise soon. If you look at the RSI reading for Meituan stock, it is around 60, which indicates that the stock has the potential to go higher.

Meituan's Challenges and Opportunities

Meituan's success depends on its ability to overcome challenges and capitalize on opportunities. Let's explore the obstacles the company faces and the opportunities that lie ahead to help you assess whether Meituan stock is a good investment.

Meituan's Risks and Challenges

- Strict regulations: As the leading food delivery company in China, Meituan is subject to strict regulatory oversight. For example, it has been investigated for anti-competitive practices. Strict regulations may slow the company's growth and increase its compliance costs.

- Thin margins:The food delivery business is notoriously thin on margins. This makes it difficult for Meituan to achieve and maintain profitability. For example, efforts to lower prices or expand capacity to counter competition may further compress margins.

- Fierce competition:With its diversified business, Meituan faces competition on multiple fronts. Here are some of Meituan's main competitors and where they pose a challenge:

|

Competitor |

Threat |

|

Meituan vs. Ele.me |

Ele.me is the local delivery division of Chinese e-commerce powerhouse Alibaba. Ele.me is a major competitor to Meituan in the delivery services business. |

|

Meituan vs. ByteDance |

After dominating the short video market, TikTok parent ByteDance is expanding into the local services space. Its Douyin unit offers food delivery services in competition with Meituan. |

|

Meituan vs. Deliveroo |

Meituan's KeeTa faces off against Foodpanda and Deliveroo in Hong Kong's online food delivery market. |

|

Meituan vs. Didi |

Didi competes with Meituan in China's ride-hailing market. |

Meituan's Competitive Advantages

- Solid financial position:With more than 25 billion yuan in cash, 250 billion in assets, and only 33 billion in long-term debt, Meituan is in a strong financial position to pursue its growth plans.

- Strong market share:Although Meituan faces competition in the food delivery business, it has a tight grip on the market. It controls approximately 70% of the Chinese food delivery market. In addition, Meituan has built a highly recognized and trusted brand. This makes it difficult for competitors to undermine their market position.

- Diversified business:Meituan operates in several markets, ranging from food delivery to bicycle rental. If one business doesn't perform well, the company can rely on its other businesses to drive growth. As a result, Meituan has been able to maintain consistent revenue growth even in tough economic times.

Meituan's Growth Opportunities

Although Meituan has already gained significant market share in the food delivery industry, there is still room for the company to grow in this area. In addition, growth opportunities exist outside of the company's primary local delivery business. These are some of the Company's revenue and profit opportunities:

- International expansion:There is a huge market for food delivery outside of China. According to Grand View Research, the global market for online food delivery services is expected to grow from $221 billion in 2022 to $505 billion in 2030. Meituan could use its Hong Kong-focused KeeTa as a testing ground to see how its business model could work in overseas markets.

- Ride-hailing: Meituan launched a standalone ride-hailing app in 2021. The Meituan Dache app has significant revenue opportunities in China's expanding ride-hailing market. China's ride-hailing revenue opportunity is projected to grow from $70 billion in 2021 to $160 billion in 2027.

- Video sharing:Meituan has entered the video-sharing business in apparent revenge for ByteDance, which has challenged it in the delivery space. In addition to using video to attract more customers to its delivery services, Meituan could use the video service to open up additional advertising revenue streams.

- AI technology:Meituan has acquired AI developer Light Years. It can use AI technology to enhance its existing services and improve its operational efficiency to reduce costs and generate more revenue.

Trading Strategies for Meituan Stock

Source: Pixabay

As one of the largest Chinese tech stocks, Meituan offers exciting profit opportunities for traders. These are the two main ways to make money with Meituan stock:

1. Long-term investment strategy

This method involves buying and holding Meituan stock for at least a year. It can work well for those who have large amounts of money to start investing and can afford to wait a long time to see returns on their investment. The Meituan stock forecast shows that the stock can deliver impressive returns in the long run.

2. Short-term investment strategy

With this method, traders try to make profit over short periods of time, such as an hour, a day or a week. This investment method can take several forms, but the most flexible and potentially more rewarding strategy is to trade Meituan stock CFDs.

CFD trading requires little initial capital. CFD trading only requires you to predict whether Meituan stock will rise or fall over a given period of time. As a result, CFD trading allows you to make money with Meituan stock in both bull and bear markets.

Trade Meituan Stock CFD with VSTAR

If you're ready to start trading Meituan Stock CFD and are looking for the best CFD broker, consider using VSTAR. Designed for beginners and professional traders alike, VSTAR offers tight spreads and commission-free trading on standard accounts to maximize your profits.

VSTAR is a fully regulated CFD trading platform that is highly rated by traders. You can start trading Meituan stock CFD on VSTAR with as little as $50 and use leverage to increase your position.

Consider opening a VSTAR account today and start trading Meituan stock CFD for short-term profits. VSTAR offers new traders a demo account with up to $100,000 in free virtual money.

Conclusion

If you're looking for the best Chinese tech stocks to invest in 2023, Meituan stock is worth considering. Meituan gives traders exposure to multiple booming markets in China's internet economy.