MercadoLibre Inc (NASDAQ: MELI) has had a strong start to 2023. The company reported first quarter earnings that beat consensus expectations and MELI stock price has climbed about 40% year-to-date.

Is MercadoLibre (NASDAQ: MELI) stock a good investment? What is MercadoLibre stock prediction? How can you invest in MELI stock?

If you’re looking for the best Latin America (Latam) ecommerce stocks to buy, MercadoLibre stock is worth considering.

MercadoLibre (NASDAQ: MELI) Stock Overview

MercadoLibre is a Latin America-focused ecommerce company. With a market cap of $60 billion, MercadoLibre ranks among Latin America’s largest technology companies.

Although MercadoLibre is best-known for its Amazon-style ecommerce operation, the company runs a diversified business that also includes offering financial services.

Founded in 1999 in Argentina, MercadoLibre has its corporate headquarters in Uruguay. The company operates in 18 countries across Latin America, including Brazil, Mexico, Chile, and Argentina. Many fondly call MercadoLibre the Amazon and eBay of South America.

MercadoLibre founder and CEO Marcos Galperin is the richest person in Argentina with a net worth of about $6 billion. Galperin studied finance at the University of Pennsylvania and attended Stanford University for graduate studies in business administration. With a stake of 8% MercadoLibre stock, Galperin has significant economic interest in the company that motivates him to work toward its long-term success.

Key Milestones in MercadoLibre’s History

|

Year |

Milestone |

|

2001 |

eBay acquires 19.5% stake in MercadoLibre and forges a partnership. |

|

2007 |

MercadoLibre stock IPO. |

|

2019 |

MercadoLibre opens its first distribution centers in Brazil, Mexico, and Argentina. |

MercadoLibre’s Business Model and Products

How MercadoLibre Makes Money

MercadoLibre operates online marketplaces in more than a dozen Latam countries. The marketplaces host third-party merchants that sell a broad variety of products. MercadoLibre makes money by taking a cut of sales made through its platform. Moreover, the company provides delivery services to its ecommerce customers for a fee. MercadoLibre also offers online advertising services and digital financial services, including crypto trading.

MercadoLibre’s Main Products and Services

The company operates several business units focused on specific market segments. These are MercadoLibre’s largest brands and the services they offer:

MercadoLibre Marketplace: This platform connects sellers and buyers. Merchants come to the marketplace to list their products for sale. Sellers can set a fixed price for their product listings or allow price bidding. The platform is sort of a blend of Amazon and eBay.

MercadoPago: This is a financial services (fintech) platform. It processes payments for MercadoLibre’s ecommerce customers and offers investing services such as cryptocurrency trading. MercadoPago is comparable to Alibaba’s Alipay.

Mercado Envios: This is a logistics platform. It handles order fulfillment for MercadoLibre’s ecommerce customers. This unit offers storage, packaging, and delivery service for merchants.

Mercado Credito:This is MercadoLibre’s lending unit. It provides loans to consumers and businesses. The company has partnered with Goldman Sachs on the credit service with the bank providing funding.

MercadoLibre’s Financial Performance

Earning reports have a profound impact on MercadoLibre’s stock price. Read on to find out MercadoLibre’s financial performance and balance sheet strength.

Revenue

The ecommerce business is MercadoLibre’s largest revenue source and Brazil is the company’s largest market. MercadoLibre reported its Q1 2023 earnings results in May. It delivered revenue of $3 billion, which increased 35% year-over-year and exceeded Wall Street expectations by more than $150 billion.

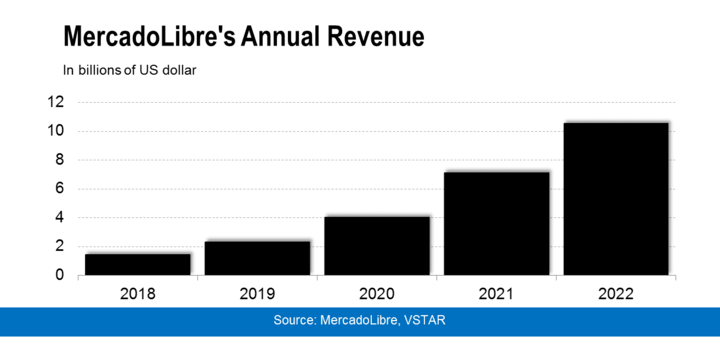

In 2022, MercadoLibre’s revenue rose almost 50% to $10.5 billion. The company’s revenue increased 78% in 2021 and 73% in 2020. The strong start to 2023 sets the company on the track for another year of solid revenue growth.

Analysts are expecting the company’s revenue to grow 28% to $13.5 billion in 2023. MercadoLibre has recorded a compound annual revenue growth rate of 49% over the past 5 years. The chart below illustrates the company’s annual revenue trend.

Net Income

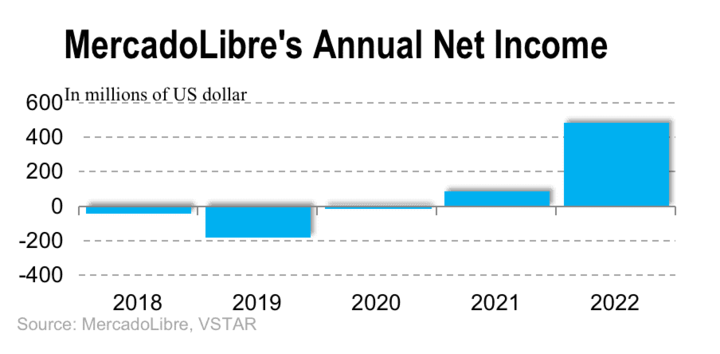

MercadoLibre’s profit more than tripled to $201 million in Q1 2023. That worked out to EPS of $3.97, which exceeded the consensus estimate by $0.66.

The company looks to be on the track for another profitable year in 2023. It made a profit of $482 million in 2022, which increased from a profit of $83 million in 2021. MercadoLibre’s fortunes are improving considering that the company reported losses in 2020, 2019, and 2018 as you can see in the chart below.

Profit Margins

MercadoLibre achieved a gross profit margin of 50.6% in Q1 2023, which improved from a margin of 48% in the previous quarter. The operating margin of 11% was flat from the previous quarter, while the net profit margin of 6.6% increased from 5.5% in the prior quarter.

MercadoLibre has maintained its annual gross margins above 42% over the past 5 years. The company’s operating and net profit margins have shown steady improvements over the past three years.

Cash Position and Balance Sheet Condition

MercadoLibre generated $859 million in cash from operations and $87 million in free cash flow in Q1. It finished the quarter with $3.2 billion in cash. The company has $14.2 billion in assets and $12.2 billion in total liabilities. With a current ratio of 1.28 and quick ratio of 1.22, MercadoLibre’s balance sheet is largely in good shape.

MercadoLibre (NASDAQ: MELI) Stock Analysis

MELI Stock Trading Information

MercadoLibre (NASDAQ: MELI) shares are listed on the Nasdaq exchange. The Latam ecommerce stock trades under the “MELI” ticker symbol.

The regular trading session in MercadoLibre (NASDAQ: MELI) stock begins at 9:30 a.m. and ends at 4 p.m. ET on weekdays. There is no trading in MELI stock on weekends and U.S. holidays. But investors seeking extra time to trade MELI stock can take advantage of Nasdaq’s extended market hours.

Premarket trading in MELI stock begins at 6.30 a.m., which gives you extra three hours to trade before market opening. Post-market trading runs until 8 p.m., which allows you extra four hours of trading after the market closes.

MercadoLibre stock split: MELI stock hasn’t split since the IPO. But with the stock price having jumped above $1,000, many expect a MELI stock split soon or later.

MercadoLibre dividend yield: Although the Latam ecommerce powerhouse is profitable, it doesn’t pay dividends yet.

MercadoLibre (NASDAQ: MELI) Stock Performance

MercadoLibre staged its IPO in August 2007. MELI stock went public at an IPO price of $18, which was at the high-end of the expected pricing range of $16 - $18.

Although MELI stock had a slow start to the public market as you can see in the chart above, it largely kept rising. The stock price crossed $50 in 2008 and across $100 in 2014.

MELI stock began rising rapidly in 2017 after crossing the $200 mark. It breached $500 in 2019, climbed above $1,000 in 2020, and hit the $2,000 all-time high in 2021.

MercadoLibre shares have gained about 40% so far in 2023, besting the S&P 500 Index’s 13% return in the same period as you can see in the chart above.

In the past year, MercadoLibre stock price has climbed more than 60%, trouncing popular ecommerce stocks such as Amazon and Alibaba.

Why Is MercadoLibre Stock Going Up?

Strong upside potential: Although MercadoLibre stock has risen sharply so far in 2023, it still has plenty of room to run to retake its $2,000 all-time high. As a result, many investors see substantial upside potential in MELI stock and they are going for it.

Promising outlook: Latin America has a rapidly expanding ecommerce market. The uptake of fintech services is also increasing fast in the region. MercadoLibre is well-positioned to capitalize on this opportunity and that explains why investors are buying MELI stock.

MercadoLibre stock split expectations: Many investors expect MercadoLibre to follow Amazon in splitting its stock to make it more affordable to retail investors. A stock split may attract more investors to MercadoLibre, potentially driving up the MELI stock price.

MercadoLibre (NASDAQ: MELI) Stock Predictions

As you can see in the chart above, MELI stock has established a solid support level at $1,152. However, the stock currently faces some resistance at $1,363.

After MercadoLibre’s recent spike, you might be wondering whether it is too late to buy MELI stock or the rally is just getting started. You can find the answer in MercadoLibre stock price predictions.

Nearly two dozen analysts have weighed on MELI stock outlook with a range of price targets. The average MercadoLibre stock forecast of $1,600 suggests more than 30% upside potential. The peak MELI stock price target of $1,800 implies nearly 50% upside. And even the base price target of $1,350 indicates more than 10% upside.

MercadoLibre Challenges and Opportunities

The success for MercadoLibre depends on its ability to navigate its challenges and capitalize on the opportunities. Let’s examine MercadoLibre’s challenge and opportunities to help you gauge what lies ahead for the company.

MercadoLibre’s Threats and Challenges

Substantial debt: Although MercadoLibre’s business is profitable, the company borrows to meet its additional cash requirements. Consequently, the company has accumulated about $5 billion debt. Although the debt is manageable for MercadoLibre, servicing debt in a high interest rate environment can be draining on resources.

Forex headwinds: MercadoLibre operates in more than a dozen countries where it prices its products and services in local currencies. The company converts its sales in local currencies into the U.S. dollar to enable it to pay some of its bills and for financial reporting purposes. The currency conversion can result in substantial value loss due to forex rate movements.

Regulations: As the ecommerce leader in Latin America, MercadoLibre is an easy target of antitrust complaints. Such complaints can result in stringent regulations that could slow down MercadoLibre’s growth or increase its costs.

Competition: MercadoLibre faces competition from local and international rivals in areas like ecommerce, financial services, and logistics. These are some of MercadoLibre’s main competitors and the threats they pose to its business:

|

Competitor |

Threat |

|

MercadoLibre vs. Sea |

Sea Ltd (NYSE: SE) operates the Shopee ecommerce platform in Brazil, competing with MercadoLibre in its most important market. |

|

MercadoLibre vs. Americanas |

Americanas is one of the largest online retailers in Brazil. Therefore, it is a major competitor in a market that MercadoLibre looks up to for nearly half of its revenue. |

|

MercadoLibre vs. Amazon |

Amazon is among MercadoLibre’s biggest foreign ecommerce rivals in the Latin America region. Amazon’s stronger financial muscles make it a particularly dangerous competitor. |

|

MercadoLibre vs. Alibaba |

Alibaba operates its international-focused ecommerce platform AliExpress in Latin America, challenging MercadoLibre for market share. Alibaba’s Cainiao unit also competes with MercadoLibre for logistics business. |

|

MercadoLibre vs. RappiPay |

RappiPay provides online payment processing and banking services in several Latam countries, giving competition to MercadoLibre’s MercadoPago unit. |

|

MercadoLibre vs. PayPal |

Although MercadoLibre and PayPal are in some partnerships, they still compete for digital payments processing business. MercadoPago’s other payment competitors are PagSeguro, SafetyPay, and Servipag. |

MercadoLibre’s Competitive Advantages

Local knowledge: MercadoLibre has focused its efforts and resources on dominating the Latin America region. Consequently, the company has gained a deepunderstanding of the region to come up with highly popular products. Therefore, MercadoLibre has been able to succeed easily in many areas where international rivals like Amazon are struggling.

Market leadership: MercadoLibre controls the largest share of the ecommerce market in the Latin America region. The head start enables MercadoLibre to make the most of the opportunities in the region as many of its competitors still try to figure out their strategy.

Strong brand: MercadoLibre has built a solid brand presence in Latin The strong brand recognition and trust that comes with it has provided MercadoLibre an important springboard to launch into additional segments beyond the ecommerce market.

Diversified business: Although it started as an ecommerce provider, MercadoLibre has expanded into other businesses including digital payments, credit services, advertising, and logistics. The company continues to seek additional growth opportunities with new products and solutions.

Good management: MercadoLibre has avoided the type of scandals and problems that have hit some of its biggest rivals and tainted their image. Additionally, MercadoLibre has routinely ranked among the best places to work in Latin America while some of its competitors have faced many labor complaints and protests.

MercadoLibre’s Opportunities

1. Significant Ecommerce Growth Potential

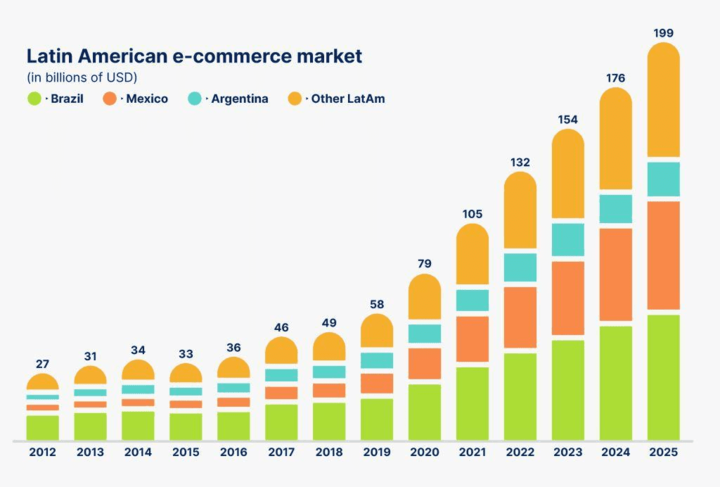

Although an increasing number of people are shopping online, only a tiny fraction of the retail business in Latin America has moved online. The ecommerce penetration in the region is estimated at 11% of total retail sales, compared to 20% for the U.S. and nearly 30% for China and other more developed economies.

The currently low ecommerce penetration in Latin America implies significant room for growth for MercadoLibre. More people will shop online as internet access in the region expands.

As you can see in the chart below, the Latam ecommerce market is on track to hit $200 billion by 2025, from less than $80 billion in 2020.

Source: Latitud.com

2. Expanding Online Advertising Market

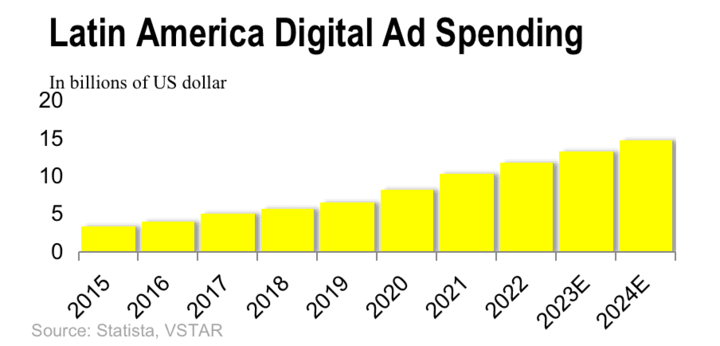

With people increasingly spending their time online, marketing budgets are also going online. This presents a huge revenue opportunity for ecommerce providers like MercadoLibre that reach millions of consumers through their platforms.

As you can see in the chart above, spending on online ads in Latin America is forecast to grow to more than $14 billion by 2024, from just over $2 billion in 2014.

3. Broadening Fintech Market

There is plenty of room for MercadoLibre to grow its financial services business. The Latin America region has a large number of unbanked people, presenting a huge growth opportunity for MercadoLibre in the fintech space.

In addition to processing payments, providing loans, and offering crypto trading, MercadoLibre can also offer online banking and money management services.

4. Digital Media Market

Amazon and Alibaba are making huge amounts of money from offering online entertainment services to their ecommerce shoppers. For example, Amazon’s Prime video service has millions of subscribers.

MercadoLibre too can earn substantial extra revenue from offering services like online video streaming. With video streaming, MercadoLibre can both generate subscription revenue and draw more views to its advertisements.

MercadoLibre (NASDAQ: MELI) Stock Trading Tips

You can make money with MercadoLibre stock in a variety of ways depending on your risk tolerance, investment goal, and investing timeline. Read on to find out the popular MercadoLibre stock investing strategies to see what might work best for you.

1. Buying and Holding MercadoLibre Shares

If you’re investing for a long-term goal such as saving for retirement or home purchase, buying and holding MercadoLibre shares in your portfolio may work best for you.

MercadoLibre Shares Investing Tips

● Apply dollar-cost averaging method to increase your position in MELI stock steadily over time.

● Diversify your portfolio by holding other stocks besides MercadoLibre to spread your risks.

Advantages of Holding MercadoLibre Shares

● You get voting rights and can influence the company’s decisions.

● You become eligible for potential future dividends.

Disadvantages of Holding MercadoLibre Shares

● You require a large starting capital.

● You can only achieve your investment goal when MELI stock price is going up.

2. Trading MercadoLibre Stock CFD

If you’re investing to fund your living expenses or other short-term goals, trading MercadoLibre stock CFD may be best for you. In CFD trading, all you need to do is to predict the direction of MELI stock price movements.

MercadoLibre Stock CFD Trading Tips

● Apply the 1% funds allocation technique to protect your account from getting wiped out if the market moves against you.

● Use risk management techniques such as stop-loss and take-profit orders.

Advantages of Trading MercadoLibre Stock CFD

● You can capture profits over short timelines such as over an hour, day, or week.

● You can make profits both when MELI stock is rising and when it is falling.

● You require little starting capital and can use leverage to boost your trade.

Disadvantages of Trading MercadoLibre Stock CFD

● You don’t get voting rights, so cannot influence the company’s decisions.

● You are ineligible for potential dividends from MercadoLibre.

Trading MercadoLibre Stock CFD With VSTAR

If you’re interested in CFD trading, the first thing you should do is choose a good trading platform. While there are many CFD brokers out there to choose from, you need to look out for scams and excessive fees. If you’re looking for a legitimate, low-cost broker for trading MercadoLibre CFD, consider VSTAR.

VSTAR is a fully licensed and regulated CFD broker that offers low fees and tight spreads that enable traders to maximize their profit. The platform is ideal for high-speed and frequent trading. VSTAR supports all the popular deposit and withdrawal methods.

VSTAR CFD trading platform has a low starting capital requirement at only $50. The platform offers generous leverage that traders with low starting capital can use to increase their market exposure.

If you’re new to CFD trading and want to sharpen your strategy before you start investing real money, you can take advantage of VSTAR’s $100,000 demo account.

Open your VSTAR account today to start trading MercadoLibre stock CFD. The account is free to open and it only takes a few minutes to get started.

Final Thoughts

MercadoLibre (NASDAQ: MELI) has strong competitive advantages in the Latin American ecommerce market and MELI stock predictions show substantial upside potential.

While there is a good reason to buy and hold MercadoLibre shares for years, you can also trade MELI stock CFD for short-term profits.