I. Introduction

A. Recent Meta Stock Performance

Meta Platforms (formerly Facebook) has displayed remarkable performance in its stock value over recent periods. As of the current data, Meta's stock is trading at $339 with a 52-week range between $108.32 and $341.87. The forward earnings per share (EPS) stands at $14.34 with a forward price-to-earnings ratio (PE) of 23.37, indicating solid investor confidence in future profitability.

Short interest, at 1.45%, is relatively low, signifying a lesser number of investors betting against the stock. With a massive market capitalization of $861.01 billion, Meta remains a substantial player in the market.

Analyzing the momentum and relative sector performance grades, Meta has consistently outperformed both its sector median and 5-year average, exhibiting robust momentum across various timeframes. Notably, its 1-year price performance stands out at an impressive 200.62%, surpassing both the sector median and 5-year average by significant margins.

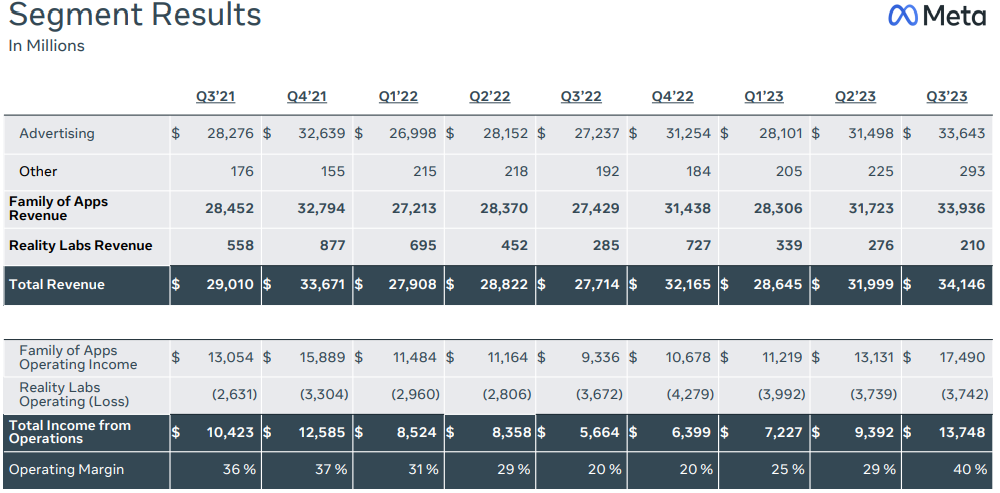

Meta's recent stock performance has been influenced by several key factors outlined in their financial report and strategic insights. The company has demonstrated significant progress and growth, driven by the following critical areas:

- User Base and Engagement: Meta boasts a massive user base of over 3.9 billion people engaging with their apps monthly. The growth and engagement across their Family of Apps, including Facebook and Instagram, indicate a strong market presence and sustained user interest. Factors such as the success of features like Reels, driving a 40% increase in time spent on Instagram, and the continued growth in daily active users across their platforms contribute significantly to the company's performance.

Source: Meta Earnings Presentation

- Technological Innovations: Meta's focus on technological advancements, particularly in AI, is a pivotal factor. The development and deployment of Meta AI across various products and services have expanded user experiences. Notable advancements include the introduction of Quest 3, a mainstream mixed reality device, and the integration of AI into Ray-Ban Meta smart glasses. The emphasis on AI Studio, Emu (image creation model), and plans for creator AIs indicate a strong commitment to leveraging AI to enhance user engagement and satisfaction.

- Monetization and Advertising: The company's revenue growth, notably from advertising, is substantial. Revenue generation from ad services like Reels and business messaging, which has seen a doubling of revenue from click-to-message ads in India, reflects the increasing importance of these avenues. The ability to drive engagement through AI-recommended content and expand monetization through improved ad targeting and measurement underscores Meta's sustained revenue growth strategy.

- Reality Labs and Metaverse Development: Investment in Reality Labs, especially in AR/VR technologies like Quest 3 and Ray-Ban Meta smart glasses, aligns with their long-term focus on building the metaverse. The evolution of Horizon, the launch of new worlds, and strides in avatar technology represent Meta's dedication to creating immersive digital experiences.

- Efficiency and Cost Management: Despite heavy investment in future technologies like AI and infrastructure, Meta has shown operational efficiency and discipline, recording its highest operating margin in two years. Plans to focus on operating efficiently and optimizing hiring practices while redirecting resources towards AI projects demonstrate a commitment to financial stability and strategic alignment.

B. Expert Insights on META Stock Forecast for 2023, 2025, 2030 and Beyond

Traders Union forecasts a progressive growth pattern, suggesting Meta stock could reach around 461.52 USD by 2025 and escalate to 1451.21 USD by 2034. This Facebook stock forecast indicates a consistent upward trend, with incremental increases in stock value each year.

Coin Price Forecast analysts present a more bullish outlook, projecting a higher potential price trajectory. Their forecast estimates Meta's stock to reach approximately 329 USD by mid-2023 and rise significantly to around 1,547 USD by the end of 2035. These Meta stock predictions showcase a more aggressive growth curve, foreseeing substantial gains over the next decade.

Walletinvestor analysts present a comparatively conservative Meta forecast, estimating a lower stock value of 254.988 USD at the beginning of 2025, with a further decrease to 178.032 USD by the start of 2028. This FB stock forecast diverges from the more optimistic projections, suggesting a possible stagnation or decline in stock value during this period.

Long Forecast analysts offer a mid-range projection, suggesting a FB stock price of 513 USD at the beginning of 2025. This forecast aligns with Traders Union's outlook, indicating a positive growth trajectory for Meta stock.

These Meta stock predictions present diverse perspectives, with some predicting substantial growth, while others indicate a more moderate or conservative outlook.

II. Meta Stock Forecast for 2023

Source: tradingview.com

Based on Meta's current trajectory, its stock price may potentially reach $367 by the end of 2023, with ongoing support near the 66-day EMA. Despite potential reversals testing lows around $309, a rapid rise to $335 that may be followed by a hit to the critical resistance level of $367, as indicated by Fibonacci expansion. However, caution is advised due to the relative strength index (RSI) indicating overbought conditions, hinting at forthcoming corrections that could drive the RSI towards 50 in the following weeks.

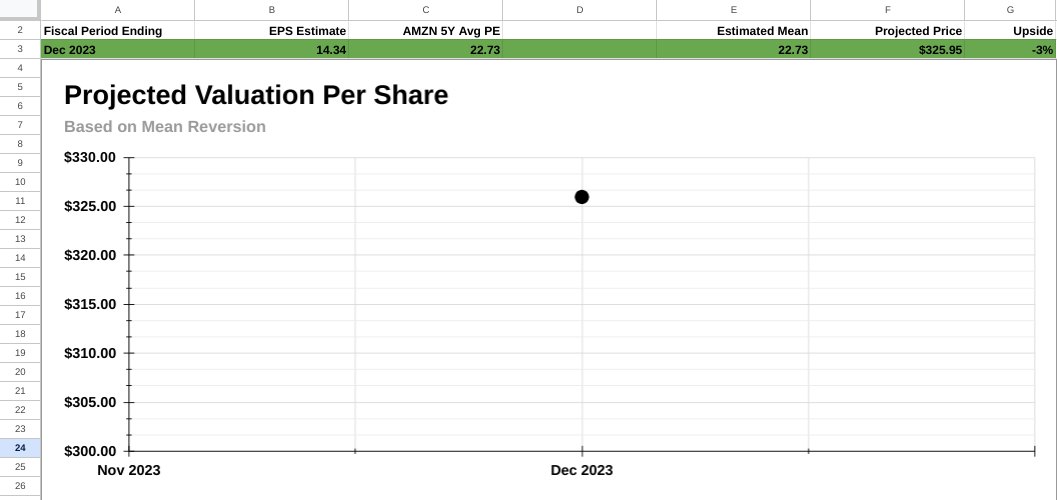

Source: Analyst's compilation

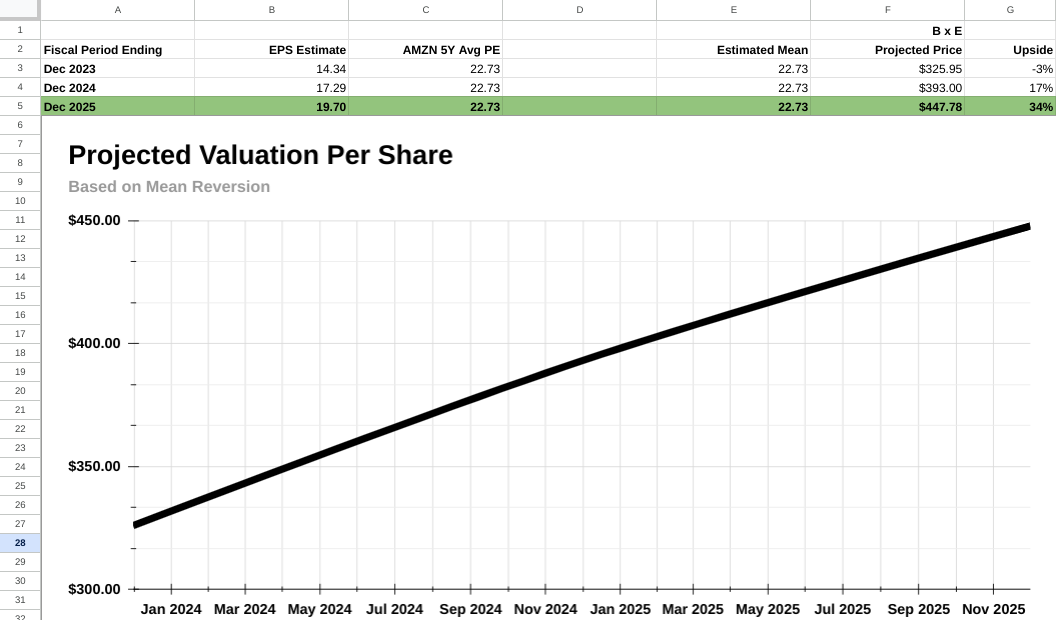

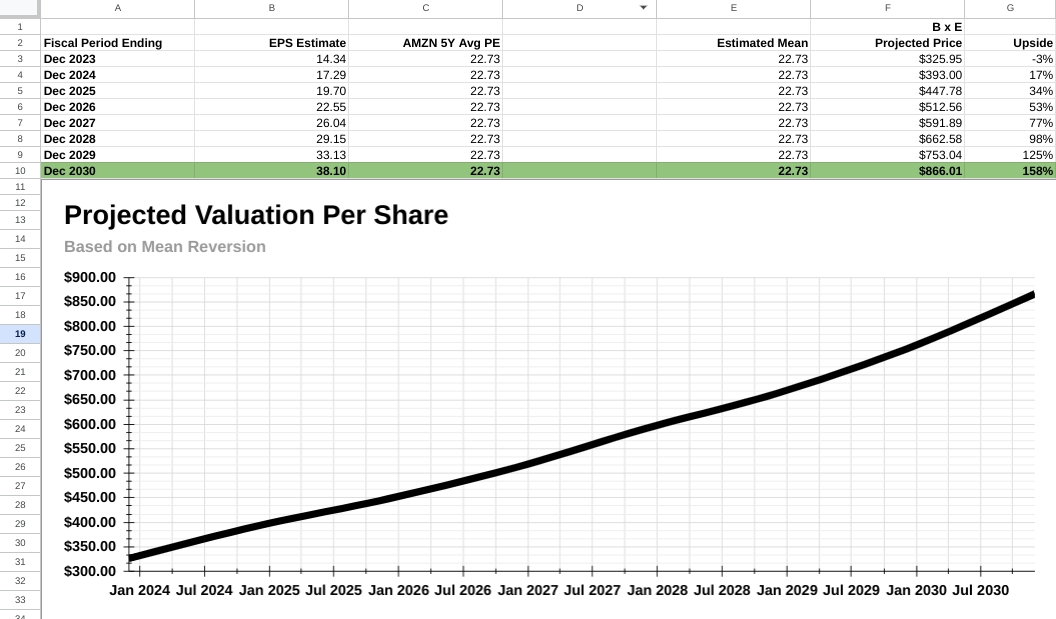

Analyzing quantitatively, Meta's forward P/E stands at 23.37 compared to the 5-year historical average of 22.73, suggesting a minor downside of 3% with a projected price of $326 based on mean reversion principles.

In the same context, the Traders Union predicts Meta (formerly Facebook) could hit 406 USD, while Coin Price Forecast estimates it might reach $350 by the end of 2023. These forecasts suggest potential growth but vary in projected stock prices, showcasing different outlooks on Meta's performance in the upcoming year.

A. Other META Stock Forecast 2023 Insights

Is Meta stock a buy? Stifel's Mark Kelley and Truist Securities' Robert Zeller both reaffirm a "Strong Buy" rating for META, projecting a Meta target price of $405. This consensus indicates an anticipated upside potential of around 20.88%. Similarly, RBC Capital's Brad Erickson maintains a "Buy" rating for META with a target of $400, suggesting a 19.39% upside.

However, variations exist among analysts regarding their perspectives on the stock's potential. For instance, Piper Sandler's Thomas Champion downgrades the Meta price target from $365 to $355, indicating a more conservative 5.96% upside. Likewise, Scott Devitt from Wedbush reiterates a "Buy" recommendation but with a Meta target price of $350, signaling a 4.47% potential increase.

Rohit Kulkarni of Roth MKM maintains a positive outlook by upholding a "Strong Buy" rating and adjusting the target from $360 to $365, projecting an 8.94% upside. Wells Fargo's Ken Gawrelski and Barclays' Ross Sandler also maintain "Buy" ratings but with different price targets of $380 and $400, respectively. This implies upside potentials of 13.42% and 19.39%, highlighting varying degrees of optimism among analysts.

Barton Crockett from Rosenblatt holds the most bullish perspective, maintaining a "Strong Buy" rating while elevating the META stock price target significantly from $372 to $411. This suggests the highest potential upside of 22.67% among the listed analysts.

B. Key Factors to Watch for Meta Stock Price Prediction 2023

Meta stock forecast for 2023 - Bullish Factors

- User Base and Engagement

Meta's report of approximately 3.9 billion monthly active users indicates a massive and engaged user base across its platforms. This vast reach presents significant potential for advertisers, as a large audience increases the appeal of the platform for marketing campaigns.

- AI Innovation

The company's focus on Artificial Intelligence (AI) development is a notable bullish factor. Meta's investment in AI-based technologies like Meta AI, AI Studio, and Emu portrays an emphasis on cutting-edge advancements. Such innovations aim to improve user experiences, potentially increasing engagement and user retention over time.

- Hardware Innovation

The launch of Quest 3 and upgraded Ray-Ban Meta smart glasses signifies Meta's commitment to hardware diversification. These products integrate Meta AI, demonstrating the company's strategic direction towards wearable tech and mixed reality, potentially tapping into a growing market.

Source: RayBan

- Monetization Milestones

The success of Reels, driving increased time spent on Instagram and achieving neutrality in overall company ad revenue, is a positive indicator. Meta's ability to monetize new features like Reels suggests potential for continued revenue growth from innovative product offerings.

- Business Messaging Growth

The escalating number of interactions between users and businesses on Meta platforms signifies growing potential for commerce and support services. The introduction of AI-driven business support systems reflects Meta's commitment to improving user experiences and revenue streams.

Meta stock price prediction for 2023 - Bearish Factors

- Rising Expenses and Operating Loss

Despite revenue growth, Meta's escalating expenses, including R&D and Reality Labs operating losses, present a challenge. Increased infrastructure costs, higher headcount-related expenses, and continuous losses in Reality Labs could strain profitability.

- Regulatory Challenges

The mention of legal and regulatory headwinds, particularly in regions like the EU and the US, poses significant risk. If regulatory restrictions tighten, it might limit Meta's operational flexibility, impacting its financial performance and growth prospects.

- Hiring and Cost Management Challenges

Meta's backlog in hiring and selective headcount growth might pose challenges in achieving optimal operational efficiency. The focus on AI-related areas while deprioritizing other projects might disrupt workforce dynamics and overall productivity.

- Market Pricing and Monetization Issues

Despite its massive user base, Meta faces challenges in maintaining ad prices due to increased impressions and decreased average ad rates. This pressure on ad pricing could hinder revenue growth in the short term.

- Uncertainty in Metaverse Development

While Meta's vision for the metaverse is ambitious, its successful execution and widespread adoption remain uncertain. The development of this concept may take considerable time, impacting short-term profitability and investor sentiment.

III. Meta Stock Forecast 2025

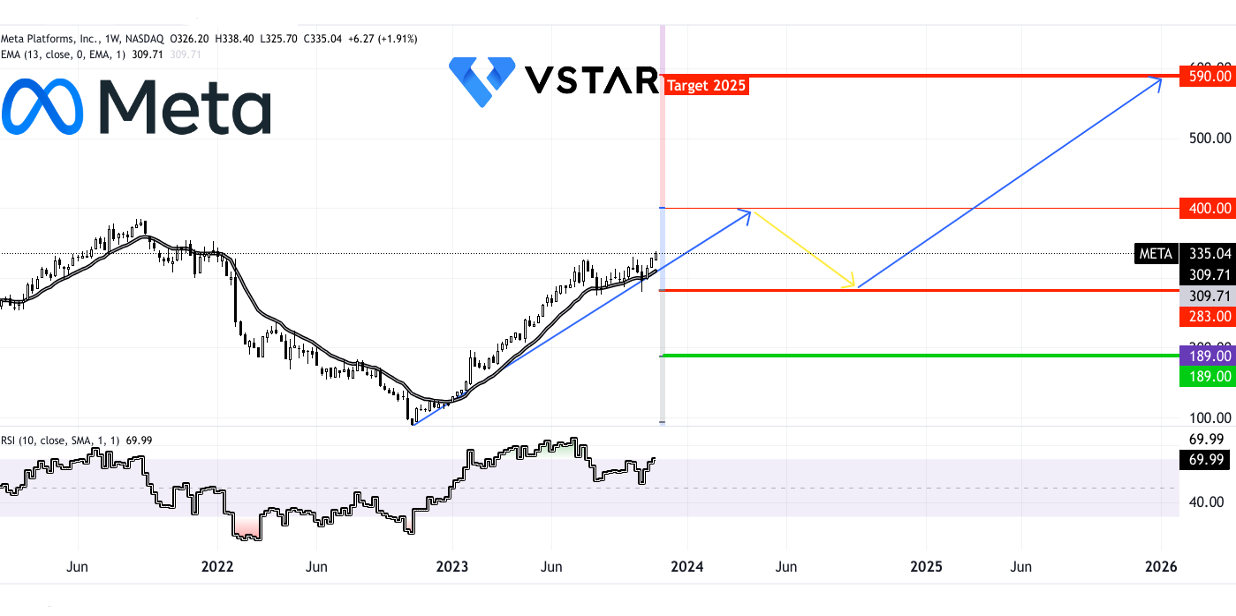

Based on technical analysis, the projected price of Meta stock appears to be heading towards $590, drawing from the present momentum aligned with the Fibonacci extension. This extension has highlighted a minor resistance level at $400. The ongoing upward trajectory in price, based on the Elliott Wave analysis, suggests the current surge as the initial impulsive wave on a weekly time frame, while encountering a potential correction around the $400 mark that might drive the price down to $283. Nevertheless, a significant drop to $283 seems less probable, as the prices might instead undergo a minor correction to establish a correcting wave pattern.

Source: tradingview.com

Applying the mean reversion theory and integrating analysts' EPS estimates along with the historical average of forward P/E, a projected target emerges. This projection suggests a potential Meta price target of $393 for the year 2024, offering an upside potential of 17%. Looking further ahead to 2025, the projection suggests a target price of $447, reflecting a substantial upside potential of 34%.

Source: Analyst's compilation

Various sources provide differing predictions for Meta stock in 2025. Coincodex.com anticipates Meta's stock reaching $512.64, projecting a 53.01% increase based on its historical yearly growth rate. Conversely, Traders Union forecasts a slightly lower figure of $461.52 for 2025. Coinpriceforecast.com offers a range, estimating Meta stock price to reach $450 by the end of 2024 and potentially climb to $600 within 2025.

A. Other META Stock Predictions 2025 Insights

The Wall Street Journal projects a target of $461 for Meta stock based on analysts' estimations. Forecasts indicate an increase in adjusted earnings per share (EPS) to $20.30 in 2025 from $14.36 in 2023.

Bank of America's analyst, Justin Post, remains bullish on Meta's growth drivers. He emphasizes the potential for increased enthusiasm regarding Meta stock due to anticipated upside in 2024 and growing optimism surrounding the company's AI capabilities. Post believes Meta's renewed focus on efficiency and the promising trends in video usage, particularly reels, will contribute positively to the company's performance. With a "buy" rating for META stock, Bank of America reflects a positive outlook.

CFRA's Angelo Zino acknowledges geopolitical and regulatory uncertainties impacting investor sentiment toward Meta. However, Zino remains optimistic about Meta's prospects in 2024, highlighting the company's emphasis on AI and the momentum in reels usage as supportive factors for engagement and gains in digital ad share. CFRA maintains a "buy" rating for Meta.

Looking forward, Meta's sustained success is likely contingent on its adept use of AI technology to bolster engagement and advertising momentum. Monetizing messaging assets and the potential success or failure of the Reality Labs metaverse project could significantly influence Meta's future trajectory in the tech industry.

However, Morningstar's analyst Ali Mogharabi points out certain limitations in Meta's current valuation. While acknowledging the company's growing user base and positive engagement trends, Mogharabi suggests that the stock's valuation might restrict further growth potential. Morningstar maintains a "neutral" rating for Meta, indicating a more conservative stance regarding the stock's potential upside.

B. Key Factors to Watch for Meta Stock Price Prediction 2025

Meta stock predictions 2025 - Bullish Factors

- AI Emphasis

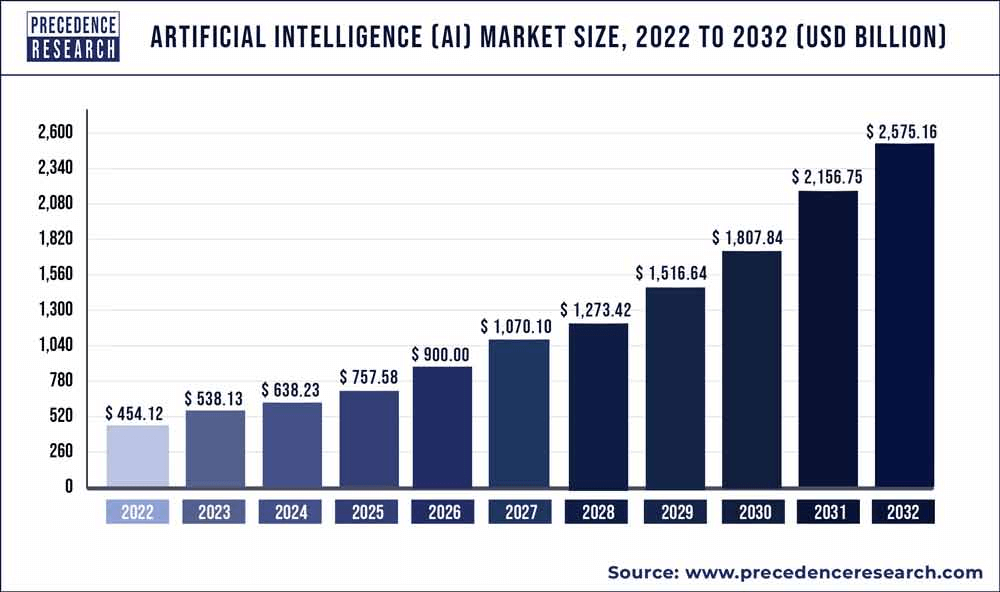

Meta's heavy investment in Artificial Intelligence (AI) presents a bullish outlook. Their focus on leveraging AI across platforms like Meta AI, AI Studio, and business AIs demonstrates a commitment to enhancing user experience and engagement. The integration of AI-driven feed recommendations has already shown increased user engagement by 7% on Facebook and 6% on Instagram.

Source: precedenceresearch.com

- Metaverse and Mixed Reality Innovation

The company's vision for the metaverse, highlighted by advancements such as Quest 3, mixed reality devices, and Meta-powered smart glasses, showcases a commitment to pioneering mixed reality experiences. These innovations could open up new revenue streams and significantly impact the way users interact with technology.

- Revenue Diversification

Meta's efforts to diversify revenue sources beyond advertising, particularly through business messaging and commerce integrations, indicate a move towards a more diverse income stream. The growth in business messaging conversations, especially in regions like India, signifies potential expansion into larger economies and increased commerce opportunities.

Meta stock price prediction 2025 - Bearish Factors

- Regulatory and Geopolitical Risks

Continued regulatory scrutiny and geopolitical tensions represent a major risk for Meta's global operations. Uncertainties regarding regulatory changes, especially in regions like the EU and the US, could impact the company's advertising revenue and overall business operations.

- Competition and Innovation Risks

Competitors in the tech industry are continually innovating. If Meta's innovations fail to gain traction or meet user expectations, it could negatively impact user engagement and revenue growth. The company faces the risk of falling behind competitors if its innovations do not resonate with users.

- Execution Challenges

The successful execution of Meta's ambitious plans, such as the metaverse and AI integration, hinges on effective implementation. Any operational hurdles or delays in delivering these innovations could lead to market disappointment.

IV. Meta Stock Forecast 2030 and Beyond

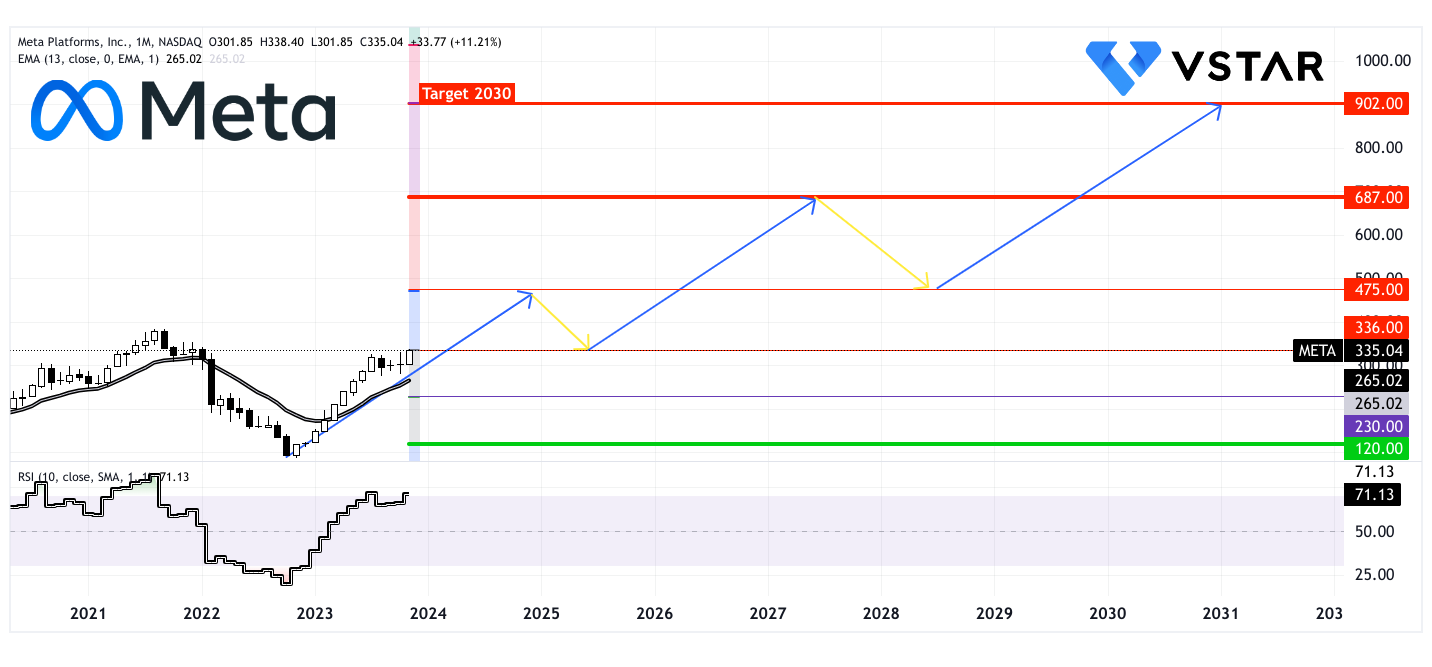

Looking ahead to Meta stock in the long term, a technical analysis suggests a potential rise to $900 by 2030. This projection aligns with the Elliott Wave theory, revealing the current uptrend as the initial impulsive wave within a sequence of 3 impulsive waves (indicated by blue arrows) and 2 corrective waves (yellow arrows). However, this ascent won't be a straightforward climb. Anticipate resistance levels at $475 and $687, likely triggering significant corrections. A potential double top formation near $687 could momentarily halt bullish momentum for a few weeks. Monitoring the 13-month EMA could serve as a trend navigator through this trajectory.

Considering downside risks, $230 and $120 are crucial long-term support levels, particularly in the event of a US economic downturn.

Source: tradingview.com

Taking a quantitative approach, projecting the FB stock price involves historical forward P/E averages combined with analysts' EPS estimates, employing a mean reversion theory. This computation foresees a 158% upside, targeting a $866 price for 2030. This estimation stems from an EPS estimate of $38.10 and a forward P/E of 22.73.

Source: Analyst's compilation

The predictions for Meta stock price in 2030 vary significantly across different sources. Coincodex.com projects a potential value of $1,506.41 for Meta by 2030, based on maintaining its current 10-year average growth rate, indicating a substantial 343.10% increase from its present price. This prediction assumes a consistent trajectory of growth over the next decade.

On the contrary, coinpriceforecast.com presents a more detailed but divergent forecast. It suggests a more gradual increase, starting from $350 by the end of 2023, reaching $450 by 2024, and subsequently rising in incremental stages: $600 in 2025, $800 in 2026, $900 in 2027, $1100 in 2028, $1200 in 2030, followed by further increments reaching $1500 by 2035.

A. Other META Stock Forecast 2030 and Beyond Insights

Is Meta a good stock to buy? The 2030 evaluation of Meta's future success revolves around its strategic advantages and market positioning.

Morningstar's assessment emphasizes Meta's strong competitive edge, known as a "wide moat." This advantage is grounded in network effects, leveraging its immense user base and data assets from platforms like Facebook, Instagram, Messenger, and WhatsApp. These network effects create barriers to entry for potential competitors and barriers to exit for existing users, enhancing the platforms' value with increased user participation.

Meta's accumulation of extensive user data through its platforms fuels its advertising revenue by offering targeted and relevant content to nearly 3 billion monthly active users. This data-rich environment, along with its advertising partnerships, enables Meta to monetize its unique information, generating substantial returns on capital.

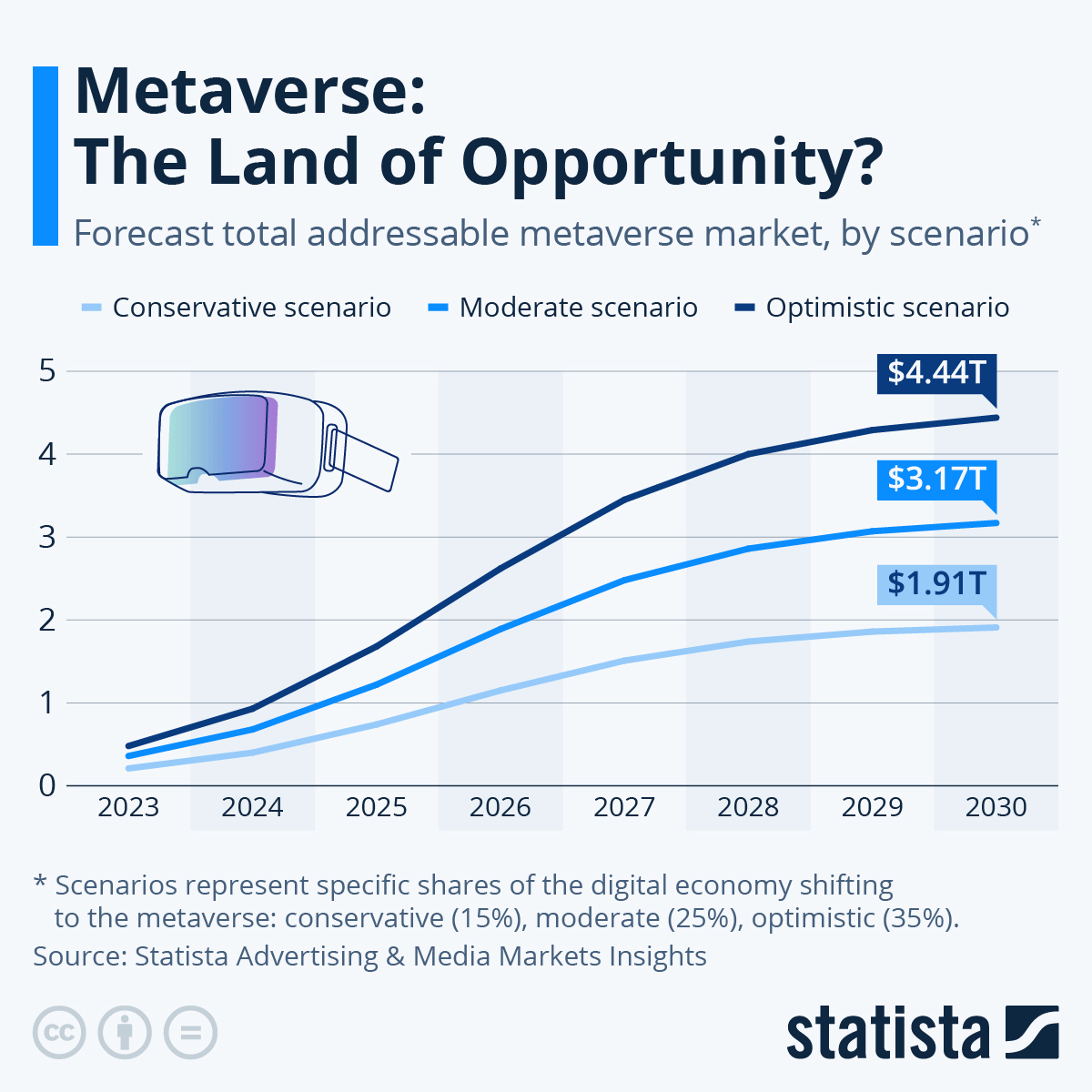

The projected growth of the metaverse market by 2030, estimated at USD 936.6 billion, indicates a promising future for immersive, interactive environments. The market's anticipated growth is attributed to the increasing adoption of XR technologies, the demand for digital assets using cryptocurrencies, and the development and distribution of AR, VR, and MR devices. The metaverse's potential applications across various industries, including gaming, healthcare, education, and entertainment, underscore its multifaceted appeal and potential for broad adoption.

The metaverse, a three-dimensional interactive environment facilitating interaction through avatars, is evolving into a space where users engage more deeply with digital content, using platforms like Facebook and blockchain technology for transactions. This shift expands opportunities for brand connections and sets the stage for multidimensional online interactions beyond traditional social media.

Recent developments in the metaverse industry further highlight its growth trajectory. Investments, partnerships, and initiatives by companies like Meta (formerly Facebook), Roblox, Niantic, and Epic Games indicate a concerted effort to develop and expand the metaverse landscape. Initiatives by governments, such as the Spanish government's funding for Web3 and metaverse technologies, signal increasing recognition of the metaverse's potential impact on innovation and economic growth.

Finally, the metaverse's integration with blockchain technology enables the creation, ownership, and trade of digital assets and virtual spaces using cryptocurrencies and NFTs. This integration opens avenues for diverse applications and revenue streams, notably within the gaming industry.

B. Key Factors to Watch for Meta Stock Price Prediction 2030 and Beyond

Meta stock predictions 2030 - Bullish Factors

- Metaverse Expansion

Meta's strategic focus on developing the metaverse presents a bullish outlook. With significant investments in virtual reality (VR), augmented reality (AR), and the creation of immersive experiences, Meta aims to capitalize on the growing demand for interactive digital environments.

Source: statista.com

- Advertising Revenue Growth

Continued monetization of its user base through targeted advertising remains a strong point. Meta's ability to leverage its vast user data for advertisers and businesses could lead to sustained revenue growth.

- Innovation and Acquisitions

Meta's commitment to innovation and acquisitions in emerging tech fields like artificial intelligence, blockchain, and AR/VR suggests future potential. Strategic acquisitions that complement its offerings and technology could drive market sentiment positively.

Meta stock price prediction 2030 - Bearish Factors

- Regulatory Challenges

Increased scrutiny from regulatory bodies worldwide poses a risk to Meta's operations. Privacy concerns, antitrust issues, and potential regulations affecting data usage and advertising practices could impact the company's growth and profitability.

- Competition and User Engagement

Rivalry from emerging platforms or established competitors could threaten Meta's dominance. Reduced user engagement or a shift to alternative platforms due to evolving preferences, privacy concerns, or a lack of innovation might negatively impact its market position.

- Technology Risks

Rapid technological advancements and shifting consumer behaviors might render current investments or technology obsolete. Failure to adapt to evolving trends or disruptions in tech landscapes could hinder Meta's growth prospects.

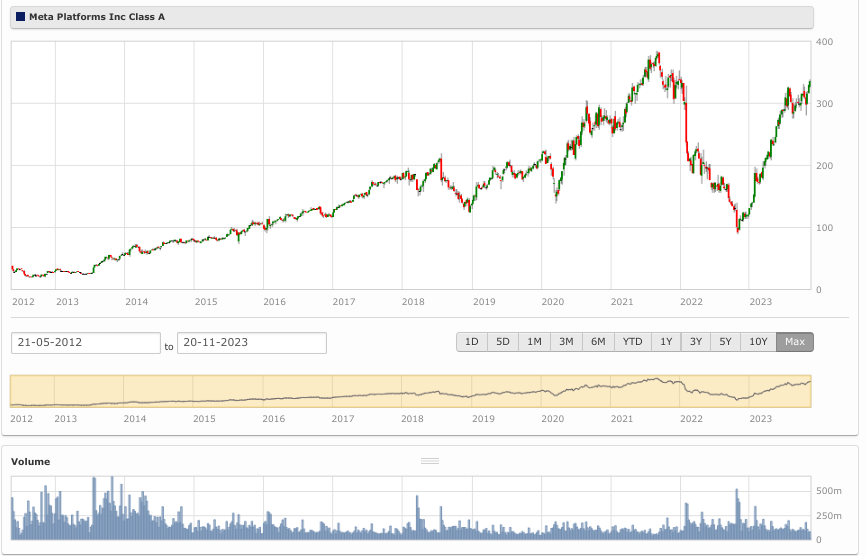

V. Meta Stock Price History Performance

Meta Platforms Stock Key Milestones

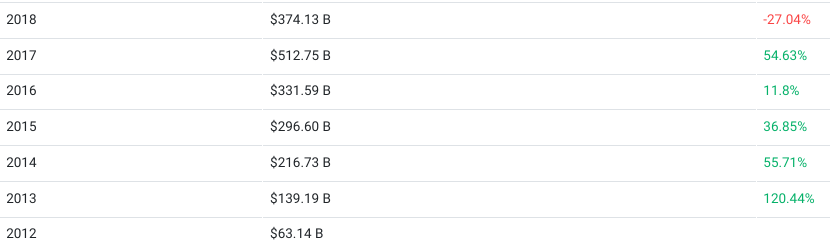

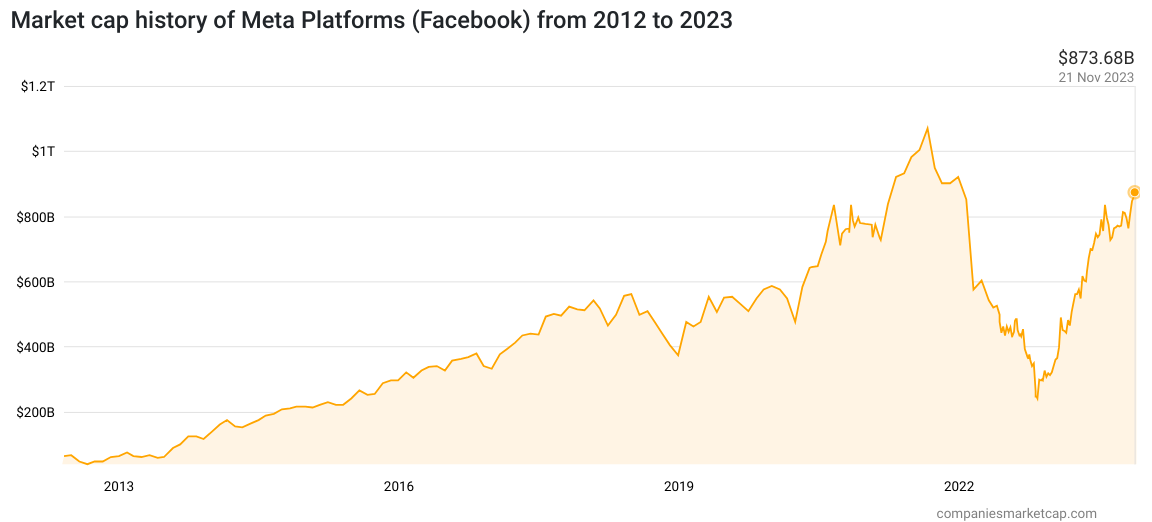

2012-2013: Meta, then known as Facebook, witnessed substantial growth, with its market cap skyrocketing from $63.14 billion in 2012 to $139.19 billion in 2013. This surge marked the company's early success, driven by expanding user bases and successful monetization strategies.

2014-2015: Continuing its upward trajectory, the company's market cap surged to $216.73 billion in 2014 and further to $296.60 billion in 2015. These years saw consistent growth attributed to enhanced advertising strategies and user engagement across its platforms.

2016-2018: Meta faced fluctuations during this period. While the market cap rose slowest (+11.8% year-over-year) to $331.59 billion in 2016, it faced the largest drop since listing (-27.04% year-over-year) to $374.13 billion in 2018. Factors contributing to these fluctuations included concerns over data privacy and the impact of algorithm changes affecting user interactions and advertiser confidence.

Source: companiesmarketcap.com

2019-2021: The company regained momentum, reaching a market cap of $585.37 billion in 2019 and hitting $921.93 billion in 2021. This resurgence was driven by improved monetization strategies, increased advertising revenue, and expanding user bases across its platforms.

2022-2023: Meta experienced a significant drop in market cap to $319.88 billion in 2022, followed by a remarkable surge to $873.67 billion in 2023. Factors impacting these fluctuations include regulatory challenges, concerns over user privacy, shifts in consumer behavior, and the company's pivot toward the metaverse concept.

Source: companiesmarketcap.com

META Stock Price Performance Analysis

Short-Term Performance (1Y, YTD, 6M, 1M, 1W): Meta stock demonstrated remarkable returns over the last year (1Y) and year-to-date (YTD), outperforming the S&P 500 index. However, shorter-term trends like the past six months and one month indicate moderate growth compared to the overall year or longer periods.

Long-Term Performance (3Y, 5Y, 10Y): Meta stock showcased impressive returns over extended periods, particularly the 10-year horizon, with substantial growth outpacing the S&P 500 index by a considerable margin.

Source: seekingalpha.com

VI. Conclusion

Meta stock price for 2023 is anticipated to reach around $367, backed by support levels near the 66-day EMA, though caution is advised due to potential corrections. Analysts predict varied prices: Traders Union suggests $406, Coin Price Forecast approximates $350, and Mean Reversion principles hint at $326.

For 2025, Meta share price forecasts vary from conservative to bullish. Technical analysis forecasts $590, while Traders Union and Coincodex present $461.52 and $512.64, respectively. Analysts from Stifel, RBC Capital, and others provide targets between $350 and $405, showcasing diverse perspectives.

Considering 2030, technical analysis points toward $900, whereas Coincodex forecasts $1,506.41. Other sources project a range from $866 to $1,500 by leveraging historical averages and EPS estimates.

Investment Recommendations and Outlook

Analysts' recommendations range from "Strong Buy" to "Buy" ratings, with price targets indicating potential upsides. The bullish outlook stems from user base growth, AI innovation, hardware advancements, diversified monetization, and metaverse development. However, regulatory challenges, rising expenses, and market pricing issues pose risks.

Trade Meta Stock CFDs with VSTAR

VSTAR offers advantages such as leveraged trading (up to 1:200), $0 commissions, access to global stock markets, and lightning-fast execution, providing opportunities for diversified trading strategies.

Key Factors for Future Predictions

Bullish factors include metaverse expansion, AI emphasis, and revenue diversification, whereas regulatory challenges, competition, and execution risks pose bearish threats. Continuous monitoring of these factors is essential for accurate price predictions.

In summary, Meta's stock forecasts exhibit a diverse range of predictions, underlining the importance of monitoring evolving market dynamics and strategic company developments for informed investment decisions. Trading Meta Stock CFDs with VSTAR presents a potential avenue to capitalize on Meta's stock movement in a dynamic market environment.

FAQs

1. Is Meta a Buy, Sell or Hold?

Most analysts currently rate Meta/Facebook stock as a buy or hold. The average 12-month price target implies upside.

2. Will Meta stock go up?

Analyst estimates expect Meta stock to move higher over the next 12 months. However, there are near-term headwinds like advertising spending pullbacks.

3. What is the P/E ratio of Meta?

Meta's current P/E ratio is about 30.7.

4. What will Meta be worth in 2025?

If Meta can effectively monetize shorts-video, messaging, and the metaverse by 2025, share prices could potentially be 20-50% higher.

5. How much will Meta stock be worth in 5 years?

Based on typical market growth and Meta's initiatives, Meta stock could potentially trade 50-100% higher in 5 years if execution goes as planned.

6. What will the price of Meta be in 2030?

Some analysts believe the stock could trade towards the $500+ level in an optimistic metaverse-adoption scenario.