In a monumental transaction worth $69 billion, Microsoft acquired Activision Blizzard, making it the largest acquisition in the video game industry's history. This acquisition immediately expands Microsoft’s retail video gaming portfolio, incorporating titles such as Call of Duty and World of Warcraft.

Microsoft Acquired Activision For $69bn

Expanding Game Pass and possibly incorporating Activision Blizzard games into its library has sparked immediate speculation. The head of Xbox, Phil Spencer, has verified that efforts are continuing to add Activision Blizzard titles to Game Pass. Nevertheless, he suggested that the availability of these games could be delayed for some time. Additionally, Activision Blizzard has stated that Diablo 4 and Call of Duty Modern Warfare 3 will not be integrated into Microsoft's subscription service will not occur until 2024.

By undertaking this enormous transaction, Xbox intends to reposition itself competitively within the gaming industry. Since introducing the Xbox One in 2013, Xbox has encountered difficulties, as Sony's PlayStation has dominated the console market. Although the Xbox Series X and S have performed superior to their predecessor, Microsoft acknowledges a deceleration in Game Pass subscription growth.

Microsoft Earnings Outlook

In the latest quarter, gaming revenue increased by $36 while Xbox content and services revenue increased by 5%, driven by growth in third-party content and Xbox Game Pass. However, the revenue was slightly hurt by weaker console sales, which might be recovered soon after this acquisition.

Microsoft hopes that this $69 billion investment will serve as a turning point. Although Call of Duty will remain accessible on PlayStation, Microsoft is determined to utilize its newly acquired assets strategically.

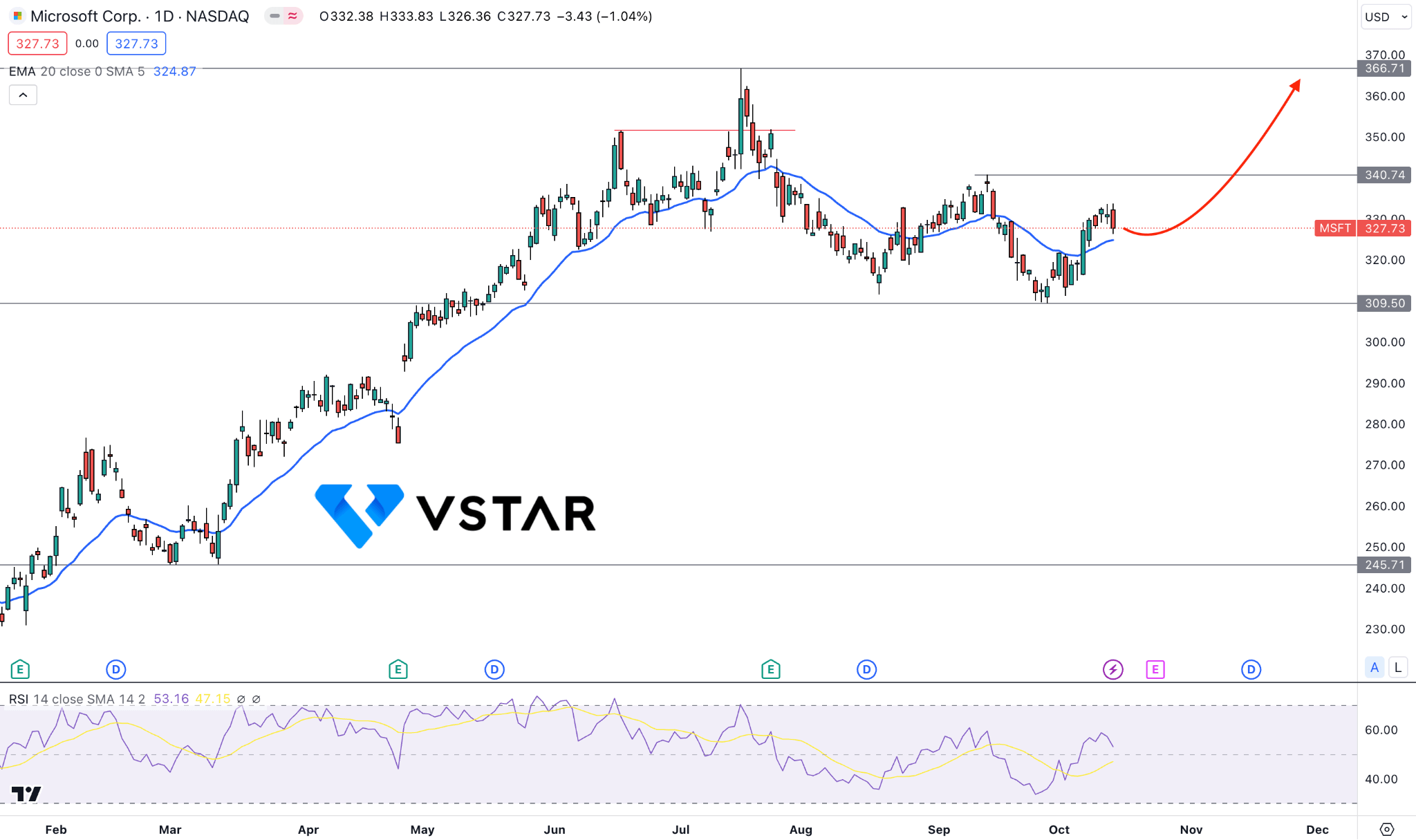

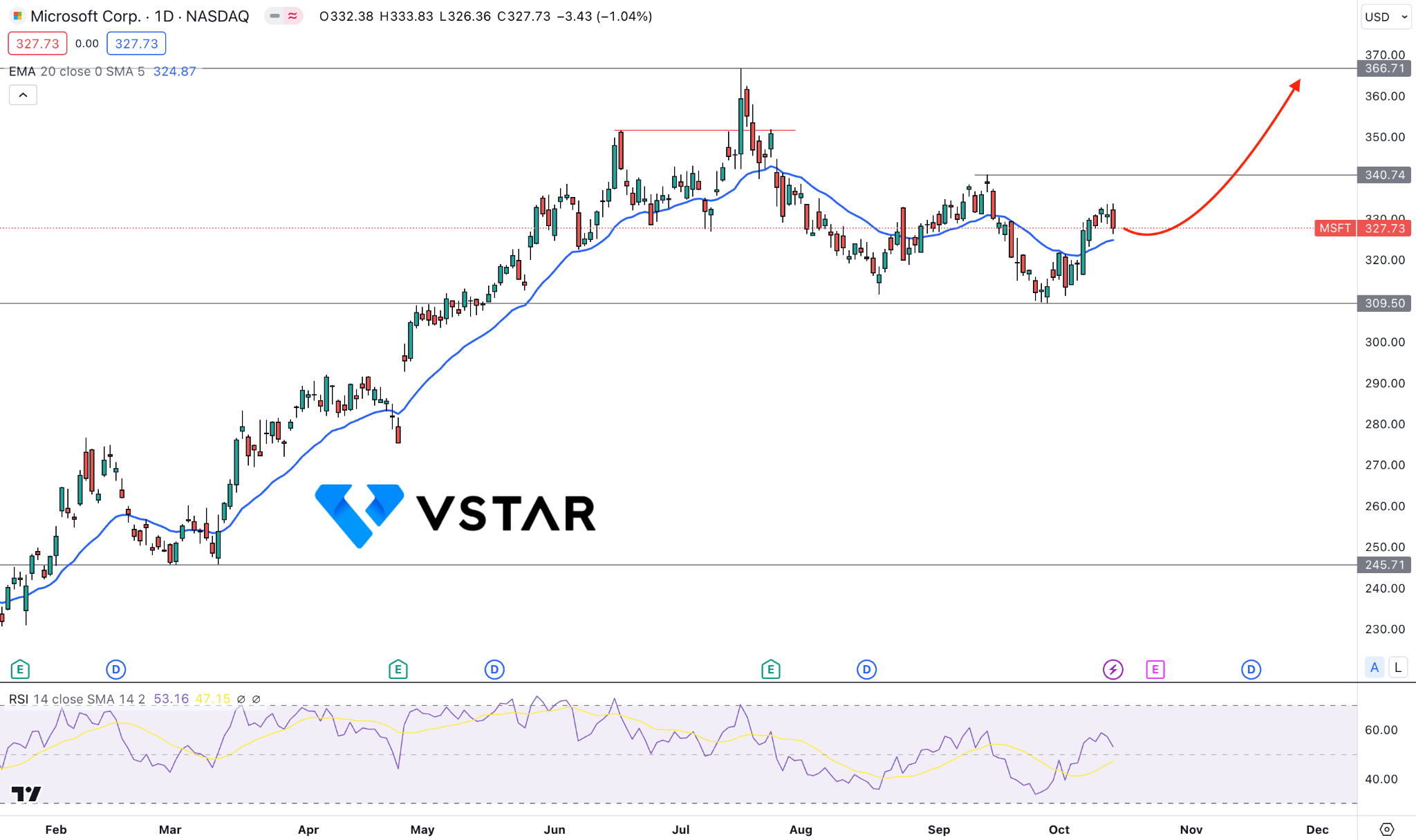

Microsoft Stock (MSFT) Technical Analysis

In the daily MSFT stock chart, the current price is within a consolidation after making a huge upward momentum. However, the bullish liquidity sweep at the 16 June high and a new lower low formation at the 309.50 level could be a potential signal of a bearish recovery.

On the other hand, the major trend is still bullish, while the recent acquisition of Activision would be a long signal. Although the revenue from the gaming segment is insignificant, the recent acquisition could signal a sign of market dominance.

Based on the current technical outlook, an immediate bullish rebound from the 20-day EMA with a daily close above the 340.74 level could be a long signal, targeting the 366.71 level. The alternative approach is to find the price below the 309.50 level, which may extend the downside pressure towards the 280.00 level.