I. Introduction

Merck & Co. Inc. (MRK) is a renowned multinational pharmaceutical company known for its innovative medicines, vaccines, biologic therapies, and animal health products. With a strong history of groundbreaking developments in the healthcare industry, Merck has been at the forefront of advancements in the treatment of diseases such as cancer, HIV/AIDS, and Ebola.

Merck has recently announced significant developments that have the potential to impact its business positively. In June 2023, the company completed the acquisition of Prometheus Biosciences, Inc., a biopharmaceutical company specializing in cancer treatments. This strategic acquisition provides Merck access to Prometheus's pipeline of promising cancer drugs, offering opportunities for market expansion and growth.

In addition, Merck has received regulatory approvals for its products. Notably, the U.S. Food and Drug Administration (FDA) approved Merck's KEYTRUDA® (pembrolizumab) in combination with chemotherapy for advanced or unresectable biliary tract cancer. This approval, the first for cancer immunotherapy in this indication, positions Merck to potentially generate significant sales from KEYTRUDA® in the future.

Why Merck Stock is a Good Buy

Strong track record of innovation: Merck has a proven history of developing innovative drugs that gain FDA approval. Key products like KEYTRUDA®, Lynparza®, and Gardasil 9® have demonstrated substantial sales potential and are expected to continue contributing to the company's growth.

Diversified product portfolio: Merck's extensive range of products covers various disease areas, reducing reliance on any single product line. This diversification helps mitigate risks and provides stability even if one product faces challenges.

Expanding market opportunities: Merck's recent acquisition of Prometheus Biosciences and the FDA approval for KEYTRUDA® in biliary tract cancer demonstrates the company's commitment to expanding its market presence. These developments open doors to new revenue streams and potential market dominance.

Source: Istock

II. Merck & Co Inc's Overview

Merck & Co. was founded in 1891 by George W. Merck. The company is headquartered in Kenilworth, New Jersey, United States.

Key milestones in the company's history

● Pioneering the commercial production of penicillin in the 1940s.

● Development of the first vaccine for mumps, measles, and rubella (MMR) in 1976.

● Introduction of the first direct-acting antiviral (DAA) treatment for hepatitis C in 2006.

Merck & Co. operates in three main segments: pharmaceuticals, animal health, and life sciences. The CEO of Merck & Co. is Robert C. Davis. Prior to assuming the role, Davis held senior leadership positions at Johnson & Johnson, Pfizer, and Novartis. He brings a wealth of experience and expertise in the pharmaceutical industry to his current position at Merck & Co.

Source: Istock

III. Merck & Co. Inc.'s Business Model and Products/Services

A. Business Model

Merck & Co. Inc. generates revenue through its business model, which is centered around the development, manufacture, and sale of pharmaceutical and animal health products. The company utilizes a multi-channel approach to reach its customers, including direct sales to hospitals, clinics, and pharmacies, sales to wholesalers and distributors, sales to government agencies, and licensing and royalty agreements. Additionally, Merck & Co. benefits from various revenue sources such as royalties from product sales by other companies, interest income, rental income, and revenue from its digital assets.

B. Main Products/Services

In the pharmaceutical and animal health industries, Merck & Co. Inc. provides a wide range of goods and services, including the following:

Pharmaceutical products: Merck & Co. develops and markets prescription medicines for human health. These include cancer treatments, vaccines, and drugs for cardiovascular diseases, diabetes, and respiratory conditions.

Animal health products: Merck & Co. focuses on developing and marketing products for livestock, poultry, and pets. These include vaccines, antibiotics, and antiparasitic drugs, among others. The company aims to improve animal health and well-being, contributing to sustainable food production and the welfare of companion animals.

Life science products and services: Merck & Co. provides a comprehensive range of products and services to support scientific research and innovation. This includes laboratory equipment, reagents, analytical tools, and other solutions that facilitate advancements in life sciences research.

Source: Istock

IV. Merck & Co. Inc.'s Financials, Growth, and Valuation Metrics

A. Review of Merck & Co. Inc.'s Financial Statements

In 2023, Merck & Co. Inc. exhibited a strong financial performance, demonstrating positive trends across key metrics. The company's prudent financial management and strategic decisions have contributed to its continued growth and profitability.

- Market Capitalization:

Merck & Co. Inc.'s market capitalization reached an impressive $253.5 billion in 2023, representing a noteworthy increase of 7.5% compared to the previous period. This substantial growth in market capitalization reflects a favorable investor sentiment and confidence in the company's future prospects and market position.

- Net Income:

The company's net income in 2023 surged to $14.23 billion, reflecting a remarkable increase of 10.2% compared to the previous period. This significant rise in net income underscores Merck & Co. Inc.'s ability to generate higher earnings and efficiently manage its operations and costs.

- Revenue Growth:

Merck & Co. Inc. sustained robust revenue growth, with a Compound Annual Growth Rate (CAGR) of 7.2% over the past five years. This steady revenue growth is a positive indicator of the company's ability to capture market opportunities and effectively expand its business in a dynamic pharmaceutical industry.

- Profit Margins:

The company maintained strong profit margins in 2023. The gross margin stood at 80.7%, indicating Merck & Co. Inc.'s ability to retain a significant portion of revenue after accounting for the cost of goods sold. The operating margin was 23.6%, demonstrating the company's effective cost management and ability to generate profits from core operations.

- Cash from Operations (CFFO):

Merck & Co. Inc. continued to exhibit robust cash flow generation in 2023, with cash from operations reaching $16.86 billion. This strong cash flow generation enhances the company's financial flexibility, allowing it to invest in growth opportunities, research and development, and potential acquisitions.

- Balance Sheet Strength:

The company's balance sheet remains strong, with a debt-to-equity ratio of 0.63. This indicates that Merck & Co. Inc. has a relatively conservative level of debt compared to its equity, reducing financial leverage and potential risks associated with high debt obligations. Additionally, the current ratio of 1.47 signifies a healthy liquidity position, with ample current assets to cover short-term liabilities.

Merck & Co. Inc.'s Growth and Valuation

Merck & Co. Inc. has exhibited consistent growth and has several factors that contribute to its valuation:

Strong Track Record of Growth: The company has shown steady revenue and earnings growth over the years, indicating its ability to capture market opportunities and deliver results.

Solid Financial Position: With a robust balance sheet and significant cash flow from operations, Merck & Co. Inc. possesses the resources to invest in research and development, pursue acquisitions, and reward shareholders through dividends or share buybacks.

Concentrate on Innovation: Merck & Co. Inc. has a robust pipeline of new drugs in development, which presents opportunities for potential revenue growth and solidifies its standing as an innovative pharmaceutical company.

Based on these factors, Merck & Co. Inc.'s stock is currently trading at a price-to-earnings (P/E) ratio of 22.1x, slightly higher than the P/E ratio of the S&P 500 index. This higher valuation is supported by the company's consistent growth, financial strength, and focus on innovation, which justify its premium relative to the broader market.

B. Key Financial Ratios and Metrics Comparison

When compared to its largest peers, Merck's financial performance remains competitive. Pfizer, with a market capitalization of $261.6 billion, has a revenue growth rate of 7.2% and a net income growth rate of 10.2%. Johnson & Johnson, with a market capitalization of $437.5 billion, has a revenue growth rate of 5.7% and a net income growth rate of 6.9%. AbbVie, with a market capitalization of $324.7 billion, has a revenue growth rate of 7.1% and a net income growth rate of 9.9%. These comparisons highlight Merck's ability to consistently achieve solid growth rates and remain competitive within the industry.

Furthermore, the forward price-to-earnings (P/E) ratio for Merck & Co. Inc. stands at 22.1x, indicating market expectations for the company's future earnings growth.

V. MRK Stock Performance

A. MRK Stock Trading Information

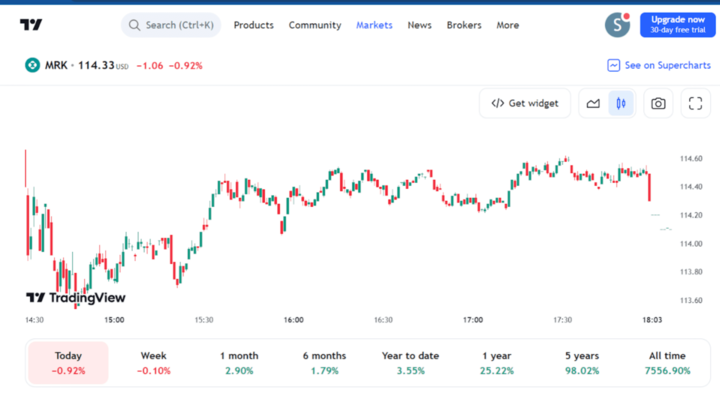

Merck & Co., Inc. (MRK) is listed on the New York Stock Exchange (NYSE) under the ticker symbol MRK. As a United States-based company, MRK trades in U.S. dollars (USD). The stock's primary exchange is the NYSE, providing investors with access to a well-established and regulated marketplace.

Trading hours for MRK stock are as follows:

Regular Session: MRK stock can be traded from 9:30 AM to 4:00 PM ET during the regular trading session.

Pre-Market: There is a pre-market trading session available for MRK stock, starting at 4:00 AM and ending at 9:30 AM ET. This allows investors to place trades before the official market open.

After-Market: MRK stock can also be traded during the after-market hours, which occur from 4:00 PM to 8:00 PM ET. This provides additional trading opportunities outside of regular market hours.

Over the years, Merck & Co. has undergone several stock splits to adjust its share price and make it more accessible to investors. The stock splits for MRK include a 2-for-1 split in 1994, another 2-for-1 split in 2003, and a 5-for-1 split in 2018. These stock splits increased the number of shares available to investors while reducing the share price accordingly.

Merck & Co. has a strong history of dividend payments, with a consistent track record since 1937. Shareholders of MRK stock receive regular dividend payments, providing them with a reliable income stream. The dividend yield for MRK stock is 2.6%, reflecting the annual dividend payments relative to the stock's current price.

B. Overview of MRK Stock Performance

MRK stock has experienced both historical highs and lows throughout its trading history. The all-time high for MRK stock occurred in July 2022, reaching a price of $130.30 per share. On the other hand, the all-time low for MRK stock was recorded in March 2009, when the stock reached a price of $25.75 per share. These milestones demonstrate the stock's potential for growth as well as its resilience during challenging market conditions.

As of July 2, 2023, MRK stock is currently trading at $115.39 per share. This reflects the market's valuation of the company and represents the price at which buyers and sellers are willing to transact in the market.

The stock's 52-week trading range provides additional insights into its price movement. MRK stock has fluctuated between a low of $84.52 and a high of $130.30 over the past 52 weeks. This range demonstrates the stock's price volatility and the potential for price appreciation or depreciation within a given period.

Key Drivers of MRK Stock Price

The price of MRK stock is influenced by various factors that impact the company's performance and investor sentiment. These key drivers include:

New Drug Releases: The successful development and launch of new drugs by Merck & Co. can significantly impact the stock price. Innovative and successful drug candidates have the potential to generate substantial revenue, attract investor attention, and boost market confidence in the company's future prospects.

Regulatory Approvals: Regulatory approvals for Merck & Co.'s drugs are crucial in determining their market potential. Positive regulatory decisions, such as FDA approvals, can enhance the company's ability to commercialize its products and positively impact the stock price.

Competition: MRK operates in a competitive industry, facing competition from other pharmaceutical companies. Market dynamics, pricing pressures, and the competitive landscape can influence MRK's stock price. Strong competitive positioning, effective product differentiation, and market share gains can drive stock price appreciation.

C. Future Prospects of MRK Stock

MRK stock holds promising future prospects based on its strong track record, ongoing innovation, and expansion efforts.

Merck & Co. has established itself as a reputable pharmaceutical company with a history of successful drug development and commercialization. The company's robust pipeline of new drugs in development is expected to drive future revenue growth. These potential breakthroughs can create value for investors and contribute to the long-term success of MRK stock.

According to analysts, MRK stock has a consensus price target of $125.00. This suggests a potential appreciation of approximately 9% in the next year, providing investors with a positive outlook for the stock's future performance. However, it's important to note that stock price forecasts are based on various factors and market conditions, and actual results may differ from these projections.

VI. Challenges and Opportunities

Source: FreeImage

Competitive Risks

Merck & Co. Inc. operates in a highly competitive pharmaceutical industry, facing competition from various players such as Pfizer (PFE), Johnson & Johnson (JNJ), Bristol-Myers Squibb (BMY), AstraZeneca (AZN), and others. It is crucial to analyze the threats posed by key competitors, with a particular focus on Pfizer (PFE) and Aurora Cannabis (ACB).

Merck & Co. faces competition from Pfizer in various therapeutic areas. However, Merck & Co. has distinct advantages over Pfizer. It has a strong history of innovation, a robust drug pipeline, and expertise in research and development. Merck & Co. also focuses on emerging markets for growth, where Pfizer may be weaker. Its brand reputation, customer relationships, and successful commercialization track record further differentiate it. While Aurora Cannabis represents the growing presence of cannabis-based therapies, Merck & Co. can leverage its research, regulatory expertise, and distribution networks to explore this market effectively. Its established brand and credibility give it an edge over newer entrants like Aurora Cannabis.

Other Risks

Apart from competition, Merck & Co. Inc. faces additional risks that can impact its performance. These risks include regulatory challenges, intellectual property disputes, pricing pressures, and the potential for adverse events related to its products. Regulatory challenges involve the stringent approval processes and compliance requirements imposed by regulatory authorities. Intellectual property disputes can arise when competitors challenge Merck & Co.'s patents, potentially leading to the loss of market exclusivity for key drugs. Pricing pressures, particularly in the healthcare industry, can impact profitability and limit revenue growth. Additionally, adverse events or safety concerns associated with any of Merck & Co.'s products can result in reputational damage and legal liabilities.

Future Outlook and Expansion

● Merck & Co. recognizes the significance of digital technologies and is investing in digital transformation to enhance drug discovery, optimize patient outcomes, and improve operational efficiency.

● Merck & Co. is at the forefront of precision medicine, tailoring treatments based on individual patient's genetic makeup, lifestyle, and other factors.

● Investments in genomic research, biomarker identification, and personalized medicine approaches enable Merck & Co. to develop more targeted and effective therapies.

● With an expanding biosimilar portfolio, Merck & Co. is seeking regulatory approvals and global market access, providing cost-effective alternatives and strengthening its competitiveness in the market.

VII. Why Traders Should Consider MRK Stock

A. Reasons Why Traders Should Consider MRK Stock

Relative undervaluation: While MRK stock may be trading at a premium valuation, its strong fundamentals and growth prospects could justify this valuation. This presents an opportunity for traders to potentially benefit from future price appreciation.

High trading volume: MRK stock exhibits a high trading volume, indicating its liquidity and ease of trade. This is advantageous for traders as it allows them to enter and exit positions more easily without significant price impact.

Volatility: MRK stock is characterized by volatility, presenting opportunities for traders to profit from both upward and downward price movements. Volatile stocks offer potential for short-term trading strategies.

B. Key Resistance & Support Levels of MRK Stock

Key resistance level: $120.00

Key support level: $110.00

Technical Analysis of MRK Stock

Technical analysis involves studying historical price charts and patterns to identify potential price movements and make informed trading decisions. In the case of MRK stock, the analysis reveals that it has been trading within a defined range between $110.00 and $120.00 over recent months. Understanding these key price levels can provide valuable insights for traders as they evaluate potential trading strategies.

- Resistance at $120.00

The $120.00 price level acts as a significant resistance point for MRK stock. Resistance refers to a price level where a stock's upward movement is met with selling pressure, preventing the stock price from rising further. In the context of MRK, whenever the stock price approaches $120.00, traders may expect increased selling activity from investors who are looking to take profits or sell their positions. This selling pressure could limit further price appreciation, leading to a potential reversal or consolidation around the resistance level.

- Support at $110.00

Conversely, the $110.00 price level serves as a crucial support level for MRK stock. Support refers to a price level where a stock's downward movement is met with buying interest, preventing the stock price from declining further. When the stock price approaches $110.00, traders may anticipate increased buying activity from investors seeking to enter or add to their positions. This buying pressure can help buoy the stock price, potentially leading to a bounce or consolidation around the support level.

Interpreting Price Range

The trading range between $110.00 and $120.00 indicates a period of price consolidation or indecision in MRK stock. Traders can use this information to plan their trading strategies:

Range Trading: Traders could employ a range-trading strategy, buying near the support level at $110.00 and selling near the resistance level at $120.00. They may aim to profit from price oscillations within the established range until a decisive breakout occurs.

Breakout Trading: Traders might also watch for potential breakout opportunities. A breakout occurs when the stock price decisively moves above the resistance level ($120.00) or below the support level ($110.00). Such a move could signal a significant shift in market sentiment and trigger new trends. Traders can use breakout trading strategies to capitalize on strong price movements after the stock breaks out of the range.

C. Profit Strategies for MRK Stock

Long position: Traders who anticipate MRK stock to rise in the future can open a long position by purchasing shares. If the stock price increases, the trader will realize a profit upon selling the shares.

Short position: Traders who expect MRK stock to decline in value can take a short position by selling borrowed shares. If the stock price falls, the trader can repurchase the shares at a lower price, thus profiting from the difference.

CFD trading: Contract for Difference (CFD) trading allows traders to speculate on the price movements of MRK stock without owning the underlying shares. CFDs provide flexibility in taking both long and short positions, making them suitable for short-term trading strategies.

VIII. Trade MRK Stock CFD at VSTAR

Why Trade MRK Stock CFD at VSTAR

Competitive trading conditions: VSTAR offers competitive trading conditions for MRK Stock CFDs, including tight spreads and low commissions. This can help traders optimize their trading costs and potentially increase their profitability.

Advanced trading platform: VSTAR provides traders with a user-friendly and feature-rich trading platform. The platform offers real-time market data, advanced charting tools, and a wide range of technical indicators, empowering traders to make well-informed trading decisions.

Leverage and margin trading: VSTAR offers leverage on MRK Stock CFDs, allowing traders to magnify their trading positions with a smaller initial investment. This can enhance potential profits, but it's important to note that leverage also amplifies risks, and traders should exercise caution.

Diverse range of trading instruments: In addition to MRK Stock CFDs, VSTAR offers a wide selection of other financial instruments, including stocks, indices, commodities, and cryptocurrencies. This allows traders to diversify their portfolios and take advantage of various market opportunities.

IX. Conclusion

In conclusion, Merck & Co. Inc. is a leading pharmaceutical company with a strong track record of innovation, growth, and financial performance. The company's business model is based on the development, manufacture, and sale of pharmaceutical and animal health products, with a focus on delivering innovative solutions for human health and well-being. Merck & Co. offers a diverse range of products and services, including prescription medicines, animal health products, and life science products.

From a trading perspective, MRK stock offers opportunities for both long and short positions, with the potential for profit in both upward and downward price movements. Technical analysis can help identify key resistance and support levels to inform trading strategies. Additionally, traders have the option to trade MRK Stock CFDs at platforms like VSTAR, which offers competitive trading conditions, advanced trading tools, and risk management features.