Moderna Inc (NASDAQ: MRNA) may be the best biotech stock to buy on the dip right now. If you recall, Moderna was one of the first companies to come out with vaccines to help control the pandemic.

The company has made a huge killing out of the vaccine business, growing its revenues from just $60 million to over $18 billion in just two years.

But what happened to Moderna stock? At $125, MRNA stock is down 30% since January and has plunged 75% from its all-time high of $484 in 2021.

Is the market wrong about this biotech stock? Is MRNA stock a good long-term investment? You be the judge. Read on to find out why some of the world's top investors are sticking with Moderna (NASDAQ: MRNA) stock despite its steep decline. And by top investors, I mean Cathie Wood's ARK Funds and a host of other elite institutional investors.

You'll also get short interest statistics on Moderna stock to help you gauge what could happen if the bears currently running the show lose their nerve.

Moderna (NASDAQ: MRNA) Stock News

Source: Pixabay

Moderna Expands Into China

The company recently inked a deal to set up its operations in China as part of its international expansion bid. It is looking to invest in drug research and manufacturing in China.

Moderna could invest as much as $1 billion in its China unit, and any drugs developed in China would be sold exclusively in the country and not exported. Pfizer has been operating in China for more than three decades. Johnson and Johnson is another American pharmaceutical company with a large presence in China.

Moderna Begins to Seek Approval for Its RSV Vaccine

Moderna's RSV vaccine showed remarkable results in a late-stage trial. The company has now begun seeking regulatory approval for the drug. It has filed for approval with U.S., European and Australian regulators. If all goes well, Moderna's RSV vaccine could hit the U.S. market in 2024.

Moderna's Skin Cancer Drug Received Breakthrough Designation

The FDA granted breakthrough designation to Moderna's experimental skin cancer treatment. The experimental drug showed promising results in skin cancer patients when used in combination with Merck's drug Keytruda.

The FDA gives the breakthrough designation to drugs with strong potential and it helps speed the development of such drugs. It means it may take Moderna less time and less money than usual to bring its skin cancer therapy to market.

Moderna (NASDAQ: MRNA) Stock Overview

Source: Pixabay

Moderna is an American biotech company. It is the manufacturer of the Spikevax Covid vaccine, which was one of the first to be introduced at the height of the pandemic. Moderna develops drugs and vaccines for a variety of other diseases and conditions, including cancer.

Moderna was founded in 2010 and is headquartered in Cambridge, Massachusetts. The company was founded by Robert Langer, Noubar Afeyan, and other biotech experts. Moderna's CEO, Stephane Bancel, is a French billionaire worth approximately $4 billion.

Moderna stock went public in 2018. The company has a market capitalization of nearly $50 billion as of July 2023.

Moderna's Top 5 Shareholders

|

Moderna shareholder |

Stake |

|

Baillie Gifford |

12.2% |

|

Vanguard Group |

6.9% |

|

BlackRock |

4.4% |

|

SSgA Funds Management |

3.7% |

|

Coatue Management |

1.7% |

Moderna is a top biotech holding in Cathie Wood's ARK Funds. Several hedge funds and other institutional investors have also recently purchased additional shares in Moderna, including Irish Life Investment Managers, Sg Americas Securities and State Street Global Advisors.

Key Milestones in Moderna's History

|

Year |

Milestone |

|

2013 |

Moderna partnered with AstraZeneca to develop drugs for heart disease. |

|

2015 |

Moderna partnered with Merck to develop cancer drugs. |

|

2016 |

Moderna received a $20 million grant funding commitment from the Bill & Melinda Gates Foundation. |

|

2018 |

Moderna stock went public. |

|

2021 |

Moderna was named one of the 10 most innovative biotech companies by Fast Company. |

Moderna's Business Model and Products

The Company is engaged in drug development. It uses messenger RNA (mRNA) technology in its drug development programs. With its mRNA platform, Moderna can direct the body to produce what is needed to prevent or treat a disease.

In addition to its internal initiatives, Moderna is involved in several drug development partnerships.

How Moderna Makes Money

The Company's revenues are derived from product sales, grants and payments from collaborative projects. Before bringing a product to market, Moderna relied on grants from government agencies and private funders.

Moderna's Main Product

The company's only marketable product at the moment is its Covid vaccine called Spikevax. But it is working on other products, including drugs for infectious diseases, cardiovascular diseases, autoimmune diseases, and rare diseases.

Moderna is aiming to launch another product, an RSV vaccine, as early as 2024. It hopes to have 5 additional products on the market within the next 5 years.

Moderna's Financial Performance and Balance Sheet Condition

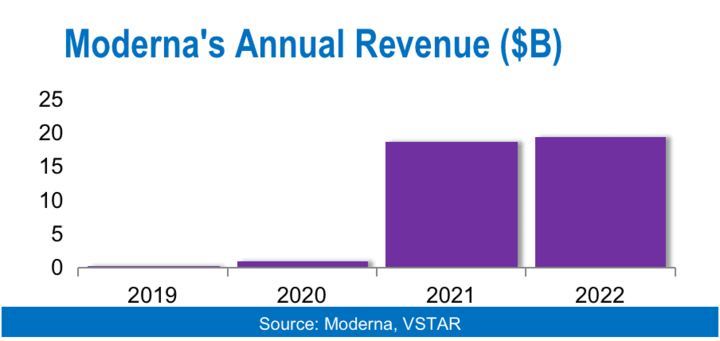

The launch of Covid vaccine Spikevax dramatically changed Moderna's fortunes. The company now reports billions of dollars in revenue and has substantial cash on hand. Let's examine Moderna's financial performance:

Moderna's Revenue

The company reported revenue of $19.3 billion in 2022, helped by strong sales of its Spikevax Covid vaccine. In 2021, revenue was $18.5 billion, with more than 95% of that coming from Spikevax sales. In 2020, Moderna generated $800 million in revenue. In 2019, before Spikevax hit the market, the company's revenue was just $60 million.

The company expects revenue of at least $5 billion in 2023. As the pandemic wanes, demand for cervical vaccines is declining, so Moderna expects Spikevax sales in 2023 to be modest compared to the booming two years before. However, the company sees 2023 as a transition year and expects revenue growth in the coming years as it expands its product line.

The company is seeking approval for at least two new drugs this year, which could help offset the decline in Covid vaccine sales.

Moderna's Net Income

The company posted a profit of $8.4 billion in 2022. This followed a record profit of $12.2 billion in 2021. Before that, the company was losing money. It made a loss of $747 million in 2020, which followed a loss of $514 million in 2019 and a loss of $385 million in 2018.

Moderna's Profit Margins

The company's operating profit margin was 48.9% in 2022, and its net profit margin was 43.3%. These metrics declined year-over-year as Moderna faced high costs almost everywhere due to inflation.

Moderna's Cash Position and Balance Sheet Strength

The company had more than $8.9 billion in cash as of March. Its balance sheet shows $24 billion in assets and less than $930 million in debt.

Moderna plans to spend $4.5 billion on research and development in 2023, up from $3.3 billion in 2022.

Moderna (NASDAQ: MRNA) Stock Analysis

Moderna (MRNA) Stock Valuation

MRNA stock currently trades at a forward P/E ratio of 32.47, a forward P/S ratio of 7.17 and a forward P/B ratio of 2.53. See how Moderna stock's valuation compares to its peers:

|

Stock |

Forward P/E |

Forward P/S |

P/B ratio |

|

Moderna (MRNA) |

32.47 |

7.17 |

2.53 |

|

Seagen (SGEN) |

909 |

17.83 |

13.46 |

|

Illumina (ILMN) |

101 |

6.56 |

4.36 |

|

Bio-Techne (TECH) |

36.42 |

10.24 |

6.89 |

|

Biogen (BIIB) |

16.77 |

4.15 |

2.90 |

As you can see from the table above, Moderna has a better forward PE valuation than all other biotech stocks shown here except Biogen. Similarly, Moderna offers a better PB ratio than its biotech stock peers shown here. Moderna also has a better forward P/E valuation than Seagen and Bio-Techne.

Moderna (MRNA) Stock Trading Information

Moderna stock trades on the Nasdaq Stock Market under the ticker symbol "MRNA".

Pre-market trading in Moderna stock begins as early as 4 a.m. ET and the after-hours session continues until 8 p.m. The regular trading session for MRNA stock begins at 9:30 a.m. and ends at 4 p.m.

On an average day, more than 3 million shares of Moderna stock trade hands.

Moderna (MRNA) Stock Split History

The biotech company hasn't split its stock since going public. Many companies choose to split their stock to make it more accessible to retail investors. Shares can skyrocket after the split if the lower share price attracts more buyers.

Moderna (MRNA) Stock's Dividend Yield

The company doesn't pay a dividend yet. While Moderna has no plans to pay a dividend in the foreseeable future, the company does return money to investors through share repurchases.

Moderna (MRNA) Stock Performance

The biotech stock debuted at an IPO price of $23. Although it was a slow start for Moderna on the public market, as you can see in the first few years, the stock began to soar in 2020. This was the time when investors were looking for the best pandemic stocks to buy, and many were attracted to Moderna because of its potential Covid drug.

Indeed, MRNA stock soared to an all-time high of $484 in 2021 as Moderna continued to win big orders for its Covid vaccine.

Over the past year, Moderna stock has traded in a range of $115 to $217. At the current price of about $125, the stock is up about 10% from its 52-week low, but down 40% from its 52-week high.

Moderna (MRNA) Stock Forecast

If you're still wondering if MRNA stock is a good buy, you might want to take a look at the price forecasts for Moderna stock. More than a dozen analysts have weighed in on Moderna with price targets ranging from $93 to $296.

The average Moderna stock price target of $182 implies an upside of 45%. The highest Moderna stock price target of $296 implies an upside of more than 130%. The Moderna stock price target of $93 implies a downside potential of 25%.

Moderna stock's upside could be even greater if it shoots back to its historical peak above $480. Analysts have a consensus buy rating on MRNA stock.

Moderna (MRNA) Stock Short Interest

A significant group of investors has taken bets against Moderna stock. Approximately 17 million shares of Moderna stock have been sold short, representing 4.6% of the shares outstanding. Notably, the number of shares shorted is more than five times Moderna's average daily volume of 3 million shares.

If Moderna's shares reverse course and begin to rise, as most analysts predict, these short sellers would be forced to cover their positions. Given the large number of shares that are shorted, a short squeeze could occur and send MRNA stock even higher.

Moderna (MRNA) Stock Technical Analysis

The chart above shows the price action of Moderna stock over the past year, along with the 50-day SMA and support levels.

As you can see from the chart, MRNA stock has been in a downtrend since January, punctuated by some consolidation around March.

It is easy to see that the 50-day SMA, now at $125.61, has long acted as a resistance level. You can also see that the stock has broken through several support levels in recent months.

You'll notice that the stock has come down to where it was in September and October 2022. If you look back at that point, that level proved to be a strong floor for MRNA stock.

Note that the stock broke out strongly to the upside after testing that support level a couple of times. Seeing where the stock is right now on that solid floor, a similar move could play out soon or later.

Moderna's Opportunities and Challenges

Moderna's Opportunities

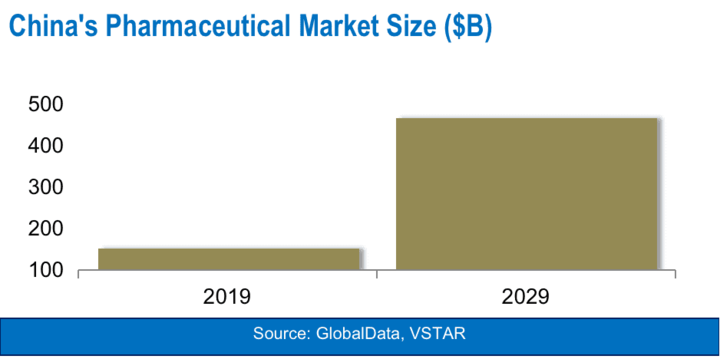

1. China's pharmaceutical market

Moderna has entered China as part of its international expansion. China's pharmaceutical market is expected to exceed $465 billion by 2029, up from about $150 billion in 2019. This represents a compound annual growth rate of 12%, according to GlobalData.

2. RSV and Flu Vaccines

Moderna is close to bringing its RSV and influenza vaccine to market. RSV is a deadly virus that often affects the lungs and airways. It kills thousands of people each year. The global RSV vaccine market is expected to grow from about $5 billion today to more than $10 billion by 2030.

3. Covid Vaccine Sales Private Customers

The company has primarily sold its Spikevax Covid vaccine to governments. But there is also a huge opportunity in the private market worldwide. Moderna has several updated Covid vaccines that could boost sales in this business.

4. Combination Therapies

Moderna has partnered with several pharmaceutical companies to explore combination therapies that include its drug candidates. For example, one of Moderna's drug candidates has proven to be highly effective in trials when paired with Merck's Keytruda for the treatment of skin cancer.

These combination agreements could help Moderna bring more of its product candidates to market more quickly.

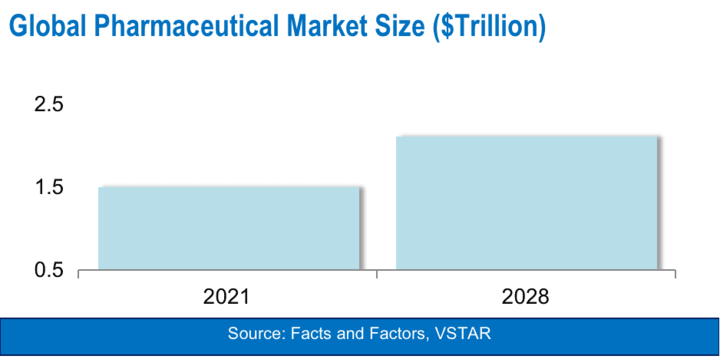

5. International Expansion

Moderna currently has a limited international presence. Outside of China and some European countries, there is still a large international market for Moderna to explore. And the revenue opportunity is enormous as the company expands its product pipeline.

According to Facts and Factors, the global general pharmaceutical market is expected to grow from $1.5 trillion in 2021 to $2.1 trillion by 2028.

Moderna's Risks and Challenges

Moderna (NASDAQ: MRNA) faces several challenges in its quest to become a larger, more profitable pharmaceutical company. Its success will depend on how it tackles its problems and seizes its opportunities. Here are some of the not-so-comfortable situations for Moderna:

- Shrinking Covid vaccine sales:Covid's Spikevax vaccine is currently Moderna's only marketable product. It accounts for more than 95% of the company's revenues. But demand for Covid vaccines is declining as the pandemic wanes, which could limit the flow of much-needed cash to Moderna.

- Patent disputes:Moderna is at the center of several legal battles over patents tied to Covid vaccines. The company has sued rivals Pfizer and BioNTech for allegedly infringing its patent in their Covid vaccine Comirnaty. However, Moderna has also been sued by several parties for patent infringement on Covid vaccines.

- High Competition:Moderna faces many competitors in the various drug markets it targets. These are some of the company's major competitors and the threats they pose:

|

Competitor |

Threat |

|

GlaxoSmithKline (GSK) |

Moderna will take on GSK in the battle for RSV vaccine market share. |

|

Pfizer (PFE) |

Pfizer will launch its RSV vaccine ahead of Moderna. |

|

BioNTech |

Moderna and BioNTech are competing to develop malaria vaccines using mRNA technology. |

|

Johnson (NYSE: JNJ) |

As Moderna enters the Chinese market, Johnson & Johnson faces a major competitive challenge. |

Moderna's Competitive Advantages

While there's a wave of competition against Moderna, the company isn't defenseless. It has several strengths that could help it grow and thrive in the pharmaceutical business. These are some of its advantages:

- Messenger RNA technology: Moderna's highly flexible platform can be used to develop a wide variety of drugs. It also supports faster drug development, which can put Moderna ahead of many of its competitors in key markets.

- Replicable drug platform: With each successful drug development effort, Moderna's drug platform improves, making it easier to take on the next challenge. As a result, Moderna can save on its research and manufacturing costs over the long term.

- Strong brand recognition:Being one of the first companies to develop Covid vaccines has helped make Moderna a household name in the biotech industry. The Moderna brand is not only widely recognized but also highly respected. The company can leverage its strong brand position to secure key deals that can fuel its growth.

Why Traders Should Consider MRNA Stock

Source: Pixabay

Moderna (NASDAQ: MRNA) is a top biotech stock with impressive prospects. The company has plenty of cash and a broad product pipeline. If you're looking for the best biotech stock to buy on the dip, Moderna is worth considering. MRNA stock now trades at a whopping 75% discount to its all-time high and a 40% discount to its 52-week high.

In addition to the upcoming product launches, the share buyback program and potential short squeeze could provide additional lift to MRNA stock.

These are the popular ways to make money with Moderna stock:

- Long-term investment strategy:This is the traditional method of investing. It involves buying and holding Moderna stock for a year or more. While this strategy makes you eligible for potential dividends, it requires a long wait for returns and a large initial investment.

- Short-Term Investment Strategy:This method allows you to make profits over short periods of time, such as an hour, a day, or a week. If you're looking for light exposure to the stock market, an opportunity to start investing with little money, and the ability to trade both bull and bear markets, consider trading Moderna stock CFDs.

Trade Moderna Stock CFD with VSTAR

VSTAR is an excellent Trustpilot rated CFD broker for both beginners and pros. The platform is fully licensed and regulated. It excels in offering a low cost CFD trading platform thanks to its tight spreads and no commission accounts.

With VSTAR, you can start trading Moderna stock CFD with as little as $50 and use leverage to increase your position. In addition to prompt customer support, VSTAR offers many features that can help maximize your profits.

It is easy to get started. Open your free VSTAR account today and start trading Moderna stock CFD. For new traders, the platform offers up to $100,000 of free virtual money in a demo account.

Final Thoughts

There are few top biotech stocks out there like Moderna (NASDAQ: MRNA). This is a company with one of the most recognized products in its market. It has solid financials, plenty of growth opportunities, and many competitive advantages.

The good news is that you can have the best of both worlds with Moderna stock. You can buy and hold Moderna shares for long-term gains and trade Moderna stock CFD for short-term profits.