Since the start of the year, there have been fluctuations in the share price of Micron Technology (NASDAQ:MU). Despite ongoing efforts to raise the value of stocks, they remain low and are still down by a significant margin. Optimism is on the rise for investors as they anticipate an improvement in supply and demand balance within the memory market, but in the volatile memory chip market, it is typical for companies to go through rocky periods, and this one is no exception. A thorough understanding of Micron Technology's recent performance coupled with an analysis of key market drivers shaping its stock price and offerings for potential investors will be revealed throughout this article.

I. Micron Technology, Inc.'s Overview

Founded by Ward Parkinson along with Joe Parkinson and Dennis Wilson in 1978, Micron Technology Inc. is a memory and chip-making company where Sanjay Mehrotra currently holds the position of CEO. Micron’s headquarters are located in Boise, which is found in Idaho and part of the USA. As of May 28, 2023, Micron Technology's stock price is $73.93. The stock has a 52-week range of $48.43 to $75.41. The company has a market capitalization of $80.91 billion.

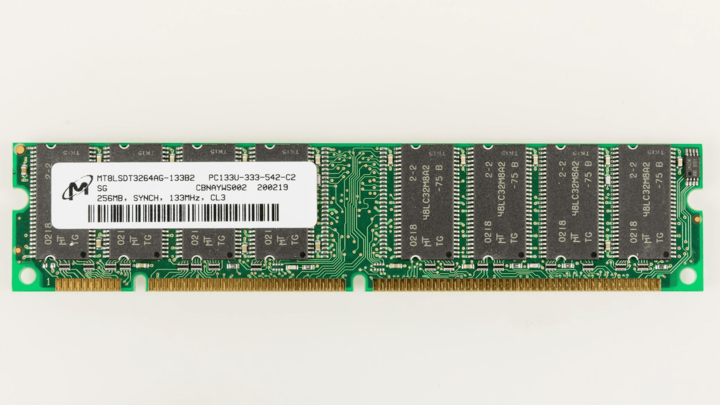

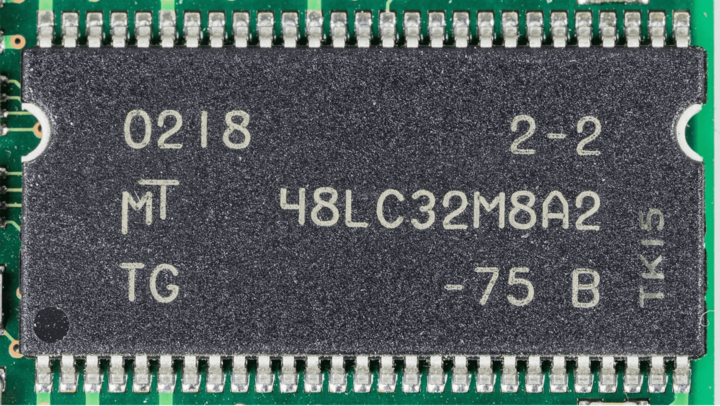

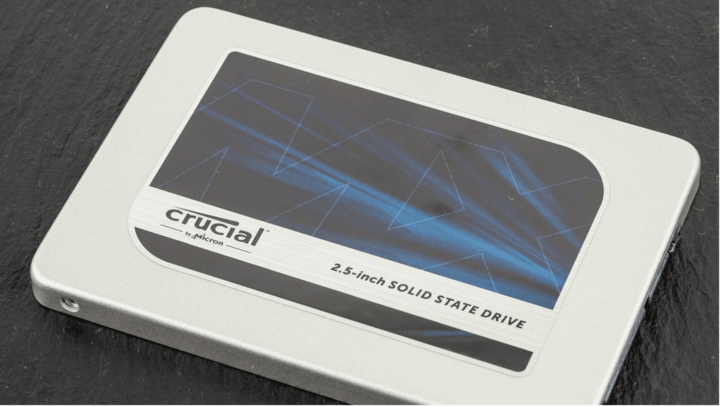

During its lifetime, Micron Technology managed to achieve multiple critical achievements. For instance, releasing the very initial model of synchronous dynamic random-access memory with capacity reaching up to two hundred fifty-six megabits back in 1968 was followed by launching an innovative solid-state-drive with a three-dimensional NAND memory structure, which became commercially available for users worldwide starting in 2016.

Currently, Micron’s operations involve working with four main business units - the Compute and Networking BU, the Mobile BU, the Storage BU, and the Embedded BU. The leadership team supporting CEO Sanjay Mehrotra at the company consists of seasoned executives hailing from the semiconductor industry.

II. Micron's Business Model and Products/Services

A. Business Model

Micron Technology makes dynamic random-access memory (DRAM) for a range of devices, such as PCs and mobile phones, among others. Hence, device manufacturers and data centers constitute the main salesmarkets for the company's products. By designing and marketing memory products to fit a wide range of customer needs across different markets, Micron is able to maintain its successful business model.

As the leading producer of memory chips in a cyclical market, Micron competes intensely, and the ups-and-downs of the company's profit margins and stock prices can be attributed to the staggering supply-demand dynamics.

Strong demand in recent times has benefited Micron even with looming concerns of oversupply risks, but volatile margins and stock prices are a direct consequence of this event.

B. Main Products and Services

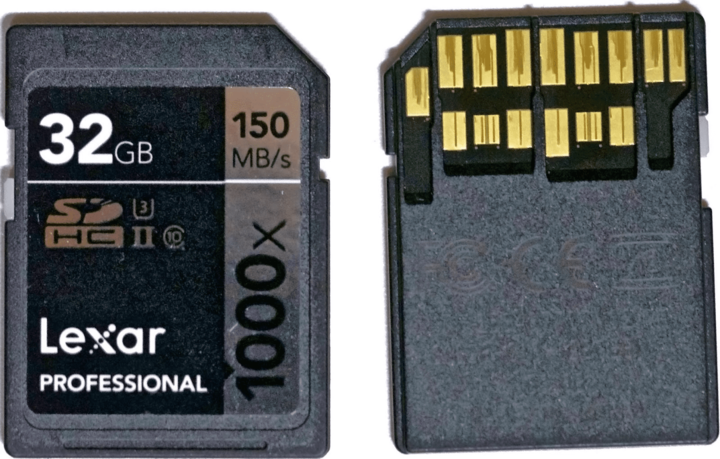

Micron Technology specializes in manufacturing DRAM and NAND memory chips as their core products, and dynamic random-access memories (DRAM) are predominantly used in computer systems and similar electronic gadgets to provide primary data-storage capabilities. NAND chips are an essential component in modern data storage devices such as solid-state drives (SSDs), memory cards, or USB flash drives.

Micron provides diverse options of DRAM with various densities & forms, such as DDR4/LPD Dr 4 that you can avail upon using PCs/mobiles while utilizing GRRD6/HBM2 exclusively intended to enhance graphic ability and high-performance computing apps.

Micron's NAND products, on the other hand, include TLC, QLC, and SLC NAND flash memory, all of which find applications in SSDs, cellphones, and other electronic gadgets. Micron also manufactures three-dimensional NAND flash memory, or 3D NAND, which has a stacked cell structure to increase data storage and processing speed.

III. Micron's Financials, Growth, and Valuation Metrics

A. Review of Micron's financial statements

Revenue Growth: Micron's revenue has shown consistent growth over the past five years, increasing from $23.41 billion in 2018 to $31.72 billion in 2022. This indicates that the company has been successful in generating higher sales and expanding its market presence.

Profit Margins: Micron's profit margins have also been strong, with a gross profit margin of 34.7% and a net profit margin of 19.1% in 2022. This means that Micron has been able to generate profits after deducting all expenses, including the cost of goods sold, operating expenses, and taxes.

Cash From Operations (CFFO): Micron has generated positive cash flow from operations in each of the past five years, with $11.54 billion in CFFO in 2022. Positive cash flow from operations is important because it allows a company to invest in growth opportunities, pay dividends to shareholders, and repay debt.

Balance Sheet Strength: Micron has a strong balance sheet, with $9.11 billion in cash and equivalents and $10.68 billion in short-term investments as of the end of 2022. The company also has relatively low levels of debt, with a debt-to-equity ratio of 0.37.

B. Key Financial Ratios and Metrics

Micron is a well-known manufacturer of memory and storage solutions, including RAM, ROM, and SSDs. While it may not be as well-known to the public as Intel or Nvidia, Micron is a major player in the semiconductor industry. In terms of revenue and size, Intel is the largest of the three with $78 billion in revenue and $153 billion in assets, followed by Nvidia with $25 billion in revenue and $52 billion in assets, and Micron with $30 billion in revenue and $54 billion in assets.

When comparing the revenue growth of Micron with its peers, AMD, Nvidia, and Intel, Micron's revenue has grown at a CAGR of 17.9% over the past five years, while AMD's revenue has grown at a CAGR of 30.6% over the past three years. Nvidia has seen a revenue increase of 82% over the past five years, and Intel's revenue has grown at a CAGR of 5.5% over the past five years.

According to a recent survey of analysts by FactSet, Micron Technology is expected to report revenue of $34.3 billion for the full year 2023. This represents an increase of 24.6% from the company's revenue of $27.6 billion in 2022.

Micron's profit margins are lower than those of Intel and Nvidia but higher than AMD's. In terms of valuation, Micron has a forward P/E ratio of 6.85, compared to Nvidia's 35.54, AMD's 26.16, and Intel's 11.59. This suggests that Micron may be undervalued compared to its peers, considering its growth potential.

IV. Micron Stock Performance

A. Micron Trading Information

Micron Technology, Inc.'s primary exchange and ticker symbol is NASDAQ:MU. It is headquartered in the United States and trades in US dollars. Trading hours for the NASDAQ are from 9:30 AM to 4:00 PM Eastern Standard Time. Pre-market trading starts at 4:00 AM Eastern Standard Time and after-market trading ends at 8:00 PM Eastern Standard Time.

Micron was first listed on NASDAQ in 1984. Since then, the company has undergone two stock splits, one in 1994 and another in 2000. What about Micron's stock dividend yield? As of 2023, Micron does not currently pay a dividend.

Moreover, you should take note of Micron's latest developments that the company has implemented in a bid to hit Micron stock price target. First is the creation of a new low-power DRAM category for Ultrabook devices. This new DDR3L-RS memory category offers reduced-power DRAM solutions, enabling longer battery life for high-performance, ultrathin devices such as laptops, tablets, and Ultrabook systems.

Micron's decision to invest considerably in production capacity could also boost its shares. Micron wants to build a megafab in Clay, New York, for $100 billion in over 20 years. This chip production facility may help Micron compete in the increasingly saturated memory chip industry.

In addition, Micron aims to spend approximately $150 billion on memory chip manufacturing and research and development over the next decade, including the Clay site.

B. Overview of Micron Stock Performance

Micron's stock price has been volatile over the years due to its fluctuating market nature, so Micron share price prediction will be hard to analyze.Micron Technology's stock has been on a tear in recent months, rising more than 30% since the beginning of the year. The company's strong earnings and revenue growth have been driving the stock higher. In its most recent quarter, Micron Technology reported earnings of $1.39 per share on revenue of $8.6 billion. Both of these figures beat analyst expectations.

Your question then could be: Is Micron a buy or sell? Well, let’s first check out the key drivers of Micron stock price.

C. Key Drivers of Micron Stock Price

The supply and demand dynamics that exist within the memory chip market are the primary forces that influence Micron's stock price. The equilibrium of supply and demand has a significant impact on Micron's profitability and stock price because the company is a market leader in the production of memory chips. The dangers associated with an oversupply in the market can lead to lower margins, which in turn can lead to lower stock prices. On the other hand, strong demand can drive margins higher, which in turn can drive stock prices higher.

The release of quarterly earnings reports and adjustments to guidance can cause big swings in the price of a company's shares because investors adjust their expectations based on the success of the company's finances.

D. Analysis of Future Prospects for Micron Stock

Micron's stock forecast for the long-term is positive, especially considering the company's position as the industry's preeminent maker of memory chips and the expansion of the technology sector overall. On the other hand, the outlook for the year 2023 is not quite as encouraging. It is anticipated that the company will incur significant net losses and have a weak cash flow, both of which may limit the company's capability to return capital to shareholders through buybacks.

In order to make educated decisions on whether to purchase or sell Micron's stock, you might need to keep a close check on Micron's financial performance. In general, the outlook for the price of Micron's stock in the future will be determined by a number of different aspects, such as the capacity of the firm to adjust to shifts in the market and advances in technical innovation.

V. Risks and Opportunities

A. Potential Risks Facing Micron

As an investor, you should be aware of the potential risks that Micron faces. One of the main risks is intense competition from semiconductor rivals such as TSM, NVIDIA, Intel, AMD, and Qualcomm. These companies have substantial resources and capabilities, and they may undercut Micron's pricing or offer better technology.

On the other hand, Micron also has competitive advantages that help it stand out in the market. For example, Micron has expertise in the development of specialized memory products, which have high margins and are in demand in specific industries. Micron also invests heavily in research and development, which helps it stay ahead of the curve in terms of technology.

When it comes to analyzing threats from competitors like NVIDIA, you should keep in mind that NVIDIA is the dominant player in the graphics card market, while Micron has bigger rivals to contend with in the memory market. However, NVIDIA's growth during difficult times comes at a premium since the stock is trading at 39 times trailing earnings. Both NVIDIA and Micron have healthy long-term prospects thanks to the markets they serve. However, NVIDIA seems better positioned as its top and bottom lines are expected to increase nicely this year.

In addition to competitive risks, Micron also faces other risks that could impact its business. These include oversupply causing weak sales/pricing, big customers switching suppliers, economic issues reducing demand, and trade/supply chain problems. Micron's high fixed costs also hurt in downturns, making it vulnerable to market changes.

B. Opportunities For Growth And Expansion

Micron Technology has several opportunities for growth and expansion in the semiconductor industry:

Growing Demand: The increasing demand for PCs, servers, mobile devices, and data centers presents a significant growth opportunity for Micron. As technology advances and more industries rely on computing power, there is a continuous need for memory chips. Micron is well-positioned to meet this demand and benefit from the expanding market.

Specialized Chips: Micron can explore opportunities in specialized chips for emerging technologies such as artificial intelligence (AI), the Internet of Things (IoT), and 5G connectivity. These technologies require specialized memory solutions to support their processing and storage needs. By developing and supplying specialized chips, Micron can tap into new markets and drive further growth.

Potential Mergers and Acquisitions: The semiconductor industry has witnessed significant consolidation in recent years. Micron could consider strategic mergers or acquisitions to enhance its product portfolio, expand its customer base, or gain access to new technologies. Such moves can fuel growth and strengthen Micron's competitive position in the market.

Future Outlook and Expansion

Micron Technology is a well-positioned company to benefit from the long-term growth of the memory market. The company has a strong track record of innovation and execution, and it is well-funded to support its growth plans.

Here are some of the factors that could drive Micron's future growth:

● Strong demand for memory products from the global smartphone market: The global smartphone market is expected to continue to grow in the coming years, and Micron is a major supplier of memory products to smartphone manufacturers.

● Strong demand for memory products from the server market: The server market is also expected to continue to grow in the coming years, as businesses increasingly adopt cloud computing services. Micron is a major supplier of memory products to server manufacturers.

● The company's ability to execute on its growth plans: Micron has a strong track record of innovation and execution. The company has been able to successfully expand its production capacity and product portfolio in recent years.

● The overall health of the global economy: The global economy is expected to continue to grow in the coming years, which will create demand for Micron's products.

Based on these factors, Micron is well-positioned for future growth. The company is expected to continue to report strong revenue and earnings growth in the coming years.

Here are some examples of how Micron is expanding its business:

● In 2022, Micron announced plans to invest $15 billion in new memory production capacity. This investment will help Micron meet the growing demand for memory products from the global smartphone and server markets.

● In 2023, Micron announced plans to acquire Israeli memory company Havok. This acquisition will give Micron access to Havok's advanced memory technology.

These are just a few examples of how Micron is expanding its business. The company is well-positioned to continue to grow in the coming years.

VI. How To Invest in Micron stock

A. Three ways to invest in Micron stock are holding its shares, buying options, or trading contracts for difference (CFDs)

These three ways are common and can easily be understood. Those holding shares have financially invested in Micron by purchasing the company's stock. Buying options allows you to speculate on the future direction of a Micron stock's price without actually purchasing the stock itself. You can speculate on the price movement of a stock without actually purchasing the stock using (CFDs), giving you access to leverage and the potential for profit from price fluctuations in either direction.

Options and Contracts for Difference (CFDs) are better suited for traders trying to take advantage of shorter-term price changes in Micron stock than holding shares which is for long-term investors who trust in the company's growth prospects. CFDs offer numerous advantages to traders, such as leverage, long/short trading, and margin trading.

B. Trading Micron Stock CFD with VSTAR

VSTAR offers a user-friendly trading platform, competitive pricing, and a range of trading tools and resources to help traders make informed trading decisions. Additionally, VSTAR offers 24/7 customer support to assist traders with any questions or concerns they may have.

In summary, trading Micron stock CFD with VSTAR offers traders the opportunity to profit from the stock's price movements, with the added advantages of leverage, the ability to go long or short, and access to a range of trading tools and resources. Sign up and start trading today!

Conclusion

With its exceptional market dominance and quality production of semiconductor memorabilia products, Micron Technologies stands at the forefront of manufacturers, and the company is doing well financially with consistent growth in both its revenue and earnings. On the other hand, Micron is exposed to possible threats, such as competitive risks emanating from heavyweights in the field of technology like TSMC, NVIDIA, Intel, AMD, or Qualcomm. In addition, Micron may have to grapple with other usual vagaries of markets, such as an oversupply of chips, economic slumps, and trade-related supply chain difficulties.

If you are interested in Micron stock, you have various options, such as holding its shares, trading options, and trading CFDs. CFD trading provides advantages such as reduced transaction expenses, increased adaptability, and the potential to benefit from market fluctuations in either direction. VSTAR provides a dependable and user-friendly platform equipped with various tools and resources to facilitate successful trading of Micron CFDs.