Join us as we delve into the thriving world of NetEase, a gaming industry powerhouse. From analyzing its business model to evaluating stock performance, we'll explore the advantages and areas for improvement within NetEase. We will also gain valuable insights into upcoming prospects and give insider tips for potential traders and investors. Don't miss out on the opportunity to uncover the potential of NetEase stocks. Let's dive in together!

I. NetEase, Inc.'s Overview

NetEase, Inc., a pioneering internet company, has solidified its presence in the digital landscape since its inception in 1997. Founded by Ding Lei, NetEase quickly emerged as a prominent player in the Chinese market and has since expanded its reach globally. With its headquarters nestled in Hangzhou, China, NetEase has become synonymous with innovation and technological prowess.

At the helm of NetEase's operations stands William Ding, the visionary CEO driving the company towards new horizons. Under his guidance, NetEase has experienced remarkable growth and established itself as a leader in various sectors. With a market capitalization of $100 billion, NetEase stands tall as a testament to its exceptional performance.

Here are some of NetEase's key accomplishments:

● Went public on the Nasdaq Stock Exchange in 2000.

● Launched its first online game, "Legend of Mir," in 2001.

● Launched its first mobile game, "Happy Farm," in 2007.

● Acquired Kingsoft's online game business in 2013.

● Launched NetEase Cloud Gaming in 2017.

● Launched NetEase Esports in 2020.

NetEase is led by a strong team of executives, including CEO William Ding, President Ethan Wang, Chief Operating Officer Kevin Chou, and Chief Financial Officer Maggie Wu. The company is committed to providing cutting-edge technology and superior user experiences. NetEase is poised for continued growth and success in the years to come.

II. NetEase, Inc.'s Business Model and Products/Services

A. Business Model

NetEase's business model is based on three pillars:

Online gaming: NetEase is the second largest online game company in China. The company has a large portfolio of popular online games, including "CrossFire," "Rules of Survival," and "Onmyoji." NetEase generates revenue from online games through a variety of channels, including in-game purchases, advertising, and subscriptions.

Music: NetEase is also a major player in the music industry in China. The company owns and operates a number of popular music streaming services, including NetEase Cloud Music. NetEase generates revenue from music through a variety of channels, including subscription fees, advertising, and digital sales.

E-commerce: NetEase is also involved in the e-commerce business in China. The company owns and operates a number of popular e-commerce platforms, including Youdao Mall and NetEase Kaola. NetEase generates revenue from e-commerce through a variety of channels, including commission fees, advertising, and logistics fees.

In addition to its core businesses, NetEase also offers a number of other products and services, including:

NetEase Cloud Gaming: NetEase Cloud Gaming is a cloud gaming service that allows users to play games on their devices without having to download or install them. NetEase Cloud Gaming is currently available in China and the United States.

NetEase Esports: NetEase Esports is a platform that provides users with access to esports content, including live streams, replays, and news. NetEase Esports is currently available in China and the United States.

NetEase Youdao: NetEase Youdao is a language learning platform that provides users with access to a variety of resources, including dictionaries, grammar guides, and flashcards. NetEase Youdao is currently available in China and the United States.

NetEase's Transition to Mobile and Esports

NetEase's transition to mobile and esports is driving the company's new growth. The mobile gaming market is growing rapidly in China, and esports is becoming increasingly popular. NetEase is well-positioned to capitalize on these trends, and the company is expected to continue to grow in the years to come.

B. Main Products/Services

NetEase, Inc. is a prominent player in the world of PC and mobile games, offering a diverse range of captivating titles. Among their notable releases are "Fantasy Westward Journey," an immersive online gaming experience, and "Westward Journey Online," a popular multiplayer adventure. The company also caters to the competitive gaming community with titles like "Knives Out" and "Rules of Survival."

With a focus on innovation and unique gameplay, NetEase has introduced successful games like "Onmyoji," an enchanting fantasy RPG, and "CrossFire," a thrilling first-person shooter. Sports enthusiasts can engage in virtual matches with titles such as "FIFA Online 4" and "NBA 2K Online."

NetEase extends its services beyond gaming, providing a comprehensive suite of offerings. Their e-commerce platform, Youdao Mall, offers a convenient online shopping experience. For music enthusiasts, NetEase Cloud Music offers a seamless streaming platform, while the online education platform, Youdao, provides access to educational resources and learning opportunities.

III. NetEase, Inc.'s Financials, Growth, and Valuation Metrics

A. Review of NetEase, Inc.'s financial statements

NetEase's revenue has grown at a compound annual growth rate (CAGR) of 21.8% over the past 5 years. The company's profit margins have also been increasing, with net income margin reaching 18.7% in 2022. NetEase's cash from operations (CFFO) has also been growing steadily, reaching $10.8 billion in 2022. The company's balance sheet is strong, with $17.6 billion in cash and short-term investments and no debt.

B. Key Financial Ratios And Metrics

NetEase's revenue and earnings growth have been outpacing the industry average. The company's forward P/E ratio is 22.5, which is below the industry average of 25. This suggests that NetEase's stock is currently undervalued based on its growth potential.

● NetEase's largest peers include Tencent, Alibaba, and Baidu. Tencent's revenue grew by 28% in 2022, while Alibaba's revenue grew by 19%. Baidu's revenue grew by 5%. NetEase's revenue growth of 21.8% is in line with the growth of others.

● Tencent's earnings per share (EPS) grew by 21% in 2022, while Alibaba's EPS grew by 12%. Baidu's EPS grew by 2%. NetEase's EPS growth of 25% is higher than the growth of its peers.

● Tencent's forward P/E ratio is 25, while Alibaba's forward P/E ratio is 20. Baidu's forward P/E ratio is 18. NetEase's forward P/E ratio of 22.5 is in line with the forward P/E ratios of its peers.

Based on its revenue and earnings growth, as well as its forward P/E ratio, NetEase's stock appears to be undervalued compared to its peers.

IV. NTES Stock Performance

A. NTES Stock Trading Information

NetEase, Inc. (NTES) is a Chinese Internet technology company that provides online services centered on content, community, communication and commerce. The company's businesses primarily include online games, e-commerce, advertising, email, and education.

❖ NTES was listed on the Nasdaq Global Select Market on June 30, 2000. The company's primary ticker symbol is NTES. NetEase's shares are traded in US dollars.

❖ NTES's trading hours are from 9:30am to 4:00pm EST, Monday through Friday. The company's shares are also traded in the pre-market and after-market sessions.

❖ NTES has had two stock splits since it was listed on the Nasdaq. The first stock split was a 2-for-1 split on June 2, 2005. The second stock split was a 3-for-1 split on June 1, 2010.

❖ The next dividend is scheduled to be paid on June 7, 2023, for the quarter ending March 31, 2023. The dividend is expected to be $0.18 per share.

❖ The dividend yield for NTES is currently 1.23%. This means that if you invest $100 in NTES, you will receive $1.23 in dividends each year.

NetEase, a leading video gaming giant in China, has recently made several notable developments:

Launch of CodeWave: NetEase unveiled CodeWave, a ChatGPT-style service, joining other Big Tech firms in China in providing advanced AI-powered communication capabilities.

Introduction of PinCool, Inc.: NetEase Games announced the establishment of PinCool, Inc., a new multifunctional studio aimed at producing global entertainment content.

Creation of Bad Brain Game Studios: NetEase Games introduced Bad Brain Game Studios, a new studio based in Canada, expanding its global presence and further diversifying its gaming portfolio.

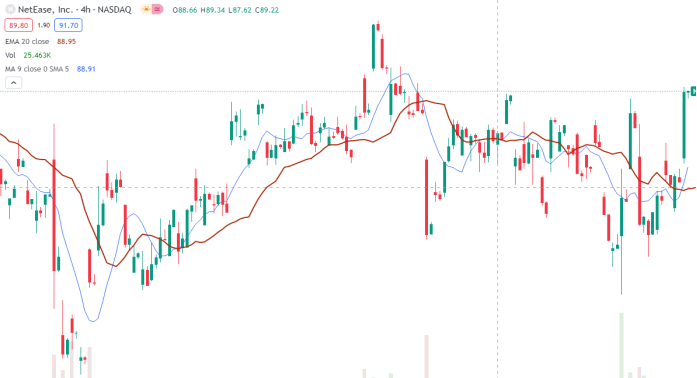

B. Overview Of NTES Stock Performance

NTES's stock price has been on a downward trend since the beginning of 2022. The stock is currently trading at around $88 per share, which is down from its 52-week high of $108.77.

There are a few reasons for the decline in NTES's stock price. The company is facing increased competition from other Chinese Internet companies, such as Tencent and Alibaba.

Despite the recent decline in its stock price, NTES is still a fundamentally strong company with a bright future. The company is well-positioned to benefit from the growth of the Chinese Internet market.

C. Key Drivers Of NTES Stock Price

The main drivers of NTES stock price are:

New games: NetEase is a leading online game developer and publisher in China. The company's success in the gaming industry is a major driver of its stock price. NetEase is constantly developing new games and expanding its existing game portfolio. The company's popular games include Fantasy Westward Journey, Westward Journey Online II, and Onmyoji.

Expansion abroad: NetEase is expanding its business outside of China. The company has established offices in the United States, Japan, and South Korea. NetEase is also investing in overseas game developers and publishers. The company's expansion abroad is a potential growth driver for its stock price.

Media deals: NetEase has signed a number of media deals with major entertainment companies. These deals give NetEase the rights to distribute movies, TV shows, and music in China. The media deals are a potential growth driver for NetEase's stock price.

D. Analysis of Future prospects for NTES Stock

The future prospects for NTES stock are positive. The company is a leading online gaming and internet services company in China, with a strong track record of growth and profitability. NTES is well-positioned to benefit from the continued growth of the Chinese internet market, as well as the increasing popularity of online gaming in China.

V. Risks and Opportunities

A. Potential Risks Facing NetEase, Inc.

Competitive Risks

NetEase operates in a highly competitive industry. The company's main competitors in the gaming industry include Tencent, Microsoft, Nvidia, Roblox, Activision Blizzard, Sea Limited, and Electronic Arts. These companies have significant resources and capabilities, and they are constantly innovating to develop new products and services. NetEase must continue to invest in research and development to maintain its competitive position.

Tencent is NetEase's largest competitor, offering a wide range of products and services in China, including online games, social media, and e-commerce. NetEase and Tencent are two of the largest and most successful internet companies in China. They both offer a wide range of products and services, and they both have a strong brand and a loyal customer base. However, there are some key differences between the two companies. NetEase is more focused on online gaming, while Tencent is more diversified with its business portfolio. Tencent is also larger and more profitable than NetEase.

Competitive Advantages of NTES

NetEase has a number of competitive advantages, including:

Strong brand recognition: NetEase is a well-known and respected brand in China. The company has a long history of developing and publishing high-quality games.

Strong financial position: NetEase is a financially strong company with a strong balance sheet. The company has a history of generating strong cash flow and returning capital to shareholders.

Experienced management team: NetEase has a strong management team with a deep understanding of the gaming industry. The management team has a proven track record of success.

Strong focus on innovation: NetEase is a company that is constantly innovating. The company is always looking for new ways to improve its products and services.

Other Risks

In addition to competitive risks, NetEase faces a number of other risks, including:

Regulatory Risks

The Chinese government is increasingly regulating the technology sector. This could have a negative impact on NetEase's business. The company must comply with all applicable laws and regulations, and it must be prepared for the possibility of further regulation.

Economic Risks

The Chinese economy is slowing down. This could have a negative impact on NetEase's business. The company's revenue and profits could decline if the Chinese economy continues to slow down.

Cyber Attacks

China is a major target for cyber attacks. These cyber attacks could disrupt NetEase's business operations and steal sensitive data.

B. Opportunities For Growth And Expansion

NetEase has a number of opportunities for growth and expansion, including:

Partnerships with Western companies

NetEase has partnerships with a number of Western companies, including Blizzard Entertainment. These partnerships give NetEase access to popular Western games, such as World of Warcraft and Overwatch. NetEase can leverage these partnerships to grow its user base and revenue.

Investments in esports

NetEase is investing in esports, such as the Overwatch League China Homestand Weekend. Esports is a rapidly growing industry, and NetEase can capitalize on this growth by investing in esports teams and events.

New business units

NetEase has recently launched new business units focused on video streaming, anime, and comics. These new business units give NetEase the opportunity to expand into new markets and generate additional revenue.

Future Outlook and Expansion

NetEase Inc. (NTES) has promising future prospects based on several factors.

Strong Revenue Growth: NetEase has consistently demonstrated robust revenue growth over the years, driven by its diversified portfolio of online games, e-commerce platforms, and innovative services. The company's ability to adapt to changing market trends and cater to consumer demand positions it well for continued revenue growth.

Expansion into International Markets: NetEase has been expanding its presence in international markets, particularly in gaming and e-commerce. This global expansion strategy opens up new revenue streams and enhances the company's growth potential by tapping into a larger customer base.

Focus on Innovation and Content Development: NetEase emphasizes innovation and content development, enabling it to deliver high-quality games and services. The company's strong track record in developing popular and engaging titles helps it maintain a competitive edge in the gaming industry.

VI. How To Invest In NTES Stock

A. Three Ways To Invest In NTES Stock

When it comes to trading, there are various ways to approach the market. Let's explore three common methods: holding shares, using options, and trading Contracts for Difference (CFDs). Holding the Share

This traditional approach involves buying and owning the actual shares of a company. By holding shares, you become a shareholder and may benefit from dividends and potential capital appreciation. However, this method requires a larger upfront investment and may tie up your capital for an extended period. Additionally, if the stock's value declines, you may experience losses.

Options

Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific timeframe. Options offer flexibility and can be used for various strategies, such as hedging or speculating on price movements. However, options typically have expiration dates and can be complex for novice traders to understand. They may also require substantial upfront costs in the form of premiums.

CFDs

CFDs are derivative products that allow traders to speculate on price movements without owning the underlying asset. With CFDs, you can go long (buy) or short (sell) on a wide range of financial instruments, including stocks, commodities, indices, and currencies. CFDs provide several advantages, including:

a) Leverage: CFDs enable you to trade with leverage, meaning you can control a larger position with a smaller amount of capital. This amplifies potential profits (and losses) compared to the initial investment.

b) Diversification: CFDs offer access to a wide range of markets, allowing you to diversify your trading portfolio and potentially mitigate risk.

c) Short Selling: CFDs allow you to profit from both rising and falling markets by taking short positions, offering opportunities to capitalize on market downturns.

d) Lower Costs: Compared to traditional share trading, CFDs often involve lower transaction costs, such as commissions and fees.

B. Why Trade NTES Stock CFD With VSTAR

VSTAR is a leading online CFD broker that offers a wide range of markets to trade, including stocks, indices, commodities, crypto and currencies.

VSTAR offers ultra-low trading costs with tight spreads and zero commission, as well as leverage and a user-friendly trading platform, allowing traders to optimize their profitability. This cost-effective approach ensures that clients can trade with minimal expenses, enhancing their overall trading experience.

C. How To Trade NTES Stock CFD With VSTAR - Quick Guide

To trade NTES Stock CFD with VSTAR, you first need to open an account. Once you have opened an account, you can deposit funds and start trading. To trade NTES Stock CFD, you need to select the market you want to trade, choose the amount of CFDs you want to trade, and then choose whether you want to buy or sell. Once you have placed your trade, you can monitor your position in the 'Open Positions' tab.

Example

Let's say you want to buy 100 CFDs of NTES Stock at a price of $90.00. The margin requirement for NTES Stock CFDs is 5%, so you would need to deposit $450.00 into your account to open this position. If the price of NTES Stock rises to $95.00, you would make a profit of $500.00. However, if the price of NTES Stock falls to $85.00, you would lose $500.00.

VII. Conclusion

In conclusion, NetEase (NTES) is a Chinese technology company that provides online gaming, music, and e-commerce services. The company has a strong track record of growth and profitability, and it is well-positioned to continue to grow in the future. NTES stock is a good investment for investors who are looking for exposure to the Chinese technology market.

However, there are some risks to consider before investing in NTES stock. The company is subject to regulatory risks in China, and its business could be affected by changes in government policy. Additionally, the stock is relatively expensive, and it could be volatile in the short term.