Many investors looking for the best stocks to buy right now have Netflix (NASDAQ: NFLX) on their radar. The recent run on Netflix stock has pushed it well above $420 and nearly 160% above its 52-week low. But the stock remains well below its all-time high of nearly $692.

Some Wall Street analysts have recently revised their price targets for Netflix stock as the company cracks down on password sharing and promotes its ad-supported plan.

If you're looking for the best stocks to buy in 2023, you may have questions like these: Should I buy NFLX stock? Is Netflix stock a good investment? What is the forecast for Netflix stock?

This article will help you determine if Netflix (NASDAQ: NFLX) stock is right for you. The article examines recent major developments surrounding the company, Netflix's business model, financials, challenges and opportunities. You'll also find out Wall Street's price targets for Netflix stock to see if the stock is expected to rise or fall from its current level.

If you're trying to figure out the best way to make money with Netflix stock, you'll find everything you need to know here. The article explains Netflix stock investment strategies, looking at the traditional method of investing for long-term exposure and Netflix CFD trading for short-term profit opportunities.

Netflix Stock News

Netflix's crackdown on password sharing boosts subscriptions

Netflix (NASDAQ: NFLX) has seen a surge in subscriptions since launching a crackdown on password sharing in the U.S., according to an analysis by Antenna. The company has banned members from sharing their passwords with people outside their households for free.

For many years, Netflix thought it was good for its business if its members shared their password with other households so they could access its content for free. In a famous 2017 tweet, the company encouraged the practice of password sharing, writing that "love is sharing a password."

As it looks to grow its revenue and raise more money to fund its expensive content strategy, Netflix no longer believes in free password sharing. As a result, the company has moved to restrict the practice of password sharing. In a change of strategy, the company is requiring members who want to share their accounts with other households to pay extra for the additional users.

Source: Pixabay

Netflix has introduced a paid sharing option that charges approximately $8 per month for each household an account is shared with. Members can share their account with up to two households. The company estimates that more than 100 million households consume its content without paying for it through free password sharing. Therefore, the paid password sharing program represents a huge incremental revenue opportunity for Netflix.

Netflix's Ad-Supported Plan Hits 5 Million Subscribers Milestone

Netflix (NASDAQ: NFLX) has added nearly 5 million subscribers to its ad-supported plan. The company launched the cheaper plan, which is aimed at cost-conscious customers, in November 2022.

Netflix's ad-supported plan costs $7 per month, which is less than half the cost of the standard plan. And the ad-supported plan isn't cannibalizing the company's ad-free business, as some had feared. Netflix has revealed that only about a quarter of new subscribers are choosing the ad-supported option.

Before we dive into the details of NFLX stock, let's first learn more about Netflix as a company.

Netflix Inc Overview

Source: Pixabay

Netflix is a multinational provider of online video streaming. The company's original name was Kibble. Netflix was founded in 1997 and is headquartered in California. Before getting into video streaming, the company offered a DVD movie rental service.

The founders of Netflix are Reed Hastings and Marc Randolph. After more than two decades at the helm, Hastings stepped down as Netflix's CEO in January 2023. However, Hastings remains the company's executive chairman. Hastings studied math and computer science in college.

Netflix's co-CEOs are Greg Peters and Ted Sarandos. Sarandos, a longtime Netflix executive, was co-CEO with Hastings. Peters joined Sarandos as Netflix co-CEO after Hastings stepped down from that role.

Who owns Netflix now?

Reed Hastings holds the most Netflix shares of any individual but institutional investors collectively control the majority stake. Ownership is dispersed among many shareholders.

Netflix's Key Milestones

|

Year |

Milestone |

|

1998 |

Netflix shipped its first DVD to a customer. |

|

1999 |

Netflix introduced a monthly DVD subscription service. |

|

2002 |

Netflix went public at an IPO price of $15 per share. |

|

2007 |

Netflix DVD deliveries hit a billion copies. Netflix launched an online video streaming service. |

|

2009 |

Netflix surpassed 10 million subscribers. |

|

2016 |

Netflix goes live in 130 countries at once in an aggressive international expansion. |

|

2017 |

Netflix hits 100 million video subscribers. |

|

2018 |

Netflix inks original content production deal with Barack Obama. |

|

2022 |

Netflix introduced an ad-supported video streaming plan. |

Netflix's Business Model and Products

Business Model

Netflix (NASDAQ: NFLX) operates an online subscription video streaming platform. The platform offers both original and licensed content. The content available on the platform ranges from movies to television shows. How does Netflix make money? The company charges its subscribers a monthly fee, the price of which depends on the plan option chosen.

Netflix began by selling movie discs, which it mailed to customers in its iconic red envelopes. The company recently decided to shut down its DVD business to focus on the more lucrative video streaming business.

Main Products and Services

Netflix (NASDAQ: NFLX) offers its video streaming service in a variety of plan options to suit different customer tastes and price points:

Ad-free plan: Netflix's ad-free service offers three plan options: basic, standard, and premium. These options differ in price and the number of devices allowed to stream content simultaneously.

Ad-supported plan: Netflix's ad plan is aimed at cost-conscious members who are willing to view advertisements in movies or shows in exchange for a cheaper subscription price.

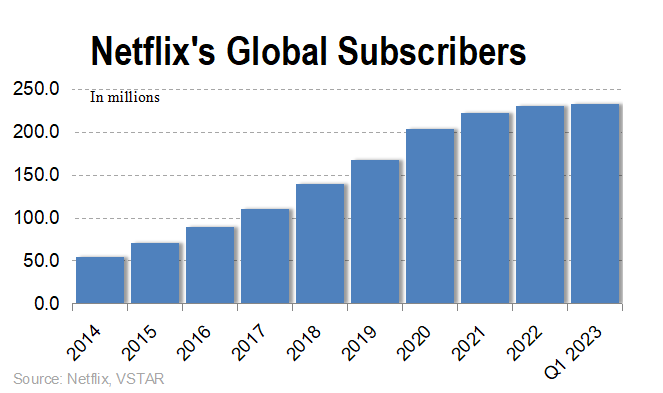

Netflix has 232.5 million subscribers to its video streaming service. The chart below shows Netflix's global subscriber base over the past few years.

Netflix investments

Netflix Financials

Financial results have a great impact on stock movements. Studying Netflix's financial performance or Netflix value can help you determine whether NFLX stock is a good investment. Let's take a look at Netflix's financial performance or Netflix valuation and balance sheet condition:

Netflix market cap

Netflix market share

Netflix has a significant share of the streaming market, although its dominance is waning amid growing competition. Its strength remains its global brand and content catalog.

- In the global streaming market, Netflix has approximately 20-25% market share by 2022.

- Netflix has approximately 220 million subscribers worldwide.

- The U.S. and Canada are Netflix's largest market with over 73 million subscribers and approximately 44% market share.

- In international markets, Netflix has around 15-20% market share, competing with services such as Amazon Prime, Disney+, HBO Max, etc.

- In terms of total TV viewing time in the US, Netflix has captured about 7-8% of TV minutes watched in recent years.

- However, Netflix's share of TV viewing is higher among streaming-centric households, especially among younger demographics like Gen Z.

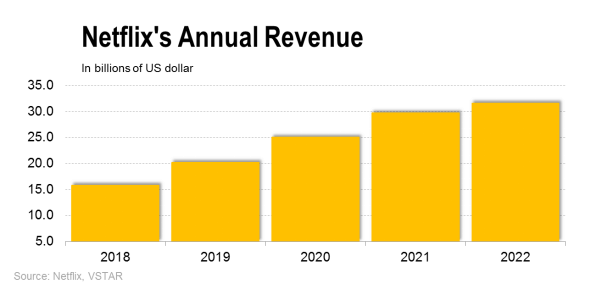

Revenue

Netflix's revenue rose 3.7% year-over-year to $8.16 billion in Q1 2023. The revenue growth was supported by an increase in the number of subscribers. The company expects its revenue to increase 3.4% to $8.24 billion in Q2 2023. Netflix's revenue increased 6.5% to $31.6 billion in 2022. Wall Street expects Netflix's revenue to grow 7% to about $34 billion in 2023.

Netflix's revenue has increased at a compound annual growth rate of about 15% over the past 5 years. The chart below shows Netflix's annual revenue trend.

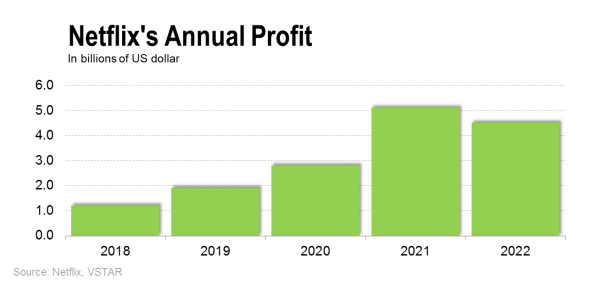

Net income

Although Netflix's profits fluctuate, the company has been consistently profitable on both a quarterly and annual basis for many years. It reported a net income of $1.3 billion for Q1 2023, which resulted in earnings per share (EPS) of $2.88. It expects net income of $1.3 billion for Q2 2023, or EPS of $2.84.

The company made a profit of $4.5 billion in 2022. The chart below shows Netflix's annual net income trend over the past 5 years.

Profit Margins

Netflix (NASDAQ: NFLX) achieved an operating profit margin of 21% in Q1 2023, marking a strong improvement from 7% in the previous quarter. The company's operating profit margin was 17.8% in 2022. The company aims to increase its operating profit margin to 18%-20% in 2023. Netflix has been implementing strategies such as job cuts, salary adjustments, and reducing its real estate footprint to reduce costs and improve its profit margins. The company aims to reduce operating expenses by $300 million in 2023.

Balance Sheet Condition

Netflix (NASDAQ: NFLX) is on solid financial footing. The company generated $2.2 billion in cash flow from operations in Q1 2023. It ended the quarter with $5.2 billion in free cash flow. Netflix is targeting $3.5 billion in free cash flow in 2023. In addition to funding content acquisitions, Netflix spends its free cash flow on share repurchases.

The company has a strong balance sheet, with nearly $50 billion in assets versus $27 billion in total liabilities. Netflix has an impressive current ratio of 1.26 and a debt-to-equity ratio of 0.66.

Netflix Stock Analysis

NFLX Stock Trading Information

Regular trading in Netflix stock runs from 9:30 a.m. to 4:00 p.m. ET on weekdays. Investors who would like more time to trade NFLX stock can take advantage of the extended trading hours. NFLX Premarket trading begins at 6:30 a.m. and after-hours trading continues until 8:00 p.m.

Netflix Stock Split History

Netflix (NASDAQ: NFLX) stock has split twice since its IPO. The first Netflix stock split was a two-for-one split in February 2004. The split meant that a position of 1,000 shares of NFLX stock increased to 2,000 shares. The second Netflix stock split was a 7-for-1 split in July 2015. The split meant that a position of 1,000 shares of the stock increased to 7,000 shares.

After the two Netflix stock splits, an original position of 1,000 shares expanded to 14,000 shares.

Many companies split their stock to make it more affordable for retail investors, which can increase demand for the stock and boost the stock price. NFLX's stock price hit new highs after the split.

Netflix dividend

Netflix doesn't currently pay a dividend.

Netflix Stock Performance

Netflix stock price soared to an all-time high of $691.69 in November 2021. The stock rose to this peak at the height of the Covid-19 pandemic, when lockdowns closed entertainment venues and people turned to online entertainment. As a result, Netflix reported strong subscriber growth and financial results during that time.

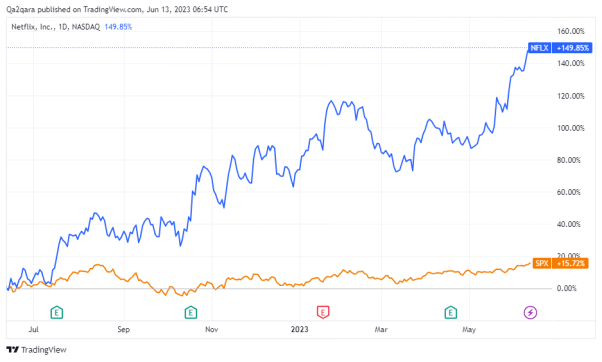

When the pandemic restrictions eased and people started going out, Netflix struggled to maintain its robust subscriber growth. In 2022, NFLX stock plunged to multiyear lows after Netflix suffered a surprise subscriber loss. But the stock rebounds in 2023 as subscriber growth returns.

Netflix stock is up more than 40% since the beginning of the year, outperforming the S&P 500 by about 12%. The stock is up nearly 150% over the past year.

Netflix Stock Forecast

After watching Netflix stock soar over the past few months, you might be wondering if the stock has more room to run.

NFLX stock forecast generally imply an upside from current levels. Wells Fargo's $500 price target for NFLX implies nearly 20% upside. Pivotal Research's $535 price target implies an upside of nearly 30%.

These are some of the factors that affect Netflix stock price:

Financial results: NFLX stock price rises on strong earnings results and falls on weak earnings.

Subscription numbers: Netflix stock rises when the company gains subscribers and falls when it loses subscribers.

Corporate actions: NFLX stock rises when the company takes actions that investors believe can increase revenue and improve profitability.

Economic conditions: Netflix's revenue and subscribers can decline during economic downturns as households prioritize spending on more essential items.

Netflix's Challenges and Opportunities

Netflix (NASDAQ: NFLX) has set out to grow its subscriber base, increase revenue, and improve profitability. To achieve these goals, the company must overcome several challenges and take advantage of opportunities as they arise. So, is netflix a good stock to buy? Let's take a look at Netflix's challenges and opportunities:

Netflix's Weaknesses and Challenges

Forex headwinds: The company operates in multiple international markets where it prices its service in local currencies. A strong U.S. dollar can shrink international revenue when converted into the reporting currency.

Content piracy: Netflix's popular shows and movies have made it a major target of online content piracy. There are platforms that illegally offer Netflix content for free, leading to revenue loss for the company.

Regulations: In some foreign markets, Netflix is required to invest a certain percentage of its revenue in local content. Such measures can make Netflix's business less profitable in some international markets.

Expensive content production: Netflix counts on its original content to attract and retain subscribers on its platform. But it can cost billions of dollars to produce a hit original show. The high cost of content production can make it tough for Netflix to maintain its desired level of profitability.

Intense competition: Since the online video streaming business has low barriers to entry, Netflix faces a growing competitive threat. The competition centers on programming and pricing. These are some of Netflix's major competitors and the threats they pose to the company:

|

Netflix competitor |

Threat |

|

Walt Disney |

Disney+ and Hulu offer great content and are less expensive than Netflix. |

|

Amazon |

Amazon Prime Video offers original content like Netflix and is free for Amazon Prime members. |

|

Warner Bros. Discovery |

HBO Max offers ad-free and ad-supported plans priced virtually similarly to Netflix's plans. |

Netflix's Competitive Advantages

Strong financial position: Netflix has substantial cash on hand and a lightly leveraged balance sheet. This gives the company the financial flexibility to continue funding the production of outstanding content. In addition, Netflix appears well positioned to weather a recession.

Strong brand: Netflix has become a household name in the online video streaming space. And the Netflix brand is synonymous with high-quality content. While many competitors are entering the video streaming business, it will take them many years to match Netflix's brand position.

Original programming: Netflix is far ahead of many of its competitors in offering original content. Original programming helps the company stand out in a competitive market. But original production is expensive, and few competitors can afford it.

Global reach: Netflix's extensive global presence offers many advantages. First, it provides a broad market for the company's content and unlocks economies of scale. In addition, its global reach provides Netflix with a large talent pool for content production and staffing needs.

Netflix's Opportunities

Source: Pixabay

Paid sharing: Netflix has introduced a paid sharing plan as it weeds out the practice of free password sharing. The company could generate as much as $5 billion in additional annual revenue, even if only half of the 100 million households that use shared passwords join the paid sharing program.

Advertising: Netflix's ad-supported plan gives it a foothold in the lucrative online video advertising market. The global digital video advertising market is on track to exceed $712 billion by 2031, up from $53 billion in 2021.

Live programming: Netflix has been exploring live programming as it looks for additional ways to engage its audience. Offering live sports and reality shows can help Netflix attract millions more subscribers to its platform, expanding subscription and advertising revenue opportunities.

International expansion: Although Netflix has launched in 190 countries, the service still has room to grow in its international markets. Developing countries, in particular, represent a huge growth opportunity for Netflix as the Internet reaches more people and the middle class expands.

Merchandising: Netflix sells clothing, toys, and other products associated with its hit shows. The company's growing subscriber base also expands the market opportunity for its merchandise business.

Content licensing: Netflix pays billions of dollars to license content from outside studios. As its own original content library grows, Netflix could make a killing licensing its hit shows and movies to other streaming platforms.

NFLX Stock Trading Tips

Netflix Stock Investing Strategies

1. Buying and Holding Netflix Shares

If you're interested in long-term exposure to NFLX stock, consider buying Netflix shares and holding them in your portfolio. While this strategy gives you voting rights and makes you eligible for potential dividends, it requires a large initial investment and a long wait for returns.

2. Trading Netflix Stock CFD

If you have a small amount of capital to start with and want to profit from short-term movements in the price of NFLX stock, consider trading Netflix stock CFDs. CFD trading allows you to profit from correctly predicting the direction of stock price movements. As a result, CFD trading allows you to profit when Netflix stock goes up as well as when it goes down. However, trading Netflix CFDs doesn't give you any voting rights in the company.

Netflix Stock CFD Trading Strategies

1. Manage Your Risks

While trading is an opportunity to make money, you can also lose money if the market goes against you. Therefore, your trading strategy should include risk management measures to help you minimize potential losses. These are some of the risk management techniques you can use when trading Netflix stock CFDs:

● Set stop-loss and take-profit points to avoid holding onto positions for too long and taking on more risk. A stop-loss point limits the amount of loss you can take on a losing trade. A take-profit point prevents you from pursuing the upside of a trade to dangerous levels.

● Apply the one-percent rule to protect against the risk of a losing bet wiping out your portfolio and crippling your trading. This rule suggests that you don't invest more than 1% of your money in a single trade.

● Diversify your trades to spread your risks and expand your opportunities. This technique suggests that in addition to Netflix CFD, you should consider trading other stock CFDs so you don't put all your eggs in one basket.

2. Plan Your Trades

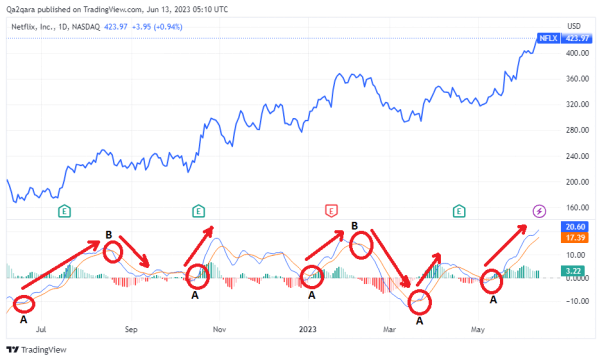

Successful trading isn't a guessing game. You can maximize your profits and minimize your losses by knowing the right times to enter and exit trades. (The MACD chart is a powerful technical indicator that can be used to identify NFLX stock price trends and help you time your trades.

The Moving Average Convergence Divergence (MACD) chart has two lines where one is the MACD line and the other is the signal line. You can study the MACD chart to identify bullish and bearish signals.

When the MACD line crosses above the signal line, it indicates that a stock is likely to enter a bullish trend. Conversely, when the MACD line crosses below the signal line, it indicates a possible bearish trend.

In the Netflix MACD chart above, the points labeled "A" show the MACD line crossing above the signal line. The points labeled "B" show the MACD line crossing below the signal line. As you can see, the price of Netflix stock went into an upward trend after the "A" points and into a downward trend after the "B" points.

Trade NFLX Stock CFD With VSTAR

If you're ready to start trading Netflix stock CFD, try VSTAR. The VSTAR CFD trading platform is fully licensed and regulated. Designed for frequent and high-speed trading, VSTAR has low fees and tight spreads to maximize your profits. Moreover, the platform offers risk management features like order stops and limits to minimize your losses. You can start trading Netflix CFD with as little as $50 on VSTAR and use leverage to boost your trading.

Consider opening a VSTAR account today. You only require an email address or phone number to open a VSTAR account and start trading Netflix stock CFD. For account funding, VSTAR supports the popular deposit options, including digital wallets, credit cards, and bank transfers.

If you're new to CFD trading, VSTAR offers a demo account to practice trading with up to $100,000 of virtual money.

Final Thoughts

Netflix (NASDAQ: NFLX) stock price looks to have more room to run. The crackdown on password sharing and the launch of the ad-supported plan promise to improve Netflix's financial performance and attract more investors to the stock.

You can buy and hold Netflix shares for long-term gains. Alternatively, you can trade Netflix stock CFD to take advantage of short-term price movements on the go.