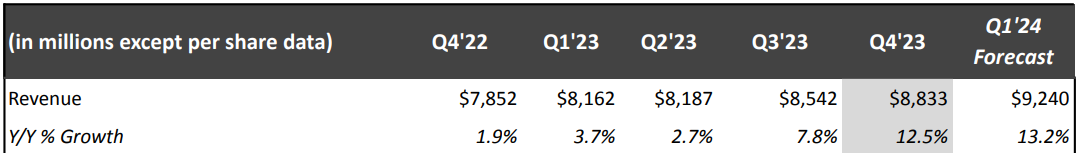

- Revenue Growth: Netflix's revenue surged by 12% year over year in 2023, fueled by a robust business model.

- Subscriber Surge: The platform's global streaming paid memberships hit 260.28 million, showcasing 12.8% year-over-year growth (Q4 2023).

- Pricing Mastery: Netflix's flexible pricing strategy balances value creation and revenue streams effectively.

- Strategic Outlook: With a 24% operating margin forecast for 2024, Netflix aims for double-digit revenue growth, ad business expansion, and increased content investment.

The article explores Netflix's (NASDAQ: NFLX) lead through the core fundamentals that propel its market value growth. From robust revenue acceleration to strategic pricing, content quality, and global expansion, Netflix's dynamic approach is reshaping the streaming landscape. Read more to uncover the key pillars supporting its ascendancy as of Q4 2023.

Core Fundamentals Supporting Market Value Growth

Robust Top Line Growth

Netflix's substantial acceleration in revenue growth, reaching 12% year-over-year by the end of 2023, reflects a robust business model. This growth can be attributed to several factors:

Source: Q4-23-Shareholder-Letter

Subscriber Base Expansion:

The primary driver of Netflix's revenue growth is its ability to consistently attract and retain subscribers. The platform's global streaming paid memberships reached 260.28 million by the end of Q4'23, showcasing a 12.8% year-over-year growth. The company's global reach and diverse content library contribute to its appeal across various demographics and geographic regions.

Pricing Strategies:

Netflix's strategic approach to pricing involves occasional adjustments to reflect improvements in the service. By providing a range of prices and plans to meet a wide range of needs, including competitive starting prices, Netflix has successfully captured the value created by its evolving service. This flexible pricing strategy has proven effective in maintaining a healthy revenue stream.

Content Quality and Variety:

A significant driver behind Netflix's revenue growth is its focus on content quality and variety. The content amortization increased almost threefold from $4.8 billion in 2016 to $14.2 billion in 2023. This substantial investment in original programming and production capabilities has enabled Netflix to offer a wide variety of movies and shows, appealing to diverse audience preferences.

Geographic Expansion:

Netflix's global launch in 2016 marked a pivotal moment, allowing the company to tap into international markets. The streaming service's ability to program at a global scale, reaching over 260 million households worldwide, indicates successful international expansion. As the streaming market expands globally, Netflix is well-positioned to capture new audiences and revenue streams.

Improving Operating Margin

Netflix's achievement of a 21% operating margin in FY23, surpassing the initial target of 20%, reflects the company's effective cost management and operational efficiency. Key factors contributing to the improvement in operating margin include:

Cost Management:

The company's ability to manage costs effectively is evident in the improvement in operating margin from 7% in the year ago quarter to 17% in Q4'23. This under-forecasted improvement was driven by lower-than-planned spending, showcasing Netflix's agility in managing its financial resources.

Operating Income Growth:

Netflix generated $7 billion of operating income in 2023, representing a significant 23% year-over-year increase. This growth in operating income is a result of the company's revenue upside in the quarter and disciplined cost management. The ability to consistently grow operating income contributes to the overall improvement in operating margin.

Strategic Investments:

While controlling costs is crucial, strategic investments in content, technology, and global expansion have played a pivotal role in Netflix's improving operating margin. The company's focus on sustaining healthy revenue growth while expanding its content library and enhancing the user experience contributes to the overall profitability.

Margin Expansion Goals:

Netflix's long-term goal is to steadily increase its operating margin each year. While the rate of margin expansion may vary, the company's focus on this goal signals a strategic focus on balancing growth with profitability. The upward trajectory in operating margin is a positive indicator of Netflix's ability to optimize its financial performance.

Free Cash Flow Expansion

Positive free cash flow is crucial for a subscription-based business model like Netflix's, providing the flexibility to invest in content creation, technology, and other strategic initiatives. Netflix's achievement of $6.9 billion in free cash flow in 2023 represents a significant improvement compared to previous years. Key factors contributing to this expansion include:

Content Investment:

Netflix's substantial investment in content, with content amortization increasing from $4.8 billion in 2016 to $14.2 billion in 2023, is a primary driver of positive free cash flow. The company's ability to balance content investment with revenue generation showcases a disciplined approach to content creation.

Financial Stability:

The positive trend in free cash flow over the past years, recouping the deficit generated from 2016-2019, reflects Netflix's focus on maintaining financial stability. This stability is crucial for sustaining long-term growth and ensuring the ability to navigate challenges such as industry strikes.

Global Reach and Scale:

With over 260 million households globally, Netflix operates at a scale unprecedented in the entertainment industry. This global reach contributes to the company's positive free cash flow by allowing it to distribute fixed costs over a large subscriber base. The economies of scale achieved through global operations enhance financial efficiency.

Flexible Capital Structure:

Netflix's flexible capital structure, including the ability to repurchase shares and manage debt, provides the company with additional financial levers. The repurchase of 5.5 million shares for $2.5 billion in Q4'23 and the remaining $8.4 billion under the current buyback authorization highlight the company's strategic use of its capital.

Membership Growth and Retention

Netflix's ability to consistently grow its subscriber base and retain customers is a fundamental strength contributing to its rapid growth potential. Key factors influencing membership growth and retention include:

Source: Q4-23-Shareholder-Letter

Global Streaming Paid Memberships:

The continuous growth of global streaming paid memberships, reaching 260.28 million by the end of Q4'23, showcases Netflix's appeal to a diverse global audience. The 12.8% year-over-year growth reflects the platform's ability to attract new subscribers and retain existing ones.

Strong Net Additions:

Netflix added 13.12 million net paid memberships in Q4'23, marking its largest Q4 ever. This strong performance in net additions demonstrates the company's effectiveness in acquiring new customers, especially during a traditionally competitive period.

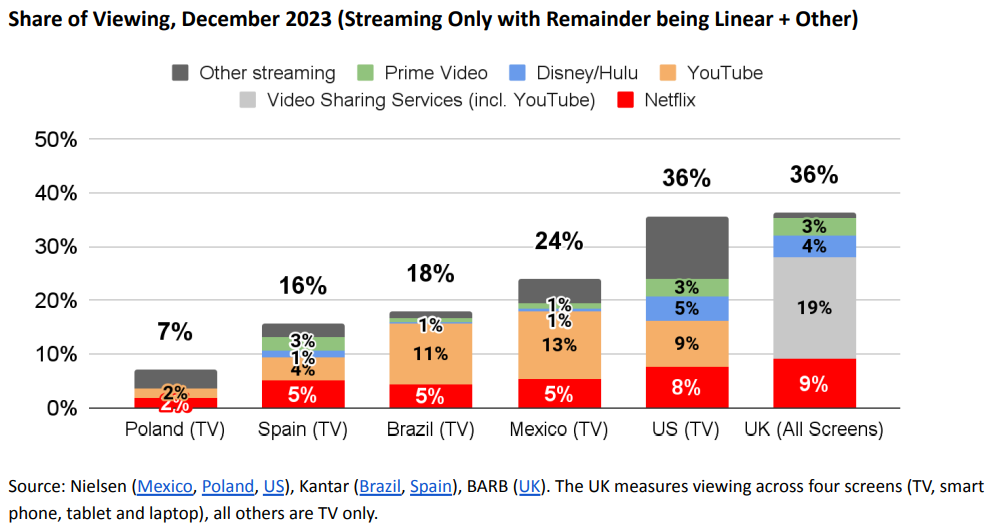

Content Quality and Engagement:

The company's dominance in original TV series, films, and acquired series, as highlighted by Nielsen data, suggests the strength of its content library. The bi-annual Netflix Engagement Report, covering over 18,000 titles, emphasizes the scale of engagement, with nearly 100 billion view hours driven between January and June 2023.

Retention Strategies:

Netflix's emphasis on content quality, user experience, and innovative features such as Transfer Profile and Extra Member contributes to member retention. Paid sharing, considered a normal course of business, has expanded the user base, enabling effective penetration of the near term addressable market.

Effective Pricing Strategy

Netflix's pricing strategy plays a pivotal role in capturing the value created by its service and sustaining a healthy revenue stream. The effectiveness of this strategy is evident in various aspects:

Range of Prices and Plans:

By providing a range of prices and plans to meet a wide range of needs, including highly competitive starting prices, Netflix caters to diverse customer segments. The flexibility in pricing allows the company to appeal to different demographics and economic conditions across its global subscriber base.

Occasional Adjustments:

Netflix's approach to occasional adjustments in pricing to reflect improvements in the service aligns with its focus on delivering high-quality content and user experience. This strategy not only captures the value perceived by customers but also enables the company to reinvest in further improvements.

Positive Flywheel Effect:

The positive flywheel effect generated by pricing adjustments contributes to a cycle of additional investment, leading to further improvements and growth. As members pay a little extra to reflect improvements, this additional revenue supports continued investment in content creation, technology, and global expansion.

Competitive Starting Prices:

Maintaining highly competitive starting prices is a strategic move to attract new subscribers and remain competitive in the streaming market. The ability to balance competitive pricing with sustained revenue growth indicates Netflix's market awareness and adaptability to changing consumer preferences.

Ads Business Growth

Netflix's strategic focus on scaling its ads business represents a significant opportunity to tap into new revenue and profit pools. The growth in the ads business is influenced by several factors:

Membership Growth in Ads Markets:

In Q4'23, the ads membership in Netflix's markets increased by nearly 70% quarter over quarter. This growth is supported by improvements in the offering, such as downloads, and the phasing out of the Basic plan for new and rejoining members in ads markets. The ads plan now accounts for 40% of all Netflix sign-ups in these markets.

Phasing Out Basic Plan:

Netflix's decision to retire the Basic plan in some of its ads countries, starting with Canada and the UK in Q2, reflects a strategic move to consolidate its ads business. Phasing out certain plans allows the company to focus on offerings that align with its long-term goals, contributing to sustained, healthy revenue growth.

Advertiser Side Improvements:

On the advertiser side, Netflix continues to enhance targeting and measurement capabilities. These improvements benefit customers by providing more effective and personalized advertising, contributing to a positive experience for both subscribers and advertisers. Netflix's focus on refining its ads business showcases a long-term vision for this revenue stream.

Strategic Outlook for 2024

Netflix's strategic outlook for 2024 positions the company for continued growth and innovation. Several key initiatives and expectations contribute to this outlook:

Double-Digit Revenue Growth:

Entering 2024 with good momentum, Netflix expects healthy double-digit revenue growth for the full year on a F/X neutral basis. This projection is driven by continued membership growth and improvements in F/X neutral Average Revenue per Membership (ARM) as prices are adjusted. The forecasted revenue growth of 13% in Q1'24 includes a three-percentage-point headwind from F/X.

Investment in Ads Business:

While the ads business is expected to experience strong growth in 2024, it remains a secondary driver of overall revenue growth. Netflix's plan to continue investing in and building the ads business aligns with a long-term vision of making ads a more substantial revenue stream. This strategic investment is expected to contribute to sustained, healthy revenue growth in 2025 and beyond.

Operating Margin Forecast:

Netflix has increased its full-year 2024 operating margin forecast from 22%-23% to 24%, based on F/X rates as of January 1, 2024. The adjustment reflects the weakening of the US dollar against most other currencies, stronger-than-forecasted Q4'23 performance, and expectations for how that performance will carry through 2024. Netflix's focus on steadily increasing its operating margin each year emphasizes a balance between growth and profitability.

Industry Competitiveness:

Acknowledging the competitive landscape, Netflix recognizes the franchise strength and programming expertise within traditional entertainment companies. The ongoing heavy investment from large tech players like YouTube, Amazon, and Apple, along with broader competition for people's time from gaming and social media, presents a dynamic environment. Netflix's focus on improving its entertainment offering, even as some competitors cut back on content spending, positions the company as a key player in the industry.

Content Amortization Increase:

In FY24, Netflix expects a high single-digit percentage year-over-year increase in content amortization, reinforcing its dedication to developing and sustaining intellectual property (IP). The ambitious content slate for 2024, spanning returning dramas, unscripted series, and brand new shows, suggests the company's ongoing investment in diverse and compelling content.

Live Programming and Experiences:

Netflix's foray into live programming and experiences, as demonstrated by events like the SAG Awards, Netflix Slam, and the exclusive live airing of WWE's Raw starting in January 2025, showcases a focus on understanding audience preferences. These initiatives enable Netflix to experiment with different formats and eventize moments, ultimately contributing to increased member engagement.

Games Offering and Engagement:

While still in its early stages, Netflix's games offering has shown promising results with a tripling of engagement in the last year. Despite being relatively small compared to the film and series business, the successful launch of the Grand Theft Auto trilogy highlights consumer interest in gaming content on the platform. As Netflix continues to invest and experiment in the gaming space, it opens up additional avenues for member engagement.

Specific Downsides and Risks

Ads Business Growth:

Netflix's ambitious expansion into the ads business, noting a substantial 70% quarter-over-quarter growth in ads membership during Q4'23. While growth is typically a positive indicator, the rapid pace of expansion raises questions about sustainability and potential consequences for the company. Notably, the ads plan now constitutes 40% of all Netflix sign-ups in ads markets, indicating a significant shift in the revenue mix. This reliance on the ads business introduces vulnerability, as any unforeseen challenges in this sector could disproportionately impact Netflix's overall financial health.

The potential for overreliance on ads becomes apparent when considering its share in overall sign-ups. If this growth is not met with a proportional increase in revenue and profitability, Netflix may find itself exposed to uncertainties in the advertising market.

Increased Reliance on Ads Revenue:

Netflix's shift toward greater dependence on ads revenue is evident, particularly as the ads plan constitutes a substantial portion of sign-ups. While diversification is a common strategy, overemphasis on a single revenue stream poses inherent risks. If the ads business were to face challenges or if the advertising market experiences downturns, Netflix's financial health could be disproportionately affected.

The relationship between ads revenue and Netflix's overall financial performance is crucial. If ads revenue does not exhibit a commensurate contribution to the company's revenue growth, its overreliance on this stream could lead to financial instability.

Transitioning Away from Basic Plan:

The decision to retire the Basic plan in some ads countries, starting with Canada and the UK in Q2, adds another layer of complexity to Netflix's strategy. The implications of this transition need thorough examination. Retiring a plan that may be familiar to existing users introduces potential disruptions, and Netflix needs to carefully assess the impact on subscriber retention and satisfaction. If the transition results in a decline in subscriber numbers or dissatisfaction among existing users, the overall success of the ads strategy could be compromised.

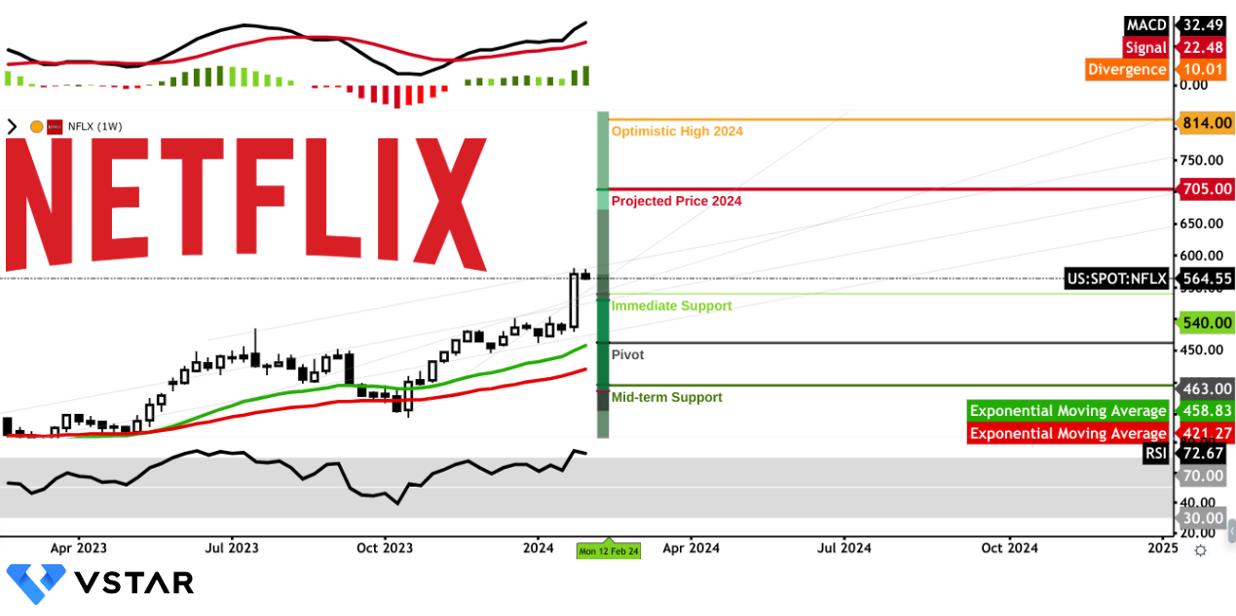

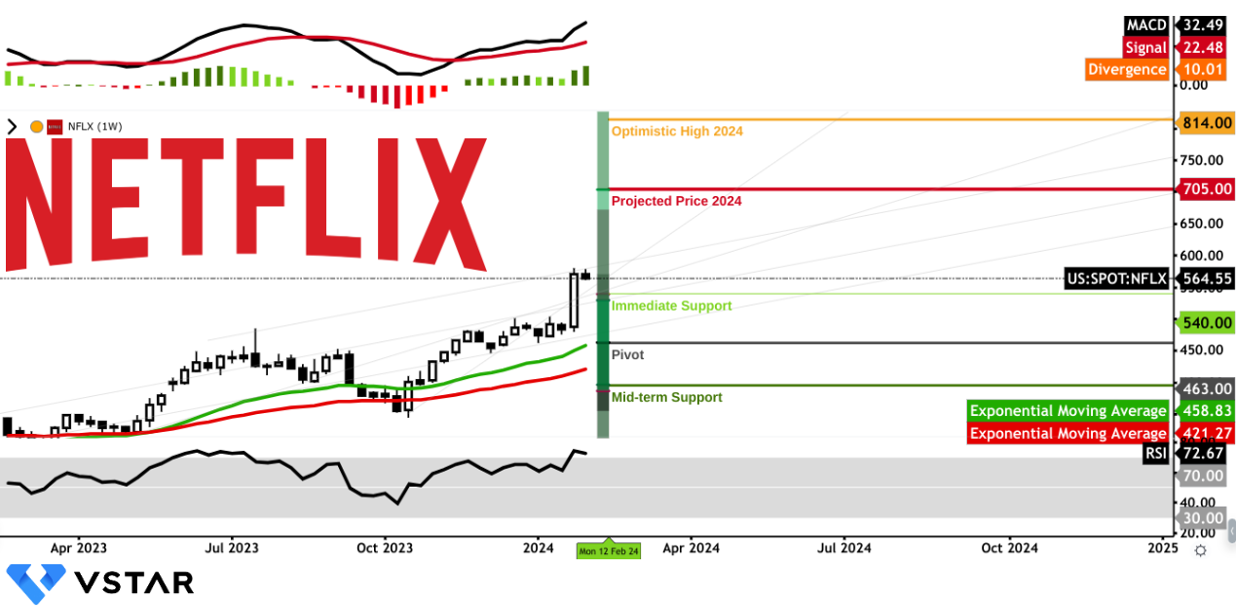

NFLX Stock Technical Take

Source: gocharting.com

The Netflix stock price may hit $705 by the end of 2024. However, considering the stock's current momentum, the NFLX stock price may reach a high of $814 by the end of 2024. The projection is primarily based on the Fibonacci retracement and ongoing bullish momentum.

Looking at the moving average convergence/divergence (MACD) and exponential moving averages (EMAs, fast-green and slow-red), a solid uptrend can be observed. Considering the strong divergence in both indicators, the stock may hit the projected price earlier than expected.

Now looking at the relative strength index (RSI), the value of 72 highlights an overbought level. Here, a small correction can be expected. On the downside, $540 serves as immediate support, whereas $463 has emerged as a pivot level, in line with the fast EMA. Finally, $395 is vital mid-term support. However, reaching this level is less likely for the stock.

In conclusion, Netflix's ascent is anchored in fundamental strengths, navigating an industry rife with competition. The pillars of robust revenue growth, subscriber loyalty, strategic pricing, and optimized operating margins form an unassailable foundation. As the streaming giant eyes 2024, its focus on content quality, innovative offerings, and global expansion remains unwavering. The stock's technical trajectory aligns with the narrative, suggesting a potential surge to $814.