I. Recent Nio Stock Performance

Nio Inc. (NYSE: NIO), a Chinese electric vehicle (EV) manufacturer, has seen volatile stock performance in recent months. With a 52-week range between $4.45 and $16.18, Nio's stock has experienced significant fluctuations.

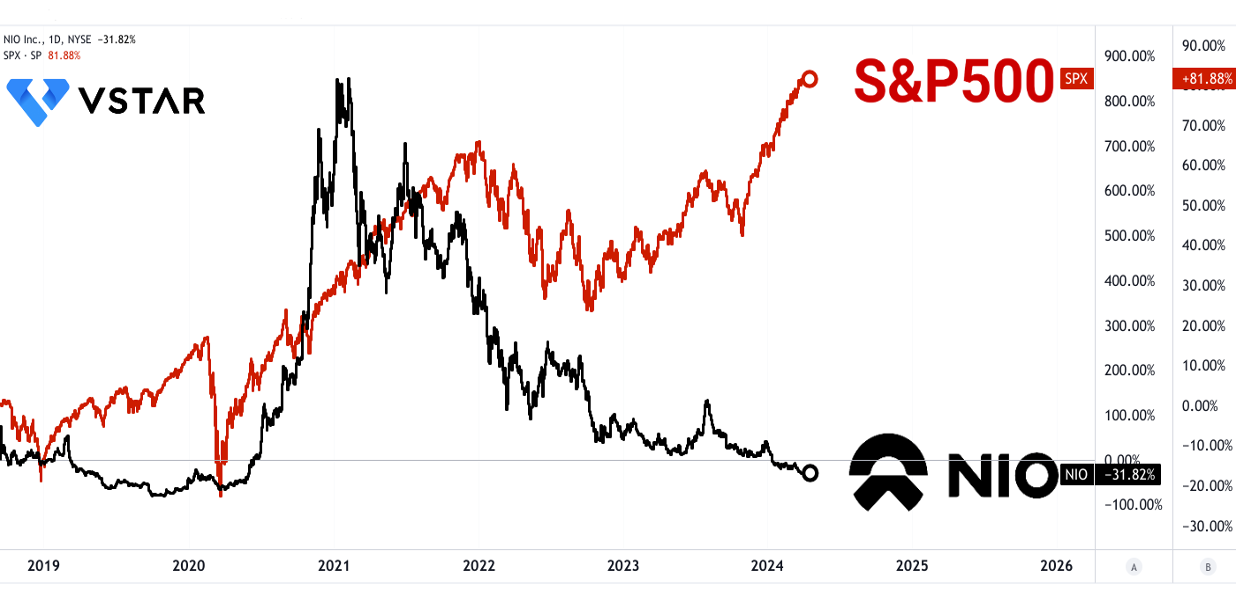

Over the past year, Nio's stock price has witnessed a decline of approximately 50%. This contrasts starkly with the positive price performance seen in the sector, with a median increase of 9% and its own historical five-year average of 253% (1Y Price Performance). This suggests that Nio's stock has underperformed compared to its peers over both short and long-term periods. Similarly, the stock has decisively underperformed the broader market, the S&P 500 yielded +28% price return over 1Y.

Source: tradingview.com

The momentum indicators further highlight this underperformance. Over the last three months, Nio's stock price dropped by 49%, which is notably lower than the sector median of +1%. Similar trends are observed over six and nine-month periods.

Several factors could have contributed to Nio's lackluster performance, including concerns over global supply chain disruptions, chip shortages impacting EV production, and broader market sentiment towards growth stocks. Additionally, competition within the EV sector, particularly from established players like Tesla and emerging competitors, might have added pressure.

To be specific, Several key factors influence Nio's stock performance and changes:

Delivery Performance: Nio's delivery figures are a crucial metric for evaluating its growth trajectory. In Q4 2023, Nio delivered 50,045 premium smart EVs, marking a 25% year-over-year increase. Full-year cumulative deliveries reached 160,038 units, showcasing substantial growth over the previous year.

Product Developments: Nio's product launches and technological advancements significantly impact investor sentiment. Nio Day 2023 unveiled the Nio ET9, featuring cutting-edge technologies like the NX9031 Full-Domain 900v architecture and the SkyRide Chassis System. Additionally, the announcement of the 2024 model with enhanced performance and computing capabilities demonstrates Nio's commitment to innovation.

Financial Performance: Nio's financial results, particularly gross margin and revenue, provide insights into its operational efficiency and profitability. Despite challenges, Nio reported a vehicle gross margin increase to 11.9% in Q4 2023, reflecting improvements in cost management and efficiency.

Market Expansion and Partnerships: Nio's strategic initiatives, such as expanding its charging and swapping network, forging partnerships with energy companies, and collaborating with other automakers on battery swap technology, demonstrate its efforts to strengthen its ecosystem and market presence.

Regulatory and Geopolitical Environment: Changes in regulations and geopolitical space regarding electric vehicles, subsidies, trade, and environmental initiatives in China, EU, and US may continue to impact Nio's business operations and valuation prospects.

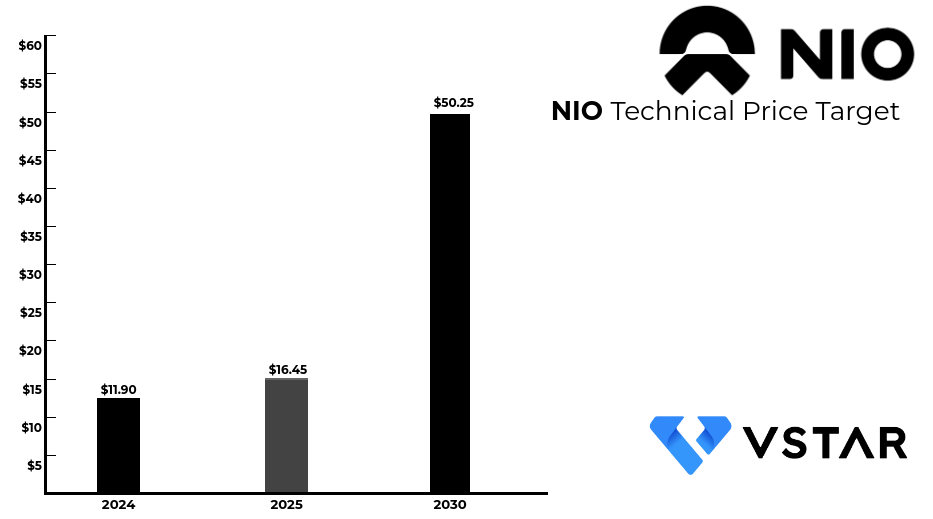

Expert Insights on NIO Stock Forecast for 2024, 2025, 2030 and Beyond

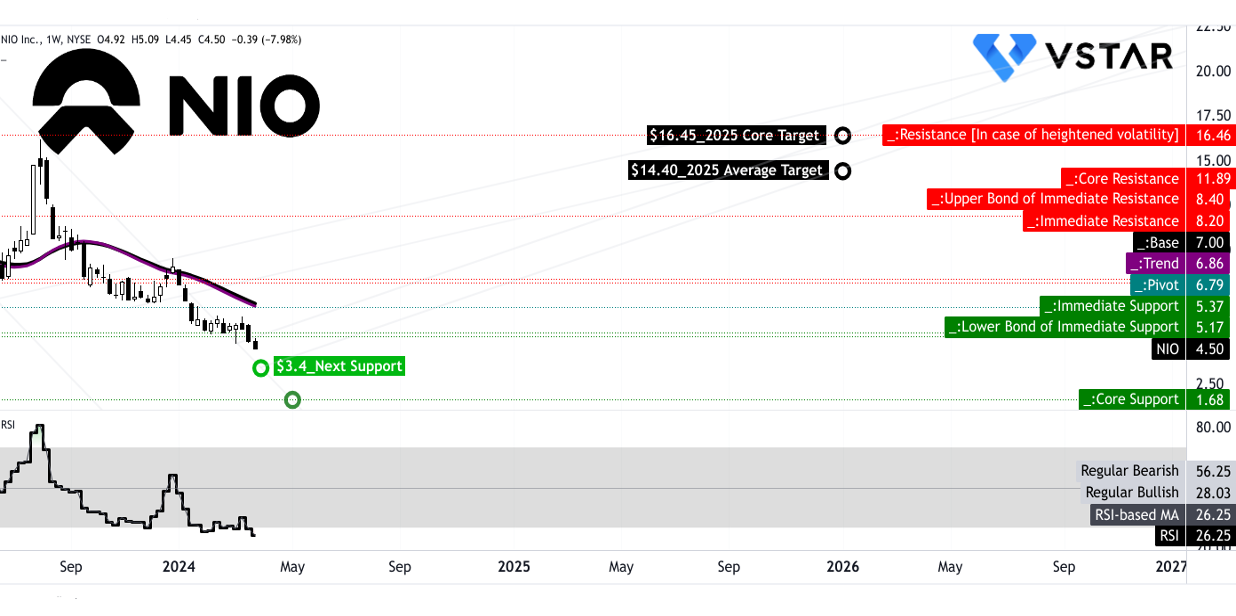

Technical analysts anticipate a positive trajectory for Nio's stock, with targets set at $11.90 for 2024, $16.45 for 2025, and $50.25 for 2030. These projections signal optimistic growth prospects buoyed by the burgeoning EV market, technological advancements, and Nio's strategic maneuvers. The forecasts reflect confidence in Nio's fundamental capability to capitalize on industry trends and solidify its position in the evolving automotive space.

Source: Analyst's compilation

II. Nio Stock Forecast 2024

Nio stock may hit $11.90 based on the current price momentum and forward projections over Fibonacci retracement and expansion levels. Currently, the stock is experiencing a severe downtrend over the past two years. In this direction, the next critical support emerged at $3.4 and $1.68. Critically, $1.68 is the last and final technical support. Below that level, only fundamentals may determine the forward price of the stock.

Looking at the relative strengths index (RSI), NIO stock is in an oversold state. At 26, the RSI suggests a high bullish opportunity to invest in the stock. The level is considered below the regular bullish level (at 28). On the upside, the price may experience severe resistances at 5.17, 6.79, and 8.20. These levels are the lower bond, pivot, and upper bond of the current horizontal price channel. After delivering a proper close above 8.20, the price may optimistically hit $14.

Source: tradingview.com

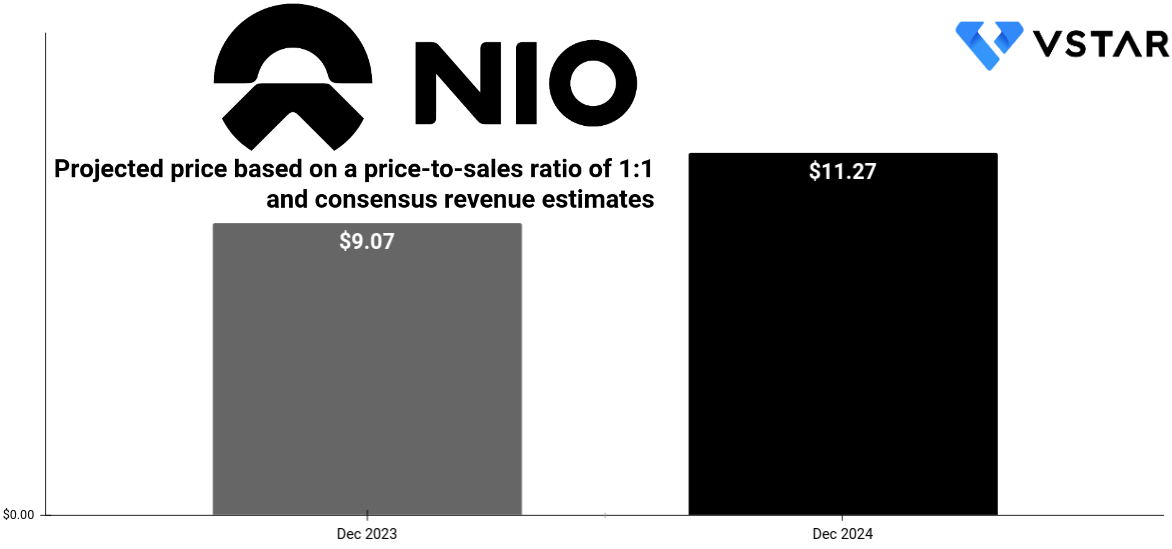

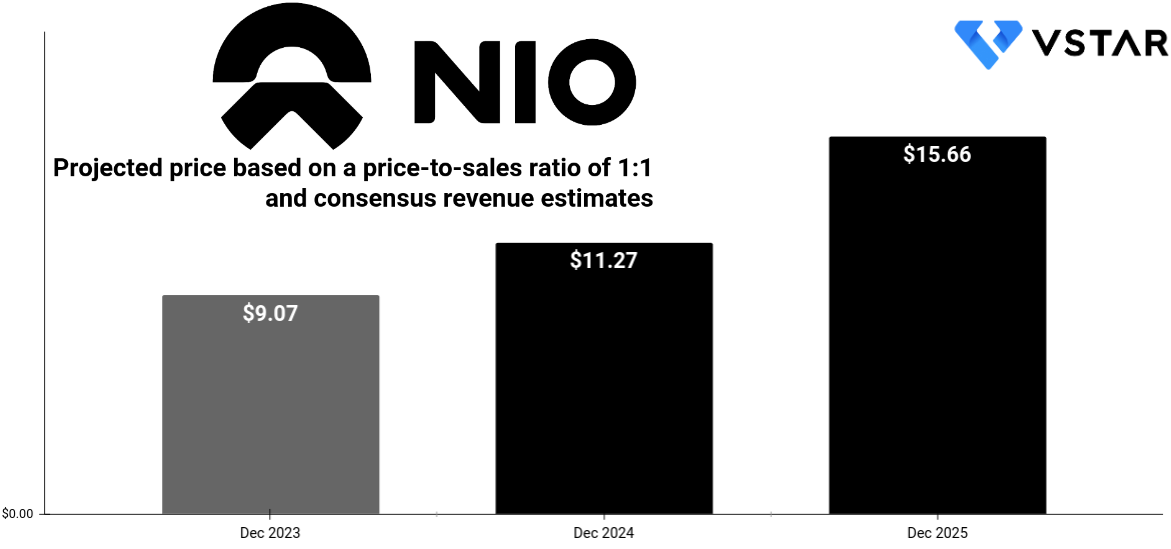

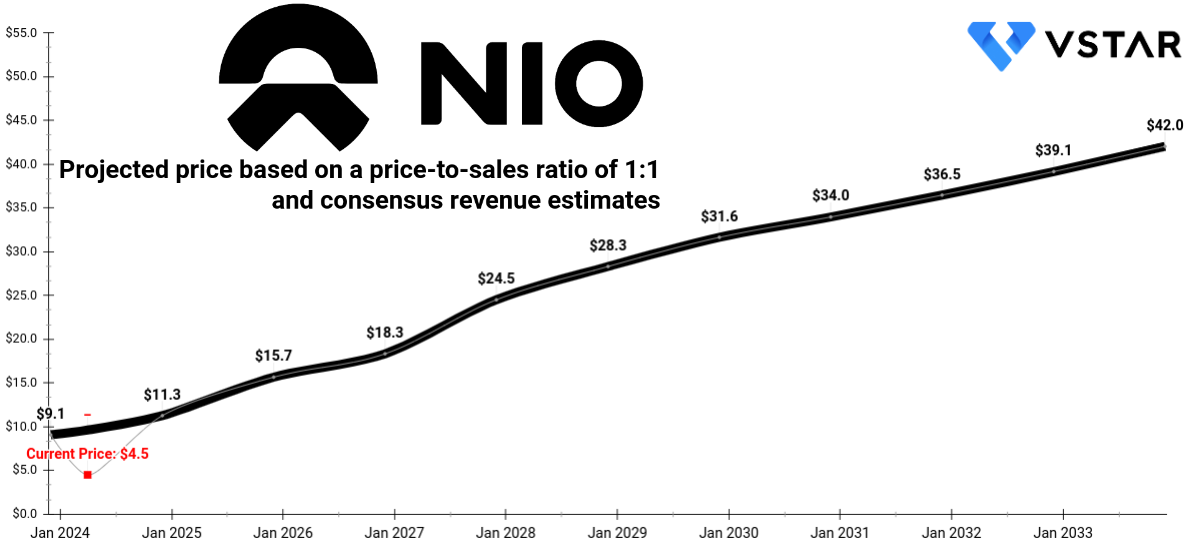

Looking at valuation fundamentally, the price-to-sales ratio of 1:1 is ideal for conservative forward price projection. Projecting the consensus revenue estimates for 2024 over this ratio leads to a price of $11.27. A price-to-sales ratio of 1:1 seems like a very applicable valuation metric for the current state of the drastically beaten-down stock price of Nio. With a positive macro signal in the business environment of Nio, the price may reach this theoretical level at least.

Source: Analyst's compilation

Coinpriceforecast.com predicts a bullish Nio stock outlook in 2024. Their forecast indicates a mid-year price of $5.33 and a year-end target of $5.87, representing a potential increase of 30%. Such projections highlight optimism surrounding Nio's performance and growth prospects in the coming year.

A. Other 2024 NIO Stock Forecast Insights: Will Nio Stock Go Up?

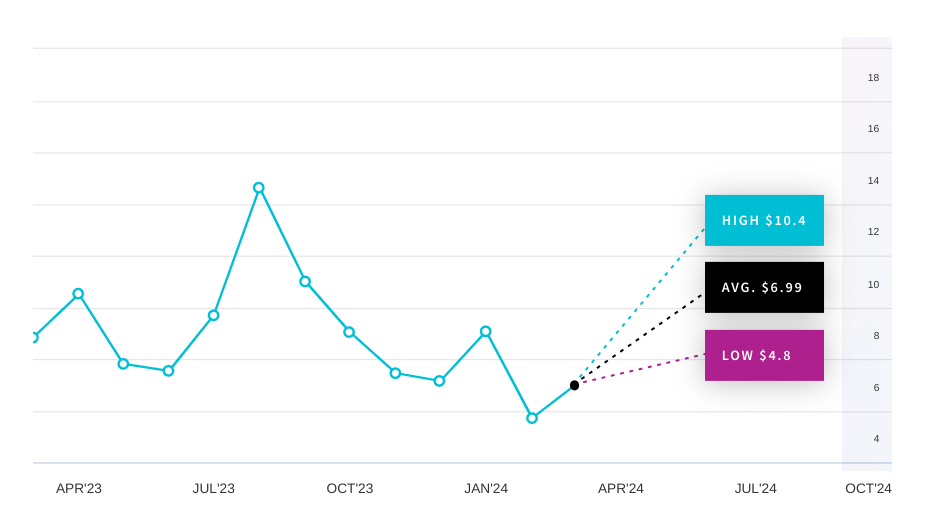

In assessing the forecast insights for NIO stock in 2024, it's crucial to analyze the recommendations and price targets provided by various institutions and analysts.

UBS (Paul Gong) - Neutral Rating:

Nio Price Target Change: $8 → $7.2

Percentage Upside: 59.63%

UBS maintains a neutral stance on NIO stock, with a price target reduction from $8 to $7.2. Despite the upside potential, the neutral rating suggests a cautious outlook.

HSBC (Yuqian Ding) - Buy Rating:

Nio Price Target Change: $10.2 → $7.9

Percentage Upside: 75.15%

HSBC maintains a Buy rating on NIO stock but lowers the price target from $10.2 to $7.9. Despite the lowered target, the substantial upside indicates confidence in the stock's performance.

Morgan Stanley (Tim Hsiao) - Overweight Rating:

Nio Price Target Change: $13 → $10

Percentage Upside: 121.71%

Morgan Stanley remains bullish on NIO, maintaining an overweight rating. However, they revised the Nio stock price target downward from $13 to $10, still indicating significant upside potential.

Bernstein (Eunice Lee) - Market Perform Rating:

Nio Price Target Change: $7.5 → $5.5

Percentage Upside: 21.94%

Bernstein maintains a market perform rating, with a lowered price target of $5.5 from $7.5. This suggests a more conservative outlook compared to some other analysts.

BofA Securities (Ming Hsun Lee) - Neutral Rating:

Nio Price Target Change: $7.5 → $6.5

Percentage Upside: 44.11%

BofA Securities maintains a neutral rating on NIO stock, with a reduced price target of $6.5 from $7.5. This indicates a moderate upside potential.

Jefferies (Xiaoyi Lei) - Hold Rating:

Nio Price Target Change: $8.3 → $5.9

Percentage Upside: 30.81%

Jefferies maintains a hold rating on NIO stock, with a lowered price target of $5.9 from $8.3. This suggests a more cautious stance on the stock's future performance.

Barclays (Jiong Shao) - Equal-Weight Rating:

Nio Price Target Change: $8 → $5

Percentage Upside: 10.86%

Barclays maintains an equal-weight rating on NIO stock, with a reduced price target of $5 from $8. This indicates a more balanced view, with modest upside potential.

Overall, Nasdaq has a collective analysts' average price target of $6.99. These forecast insights reveal a range of perspectives from different institutions and analysts. While some maintain bullish outlooks with significant upside potential, others adopt a more cautious or neutral stance, reflecting varying assessments of NIO's future performance.

Source: nasdaq.com

B. Key Factors to Watch for Nio Stock Price Prediction 2024

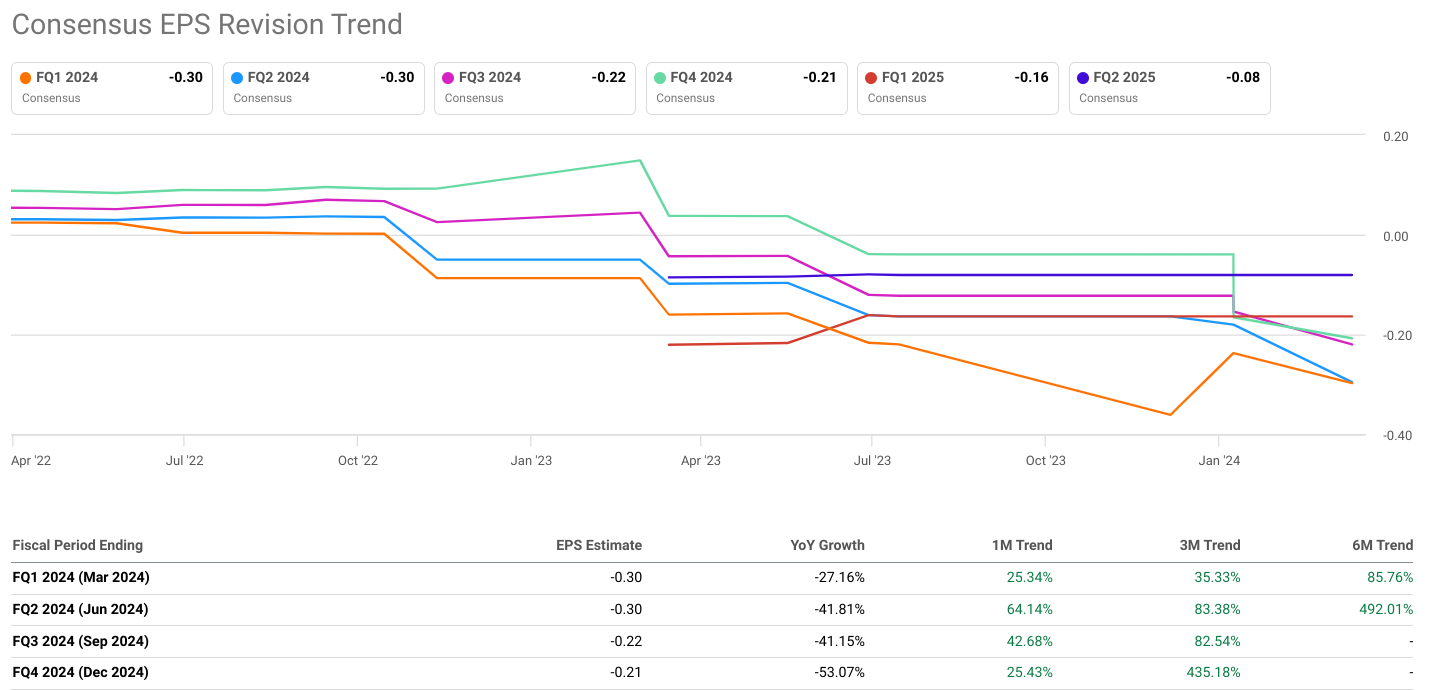

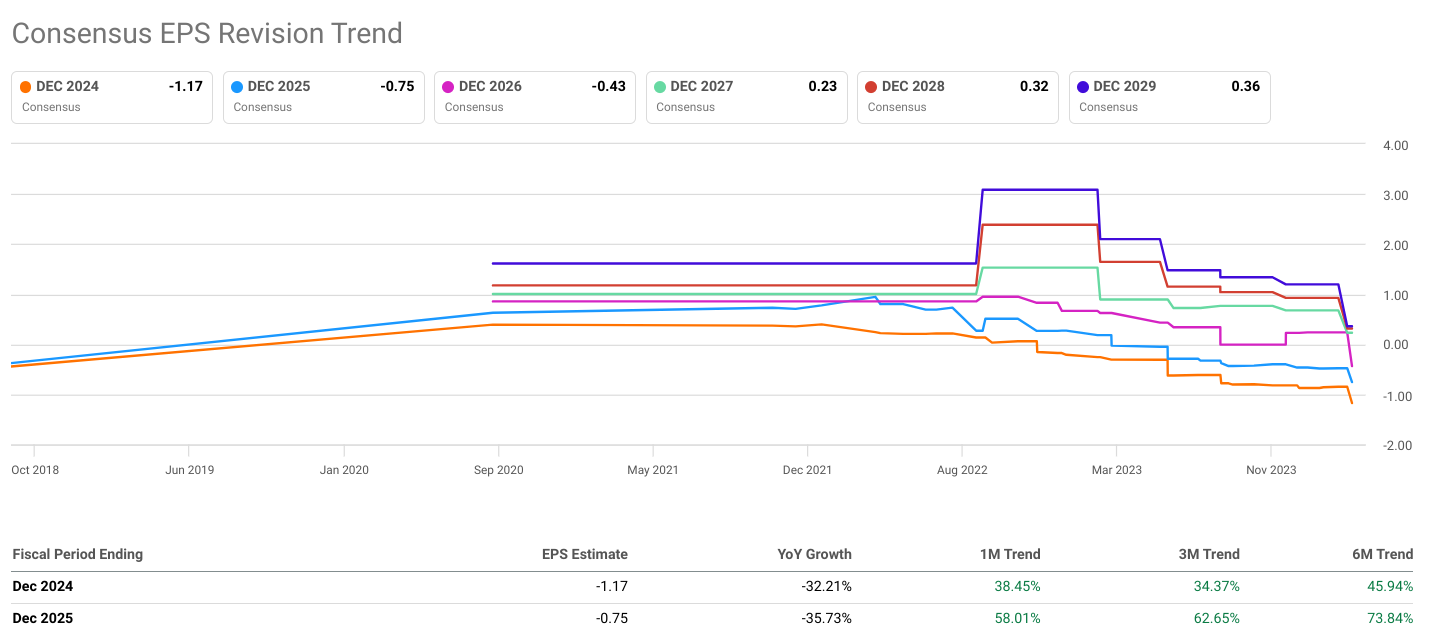

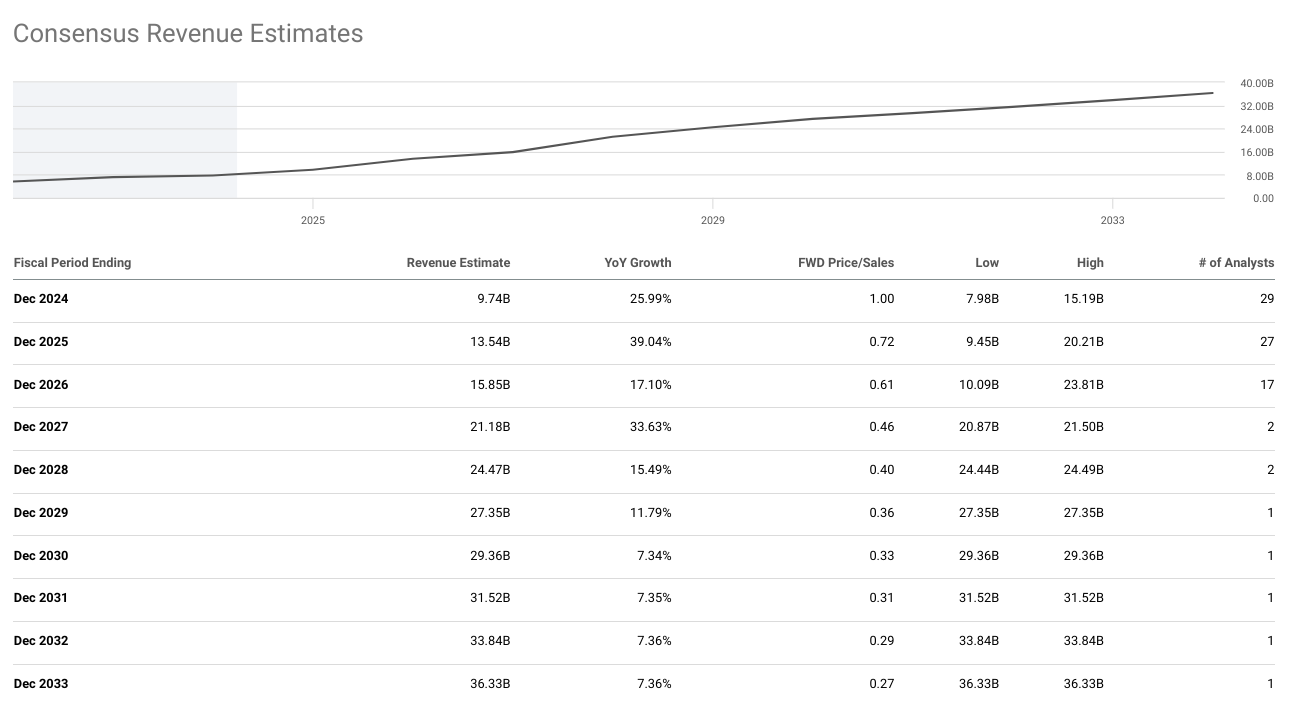

Nio's financial forecast for 2024 showcases both positive and negative indicators. Consensus estimates suggest a YoY growth in EPS of 32.21%, with an estimated EPS of -1.17. Similarly, revenue estimates anticipate a YoY growth of 25.99%, with estimated revenue of $9.74 billion. However, these estimates also reveal a forward P/E ratio of -3.84 and a forward Price/Sales ratio of 1.00. The recent EPS revisions solid drop for each quarter of 2024.

Source: seekingalpha.com

Bullish Factors for Nio Stock Forecast 2024

Strong Delivery Growth: Nio has consistently demonstrated robust delivery growth, with significant year-over-year increases. In Q4 2023, Nio delivered 50,045 premium smart EVs, marking a 25% YoY growth. This consistent growth trajectory bodes well for Nio's future performance and revenue generation potential.

Product Innovations: Nio continues to innovate its product lineup, enhancing performance and driving consumer interest. The unveiling of the Nio ET9 at Nio Day 2023 showcased the company's technological prowess and commitment to offering cutting-edge electric vehicles. Such innovations can attract investors and boost market sentiment towards Nio's stock.

Bearish Factors for Nio Stock Prediction 2024

Supply Chain Disruptions: Global supply chain disruptions, particularly semiconductor shortages, have plagued the automotive industry. These disruptions can hinder Nio's production capabilities and lead to delays in vehicle deliveries, impacting revenue generation and investor confidence.

Competition: The electric vehicle market is becoming increasingly competitive, with both domestic and international players vying for market share. Established competitors like Tesla and emerging rivals pose challenges to Nio's market position and profitability. Intensifying competition could exert downward pressure on Nio stock price.

III. Nio Stock Forecast 2025

By the end of 2025, Nio stock price may hit $16.45 based on recent stock price momentum projected over Fibonacci retracement and expansion levels. However, if recent swings are considered to be forming support levels between $5.17 and $3.40, then the price target for Nio price prediction 2025 can be expected to be $14.40.

Similar to the 2024 forecast, On the upside, the price may experience severe resistances at 5.17, 6.79, and 8.20. These levels are the lower bond, pivot, and upper bond of the current horizontal price channel. Therefore, these levels are equally applicable to the Nio forecast 2025. On its move towards the targets, the price may experience around $11.90.

Furthermore, looking at RSI at 26, over the midterm, the price may require an extended markup phase to hit the overbought level above 70. Following the historical pattern, the indicator will create a double bottom over the next few weeks, which may lead to a price consolidation. This price consolidation signifies a potential accumulation phase. This will be followed by the rapid price ascent under a markup phase over the mid-term.

Source: tradingview.com

Projecting the price over the price-to-sale ratio of 1:1 with the consensus revenue estimate of $13.54 billion for 2025. The revenue estimate here signifies a 39% YoY growth over 2024 revenues. The growth may lead the stock to a price of $15.66 for the year. It is assumed that Nio will not issue new equity over the same period.

Source: Analyst's compilation

Nio stock forecasts for 2025 vary among different sources. Coincodex.com predicts a long-term Nio target price of $11.60 by the end of 2025, suggesting substantial growth potential. Conversely, coinpriceforecast.com forecasts a lower long-term Nio stock price target 2025 of $7 by the same period. Such disparities highlight the uncertainty in predicting stock performance and the importance of considering multiple sources for informed decision-making.

A. Other 2025 NIO Stock Prediction Insights: Is Nio a Good Stock to Buy?

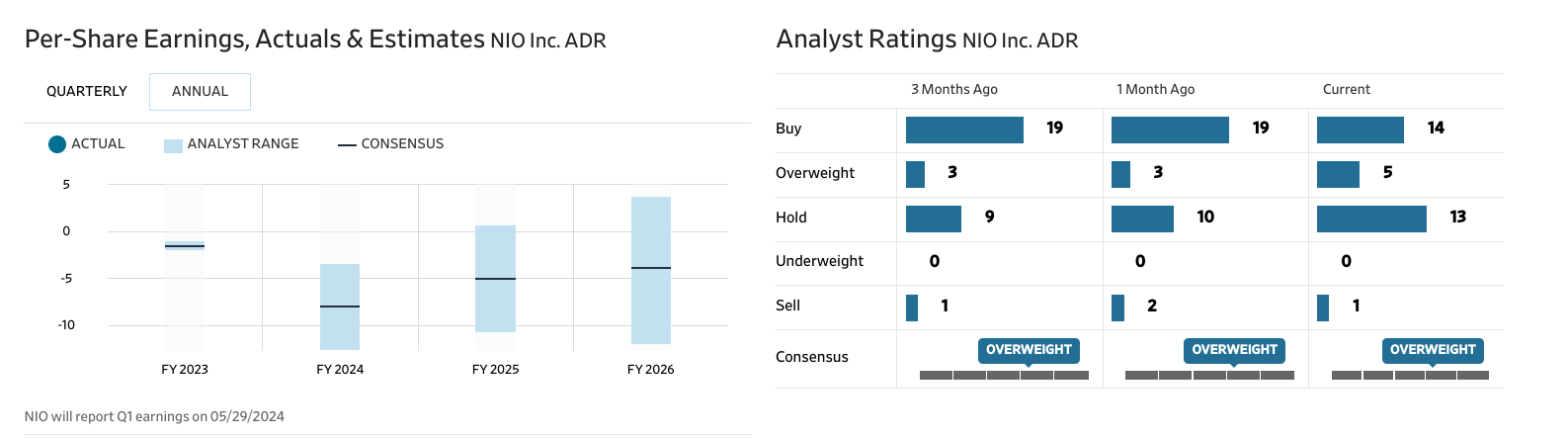

The Wall Street Journal's listed EPS estimates indicate progression after 2024. This is a positive development for the market valuation of Nio. Following the current analysts' rating on NIO ADRs, the sentiment seems neutral (no buy, no sell).

Source: WSJ.com

BofA Securities downgraded to Neutral, citing a lack of new models in the first half of the year, which could dampen sales. To support the launch of its new brands, including the high-end ET9 sedan, NIO may need to adjust pricing strategies and bolster marketing efforts.

Goldman Sachs' sales forecast for NIO from 2024 to 2025 falls 11-14% below consensus expectations due to overly optimistic sales volume projections. NIO's portfolio may result in a relatively limited pipeline of new models over the next two years, with one model under the NIO brand and two under the Alps sub-brand.

While recent financing activities, such as a $1 billion convertible bond issuance and a $2.2 billion equity investment, have alleviated financial pressures, Goldman Sachs anticipates negative free cash flow for NIO until 2026. Despite the challenges, NIO remains optimistic about improved sales volume by the end of the year and into 2025, buoyed by positive market sentiment and an investment infusion from Abu Dhabi's CYVN Holdings.

These developments underscore the dynamic nature of NIO's market positioning and financial outlook. While near-term concerns persist regarding sales projections and operational expenses, the company's strategic initiatives, including the expansion of its product lineup and financial restructuring, are aimed at sustaining long-term growth and competitiveness in the electric vehicle sector.

B. Key Factors to Watch for Nio Stock Price Prediction 2025

Nio's financial forecast for 2025 suggests improvements in both earnings per share (EPS) and revenue. Consensus estimates anticipate a YoY growth in EPS of 35.73%, with an estimated EPS of -0.75. Similarly, revenue estimates indicate a YoY growth of 39.04%, with estimated revenue of $13.54 billion. However, these estimates also reveal a forward P/E ratio of -5.97 and a forward Price/Sales ratio of 0.72.

The overall bearish sentiment for the Nio's bottomline can be observed in the analysts' annual EPS estimates revised downwards for upcoming years.

Source: seekingalpha.com

Bullish Factors for Nio Stock Forecast 2025

Product Innovation and Expansion: Nio is poised to introduce new models and enhance existing ones, leveraging technological advancements to meet consumer demand. The company's plans for subsequent models demonstrate a commitment to innovation and product differentiation, which can drive sales and revenue growth.

Expansion of Ecosystem: Nio is expanding its ecosystem beyond vehicle manufacturing, focusing on charging infrastructure and battery swap stations. The company's plans to build 1000 new battery swap stations and 20,000 chargers by the end of 2024 demonstrate its commitment to infrastructure development, which can support future sales growth and revenue streams.

Market Expansion: Nio aims to expand its market presence both domestically and internationally. The company's focus on entering new markets and increasing brand visibility can drive sales volume and revenue growth. Expansion into key markets such as Europe presents significant opportunities for Nio to capture market share and achieve sustainable growth.

Bearish Factors for Nio Stock Prediction 2025

Competition: The EV market is highly competitive, with numerous players vying for market share. Established competitors like Tesla and emerging rivals pose challenges to Nio's market position and profitability. Intensifying competition could exert downward pressure on Nio's sales volume and margins, impacting its stock price.

Financial Metrics: Despite revenue growth projections, Nio's forward P/E ratio and Price/Sales ratio indicate negative valuations, suggesting investor concerns regarding profitability and financial performance. These metrics may deter potential investors and weigh on Nio's stock price, especially if the company fails to demonstrate improvement in key financial indicators.

IV. Nio Stock Forecast 2030 and Beyond

Nio stock price may hit $50.25 by the end of 2030. The projection is based on the swings in the monthly time frame projected over Fibonacci retracement and expansion levels. Although $50.25 is the primary target, the average projection suggests $42.50 as a target for the decade.

On the down side, $3.40 serves as a final support for Nio stock; the technical analysis will only be effective above this level. Establishing a long position below this level can be considered speculative and may or may not yield considered price returns over the upcoming years.

Looking at the RSI, an emerging bearish divergence can be observed at current price levels. This divergence signals massive upside potential and should not be ignored. On the upside, closes above $9.90, $13.75, and $22 are vital, as these are the critical long-term resistance levels. These levels may serve as sharp fractions of the potential markup phase.

Source: tradingview.com

Moving to theoretical valuations using a price-to-sales ratio of 1:1, the stock price can be projected over consensus revenue estimates related to 2026–2033. This projection suggests $34 as a price target for 2030. Considering the variability of the current price from the ongoing projections, These levels hold massive volatility over the time frame. For instance, the price should be $9.6 as of now based on the projections, but it is still hovering at $4.5. This drift suggests inherent risk in long-term investment.

Source: Analyst's complication

The forecasts for Nio stock 2030 from coincodex.com and coinpriceforecast.com present divergent perspectives. Coincodex.com predicts an aggressive growth trajectory, with Nio stock price projected to reach $1,318.54 by the end of 2030. This forecast implies an astronomical increase of 29,200.79% from the base year, showcasing exceptionally bullish sentiment.

Conversely, coinpriceforecast.com offers a more conservative outlook, forecasting Nio stock to reach $15.99 by the end of 2030. While this projection still demonstrates significant growth potential, it falls considerably short of coincodex.com's forecast.

These disparities underscore the uncertainty inherent in long-term stock forecasting, influenced by various factors such as market trends, company performance, technological advancements, and regulatory developments. Nio's future performance will likely hinge on its ability to navigate challenges, capitalize on opportunities, and deliver sustained growth in the competitive electric vehicle market.

A. Other NIO Stock Prediction 2030 and Beyond Insights: Is Nio a Buy?

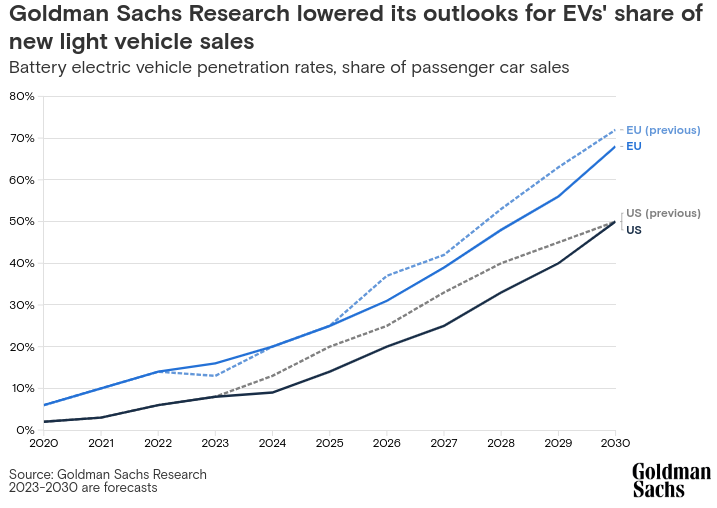

Goldman Sachs's outlook on EVs emphasizes several key points that shape the trajectory of the electric vehicle industry. These developments are positive for Nio's fundamental performance, especially its expansion in the international market (US and EU), which will in turn boost the market valuation of the company.

Despite a temporary slowdown in EV sales, falling battery prices are anticipated to drive future growth. Lower battery costs are crucial for enhancing EV affordability and competitiveness against traditional internal combustion engine vehicles. Goldman Sachs forecasts a significant decline in battery prices by nearly 40% between 2023 and 2025, facilitating cost parity with conventional cars in certain markets by next year.

In the market, Car manufacturers have expressed concerns about EV profitability due to price competition and high raw material costs. However, recent moderation in raw material prices and advancements in battery technology, such as simplifying manufacturing processes and using innovative materials like silicon, are expected to alleviate profit pressures. Solid-state batteries, a potential game-changer in the industry, promise higher energy density and faster charging times.

However, supportive government policies, particularly in the US and EU, play a crucial role in driving EV adoption. Initiatives like the US Inflation Reduction Act's subsidies and the EU's carbon emission targets and bans on internal combustion engine cars incentivize consumers and manufacturers to transition to electric vehicles. Similarly, mandates and subsidies in countries like the UK, Spain, and France further bolster demand for EVs.

Finally, Goldman Sachs projects a significant increase in EV market share, reaching 50% in the US and 68% in the EU by 2030. This bullish outlook reflects the anticipated convergence of favorable market conditions, technological advancements, and supportive regulatory frameworks driving widespread EV adoption.

Source: goldmansachs.com

B. Key Factors to Watch for Nio Stock Price Prediction 2030 and Beyond

Nio's financial forecast for 2030 projects significant growth in both earnings per share (EPS) and revenue. Consensus estimates anticipate a YoY growth in EPS of 10.04%, with an estimated EPS of $0.40. Similarly, revenue estimates indicate a YoY growth of 7.34%, with estimated revenue of $29.36 billion. However, these estimates also reveal a forward PE ratio of 11.36 and a forward Price/Sales ratio of 0.33. Over the long-term the consensus revenue projections are progressive.

Bullish Factors for Nio Forecast 2030 and Beyond

Market Expansion: Nio is strategically expanding its market presence beyond China, with plans to enter key international markets such as Europe and North America. By tapping into these markets, Nio can access a broader customer base and diversify its revenue streams, reducing reliance on any single market and mitigating geopolitical risks.

Ecosystem Development: Nio's ecosystem approach, which includes battery swap stations, charging infrastructure, and value-added services like Nio Life, strengthens customer loyalty and engagement. The expansion of Nio's ecosystem enhances the overall ownership experience for customers, driving brand loyalty and repeat purchases, ultimately boosting revenue and profitability.

Sustainable Initiatives: As sustainability becomes increasingly important in the automotive industry, Nio's focus on eco-friendly practices and renewable energy solutions positions it favorably among environmentally conscious consumers. Initiatives such as carbon neutrality goals, recycling programs, and sustainable manufacturing processes not only align with consumer preferences but also enhance Nio's brand reputation and market appeal.

Bearish Factors for Nio Price Prediction 2030 and Beyond

Competition Intensification: The EV market is becoming increasingly competitive, with both traditional automakers and new entrants investing heavily in electric vehicle technology. Intensifying competition could lead to pricing pressures, reduced margins, and higher marketing expenses for Nio, potentially affecting its market share and profitability in the long term.

Supply Chain Vulnerability: Nio's operations are vulnerable to disruptions in the global supply chain, including shortages of critical components like semiconductors and batteries. Supply chain disruptions could lead to production delays, increased costs, and reduced revenue, impacting Nio's financial performance and investor confidence.

Macroeconomic Factors: Nio's stock price could be influenced by broader macroeconomic factors such as economic downturns, geopolitical issues, fluctuations in consumer sentiment, and currency exchange rates. Economic uncertainties or geopolitical tensions may affect consumer spending habits and investor confidence, impacting Nio's sales volume, revenue growth, and stock valuation.

V. Nio Stock Price History Performance

Nio Stock Price Year-Wise Key Milestones

The market capitalization of Nio has evolved year wise. The related major events are listed alongside that led to the YoY change in the market cap.

2018:

Market Cap: $6.69 billion

Key Events: Nio's IPO in September 2018 marked a significant milestone for the company. The stock debuted on the New York Stock Exchange (NYSE) at $6.26 per share. Despite challenges in the Chinese EV market, Nio's listing garnered attention due to its potential to compete with Tesla.

2019:

Market Cap: $4.27 billion

Change: -36.07%

Key Events: In 2019, Nio faced numerous challenges, including a slowdown in EV demand in China, subsidy reductions, and liquidity concerns. The company reported lower-than-expected vehicle deliveries and incurred substantial losses, leading to a decline in its market cap.

2020:

Market Cap: $75.98 billion

Change: 1675.6%

Key Events: Nio stock experienced a remarkable turnaround in 2020, fueled by strong sales growth, improved vehicle deliveries, and positive sentiment towards EV stocks. The company launched its flagship ES6 and ES8 models, expanding its product lineup and attracting investors' attention amid growing EV adoption globally.

2021:

Market Cap: $50.38 billion

Change: -33.68%

Key Events: Despite continued revenue growth and expansion efforts, Nio stock experienced volatility in 2021. Concerns over increasing competition, supply chain disruptions, and regulatory challenges in China contributed to fluctuations in the stock price and a decline in market capitalization.

2022:

Market Cap: $16.34 billion

Change: -67.56%

Key Events: In 2022, Nio stock price faced significant headwinds amid broader market volatility, inflation concerns, and regulatory uncertainties. The company grappled with production disruptions, supply chain constraints, and increased scrutiny from Chinese regulators, leading to a sharp decline in market capitalization.

2023:

Market Cap: $16.19 billion

Change: -0.89%

Key Events: Despite ongoing challenges, Nio stabilized its stock price in 2023, reflecting efforts to address operational issues, enhance product quality, and expand its market presence. The company focused on improving profitability, streamlining operations, and investing in research and development to strengthen its competitive position.

2024:

Market Cap: $9.40 billion

Change: -41.94%

Key Events: In 2024, Nio faced renewed investor concerns over slowing growth, margin pressures, and regulatory risks. The company's stock price experienced a significant decline, reflecting broader market volatility and skepticism towards high-growth stocks. Nio continued to navigate challenges in the competitive EV market while focusing on innovation and operational efficiency.

Source: tradingview.com

Nio Stock Price History Performance

1-Week Performance:

Nio's stock price experienced a decline of 11.76% over the past week, underperforming the S&P 500, which had a positive return of 0.57%. This short-term performance may be influenced by various factors such as market sentiment, company news, or broader economic conditions.

1-Month Performance:

Over the past month, Nio's stock price declined by 22.15%, while the S&P 500 posted a return of 3.47%. This significant decrease in Nio's stock price could be attributed to concerns over supply chain issues, competition in the electric vehicle (EV) market, or changes in investor sentiment towards growth stocks.

6-Month Performance:

Nio's stock price performance over the past six months reflects a substantial decline of 46.81%, significantly underperforming the S&P 500, which recorded a positive return of 22.92%. Factors contributing to this decline may include regulatory challenges in China, chip shortages impacting production, and concerns about EV subsidies.

Year-to-Date (YTD) Performance:

Year-to-date, Nio's stock price has decreased by 50.39%, reflecting challenges faced by the company amid the broader market rally. In contrast, the S&P 500 posted a positive return of 10.16% during the same period. Investor concerns regarding Nio's delivery targets, margin pressures, and global semiconductor shortages likely contributed to this performance.

1-Year Performance:

Over the past year, Nio's stock price declined by 49.61%, while the S&P 500 recorded a return of 32.10%. This underperformance may reflect investor apprehensions regarding Nio's ability to maintain growth momentum amidst increasing competition, regulatory uncertainties, and concerns about profitability.

3-Year Performance:

Nio's stock price performance over the past three years has been particularly volatile, with a significant decline of 87.54%. In comparison, the S&P 500 posted a positive return of 32.20% during the same period. Factors such as fluctuating EV market dynamics, geopolitical tensions, and company-specific challenges contributed to this decline.

5-Year Performance:

Over the past five years, Nio stock price exhibited a negative return of 9.64%, while the S&P 500 recorded a positive return of 87.30%. Nio's performance may have been affected by early-stage business challenges, including production ramp-up issues, liquidity concerns, and competitive pressures in the EV sector.

Source: tradingview.com

VI. Conclusion

In conclusion, the Nio stock forecast for 2024, 2025, and 2030 presents a mixed outlook with varying perspectives from analysts and forecasters.

Nio Stock Forecast 2024:

Technical analysts project a positive trajectory for Nio stock, with targets set around $11.90 for 2024. Analysts' price targets reflecting varying degrees of optimism or caution. Factors influencing the stock's performance include delivery performance, product developments, financial results, market expansion, and the regulatory environment.

Nio Stock Prediction 2025:

Technical analysis suggests potential price targets around $16.45 for 2025. Analysts predict different outlooks on Nio's growth prospects. Bullish factors include product innovation, market expansion, and ecosystem development, while bearish factors encompass regulatory challenges, competition, and supply chain disruptions.

Nio Stock Price Prediction 2030:

Long-term forecasts project the stock price of $50.25 by 2030, highlighting uncertainty in long-term predictions. Factors influencing the stock's performance include financial performance, technological advancements, market expansion, ecosystem development, regulatory challenges, competition intensification, and supply chain vulnerabilities.

Additionally, trading Nio stock CFDs with VSTAR could offer opportunities. For traders considering exposure to Nio stock through CFDs, VSTAR offers benefits such as leverage up to 1:200, low trading costs with a $0 commission, access to global stock markets, and lightning-fast execution. These features enable traders to maximize opportunities and capitalize on Nio's stock performance within a dynamic trading environment.

FAQs

1. Is NIO stock expected to go up?

Yes, analysts are predicting an increase, with an average 12-month price target of $8.57, which implies an upside of 81.95% from the current price.

2. What is the 1-year price target for NIO stock?

The one-year target for NIO stock is $8.74 on average, with a high target of $19.20 and a low target of $4.00.

3. What will the price of NIO be in 2025?

Analysts predict an average price of $14.12 for Nio stock, with a high estimate of $24.59 and a low estimate of $3.64.

4. What will NIO stock be worth in 5 years?

The forecast for NIO stock over the next five years suggests a significant increase. By 2030, NIO stock price is expected to reach $50.25.