- Báo cáo thu nhập quý 3 của Nvidia cho thấy doanh thu của Trung tâm dữ liệu tăng 279% so với cùng kỳ năm ngoái, đạt 14,5 tỷ USD.

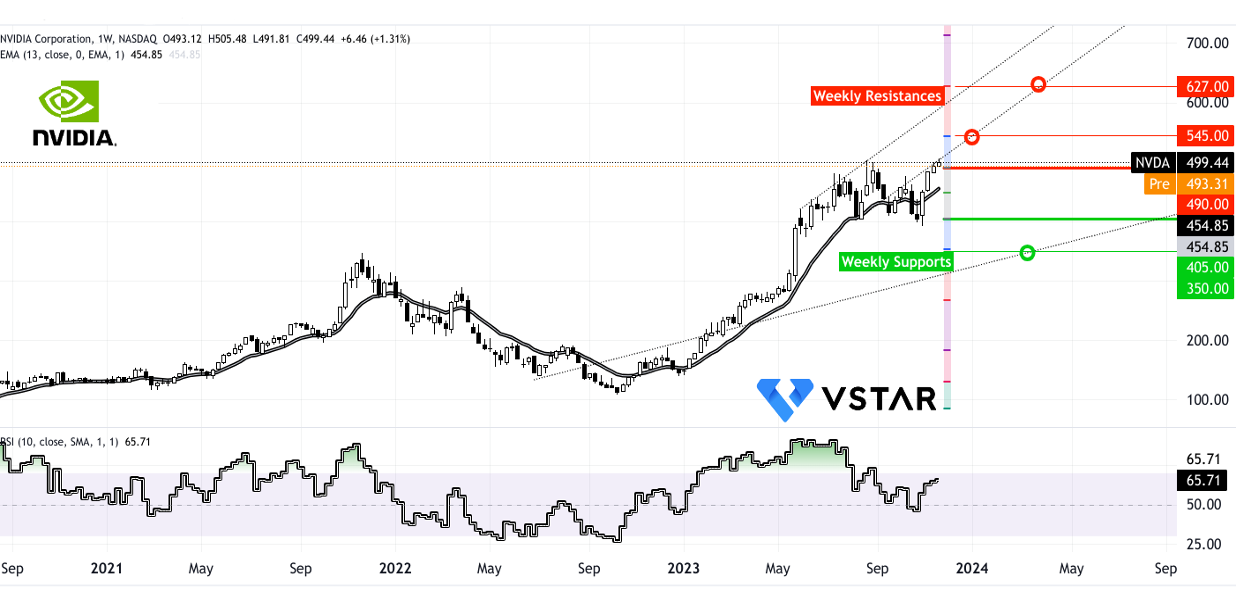

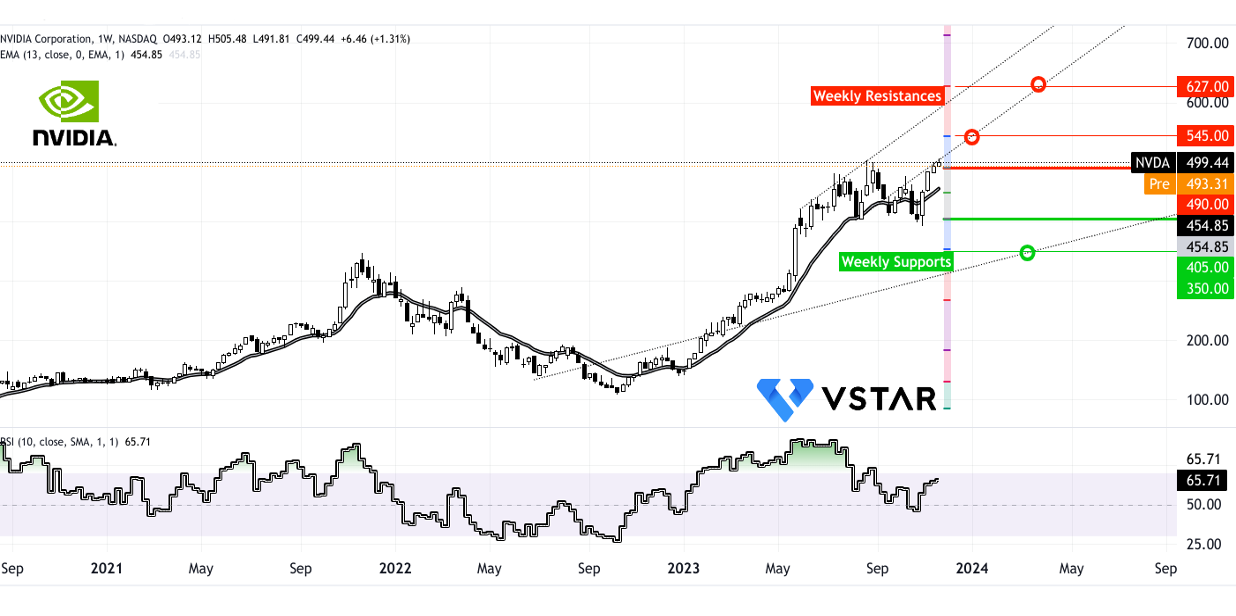

- Công ty phải đối mặt với ngưỡng kháng cự ở mức 490 USD, với RSI ở mức 65, có khả năng cản trở đà tăng giá tiếp theo của cổ phiếu.

- Mức kháng cự dự kiến ở mức 545 USD có thể kích hoạt một đợt thoái lui để kiểm tra lại mức 490 USD, tuân theo nguyên tắc thay đổi cực.

- Suy đoán cho thấy khả năng biến động giá, với kịch bản tăng giá đạt 627 USD do sự phấn khích của AI và sự nhiệt tình của nhà đầu tư.

Tập đoàn NVIDIA (NVDA) đã thể hiện sự tăng trưởng mạnh mẽ trong quỹ đạo Quý 3 năm tài chính 2024 nhờ những thế mạnh cơ bản cụ thể giúp củng cố vị thế là công ty đi đầu trong ngành công nghệ, đặc biệt là trong lĩnh vực trí tuệ nhân tạo (AI), trung tâm dữ liệu, trò chơi, trực quan hóa chuyên nghiệp và lĩnh vực ô tô. Sự tăng trưởng vượt trội của công ty có thể được phân tích thành các yếu tố chính làm sáng tỏ sự mở rộng nhanh chóng và tiềm năng tăng trưởng liên tục của công ty.

Sự thống trị của trung tâm dữ liệu

Doanh thu tăng vọt: Phân khúc Trung tâm dữ liệu của Nvidia có hoạt động nổi bật, chứng kiến doanh thu tăng theo cấp số nhân—tăng đáng kinh ngạc 279% so với cùng kỳ năm trước và tăng tuần tự 41% lên 14,5 tỷ USD. Sự tăng trưởng vượt trội này được củng cố bởi nhu cầu mạnh mẽ đối với nền tảng HGX và mạng InfiniBand, biến nó thành kiến trúc tham chiếu phù hợp cho siêu máy tính AI và cơ sở hạ tầng trung tâm dữ liệu.

Năng lực cơ sở hạ tầng AI: Việc tích hợp nền tảng HGX và InfiniBand là minh chứng cho sự vững mạnh của Nvidia trong lĩnh vực AI. Các công ty lớn, bao gồm Adobe, Microsoft, ServiceNow và Zoom, tận dụng công nghệ của Nvidia cho các ứng dụng AI đột phá như AI tổng hợp, chatbot và học sâu.

Nhu cầu đa dạng: Các khoản đầu tư chiến lược của công ty vào cơ sở hạ tầng AI cho nhiều ứng dụng khác nhau như học sâu, hệ thống đề xuất và AI tổng hợp đã thúc đẩy nhu cầu đáng kể và đa dạng trong phân khúc Trung tâm dữ liệu. Đáng chú ý, các công ty và doanh nghiệp internet tiêu dùng là công cụ thúc đẩy tăng trưởng tuần tự đặc biệt, chiếm gần một nửa doanh thu của Trung tâm dữ liệu và vượt qua tốc độ tăng trưởng chung.

Chiến lược mở rộng toàn cầu và địa chính trị

Đa dạng hóa chiến lược: Mặc dù gặp phải thách thức do các quy định kiểm soát xuất khẩu mới ảnh hưởng đến một số khu vực như Trung Quốc và Trung Đông, cách tiếp cận chủ động của Nvidia nhằm bù đắp sự suy giảm này bằng cách thúc đẩy tăng trưởng ở các thị trường toàn cầu khác. Chiến lược linh hoạt của công ty nhấn mạnh đến việc đa dạng hóa địa lý và thâm nhập thị trường trên khắp các khu vực, thể hiện sự hiện diện và khả năng thích ứng toàn cầu của công ty.

Đầu tư cơ sở hạ tầng AI quốc gia: Sự hợp tác của Nvidia với các quốc gia như Ấn Độ và Pháp, song song với những gã khổng lồ công nghệ như Infosys và Reliance, thể hiện nỗ lực của họ trong việc củng cố cơ sở hạ tầng AI có chủ quyền. Liên minh chiến lược này giúp Nvidia khai thác cơ hội trị giá hàng tỷ đô la đồng thời hỗ trợ các quốc gia phát triển năng lực AI của họ.

Đổi mới và mở rộng sản phẩm

Ra mắt sản phẩm tiên tiến: Việc Nvidia giới thiệu các sản phẩm đột phá như GPU H200 được trang bị bộ nhớ HBM3e và Superchip Grace Hopper—tích hợp CPU Grace dựa trên ARM với GPU Hopper—thể hiện một bước nhảy vọt đáng kể. Những đổi mới này biểu thị một dòng sản phẩm mới trị giá hàng tỷ đô la và tái khẳng định cam kết của Nvidia trong việc thúc đẩy điện toán AI.

Lãnh đạo siêu máy tính AI: Sự hợp tác với các trung tâm siêu máy tính nổi tiếng và chính phủ ở Hoa Kỳ, Châu Âu và Nhật Bản nhấn mạnh năng lực của Nvidia trong việc xây dựng một số siêu máy tính AI mạnh nhất thế giới. Các dự án đáng chú ý bao gồm hợp tác với Phòng thí nghiệm quốc gia Los Alamos, Trung tâm siêu máy tính quốc gia Thụy Sĩ, Isambard-AI của chính phủ Anh và Julich của Đức—củng cố vai trò then chốt của Nvidia trong bối cảnh điện toán AI.

Tăng tốc và hiệu suất AI: Những tiến bộ liên tục trong việc nâng cao hiệu suất và giảm chi phí cho các mô hình suy luận và đào tạo AI thông qua các sáng kiến như TensorRT-LLM và H200 thể hiện sự cống hiến không ngừng nghỉ của Nvidia trong việc thúc đẩy tiến bộ trong lĩnh vực điện toán AI. Đạt được mức tăng hiệu suất gấp 4 lần hoặc giảm chi phí trong vòng một năm là minh chứng cho sự đổi mới và cam kết cải tiến công nghệ AI của Nvidia.

Quan hệ đối tác chiến lược và dịch vụ

Hợp tác dịch vụ đám mây: Tăng cường quan hệ đối tác với các nhà cung cấp dịch vụ đám mây lớn như Microsoft Azure và việc cung cấp dịch vụ đúc AI cũng như phiên bản điện toán bí mật dựa trên GPU H100 sẽ củng cố sự hiện diện của Nvidia trong lĩnh vực điện toán đám mây. Những sự hợp tác này biểu thị sự liên kết chiến lược của Nvidia với các công ty hàng đầu trong ngành, cho phép công ty cung cấp các dịch vụ và công nghệ tiên tiến.

Cung cấp phần mềm và dòng doanh thu: Sự tăng trưởng ổn định của Nvidia trong việc cung cấp phần mềm, hỗ trợ và dịch vụ định kỳ, nhằm đạt tốc độ doanh thu hàng năm là 1 tỷ USD, cho thấy một con đường bổ sung để tạo doanh thu. Sự hợp tác với các doanh nghiệp như Adobe, Dropbox, SAP và Snowflake tiếp tục mở rộng phạm vi tiếp cận và các dịch vụ của Nvidia trong lĩnh vực AI dành cho doanh nghiệp.

Lĩnh vực trò chơi và hình ảnh chuyên nghiệp

Mở rộng trò chơi: Phân khúc trò chơi của Nvidia đã có mức tăng trưởng doanh thu đáng kể—tăng hơn 80% so với cùng kỳ năm ngoái—được thúc đẩy bởi những cải tiến như dò tia RTX và DLSS có sẵn ở nhiều mức giá khác nhau. Hệ sinh thái RTX phát triển mạnh mẽ, được hỗ trợ bởi hơn 475 trò chơi và ứng dụng hỗ trợ RTX, củng cố vị trí dẫn đầu của Nvidia trong bối cảnh công nghệ chơi game.

Những tiến bộ về Trực quan hóa Chuyên nghiệp: Phân khúc Trực quan hóa Chuyên nghiệp, được thúc đẩy bởi Nvidia RTX làm nền tảng ưa thích cho thiết kế, kỹ thuật và mô phỏng chuyên nghiệp, cũng đang tận dụng các ứng dụng AI trong không gian chăm sóc sức khỏe và thông minh. Sự ra mắt của máy trạm để bàn mới dựa trên GPU Nvidia RTX Ada Lovelace và ConnectX SmartNIC nhấn mạnh cam kết của Nvidia trong việc nâng cao hiệu suất và khối lượng công việc AI.

Đổi mới trong lĩnh vực ô tô

Quan hệ đối tác chiến lược trong lĩnh vực ô tô: Sự hợp tác của Nvidia với Foxconn để phát triển các giải pháp hệ thống trên chip ô tô (SOC) và buồng lái AI thế hệ tiếp theo đã củng cố vị thế của Nvidia trong bối cảnh công nghệ ô tô. Bằng cách cung cấp nền tảng điện toán và cảm biến AV được tiêu chuẩn hóa, Nvidia cho phép khách hàng chế tạo các phương tiện được xác định bằng phần mềm an toàn và bảo mật.

Thông tin kỹ thuật của cổ phiếu Nvidia (NVDA)

Cổ phiếu Nvidia gần đây đã tăng lên mức cao mới nhờ hiệu ứng thu nhập. Tuy nhiên, hiện tại nó đang gặp phải ngưỡng kháng cự quanh mốc 490 USD, kèm theo chỉ số RSI (Chỉ số sức mạnh tương đối) là 65, cho thấy những hạn chế tiềm ẩn đối với xu hướng đi lên hơn nữa của người mua. Xu hướng hiện tại cho thấy mức kháng cự đáng kể có thể xảy ra ở mức 545 USD, điều này có thể thúc đẩy sự thoái lui để kiểm tra lại mức 490 USD — một hiện tượng được gọi là sự thay đổi phân cực.

Điều quan trọng cần lưu ý là sự biến động tăng cao, được thúc đẩy bởi sự cường điệu xung quanh AI và tâm lý nhiệt tình của nhà đầu tư, có thể đẩy giá cao hơn nữa, có thể đạt tới 627 USD. Sự phấn khích này có thể dẫn đến những biến động đáng kể về giá trị của cổ phiếu.

Nguồn: tradingview.com

Tóm lại, sự tăng trưởng nhanh chóng của Nvidia được củng cố bởi vị trí thống trị trong cơ sở hạ tầng AI, chiến lược mở rộng toàn cầu, không ngừng tập trung vào đổi mới trong phát triển sản phẩm, quan hệ đối tác chiến lược, dòng doanh thu đa dạng trên nhiều phân khúc và cam kết thúc đẩy các lĩnh vực công nghệ tiên tiến. Những trụ cột quan trọng này cùng nhau tạo thành nền tảng cho sự phát triển hiện tại của Nvidia và vẽ nên một bức tranh đầy hứa hẹn về quỹ đạo tăng trưởng trong tương lai của công ty trong ngành công nghệ.